Ciena Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciena Bundle

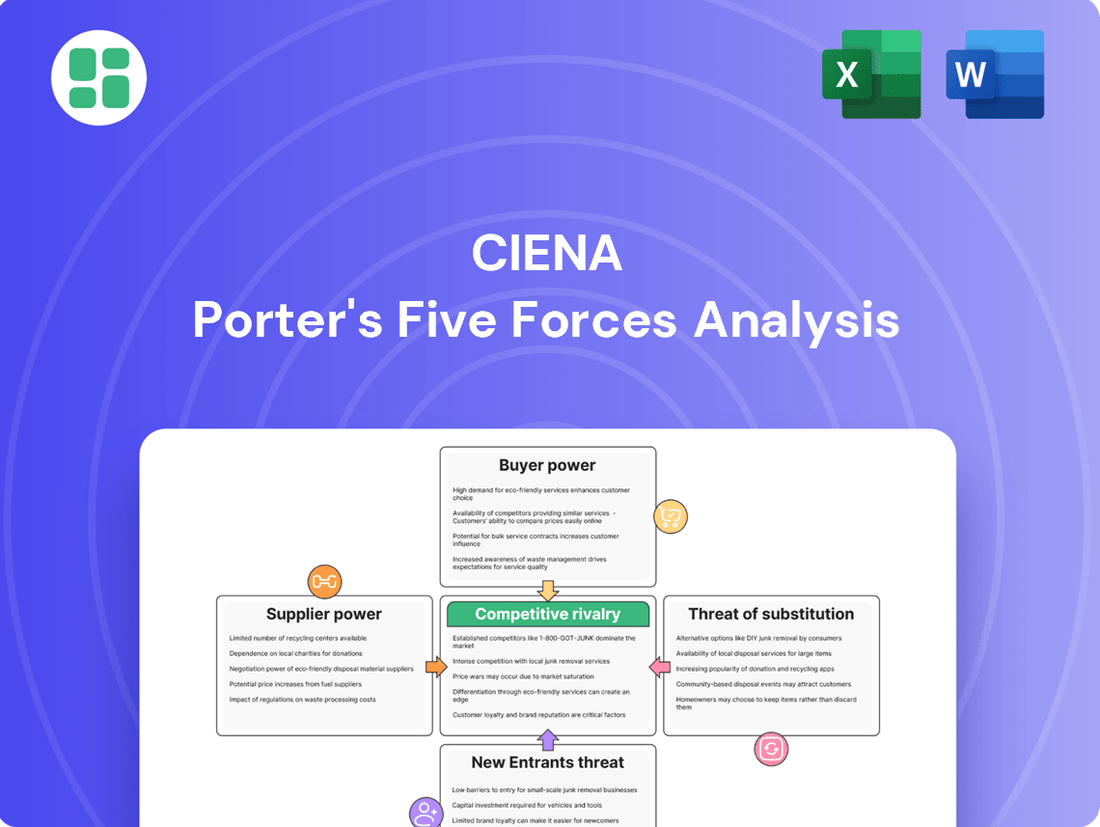

Ciena operates within a dynamic telecommunications infrastructure landscape, heavily influenced by the bargaining power of its buyers and the intense rivalry among existing players. Understanding these forces is crucial for navigating its competitive environment.

The full Porter's Five Forces Analysis for Ciena delves deeper into the threat of new entrants and the power of suppliers, revealing the intricate web of pressures shaping its market. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ciena's dependence on highly specialized components, like coherent optical transceivers and advanced semiconductors, places significant bargaining power in the hands of its suppliers. These critical parts are often produced by a select few manufacturers, creating a concentrated supply chain.

This limited supplier base translates to considerable leverage, especially when global demand surges or when specific components face shortages. For example, the widespread semiconductor shortages experienced in 2021 and 2022 directly impacted Ciena's component availability and extended lead times, underscoring the influence of these upstream providers.

Ongoing supply chain challenges, particularly the global semiconductor shortage, have significantly impacted Ciena's operational capabilities throughout 2024. This scarcity directly affects component availability, a critical factor in Ciena's product manufacturing.

These disruptions can force Ciena to accept higher prices or endure extended delivery times, thereby bolstering the bargaining power of its suppliers. The company has specifically highlighted that unexpected shortfalls in lower average selling price (ASP) electronic components present a notable challenge.

