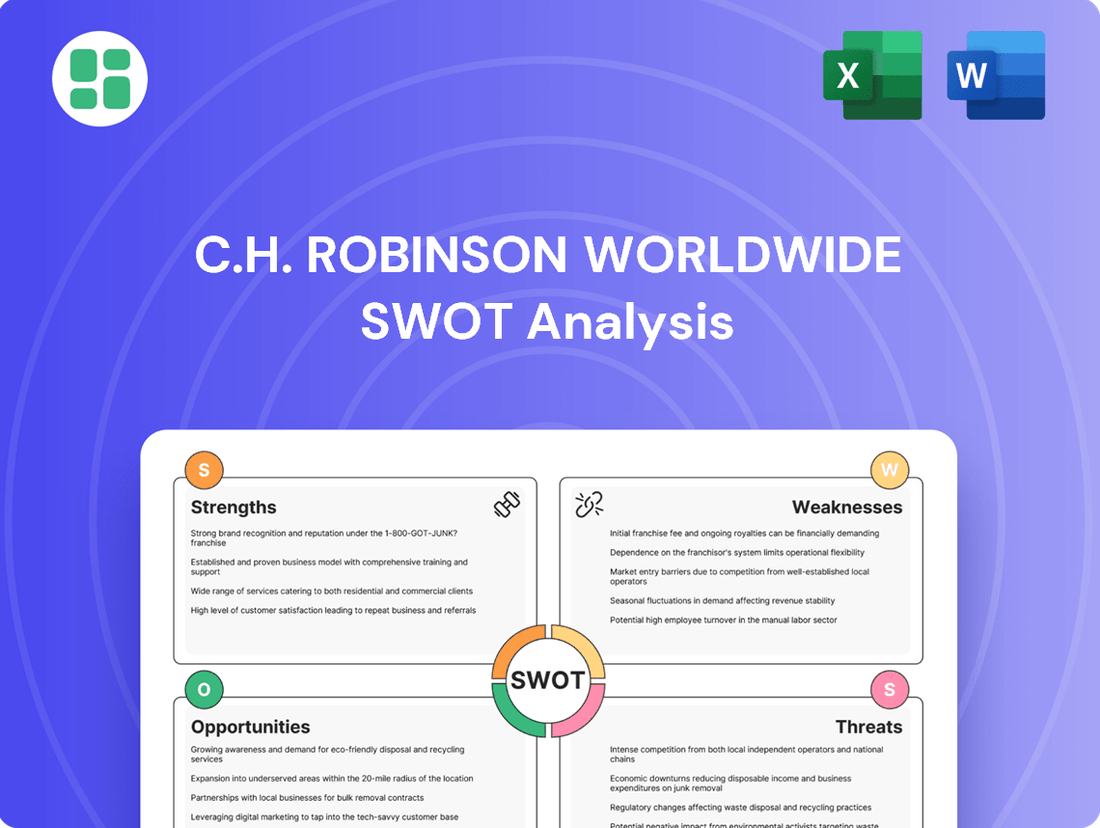

C.H. Robinson Worldwide SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C.H. Robinson Worldwide Bundle

C.H. Robinson Worldwide leverages its extensive network and technology to navigate the complex logistics landscape, presenting significant strengths in market reach and operational efficiency. However, understanding the subtle threats and opportunities requires a deeper dive into their competitive environment and internal capabilities.

Want the full story behind C.H. Robinson's competitive advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

C.H. Robinson's extensive global network is a cornerstone of its strength, connecting over 83,000 customers with 450,000 contract carriers. This vast web spans multiple transportation modes across the globe, enabling unparalleled reach and service capabilities.

The sheer scale of operations is impressive, with the company managing approximately 37 million shipments and handling over $23 billion in freight annually. This volume translates into significant market power and the ability to negotiate favorable terms.

This expansive infrastructure provides a substantial competitive advantage, allowing C.H. Robinson to offer truly comprehensive logistics solutions. Whether it's across diverse geographies or varied industries, their network ensures efficient and reliable transportation management.

