CIE Automotive Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

CIE Automotive navigates a complex automotive supply chain where buyer power from major OEMs significantly influences pricing and terms. While the threat of new entrants is moderate due to high capital requirements, the intensity of rivalry among existing players demands constant innovation and efficiency. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping CIE Automotive’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The prices for essential inputs such as steel, aluminum, and various plastics are subject to significant fluctuations. This volatility inherently strengthens the hand of suppliers, as they can leverage market conditions to their advantage when negotiating with CIE Automotive. For instance, in early 2024, the price of aluminum saw a notable increase due to supply chain disruptions in key producing regions, directly impacting the cost of components for the automotive sector.

Suppliers offering highly specialized components, particularly for advanced vehicle systems and electric vehicle (EV) parts, wield considerable influence. CIE Automotive's dependence on these crucial inputs allows these suppliers to dictate higher prices and enforce less favorable terms. For instance, the increasing demand for battery management systems and advanced power electronics, critical for EVs, places significant bargaining power in the hands of a few specialized manufacturers.

Supplier concentration significantly impacts CIE Automotive's bargaining power. When a few dominant suppliers control critical components or raw materials, they gain leverage. This can force CIE Automotive to accept less favorable pricing and terms, directly affecting its profitability.

For instance, in the automotive sector, specialized electronic components or advanced materials might be sourced from a limited number of manufacturers. If these suppliers are highly concentrated, CIE Automotive has fewer alternatives, increasing the suppliers' ability to dictate prices and supply conditions. This is particularly true for niche technologies where few companies possess the necessary expertise or patents.

Switching Costs

High switching costs significantly bolster the bargaining power of CIE Automotive's suppliers. These costs can arise from lengthy qualification processes, the need for specialized tooling, or the deep integration of suppliers into CIE's existing supply chain and production systems. For instance, in 2024, the automotive industry continued to see extended lead times for specialized components, often requiring suppliers to invest in unique manufacturing equipment, making it costly for CIE to find and onboard new providers.

Once a supplier's products or processes are deeply embedded within CIE Automotive's operations, the effort and expense to transition to an alternative can be substantial. This creates a lock-in effect, where established supplier relationships are difficult to disrupt. This integration can involve shared IT platforms or custom-designed parts, making a swift replacement impractical and financially burdensome for CIE.

- Supplier Integration: Suppliers deeply integrated into CIE Automotive's production lines represent a significant barrier to switching.

- Tooling Investment: Specialized tooling developed by suppliers for CIE's specific product needs increases the cost of changing providers.

- Qualification Hurdles: The rigorous and time-consuming qualification processes for new automotive suppliers further entrench existing relationships.

- Operational Disruption: Switching suppliers can lead to production downtime and quality control issues, impacting CIE's operational efficiency.

Forward Integration Threat

The threat of suppliers engaging in forward integration, where they move into component manufacturing or assembly, could significantly bolster their bargaining power. This strategic shift would position them as direct competitors, potentially bypassing CIE Automotive altogether.

While less likely for suppliers of basic raw materials, specialized component manufacturers with proprietary technology or unique production skills might explore this avenue. For instance, a supplier of advanced sensor technology could decide to integrate directly into vehicle assembly lines, thereby gaining leverage over automotive manufacturers like CIE Automotive.

This potential for vertical integration poses a tangible risk to CIE Automotive's established market position. For example, if a key supplier of advanced electronic control units (ECUs) were to integrate forward, they could dictate terms more aggressively or even capture a larger share of the value chain, impacting CIE Automotive's profitability and market access.

- Forward Integration Threat: Suppliers moving into component manufacturing or assembly increases their power by becoming direct competitors.

- Specialized Component Providers: These suppliers, possessing unique IP or manufacturing capabilities, are more likely to consider forward integration.

- Market Disruption: Potential vertical integration by suppliers can disrupt CIE Automotive's market position and value chain control.

