C.H. Robinson Worldwide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C.H. Robinson Worldwide Bundle

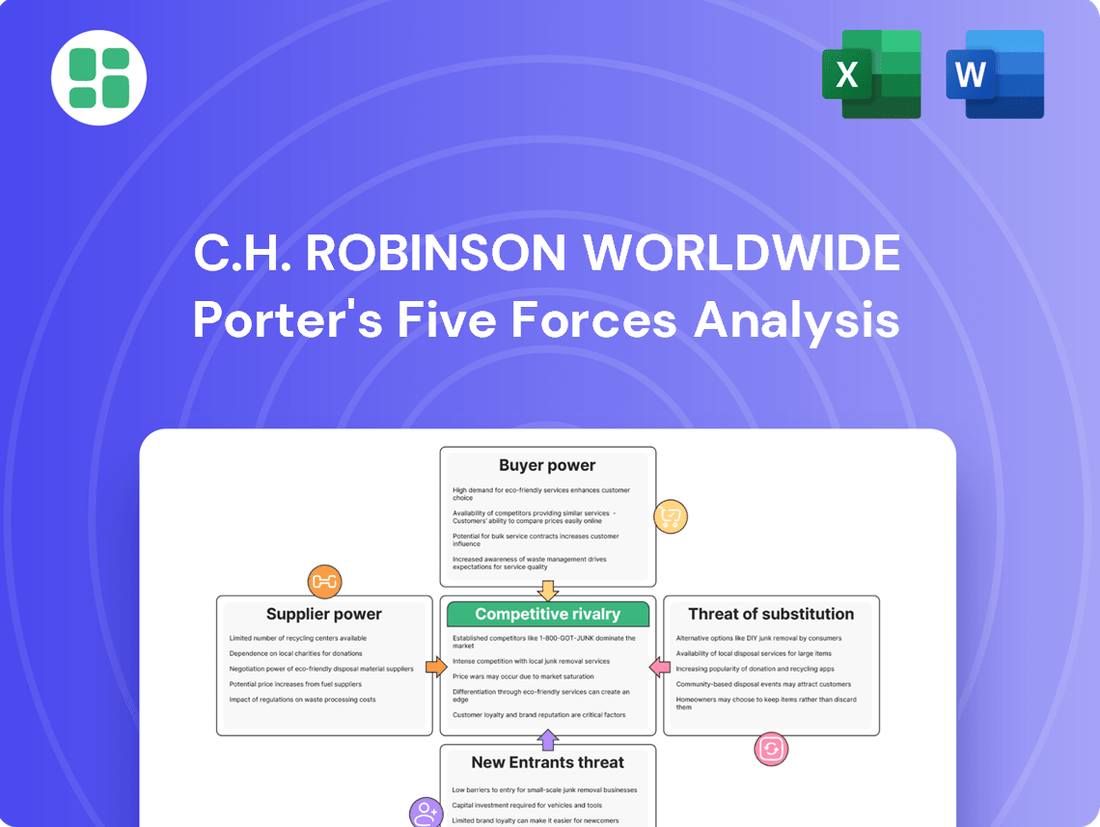

C.H. Robinson Worldwide navigates a complex logistics landscape, facing intense rivalry and the constant pressure of buyer power. Understanding the nuances of supplier relationships and the threat of new entrants is crucial for their sustained success.

The complete report reveals the real forces shaping C.H. Robinson Worldwide’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers in the logistics sector, particularly transportation carriers, is generally low due to significant fragmentation. C.H. Robinson, as a major logistics provider, benefits from a vast network of independent trucking companies, regional carriers, and smaller freight operators. This broad supplier base allows the company to easily substitute carriers, limiting the leverage any single supplier can exert.

However, this dynamic can shift for specialized services. For instance, carriers with unique equipment, such as refrigerated trucks for temperature-sensitive goods or those serving niche, less-trafficked routes, may command higher rates. In 2024, while overall carrier capacity remained a consideration, specific demands for specialized equipment or routes could still grant these niche suppliers increased bargaining power.

