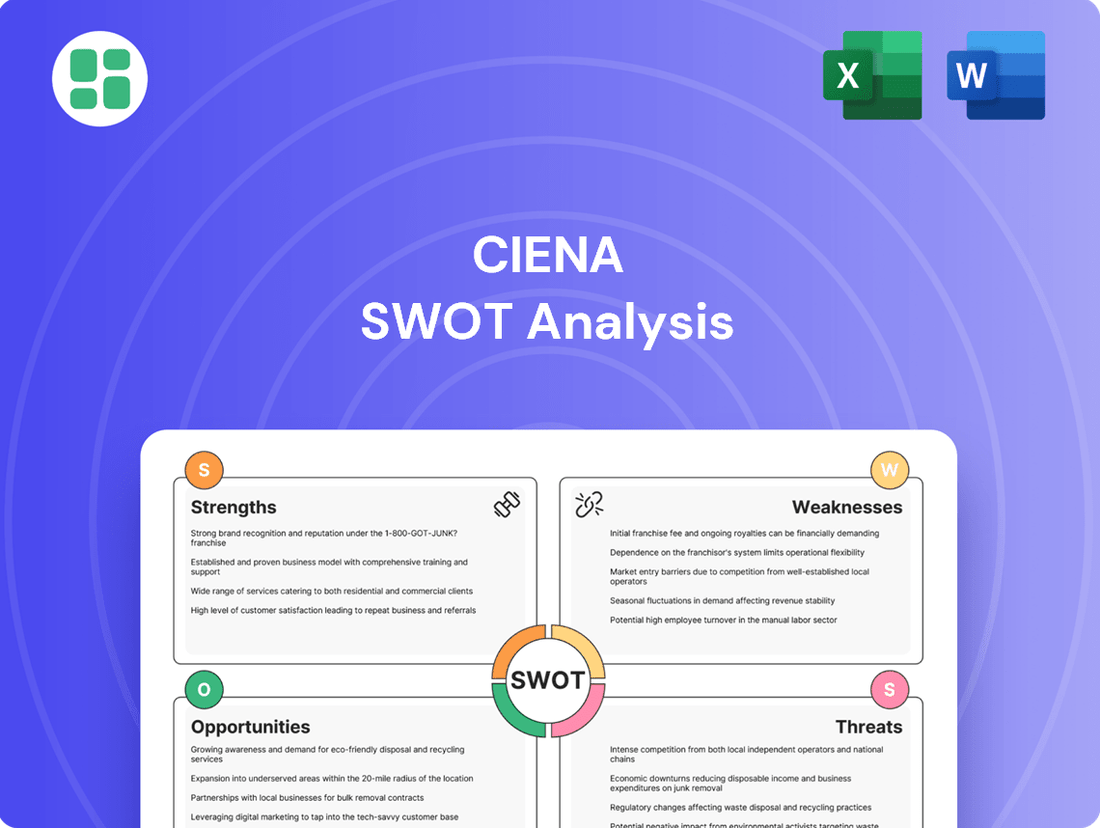

Ciena SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciena Bundle

Ciena's robust technology portfolio and strong market position in optical networking are key strengths, but the company faces intense competition and evolving market demands. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Ciena's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ciena consistently leads in optical networking, pouring significant resources into research and development. A prime example is their WaveLogic 6 Extreme technology, a coherent optics platform delivering unparalleled speeds and energy efficiency crucial for today's data-hungry networks.

This commitment to cutting-edge innovation, like the advancements in WaveLogic 6 Extreme, directly translates into a powerful competitive advantage for Ciena, fueling the growth of their core business operations and market position.

Ciena boasts a significantly diversified customer base, moving beyond its traditional telecommunications roots. This strategic expansion means a substantial portion of its revenue now comes from non-telco clients, a testament to its adaptability.

A key driver of this diversification is the robust growth in direct cloud provider revenue. For instance, Ciena reported a significant year-over-year increase in this segment, highlighting its success in capturing opportunities in the cloud infrastructure market.

This broadening of its customer portfolio effectively reduces Ciena's dependence on any single industry segment. It strategically positions the company to benefit from the ongoing expansion of cloud computing and the burgeoning demand driven by artificial intelligence infrastructure.

Ciena maintains a robust financial position, underscored by a substantial cash and investments balance. For the fiscal year ending September 30, 2023, Ciena reported cash and cash equivalents of $1.3 billion, alongside $1.8 billion in marketable securities, totaling over $3.1 billion in liquid assets. This healthy liquidity, coupled with consistent operating cash flow, provides significant strategic and operational flexibility.