The bargaining power of suppliers for CIE Automotive is significant due to the specialized nature of many automotive components and the increasing complexity of vehicle manufacturing. In 2024, the automotive industry faced ongoing supply chain challenges, particularly for semiconductors and advanced materials, which amplified supplier leverage. This situation means CIE Automotive must carefully manage its supplier relationships to mitigate cost increases and ensure consistent supply.

Suppliers of critical, high-tech components, especially those integral to electric vehicles (EVs) and advanced driver-assistance systems (ADAS), hold substantial power. For example, the demand for specialized battery components and sophisticated sensor arrays in 2024 continued to outstrip supply, allowing a limited number of manufacturers to command premium pricing and favorable terms. This dependency limits CIE Automotive's ability to negotiate aggressively on price for these essential inputs.

The concentration of suppliers for certain specialized automotive parts is a key factor. When only a few companies possess the necessary technology, patents, or manufacturing capacity, they can exert considerable influence over pricing and supply conditions. This is evident in the market for advanced electronic control units (ECUs) and high-performance battery management systems, where a handful of suppliers dominate, forcing companies like CIE Automotive to accept less advantageous terms.

| Supplier Characteristic | Impact on CIE Automotive | Example (2024 Context) |

|---|---|---|

| Specialized Components (EVs, ADAS) | High Bargaining Power | Limited suppliers for advanced battery cells and sensor modules |

| Supplier Concentration | Increased Leverage for Suppliers | Few manufacturers of high-performance ECUs |

| High Switching Costs | Entrenched Supplier Relationships | Costly re-tooling and qualification for new component providers |

| Potential Forward Integration | Risk of Direct Competition | Specialized tech suppliers entering assembly |

What is included in the product

This analysis meticulously examines the competitive forces impacting CIE Automotive, including buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry, to reveal strategic opportunities and challenges.

Effortlessly navigate the competitive landscape of the automotive industry by visualizing the impact of each of Porter's Five Forces on CIE Automotive.

Customers Bargaining Power

CIE Automotive's customer base is dominated by a few large global vehicle manufacturers, known as Original Equipment Manufacturers (OEMs). This concentration means these OEMs hold significant sway. For instance, in 2024, the top five global automakers accounted for roughly 40% of all vehicle sales worldwide, highlighting the substantial market share wielded by these buyers.

Their immense purchasing volume allows these OEMs to negotiate aggressively on price and demand strict quality specifications, directly impacting CIE Automotive's profitability and operational flexibility. This concentrated buyer power can force suppliers to accept lower margins to secure vital contracts.

The sheer volume of components purchased by major Original Equipment Manufacturers (OEMs) grants them considerable negotiation power over CIE Automotive. For instance, in 2023, CIE Automotive's top ten customers accounted for approximately 70% of its net sales, highlighting the significant reliance on a few large clients.

A single substantial contract with a major OEM can represent a significant slice of CIE Automotive's overall revenue. This dependency makes the company particularly susceptible to the purchasing decisions and pricing demands of these key customers, directly impacting its ability to dictate terms and maintain healthy profit margins.

When automotive components are highly standardized, Original Equipment Manufacturers (OEMs) gain significant leverage. They can readily find multiple suppliers capable of producing these identical parts, diminishing their dependence on any single entity, including CIE Automotive. This ease of multi-sourcing empowers OEMs to negotiate more favorable terms, as switching suppliers becomes a straightforward and cost-effective option if current arrangements are unsatisfactory.

Backward Integration Threat

Original Equipment Manufacturers (OEMs) often have the financial muscle and technical know-how to bring component production in-house. This backward integration capability, though usually reserved for critical or unique parts, acts as a constant pressure on suppliers like CIE Automotive. For instance, in 2024, major automotive OEMs continued to invest heavily in R&D for advanced materials and electronics, signaling their potential to vertically integrate these areas.

This implicit threat forces suppliers to remain highly competitive on price and to consistently innovate. OEMs can leverage this potential to negotiate better terms, knowing that if supplier pricing or innovation falters, they have the option to produce certain components themselves. The automotive industry's trend towards electrification and autonomous driving in 2024 further highlights this, with OEMs exploring in-house battery production and software development.