Fluctuations in fuel prices and driver shortages directly influence carriers' operating expenses and available capacity, bolstering their bargaining power. For instance, in early 2024, diesel prices saw significant volatility, impacting carriers' bottom lines. This situation forces carriers to raise their rates, which C.H. Robinson then faces the decision of absorbing or passing on to its clients.

The ongoing scarcity of qualified truck drivers further constrains the industry's capacity. As of late 2023 and into 2024, the American Trucking Associations reported a persistent driver shortage, estimated to be over 78,000 drivers. This limited capacity grants carriers greater leverage in negotiating pricing, directly affecting C.H. Robinson's cost structure and service availability.

C.H. Robinson's substantial role as a freight broker means it generates significant business for many trucking companies, particularly smaller operations. This consistent flow of freight volume can diminish a carrier's individual leverage, as the loss of C.H. Robinson's business would have a considerable impact.

In 2023, C.H. Robinson facilitated freight for over 100,000 customers, underscoring its broad reach and the dependence many carriers have on its services. This scale inherently shifts bargaining power towards C.H. Robinson, especially when dealing with carriers that are not highly specialized or are seeking to fill less in-demand routes.

Switching Costs for C.H. Robinson

While C.H. Robinson leverages a massive network of carriers, the costs for shippers to switch between individual carriers are typically low. This is largely due to the standardized nature of many freight services, meaning a carrier's ability to provide a specific service is often comparable across different providers.

C.H. Robinson's proprietary technology platform plays a crucial role in streamlining these carrier transitions. This platform simplifies the process of onboarding and managing different carriers, further reducing the perceived switching costs for their clients. For instance, in 2023, the company reported managing over 10 million loads, highlighting the scale and efficiency of their network management capabilities.

- Low Individual Carrier Switching Costs: Shippers can generally move freight between carriers with minimal disruption and cost due to service standardization.

- Technology as an Enabler: C.H. Robinson's platform facilitates efficient carrier selection and management, mitigating switching friction.

- Relationship Investment: The true cost for C.H. Robinson lies in the continuous effort to build and maintain relationships with a broad and dependable carrier base, a critical asset for service reliability.

Specialized Services and Niche Carriers

For highly specialized transportation needs, like oversized cargo or precise temperature control, the pool of qualified carriers shrinks significantly. This scarcity naturally elevates the bargaining power of these niche providers, as C.H. Robinson Worldwide depends on them to meet unique customer demands. In 2024, the demand for specialized freight, particularly in sectors like pharmaceuticals and heavy machinery, continued to outpace the readily available capacity, reinforcing the leverage of these specialized carriers.

- Niche Carrier Dependence: C.H. Robinson's reliance on a limited number of specialized carriers for complex shipments grants these suppliers greater negotiation leverage.

- Market Scarcity: The reduced availability of carriers equipped for oversized, temperature-sensitive, or specific international routes strengthens their bargaining position.

- 2024 Market Dynamics: Increased demand for specialized freight services in 2024, driven by sectors like advanced manufacturing and life sciences, amplified the power of niche carriers.

The bargaining power of suppliers for C.H. Robinson Worldwide is generally low due to the fragmented nature of the trucking industry and the company's vast network. However, this power increases for carriers offering specialized services or those operating in markets with limited capacity, a trend observed into 2024. Factors like driver shortages and fuel price volatility, as seen in early 2024, can temporarily bolster carrier leverage.

| Factor | Impact on Supplier Bargaining Power | Relevance to C.H. Robinson |

|---|---|---|

| Industry Fragmentation | Low | C.H. Robinson works with a vast number of carriers, limiting individual supplier leverage. |

| Specialized Services | High | Niche carriers (e.g., refrigerated, oversized) have more power due to limited availability. |

| Driver Shortage (2023-2024) | High | Constrained capacity due to shortages (over 78,000 drivers estimated by ATA) increases carrier pricing power. |

| Fuel Price Volatility (Early 2024) | Medium to High | Impacts carrier operating costs, potentially leading to rate increases passed to C.H. Robinson. |

| C.H. Robinson's Volume | Low | The large volume of freight C.H. Robinson provides makes many carriers dependent on its business. |

What is included in the product

Tailored exclusively for C.H. Robinson Worldwide, analyzing its position within its competitive landscape by examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats by visualizing C.H. Robinson's Porter's Five Forces, offering a clear roadmap to navigate industry pressures.

