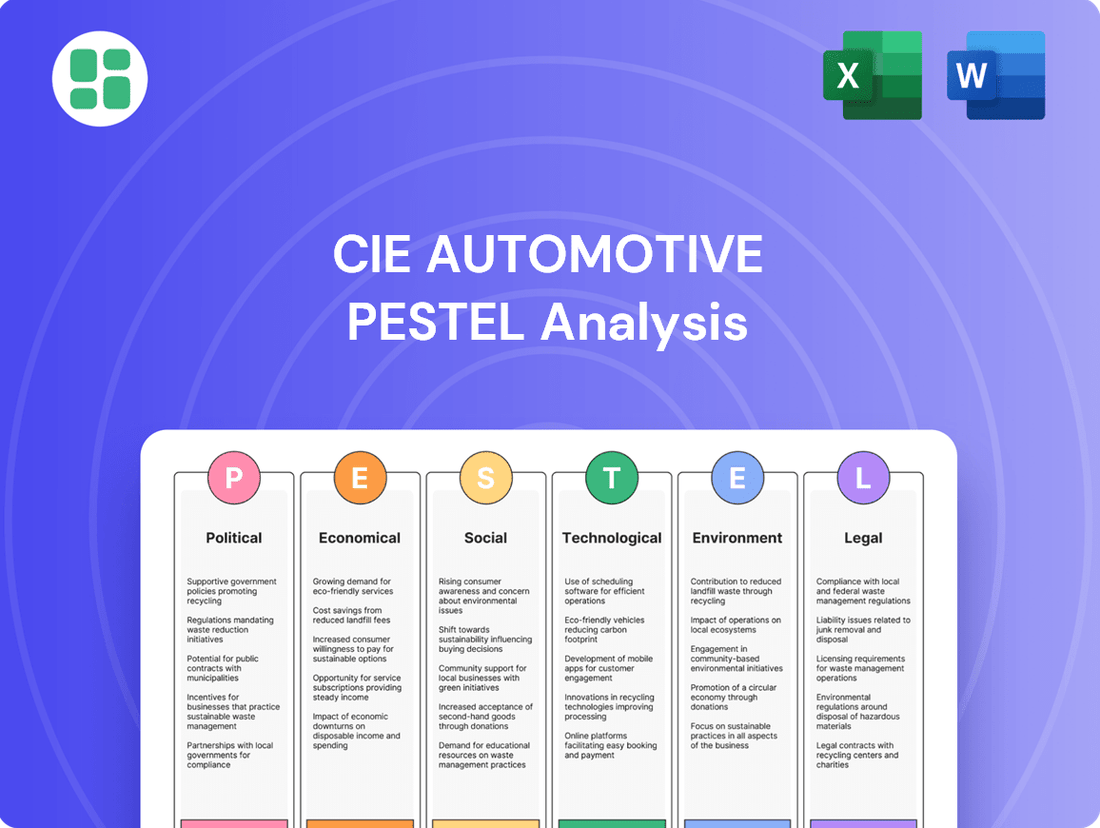

CIE Automotive PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

Navigate the complex external forces impacting CIE Automotive with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and socio-cultural trends are shaping the automotive industry and CIE Automotive's strategic landscape. Download the full version now to gain critical insights for informed decision-making and to solidify your competitive advantage.

Political factors

Government policies are a major driver for electric vehicle (EV) adoption, directly impacting CIE Automotive. Incentives like purchase subsidies and tax credits encourage consumers to buy EVs, increasing demand for the components CIE manufactures for these vehicles. For instance, the US Inflation Reduction Act of 2022 offers significant tax credits for EV purchases, boosting market growth.

Regulations also play a crucial role. Many countries are setting targets for EV sales and phasing out internal combustion engine vehicles. The European Union's CO2 emission standards are pushing automakers to increase EV production, creating more business opportunities for CIE Automotive's EV-focused product lines.

Conversely, changes in these policies can create uncertainty. A reduction in subsidies or a shift in regulatory priorities could slow down EV market expansion, potentially affecting CIE Automotive's production volumes and investment strategies for EV components.

Fluctuations in international trade policies, including tariffs between major economic blocs, directly impact CIE Automotive's global supply chains. For instance, the US-China trade tensions have led to increased costs for certain components, forcing companies like CIE to re-evaluate sourcing strategies. In 2024, the ongoing recalibration of trade agreements, such as potential revisions to the USMCA, could further influence the cost of raw materials and finished goods.

