CIE Automotive SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

CIE Automotive's strengths lie in its diversified product portfolio and strong global presence, but its reliance on specific automotive markets presents a significant threat. Uncover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

CIE Automotive's global footprint across key automotive markets, including Europe, North America, and Asia, provides a significant advantage. This geographical spread, coupled with their mastery of diverse manufacturing technologies such as forging, casting, machining, and injection molding, allows them to weather regional economic fluctuations and adapt to varied market demands. For instance, in 2023, CIE Automotive reported a 14% increase in revenue, with their international operations playing a crucial role in this growth, demonstrating the resilience of their diversified strategy.

CIE Automotive has showcased impressive financial strength, highlighted by a record net profit of 326 million euros in 2024. This represents a nearly 5% increase over 2023 figures when considering a comparable operational scope.

The company's ability to generate substantial cash flow has been a key driver of its success. This robust cash generation has enabled CIE Automotive to reduce its financial leverage to historic lows.

These financial achievements are a testament to the effectiveness of their management strategies and their solid standing within the competitive global automotive sector.

CIE Automotive's dedication to innovation and sustainability is a significant strength. The company is actively developing solutions for the growing electric vehicle market, aligning its strategy with future mobility trends.

Their commitment is underscored by validation of near-term and net-zero targets by the Science Based Targets initiative (SBTi). This focus on R&D and engineering aims to minimize environmental impact, supporting the transition to sustainable transportation.

In 2024, nearly 15% of CIE Automotive's revenue was derived from environmentally sustainable product lines, demonstrating the tangible commercial success of their green initiatives.

Adaptability to EV Transition and Lightweighting Trends

CIE Automotive is strategically positioning itself to capitalize on the automotive industry's shift towards electric vehicles (EVs) and the increasing emphasis on lightweighting. The company is actively retooling its manufacturing and product development to meet these evolving demands.

Their efforts include developing specialized components for EV transmissions and substituting heavier traditional parts with lighter alternatives. For instance, they are incorporating aluminum forged parts and specific steel grades designed for EV applications, demonstrating a clear commitment to this transition.

Furthermore, CIE Automotive's expertise in plastic injection technology is a significant asset, as this is a critical area for many EV components. This focus ensures they remain competitive in a rapidly changing market.

- EV Component Development: CIE Automotive is enhancing its portfolio with parts specifically engineered for electric vehicle powertrains.

- Lightweighting Solutions: The company is replacing heavier materials with aluminum and specialized steel to improve EV efficiency.

- Plastic Injection Expertise: Their strong capabilities in plastic injection molding are directly applicable to the growing needs of the EV sector.

Established Customer Relationships and Strategic Positioning

CIE Automotive boasts deeply entrenched relationships with major global Original Equipment Manufacturers (OEMs) and Tier-1 suppliers, a testament to their reliability and value. This established customer base provides a stable foundation for continued business and growth.

Their strategic positioning is further reinforced by ongoing investments and acquisitions, particularly in key regions like the Basque Country, which enhances their capabilities and market access. These actions solidify CIE Automotive's standing as a critical and preferred partner within the automotive supply chain.

- Global OEM Partnerships: CIE Automotive is a key supplier to leading automotive brands worldwide, underscoring the strength and longevity of these relationships.

- Strategic Regional Investments: Continued investment in areas like the Basque Country demonstrates a commitment to strengthening operational hubs and expanding market influence.

- Reference Supplier Status: The company's consistent performance and strategic growth have positioned it as a reference supplier, sought after by major industry players.

CIE Automotive's diversified global presence across Europe, North America, and Asia, coupled with its advanced manufacturing capabilities, provides significant resilience against regional economic downturns. The company's record net profit of 326 million euros in 2024, a nearly 5% increase from 2023, underscores its robust financial health and effective management. This strong financial performance is further bolstered by substantial cash flow generation, which has allowed CIE Automotive to achieve historically low financial leverage.