Customers Bargaining Power

C.H. Robinson's customer base is incredibly diverse, ranging from small businesses to massive corporations across numerous sectors. This fragmentation means that while individual small customers have minimal leverage, larger clients who represent a significant portion of C.H. Robinson's revenue wield considerable power. These major players can negotiate for better pricing or specialized services due to the substantial volume of freight they entrust to the company.

Customers in the logistics sector often encounter minimal costs when shifting between third-party logistics (3PL) providers. This is largely because many fundamental services are treated as commodities, and contract arrangements tend to be adaptable. For instance, in 2023, the average contract length for many logistics services remained relatively short, allowing for easier renegotiation or termination.

This low barrier to switching significantly amplifies customer bargaining power. Consequently, companies like C.H. Robinson must consistently focus on competitive pricing and superior service to retain their client base. Customers can easily obtain quotes from a variety of providers, fostering a competitive environment that C.H. Robinson must navigate.

Many large shippers possess the ability to handle logistics internally, either fully or partially, by running their own fleets or directly engaging carriers. This capability serves as a significant bargaining tool for customers, establishing an implicit price limit for C.H. Robinson's services.

For instance, in 2024, the trucking industry faced ongoing challenges with driver shortages and rising fuel costs, which could make in-house logistics more appealing for some large companies if they have the infrastructure. The decision to insource often weighs the potential cost savings against the convenience and specialized expertise that a third-party logistics provider like C.H. Robinson offers.

Information Transparency and Price Comparison

The rise of digital freight platforms and readily available industry benchmarks has significantly increased information transparency for customers. This allows them to easily compare pricing and service levels across multiple 3PL providers, directly enhancing their bargaining power.

In 2024, the freight brokerage market continued to see a proliferation of digital tools, making it simpler for shippers to access real-time rate data and benchmark performance. For instance, platforms offering instant freight quotes empower shippers to negotiate more effectively, expecting competitive pricing from established players like C.H. Robinson.

- Increased Price Visibility: Digital platforms provide shippers with immediate access to market rates, reducing information asymmetry.

- Enhanced Negotiation Leverage: Customers can easily compare offerings from various 3PLs, strengthening their position in price discussions.

- Focus on Value Beyond Price: C.H. Robinson must differentiate itself by highlighting superior service, reliability, and integrated solutions, not just cost.

Standardization of Core Services

The bargaining power of customers for C.H. Robinson is significantly influenced by the standardization of core transportation services. While the company provides advanced logistics solutions, fundamental offerings like truckload and less-than-truckload (LTL) shipping are largely similar across the industry. This makes it simpler for clients to benchmark prices and view providers as interchangeable for these basic needs.

This inherent standardization allows customers to exert considerable pricing pressure on C.H. Robinson for its more commoditized services. For instance, in 2024, the freight brokerage market continued to see intense competition, with spot rates for truckload services fluctuating based on capacity and demand, giving shippers leverage.

- Standardized Offerings: Core services like truckload and LTL are easily comparable across competitors.

- Price Sensitivity: Customers can readily switch providers for standard freight needs, increasing price sensitivity.

- Customer Leverage: This ease of comparison and switching empowers customers to negotiate lower rates for basic transportation.

C.H. Robinson's customers, especially large enterprises, possess substantial bargaining power due to the commoditized nature of many logistics services and the ease of switching providers. This is further amplified by increased price transparency through digital platforms, allowing clients to readily compare rates and negotiate effectively. For instance, in 2024, the freight brokerage market saw continued intense competition, with shippers leveraging spot rate data to secure favorable pricing.

