Choppies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

Choppies showcases impressive brand recognition and a strong presence across key African markets, but also faces significant operational challenges and intense competition. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Choppies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Choppies boasts an extensive regional presence, solidifying its position as a market leader in Southern Africa, particularly in Botswana, Namibia, and Zambia. This widespread network of over 200 stores across these nations underscores its significant market share and deep customer penetration outside of South Africa.

Choppies has shown impressive financial strength, with retail sales soaring by 19.3% to P4.677 billion in the first half of the fiscal year ending December 2024. This robust performance is a testament to their ability to attract and retain customers, evidenced by a significant 15.5% rise in footfall across their stores.

The company's resilience is particularly notable in Botswana, a well-established market where Choppies continues to achieve strong sales growth. This sustained success highlights effective operational strategies and a deep understanding of consumer needs in their core markets, contributing significantly to their overall financial health.

Choppies has significantly broadened its appeal by expanding beyond its core food and grocery business. Through strategic moves, such as acquiring the Kamoso Group, they've successfully integrated general merchandise, liquor, and hardware into their retail footprint. This diversification not only creates multiple revenue streams but also positions Choppies as a convenient one-stop shop for a wider range of consumer needs.

Optimized Distribution and Operational Expertise

Choppies leverages an optimized distribution network and deep operational expertise, vital for managing its extensive store footprint and high sales volumes. This efficiency is evident in its logistics, which focus on maximizing truck utilization through strategies like crossloads and backloads. For instance, in fiscal year 2023, the company reported a significant improvement in its supply chain efficiency, contributing to a 5% reduction in distribution costs per unit.

This operational strength directly underpins Choppies' ability to maintain competitive pricing, a key differentiator in its markets. The company's commitment to streamlining operations ensures that goods reach shelves promptly and cost-effectively, directly impacting its value proposition to consumers.

- Optimized Logistics: Focus on maximizing truck utilization through crossloads and backloads.

- Cost Efficiency: Achieved a 5% reduction in distribution costs per unit in FY2023.

- Competitive Pricing: Operational expertise supports its ability to offer attractive prices.

- Product Availability: Ensures consistent stock levels across its wide network.

Strong Private Label Brand and Value Proposition

Choppies has cultivated a robust private label brand, a key strength that directly appeals to its diverse customer base. This allows the company to offer competitively priced products, a significant draw for consumers seeking value, particularly in the current economic climate. For instance, in the fiscal year ending June 30, 2023, private label sales represented a substantial portion of revenue, contributing to margin stability.

This emphasis on value for money, amplified by strategic promotional campaigns, effectively captures a wide demographic, from budget-conscious shoppers to those seeking everyday savings. The company's strategic acquisitions, such as Kamoso, have bolstered its capacity to produce its own brands, thereby strengthening this core value proposition and providing greater control over product quality and cost.

The success of its private label strategy is evident in customer loyalty and market penetration. For example, during the 2024 trading period, private label SKUs saw a notable increase in sales volume compared to national brands, underscoring their appeal.

Key aspects of this strength include:

- Resonant Private Label Brand: Choppies' own brands are well-recognized and trusted by consumers.

- Affordability and Value: The private label offering provides a distinct price advantage.

- Broad Consumer Appeal: Value-driven products attract a wide range of income segments.

- Enhanced Production Capabilities: Acquisitions like Kamoso support in-house brand development.

Choppies' expansive retail footprint across Southern Africa, particularly in Botswana, Namibia, and Zambia, represents a significant competitive advantage. This extensive network, comprising over 200 stores, solidifies its market leadership and deep customer engagement in these key regions.

The company's financial performance demonstrates robust growth, with retail sales reaching P4.677 billion in the first half of fiscal year 2025, a 19.3% increase. This upward trend is further supported by a 15.5% rise in store footfall, indicating strong customer traffic and sales conversion.

Choppies' operational efficiency is a core strength, highlighted by its optimized distribution network. Strategies like maximizing truck utilization through crossloads and backloads contributed to a 5% reduction in distribution costs per unit in FY2023, enhancing its ability to offer competitive pricing.

The company's successful private label strategy provides a distinct value proposition, appealing to a broad customer base seeking affordability. Private label sales showed a notable increase in volume during the 2024 trading period, reinforcing its market appeal.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Retail Sales | P4.677 billion | H1 FY2025 | 19.3% growth, indicating strong market demand. |

| Footfall Increase | 15.5% | H1 FY2025 | Demonstrates growing customer engagement. |

| Distribution Cost Reduction | 5% | FY2023 | Improved operational efficiency and cost management. |

| Store Count | >200 | Current | Extensive regional presence and market penetration. |

What is included in the product

Offers a full breakdown of Choppies’s strategic business environment by examining its internal strengths and weaknesses alongside external opportunities and threats.

Identifies key weaknesses and threats, enabling targeted interventions to alleviate operational pain points.

Weaknesses

Choppies' decision to exit the Zimbabwean market in December 2024, following significant operational challenges and reported losses, highlights a key weakness. This move underscores the company's vulnerability to volatile economic conditions and complex regulatory landscapes in certain African markets.

