C.H. Robinson Worldwide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

C.H. Robinson Worldwide Bundle

Navigate the complex external forces shaping C.H. Robinson Worldwide's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for this logistics giant. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now and unlock critical insights.

Political factors

Geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to disrupt global trade routes. This forces logistics companies like C.H. Robinson to adapt by finding alternative shipping lanes and managing increased transit times. For instance, the Red Sea shipping crisis, which intensified in late 2023 and continued into early 2024, saw many vessels reroute around Africa, adding weeks to delivery schedules and boosting fuel costs.

Trade wars and the imposition of tariffs remain a significant concern. For example, the US-China trade relationship, while seeing some de-escalation, still involves substantial tariffs on many goods. In 2024, the potential for new tariffs or trade barriers from major economic blocs could further complicate international shipping, increasing costs for businesses and requiring C.H. Robinson to adjust its strategies and pricing to maintain competitiveness and client service levels.

Government policies aimed at speeding up infrastructure projects and boosting housing supply directly impact the need for logistics and distribution centers. For example, the United States' Bipartisan Infrastructure Law, enacted in 2021 and continuing its implementation through 2024 and beyond, allocates significant funds to road, bridge, and transit improvements, which in turn supports freight movement.

This increased construction activity generates demand for industrial spaces, and a growing population, especially with rising incomes as seen in the projected 2.5% GDP growth for the US in 2024, fuels the need for warehousing, particularly to support the booming e-commerce sector. This creates a solid base of demand for transportation services, benefiting companies like C.H. Robinson.

Governments worldwide are actively encouraging nearshoring and reshoring to build more resilient supply chains, a trend that directly benefits logistics providers. For instance, the US reshoring initiative, supported by policies aimed at boosting domestic manufacturing, is projected to increase manufacturing output by 5-10% by 2025, according to industry analysts.

This shift means more goods will be manufactured and distributed domestically, creating a heightened demand for trucking and transportation services within North America. C.H. Robinson, with its extensive North American network, is well-positioned to capture increased volumes, particularly in less-than-truckload (LTL) freight, which is crucial for shorter, regional movements.

The company’s ability to manage complex domestic logistics and offer integrated solutions makes it a prime candidate to support businesses undergoing this supply chain restructuring. C.H. Robinson’s 2024 first-quarter results showed a 7% increase in total revenue, partly attributed to strong demand in its North American surface transportation segment.

International Trade Agreements and Customs Policies

Shifting international trade agreements and evolving customs policies present ongoing challenges for third-party logistics (3PL) providers. For instance, the implementation of new rules of origin under various trade pacts, such as the USMCA, necessitates meticulous tracking of component sourcing to ensure compliance and avoid tariffs. C.H. Robinson, a major player, must continuously adapt its operations and invest in technology to manage these intricate requirements.

Changes in documentation standards and an increase in customs audits globally heighten the need for accuracy in declarations. In 2024, customs authorities worldwide are intensifying scrutiny on import/export paperwork, making even minor errors potentially costly through delays or penalties. This environment underscores the crucial role of C.H. Robinson's customs brokerage services in expertly navigating these complex regulatory landscapes.

The global trade landscape is dynamic, with ongoing negotiations and potential revisions to existing agreements impacting supply chains. For example, discussions around potential new trade frameworks in 2024-2025 could introduce further complexities. C.H. Robinson's ability to provide agile customs solutions is paramount for its clients' ability to maintain smooth international operations.

C.H. Robinson's customs brokerage services are a key differentiator, helping clients manage:

- Compliance with evolving rules of origin.

- Accurate and timely customs declarations.

- Adaptation to new documentation standards.

- Mitigation of risks associated with increased audits.

Political Stability and Labor Relations

Political stability in regions where C.H. Robinson operates is crucial for maintaining smooth supply chain operations. Unforeseen political shifts can introduce uncertainty, impacting freight volumes and transportation costs. For instance, the ongoing geopolitical tensions in Eastern Europe continue to affect global trade routes and fuel prices, directly influencing the cost of international shipping and the need for adaptable logistics solutions.

Labor relations present a significant variable for C.H. Robinson. Potential disruptions like port strikes or contentious union negotiations can severely impede freight movement. The outcome of contract negotiations, such as those involving the International Longshoremen's Association (ILA) on the East Coast, directly impacts import volumes and the overall efficiency of port operations. In 2024, the threat of labor disputes at major ports remains a key concern for the logistics industry.

- Political Stability: Geopolitical events can alter trade flows and increase operational risks for global logistics providers.

- Labor Relations: Union activity and contract negotiations at key transportation hubs, like ports, can cause significant delays and cost increases.

- Regulatory Environment: Changes in trade policies, tariffs, or transportation regulations can directly impact C.H. Robinson's business model and profitability.

- Government Spending: Infrastructure investment, such as road and bridge improvements, can enhance transportation efficiency, while budget cuts may lead to deterioration.