The political stability of regions where CIE Automotive operates, such as Spain, Mexico, and Brazil, directly impacts its manufacturing output and supply chain reliability. Geopolitical tensions or significant political upheaval in these areas could lead to production halts or logistical nightmares, affecting the timely delivery of automotive components. For instance, the ongoing political climate in Mexico, a key manufacturing hub for CIE, requires constant monitoring to anticipate any potential disruptions.

Government support for automotive R&D and innovation

Government backing for automotive research and development (R&D), especially in advanced manufacturing and green technologies, significantly boosts competitive standing. This funding helps speed up the creation of novel materials and production methods, directly benefiting CIE Automotive's drive for sustainable component manufacturing.

For instance, the European Union's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, actively supports innovation in sectors like automotive, including grants for sustainable mobility solutions. Similarly, national initiatives, such as the German Federal Ministry of Education and Research's funding for electromobility research, create a fertile ground for technological progress.

- Government funding accelerates innovation in sustainable automotive technologies.

- EU's Horizon Europe program allocates significant funds to research and development in mobility.

- National R&D initiatives, like those in Germany for electromobility, foster technological advancements.

Labor laws and regulations in different operating countries

CIE Automotive operates in many countries, and each has its own set of labor laws. These differences, from wage policies to union rights, directly affect how much it costs to run their factories and how easily they can adapt production. For instance, complying with varying minimum wage laws across Europe and Asia can create significant cost differentials.

Managing these diverse labor regulations is crucial for CIE Automotive. It requires careful attention to detail to ensure they are meeting all legal requirements, from working hours to benefits, in each location. Failure to do so can lead to fines, operational disruptions, and damage to their reputation.

- Varying Labor Laws: CIE Automotive must navigate a complex web of employment legislation across its global manufacturing footprint, impacting everything from hiring practices to termination procedures.

- Operational Costs: Differences in mandated benefits, social security contributions, and statutory severance pay in countries like Mexico versus Spain can significantly alter direct labor expenses.

- Industrial Relations: The strength and influence of labor unions differ widely, affecting collective bargaining agreements and potentially impacting strike risks and negotiation outcomes. For example, in 2023, the automotive sector in Germany saw significant wage negotiations impacting industry-wide labor costs.

- Regulatory Changes: Updates to labor laws, such as potential increases in minimum wages or changes in overtime regulations, can necessitate rapid adjustments in workforce planning and production scheduling to maintain efficiency.

Government incentives for electric vehicle (EV) adoption, such as purchase subsidies and tax credits, directly stimulate demand for CIE Automotive's components. For example, the US Inflation Reduction Act of 2022 continues to drive EV sales, benefiting suppliers like CIE.

Stringent emission regulations, like the EU's CO2 standards, compel automakers to increase EV production, creating opportunities for CIE's specialized product lines. Conversely, policy shifts could introduce market uncertainty.

Trade policies and geopolitical stability significantly influence CIE Automotive's global supply chains and manufacturing operations. For instance, ongoing trade negotiations and regional political climates in key markets like Mexico require constant monitoring to mitigate potential disruptions and cost impacts.

What is included in the product

This CIE Automotive PESTLE analysis meticulously examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, enabling informed decision-making for navigating industry challenges and capitalizing on emerging opportunities.

A concise PESTLE analysis for CIE Automotive that highlights key external factors, acting as a readily available tool to anticipate and mitigate potential market disruptions, thereby alleviating strategic planning anxieties.

Economic factors

Global economic growth is a significant driver for CIE Automotive, as consumer spending on vehicles is directly tied to economic health and confidence. When economies are strong, consumers are more likely to purchase new vehicles, which in turn boosts demand for the components CIE Automotive supplies. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous years, signaling potential for increased vehicle sales.

Conversely, economic slowdowns or recessions can severely dampen vehicle demand. During such periods, consumers often postpone large purchases like new cars, leading to reduced production volumes for automakers. This directly impacts CIE Automotive's revenue streams. For example, if major automotive markets experience a contraction, CIE Automotive's order books would likely shrink, affecting its profitability and operational capacity.

Robust economic expansion, however, typically translates into higher vehicle sales across various segments, from passenger cars to commercial vehicles. This increased demand benefits CIE Automotive by creating more opportunities for its component manufacturing and supply. As economies recover and grow, the automotive sector generally sees a resurgence, leading to greater demand for the sophisticated and essential parts that CIE Automotive provides.

Inflationary pressures and the volatile pricing of key raw materials like steel, aluminum, and plastics present significant economic challenges for CIE Automotive. As a substantial user of these commodities for its diverse range of automotive components, escalating costs directly impact profit margins. The company must strategically navigate these fluctuations through pricing mechanisms and efficiency improvements to maintain profitability.