The ability for some large shippers to manage logistics internally or directly engage carriers acts as a significant counter-pressure, setting a ceiling on what C.H. Robinson can charge. This "threat of backward integration" forces the company to maintain competitive pricing and focus on delivering value beyond basic transportation, such as specialized solutions and reliable service to retain its client base.

| Factor | Impact on C.H. Robinson | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High volume clients have significant leverage. | While C.H. Robinson serves many customers, a few large accounts represent a substantial revenue share, granting them negotiation power. |

| Switching Costs | Low switching costs empower customers. | Many logistics services are viewed as commodities, with adaptable contracts, making it easy for clients to move to competitors. |

| Information Transparency | Digital platforms increase customer knowledge. | In 2024, digital freight marketplaces provided real-time rate data, enabling shippers to benchmark and negotiate more aggressively. |

| Threat of Backward Integration | Internal logistics capabilities limit external provider power. | Large companies with existing fleets or the ability to build them can leverage this to negotiate better terms with 3PLs. |

Full Version Awaits

C.H. Robinson Worldwide Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for C.H. Robinson Worldwide, providing a detailed examination of industry competition, buyer and supplier power, threat of new entrants, and substitute products. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately upon purchase, ensuring you get the exact insights you expect for strategic decision-making.

Rivalry Among Competitors

The third-party logistics and freight brokerage sector is incredibly fragmented, meaning there are a lot of companies vying for business. This includes everything from massive global players to smaller, specialized firms and even individual brokers operating locally. This sheer volume of competition creates a very intense environment for companies like C.H. Robinson.

C.H. Robinson doesn't just compete with other big names in the 3PL space; they also go head-to-head with niche providers who focus on specific industries or services, and even smaller, independent brokers who can be very agile. This broad spectrum of rivals means constant pressure to win and keep business.

The intense rivalry among these numerous competitors often translates into aggressive pricing strategies and a strong focus on service differentiation. For instance, in 2023, the U.S. freight brokerage market saw significant price fluctuations, particularly in the truckload segment, highlighting the competitive pressures faced by all participants.

The freight brokerage industry, including players like C.H. Robinson, often sees its core services viewed as commodities. While technological advancements and the sheer size of a company's network can provide some distinction, many fundamental freight transportation and logistics functions are very similar across providers. This makes it challenging for companies to truly differentiate themselves based on service alone.

This lack of significant differentiation in core offerings typically drives competition towards price. When services are perceived as largely interchangeable, customers will naturally gravitate towards the most cost-effective option. This price-based competition can put considerable pressure on profit margins for all participants in the market, including C.H. Robinson.

In 2023, the transportation and warehousing sector faced ongoing economic headwinds, with freight volumes fluctuating. For instance, the Cass Freight Index showed a notable year-over-year decline in shipments throughout much of 2023, indicating a softer demand environment where price sensitivity likely increased for many shippers.

To combat this, companies like C.H. Robinson increasingly focus on value-added services. These might include advanced analytics, supply chain visibility tools, or specialized handling capabilities. Such offerings are vital for creating a more distinct value proposition and moving beyond pure price competition.

The logistics industry's growth, while generally stable, saw a projected 3.5% compound annual growth rate (CAGR) for the global freight forwarding market from 2024 to 2029. However, periods of slower growth, like the 2.2% expansion in global trade volume observed in 2023, can significantly intensify competitive rivalry.

During these slower periods, companies like C.H. Robinson Worldwide face increased pressure as the focus shifts from market expansion to capturing existing market share. This often results in more aggressive pricing and marketing tactics among competitors, making it a zero-sum game to maintain or grow their standing.

Acquisition and Consolidation Activity

The third-party logistics (3PL) sector is characterized by frequent mergers and acquisitions, a trend that significantly impacts competitive rivalry. Larger 3PL providers often acquire smaller companies to expand their service offerings, geographic reach, or technological capabilities. This consolidation activity can create more formidable competitors for C.H. Robinson, shifting the competitive landscape and intensifying the pressure to innovate and grow.

For instance, in 2023, the 3PL market saw notable consolidation. While specific major deals involving C.H. Robinson's direct competitors are often proprietary until announced, the broader industry trend indicates a continuous reshaping of market power. Companies like XPO Logistics and Ryder System have been active in strategic acquisitions to bolster their market positions, demonstrating the ongoing drive for scale and efficiency within the sector.

This dynamic means C.H. Robinson must constantly evaluate opportunities to expand its own capabilities or market presence, either organically or through strategic partnerships and acquisitions, to maintain its competitive edge. The pursuit of scale and enhanced service portfolios is a direct response to the increasing size and scope of rivals emerging from this consolidation.

