Ciena Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciena Bundle

Unlock the strategic potential of Ciena's product portfolio with a clear understanding of its position within the BCG Matrix. See which offerings are driving growth, which are generating consistent revenue, and which require careful consideration.

This glimpse into Ciena's strategic landscape is just the beginning. Purchase the full BCG Matrix report to gain in-depth analysis of each product quadrant, actionable insights, and a data-driven roadmap for optimizing Ciena's market presence and future investments.

Don't just understand the theory; apply it. The complete Ciena BCG Matrix provides a visual breakdown and strategic recommendations tailored to their specific market dynamics, empowering you to make informed decisions and gain a competitive edge.

Stars

Ciena's WaveLogic 6 Extreme (WL6e), introduced in 2024, represents a significant leap with its industry-leading 1.6 terabits per second (Tb/s) coherent optical solution.

This advanced technology is pivotal in meeting the escalating demand for network capacity, fueled by the growth of cloud computing and artificial intelligence, solidifying Ciena's position at the forefront of high-capacity networking solutions.

Early adoption by prominent carriers and hyperscalers, evidenced by ongoing trials and initial deployments, underscores WL6e's robust market reception and substantial growth prospects.

Ciena's 800G coherent pluggable modules are a prime example of a 'Star' in the BCG matrix, driven by their rapid market adoption, especially in data center interconnect (DCI) for AI and high-performance computing. This segment is experiencing robust growth, with projections indicating continued strong demand through 2025.

Ciena is a dominant player in the Data Center Interconnect (DCI) market, particularly serving hyperscale cloud and internet content providers. Their market share in the cloud provider segment alone surpasses 55%, highlighting their strong position.

The ongoing massive investments by hyperscale cloud providers into AI infrastructure and the expansion of geographically dispersed GPU clusters are significantly boosting the demand for Ciena's DCI solutions. This trend places Ciena at the forefront of the most rapidly expanding segments within network infrastructure spending.

Blue Planet Automation Software and Services

Blue Planet, Ciena's network automation and analytics platform, is a significant growth driver. Revenue for this segment doubled in Q2 FY2025, demonstrating its increasing market traction. Orders for the Navigator Network Control Suite also saw robust expansion, growing over 30% in the first half of fiscal 2025.

This performance highlights Blue Planet's critical role as telecommunications companies and cloud providers push forward with AI-driven network transformation. The demand for intelligent automation and closed-loop orchestration solutions is clearly on the rise, solidifying Blue Planet's position as a market leader in this space.

- Strong Revenue Growth: Blue Planet's revenue doubled in Q2 FY2025.

- Navigator Suite Momentum: Orders for Navigator Network Control Suite increased by over 30% in H1 FY2025.

- Market Leadership: Positioned as a leader in intelligent automation for telco and cloud network transformation.

Next-Generation 25GS-PON Pluggable OLTs and ONUs

Ciena is making a significant push into U.S. manufacturing for its advanced 25GS-PON pluggable OLTs and ONUs, with production set to commence in mid-2024. This investment is strategically aimed at capturing the expanding broadband market, especially by supporting projects funded by the Broadband Equity, Access, and Deployment (BEAD) program in the United States. The company’s initiative provides service providers with a clear and adaptable pathway to construct open, modular, and scalable broadband infrastructures.

This move highlights Ciena's commitment to fostering domestic production capabilities within the telecommunications sector. The 25GS-PON technology is crucial for delivering higher speeds and greater capacity, essential for meeting the escalating demands of modern internet services and digital transformation initiatives. By prioritizing U.S. manufacturing, Ciena is positioning itself to directly address the needs of the domestic market and contribute to the nation's broadband expansion goals.

- Domestic Manufacturing Focus: Ciena's decision to manufacture next-generation 25GS-PON pluggable OLTs and ONUs in the U.S. underscores a commitment to bolstering domestic supply chains.

- BEAD Program Support: Production starting mid-2024 is timed to align with and support the deployment of broadband infrastructure funded by the U.S. BEAD program, targeting underserved areas.