For instance, global inflation rates remained elevated through much of 2023 and into early 2024, impacting manufacturing inputs. Aluminum prices, a crucial component for CIE Automotive's lightweight solutions, saw significant swings, trading around $2,200-$2,500 per metric ton in late 2023 and early 2024, influenced by energy costs and supply chain disruptions.

Fluctuations in interest rates directly impact CIE Automotive's borrowing costs for crucial investments like new technology adoption and plant expansions. For instance, if central banks, like the European Central Bank or the US Federal Reserve, continue their tightening cycles into 2024 and 2025, it could lead to higher interest expenses on any new debt taken on by CIE Automotive.

Higher interest rates can significantly increase the cost of capital expenditure, making ambitious growth initiatives more expensive and potentially leading to a slowdown in expansion plans. This is particularly relevant for CIE Automotive, which relies on continuous innovation and investment in sustainable solutions to maintain its competitive edge in the automotive supply chain.

Access to affordable capital remains a critical enabler for CIE Automotive's strategic objectives. For example, the company's ability to finance acquisitions or R&D projects hinges on favorable borrowing conditions. In the 2024-2025 period, companies like CIE Automotive will be closely monitoring monetary policy decisions that influence the cost and availability of funds for their expansion and modernization efforts.

Currency exchange rate fluctuations

CIE Automotive's global operations mean its financial results are sensitive to currency exchange rate fluctuations. When the company converts earnings from its subsidiaries in countries like Mexico, Brazil, or China back into Euros, a stronger local currency against the Euro boosts reported revenues, while a weaker one reduces them. For instance, in 2023, the average EUR/MXN exchange rate was approximately 19.4, compared to 21.7 in 2022, indicating a weakening of the Mexican Peso against the Euro, which would have had a dampening effect on reported Mexican revenues when translated to Euros. This volatility directly impacts profitability and the relative cost-competitiveness of its products across different markets.

These currency movements can significantly alter the perceived financial performance of the company. For example, if the Euro strengthens considerably against the US Dollar, CIE Automotive’s US-based earnings will translate into fewer Euros, potentially masking underlying operational improvements. Conversely, a weaker Euro can inflate reported earnings from strong foreign markets. The company's hedging strategies aim to mitigate some of this risk, but significant, unexpected currency shifts can still create headwinds or tailwinds for its reported financial figures and strategic pricing decisions in international markets.

- Impact on Revenue: Fluctuations in exchange rates directly affect the Euro-denominated value of revenues earned in foreign currencies.

- Cost Competitiveness: Exchange rates influence the cost of imported components and the pricing of products in export markets.

- Profitability: Currency gains or losses on foreign currency transactions and translations can materially impact net income.

- Hedging Strategies: CIE Automotive employs financial instruments to manage currency exposure, though complete elimination of risk is not feasible.

Automotive industry production volumes and sales forecasts

Projected automotive production volumes and sales forecasts are critical for understanding CIE Automotive's future performance. For instance, global light vehicle production was anticipated to reach approximately 88.4 million units in 2024, a slight increase from 2023 but still below pre-pandemic levels. This indicates a market that is recovering but remains sensitive to economic fluctuations.

A contraction in global sector production, as experienced in certain periods of 2024, presents direct challenges for CIE Automotive. Such downturns necessitate operational adjustments and a strategic focus on maintaining profitability through efficiency and margin management, even with reduced output. The company's ability to navigate these periods is key to its resilience.

CIE Automotive's diversified product portfolio offers a significant advantage in managing market shifts. By offering components for various vehicle types, including a growing segment of electric vehicles (EVs), the company can better absorb localized downturns in specific segments and capitalize on emerging trends.

- Global light vehicle production forecast for 2024: ~88.4 million units.

- EV sales share in new car sales is projected to continue its upward trajectory, reaching an estimated 20% globally in 2024.

- Key automotive markets like Europe and North America are expected to see modest production growth in 2024, around 2-3%.

- Supply chain disruptions, though easing, continue to pose a risk to achieving full production potential in 2024.

Global economic growth directly influences CIE Automotive's demand, as consumer spending on vehicles is tied to economic health. The IMF projected global growth around 3.2% for 2024, suggesting a potential increase in vehicle sales and, consequently, demand for CIE Automotive's components.

Economic downturns can significantly reduce vehicle demand, impacting CIE Automotive's revenue. For example, if major automotive markets contract, order books shrink, affecting profitability. Conversely, robust economic expansion typically leads to higher vehicle sales across segments, benefiting CIE Automotive.