Government policies promoting nearshoring and reshoring are reshaping supply chains, directly benefiting logistics companies like C.H. Robinson by increasing domestic freight volumes. The US reshoring initiative, backed by supportive policies, is anticipated to boost manufacturing output, creating a heightened demand for trucking and transportation services within North America.

Changes in international trade agreements and customs policies necessitate ongoing adaptation for third-party logistics providers. For instance, new rules of origin under pacts like the USMCA require meticulous tracking of component sourcing to ensure compliance and avoid tariffs, a complex task C.H. Robinson's expertise helps manage.

Labor relations at key transportation hubs, such as ports, present a significant variable. Union activity and contract negotiations can cause substantial delays and cost increases, as seen with potential disruptions at major ports in 2024, directly impacting freight movement efficiency.

Political stability is crucial for maintaining smooth supply chain operations; geopolitical events can alter trade flows and increase operational risks. For example, ongoing tensions in Eastern Europe continue to affect global trade routes and fuel prices, influencing international shipping costs and the need for adaptable logistics solutions.

| Political Factor | Impact on C.H. Robinson | Example/Data (2024-2025) |

|---|---|---|

| Nearshoring/Reshoring Policies | Increased domestic freight demand | US reshoring initiative projected to boost manufacturing output 5-10% by 2025. |

| Trade Agreements & Customs | Need for compliance and adaptation | USMCA rules of origin require meticulous component tracking. |

| Labor Relations | Potential for operational disruptions | Threat of labor disputes at major ports in 2024 impacting freight movement. |

| Geopolitical Stability | Alteration of trade flows and increased risks | Eastern European tensions impacting global routes and fuel prices. |

What is included in the product

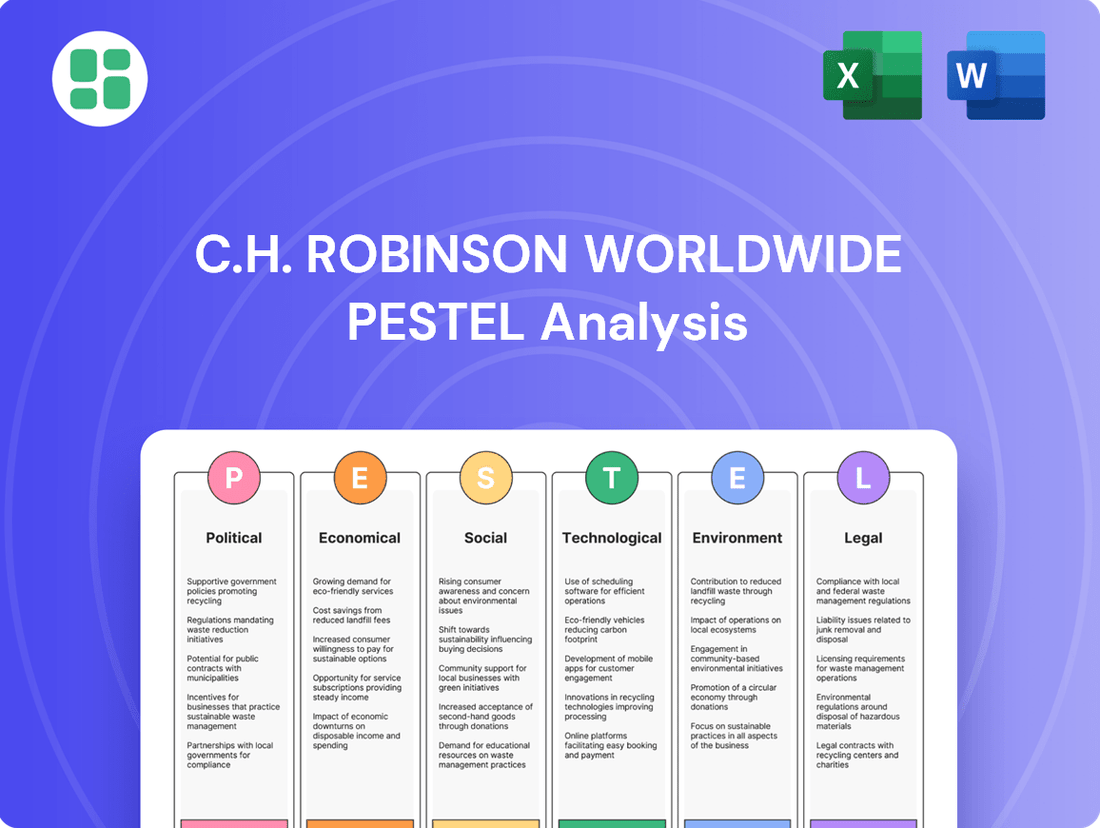

This PESTLE analysis examines the external macro-environmental factors influencing C.H. Robinson Worldwide, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these global trends create both challenges and strategic advantages for the company's operations and future growth.