| Metric | 2023 (Approx.) | 2024 (Reported) |

|---|---|---|

| Revenue Growth | 14% | N/A (Growth driven by international operations) |

| Net Profit | ~311 million euros | 326 million euros |

| Financial Leverage | Historic Lows | Historic Lows |

What is included in the product

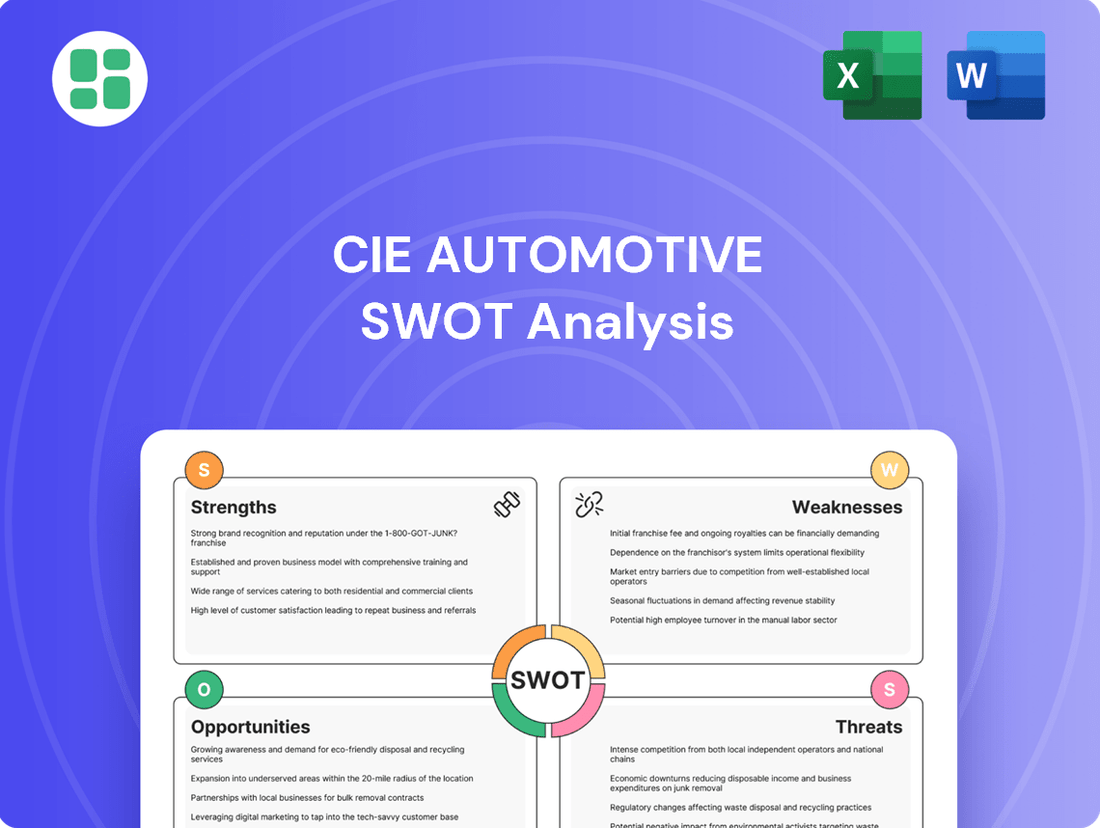

Analyzes CIE Automotive’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address CIE Automotive's strategic challenges and opportunities.

Weaknesses

CIE Automotive's significant reliance on the automotive industry, despite its diversification efforts, exposes it to the sector's inherent volatility. This dependence means that downturns in global vehicle production, such as the projected slowdown in 2024, can directly curtail CIE's sales and operational performance, especially in markets already experiencing economic headwinds.

CIE Automotive's European segment has been a notable weak point, particularly in 2024. While its Indian operations are experiencing robust expansion, Europe has grappled with declining sales and shrinking EBITDA margins. These challenges are partly attributed to significant restructuring expenses and a subdued performance in both the light vehicle and commercial vehicle sectors across the continent.

This regional disparity is a key concern, as the weaker performance in Europe can significantly impact CIE Automotive's overall consolidated financial results. For instance, in the first quarter of 2024, while India contributed positively, the European market presented headwinds, creating an uneven growth picture for the company.

CIE Automotive, as a significant manufacturer of metal, plastic, and aluminum parts, faces inherent risks from fluctuating raw material costs. These price swings can directly impact the company's cost of goods sold, potentially squeezing profit margins if increases cannot be passed on to customers. For instance, aluminum prices saw considerable volatility in 2024, with LME prices trading in a range that could significantly affect input costs for companies like CIE Automotive.