- Industry Consolidation: The 3PL sector consistently experiences M&A activity, with larger players acquiring smaller ones.

- Competitive Landscape Shifts: Consolidation creates larger, more powerful rivals, intensifying competition.

- Scale and Scope Expansion: Acquiring companies allows competitors to increase their operational scale and service breadth.

- Strategic Imperative: C.H. Robinson must adapt through growth and capability enhancement to counter consolidated rivals.

Technological Advancements and Digital Platforms

The logistics industry is witnessing a fierce battle driven by rapid technological advancements. Companies are pouring resources into digital freight matching, AI for route optimization, and real-time tracking systems to gain a competitive advantage. For instance, in 2024, the global logistics technology market was projected to reach over $60 billion, highlighting the significant investment in this area.

This constant innovation means competitors are frequently rolling out new features and efficiency improvements. C.H. Robinson, like its peers, faces immense pressure to continually update and enhance its technology infrastructure to remain competitive. The company’s 2023 annual report indicated substantial capital expenditures allocated towards technology and digital solutions, reflecting this ongoing arms race.

- Digital Freight Matching: Platforms connecting shippers and carriers digitally are becoming standard, increasing price transparency and operational speed.

- AI-Driven Optimization: Artificial intelligence is crucial for optimizing routes, load consolidation, and predictive maintenance, reducing costs and improving delivery times.

- Real-Time Visibility: Advanced tracking and visibility tools are essential for shippers to monitor their goods throughout the supply chain, a capability customers increasingly expect.

The competitive rivalry within the third-party logistics (3PL) sector is extremely high due to the industry's fragmented nature, with numerous players ranging from global giants to niche specialists and independent brokers. This intense competition often leads to aggressive pricing and a strong emphasis on service differentiation, especially as core logistics services are frequently perceived as commodities. For example, the U.S. freight brokerage market in 2023 experienced significant price volatility, underscoring the constant pressure on all participants.

The drive to stand out in this crowded market pushes companies like C.H. Robinson to invest heavily in value-added services, such as advanced analytics and enhanced supply chain visibility, moving beyond basic transportation. This is crucial as the global freight forwarding market, projected for a 3.5% CAGR from 2024-2029, can see rivalry intensify during slower growth periods, like the 2.2% global trade volume expansion in 2023, where market share capture becomes paramount.

Industry consolidation, marked by frequent mergers and acquisitions, further reshapes the competitive landscape, creating larger, more formidable rivals. This trend, evident in 2023 with companies like XPO Logistics and Ryder System actively pursuing strategic acquisitions, necessitates that C.H. Robinson continuously enhances its capabilities to maintain its competitive edge.

Technological advancements are also a major battleground, with significant investments in areas like digital freight matching and AI-driven optimization. The global logistics technology market, expected to exceed $60 billion in 2024, highlights the critical need for companies like C.H. Robinson to continually innovate its technology infrastructure, as demonstrated by their substantial capital expenditures in digital solutions in 2023.

SSubstitutes Threaten

The most significant threat of substitutes for C.H. Robinson's services comes from customers choosing to handle logistics in-house. This can involve maintaining their own private fleets or directly engaging with individual carriers. For large companies with predictable, high-volume shipping, this internal management can appear appealing.

The decision to insource versus outsource hinges on a careful comparison of costs, the desire for direct control, and existing internal capabilities against the specialized efficiency and expertise that a third-party logistics (3PL) provider like C.H. Robinson offers. For instance, while a company might save on 3PL fees, they must factor in the substantial capital expenditure for fleet acquisition and maintenance, driver recruitment, and the overhead of managing a complex logistics operation themselves.

Customers can bypass third-party logistics (3PL) providers like C.H. Robinson by forging direct connections with carriers. This is particularly tempting for businesses with consistent, high-volume freight needs, as direct negotiation might yield cost efficiencies or enhanced operational oversight. For instance, in 2024, the trucking industry saw continued pressure on rates, making direct deals appealing to some shippers.