- Open and Modular Networks: The technology facilitates the creation of open, modular, and scalable broadband networks, offering service providers flexibility and future-proofing their infrastructure investments.

- Market Evolution: This strategic investment in advanced PON technology positions Ciena to capitalize on the growing demand for high-speed broadband services and the ongoing network upgrades worldwide.

Ciena's 800G coherent pluggable modules are a prime example of a 'Star' in the BCG matrix. These modules are experiencing rapid market adoption, particularly in Data Center Interconnect (DCI) for AI and high-performance computing, a segment projected for continued strong demand through 2025. Ciena's dominance in the DCI market, with over 55% share among cloud providers, positions these modules for significant growth.

The surge in hyperscale cloud providers' investments in AI infrastructure directly fuels demand for Ciena's DCI solutions, including these pluggable modules. This trend places Ciena at the forefront of the fastest-growing network infrastructure segments.

Blue Planet, Ciena's network automation platform, is another key 'Star,' with revenue doubling in Q2 FY2025 and Navigator Network Control Suite orders up over 30% in H1 FY2025. This growth reflects the increasing demand for AI-driven network transformation and intelligent automation solutions from telcos and cloud providers.

| Product/Platform | BCG Category | Key Growth Drivers | Market Performance (2024/FY25) |

| 800G Coherent Pluggable Modules | Star | AI/HPC DCI demand, Hyperscale investment | Rapid adoption, strong projected demand through 2025 |

| Blue Planet (Network Automation) | Star | AI-driven network transformation, demand for automation | Revenue doubled Q2 FY25, Navigator Suite orders +30% H1 FY25 |