For Ciena, switching suppliers for highly integrated and proprietary networking components presents a significant hurdle. The process involves substantial costs related to redesigning systems, rigorous testing, and lengthy qualification procedures, often taking months and millions in investment. This complexity directly translates into high switching costs for Ciena, granting considerable leverage to its existing key component providers.

This reliance on specialized fiber and advanced chip components, particularly in the optical transceiver market, further empowers suppliers. For instance, in 2024, the global optical transceiver market was valued at approximately $10 billion, with a compound annual growth rate projected to exceed 7% through 2030. Suppliers of these critical, often patented, technologies can command higher prices and dictate terms due to Ciena's limited ability to easily find and integrate alternatives.

Geographic Concentration of Manufacturing

Ciena's manufacturing base spans several countries, including Canada, Mexico, India, and Thailand. This geographic distribution, while offering some diversification, also presents potential vulnerabilities. For instance, geopolitical tensions or the imposition of tariffs in any of these manufacturing hubs can disrupt supply chains and inflate costs, thereby strengthening the bargaining power of suppliers located in or serving these regions.

The impact of such disruptions is tangible. Ciena, for example, anticipated approximately $10 million in quarterly tariff costs in 2024. This figure highlights how external factors affecting specific manufacturing locations can translate directly into increased costs of goods sold and provide leverage to suppliers who can navigate or are less affected by these trade policies.

- Geographic Concentration: Ciena's manufacturing presence in Canada, Mexico, India, and Thailand creates dependencies on these specific regions.

- Tariff Impact: Anticipated quarterly tariff costs of roughly $10 million for 2024 demonstrate the financial exposure to trade policies in these manufacturing locations.

- Supplier Leverage: Suppliers in or serving these geographically concentrated manufacturing areas gain bargaining power due to potential disruptions and increased costs for Ciena.

- Cost of Goods Sold: Geopolitical issues and tariffs directly influence Ciena's cost of goods sold, impacting profitability and pricing strategies.

Proprietary Technology of Suppliers

Suppliers of cutting-edge optical and networking technologies often possess proprietary intellectual property and patents that are essential for Ciena's product innovation. This exclusivity limits Ciena's options for replicating or sourcing alternative components, necessitating strong supplier relationships and potentially leading to less favorable contract terms. For instance, advancements in optical transceiver modules, a key driver in the optical networking market, are frequently proprietary.

- Proprietary Technology: Suppliers holding unique patents for critical components significantly increase their bargaining power.

- Reduced Substitutability: When alternatives are scarce or non-existent due to proprietary tech, Ciena faces higher supplier leverage.

- Market Dependence: Key advancements in optical networking, such as next-generation coherent optics, often originate from a limited number of specialized, patent-holding suppliers.

- Impact on Ciena: This reliance can translate into higher input costs or constraints on Ciena's product development timelines if supplier relationships are not managed effectively.

Ciena's reliance on specialized components, often protected by patents and developed by a limited number of manufacturers, grants significant bargaining power to its suppliers. The high costs associated with switching suppliers, due to extensive redesign and qualification processes, further solidify this supplier leverage. This dynamic was evident in 2024, where Ciena anticipated approximately $10 million in quarterly tariff costs, highlighting how geopolitical and trade policies in key manufacturing regions can empower suppliers by increasing Ciena's operational expenses and limiting its flexibility.

| Factor | Description | Impact on Ciena | 2024 Relevance |

|---|---|---|---|

| Component Specialization | Reliance on unique, high-performance optical and semiconductor components. | Limited supplier options, increased dependency. | Critical for next-generation coherent optics. |

| Supplier Concentration | Few manufacturers produce essential, specialized parts. | Suppliers dictate terms and pricing. | Exacerbated by ongoing global semiconductor shortages. |

| Switching Costs | High expenses and time for redesigning and qualifying new suppliers. | Reinforces existing supplier relationships and power. | Months of investment and millions of dollars required. |

| Geopolitical/Trade Risks | Tariffs and regional disruptions impacting manufacturing hubs. | Increased cost of goods sold, supply chain volatility. | Anticipated $10 million quarterly tariff costs in 2024. |

What is included in the product

This analysis dissects the competitive landscape for Ciena, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes to understand Ciena's strategic positioning.