- OEMs' Financial Capacity: Leading OEMs in 2024 reported billions in free cash flow, providing ample resources for potential backward integration projects.

- Technical Expertise: OEMs are increasingly acquiring or developing expertise in areas like advanced battery technology and AI for autonomous driving systems.

- Strategic Component Focus: The threat is most pronounced for components that are crucial for vehicle performance or brand differentiation, such as powertrain components or advanced driver-assistance systems (ADAS).

Price Sensitivity

The automotive sector, particularly in established regions like Europe, exhibits significant price sensitivity. This is largely driven by factors such as declining vehicle production volumes and existing overcapacity within the industry. Consequently, Original Equipment Manufacturers (OEMs) are compelled to engage in aggressive price negotiations with their component suppliers.

This intense price pressure directly affects CIE Automotive's profitability. To counter this, the company must consistently focus on enhancing operational efficiencies and diligently managing its costs across all production processes. For instance, in 2023, the European automotive market saw a slight recovery but remained under pressure from high energy costs and supply chain disruptions, contributing to continued price sensitivity from OEMs.

- Price Sensitivity: European automotive market faces price sensitivity due to declining production and overcapacity.

- OEM Negotiations: OEMs aggressively negotiate component prices, impacting supplier margins.

- CIE Automotive Impact: CIE Automotive's profitability is directly influenced by this customer price pressure.

- Mitigation Strategy: Continuous efficiency improvements and cost management are crucial for CIE Automotive.

CIE Automotive's bargaining power with customers is significantly constrained by the concentrated nature of the automotive industry. A few dominant Original Equipment Manufacturers (OEMs) purchase a substantial portion of its output, giving them considerable leverage in negotiations. In 2023, CIE Automotive's top ten customers represented approximately 70% of its net sales, underscoring this dependency.

The ability of OEMs to switch suppliers easily, especially for standardized components, further amplifies their bargaining power. This dynamic forces CIE Automotive to remain highly competitive on pricing and to continually focus on operational efficiencies to maintain profitability amidst intense customer demands.

The financial capacity of major OEMs, coupled with their increasing technical expertise in areas like battery technology, presents a credible threat of backward integration. This potential for OEMs to bring component production in-house acts as a constant pressure on CIE Automotive to offer favorable terms and innovative solutions.