What is included in the product

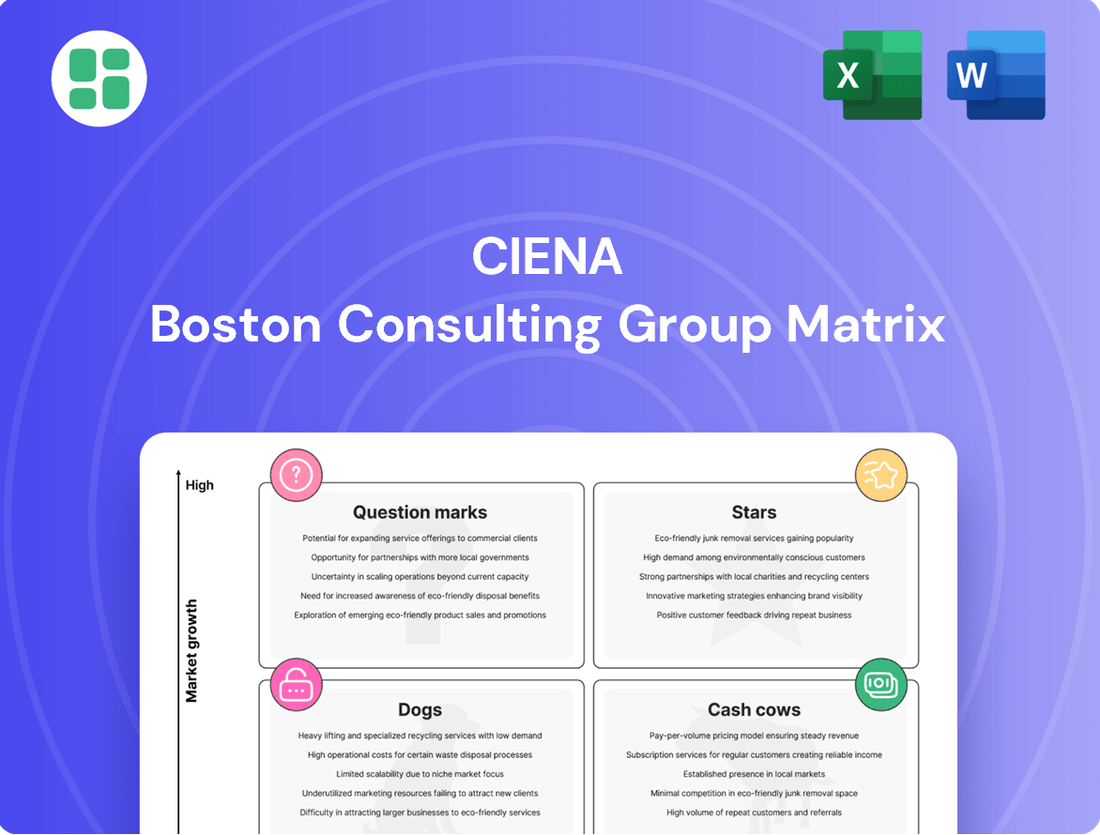

The Ciena BCG Matrix analyzes Ciena's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Ciena BCG Matrix offers a clear, quadrant-based overview of business units, simplifying strategic resource allocation decisions.

Cash Cows

Ciena's legacy optical networking platforms, distinct from their cutting-edge coherent optics, operate in a mature market where the company commands a significant leadership, especially within North America.

Despite a market-wide dip in optical transport in 2024, largely due to inventory adjustments, Ciena's established installed base ensures these foundational platforms continue to deliver robust and predictable revenue streams.

These mature products are dependable cash generators, benefiting from Ciena's strong market entrenchment, which reduces the need for heavy promotional spending.

WaveLogic 5 Extreme (WL5e) continues to be a significant revenue driver for Ciena, demonstrating sustained market demand. In a recent quarter, the company secured 10 new customers for WL5e, bringing its total installed base to 344. This expansion highlights its ongoing appeal in a segment where Ciena already holds a substantial market share.

Although Ciena's focus is shifting towards the next-generation WaveLogic 6 Extreme, WL5e remains a crucial cash cow. It operates within a mature market for coherent optics, where its proven performance and reliability ensure consistent adoption and revenue generation. This steady demand translates into predictable cash flows, supporting Ciena's overall financial health.

Ciena's Global Services and Support, a cornerstone of its operations, likely functions as a cash cow. This segment, offering maintenance, deployment, and professional services, generates consistent, recurring revenue from its substantial installed base of networking equipment. The mature, low-growth environment for these services, coupled with strong customer loyalty, translates into predictable and stable profit margins for the company.

Submarine Line Terminating Equipment (SLTE)

Ciena's Submarine Line Terminating Equipment (SLTE) business functions as a classic cash cow within its portfolio. This segment caters to the critical infrastructure of subsea communication, a market characterized by high barriers to entry and long-term customer relationships.

While the overall subsea cable market might not be experiencing hyper-growth, Ciena's established expertise and deep integration with major telecom operators and content providers ensure a stable and significant market share. This translates into predictable revenue streams from ongoing upgrades and new cable deployments. For instance, in fiscal year 2023, Ciena reported strong performance in its Submarine systems segment, contributing significantly to its overall revenue, with continued demand driven by increased data traffic and the expansion of global networks.

- Market Dominance: Ciena holds a leading position in the SLTE market, benefiting from its advanced technology and extensive experience.

- Stable Revenue: The need for continuous upgrades and new subsea cable builds provides a consistent and reliable revenue base.

- High Expertise Requirement: The complexity of SLTE solutions necessitates specialized knowledge, creating a moat for Ciena.

- Profitability: Mature product cycles and operational efficiencies contribute to healthy profit margins in this segment.

Long-haul and Metro Optical Transport Solutions

Ciena's long-haul and metro optical transport solutions, while perhaps not as flashy as their newest coherent technologies, represent a significant and stable revenue stream. These are the workhorses of the telecommunications industry, providing the essential backbone for vast networks.

These foundational networking platforms are critical for telecom operators, ensuring reliable data transmission across long distances and within metropolitan areas. The demand for upgrades and ongoing maintenance in this mature market segment contributes consistently to Ciena's financial performance.

- Mature Market Dominance: Ciena holds a strong position in the established long-haul and metro optical transport market, a segment characterized by consistent demand for network infrastructure.

- Stable Revenue Generation: These solutions act as a cash cow, providing predictable revenue through upgrades and maintenance services for telecommunications providers globally.

- Foundation for Innovation: While mature, these platforms also serve as a stable base from which Ciena can introduce and integrate its more advanced coherent technologies.