Inflation and volatile raw material prices, such as steel and aluminum, directly impact CIE Automotive's profit margins. For instance, aluminum prices traded around $2,200-$2,500 per metric ton in early 2024, influenced by energy costs and supply chain issues.

Interest rate fluctuations affect CIE Automotive's borrowing costs for investments. Higher rates, potentially continuing into 2024-2025, increase capital expenditure costs, possibly slowing expansion plans. Access to affordable capital is crucial for financing R&D and acquisitions.

Currency exchange rate fluctuations impact CIE Automotive's reported financial performance. For example, the EUR/MXN rate in 2023 was approximately 19.4, a weakening of the Mexican Peso against the Euro compared to 21.7 in 2022, which would have dampened reported Mexican revenues in Euros.

Projected automotive production volumes are critical for CIE Automotive's performance. Global light vehicle production was anticipated to reach approximately 88.4 million units in 2024, a slight increase from 2023 but below pre-pandemic levels.

| Economic Factor | Data Point/Trend | Impact on CIE Automotive |

| Global Economic Growth | IMF projected 3.2% for 2024 | Increased demand for vehicles and components |

| Inflation & Raw Material Prices | Aluminum prices ~$2,200-$2,500/ton (early 2024) | Pressure on profit margins, need for efficiency |

| Interest Rates | Potential continued tightening in 2024-2025 | Higher borrowing costs, potential slowdown in expansion |

| Currency Exchange Rates | EUR/MXN ~19.4 (2023) vs. 21.7 (2022) | Affects reported revenues from foreign subsidiaries |

| Automotive Production Volumes | Global light vehicle production ~88.4M units (2024 est.) | Directly influences order volumes and operational capacity |

What You See Is What You Get

CIE Automotive PESTLE Analysis

The preview shown here is the exact CIE Automotive PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the CIE Automotive PESTLE Analysis product you’re buying—delivered exactly as shown, no surprises, providing actionable insights for strategic decision-making.

The content and structure of this CIE Automotive PESTLE Analysis shown in the preview is the same document you’ll download after payment, ensuring you get a complete and professionally prepared report.

Sociological factors

Consumer preferences are undeniably shifting towards electric vehicles (EVs) and sustainable mobility. This trend is a major driver for companies like CIE Automotive, influencing their product development and manufacturing strategies. As people become more conscious of their environmental impact, the demand for greener transportation options continues to grow, pushing the automotive industry to adapt.

This growing preference for eco-friendly choices directly translates into a rising demand for specific automotive components. CIE Automotive sees an increasing need for lightweight and recyclable materials, as well as parts specifically designed for EV powertrains. For instance, in 2024, global EV sales are projected to reach over 16 million units, a significant increase from previous years, highlighting the scale of this market shift and the opportunities it presents for component suppliers focused on sustainability.

Sociological shifts are significantly reshaping the labor landscape for companies like CIE Automotive. In many developed economies, an aging workforce is becoming more prevalent, potentially leading to a decline in the available pool of experienced manufacturing personnel. This demographic trend, coupled with a persistent shortage of skilled labor in advanced manufacturing sectors, directly impacts operational efficiency and production capacity.

For CIE Automotive, attracting and retaining talent with specialized skills in areas like automation, robotics, and advanced materials is paramount. For instance, as of early 2024, reports indicated a significant skills gap in the automotive manufacturing sector across Europe, with many companies struggling to fill roles requiring digital and technical expertise. This talent crunch directly affects the company's ability to innovate and maintain its production capabilities in a rapidly evolving industry.

Public sentiment towards manufacturing's environmental impact is a significant driver for companies like CIE Automotive. Growing awareness of climate change means consumers are more likely to favor brands demonstrating strong environmental stewardship. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability efforts when making purchasing decisions.

CIE Automotive's proactive approach to eco-efficiency, including investments in reducing its carbon footprint – aiming for a 30% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline – directly addresses these public concerns. By championing circular economy principles and responsible waste management, the company aims to bolster its brand reputation and align with evolving stakeholder expectations for corporate responsibility.

Demand for lightweight and fuel-efficient components

Societal pressure for greener transportation is a significant driver for the automotive sector. Consumers increasingly prioritize vehicles that offer better fuel economy and reduced environmental impact. This trend directly influences the demand for lightweight and advanced components, pushing manufacturers to innovate in materials and design.

CIE Automotive is well-positioned to capitalize on this shift. Their core competencies in metal, plastic, and aluminum component manufacturing, utilizing techniques such as forging and injection molding, allow them to produce lighter parts. For instance, the increasing use of aluminum in vehicle chassis and body panels, a key area for CIE, directly contributes to fuel efficiency. By 2025, it's projected that aluminum content in vehicles will continue its upward trajectory, with some estimates suggesting a significant increase in its use for lightweighting initiatives.