| Customer Segment | Concentration Impact | Negotiation Leverage |

|---|---|---|

| Top 10 OEMs (2023) | ~70% of Net Sales | High |

| Global Top 5 Automakers (2024 Sales Share) | ~40% of Global Sales | High |

| Potential for Backward Integration | Threat of In-house Production | High |

Preview Before You Purchase

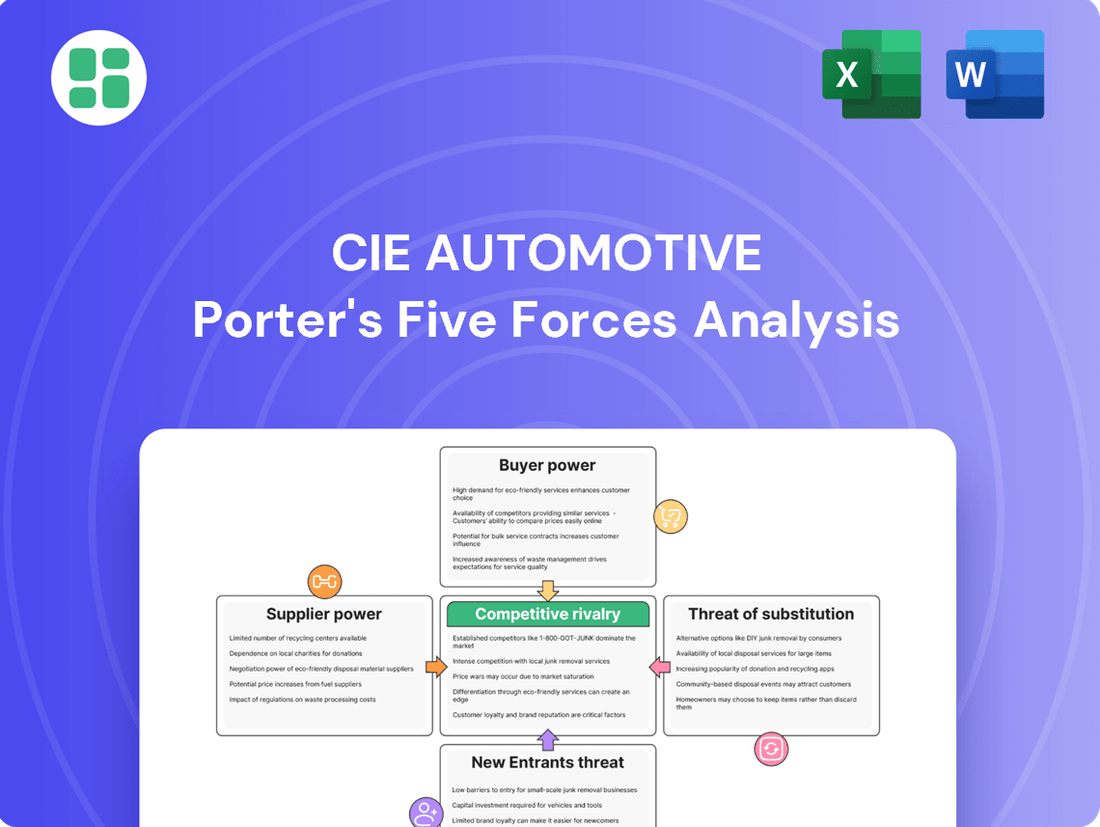

CIE Automotive Porter's Five Forces Analysis

This preview showcases the comprehensive CIE Automotive Porter's Five Forces analysis, detailing the competitive landscape within the automotive industry. You're viewing the exact document you'll receive immediately after purchase, offering insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This professionally formatted analysis is ready for immediate use, providing a clear understanding of the strategic forces shaping CIE Automotive's market position.

Rivalry Among Competitors

The automotive components market is notably fragmented, featuring a vast number of suppliers globally. This fragmentation, however, is increasingly counterbalanced by a trend towards consolidation, which naturally heightens competitive rivalry. CIE Automotive, despite its significant global presence, contends with a multitude of Tier-1 and Tier-2 suppliers, all vying for lucrative contracts and expanding their market share.

This intense competition necessitates continuous adaptation and strategic moves, including acquisitions, to maintain and grow its competitive edge. For instance, the global automotive supplier market, valued at hundreds of billions of dollars, sees new entrants and established players alike battling for dominance. In 2024, the pressure to innovate and secure supply chain agreements remains a critical factor for success.

CIE Automotive faces intense competition across its diverse technological capabilities, including forging, casting, machining, and injection molding. This broad operational scope means rivalry isn't confined to a single segment but spans specialists in each area as well as other global, multi-technology suppliers. For instance, in the automotive casting sector, companies like Nemak, a direct competitor, also operate globally, intensifying the competitive landscape.

The automotive sector faced a global production slowdown in 2024, creating significant overcapacity, especially within Europe's supply chain. This situation naturally fuels fiercer competition among manufacturers vying for limited business, often resulting in price reductions and squeezed profit margins.

CIE Automotive's resilience, demonstrated by its ability to sustain strong margins amidst this challenging environment, underscores its competitive edge. For instance, while many suppliers felt the pinch of reduced OEM orders, CIE Automotive's strategic focus on value-added components and operational efficiency allowed it to navigate these headwinds more effectively.

Innovation and Electrification Race

The automotive industry is in the midst of a significant transformation, driven by the swift adoption of electric vehicles (EVs) and a growing consumer preference for lightweight, eco-friendly materials. This shift has ignited a fierce innovation race among manufacturers and suppliers alike.