This C.H. Robinson Worldwide PESTLE analysis offers a concise, easily digestible summary of external factors, acting as a pain point reliever by providing clarity and focus for strategic decision-making.

Economic factors

A projected global economic slowdown, with forecasts suggesting growth rates around 2.5% for 2024 and a similar outlook for 2025, directly impacts C.H. Robinson. This slowdown typically translates to reduced consumer spending and business investment, consequently lowering demand for freight services and potentially decreasing cargo volumes.

Persistent inflationary pressures, which saw consumer price indices in major economies like the US and Eurozone hovering around 3-4% in late 2024, present a dual challenge. While C.H. Robinson's variable-cost structure provides some flexibility during volume downturns, rising fuel prices and increased labor costs directly elevate operating expenses, squeezing profit margins.

For instance, the average diesel price in the US remained elevated, often exceeding $4.00 per gallon throughout much of 2024, a significant cost factor for trucking operations. Managing these escalating input costs while navigating a potentially softer freight market is a critical balancing act for C.H. Robinson's profitability and competitive positioning.

The relentless expansion of e-commerce, with global sales anticipated to hit $7.4 trillion by 2025, is a primary catalyst for heightened demand in last-mile delivery services. This surge directly fuels the need for sophisticated logistics solutions and specialized transportation, areas where C.H. Robinson excels.

This e-commerce boom necessitates a significant increase in warehousing capacity and enhanced fulfillment operations. Consequently, third-party logistics (3PL) providers like C.H. Robinson, offering end-to-end services, are well-positioned to capitalize on this trend.

The fundamental shift from brick-and-mortar to online retail inherently requires more extensive warehousing infrastructure compared to traditional brick-and-mortar models, creating a sustained demand for storage and distribution capabilities.

Volatile fuel prices remain a critical economic influencer for C.H. Robinson, directly affecting their purchased transportation costs. For instance, the average diesel price in the US hovered around $4.00 per gallon in early 2024, a significant factor in their operational expenses.

Managing these fluctuating costs is paramount. C.H. Robinson’s strategies, including optimizing routes and fostering strong carrier partnerships, are key to mitigating the impact on their profitability. This also encourages investment in more fuel-efficient fleets and potentially alternative fuel solutions.

Interest Rate Trends and Investment Climate

Monetary policies, particularly interest rate adjustments by central banks, significantly shape the investment climate for sectors crucial to logistics. For instance, the Federal Reserve's actions in 2024 and early 2025 are key. Lower interest rates tend to make investments in industrial and logistics real estate more attractive, potentially leading to increased development and expansion of warehousing and transportation infrastructure. This can indirectly benefit C.H. Robinson by enhancing network capacity and operational efficiency.

The availability and cost of capital are directly tied to interest rate trends. In 2024, many analysts anticipated a period of stable to slightly declining interest rates compared to the higher levels seen in 2023, which could stimulate capital deployment into logistics assets. This improved investment climate directly supports industry expansion, a positive factor for a large logistics provider like C.H. Robinson.

- Federal Reserve Interest Rate Policy: The Fed's benchmark federal funds rate, which influences borrowing costs across the economy, is a primary driver. Rates held steady through much of late 2023 and early 2024, with market expectations for potential cuts later in 2024.

- Impact on Real Estate Investment: Lower borrowing costs make it cheaper for developers and investors to acquire land and build new logistics facilities, potentially increasing the supply of modern warehouse space.

- Capital Availability for Expansion: A favorable interest rate environment generally increases the ease with which companies like C.H. Robinson can access capital for fleet upgrades, technology investments, and strategic acquisitions.

- Global Economic Outlook: Broader economic conditions and global interest rate differentials also play a role, influencing international investment flows into logistics infrastructure.

Outsourcing Trend to Third-Party Logistics (3PLs)

The increasing reliance on third-party logistics (3PLs) is a significant economic factor. Businesses are outsourcing to 3PLs to cut costs, speed up deliveries, and boost supply chain resilience and sustainability. This shift is driven by the growing complexity of global supply chains, creating a fertile ground for companies like C.H. Robinson to expand their market presence and service portfolios.

Businesses are actively seeking 3PL expertise to manage intricate transportation requirements. For instance, the global 3PL market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially. This growth underscores the demand for specialized logistics services that C.H. Robinson is well-positioned to meet.

- Market Growth: The global 3PL market is expected to reach over $1.7 trillion by 2028, indicating strong demand for outsourced logistics solutions.

- Cost Efficiency: Companies utilizing 3PLs often see significant savings, with some reporting reductions of 10-15% in logistics costs.

- Supply Chain Complexity: The increasing number of SKUs, international shipping regulations, and e-commerce demands necessitate specialized 3PL capabilities.

- Sustainability Focus: A growing percentage of businesses are prioritizing 3PLs that offer sustainable logistics solutions, impacting provider selection.