While not an immediate concern, future innovations in transportation, such as widespread adoption of autonomous trucks or the development of hyperloop systems, pose a potential threat. These technologies could bypass traditional freight brokerage models, fundamentally changing how goods are moved. For instance, the U.S. Department of Transportation is actively supporting research into autonomous vehicle safety, with pilot programs already underway in several states, indicating a tangible move towards these future solutions.

Shift to Localized Supply Chains

The increasing trend of businesses localizing their supply chains poses a significant threat to logistics providers like C.H. Robinson. This strategic shift, often fueled by geopolitical uncertainties and a drive for enhanced resilience, directly reduces the need for extensive, long-haul, and international transportation services. As companies increasingly source and manufacture goods closer to their end consumers, the reliance on vast third-party logistics (3PL) networks may naturally decline, potentially shrinking the overall market for global logistics operations.

For instance, in 2024, many companies continued to re-evaluate their global footprints. A survey by McKinsey indicated that over 60% of manufacturers were considering or actively pursuing supply chain regionalization. This move away from highly centralized international hubs can diminish the volume of freight requiring C.H. Robinson's cross-border and long-distance capabilities. The potential impact is a reduction in the overall addressable market for services that depend on complex, multi-segment global movements.

- Reduced Demand for Long-Haul Freight: Localized sourcing directly cuts into the need for extensive cross-country or international freight movements, a core service for many 3PLs.

- Shrinking Global Logistics Market: As companies bring production closer to home, the overall volume of international shipments, a significant revenue driver for global logistics firms, is likely to decrease.

- Increased Competition from Regional Players: A more localized supply chain environment can foster the growth of smaller, regional logistics providers who are better positioned to serve these shorter, more focused routes.

- Geopolitical Influence on Supply Chains: Ongoing global tensions and trade policy shifts in 2024 and beyond continue to incentivize companies to de-risk by diversifying their supply chains, often through localization.

Digital Freight Brokerage Platforms

Digital freight brokerage platforms, while often seen as direct competitors, can also function as substitutes for C.H. Robinson's more integrated services. These platforms, focusing on streamlined, automated transactions, cater to shippers needing basic, quick freight bookings for standard loads. This can siphon off a portion of the market that doesn't require C.H. Robinson's full suite of managed solutions.

The threat of these digital substitutes is amplified by their ability to commoditize simpler freight services. For instance, in 2024, the digital freight market continued its expansion, with companies like Convoy and Uber Freight offering increasingly sophisticated, yet still largely transactional, booking capabilities. This trend poses a risk to C.H. Robinson if a significant number of shippers opt for these lower-cost, less service-intensive alternatives for a substantial portion of their freight needs.

- Digital platforms offer simplified, transactional booking for standard freight.

- This can erode C.H. Robinson's market share in less complex shipping segments.

- The threat is the commoditization of basic freight brokerage services.

Customers might opt for in-house logistics or direct carrier relationships, particularly for high-volume, predictable shipping needs. This insourcing decision weighs the costs of private fleets against the specialized efficiency of 3PLs like C.H. Robinson. For example, in 2024, trucking rate pressures made direct deals attractive to some shippers, even with the capital outlay for fleet management.

The rise of digital freight platforms presents a substitute threat by offering streamlined, automated booking for simpler loads. These platforms can commoditize basic freight services, potentially drawing shippers away from more comprehensive managed solutions. In 2024, the digital freight market continued to grow, with companies like Convoy and Uber Freight expanding their transactional capabilities, posing a risk if a significant portion of shippers favor these lower-cost alternatives.

| Substitute Type | Description | Potential Impact on C.H. Robinson | 2024 Relevance |

|---|---|---|---|

| In-house Logistics | Companies managing their own fleets and operations. | Reduced outsourcing volume, direct competition for carriers. | Continued rate pressures made direct sourcing appealing. |

| Direct Carrier Engagement | Shippers bypassing brokers to negotiate directly with carriers. | Lower transaction volumes, potential margin erosion. | Persistent interest due to fluctuating market rates. |

| Digital Freight Platforms | Online marketplaces for booking standard freight shipments. | Market share loss in transactional segments, commoditization of services. | Market expansion and increased sophistication of offerings. |

Entrants Threaten

The threat of new entrants in the Third-Party Logistics (3PL) sector is significantly mitigated by the immense capital required to establish a competitive presence. Companies need to invest heavily in advanced technology, robust data analytics, and building extensive global networks of carriers and customers. For instance, C.H. Robinson, a leader in the industry, has consistently prioritized these investments, creating a substantial barrier for any new player looking to enter the market.