The company's commitment to shareholder value is evident in its active share repurchase programs. In fiscal year 2023, Ciena repurchased approximately $400 million of its common stock, demonstrating confidence in its valuation and a strategy to enhance shareholder returns. This financial discipline allows for prudent capital allocation.

Growth in Blue Planet Automation Software

Ciena's Blue Planet Automation Software and Services segment is a significant strength, demonstrating impressive growth. In the first quarter of fiscal year 2024, this segment nearly doubled its revenue year-over-year, reaching $278 million. This rapid expansion underscores the increasing demand for advanced network orchestration and automation solutions.

The Blue Planet platform is pivotal in helping customers navigate and manage increasingly complex, multi-vendor network environments. Its ability to streamline operations and improve efficiency is a key differentiator for Ciena in the market. This strong performance signals a successful strategic pivot towards higher-margin software and services, which are vital for future profitability.

- Exceptional Revenue Growth: Blue Planet Automation Software and Services revenue nearly doubled in Q1 FY24, reaching $278 million.

- Strategic Importance: This segment is critical for network orchestration and automation in complex, multi-vendor environments.

- Market Demand: The strong performance reflects a growing market need for efficient network management solutions.

- Shift to Software and Services: Blue Planet's success highlights Ciena's effective transition towards higher-growth software and services.

Strategic Focus on High-Growth Areas

Ciena is strategically positioning itself by expanding into burgeoning markets like broadband access, metro routing, and data center connectivity. This move is designed to significantly broaden its addressable market and capitalize on future growth opportunities.

The company’s product portfolio is particularly well-suited to meet the escalating demand for bandwidth. This surge is fueled by widespread AI adoption, the ongoing deployment of 5G networks, and the continuous expansion of cloud services.

This deliberate focus on high-growth sectors ensures a robust and sustained demand for Ciena's sophisticated networking solutions. For instance, the global network infrastructure market is projected to reach $242.4 billion by 2027, growing at a CAGR of 7.1% from 2023, according to Mordor Intelligence, highlighting the fertile ground for Ciena's strategic investments.

- Expansion into adjacent high-growth markets: Broadband access, metro routing, data center connectivity.

- Alignment with key demand drivers: AI applications, 5G build-outs, cloud adoption.

- Projected market growth: Global network infrastructure market expected to reach $242.4 billion by 2027.

Ciena's leadership in optical networking is solidified by its continuous investment in R&D, exemplified by WaveLogic 6 Extreme, a platform offering superior speed and energy efficiency. This innovation fuels its competitive edge and market growth.

The company benefits from a diversified customer base, with significant revenue now generated from non-telecom clients, particularly cloud providers. This expansion, demonstrated by strong year-over-year growth in cloud revenue, reduces reliance on any single sector and capitalizes on AI infrastructure demand.

Ciena's financial strength is evident in its substantial liquidity, with over $3.1 billion in cash and marketable securities as of September 30, 2023. Strategic capital allocation is further supported by active share repurchases, such as the $400 million bought back in fiscal year 2023.

The Blue Planet Automation Software and Services segment is a key growth driver, nearly doubling revenue to $278 million in Q1 FY24. This success highlights Ciena's strategic shift towards high-margin software and services, meeting critical market needs for network orchestration.

Ciena is expanding into high-growth areas like broadband access, metro routing, and data center connectivity, aligning with demand from AI, 5G, and cloud services. The global network infrastructure market is projected to reach $242.4 billion by 2027, indicating substantial opportunity.

What is included in the product

Analyzes Ciena’s competitive position through key internal and external factors, detailing its strengths in optical networking, weaknesses in software integration, opportunities in 5G and cloud, and threats from competitors and supply chain disruptions.

Offers a clear, actionable framework to identify and address Ciena's strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Ciena has faced challenges with its adjusted gross margins, which saw a dip despite revenue increases. For instance, in the first quarter of fiscal year 2024, Ciena reported an adjusted gross margin of 41.7%, a decrease from 43.1% in the same period of the prior year.

This compression in margins is partly due to shifts in product mix towards lower-margin offerings and the impact of tariffs, which increase the cost of goods sold. Effectively navigating these cost pressures and optimizing the product portfolio will be key for Ciena to bolster its profitability going forward.

Ciena's reliance on a concentrated customer base presents a significant weakness. In fiscal year 2023, its top ten customers represented a substantial percentage of its overall revenue, highlighting a vulnerability to shifts in demand from these key accounts. This concentration can lead to revenue fluctuations if major clients scale back purchases or opt for competing solutions.