Easily identify and mitigate competitive threats with a visual breakdown of industry power dynamics, streamlining strategic planning.

Customers Bargaining Power

Ciena's customer base is primarily comprised of major service providers, cloud giants, large enterprises, and government entities. These significant buyers wield considerable influence due to the sheer volume of their purchases and the scale of their network infrastructure needs.

The bargaining power of these customers is amplified by their substantial investment commitments. For instance, cloud providers represent an increasing share of Ciena's revenue. In Q2 2025, a notable three of Ciena's top five customers were identified as cloud providers, underscoring their growing importance and leverage.

Service providers, especially in North America and Europe, have been grappling with substantial inventory levels of networking gear. This situation has directly translated into more cautious and slower ordering patterns for Ciena.

This inventory overhang significantly bolsters the bargaining power of Ciena's customers. They can effectively delay new equipment purchases, waiting until their current stock is fully deployed, which naturally impacts Ciena's near-term revenue projections.

Customers in the telecommunications and cloud sectors are relentlessly pursuing solutions that offer high capacity, flexibility, and security, all while remaining budget-friendly and energy-conscious. This persistent demand puts significant pressure on network equipment providers like Ciena.

This dynamic empowers customers, enabling them to negotiate for better pricing and demand cutting-edge features. For instance, the drive for higher speeds and efficiency means customers actively seek advancements such as Ciena's WaveLogic 6 Extreme technology, which promises increased capacity and reduced power consumption.

Furthermore, customers are increasingly stipulating stringent service level agreements (SLAs) to ensure network reliability and performance. In 2023, for example, major telecom operators reported significant investments in network upgrades, driven by the need to meet growing data demands and maintain competitive service offerings, which directly translates to their increased bargaining power with suppliers.

Availability of Multiple Vendors

Ciena faces significant bargaining power from its customers due to the availability of multiple vendors in the optical and packet networking solutions market. This competitive landscape, featuring major players like Nokia, Ericsson, Juniper Networks, and Cisco, means customers have readily available alternatives.

This abundance of choice directly empowers customers, allowing them to switch providers with relative ease and leverage this flexibility to negotiate more favorable terms and pricing. For instance, in 2023, the global optical networking market was valued at approximately $16.5 billion, with numerous vendors vying for market share, underscoring the competitive pressure Ciena operates under.

- High customer choice: Ciena's customers can select from multiple established competitors offering similar technology.

- Switching costs: While some switching costs exist, the availability of alternatives reduces their impact, enhancing customer leverage.

- Price negotiation: Customers can effectively negotiate prices and service agreements due to the competitive vendor environment.

Strategic Importance of Network Infrastructure

While customers in the telecommunications sector can exert significant bargaining power, the mission-critical nature of their network infrastructure demands reliability and long-term partnerships. This reliance on stable, high-performance equipment can temper outright price concessions.

Ciena's strategic approach, exemplified by its continued investment in innovation like its WaveLogic coherent optics technology, directly addresses this. By offering superior performance and reliability, Ciena aims to demonstrate value that transcends simple price comparisons, thereby mitigating some of the direct buyer power.

- Customer Dependence: The essential role of Ciena's networking solutions in enabling critical communication services means customers are inherently hesitant to switch providers without substantial risk, limiting their bargaining leverage.

- Innovation as a Differentiator: Ciena's commitment to R&D, with significant investments fueling advancements like WaveLogic, creates a value proposition that can command loyalty and reduce price sensitivity.

- Long-Term Relationships: Ciena fosters deep relationships with major telecommunication providers, built on trust and consistent delivery, which can act as a counterweight to aggressive price negotiations.