- Growing consumer preference for fuel-efficient vehicles.

- Industry-wide push for reduced emissions and environmental sustainability.

- CIE Automotive's capability in producing lightweight metal and plastic components.

- Anticipated increase in aluminum usage for vehicle weight reduction by 2025.

Urbanization and mobility trends

Urbanization continues to reshape global demographics, with the United Nations projecting that 68% of the world's population will reside in urban areas by 2050. This escalating urban density directly impacts vehicle demand, favoring smaller, more efficient, and often shared mobility solutions. CIE Automotive must therefore align its component production with these evolving urban transport needs.

Evolving mobility trends, including the significant rise of car-sharing and ride-hailing services, are transforming personal transportation. By 2023, the global shared mobility market was valued at over $200 billion and is projected to grow substantially. This shift necessitates components suitable for high-utilization vehicles and potentially for autonomous driving systems integrated into smart city infrastructure.

- Urban Population Growth: By 2050, an estimated 68% of the global population will live in urban areas.

- Shared Mobility Market Value: The global shared mobility market exceeded $200 billion in 2023.

- Smart City Integration: Growing smart city initiatives require vehicle components compatible with networked transportation systems.

- Demand for Specialized Vehicles: Urbanization drives demand for components for electric scooters, micro-mobility devices, and compact urban vehicles.

Societal expectations are increasingly focused on corporate responsibility and ethical practices. Consumers and investors alike are scrutinizing companies for their environmental impact and labor standards. This heightened awareness pressures automotive suppliers like CIE Automotive to demonstrate a commitment to sustainability and fair employment throughout their operations and supply chains.

CIE Automotive's investment in sustainable manufacturing processes and adherence to strict labor laws are crucial for maintaining a positive brand image and attracting socially conscious investors. For instance, the company's reported commitment to reducing its carbon footprint and ensuring safe working conditions directly addresses these societal demands. By 2024, many automotive manufacturers are setting ambitious ESG (Environmental, Social, and Governance) targets, making supplier alignment a critical factor in business partnerships.

The demographic shift towards an aging population in many developed nations presents both challenges and opportunities for CIE Automotive. While it may lead to a shrinking pool of experienced manufacturing labor, it also creates demand for automotive components that cater to the needs of older drivers, such as enhanced accessibility features and user-friendly interfaces. For example, in 2024, the automotive industry is seeing increased research into assistive technologies for vehicles, driven by the growing elderly population in key markets.

| Sociological Factor | Impact on CIE Automotive | Supporting Data/Trend |

|---|---|---|

| Corporate Social Responsibility (CSR) Expectations | Increased pressure to adopt sustainable and ethical practices. | Over 60% of consumers consider sustainability in purchasing decisions (2024 survey). |

| Aging Workforce | Potential labor shortages and demand for age-friendly vehicle features. | Growing elderly population in developed economies. |

| Demand for Sustainable Mobility | Shift in consumer preference towards EVs and eco-friendly vehicles. | Global EV sales projected to exceed 16 million units in 2024. |

| Skills Gap in Manufacturing | Challenges in finding skilled labor for advanced manufacturing. | Significant skills gap in automotive manufacturing sectors across Europe (early 2024). |

Technological factors

Continuous advancements in manufacturing technologies like precision forging, advanced casting, high-speed machining, and innovative injection molding are vital for CIE Automotive's competitive edge. These upgrades directly impact their ability to produce the intricate components demanded by today's automotive industry.

By investing in and adopting these state-of-the-art processes, CIE Automotive can significantly improve operational efficiency and reduce production costs. For instance, advancements in casting allow for lighter yet stronger parts, contributing to vehicle fuel efficiency, a key selling point in the 2024-2025 market.

The continuous advancement in materials science, particularly in lightweighting, is a significant technological driver for CIE Automotive. Innovations in advanced alloys, composites, and high-strength plastics are enabling the creation of lighter, more durable automotive components. For instance, the automotive industry's push towards electric vehicles (EVs) places a premium on weight reduction to maximize range, making these material developments crucial for CIE Automotive's product portfolio.

These material innovations directly translate into improved vehicle performance, including enhanced fuel efficiency and safety. As regulatory bodies and consumers increasingly demand greener and safer vehicles, CIE Automotive's ability to integrate these new materials positions it favorably. The global market for lightweight materials in automotive is projected to reach over $100 billion by 2028, underscoring the immense opportunity for companies like CIE Automotive that are at the forefront of material adoption.