The global economic outlook for 2024 and 2025 suggests a continued period of moderate growth, with projections around 2.5% annually. This generally stable, albeit not robust, economic environment supports freight volumes, though specific sector performance can vary. Persistent inflation, with consumer prices in major economies like the US and Eurozone averaging between 3% and 4% in late 2024, continues to impact operational costs, particularly fuel and labor. Volatile fuel prices, with US diesel prices often exceeding $4.00 per gallon throughout 2024, directly affect C.H. Robinson's transportation expenses.

| Economic Factor | 2024/2025 Outlook | Impact on C.H. Robinson |

|---|---|---|

| Global Economic Growth | Projected around 2.5% for 2024 and 2025 | Supports stable freight demand, but potential for reduced consumer spending can impact volumes. |

| Inflation (CPI) | 3-4% in major economies (late 2024) | Increases operating costs (fuel, labor), potentially squeezing margins if not passed on. |

| Fuel Prices (US Diesel) | Exceeded $4.00/gallon in 2024 | Directly raises purchased transportation costs, requiring efficient cost management. |

| E-commerce Growth | Global sales projected to hit $7.4 trillion by 2025 | Drives demand for last-mile delivery and sophisticated logistics solutions, benefiting 3PLs. |

| Interest Rates | Anticipated stable to declining in 2024/2025 | Can stimulate investment in logistics real estate and capital for expansion, improving network capacity. |

Same Document Delivered

C.H. Robinson Worldwide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive C.H. Robinson Worldwide PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed breakdown of how external forces shape C.H. Robinson's business landscape, offering valuable insights for strategic decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to be a complete, actionable resource for understanding the macro-environmental influences on C.H. Robinson Worldwide.

Sociological factors

The logistics sector, including companies like C.H. Robinson, continues to face significant labor shortages, especially for truck drivers and warehouse staff. This persistent scarcity directly impacts operational costs through rising wages. For instance, the American Trucking Associations reported in early 2024 that the driver shortage could reach 160,000 by 2028 if current trends continue.

This workforce deficit also highlights a growing skills gap within the industry. C.H. Robinson must therefore invest heavily in employee training programs and explore advanced automation solutions to maintain efficiency and service levels. These investments are critical for ensuring smooth operations and competitiveness in the face of ongoing labor market challenges.

Consumers now expect near-instantaneous delivery and constant updates, a trend significantly fueled by the e-commerce boom. For instance, by the end of 2024, a significant majority of online shoppers in developed markets anticipate same-day or next-day delivery options for a wider range of goods.

This societal shift compels logistics companies like C.H. Robinson to invest heavily in optimizing last-mile operations and providing granular, real-time visibility into shipments. Companies failing to adapt risk losing market share to more agile competitors who can meet these heightened expectations for speed and transparency.

Societal awareness of supply chain vulnerabilities has surged, particularly following recent global disruptions. This heightened awareness translates into a strong demand for logistics solutions that are not just efficient but also resilient and adaptable. Consumers and businesses alike are increasingly prioritizing supply chains capable of weathering unexpected shocks.

This societal shift is driving greater investment in strategies like diversified sourcing, strategic inventory positioning, and robust risk mitigation. For instance, a 2024 survey indicated that 75% of companies are actively increasing their supply chain resilience efforts. C.H. Robinson, with its extensive network and expertise, is well-positioned to capitalize on this trend by offering solutions that enhance supply chain stability and reliability for its clients.

Shifting Workforce Demographics and Preferences

Generational shifts are significantly altering the workforce, with younger generations prioritizing work-life balance and flexible arrangements. This trend directly impacts recruitment and retention in the logistics sector, a field often associated with demanding schedules. Companies like C.H. Robinson must adapt their employment strategies to attract and retain this evolving talent pool.

To remain competitive, logistics firms are increasingly exploring options such as offering more flexible work schedules, remote work possibilities where feasible, and investing in comprehensive employee well-being programs. These adjustments are crucial for addressing changing employee preferences and ensuring a stable, skilled labor force. This directly influences the availability and cost of labor within the industry.

- Generational Shift: By 2025, Millennials and Gen Z will constitute a significant majority of the global workforce, bringing distinct expectations regarding flexibility and purpose.

- Work-Life Balance Demand: Surveys consistently show that a substantial percentage of younger workers would accept lower pay for better work-life balance, impacting wage negotiations.

- Retention Challenges: High turnover rates in the logistics sector, often exceeding 70% in certain roles, underscore the need for improved retention strategies driven by changing workforce preferences.

- Talent Attraction: Companies offering robust benefits, professional development, and flexible work options are better positioned to attract top talent in a competitive market.

Societal Pressure for Ethical Sourcing and Practices

Societal pressure for ethical sourcing and practices is a significant driver in the logistics industry. Consumers and stakeholders are increasingly demanding transparency regarding fair labor, responsible sourcing, and the overall ethical footprint of supply chains. This heightened scrutiny directly impacts how goods are transported and managed.