High Capital Expenditure Requirements

CIE Automotive faces a significant hurdle with its high capital expenditure requirements. To maintain and grow its global manufacturing presence across various technologies, the company must consistently invest heavily in new plants, advanced machinery, and ongoing research and development. For instance, in 2023, CIE Automotive reported capital expenditures of €265.3 million, a substantial outlay reflecting these ongoing needs.

This continuous need for investment, while crucial for competitiveness, can strain financial flexibility. Although CIE Automotive demonstrates strong cash generation capabilities, sustained high capital spending could potentially impact its ability to increase dividends or pursue other strategic investments if profitability doesn't keep pace with these demands.

- Significant Investment Needs: Maintaining and expanding a global, multi-technology manufacturing footprint necessitates substantial capital for plants, machinery, and R&D.

- Impact on Financial Flexibility: While cash generation is strong, sustained high capital expenditure can limit financial maneuverability.

- Dividend Policy Considerations: Consistent high investment needs may affect the company's capacity to increase shareholder dividends if returns are not robust enough.

Slowdown in EV Penetration Rate

The expected rapid increase in electric vehicle (EV) adoption has moderated in crucial regions like Europe and North America. This has led to postponed EV component projects and tempered the anticipated revenue growth from new EV orders for CIE Automotive. For instance, while EV sales in Europe grew significantly, the pace of penetration in some segments has not met earlier aggressive forecasts, impacting the immediate return on investments in new EV technologies.

This recalibration in EV market growth directly affects the realization of CIE Automotive's investments in specialized EV components. The company's strategic planning, which likely factored in a more aggressive EV ramp-up, now needs to adapt to a potentially longer gestation period for some of these new revenue streams. This could mean a slower payback on R&D and capital expenditures dedicated to EV technologies.

- Slower EV adoption in key markets like Europe and the US.

- Delays in planned EV-related projects for CIE Automotive.

- Impact on expected growth from new EV orders.

- Potential for delayed return on investments in EV component development.

CIE Automotive's significant reliance on the automotive industry, despite diversification, exposes it to sector volatility. Downturns in global vehicle production, like the projected slowdown in 2024, can directly impact sales and performance, especially in economically challenged markets.

The European segment, particularly in 2024, has been a weakness, with declining sales and shrinking EBITDA margins. This is partly due to restructuring costs and subdued performance in both light and commercial vehicle sectors across the continent, creating an uneven growth picture compared to its expanding Indian operations.

Fluctuating raw material costs, such as volatile aluminum prices seen in 2024, pose an inherent risk. These price swings can directly affect CIE Automotive's cost of goods sold, potentially squeezing profit margins if increases cannot be passed on to customers.

The company faces substantial capital expenditure needs, with €265.3 million spent in 2023 alone. This continuous investment in plants, machinery, and R&D, while crucial for competitiveness, can strain financial flexibility and potentially impact dividend increases if profitability doesn't keep pace.

Moderated EV adoption in key regions like Europe and North America has led to postponed EV component projects and tempered anticipated revenue growth from new EV orders for CIE Automotive. This recalibration impacts the realization of investments in specialized EV components and could mean a slower payback on related R&D and capital expenditures.

Full Version Awaits

CIE Automotive SWOT Analysis

This is the actual CIE Automotive SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats. This detailed report is ready for immediate use.

Opportunities

The global transition to electric vehicles offers CIE Automotive a substantial growth avenue. India, for instance, is projected to see a steady rise in EV adoption, creating a fertile ground for expansion.

CIE Automotive's strategic emphasis on producing EV components, such as aluminum and steel parts, directly aligns with this burgeoning market demand. This focus ensures the company is well-positioned to benefit from the increasing electrification trend in the automotive sector.

The automotive industry's relentless pursuit of enhanced fuel efficiency and extended electric vehicle (EV) range is a significant tailwind for lightweighting solutions. This trend directly fuels demand for advanced materials such as aluminum castings, forgings, and composites, areas where CIE Automotive possesses considerable expertise.

CIE Automotive's established capabilities in producing these advanced materials position it favorably to capture a larger share of this growing market. For instance, the global lightweight automotive materials market was valued at approximately USD 100 billion in 2023 and is projected to reach over USD 150 billion by 2028, demonstrating substantial growth potential.