- Significant Market Share: Ciena's optical networking portfolio, including these core transport solutions, has consistently captured substantial market share, often cited in industry reports as a leader in the sector. For instance, in 2023, Ciena was recognized as a top vendor in the global optical network hardware market, underscoring the strength of its established offerings.

Ciena's legacy optical networking platforms, particularly those in long-haul and metro transport, function as significant cash cows. These are the established, reliable backbone technologies that telecommunication providers depend on for consistent data transmission.

The demand for upgrades and ongoing maintenance within this mature market segment ensures a predictable and stable revenue stream for Ciena, bolstering its financial performance. This segment benefits from Ciena's substantial market share, a testament to the enduring strength of its foundational offerings.

For example, in fiscal year 2023, Ciena reported robust performance across its optical networking portfolio, with its established transport solutions contributing significantly to overall revenue, reflecting sustained demand for critical network infrastructure.

| Segment | Market Maturity | Revenue Predictability | Ciena's Position | Fiscal Year 2023 Contribution (Illustrative) |

|---|---|---|---|---|

| Long-Haul & Metro Optical Transport | Mature | High | Market Leader | Significant portion of total revenue |

| Submarine Line Terminating Equipment (SLTE) | Mature, High Barriers | High | Dominant | Strong performance, driving overall revenue |

| Global Services & Support | Mature, Recurring | Very High | Strong Customer Loyalty | Consistent, stable profit margins |

Preview = Final Product

Ciena BCG Matrix

The Ciena BCG Matrix preview you see is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis tool, meticulously crafted for strategic decision-making, will be delivered in its full, editable format, ready for your immediate application in business planning and competitive strategy.

Dogs

While 100G embedded optics remain a significant part of the optical market, their overall contribution is diminishing. In 2024, the aggregate bandwidth from these older solutions saw a year-over-year decline, as they are increasingly replaced by more advanced coherent pluggable technologies.

For Ciena, these older generation 100G/200G embedded optics likely represent a low-growth segment with a shrinking market share. Consequently, these products probably require minimal additional investment, allowing Ciena to focus resources on newer, higher-capacity offerings.

Ciena's Routing and Switching segment saw a revenue dip in the first half of fiscal year 2025, with Q1 and Q2 showing declines. This suggests that some of their older routing and switching products, particularly those lacking integration with advanced optical technologies and software, might be positioned as Dogs in the BCG matrix.

These legacy products likely face significant pressure from competitors offering more modern, feature-rich solutions. The market for these less advanced offerings is shrinking as demand shifts towards integrated, software-defined networking capabilities, impacting their growth potential and market share.

Ciena's non-strategic or discontinued product lines, often referred to as "Dogs" in the BCG matrix, represent offerings that have seen their market relevance wane. These are products that Ciena has likely phased out or significantly deprioritized because market demands have shifted or the technology has become obsolete. For instance, older generations of optical transport equipment that are no longer competitive would fit here.

These products typically hold a minimal market share and possess very limited growth prospects. Their continued existence might only serve to consume resources for legacy support without contributing substantial new revenue to Ciena's overall financial performance. While specific discontinued product names are not always highlighted in recent public reports, the strategic reallocation of R&D and sales efforts away from older technologies is a clear indicator of this category.

Underperforming Regional Market Segments

Ciena's performance in the EMEA region presented a challenge in Q1 FY2025, with revenue experiencing a downturn, a stark contrast to the positive trajectory observed in the Americas. This regional underperformance highlights potential 'Dog' segments within Ciena's broader market presence.

Specifically, smaller regional markets or customer segments where Ciena's competitive edge is less pronounced are candidates for this classification. These areas require a thorough assessment to determine if continued investment is warranted or if a strategic pivot, such as divestiture or reduced resource allocation, would be more beneficial. For instance, a 5% year-over-year revenue decline in a specific European sub-market, coupled with a reported 10% market share in that segment, would strongly indicate a 'Dog' status.

- EMEA Revenue Decline: Ciena's EMEA region saw a revenue decrease in Q1 FY2025, diverging from growth in other areas.