Ciena's customers, particularly large service providers and cloud giants, possess significant bargaining power due to their substantial purchasing volumes and the availability of alternative vendors in the networking solutions market. This leverage allows them to negotiate for better pricing and demand advanced features, putting pressure on Ciena to maintain competitive offerings and cost efficiencies.

| Customer Segment | Bargaining Power Factors | Impact on Ciena |

|---|---|---|

| Major Service Providers | Large order volumes, inventory overhang, critical network reliance | Price negotiation, slower order cycles, demand for reliability |

| Cloud Giants | Increasing revenue share, high capacity needs, budget consciousness | Negotiation for pricing and features, demand for energy efficiency |

| Government Entities | Strategic infrastructure investments, stringent SLAs | Demand for security, reliability, and long-term partnerships |

Full Version Awaits

Ciena Porter's Five Forces Analysis

This preview showcases the complete Ciena Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the telecommunications equipment industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The telecommunications networking equipment market is highly concentrated, with a few dominant global players. This intense rivalry means Ciena faces stiff competition from giants like Ericsson, Nokia, Huawei, Juniper Networks, and Cisco. Market share gains are therefore a significant challenge, often necessitating aggressive strategic maneuvers.

The networking industry Ciena operates in is defined by relentless technological progress. Innovations in coherent optics, intelligent automation, and software-defined networking are crucial, fueled by the insatiable demand from AI, 5G, and cloud computing. This necessitates constant, significant investment in research and development to stay ahead.

Ciena actively addresses this through its commitment to R&D, exemplified by its WaveLogic technology, a leader in high-speed optical transmission. The company's strategic focus on AI-driven solutions further underscores its dedication to leveraging cutting-edge advancements to maintain its competitive standing.

Customers investing heavily in network infrastructure often exhibit strong price sensitivity, directly impacting Ciena's profitability. This dynamic intensifies competition, forcing Ciena and its rivals to compete aggressively on price to secure lucrative contracts.

The pressure to offer competitive pricing can lead to significant margin erosion. For instance, Ciena reported an adjusted gross margin in the low 40s for its second quarter of fiscal year 2025, a figure that reflects the ongoing challenges of balancing market demands with profitability.

Global Market Reach and Regional Differences

Competitive rivalry in the telecommunications infrastructure market is intense and global, with significant regional variations influencing market dynamics. Ciena, a major player, faces strong competition from companies like Nokia and Ericsson, each possessing substantial regional strengths and market share.

Market conditions can differ dramatically across geographies. For instance, Ciena has observed a cautious approach from service providers in Europe during 2024, driven by macroeconomic uncertainties. This caution has translated into reduced order volumes for network equipment and services in that specific region.

- Global Competition: Ciena competes with established players like Nokia and Ericsson, as well as emerging vendors in various markets.

- Regional Strength: Competitors often have deeply entrenched relationships and market share in specific geographic areas, creating localized competitive advantages.

- European Market Impact: In 2024, Ciena reported that macroeconomic concerns in Europe led to a more cautious spending environment among service providers, affecting order patterns.

- Market Share Fluctuations: The success of competitors in securing large contracts or adapting to regional demand shifts can lead to ongoing changes in market share.

Convergence of Technologies and Broadening Competitive Landscape

The competitive arena for companies like Ciena is rapidly expanding. This is happening because network technologies, their features, and even the foundational layers are starting to merge. Think of it like different parts of a complex system all coming together under one umbrella, managed by unified software. This convergence means Ciena isn't just facing other optical networking companies anymore.

Ciena anticipates facing a more diverse set of competitors. This includes not only traditional IP router vendors but also system integrators, and importantly, IT and software companies. This shift necessitates a broader, more adaptable competitive strategy that moves beyond Ciena's established strengths in optical networking alone.

For example, in 2024, the telecommunications infrastructure market saw significant investments in software-defined networking (SDN) and network function virtualization (NFV), areas where IT and software vendors have traditionally excelled. Ciena’s own financial reports for fiscal year 2024 highlight their increased focus on software solutions, indicating a strategic response to this evolving competitive landscape. The company is actively developing and acquiring capabilities to address these new competitive pressures.

- Convergence: Network technologies, features, and layers are merging, bringing different types of players into competition.

- Software Management: Unified software control is a key driver of this convergence, blurring traditional industry lines.

- New Competitors: Ciena expects to increasingly compete with IP router vendors, system integrators, and IT/software companies.

- Strategic Shift: This broadening landscape requires Ciena to diversify its competitive strategy beyond its core optical networking business.

Competitive rivalry is a defining characteristic of Ciena's operating environment, marked by the presence of major global players like Ericsson, Nokia, Huawei, Juniper Networks, and Cisco. This intense competition, driven by rapid technological advancements and customer demand for innovative solutions, forces companies to constantly invest in research and development to maintain market share and profitability.