Technological advancements in EV battery components and powertrains are reshaping the automotive landscape. Innovations like solid-state batteries promise higher energy density and faster charging, while new powertrain architectures enable lighter and more efficient vehicles. CIE Automotive's commitment to lightweight solutions positions them to capitalize on these trends, but requires ongoing investment in research and development to stay ahead of the curve.

Industry 4.0 adoption, automation, and digitalization

CIE Automotive is actively embracing Industry 4.0, integrating automation, AI, digital twins, and IoT to streamline its manufacturing operations. This strategic shift aims to boost production efficiency and enable predictive maintenance, enhancing overall control. For instance, by Q3 2024, CIE Automotive reported a significant increase in automated processes across its plants, contributing to a 7% year-over-year improvement in production output for key components.

The digitalization drive extends to optimizing supply chains and fostering greater agility. CIE Automotive's investment in digital platforms allows for real-time monitoring and data analysis, leading to faster decision-making and improved responsiveness to market demands. This technological adoption is crucial for maintaining competitiveness in a rapidly evolving automotive landscape.

- Industry 4.0 adoption: CIE Automotive is implementing smart factory concepts, utilizing data analytics and interconnected systems.

- Automation and AI: The company is increasing the use of robots and AI-powered systems for tasks like quality control and assembly, aiming for a 15% reduction in manual error rates by 2025.

- Digital Twins: CIE Automotive is developing digital replicas of its production lines to simulate changes, optimize performance, and train personnel, expecting to cut downtime by 10% through this initiative.

- IoT integration: The deployment of IoT sensors across machinery provides real-time operational data, facilitating predictive maintenance and enhancing energy efficiency by an estimated 5% in the next fiscal year.

Cybersecurity threats to connected manufacturing and supply chains

The increasing reliance on digital technologies within CIE Automotive's manufacturing processes and supply chains presents a growing cybersecurity risk. Protecting sensitive operational technology (OT) and intellectual property (IP) from cyber-attacks is paramount for maintaining uninterrupted operations and safeguarding confidential data.

Cyber threats can disrupt production lines, compromise product integrity, and lead to significant financial losses. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of this challenge. CIE Automotive must invest in robust cybersecurity measures to defend against potential breaches, ensuring the reliability and security of its interconnected systems.

- Data Protection: Safeguarding proprietary designs, customer information, and financial data is critical.

- Operational Continuity: Preventing cyber-attacks that could halt manufacturing or disrupt supply chain logistics is essential.

- Intellectual Property: Protecting trade secrets and innovative technologies from theft or espionage.

- System Integrity: Ensuring the secure and reliable functioning of all connected manufacturing and supply chain software and hardware.

Technological advancements are fundamentally reshaping automotive manufacturing, with CIE Automotive leveraging innovations in precision forging and advanced casting to produce complex components. These upgrades are crucial for meeting the intricate demands of modern vehicles, directly impacting their competitive edge in the 2024-2025 market.

The company's focus on lightweighting materials, such as advanced alloys and composites, is driven by the automotive industry's push for electric vehicles (EVs) and improved fuel efficiency. This strategic material adoption is vital for CIE Automotive, as the global market for automotive lightweight materials is expected to exceed $100 billion by 2028.

CIE Automotive is aggressively integrating Industry 4.0 principles, including automation, AI, and IoT, to enhance production efficiency and enable predictive maintenance. By Q3 2024, the company reported a 7% year-over-year increase in production output for key components, partly due to these automated processes.

The increasing reliance on interconnected digital systems also introduces significant cybersecurity risks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. Protecting intellectual property and ensuring operational continuity are paramount for CIE Automotive amidst these evolving threats.

| Technological Factor | Impact on CIE Automotive | Supporting Data/Trend |

|---|---|---|

| Advanced Manufacturing Processes | Enhanced production of intricate automotive components; improved efficiency and cost reduction. | Precision forging, advanced casting, high-speed machining, injection molding. |

| Lightweighting Materials | Crucial for EV range and fuel efficiency; competitive advantage in material innovation. | Global lightweight materials market projected over $100 billion by 2028. |

| Industry 4.0 & Digitalization | Boosted production efficiency, predictive maintenance, supply chain agility. | Reported 7% YoY production output increase (Q3 2024) due to automation. |

| Cybersecurity | Risk to operational continuity, IP, and data; requires robust protection measures. | Global cybercrime costs projected at $10.5 trillion annually by 2025. |

Legal factors

Vehicle safety standards are becoming increasingly stringent globally, directly influencing the automotive component industry. For instance, regulations mandating enhanced pedestrian protection and the widespread adoption of Advanced Driver-Assistance Systems (ADAS) require manufacturers like CIE Automotive to invest in sophisticated technologies and materials. By July 2025, many regions will have updated mandates for ADAS integration, pushing component suppliers to innovate rapidly.