This focus on lightweighting also presents a prime opportunity for CIE Automotive to drive product innovation, developing next-generation components that meet evolving OEM requirements for performance and sustainability, thereby solidifying its competitive edge.

CIE Automotive has a proven track record of growth through strategic acquisitions, notably the integration of Techniplas in Brazil, which bolstered its plastic component offerings. This historical success fuels the ongoing search for opportunities to expand its technological and product capabilities.

Further targeted acquisitions or strategic alliances present a significant avenue for CIE Automotive to enhance its market presence, particularly in emerging technologies, and to broaden its customer base. For instance, a partnership in advanced battery component manufacturing could align with evolving automotive trends.

Leveraging Industry 4.0 and Digitalization

Adopting Industry 4.0 principles like automation and data analytics can significantly boost CIE Automotive's operational efficiency and product quality, leading to cost reductions. The company's strategic focus on these advancements is a key driver for its competitive advantage and future expansion.

CIE Automotive's commitment to digitalization is evident in its investments. For instance, in 2023, the company continued to integrate smart manufacturing technologies across its global facilities, aiming to streamline production processes and enhance data-driven decision-making. This focus is projected to yield tangible benefits by 2025, with anticipated improvements in production throughput and a reduction in manufacturing waste.

- Enhanced Operational Efficiency: Implementing automation and smart manufacturing can reduce cycle times and improve resource utilization.

- Cost Reduction: Digitalization and optimized processes contribute to lower operational expenses and waste.

- Improved Product Quality: Advanced analytics and real-time monitoring allow for greater precision and consistency in manufacturing.

- Competitive Edge: Early adoption of Industry 4.0 technologies positions CIE Automotive ahead of competitors in terms of innovation and agility.

Geographic Expansion into High-Growth Markets

CIE Automotive can significantly boost its growth by venturing into emerging markets with rapidly expanding automotive sectors. For instance, Southeast Asian countries like Vietnam and Indonesia, along with select African nations, are showing promising automotive sales growth projections for 2024-2025.

This geographic expansion would not only tap into new customer bases but also diversify CIE Automotive's revenue sources, reducing reliance on existing, potentially saturated markets.

Key opportunities include:

- Entry into high-demand emerging economies: Targeting regions with increasing disposable incomes and a growing middle class that is increasingly purchasing vehicles.

- Strategic partnerships: Collaborating with local players in new markets to navigate regulatory landscapes and establish a strong distribution network.

- Leveraging existing product portfolio: Adapting its current offerings to meet the specific needs and price points of consumers in these new geographies.

CIE Automotive's strategic focus on lightweight materials, particularly aluminum components, aligns perfectly with the automotive industry's drive for fuel efficiency and extended EV range. The global lightweight automotive materials market was valued at approximately USD 100 billion in 2023 and is forecast to exceed USD 150 billion by 2028, presenting a substantial growth opportunity for CIE Automotive's expertise in this area.

The company's proven success with strategic acquisitions, such as Techniplas in Brazil, highlights a clear opportunity for further expansion. Targeted acquisitions or alliances in advanced battery components or other emerging technologies could significantly broaden its technological capabilities and customer reach.

Embracing Industry 4.0, including automation and data analytics, offers a pathway to enhanced operational efficiency and cost reduction. CIE Automotive's ongoing integration of smart manufacturing technologies, with projected benefits by 2025, positions it for improved production and reduced waste.

Expanding into high-growth emerging markets, such as Southeast Asia and select African nations, presents a significant opportunity for CIE Automotive to diversify revenue streams and tap into new customer bases. These regions are projected to experience robust automotive sales growth in the 2024-2025 period.

Threats

The automotive components industry is a battlefield, with established giants and emerging players, especially from China, aggressively seeking market share. This intense rivalry inevitably translates into significant pricing pressure on components, directly impacting CIE Automotive's profit margins and overall market standing.

Economic downturns, including the projected slowdown in global GDP growth for 2024, coupled with elevated borrowing costs, can significantly dampen consumer spending on vehicles. This often translates into reduced vehicle production volumes, a trend that began to materialize in late 2023 and is expected to persist through much of 2024, impacting overall industry output.