The market's dynamic nature means that success often hinges on adapting to evolving customer needs and regional economic conditions. For instance, Ciena observed in 2024 that macroeconomic uncertainties in Europe led to a more cautious spending approach by service providers, impacting order volumes in that region.

Furthermore, the convergence of network technologies is broadening the competitive landscape, bringing in IT and software companies alongside traditional hardware vendors. This necessitates a strategic evolution for Ciena, moving beyond its core optical networking strengths to encompass a wider range of solutions and capabilities.

| Competitor | Key Offerings | 2024 Market Focus |

|---|---|---|

| Ericsson | 5G infrastructure, Cloud core, Managed services | Expanding enterprise 5G, Cloud-native solutions |

| Nokia | Optical networking, IP routing, Software solutions | Network automation, Edge computing, 5G SA deployment |

| Huawei | Broad portfolio including optical, wireless, IP | Continued focus on 5G, enterprise solutions (where permitted) |

| Juniper Networks | IP routing, Switching, Security | AI-driven enterprise networking, Cloud-native platforms |

| Cisco | Networking hardware, Software, Security | Hybrid cloud, IoT, AI-powered networking solutions |

SSubstitutes Threaten

Software-Defined Networking (SDN) and Network Function Virtualization (NFV) pose a substantial threat by allowing network functions to be handled by software instead of specialized hardware. This shift can diminish the demand for Ciena's traditional networking equipment.

While Ciena's Blue Planet automation software addresses this trend, the increasing popularity of open-source SDN solutions and virtualized network functions could lessen the need for proprietary hardware. This directly impacts Ciena's core equipment revenue streams.

The SDN market is experiencing robust growth, with major contributions from large enterprises and cloud service providers. For instance, the global SDN market was valued at approximately $19.5 billion in 2023 and is expected to reach over $100 billion by 2030, showcasing a significant market shift.

The rise of cloud-based infrastructure presents a significant threat of substitution for traditional on-premise hardware. As more businesses embrace cloud computing, they can increasingly source network services directly from cloud providers, potentially reducing their reliance on equipment manufacturers like Ciena for certain deployments. This shift allows customers to access scalable and flexible network capabilities without substantial upfront hardware investments.

However, this trend also offers Ciena an opportunity. By providing the essential optical and networking hardware that underpins these cloud data centers, Ciena can still capture value. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, highlighting the immense scale of infrastructure required to support these services. Ciena's role in supplying this foundational technology is crucial.

While Ciena's optical solutions are crucial for 5G backhaul, the increasing capabilities of wireless technologies, including future iterations beyond 5G, present a potential threat. These advancements could offer alternative connectivity in certain use cases, although the fundamental need for high-capacity optical networks to support these wireless innovations remains. The optical networking market, in fact, saw significant growth driven by 5G deployments, with global spending on 5G infrastructure projected to reach hundreds of billions by 2024.

Alternative Data Transmission Technologies

While fiber optics remains dominant for Ciena's high-capacity network solutions, alternative data transmission technologies pose a potential, albeit currently niche, threat. Enhanced copper solutions offer viable options for shorter-range data transfer, and emerging technologies like quantum communication are poised for significant growth, with the quantum communication market projected to expand considerably in the coming years.

These alternatives, though not directly competing at Ciena's core operational scale today, represent areas where innovation could shift market dynamics. For instance, advancements in copper could reduce reliance on fiber in specific, less demanding applications. The burgeoning quantum communication sector, while still in its early stages, signals a future where entirely new paradigms of data transmission might emerge, potentially impacting even high-capacity networks.

- Fiber Optics Dominance: Ciena's core business relies on fiber optics for high-capacity, long-distance data transmission, a technology that currently offers unparalleled speed and bandwidth.

- Niche Alternatives: Enhanced copper solutions serve as substitutes for shorter distances, and future technologies like quantum communication present a longer-term, potentially disruptive threat.

- Quantum Communication Growth: The quantum communication market is anticipated to see substantial growth, indicating a future where these alternative technologies could become more significant.