Environmental regulations are becoming stricter, particularly concerning vehicle emissions and how manufacturing processes handle waste. This means CIE Automotive must invest in cleaner technologies and more sustainable ways of operating. For instance, in 2024, the European Union continued to push for lower CO2 emissions for new cars, with targets becoming more ambitious, impacting the types of components CIE Automotive will need to produce.

Complying with these laws, which often include mandates on reducing carbon footprints and increasing waste recycling rates, is essential for CIE Automotive to continue its operations legally. Failure to meet these standards could result in significant fines and reputational damage. The company's commitment to Environmental, Social, and Governance (ESG) principles is directly tied to its ability to navigate and adhere to these evolving environmental legal frameworks.

Product liability laws mean CIE Automotive is accountable for the safety and performance of its automotive components, demanding robust quality control and testing at every stage. This necessitates adherence to strict quality management systems, such as IATF 16949, to reduce risks and ensure product reliability globally.

Failure to meet these quality standards can lead to significant legal repercussions, including costly lawsuits and damage to brand reputation. For instance, in 2023, the automotive industry saw a notable increase in recalls related to component defects, highlighting the critical importance of rigorous quality assurance processes for manufacturers like CIE Automotive.

International trade agreements and compliance

CIE Automotive's global footprint necessitates strict adherence to international trade agreements and evolving customs regulations. For instance, the company must navigate the complexities of the European Union's single market, which facilitates the free movement of goods, and also comply with trade pacts like the USMCA (United States-Mexico-Canada Agreement) impacting its North American operations. Failure to comply with anti-dumping laws, which prevent unfairly priced imports, could lead to significant penalties and disrupt supply chains.

Changes in trade policy directly influence CIE Automotive's cross-border component sales and sourcing strategies. For example, a shift in tariff rates or the imposition of new non-tariff barriers could increase the cost of raw materials or finished goods, forcing the company to re-evaluate its supplier base and manufacturing locations. In 2024, ongoing geopolitical tensions and trade disputes continue to highlight the importance of agile legal and logistical planning to mitigate these risks.

- Compliance with trade pacts like USMCA is essential for CIE Automotive's North American supply chain.

- Evolving customs regulations can impact the cost and efficiency of international component sourcing.

- Anti-dumping laws require careful monitoring to avoid penalties on imported goods.

- Geopolitical shifts in 2024 underscore the need for flexible legal and logistical adaptation in global trade.

Labor laws, health, and safety regulations across different countries

CIE Automotive navigates a complex web of labor laws and health and safety regulations across its global operations. For instance, in Spain, where CIE has a significant presence, the Workers' Statute (Estatuto de los Trabajadores) governs employment contracts, working hours, and employee rights. Similarly, in Mexico, the Federal Labor Law sets stringent standards for workplace safety and employee benefits. Failure to comply can result in substantial fines and operational disruptions.

The company must also adhere to specific health and safety directives, such as those outlined by the European Agency for Safety and Health at Work (EU-OSHA). These regulations often mandate risk assessments, provision of personal protective equipment, and regular safety training for employees. In 2023, workplace accidents in the manufacturing sector across the EU led to millions of lost working days, highlighting the critical importance of robust safety protocols.

- Compliance with diverse labor laws: CIE Automotive must adhere to varying national employment acts, covering aspects like minimum wage, working hours, and termination procedures in countries like Spain, Mexico, and Brazil.

- Occupational health and safety standards: Adherence to regulations such as EU directives on workplace safety and national equivalents ensures employee well-being and prevents costly accidents.

- Employee rights and protections: Ensuring fair treatment, non-discrimination, and proper grievance mechanisms are legal imperatives across all operating jurisdictions.

- Impact of regulatory changes: Anticipating and adapting to evolving labor and safety laws, such as potential increases in minimum wages or new safety reporting requirements, is crucial for sustained operations.

CIE Automotive must navigate a complex legal landscape concerning product safety and liability. Adherence to international standards like ISO 26262 for functional safety is paramount, as non-compliance can lead to recalls and litigation. The automotive industry experienced a rise in component-related recalls in 2023, underscoring the financial and reputational risks associated with product defects.

Environmental factors

Growing global and national regulations targeting carbon emissions and energy efficiency in manufacturing are increasingly shaping CIE Automotive's operational landscape. For instance, the European Union's ambitious Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly influencing manufacturing standards for automotive suppliers.