Competitors are aggressively investing in research and development to pioneer advanced components and cutting-edge technologies essential for EVs. Consequently, a company's R&D prowess and its ability to bring new solutions to market quickly are becoming paramount differentiators. For instance, the global EV market was projected to reach over $800 billion in 2024, highlighting the immense opportunities and the pressure to innovate.

CIE Automotive's strategic emphasis on developing specialized EV components and sustainable material solutions positions it to capitalize on these industry trends. This focus is vital for maintaining a competitive edge in an arena where technological advancement dictates market leadership.

- EV Market Growth: The global electric vehicle market is expanding rapidly, with projections indicating significant growth through 2024 and beyond.

- Innovation Drivers: Demand for lightweight materials and sustainable manufacturing processes are key catalysts for innovation in the automotive sector.

- Competitive Factors: R&D capabilities and speed to market are critical for success in the EV component supply chain.

- CIE Automotive's Strategy: The company's specialization in EV parts and sustainable solutions aligns with industry demands and competitive pressures.

Established Relationships and Quality Standards

Competitive rivalry within the automotive supply sector is significantly shaped by deeply entrenched relationships with Original Equipment Manufacturers (OEMs). Suppliers like CIE Automotive, who have cultivated strong, long-standing partnerships, benefit from a distinct advantage. These established ties are often built on a consistent history of reliability and a proven ability to meet the exceptionally stringent quality and safety benchmarks demanded by automotive giants.

The ability to consistently deliver on these high standards is paramount. CIE Automotive’s success, for instance, is underpinned by its capacity to satisfy rigorous OEM specifications, which often include zero-defect targets and adherence to complex regulatory frameworks. This focus on quality not only solidifies existing relationships but also acts as a barrier to entry for newer, less established competitors.

Maintaining these crucial OEM relationships necessitates unwavering performance and a commitment to continuous improvement. For example, in 2024, the automotive industry saw an increased focus on supply chain resilience and technological integration, requiring suppliers to constantly adapt and innovate. CIE Automotive’s investment in advanced manufacturing processes and digital solutions reflects this ongoing need to meet evolving OEM expectations and stay ahead in a competitive landscape.

Key factors influencing rivalry include:

- Established OEM Relationships: Long-term partnerships provide a stable customer base and preferential access.

- Stringent Quality and Safety Standards: Meeting and exceeding these benchmarks is critical for supplier selection and retention.

- Proven Track Record and Trust: Suppliers with a history of consistent performance build significant customer loyalty.

- Continuous Improvement and Innovation: Adapting to evolving industry demands, such as electrification and digitalization, is essential for maintaining competitiveness.

The automotive components market is intensely competitive, characterized by a large number of global suppliers, many of whom are specialists in particular technologies. CIE Automotive operates within this dynamic environment, facing rivals across its diverse product portfolio, from casting and forging to injection molding. The pressure to innovate, especially with the rapid shift towards electric vehicles (EVs), intensifies this rivalry, as companies like Nemak, a direct competitor in casting, also have a significant global footprint.

In 2024, the automotive sector experienced overcapacity, particularly in Europe, which heightened competition among suppliers vying for limited contracts, often leading to price pressures. Despite this, CIE Automotive has demonstrated resilience, maintaining strong margins by focusing on value-added components and operational efficiencies. The company's strategic investments in EV components and sustainable materials are crucial for navigating this competitive landscape and capitalizing on the projected growth of the EV market, which was anticipated to exceed $800 billion in 2024.