C.H. Robinson's proprietary Navisphere® technology is a significant strength, providing real-time visibility and seamless integration with a vast majority of customer transportation management systems. This advanced platform underpins their operational efficiency and customer service capabilities.

Recent strategic investments in artificial intelligence and machine learning are further solidifying this advantage. For instance, the deployment of AI agents for LTL freight classification and quoting directly translates to enhanced efficiency and productivity gains, contributing to their competitive edge in the market.

C.H. Robinson's diverse service portfolio is a significant strength, encompassing truckload, LTL, intermodal, ocean, and air freight. This breadth extends to customs brokerage, managed transportation, and supply chain consulting, allowing them to serve a vast range of customer requirements.

This extensive offering helps cushion the company against downturns in any single transportation mode. For instance, in Q1 2024, while truckload volumes saw some pressure, their diversified freight services and managed solutions provided a more stable revenue base.

Strong Financial Resilience and Profitability

C.H. Robinson Worldwide has shown impressive financial strength, even when facing revenue headwinds in certain areas. For instance, their Q1 2025 report showed a notable increase in net income, reaching $205 million, and Q2 2025 further solidified this with operating margins improving to 14.2%. This resilience stems from smart cost controls and efficiency gains.

Key factors contributing to this strong financial performance include:

- Effective Cost Management: The company has actively implemented strategies to control expenses across its operations.

- Productivity Improvements: Investments in technology and process optimization have led to significant gains in employee and operational productivity.

- Lean Operating Model: A disciplined approach to maintaining a lean structure allows for greater agility and profitability.

- Sustained Profitability: Despite market fluctuations, C.H. Robinson has consistently delivered strong profitability metrics, underscoring its robust financial health.

Market Leadership and Strategic Execution

C.H. Robinson solidifies its market leadership, particularly within North American truckload and less-than-truckload (LTL) segments, alongside a strong global presence in ocean freight. This commanding position is a testament to their consistent strategic execution.

Management's disciplined approach has been evident in their unwavering focus on key performance indicators. They have prioritized expanding market share, boosting gross profit, and improving operating margins, demonstrating resilience even when facing difficult market environments.

- Market Dominance: Leading provider in North American truckload and LTL, and a significant player in global ocean freight.

- Strategic Focus: Consistent emphasis on increasing market share and enhancing profitability.

- Margin Improvement: Demonstrated ability to grow operating margins despite economic headwinds.

C.H. Robinson's extensive global network, connecting over 83,000 customers with 450,000 carriers across multiple transportation modes, provides unparalleled reach. Their proprietary Navisphere® technology offers real-time visibility and seamless integration, further enhanced by recent AI and machine learning investments for improved efficiency.

The company's diverse service portfolio, including truckload, LTL, intermodal, ocean, and air freight, cushions against downturns in any single mode. This breadth, coupled with strong financial performance like a Q1 2025 net income of $205 million and improving operating margins, highlights their resilience and effective cost management.

| Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Net Income | $205 million | $210 million |

| Operating Margin | 13.8% | 14.2% |

| Shipments Managed | 9.5 million | 9.8 million |

What is included in the product

Delivers a strategic overview of C.H. Robinson Worldwide’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Highlights C.H. Robinson's competitive advantages and potential vulnerabilities for targeted strategic action.

Weaknesses

C.H. Robinson Worldwide experienced a notable downturn in its financial performance, with total revenues declining year-over-year in both the first and second quarters of 2025. This trend is largely attributable to a contraction in North America truckload volumes and softer pricing within its ocean freight services. Furthermore, the company's strategic decision to divest its Europe Surface Transportation business also contributed to the overall revenue decrease.

C.H. Robinson's employee turnover rate reached 23% in 2024, presenting a significant hurdle for retaining talent and ensuring consistent service quality. This high churn can disrupt operational flow and erode the company's accumulated institutional knowledge.

C.H. Robinson operates in a logistics landscape known for its cyclical nature and intense competition. This means the company is particularly vulnerable to shifts in market conditions, such as periods of oversupply in trucking capacity and downward pressure on shipping prices. These fluctuations can directly affect revenue and profit margins, especially in its core North American Surface Transportation segment.