In-house Network Development by Hyperscalers

Hyperscalers, like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are increasingly investing in proprietary network infrastructure. This in-house development acts as a significant substitute threat to companies like Ciena, as these tech giants aim to control their network architecture and reduce dependency on third-party suppliers. For instance, in 2023, AWS announced further expansion of its custom silicon development, including networking chips, signaling a deeper dive into self-sufficiency.

This strategic shift by major cloud providers means they may opt to build rather than buy networking solutions, directly impacting Ciena's market share. While this presents a long-term substitute threat, it also opens avenues for Ciena to supply specialized components or offer integration services for these custom-built networks. The ongoing trend shows a clear move towards vertical integration within the hyperscale sector.

- Hyperscaler Investment in Custom Silicon: Major cloud providers are dedicating substantial R&D budgets to develop their own networking hardware and software, exemplified by continued advancements in custom silicon for networking functions.

- Reduced Reliance on External Vendors: This in-house development strategy directly reduces the addressable market for traditional networking equipment vendors like Ciena.

- "Build vs. Buy" Decision: The increasing capability and willingness of hyperscalers to build their own solutions present a powerful substitute threat, potentially eroding market share.

- Opportunities for Specialized Solutions: Despite the threat, Ciena can capitalize by providing niche components, advanced software, or integration expertise for these bespoke hyperscale networks.

The rise of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) presents a significant substitute threat, as these technologies allow network functions to be managed by software rather than specialized hardware, potentially reducing demand for Ciena's traditional equipment. The global SDN market, valued at approximately $19.5 billion in 2023, is projected to exceed $100 billion by 2030, indicating a substantial shift towards software-centric networking solutions.

Cloud computing infrastructure also acts as a substitute, enabling businesses to access network services from cloud providers, thereby lessening their reliance on hardware manufacturers like Ciena for certain deployments. The vast scale of the cloud computing market, projected to surpass $1.3 trillion in 2024, underscores the potential for cloud services to replace on-premise hardware solutions.

Hyperscalers' increasing investment in proprietary network infrastructure, including custom silicon for networking, directly substitutes for third-party vendor solutions. This trend towards vertical integration by major cloud providers means they may choose to build their own network architectures, reducing the addressable market for companies like Ciena.

| Threat Category | Key Substitute Technologies/Trends | Market Context/Data | Impact on Ciena |

|---|---|---|---|

| Software-Defined Networking (SDN) & Network Function Virtualization (NFV) | Software-based network management, virtualized network functions | Global SDN market: ~$19.5 billion (2023), projected >$100 billion (2030) | Reduced demand for specialized hardware, potential shift in revenue streams |

| Cloud Computing | Network services sourced from cloud providers | Global cloud computing market: Projected >$1.3 trillion (2024) | Decreased reliance on hardware for certain deployments, shift to service-based models |

| Hyperscaler In-house Development | Proprietary network infrastructure, custom silicon development | Continued investment in custom networking chips by major cloud providers (e.g., AWS) | Erosion of market share for traditional vendors, "build vs. buy" dynamic |

Entrants Threaten

The telecommunications networking equipment sector, especially optical and packet networking, demands substantial capital for R&D, production, and patents. This high cost of entry acts as a significant deterrent for newcomers looking to compete.

Ciena's commitment to innovation is evident in its $633 million R&D investment in 2023, equating to 16.4% of its revenue. Such substantial spending creates a formidable financial hurdle for any new player aiming to enter the market and challenge established companies.

The intricate nature of developing advanced networking technologies, such as coherent optics and software-defined networking, presents a significant hurdle for potential new entrants. Ciena, for instance, invests heavily in research and development, with R&D expenses totaling $778 million in fiscal year 2023, underscoring the specialized knowledge and capital required.

Established players like Ciena benefit from deeply entrenched customer relationships, often cultivated over many years with key service providers and large enterprises. These strong ties, built on trust and proven performance, create significant barriers for newcomers.

The integration of Ciena's solutions into existing network infrastructures is often complex and costly, leading to vendor lock-in. For instance, a service provider heavily invested in Ciena's optical networking hardware and software may face substantial switching costs, hindering the adoption of alternative solutions from new entrants.