Established relationships with Original Equipment Manufacturers (OEMs) are a significant factor in competitive rivalry. CIE Automotive's long-standing partnerships, built on a history of reliability and meeting stringent quality standards, provide a competitive advantage. The automotive industry's increasing demand for supply chain resilience and technological integration in 2024 means suppliers must continuously adapt. CIE Automotive's commitment to advanced manufacturing and digital solutions helps it meet these evolving OEM expectations and maintain its competitive edge.

| Key Competitors | Market Focus | Competitive Strengths |

| Nemak | Aluminum casting (engine blocks, cylinder heads) | Global presence, strong OEM relationships, advanced casting technology |

| Magna International | Broad range of automotive components and systems | Diversified product portfolio, global manufacturing footprint, innovation in ADAS and electrification |

| ZF Friedrichshafen | Drivetrain and chassis technology, active and passive safety technology | Leadership in transmission and chassis systems, significant R&D investment, strong presence in EV powertrains |

SSubstitutes Threaten

The threat of substitutes for CIE Automotive's products is growing as new materials and manufacturing techniques emerge. Advanced composites and novel lightweight alloys, for instance, could replace traditional metal and plastic parts, offering better performance or cost advantages. This trend is amplified by the industry's focus on vehicle lightweighting and the evolution of battery technologies, potentially rendering current components less desirable.

The accelerating global shift towards electric vehicle (EV) architectures represents a significant threat of substitution for traditional automotive component suppliers like CIE Automotive. As the industry moves away from internal combustion engines (ICE), demand for components like exhaust systems, fuel injection systems, and traditional transmissions, which form a core part of CIE's historical business, is expected to decline. For instance, by the end of 2023, EV sales in Europe surpassed 1.5 million units, a substantial increase from previous years, indicating a tangible market shift away from ICE vehicles.

The increasing prevalence of software-defined vehicles (SDVs) presents a significant threat of substitutes for traditional automotive hardware suppliers. As more vehicle functions are managed by software, the reliance on complex, physical components diminishes, potentially reducing the demand for certain parts that CIE Automotive specializes in.

This shift means that companies offering integrated software and hardware solutions, or even purely software-based functionalities that replace hardware, can become viable substitutes. For instance, advancements in over-the-air updates could reduce the need for hardware upgrades or replacements, impacting the aftermarket business for physical components.

In 2024, the automotive industry continued its strong push towards software integration, with major OEMs investing billions in developing their SDV platforms. This trend is expected to accelerate, with projections indicating that a significant portion of new vehicle sales will be software-defined by the end of the decade, underscoring the urgency for CIE Automotive to adapt.

Modularization and Platform Strategies

OEMs are increasingly adopting modularization and platform strategies, a trend that presents a significant threat of substitutes for companies like CIE Automotive. By using standardized components and shared platforms across various vehicle models, automakers aim to slash production costs and streamline operations. For instance, Volkswagen Group's MQB platform underpins a vast array of models from brands like VW, Audi, Skoda, and Seat, demonstrating the power of this approach.

This shift means CIE Automotive, while benefiting from supplying these modular systems, faces a risk. Original Equipment Manufacturers (OEMs) might choose to bring more of this modular production in-house or consolidate their supplier base to a few highly integrated system providers. This could shrink the market for individual component suppliers, forcing them to compete on price or offer more comprehensive solutions to remain relevant. In 2024, the automotive industry continued to see significant investment in platform consolidation, with many manufacturers announcing plans to reduce the number of distinct vehicle architectures they utilize.

- OEMs leverage modular platforms to reduce costs and complexity.

- This strategy can lead to a consolidation of the supplier base.

- Potential for OEMs to internalize component production increases.

- CIE Automotive must adapt by offering integrated solutions to counter this threat.

Cost-Effective Imports and New Entrant Technologies

The threat of substitutes for CIE Automotive is amplified by cost-effective imports and disruptive new entrant technologies. Lower-cost regions can offer functionally similar components at significantly reduced prices, putting pressure on established players. For instance, Chinese automotive suppliers have rapidly advanced, leveraging vertical integration to provide competitive alternatives and introduce innovative technologies that challenge existing market dynamics.