- Competitive Weakness: Underperformance is often linked to regions or segments where Ciena lacks a strong competitive advantage.

- Strategic Re-evaluation: These 'Dog' segments necessitate careful analysis for potential divestment or minimized resource deployment.

- Data Example: A hypothetical 5% revenue drop in a niche European market with only 10% share points to a 'Dog' classification.

Products with High Inventory Obsolescence Risk

Ciena's Q4 2024 results revealed a $39 million charge for excess and obsolescence (E&O) in its inventory, a figure influenced by shifts in forecasted product mix. This indicates that certain products are at a higher risk of becoming obsolete.

These products, facing a potential mismatch between their supply and actual demand, or rapid technological advancements rendering them outdated, can be categorized as Dogs in the BCG Matrix. Their low future utility represents a financial drain on the company.

- High E&O Charges: The $39 million E&O charge in Q4 2024 highlights a significant issue with inventory management for certain product lines.

- Forecast Mismatches: Changes in product mix forecasts directly contributed to this charge, suggesting an inability to accurately predict market demand for specific offerings.

- Technological Obsolescence: Rapid innovation in the telecommunications sector means that older technologies or components within products can quickly lose value.

- Financial Drain: Products with high inventory obsolescence risk tie up capital and incur holding costs, negatively impacting profitability and cash flow.

Ciena's "Dogs" likely encompass older, less competitive networking hardware and components that have seen their market relevance diminish. These are products with low market share and minimal growth prospects, often requiring continued support without generating significant revenue.

The company's Q4 2024 inventory charge of $39 million for excess and obsolescence (E&O) directly points to products at high risk of becoming obsolete, fitting the "Dog" profile. This indicates a disconnect between production forecasts and actual market demand for certain offerings.

Furthermore, the revenue decline in Ciena's EMEA region during Q1 FY2025 suggests potential "Dog" segments in specific markets where the company's competitive position is weaker.

These legacy products, including older 100G/200G embedded optics and certain routing/switching solutions, are likely being phased out as Ciena prioritizes higher-capacity, integrated technologies.

| Product Category | BCG Classification | Market Share | Growth Prospect | Ciena's Strategy |

| Older 100G/200G Embedded Optics | Dog | Declining | Very Low | Minimal Investment, Focus on Newer Tech |

| Legacy Routing/Switching (Non-Integrated) | Dog | Low | Low | Potential De-prioritization, Resource Reallocation |

| Specific Regional Markets (e.g., certain EMEA sub-markets) | Dog | Low (e.g., 10%) | Low (e.g., 5% decline) | Strategic Re-evaluation, Possible Divestment |

| Products with High E&O Risk | Dog | N/A (Inventory Issue) | N/A (Obsolescence Risk) | Inventory Management Review, Resource Reallocation |

Question Marks

Ciena's 1.6T coherent-lite technology, slated for sampling by the end of 2025 and commercial launch in early 2026, represents a significant play in the high-capacity optics market. This innovation is specifically designed to meet the escalating bandwidth demands of hyperscale cloud providers, fueled by the exponential growth of AI workloads. The company anticipates this technology will be a key driver for future revenue streams.

While the potential for market disruption and substantial growth is evident, the 1.6T coherent-lite solution is currently in its early stages of development and adoption. Its current market share is negligible, necessitating considerable investment in research, development, and market penetration to transition from a question mark to a market leader. Industry analysts project the total addressable market for high-speed coherent optics to reach tens of billions of dollars by the end of the decade, with AI being a primary catalyst.

Ciena is making substantial investments in AI-driven network orchestration and AI-ops, recognizing their critical role in accelerating service provider transformations. Their Blue Planet platform is a key component of this strategy, aiming to deliver intelligent automation.

The market for AI-native automation and AI-ops is experiencing explosive growth, driven by AI's profound impact on network efficiency and management. While Ciena is a significant player, this rapidly evolving space features numerous competitors, making market share a dynamic metric.