While Ciena's Optical Networking segment is a strong performer, its Routing and Switching segment has seen a revenue downturn. For fiscal year 2023, Ciena reported $3.7 billion in revenue from its Optical Networking business, a significant increase. However, the Routing and Switching segment's performance needs attention to ensure a more balanced growth across Ciena's product portfolio.

Intense Competitive Landscape

Ciena operates in a telecommunications equipment sector where competition is fierce. Major global players like Huawei, Nokia, Cisco, and Ericsson are constant rivals, pushing down prices and demanding ongoing research and development investment to stay relevant.

This intense rivalry means Ciena must continually innovate to distinguish its products and services. For instance, in the first quarter of fiscal year 2024, Ciena reported revenue of $1.04 billion, facing significant market pressures. The need for continuous R&D investment to maintain market share is a critical challenge.

- Intense Rivalry: Ciena competes directly with established giants like Huawei, Nokia, Cisco, and Ericsson.

- Pricing Pressures: The crowded market forces competitive pricing strategies.

- R&D Imperative: Sustained investment in innovation is crucial for market differentiation and share retention.

Vulnerability to Supply Chain and Tariffs

Ciena's reliance on a global supply chain presents a significant vulnerability. Disruptions, whether from geopolitical events or natural disasters, can directly impact production schedules and component availability. For instance, the semiconductor shortages experienced globally in 2021-2022, which continued to some extent into 2023, highlighted how dependent Ciena is on a steady flow of electronic components.

Furthermore, tariffs and trade policy shifts can inflate operating costs and squeeze profit margins. As Ciena sources materials and manufactures across different regions, changes in import/export duties can quickly alter the cost structure of its products. Navigating these evolving trade landscapes requires constant vigilance and strategic adjustments to sourcing and manufacturing locations to mitigate adverse financial impacts.

- Global Sourcing Risks: Ciena's extensive global supply chain makes it susceptible to disruptions from geopolitical tensions, trade disputes, and logistical challenges, impacting component availability and delivery times.

- Tariff Impact: Changes in international trade policies and the imposition of tariffs can directly increase the cost of goods sold, potentially reducing profitability if not effectively passed on to customers or offset by other efficiencies.

- Component Dependency: The company's dependence on specialized components, particularly semiconductors, means that supply chain constraints in these areas can significantly hinder production capacity and revenue generation.

Ciena's profitability is affected by declining adjusted gross margins, which fell to 41.7% in Q1 FY24 from 43.1% in Q1 FY23, partly due to a shift towards lower-margin products and tariffs. The company's heavy reliance on its top ten customers, who represented a significant portion of fiscal year 2023 revenue, also poses a risk, making it vulnerable to changes in demand from these key accounts. Additionally, while Optical Networking is strong, the Routing and Switching segment experienced a revenue downturn in fiscal year 2023, indicating a need for more balanced portfolio growth.

Preview the Actual Deliverable

Ciena SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This ensures transparency and allows you to assess the quality and depth of our professional analysis before committing. You get exactly what you see, with no hidden content or altered information.

This is a real excerpt from the complete Ciena SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of the company's strategic position. The preview accurately represents the detailed insights contained within the complete report.

Opportunities

The rapid expansion of AI and cloud computing is fueling an insatiable appetite for advanced networking solutions. This surge in demand for high-speed, low-latency connectivity is a direct consequence of AI's computational needs and the increasing reliance on data centers. For instance, global data center traffic is projected to nearly triple between 2021 and 2026, reaching 206 exabytes per month by 2026, according to Cisco’s Annual Internet Report.

Ciena's cutting-edge optical technologies, particularly its WaveLogic 6 Extreme, are perfectly suited to address this infrastructure upgrade imperative. These advancements provide the necessary bandwidth and efficiency to support the massive data flows generated by AI workloads. This positions Ciena as a key enabler for the next generation of digital infrastructure.

This trend represents a substantial and enduring growth avenue for Ciena. The ongoing development and deployment of AI globally ensure a sustained need for the high-performance networking capabilities that Ciena offers, translating into significant long-term revenue potential.

Ciena is strategically positioning itself to tap into burgeoning adjacent markets, moving beyond its established optical networking stronghold. This includes significant opportunities in broadband access, metro routing, and the rapidly growing data center connectivity sector. By entering these higher-growth areas, Ciena aims to substantially expand its total addressable market and achieve revenue growth exceeding historical norms.