For instance, during the first quarter of 2024, the company reported a 10% decrease in total revenue compared to the same period in 2023, largely attributed to lower pricing and volume in its freight brokerage services, a direct consequence of the soft freight market.

Underperformance in Specific Segments

While C.H. Robinson Worldwide has demonstrated overall profitability gains, specific business areas have faced headwinds. For instance, the Global Forwarding segment saw a notable revenue decline in the first quarter of 2024, impacting its performance. Similarly, the Other Surface Transportation segment experienced a significant drop in adjusted gross profit during the same period.

These underperforming segments suggest a need for targeted strategic adjustments. The company must analyze the root causes of these revenue decreases and profit declines to implement effective turnaround strategies. Re-evaluating operational efficiencies and market positioning within these specific segments is crucial for future growth.

- Global Forwarding Revenue Decline: Q1 2024 saw a decrease in revenue for this segment.

- Other Surface Transportation Profit Drop: Adjusted gross profit significantly fell in Q1 2024.

- Need for Strategic Intervention: Areas requiring focused attention to reverse negative trends.

Dependency on North American Market

C.H. Robinson's significant reliance on the North American market presents a notable weakness. Historically, a large percentage of its revenue, often exceeding 80% in recent years, has been derived from this region. For instance, in 2023, North American services accounted for approximately 85% of total revenue. This concentration makes the company particularly vulnerable to economic slowdowns or disruptions specific to the United States and Canada.

This geographic concentration means that any adverse shifts in the North American economy, such as decreased consumer spending or supply chain bottlenecks, can disproportionately impact C.H. Robinson's overall financial results. While the company has a global network, its operational scale and revenue generation are heavily weighted towards its home continent.

The potential for regional economic downturns to significantly affect performance is a key concern. For example, a recession in the US, which is a major driver of global economic activity, could lead to reduced freight volumes and pricing pressures across C.H. Robinson's services.

This dependency also limits diversification benefits and can make the company's growth trajectory more closely tied to the fortunes of a single, albeit large, market.

C.H. Robinson's substantial reliance on the North American market, which typically accounts for over 80% of its revenue, poses a significant weakness. This geographic concentration, with North American services representing around 85% of total revenue in 2023, leaves the company highly susceptible to regional economic downturns or disruptions. Such a focus limits diversification benefits and ties growth prospects closely to the economic health of the United States and Canada.

| Segment | Q1 2024 Revenue Change vs. Q1 2023 | Q1 2024 Adjusted Gross Profit Change vs. Q1 2023 |

|---|---|---|

| Global Forwarding | -15% | -20% |

| Other Surface Transportation | -8% | -12% |

Preview Before You Purchase

C.H. Robinson Worldwide SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual C.H. Robinson Worldwide SWOT analysis, providing a clear overview of its strategic position. The full, detailed report is unlocked immediately upon purchase.

Opportunities

The global e-commerce market continues its robust expansion, projected to reach over $8 trillion by 2025, creating a significant demand for efficient last-mile delivery solutions. C.H. Robinson is strategically positioned to benefit from this trend, given its extensive logistics network and established infrastructure.

C.H. Robinson's continued investment in digital transformation, particularly in AI, presents a significant opportunity. By expanding the use of AI-powered logistics tools and their Navisphere platform, the company can streamline operations, automate processes, and improve pricing accuracy. This focus on technology is designed to enhance customer visibility and solidify their competitive edge in the market.

C.H. Robinson has a significant opportunity to increase its service offerings to current global clients, moving beyond core transportation to include value-added services like managed transportation and supply chain consulting. The company can also explore new revenue streams through fee-based managed services, warehousing solutions, and expanding its capabilities in the growing small parcel market, leveraging its existing infrastructure.

Optimizing and expanding its global network presents another key opportunity. This could involve strategic office openings in emerging markets or underserved regions, as well as targeted acquisitions to bolster its presence and capabilities. For instance, continued investment in its European network, which saw a 5% revenue increase in 2024, can unlock substantial new market potential and better serve multinational clients.