This trend is particularly evident in the electric vehicle (EV) sector, where new entrants are often unburdened by legacy systems and can adopt cutting-edge manufacturing processes. By 2024, the global automotive market saw a notable increase in the market share of vehicles produced by companies with strong ties to Asian manufacturing hubs, often characterized by aggressive pricing strategies. This influx of alternatives necessitates continuous innovation and cost management for CIE Automotive to maintain its competitive edge.

- Global EV market share growth: By the end of 2023, battery electric vehicles (BEVs) accounted for over 15% of global new car sales, a figure projected to rise significantly by 2025, driven by diverse and often lower-cost offerings from new manufacturers.

- Chinese supplier impact: Chinese automotive component suppliers have expanded their global reach, with exports of key parts like battery systems and power electronics showing double-digit percentage growth year-over-year leading into 2024.

- Technological parity: Advancements in areas such as advanced driver-assistance systems (ADAS) and lightweight materials are allowing new entrants to quickly achieve technological parity with established suppliers, often at a lower price point.

The increasing adoption of electric vehicle (EV) architectures poses a significant substitution threat to CIE Automotive, as demand for traditional internal combustion engine (ICE) components declines. By the close of 2023, EV sales in Europe alone surpassed 1.5 million units, a clear indicator of this market shift. This transition necessitates a strategic pivot for CIE Automotive to align with the evolving needs of the automotive industry.

Furthermore, the rise of software-defined vehicles (SDVs) and modularization strategies adopted by Original Equipment Manufacturers (OEMs) present additional substitution risks. OEMs are increasingly standardizing components and consolidating platforms, potentially leading to a reduced supplier base or even in-house production. In 2024, major automotive players continued to invest heavily in SDV development and platform consolidation, underscoring the urgency for CIE Automotive to adapt its offerings.

The competitive landscape is also being reshaped by cost-effective imports and disruptive new technologies, particularly from emerging markets. Chinese automotive suppliers, for example, have rapidly gained ground by offering competitive alternatives and innovative solutions, especially in the EV sector. By 2024, the global automotive market witnessed a notable increase in market share for vehicles from manufacturers with strong ties to Asian production hubs, often characterized by aggressive pricing and rapid technological advancement.

Entrants Threaten

The automotive components manufacturing sector demands significant upfront capital for state-of-the-art facilities and sophisticated machinery, presenting a formidable hurdle for newcomers. For instance, setting up a new, modern automotive parts plant can easily run into hundreds of millions of dollars. This high barrier means fewer companies can even consider entering the market, thereby reducing the threat of new competition.

Established OEM Relationships and Trust are significant barriers for new entrants into the automotive supply chain, including for companies like CIE Automotive. Building the deep trust and proven reliability that global vehicle manufacturers demand takes years, if not decades. For instance, major OEMs often have multi-year supply agreements and rigorous supplier qualification processes that new players struggle to navigate. This existing network of trusted relationships creates a powerful moat, making it incredibly difficult for newcomers to gain a foothold and secure the substantial, long-term contracts that define success in this sector.

The production of sophisticated automotive components, particularly those for emerging electric vehicle (EV) technology and advanced driver-assistance systems (ADAS), requires significant technological know-how and ongoing investment in research and development. New players entering the market would need to commit substantial resources to R&D to rival the innovation capacity of established companies like CIE Automotive.

This high intensity of R&D spending acts as a considerable barrier to entry, as it necessitates a deep well of specialized knowledge and a continuous pipeline of new ideas to remain competitive. For instance, the global automotive R&D spending reached an estimated $200 billion in 2023, highlighting the scale of investment required.

Regulatory Hurdles and Certification

The automotive sector is heavily regulated, with stringent safety, environmental, and manufacturing standards. For instance, in 2024, the European Union continued to implement stricter CO2 emission targets, requiring significant investment in new technologies for compliance. New entrants must navigate these complex and costly certification processes across various global markets, which can take years and substantial capital to achieve. This regulatory landscape acts as a significant barrier, protecting established players like CIE Automotive who have already invested in meeting these evolving demands.