C.H. Robinson, as a major global logistics provider, must navigate these expectations. The company faces pressure to ensure its own operations, as well as those of its extensive network of carriers, adhere to stringent ethical standards. This commitment is crucial for maintaining brand reputation and building customer trust.

- Ethical Sourcing Demands: Consumers are increasingly researching product origins and labor conditions, pushing logistics companies to verify ethical practices throughout the supply chain.

- Brand Reputation: In 2024, a significant percentage of consumers stated they would boycott brands perceived as unethical, highlighting the financial risk of non-compliance for logistics partners.

- Carrier Compliance: C.H. Robinson's commitment to responsible carrier selection, including checks on labor practices and environmental compliance, directly addresses these societal expectations.

- Supply Chain Transparency: The demand for visibility into the entire logistics process, from origin to destination, requires robust systems for tracking and verifying ethical conduct.

Societal expectations for sustainability and environmental responsibility are increasingly shaping the logistics industry. Consumers and businesses alike are demanding greener transportation methods and reduced carbon footprints. For instance, by 2025, a notable percentage of global corporations are expected to have ambitious net-zero emissions targets for their supply chains.

This societal pressure necessitates that companies like C.H. Robinson invest in and promote eco-friendly logistics solutions, such as optimizing routes for fuel efficiency and exploring alternative fuels. Adapting to these environmental concerns is vital for maintaining a positive public image and meeting regulatory requirements.

The growing emphasis on health and safety, particularly post-pandemic, is a significant sociological factor. This translates to increased expectations for hygiene protocols, driver well-being, and overall safe working conditions within warehouses and during transit. By 2024, many logistics firms are enhancing their safety training and implementing stricter health measures.

C.H. Robinson must prioritize robust safety programs and transparent communication about health protocols to ensure employee and customer confidence. This focus on well-being is crucial for attracting and retaining talent and for building trust in the reliability of their services.

Technological factors

C.H. Robinson is making substantial investments in artificial intelligence (AI) and generative AI to streamline freight management. These technologies are being deployed to automate critical functions like price quoting, order processing, and appointment scheduling, enhancing efficiency across millions of daily transactions.

The company's strategic focus on AI aims to boost productivity by reducing manual labor and delivering quicker, more precise services to both customers and carriers. This technological push is central to C.H. Robinson's operational evolution, as evidenced by their ongoing development of AI-powered platforms.

Automation, powered by robotics and collaborative robots (cobots), is fundamentally reshaping logistics, especially within warehouses. This trend directly combats labor shortages, boosts operational efficiency, and refines demand forecasting accuracy. For instance, the global warehouse robotics market was valued at approximately $4.5 billion in 2023 and is projected to reach over $10 billion by 2028, highlighting the significant investment in this area.

C.H. Robinson is well-positioned to capitalize on these technological shifts. By integrating advanced automation into its managed transportation services, the company can offer clients enhanced supply chain optimization. This includes faster processing times, reduced errors, and more predictable delivery schedules, ultimately improving the overall customer experience and driving cost savings for businesses relying on their logistics expertise.

The growth of digital freight platforms is revolutionizing how goods move, making the process more efficient and transparent. These platforms connect shippers directly with carriers, often in real-time, leading to better pricing and clearer visibility into the supply chain. This digital shift is a major technological factor impacting logistics companies like C.H. Robinson.

C.H. Robinson leverages its own digital platform, Navisphere, to enhance these capabilities. By integrating technologies like IoT sensors and advanced data analytics, the company provides its customers with real-time tracking of shipments and data-driven insights for better decision-making. This enhanced transparency and control are crucial for maintaining a competitive edge in the modern logistics landscape.

Big Data Analytics for Supply Chain Optimization

Big data analytics is a cornerstone for optimizing supply chains, impacting everything from predicting customer demand and planning the most efficient delivery routes to actively monitoring potential risks. C.H. Robinson leverages its extensive data resources to provide smarter solutions, enabling businesses to boost efficiency and cut expenses by harnessing data-driven insights. This translates to more proactive and well-informed operational decisions.

The company's focus on data analytics allows for sophisticated demand forecasting, which is critical in navigating market fluctuations. For instance, in 2024, the logistics industry saw increased volatility, making accurate forecasting essential for inventory management and resource allocation. C.H. Robinson's ability to process vast datasets helps clients anticipate these shifts more effectively.

Predictive analytics further enhances operational efficiency by identifying potential disruptions before they occur. This includes anticipating weather-related delays, port congestion, or supplier issues. By proactively addressing these challenges, C.H. Robinson helps its clients maintain continuity and reduce the impact of unforeseen events on their supply chains.

- Demand Forecasting Accuracy: Big data enables more precise predictions of future shipping volumes, crucial for resource planning.

- Route Optimization: Advanced analytics identify the most cost-effective and time-efficient routes, reducing fuel consumption and delivery times.

- Risk Mitigation: Predictive models can flag potential supply chain disruptions, allowing for timely intervention.