A sustained contraction in automotive demand directly curtails the need for components, thereby affecting CIE Automotive's sales volumes and overall revenue. For instance, if major automotive markets experience a 5-10% drop in vehicle sales in 2024, it would directly reduce the demand for CIE's specialized components.

Geopolitical tensions and trade disputes, such as those seen in 2024 impacting global shipping routes, pose a significant threat to CIE Automotive's supply chain. These disruptions can cause delays and inflate logistics costs, directly affecting production timelines and profitability.

Unforeseen global events, like the ongoing semiconductor shortages that continued to affect the automotive sector into 2025, can lead to critical raw material shortages. This scarcity directly impacts CIE Automotive's ability to meet production demands, potentially reducing revenue and market share.

Technological Obsolescence and Rapid Industry Changes

The automotive sector is experiencing a seismic shift, with electric and autonomous vehicle technologies rapidly advancing. This transition presents a significant threat of technological obsolescence for CIE Automotive's traditional component offerings. For instance, the global market for electric vehicles (EVs) is projected to reach over 30 million units annually by 2025, a substantial increase from previous years, impacting demand for internal combustion engine components.

To mitigate this risk, CIE Automotive faces the imperative to consistently allocate substantial resources to research and development. Staying ahead of the curve requires ongoing investment in new materials, manufacturing processes, and software integration to support emerging vehicle architectures. Failure to adapt could lead to a loss of market share and diminished competitiveness.

Key areas of concern include:

- Shift to EV Powertrains: Decreasing demand for traditional engine and transmission components.

- Autonomous Driving Systems: Need for expertise in sensors, software, and advanced electronics.

- Connectivity and Software: Growing importance of in-car digital experiences and vehicle-to-everything (V2X) communication.

Regulatory Changes and Environmental Compliance Costs

Stricter environmental regulations, such as the Euro 7 emissions standards set to be implemented in Europe, pose a significant threat to CIE Automotive. These evolving standards necessitate substantial investments in new technologies and process modifications to ensure compliance, potentially increasing operational costs. For instance, the automotive industry is facing increased scrutiny on CO2 emissions, with targets becoming more ambitious year on year, impacting component suppliers like CIE Automotive.

Furthermore, evolving trade policies and tariffs across key markets where CIE Automotive operates can introduce complexities and additional costs. Navigating these diverse regulatory landscapes requires constant vigilance and adaptability. Failure to meet these environmental and trade requirements could lead to penalties, fines, or even restricted market access, directly impacting revenue streams and profitability.

- Increased Capital Expenditure: Anticipated investments in cleaner production technologies to meet stringent emissions standards like Euro 7.

- Supply Chain Disruptions: Potential impact of new trade policies or tariffs on the cost and availability of raw materials and components.

- Market Access Limitations: Risk of penalties or reduced market access in regions with non-compliance to environmental regulations, affecting sales volumes.

Intense competition, particularly from Asian manufacturers, is driving down component prices, squeezing CIE Automotive's profit margins. Economic slowdowns and rising interest rates are dampening vehicle demand, with global vehicle production expected to see only modest growth in 2024, impacting sales volumes.

The rapid shift towards electric and autonomous vehicles threatens to make CIE's traditional component offerings obsolete, requiring significant R&D investment to adapt. Stricter environmental regulations, such as Euro 7, necessitate costly upgrades to production processes and technologies.

| Threat Category | Specific Threat | Impact on CIE Automotive | 2024/2025 Data/Projection |

|---|---|---|---|

| Competition | Aggressive pricing from new market entrants | Reduced profit margins, market share erosion | Chinese EV component exports grew by an estimated 20-30% in 2024. |

| Economic Factors | Global economic slowdown, higher interest rates | Lower vehicle demand, reduced production volumes | Projected global GDP growth of 2.5% for 2024, down from 3.0% in 2023. |

| Technological Disruption | Transition to EVs and autonomous driving | Obsolescence of traditional components, need for new R&D | Global EV sales projected to exceed 15 million units in 2025. |

| Regulatory Environment | Stricter emissions standards (e.g., Euro 7) | Increased capital expenditure for compliance, higher operational costs | Euro 7 implementation expected to add 5-10% to vehicle manufacturing costs. |

SWOT Analysis Data Sources

This CIE Automotive SWOT analysis is built upon a robust foundation of data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded perspective.