The company's success in these new ventures hinges on its ability to leverage its core optical technology expertise. For instance, in data center connectivity, Ciena's advanced optical solutions can offer superior performance and efficiency compared to existing technologies. This strategic diversification is crucial for Ciena to maintain its competitive edge and capitalize on evolving market demands, particularly as global data traffic continues its upward trajectory.

Global bandwidth consumption is on a relentless upward trajectory, driven by the ever-growing demand for high-definition streaming, the widespread adoption of 5G networks, and the proliferation of digital services. This sustained increase necessitates continuous network modernization and capacity enhancements, presenting a significant opportunity for companies like Ciena.

Ciena's advanced networking solutions are specifically designed to meet these escalating demands, facilitating the high-capacity delivery of data, voice, and video services. The company's product portfolio is well-positioned to capitalize on this fundamental market trend, offering the infrastructure required to support the digital economy's expansion.

For instance, Ciena reported that its WaveLogic 5 Nano, a key component in its high-capacity optical networking portfolio, enables data rates up to 400Gbps, crucial for handling the surge in traffic. This secular growth in bandwidth demand acts as a powerful tailwind for Ciena's business, underscoring the persistent need for its advanced technological offerings.

Leveraging Sustainable Technology and Practices

Ciena can capitalize on the growing demand for environmental sustainability by highlighting its energy-efficient networking solutions. The company’s WaveLogic 6 Extreme, for instance, offers a significant reduction in power consumption per bit, a key metric for network operators aiming to reduce their carbon footprint. This focus on green technology aligns with global sustainability initiatives and can attract a growing segment of environmentally conscious customers, potentially opening new revenue streams and strengthening Ciena's market position.

This strategic focus on sustainability presents several key opportunities:

- Market Differentiation: Position Ciena as a leader in eco-friendly networking, appealing to customers prioritizing environmental impact.

- Customer Acquisition: Attract new clients who are actively seeking to reduce their operational energy costs and meet their corporate social responsibility goals.

- Enhanced Brand Reputation: Build a stronger brand image associated with innovation and environmental stewardship, which can lead to increased customer loyalty.

- New Business Avenues: Explore partnerships and service offerings that further support network operators' sustainability objectives.

Strategic Partnerships and Ecosystem Development

Ciena's strategic partnerships are crucial for expanding its market presence and enriching its product portfolio. By aligning with major cloud providers and other industry leaders, Ciena can tap into new customer segments and integrate complementary technologies. This collaborative approach is evident in its work with significant clients such as Verizon and Telxius, underscoring Ciena's integral role in developing and maintaining essential network infrastructure.

These alliances not only broaden Ciena's reach but also drive innovation by fostering deeper integration within the wider networking ecosystem. Such collaborations are vital for staying competitive and delivering comprehensive solutions in a rapidly evolving technological landscape. For instance, Ciena's continued investment in its partner ecosystem is a key component of its strategy to address the growing demand for high-capacity, intelligent networks.

- Expanded Market Access: Partnerships with cloud providers unlock access to their extensive customer bases and cloud-native service offerings.

- Enhanced Product Innovation: Collaborations accelerate the development of integrated solutions, combining Ciena's networking expertise with partner technologies.

- Critical Infrastructure Projects: Aligning with major telecommunications companies like Verizon and Telxius solidifies Ciena's position in vital network upgrades and deployments.

- Ecosystem Integration: Fostering a robust ecosystem encourages interoperability and the creation of more comprehensive, end-to-end networking solutions.

The burgeoning demand for AI and cloud services is creating a massive need for advanced networking infrastructure, a trend Ciena is well-positioned to capitalize on. This surge in data traffic, projected to reach 206 exabytes per month by 2026 according to Cisco, necessitates high-capacity optical solutions like Ciena's WaveLogic 6 Extreme. The company's expansion into adjacent markets like data center connectivity and broadband access further broadens its growth potential, aiming to exceed historical revenue norms by leveraging its core optical expertise.

Ciena's commitment to energy-efficient networking solutions presents a significant opportunity for market differentiation and customer acquisition, particularly as global sustainability initiatives gain momentum. By highlighting products like WaveLogic 6 Extreme, which offers reduced power consumption per bit, Ciena can attract environmentally conscious customers and enhance its brand reputation. This focus on green technology can also open new business avenues through partnerships aimed at supporting network operators' sustainability goals.

Strategic partnerships are a cornerstone of Ciena's growth strategy, enabling access to new customer segments and fostering product innovation. Collaborations with major cloud providers and telecommunications companies like Verizon and Telxius are critical for integrating complementary technologies and solidifying Ciena's role in vital network infrastructure projects. This ecosystem integration accelerates the development of comprehensive, end-to-end networking solutions, crucial for maintaining competitiveness in a rapidly evolving technological landscape.