Meeting these diverse and often changing regulations presents a considerable challenge for newcomers. For example, in the United States, the National Highway Traffic Safety Administration (NHTSA) sets rigorous safety standards that require extensive testing and validation. CIE Automotive, with its long-standing presence, has developed the expertise and infrastructure to manage these compliance requirements efficiently. This established capability reduces the threat of new entrants who would otherwise face substantial delays and upfront costs to bring compliant products to market.

The financial implications of regulatory compliance are substantial. New entrants must allocate significant resources not only to product development but also to testing, legal counsel, and obtaining necessary certifications. In 2024, the cost of compliance for new vehicle models could easily run into tens of millions of dollars. CIE Automotive's existing operational framework and experience in navigating these hurdles provide a distinct competitive advantage, thereby diminishing the threat posed by potential new market participants.

- Global Regulatory Complexity: Navigating distinct safety and environmental standards across North America, Europe, and Asia presents a multi-faceted challenge for new entrants.

- Certification Costs: Obtaining necessary certifications, such as Euro 7 emissions standards or NHTSA safety ratings, can cost new automotive suppliers tens of millions of dollars.

- Time-to-Market Delays: The lengthy certification processes can add years to a new entrant's product launch timeline, allowing established firms like CIE Automotive to maintain market share.

- Evolving Standards: Continuous updates to regulations, like those concerning electric vehicle battery safety or autonomous driving systems, require ongoing investment and adaptation, favoring incumbents with established R&D and compliance teams.

Intellectual Property and Patents

Existing players like CIE Automotive possess a robust portfolio of patents and proprietary manufacturing techniques. These intellectual assets serve as a significant shield, protecting their innovative technologies and product designs from imitation. For instance, by 2024, CIE Automotive's commitment to R&D, which historically represents a substantial portion of their investment, underpins these protective barriers.

New entrants face a considerable hurdle in needing to develop their own unique intellectual property or incur the substantial costs and time associated with licensing existing technologies. This financial and temporal investment makes it challenging for newcomers to quickly establish a competitive product offering. The complexity and expense involved in navigating patent landscapes can effectively deter potential market entrants.

- Patented Technologies: CIE Automotive's existing patents create a barrier by requiring competitors to either invent around them or pay licensing fees.

- Proprietary Processes: Unique manufacturing methods developed by CIE Automotive are not easily replicated, increasing the cost and time for new entrants.

- R&D Investment: The significant R&D spending by established players like CIE Automotive, often running into millions of euros annually, reinforces their IP advantage.

- Market Entry Cost: The need for substantial investment in developing or acquiring IP significantly raises the cost of entry for new companies.

The threat of new entrants for CIE Automotive is moderate, primarily due to high capital requirements for manufacturing facilities and advanced machinery, which can cost hundreds of millions of dollars to establish. Furthermore, securing long-term contracts with Original Equipment Manufacturers (OEMs) requires years of building trust and proving reliability, a significant hurdle for newcomers. The substantial investment in research and development, estimated at $200 billion globally in 2023, and the complex, costly regulatory landscape, with compliance costs potentially reaching tens of millions of dollars for new models in 2024, also act as strong deterrents.

| Barrier to Entry | Estimated Cost/Timeframe | Impact on New Entrants |

|---|---|---|

| Capital Investment (Facilities) | Hundreds of millions of USD | High barrier, requires substantial funding. |

| OEM Relationship Building | Years to decades | Difficult to gain trust and secure contracts. |

| R&D Investment | Estimated $200 billion globally (2023) | Requires significant ongoing spending for innovation. |

| Regulatory Compliance | Tens of millions of USD per model (2024) | Costly and time-consuming certification processes. |

Porter's Five Forces Analysis Data Sources

Our CIE Automotive Porter's Five Forces analysis is built upon a robust foundation of data, drawing from annual reports, investor presentations, and financial statements of CIE Automotive and its key competitors. We also incorporate insights from reputable industry research firms and market intelligence platforms to ensure a comprehensive understanding of the competitive landscape.