- Cost Reduction: Data-driven insights empower businesses to identify and eliminate inefficiencies, leading to significant cost savings.

Cybersecurity Risks and Data Protection

As logistics operations increasingly depend on interconnected digital systems, the threat of cyberattacks and data breaches escalates. C.H. Robinson faces the critical need to bolster its cybersecurity defenses to safeguard sensitive customer and shipment data. This includes substantial investment in advanced security protocols and adherence to evolving global data privacy laws.

Protecting proprietary information and maintaining customer trust are paramount. A significant data breach could severely damage C.H. Robinson's reputation and disrupt its operations, impacting its ability to serve clients effectively. The company's commitment to robust cybersecurity is therefore directly linked to its operational continuity and market standing.

- Increased Reliance on Technology: Logistics platforms are becoming more digitized, creating a larger attack surface for cyber threats.

- Data Protection Mandates: Compliance with regulations like GDPR and CCPA requires stringent data handling and security measures.

- Financial Impact of Breaches: Cybersecurity incidents can lead to significant financial losses through remediation, fines, and lost business.

- Reputational Damage: A breach can erode customer confidence, which is vital in the logistics sector.

C.H. Robinson's technological investments focus on AI and automation to enhance freight management efficiency. These advancements aim to automate processes like quoting and scheduling, improving speed and accuracy. The company's digital platform, Navisphere, integrates IoT and data analytics for real-time tracking and insights.

The logistics industry is increasingly adopting digital freight platforms, fostering greater transparency and efficiency. C.H. Robinson's use of big data analytics allows for sophisticated demand forecasting, crucial for navigating market volatility, as seen in 2024's unpredictable logistics landscape. Predictive analytics further aids in mitigating risks by anticipating disruptions.

The escalating reliance on interconnected digital systems heightens cybersecurity risks. C.H. Robinson must invest in robust defenses to protect sensitive data, as breaches can lead to significant financial losses and reputational damage. Compliance with data privacy regulations is also a key technological consideration.

| Technology Focus | Impact on C.H. Robinson | Industry Trend | Key Data/Metric |

| Artificial Intelligence (AI) & Generative AI | Streamlining freight management, automating quoting and scheduling | Increased adoption for operational efficiency | AI investment driving productivity gains |

| Automation (Robotics/Cobots) | Boosting warehouse efficiency, combating labor shortages | Global warehouse robotics market projected to exceed $10 billion by 2028 | Improved demand forecasting accuracy |

| Digital Freight Platforms | Enhancing transparency, connecting shippers and carriers | Revolutionizing freight movement | Real-time pricing and visibility |

| Big Data & Predictive Analytics | Optimizing routes, demand forecasting, risk mitigation | Essential for navigating market volatility | Data-driven insights for cost reduction |

| Cybersecurity | Protecting sensitive data, maintaining customer trust | Growing threat landscape | Significant investment in advanced security protocols |

Legal factors

The trucking and shipping sectors are constantly adapting to new rules. For instance, the Federal Motor Carrier Safety Administration (FMCSA) has been considering mandates for Automatic Emergency Braking (AEB) systems and speed limiters, alongside proposals to eliminate MC Numbers, which are crucial for operating authority. These evolving legal landscapes directly impact how companies like C.H. Robinson must manage their operations.

Compliance with these changing regulations necessitates significant investment in updated equipment, streamlined administrative processes, and rigorous driver training. For a third-party logistics (3PL) provider such as C.H. Robinson, this means ensuring that all contracted carriers meet the latest standards to maintain operational legality and avoid potential penalties. Staying informed and proactive is key to navigating these legal shifts effectively and ensuring business continuity.

C.H. Robinson, a major player in global logistics, constantly adapts to evolving international trade laws and customs brokerage demands. Staying compliant with updated documentation, like the EU's new import control system (ICS2), and adhering to shifting rules of origin is vital for preventing costly delays and ensuring efficient international shipments.

The company's deep knowledge of customs brokerage acts as a significant competitive advantage, helping clients manage the complexities of cross-border trade. For instance, in 2024, the World Trade Organization (WTO) continued its efforts to streamline trade procedures, a landscape C.H. Robinson actively navigates.

Data privacy and security regulations are increasingly critical for logistics companies like C.H. Robinson. With operations becoming more digital, adhering to rules like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is essential. These laws dictate how C.H. Robinson handles sensitive customer and shipment information, impacting everything from data collection to storage and usage.

Maintaining strong data security is not just a legal requirement but a cornerstone of customer trust. A data breach could have severe repercussions, including hefty fines and significant damage to the company's reputation. For instance, GDPR violations can result in penalties of up to 4% of annual global revenue or €20 million, whichever is higher, underscoring the financial risks of non-compliance.