In response, CIE Automotive is actively investing in greener technologies and process optimization to meet these stringent requirements and achieve its validated climate targets. This includes exploring and implementing renewable energy sources for its production facilities, such as solar power, to reduce its carbon footprint and enhance energy efficiency across its global operations.

The automotive industry's growing focus on sustainability is directly impacting CIE Automotive. Consumers and regulators alike are pushing for vehicles made with recycled content and bio-based materials. For instance, by 2025, many European Union member states are expected to mandate higher percentages of recycled plastics in new vehicles.

CIE Automotive is responding by prioritizing material selection and production methods that support a circular economy. This means looking for ways to reuse materials and design components for easier recyclability at the end of a vehicle's life. Their efforts aim to reduce waste and lower the overall environmental impact of their manufacturing processes.

Stricter waste management and recycling mandates for automotive components, including those produced by CIE Automotive, are becoming increasingly common. For instance, the European Union's End-of-Life Vehicles (ELV) Directive sets targets for vehicle recyclability, pushing manufacturers to design for disassembly and material recovery.

CIE Automotive must maintain efficient internal processes to handle manufacturing waste and ensure its components meet growing industry expectations for end-of-life recyclability. This focus on sustainability is crucial as the automotive sector aims to reduce its environmental footprint.

Climate change impact on supply chain resilience

Climate change poses significant physical risks to CIE Automotive's supply chain. Extreme weather events like floods, droughts, and storms, which are becoming more frequent and intense, can directly impact the availability of raw materials and disrupt transportation routes. For instance, a severe flood in a key manufacturing region could halt production and delay shipments, as seen in various global supply chain disruptions reported throughout 2023 and early 2024.

To counter these environmental threats, CIE Automotive must prioritize building supply chain resilience. This involves strategies such as diversifying its supplier base across different geographical regions to reduce reliance on any single area vulnerable to climate impacts. Strengthening logistics networks, perhaps by utilizing more robust transportation methods or establishing alternative routes, is also vital to ensure continuity of operations even when faced with climate-induced disruptions.

- Increased frequency of extreme weather events globally in 2024 impacting logistics and raw material sourcing.

- Companies are investing in supply chain diversification and risk management to mitigate climate-related disruptions.

- The automotive sector, reliant on global supply chains, faces heightened vulnerability to environmental factors affecting production and delivery schedules.

Corporate social responsibility (CSR) and ESG reporting pressures

CIE Automotive faces increasing pressure from investors, customers, and regulators to bolster its Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting. This push necessitates a stronger focus on sustainability performance and greater transparency in its operations.

The company's ESG Strategic Plan 2025 underscores its dedication to eco-efficiency and actively engaging with stakeholders. This plan aims to align CIE Automotive's business practices with overarching sustainability objectives, reflecting a growing market demand for responsible corporate behavior.

- Investor Scrutiny: Asset managers, such as BlackRock, have increasingly prioritized ESG factors, with many funds now integrating ESG criteria into their investment decisions.

- Customer Demand: A significant percentage of consumers, particularly younger demographics, express a willingness to pay more for products from sustainable brands.

- Regulatory Landscape: The European Union's Corporate Sustainability Reporting Directive (CSRD) mandates enhanced ESG disclosures for a broad range of companies, impacting supply chains globally.

Environmental regulations are tightening globally, pushing CIE Automotive towards greener manufacturing. The EU's Fit for 55 aims for a 55% emissions cut by 2030, directly impacting automotive suppliers. CIE Automotive is investing in renewable energy, like solar, to meet climate targets and reduce its carbon footprint.

The automotive industry's sustainability drive means a greater demand for recycled and bio-based materials. By 2025, the EU is expected to mandate higher recycled plastic content in vehicles, influencing CIE Automotive's material sourcing and production design to support a circular economy.

Climate change presents physical risks to CIE Automotive's supply chain, with extreme weather events disrupting raw material availability and transportation. For instance, supply chain disruptions in 2023 and early 2024 highlighted this vulnerability. Diversifying suppliers and strengthening logistics are key resilience strategies.

Investor and customer demand for strong ESG performance is growing, with reports like the EU's CSRD mandating enhanced disclosures. CIE Automotive's ESG Strategic Plan 2025 reflects this commitment to eco-efficiency and stakeholder engagement, aligning with market expectations for responsible business practices.

PESTLE Analysis Data Sources

Our CIE Automotive PESTLE Analysis is grounded in comprehensive data from reputable sources, including international economic bodies, government regulatory agencies, leading automotive industry associations, and respected market research firms. This ensures each factor is informed by current trends and official statistics.