Established players like C.H. Robinson leverage substantial economies of scale, enabling them to negotiate more favorable rates with carriers due to their high freight volumes. In 2023, C.H. Robinson reported total revenue of $21.5 billion, showcasing the scale of their operations. New entrants face a significant hurdle in matching these cost efficiencies, as building comparable volume to secure competitive pricing is a considerable challenge.

Building trust and strong customer relationships is a significant barrier for new entrants in the logistics sector. C.H. Robinson has cultivated these over decades, making it difficult for newcomers to gain shipper confidence. For instance, in 2023, C.H. Robinson reported total revenues of $21.5 billion, a testament to its established market presence and client loyalty.

Regulatory Compliance and Complexity

The logistics industry faces significant hurdles for new players due to the intricate landscape of national and international regulations. These include diverse transportation laws, customs protocols, and evolving environmental standards that demand specialized knowledge and substantial investment to navigate effectively.

C.H. Robinson's established infrastructure and deep expertise in managing these complex compliance requirements create a formidable barrier to entry. For instance, in 2024, the company continued to invest heavily in its compliance and sustainability initiatives, a critical factor for operating across global supply chains.

- Regulatory Expertise: C.H. Robinson possesses decades of experience in managing diverse regulatory frameworks, reducing risk for clients.

- Compliance Investment: The company's ongoing commitment to compliance technology and personnel ensures adherence to evolving global standards.

- Barrier to Entry: The significant resources and specialized knowledge required to meet regulatory demands deter potential new competitors.

Access to Carrier Networks and Expertise

Developing a robust and reliable network of thousands of qualified carriers across various modes and geographies, like C.H. Robinson's, takes years of dedicated effort and relationship building. This extensive carrier base is not easily replicated by newcomers.

New entrants would face significant hurdles in matching C.H. Robinson's established carrier relationships and the deep operational expertise needed to manage such a complex network efficiently. This creates a strong barrier to entry.

- Network Effect: C.H. Robinson's vast carrier network and the associated operational knowledge create a powerful network effect, making it difficult for new competitors to achieve comparable scale and efficiency.

- Relationship Capital: The years invested in building trust and strong partnerships with carriers represent significant intangible assets that new entrants cannot quickly acquire.

- Operational Complexity: Managing a diverse fleet and ensuring consistent service quality across numerous routes requires sophisticated systems and experienced personnel, a high bar for challengers.

The threat of new entrants in the third-party logistics (3PL) sector, particularly for a company like C.H. Robinson, is generally low due to substantial capital requirements for technology, data analytics, and network development. High switching costs for customers, built on trust and established relationships, further solidify this position.

New entrants would also struggle to match C.H. Robinson's economies of scale, which provide significant cost advantages in carrier negotiations. For example, C.H. Robinson's 2023 revenue of $21.5 billion demonstrates the operational scale needed to secure competitive pricing, a feat difficult for newcomers to replicate quickly.

| Factor | Impact on New Entrants | C.H. Robinson's Advantage |

|---|---|---|

| Capital Investment | High (Technology, Network) | Established infrastructure and ongoing R&D investment |

| Economies of Scale | Low (Difficult to match volume) | Significant cost savings through high freight volumes ($21.5B revenue in 2023) |

| Customer Relationships | Low (Trust takes time) | Decades of cultivated client loyalty and trust |

| Regulatory Complexity | High (Knowledge, Compliance Investment) | Deep expertise and continuous investment in compliance initiatives (2024) |

| Carrier Network | Low (Time-intensive relationship building) | Extensive, long-standing carrier partnerships and operational expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for C.H. Robinson Worldwide leverages data from their annual reports and SEC filings, alongside industry analysis from IBISWorld and market intelligence from Statista.