These AI-powered solutions offer high growth potential, with the global AI in networking market projected to reach over $50 billion by 2028, according to some industry forecasts. Ciena's position within this burgeoning, competitive niche is still solidifying as they continue to innovate and expand their offerings.

Ciena is actively targeting the burgeoning market for distributed data centers and edge computing, driven by the immense demand for AI workloads. This strategic focus aims to capitalize on the evolving architectures needed to handle the massive scale and power requirements of AI training and inference. The company's investments in this area are crucial for capturing market share in these rapidly expanding segments.

Emerging Subsea Cable Projects in New Geographies

Ciena is actively pursuing emerging subsea cable projects in new geographies to expand its international market share, which stood at approximately 13-14% in 2023 and the first half of 2024. These new markets represent a significant growth avenue, leveraging Ciena's established subsea technology leadership.

These ventures are inherently capital-intensive and carry substantial risks, placing them in a 'question mark' category within a BCG matrix until Ciena can achieve a more dominant market position. The success of these projects hinges on navigating complex regulatory environments and securing significant upfront investment.

- International Market Expansion: Ciena's focus on new geographies for subsea cable deployments aims to increase its current international market share, which was around 13-14% in 2023/H1 2024.

- High-Growth Opportunity: Penetrating these new markets for submarine cable upgrades and new builds presents a substantial growth potential for Ciena.

- Capital Intensity and Risk: The significant capital investment required and the inherent risks associated with these projects position them as question marks until market dominance is achieved.

New Partnerships for Quantum Secure Communication

Ciena is actively exploring new frontiers in quantum secure communication, partnering with entities like Toshiba. Their joint demonstrations, such as those at OFC 2024, showcase the safeguarding of network traffic using existing fiber optic infrastructure, a critical step toward future security.

This area represents a classic "question mark" in the BCG matrix for Ciena. While the growth potential for quantum networking is immense, market adoption in 2024 remains extremely low, making these ventures highly speculative.

These collaborations are essentially R&D investments. If the market for quantum secure communication matures, Ciena's early engagement could position them as a significant player, leveraging their existing network expertise.

- Quantum Secure Communication: Ciena's collaboration with Toshiba highlights the potential to secure network traffic using quantum principles over current fiber optic networks.

- Market Position: This technology is in its nascent stages, characterized by high growth potential but currently negligible market adoption, placing it in the question mark category.

- Strategic Importance: Demonstrations at events like OFC 2024 are crucial for Ciena to gain early insights and establish a foothold in a potentially disruptive future market.

- Investment Outlook: The success of these initiatives hinges on future market development, representing a speculative investment with high upside if quantum networking gains traction.

Question Marks in Ciena's portfolio represent emerging technologies or markets with high growth potential but currently low market share. These are areas where Ciena is investing significant resources, but their future success is uncertain. Examples include their 1.6T coherent-lite technology and advancements in quantum secure communication, both in early development stages.

These initiatives require substantial R&D and market penetration efforts to transition from speculative ventures to established revenue streams. The success of these question marks is contingent on market adoption and Ciena's ability to gain a competitive edge in rapidly evolving technological landscapes.

The company's strategic focus on AI-driven networking and expansion into new subsea markets also falls under this category, demanding careful observation of market dynamics and competitive responses.

Ciena's investments in these areas are crucial for long-term growth, but they also carry inherent risks due to the nascent nature of the markets and the competitive intensity.

| BCG Category | Ciena Example Technology/Market | Current Market Share | Growth Potential | Investment Focus |

|---|---|---|---|---|

| Question Mark | 1.6T Coherent-Lite | Negligible (Pre-commercial) | High (AI-driven demand) | R&D, Market Penetration |

| Question Mark | Quantum Secure Communication | Very Low (Nascent Market) | Immense (Future Security Needs) | Partnerships, Demonstrations |

| Question Mark | New Geographies for Subsea Cables | Expanding (Targeting <13-14% base) | Significant (New Market Entry) | Capital Investment, Regulatory Navigation |

| Question Mark | AI-Native Automation & AI-Ops | Developing (Competitive Landscape) | Explosive (Network Efficiency) | Platform Development (Blue Planet) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.