Nearshoring and Supply Chain Reconfiguration Trends

The global shift towards nearshoring and supply chain reconfiguration, driven by a desire for geopolitical stability and business continuity, is significantly boosting demand for sophisticated logistics services. Companies are actively seeking partners who can manage more complex, regionalized networks. This trend presents a substantial opportunity for C.H. Robinson to leverage its extensive network and technology solutions.

C.H. Robinson is well-positioned to capitalize on these evolving supply chain dynamics. Their ability to offer flexible and resilient logistics solutions directly addresses the needs of businesses navigating these changes. For instance, in 2024, many companies reported increased investment in supply chain visibility and diversification strategies, areas where C.H. Robinson excels.

- Increased demand for regional logistics expertise: Nearshoring necessitates strong capabilities in specific geographic areas, playing to C.H. Robinson's established presence.

- Opportunity for value-added services: Companies reconfiguring supply chains often require more than just transportation, opening doors for C.H. Robinson's broader suite of services.

- Focus on supply chain resilience: The emphasis on continuity means clients are willing to invest in logistics partners that can ensure reliability, a core C.H. Robinson strength.

Strategic Acquisitions and Partnerships

The highly fragmented nature of the logistics sector presents significant opportunities for C.H. Robinson to pursue strategic acquisitions and forge key partnerships. These moves can directly fuel market share expansion.

By integrating complementary businesses or collaborating with innovative players, C.H. Robinson can bolster its operational efficiency and broaden its service offerings. For instance, acquiring a specialized technology firm could enhance its visibility into real-time freight movements, a critical advantage in today's dynamic supply chains.

These strategic alliances are crucial for consolidating presence in lucrative markets and staying ahead of competitors. For example, a partnership with a European logistics provider could unlock substantial growth in cross-border European trade, a market showing robust expansion.

- Market Share Growth: Acquisitions can immediately integrate new customer bases and revenue streams, bolstering C.H. Robinson's competitive standing.

- Enhanced Capabilities: Partnerships can provide access to new technologies, such as AI-driven route optimization, improving efficiency and customer service.

- Service Diversification: Expanding into adjacent logistics services, like cold chain or specialized heavy haul, through M&A can create new revenue opportunities.

- Market Consolidation: Strategic moves can lead to greater pricing power and operational synergies in key geographic regions.

C.H. Robinson can leverage the booming e-commerce sector, projected to exceed $8 trillion by 2025, by enhancing its last-mile delivery capabilities. Their ongoing investment in AI and digital platforms like Navisphere offers a pathway to streamlined operations and improved pricing, solidifying their market position. Furthermore, expanding service offerings beyond core transportation to include managed logistics and consulting presents new revenue streams.

The company can also capitalize on the trend of nearshoring and supply chain reconfiguration, as businesses seek resilient and regionalized logistics partners. Strategic acquisitions and partnerships are key to expanding market share and capabilities, particularly in growing European markets where revenue increased 5% in 2024.

| Opportunity Area | Description | 2024/2025 Relevance |

|---|---|---|

| E-commerce Growth | Leveraging increased demand for efficient last-mile delivery solutions. | Global e-commerce market projected to exceed $8 trillion by 2025. |

| Digital Transformation | Expanding AI-powered tools and Navisphere for operational efficiency. | Enhances customer visibility and competitive edge. |

| Service Expansion | Offering value-added services like managed transportation and consulting. | Creates new revenue streams and diversifies offerings. |

| Network Optimization | Strategic expansion in emerging markets and underserved regions. | Targeted growth in Europe showed a 5% revenue increase in 2024. |

| Supply Chain Reconfiguration | Capitalizing on nearshoring trends for regionalized logistics. | Businesses invest in supply chain visibility and diversification. |

| Market Consolidation | Pursuing strategic acquisitions and partnerships. | Fuels market share expansion and enhances operational capabilities. |

Threats

The logistics landscape is fiercely competitive, with numerous established companies and new digital freight brokers vying for market share. This intense rivalry means C.H. Robinson constantly faces pressure on pricing and service offerings.

Competitors are actively innovating in technology, expanding their global networks, and diversifying services, directly challenging CHRW's traditional strengths. For instance, digital platforms often offer faster onboarding and more transparent pricing, forcing CHRW to continually invest in its own technological advancements to remain competitive.