Labor Laws and Workforce Management Regulations

C.H. Robinson operates under a complex web of labor laws that directly influence its workforce and operational efficiency. Key among these are regulations governing driver hours-of-service, which dictate how long drivers can operate commercial vehicles. The Federal Motor Carrier Safety Administration's (FMCSA) Drug and Alcohol Clearinghouse, for instance, requires employers to conduct pre-employment and random drug and alcohol testing, impacting driver availability and compliance costs. These regulations are crucial for ensuring safety and legal operation.

These labor laws have a tangible impact on C.H. Robinson's business. For example, stricter hours-of-service rules can reduce the number of miles a driver can cover in a given period, potentially affecting delivery times and requiring more drivers to meet demand. In 2024, the ongoing driver shortage, exacerbated by regulatory compliance and an aging workforce, continued to put upward pressure on wages and benefits, impacting overall labor costs. Fair employment practices, including anti-discrimination and wage and hour laws, also necessitate careful management to avoid legal challenges and maintain a positive work environment.

- Driver Hours-of-Service: Regulations limit driving time, affecting route planning and driver utilization.

- Drug and Alcohol Testing: Compliance with programs like the FMCSA Clearinghouse is mandatory, impacting driver recruitment and retention.

- Fair Employment Practices: Adherence to laws concerning wages, working conditions, and non-discrimination is essential for legal operation and employee morale.

- Labor Costs: Regulatory compliance and market conditions, such as driver shortages, contribute to increased labor expenses.

Environmental Regulations on Shipping and Emissions

The shipping industry, a critical component of C.H. Robinson's operations, faces a tightening web of environmental regulations. Initiatives like the EU Emissions Trading Scheme (EU ETS) and FuelEU Maritime are pushing for significant greenhouse gas emission reductions. These mandates require substantial investments in cleaner fuels and vessel retrofits, directly impacting operational costs for shipping lines and, consequently, their logistics partners like C.H. Robinson. Failure to comply can result in hefty financial penalties, underscoring the need for proactive adaptation.

These regulatory shifts are already manifesting in market dynamics. For instance, the EU ETS, which began covering maritime emissions in January 2024, is expected to add significant costs for shipping companies operating within European waters. Estimates suggest these costs could range from hundreds of millions to billions of euros annually across the industry, depending on fuel choices and emission levels. This financial pressure encourages the adoption of technologies and fuels with lower carbon footprints, influencing the choices available to logistics providers.

- EU ETS implementation: Maritime sector included from January 2024, impacting emissions from voyages within the EU and to/from the EU.

- FuelEU Maritime: Aims to increase the uptake and use of sustainable alternative fuels in shipping, setting binding targets for greenhouse gas intensity reduction.

- Hong Kong Convention: Governs the environmentally sound management of ships' recycling, influencing vessel lifespan and disposal practices.

- Investment in cleaner technologies: Shipping companies are accelerating investments in LNG, methanol, and future ammonia-powered vessels to meet compliance targets.

Legal factors significantly shape C.H. Robinson's operational landscape, from federal safety mandates to international trade pacts. Evolving regulations like those from the FMCSA regarding Automatic Emergency Braking systems directly influence fleet management and technology investments. Furthermore, the company must navigate complex customs brokerage laws, such as the EU's Import Control System 2 (ICS2), to ensure seamless cross-border operations.

Data privacy laws, including GDPR and CCPA, are paramount as C.H. Robinson handles extensive customer and shipment data, with non-compliance carrying substantial financial penalties. Labor laws, particularly driver hours-of-service and drug testing requirements via the FMCSA Clearinghouse, impact driver availability and operational costs, especially with the ongoing driver shortage noted in 2024. Environmental regulations, like the EU ETS for maritime transport, are also driving investments in sustainable practices throughout the supply chain.

| Legal Factor Area | Key Regulations/Initiatives | Impact on C.H. Robinson | Relevant Data/Trends (2024/2025) |

|---|---|---|---|

| Transportation Safety | FMCSA mandates (e.g., AEB, speed limiters) | Requires investment in vehicle technology and compliance monitoring. | Ongoing discussions and potential implementation of new safety mandates. |

| International Trade & Customs | EU ICS2, WTO trade facilitation efforts | Demands expertise in documentation and compliance for global shipments. | Continued focus on streamlining international trade procedures by global bodies. |

| Data Privacy & Security | GDPR, CCPA | Necessitates robust data protection measures and impacts data handling practices. | Increased scrutiny on data breaches and evolving privacy regulations globally. |

| Labor & Employment | FMCSA Hours-of-Service, Clearinghouse | Affects driver scheduling, recruitment, and overall labor costs. | Persistent driver shortage in 2024 continues to pressure wages and compliance. |

| Environmental Compliance | EU ETS, FuelEU Maritime | Drives investment in greener logistics solutions and impacts shipping costs. | EU ETS maritime sector inclusion from Jan 2024 adds costs for voyages within EU waters. |

Environmental factors

Global organizations like the International Maritime Organization (IMO) and regional bodies such as the European Union are progressively tightening emission standards. For instance, the IMO's Carbon Intensity Indicator (CII) and the EU's upcoming Emissions Trading System (ETS) for shipping, set to begin in 2024, directly affect C.H. Robinson's ocean freight operations. These regulations necessitate carriers to adopt cleaner fuels, like Liquefied Natural Gas (LNG) and potentially green hydrogen in the future, and invest in upgrading their fleets to meet efficiency targets.