Threats

The telecommunications equipment sector is a battlefield, with giants like Cisco and Nokia, alongside emerging players, constantly fighting for dominance. This fierce rivalry often translates into significant pricing pressure, especially from major telecom providers and hyperscalers who wield considerable purchasing power. For instance, in Ciena's fiscal year 2023, the company navigated this challenging landscape, demonstrating resilience despite these market forces.

Ciena faces significant headwinds from macroeconomic shifts, such as the elevated interest rates and persistent inflation observed through late 2024 and into 2025. These factors directly impact the capital budgets of its core clientele, primarily telecom operators. For instance, a slowdown in global economic growth, projected by many institutions to continue into 2025, often leads these providers to defer or reduce infrastructure upgrades, directly affecting Ciena's order pipeline.

The sensitivity to capital expenditure cycles presents an ongoing challenge for Ciena. During economic downturns, telecom service providers are more inclined to conserve cash, leading to a contraction in spending on network modernization and expansion. This cyclicality can create volatility in Ciena's revenue streams, making consistent forecasting and resource allocation more complex as the industry navigates these unpredictable spending patterns.

The telecommunications sector is known for its lightning-fast technology evolution, making obsolescence a persistent threat. Ciena, despite its innovative edge, faces the risk that emerging technologies or competitor breakthroughs could rapidly devalue its current offerings. This necessitates ongoing, substantial R&D spending, which, while crucial, doesn't automatically ensure market leadership or improved profitability.

Geopolitical Risks and Trade Tariffs

Geopolitical tensions and the potential for new trade tariffs represent a significant threat to Ciena's operations. These factors can directly impact the company's operating costs and disrupt its intricate global supply chain.

Ciena's reliance on manufacturing partners located in various countries makes it particularly susceptible to shifts in international trade policies. Changes in tariffs can escalate expenses, thereby affecting the company's overall profitability. For instance, during recent earnings calls, management has acknowledged the pressure these trade dynamics can exert on margins.

- Supply Chain Vulnerability: Ciena's global manufacturing footprint exposes it to risks from trade disputes and protectionist policies.

- Increased Costs: New tariffs on components or finished goods can directly increase Ciena's cost of goods sold.

- Profitability Impact: Higher expenses stemming from tariffs can erode profit margins, as observed in recent financial reporting.

- Operational Disruptions: Geopolitical instability can lead to delays or interruptions in the flow of goods and services.

Customer Inventory Overhangs

A significant threat for Ciena stems from customer inventory overhangs, particularly within the telecom sector. Many service providers over-ordered equipment in prior periods, leading to a substantial glut of inventory. This oversupply directly impacts Ciena by creating a lull in new orders and consequently, a decline in revenue. For instance, Ciena itself faced this challenge in 2024, underscoring the direct correlation between market oversupply and reduced sales volume.

The persistent issue of excess inventory among Ciena’s customers, especially telecom operators, poses a considerable risk. This situation can significantly dampen demand for new network equipment, directly affecting Ciena's order intake and revenue streams. The company's experience in 2024 highlighted how these market-wide inventory build-ups translate into slower sales cycles and reduced financial performance.

- Market Oversupply: Telecom service providers accumulated excess inventory, leading to a slowdown in new equipment purchases.

- Revenue Impact: Ciena experienced a direct hit to its sales volume and financial results due to this customer inventory overhang in 2024.

- Forecasting Challenge: Accurately managing inventory levels and predicting future demand remains a critical challenge for Ciena in this environment.

Intense competition, particularly from established players like Cisco and Nokia, creates pricing pressure, impacting Ciena's margins. Macroeconomic factors, including elevated interest rates and inflation through late 2024 and into 2025, are curtailing telecom operator capital expenditures, directly affecting Ciena's order pipeline. Furthermore, rapid technological advancements pose a constant threat of obsolescence, necessitating continuous, significant R&D investment without guaranteed market advantage.

Customer inventory overhangs, a significant issue in 2024, continue to suppress demand for new equipment, leading to reduced sales volumes and revenue challenges for Ciena. Geopolitical tensions and potential trade tariffs add further risk, threatening to increase operating costs and disrupt Ciena's global supply chain, as acknowledged by management regarding margin pressures.

SWOT Analysis Data Sources

This SWOT analysis draws from a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide a thorough and data-driven assessment of Ciena's strategic position.