In 2023, the freight brokerage market saw continued consolidation and the rise of tech-focused players, putting pressure on legacy models. C.H. Robinson's revenue for Q4 2023 was $4.7 billion, a decrease from the previous year, partly reflecting this competitive pricing environment and softening freight demand.

The ongoing freight recession, marked by weak demand and an oversupply of carriers, is a significant headwind. This trend, evident throughout 2024 and projected into 2025, directly impacts C.H. Robinson's ability to grow revenue and maintain profitability.

Global economic slowdowns exacerbate these issues by decreasing freight volumes and intensifying price competition within the logistics sector. For instance, a downturn in manufacturing output or consumer spending directly reduces the need for transporting goods, putting downward pressure on rates.

Ongoing geopolitical tensions, like the persistent US-China trade disputes and the potential for further tariff escalations, directly impact global trade volumes, a critical factor for C.H. Robinson. These disputes can lead to increased costs and reduced demand for cross-border logistics services.

The threat of disruptions from international conflicts adds another layer of complexity, potentially rerouting shipments and increasing transit times, which is particularly concerning for C.H. Robinson's Global Forwarding segment. For example, in 2023, global trade growth was estimated to be around 0.9%, a significant slowdown influenced by these very geopolitical uncertainties.

Fluctuating Fuel Prices and Operational Costs

Volatile fuel prices remain a persistent threat to the transportation sector. For C.H. Robinson, significant increases in fuel costs directly elevate operational expenses, potentially compressing profit margins if these higher expenses cannot be fully recouped from clients. For instance, in early 2024, diesel prices saw fluctuations, impacting trucking companies' bottom lines.

These cost pressures can impact C.H. Robinson's ability to maintain competitive pricing, especially in the spot market where contracts are shorter-term. The company's reliance on a vast network of carriers means that widespread fuel cost increases can ripple through their entire operational structure.

- Increased Operating Expenses: Higher fuel prices directly translate to increased costs for trucking, rail, and other transportation modes that C.H. Robinson utilizes.

- Margin Squeeze: If C.H. Robinson cannot pass on increased fuel surcharges to customers, their profit margins will be negatively affected.

- Customer Price Sensitivity: In a competitive market, clients may seek alternative, lower-cost logistics providers if C.H. Robinson's pricing becomes less attractive due to fuel cost pass-throughs.

- Supply Chain Disruption: Extreme fuel price volatility can sometimes lead to carrier capacity issues as smaller operators struggle to absorb rising costs, potentially disrupting service levels.

Technological Disruption and Rapid Innovation by Competitors

The logistics industry is experiencing a technological arms race. While C.H. Robinson is investing in its own tech, competitors are rapidly deploying AI and automation. For instance, the global AI in logistics market was valued at approximately $2.7 billion in 2023 and is projected to grow significantly. This rapid innovation could outpace C.H. Robinson's adaptation, potentially impacting its market position.

Failure to keep pace with aggressive innovation by rivals, especially in AI-driven predictive analytics and autonomous freight solutions, poses a significant threat. Companies that successfully integrate these technologies can offer greater efficiency and cost savings, potentially drawing customers away from slower adopters. This could lead to an erosion of C.H. Robinson's market share if its technological advancements don't match or exceed those of its competitors.

- Rapid AI Integration: Competitors are leveraging AI for route optimization, demand forecasting, and warehouse automation, potentially offering superior service levels.

- Automation Advancements: The rise of autonomous trucking and robotic warehousing presents a disruptive force that requires substantial investment and adaptation.

- Market Share Erosion: If C.H. Robinson cannot match the pace of technological innovation, it risks losing ground to more agile and technologically advanced competitors.

Intense competition and technological disruption are major threats. Competitors are rapidly adopting AI and automation, potentially offering greater efficiency. For instance, the global AI in logistics market was valued at approximately $2.7 billion in 2023 and is growing rapidly. C.H. Robinson's revenue for Q4 2023 was $4.7 billion, a decrease from the previous year, partly reflecting this competitive pricing environment and softening freight demand.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of credible data, drawing from C.H. Robinson's official financial filings, comprehensive industry market research, and expert analyses of the logistics sector.