Economies of Scale and Experience Curve Effects

Incumbent companies in the telecommunications equipment sector, like Ciena, benefit significantly from economies of scale. This allows them to spread fixed costs over a larger production volume, leading to lower per-unit costs in manufacturing, procurement of raw materials, and distribution networks. For instance, a major player might secure bulk discounts on optical components that a new entrant, starting with smaller orders, simply cannot match, directly impacting their ability to compete on price.

Furthermore, established firms possess a deep experience curve. Over years of operation, they've optimized production processes, improved product reliability, and developed efficient supply chains. Ciena, for example, has decades of experience in designing, manufacturing, and deploying complex networking solutions. This accumulated know-how translates into higher quality products and more efficient operations, creating a substantial barrier for newcomers who would face a steep learning curve and significant investment to reach comparable levels of efficiency and product maturity.

- Economies of Scale: Lower per-unit costs for established players due to high-volume production and purchasing power.

- Experience Curve Effects: Incumbents leverage refined processes and technologies developed over time, offering a competitive advantage in efficiency and product quality.

- Pricing Power: Lower cost structures enable incumbents to offer more aggressive pricing, making it difficult for new entrants to gain market share.

- R&D Investment: Larger companies can invest more in research and development, further widening the technological gap and increasing the barrier to entry.

Regulatory Hurdles and Compliance Requirements

The telecommunications sector, including companies like Ciena, is heavily regulated. New entrants must contend with a labyrinth of compliance standards, licensing, and certification processes. For instance, in 2024, navigating spectrum allocation and data privacy laws, such as GDPR and its global counterparts, presents substantial upfront costs and delays for any potential competitor aiming to enter the market.

These regulatory hurdles significantly increase the barrier to entry. Companies must invest heavily in legal expertise and compliance infrastructure to even begin operations. This complexity means that new players face a steep learning curve and considerable financial commitment before they can offer competitive services, thereby protecting established firms.

- Complex Licensing: Obtaining necessary operating licenses can be a lengthy and expensive process, often involving government auctions or tenders.

- Spectrum Access: Securing radio frequency spectrum, crucial for wireless services, is a major hurdle, with licenses frequently costing billions of dollars.

- Data Privacy & Security: Adhering to stringent data protection regulations (e.g., CCPA, GDPR) requires significant investment in cybersecurity and compliance frameworks.

- Interconnection Standards: Meeting technical and operational standards for interconnecting with existing networks adds another layer of complexity and cost.

The threat of new entrants in the telecommunications networking equipment sector, where Ciena operates, is generally low due to significant barriers. These include the immense capital required for research and development, production, and patent acquisition, as demonstrated by Ciena's substantial R&D investments. For example, Ciena's fiscal year 2023 R&D spending reached $778 million, a clear indicator of the financial muscle needed to compete technologically.

Economies of scale and experience curve effects further solidify this low threat. Established players like Ciena benefit from lower per-unit costs due to high-volume production and optimized processes honed over years. This cost advantage, coupled with strong customer relationships and the complexity of integrating new solutions into existing networks, makes it difficult for newcomers to gain a foothold.

Regulatory complexities, including licensing and compliance with data privacy laws, also act as a substantial deterrent. Navigating these requirements demands significant investment in legal and technical expertise, adding considerable upfront costs and delays for any potential competitor. For instance, in 2024, adherence to evolving data privacy regulations presents ongoing challenges and costs.

| Barrier Type | Description | Example Impact on New Entrants |

| Capital Requirements | High costs for R&D, manufacturing, and patents. | Ciena's FY23 R&D of $778M sets a high bar for innovation investment. |

| Economies of Scale | Lower per-unit costs for high-volume producers. | New entrants struggle to match bulk purchasing discounts on components. |

| Customer Relationships & Switching Costs | Established trust and complex integration create vendor lock-in. | Service providers face significant costs to replace Ciena's embedded solutions. |

| Regulatory Hurdles | Complex licensing, spectrum access, and data privacy compliance. | 2024 regulations require substantial investment in legal and compliance infrastructure. |

Porter's Five Forces Analysis Data Sources

Our Ciena Porter's Five Forces analysis is built on data from Ciena's investor relations website, annual reports, and SEC filings, alongside industry analysis from firms like IDC and Gartner. We also incorporate market share data and competitor announcements to provide a comprehensive view.