These environmental shifts are compelling C.H. Robinson to actively seek and promote sustainable logistics solutions. The company's reliance on ocean and air freight means it must collaborate with carriers committed to decarbonization. This includes evaluating carriers based on their environmental performance and offering clients options that minimize carbon footprints, aligning with the growing demand for greener supply chains. For example, many shipping lines are already investing billions in new vessel designs and alternative fuel capabilities to comply with these evolving regulations.

There's a significant industry-wide movement towards green logistics and sustainable supply chains, aiming to lessen the environmental footprint of transportation and warehousing. This involves strategies like route optimization to cut fuel use, increased reliance on intermodal transport, and adopting eco-friendly warehousing. For instance, in 2023, the global green logistics market was valued at an estimated $25.6 billion, with projections indicating substantial growth.

C.H. Robinson's capacity to provide these environmentally conscious solutions is increasingly becoming a key competitive advantage. It directly supports their clients' own sustainability objectives, which are becoming more critical for corporate social responsibility and investor relations. Companies are actively seeking partners who can help them achieve their carbon reduction targets, making green logistics a vital service offering.

The shipping industry is facing evolving environmental regulations, with the Hong Kong Convention for the Safe and Environmentally Sound Recycling of Ships set to take effect in June 2025. This international treaty mandates stricter standards for ship dismantling, pushing for safer practices and minimizing environmental impact. While C.H. Robinson Worldwide is not a shipowner, these regulations significantly influence the logistics landscape by increasing accountability for end-of-life vessel management across the supply chain, fostering a more circular economy approach.

Ballast Water Management Regulations

New ballast water record-keeping standards, effective February 2025, mandate detailed digital logs for ballast water treatment and discharge. These regulations, designed to curb the spread of invasive aquatic species, are accompanied by increased compliance inspections and stricter penalties for non-compliance.

C.H. Robinson's ocean freight partners are obligated to rigorously adhere to these environmental protocols. This includes ensuring all vessels in their network meet the updated standards, which could involve investments in new ballast water treatment systems or enhanced digital logging capabilities. For instance, the global maritime industry is projected to spend billions on ballast water management systems in the coming years to meet evolving international and national regulations.

- February 2025: Implementation of new ballast water record-keeping standards.

- Objective: Prevent the introduction and spread of invasive aquatic species.

- Consequences of Non-Adherence: Increased inspections and significant penalties.

- Impact on C.H. Robinson: Requirement for ocean freight partners to ensure strict compliance.

Climate Change Adaptation and Supply Chain Resilience

Climate change is significantly impacting global logistics. The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, directly threaten transportation infrastructure and can cause substantial disruptions and delays. For instance, the Federal Highway Administration reported that extreme weather events cost the U.S. transportation sector billions annually in repairs and lost productivity, a figure expected to rise.

C.H. Robinson is actively addressing these challenges by integrating climate risk assessments into its services. This proactive approach helps clients build more resilient supply chains. By diversifying routes and utilizing advanced predictive analytics, the company aims to mitigate the impact of weather-related disruptions.

The company's focus on resilience is crucial given the growing economic impact of climate events. In 2023 alone, NOAA estimated that U.S. billion-dollar disasters caused over $170 billion in damages, highlighting the vulnerability of interconnected supply chains.

Key strategies C.H. Robinson employs include:

- Diversifying transportation routes to avoid areas prone to extreme weather.

- Leveraging predictive analytics to anticipate and prepare for weather-related disruptions.

- Advising clients on supply chain adaptation strategies to enhance overall resilience.

Stricter emission standards from bodies like the IMO and EU are pushing C.H. Robinson's ocean freight partners toward cleaner fuels and fleet upgrades, impacting operational costs. The company's commitment to offering sustainable logistics solutions, such as route optimization and intermodal transport, is becoming a significant competitive advantage as clients prioritize greener supply chains.

The growing emphasis on green logistics, with the global market valued at an estimated $25.6 billion in 2023, necessitates C.H. Robinson's collaboration with carriers dedicated to decarbonization to meet client sustainability objectives.

Climate change is increasing the frequency of extreme weather events, costing the U.S. transportation sector billions annually in repairs and lost productivity, prompting C.H. Robinson to integrate climate risk assessments and diversify routes for enhanced supply chain resilience.

PESTLE Analysis Data Sources

Our C.H. Robinson Worldwide PESTLE Analysis is built on comprehensive data from leading industry publications, government economic reports, and market research firms. We integrate insights from global logistics trends, technological advancements, and regulatory changes to provide a thorough understanding of the macro-environment.