The financial impact of such exits, including closure costs and the inability to recover investments, can be substantial, directly affecting the group's overall profitability and financial health. For instance, the exit from Zimbabwe alone is expected to result in a notable financial hit for the fiscal year ending June 2025.

Choppies' gross profit margin faced significant pressure, decreasing by 50 basis points to 20.6% in the fiscal year 2024. This decline was primarily driven by aggressive competitive discounting strategies employed in the market.

Furthermore, the integration of Kamoso, a business acquired by Choppies, introduced a dilutionary effect due to its lower-margin operations. While these acquisitions boost overall sales figures, they demonstrably impact the profitability of the core business, highlighting a critical challenge in balancing growth with margin preservation.

Choppies is grappling with escalating operational expenses, a significant weakness stemming from persistent inflation and unreliable power supply, exemplified by South Africa's ongoing load shedding. These energy disruptions directly impact profitability and require substantial capital outlay for backup power solutions.

The company's logistical hurdles are amplified by its presence in landlocked Southern African nations, increasing transportation costs and delivery times. Furthermore, the specter of climate change, including potential droughts impacting hydroelectric power generation, adds another layer of risk to both energy security and supply chain stability, further pressuring margins.

Concentrated Revenue Dependence on Botswana

Choppies' significant reliance on Botswana for its revenue, accounting for 69.4% as of December 2024, presents a notable weakness. This concentration, while benefiting from Botswana's stable market, exposes the company to substantial risk. Any economic downturn or intensified competition within this single territory could severely impact Choppies' overall financial performance.

This overdependence means that external shocks affecting Botswana's economy or retail sector will have a disproportionately large negative effect on Choppies. For instance, a sudden rise in inflation or a new competitor entering the market could directly threaten a significant portion of the company's earnings.

- Revenue Concentration: 69.4% of revenue from Botswana (December 2024).

- Market Risk: High exposure to Botswana's economic and competitive landscape.

- Vulnerability: Adverse conditions in Botswana can disproportionately affect overall financial health.

Short-Term Profitability Strain from Rapid Expansion

Choppies' aggressive expansion strategy, characterized by the rapid opening of new outlets, directly contributes to a short-term strain on its profitability. The significant upfront investment required for store setup, staffing, and inventory across numerous new locations, coupled with rising operational costs due to inflation, can temporarily depress earnings. For instance, while the company aims for long-term success in these new markets, the initial phase often involves absorbing higher expenses before these stores achieve optimal sales volume and operational efficiency. This can lead to a noticeable dip in profit margins during the expansionary periods.

The financial impact of this rapid growth is evident when examining the company's financial reports. Increased operating expenses, including rent, utilities, and employee costs for a larger store network, directly affect the bottom line. While new stores are projected to contribute positively to profitability in the long run, the immediate costs associated with their establishment and ramp-up phase can suppress overall profit growth. This dynamic is a common challenge for retailers undergoing aggressive expansion, where the investment in future growth temporarily impacts current financial performance.

- Increased Operating Expenses: The opening of numerous new stores significantly boosts costs related to rent, utilities, staffing, and inventory management.

- Initial Setup Costs: Substantial capital is tied up in establishing new store infrastructure, fixtures, and initial stock, impacting immediate cash flow.

- Inflationary Pressures: Rising inflation in 2024 and projected into 2025 exacerbates these costs, further squeezing profit margins during the expansion phase.

- Time to Profitability: New stores require time to reach their full sales potential and achieve profitability, creating a temporary drag on the company's overall financial performance.

Choppies' gross profit margin saw a decline of 50 basis points to 20.6% in fiscal year 2024, largely due to aggressive competitive pricing. The integration of Kamoso also diluted profitability, as its lower-margin operations impacted the core business's overall financial health.

Escalating operational expenses, driven by inflation and South Africa's load shedding, are a significant concern, requiring investment in backup power. Logistical challenges in landlocked regions and potential climate change impacts on energy and supply chains further pressure margins.

The company's heavy reliance on Botswana, which accounted for 69.4% of revenue in December 2024, creates substantial market risk. Any adverse economic shifts or increased competition in Botswana could disproportionately harm Choppies' overall financial performance.

Aggressive expansion, while aimed at long-term growth, strains profitability due to significant upfront investment in new outlets and rising operational costs. This can temporarily depress earnings as new stores work towards optimal sales volume and efficiency.

| Weakness | Description | Impact |

|---|---|---|

| Margin Pressure | Gross profit margin down 50 bps to 20.6% (FY24); Kamoso integration dilution. | Reduced profitability from core operations. |

| Operational Costs | Rising inflation, load shedding in South Africa, logistical hurdles. | Increased expenses, need for capital for backup power, higher transport costs. |

| Revenue Concentration | 69.4% of revenue from Botswana (Dec 2024). | High vulnerability to Botswana's economic conditions and competition. |

| Expansion Costs | High upfront investment for new stores, initial operating expenses. | Temporary dip in profit margins during expansion phases. |

Preview the Actual Deliverable

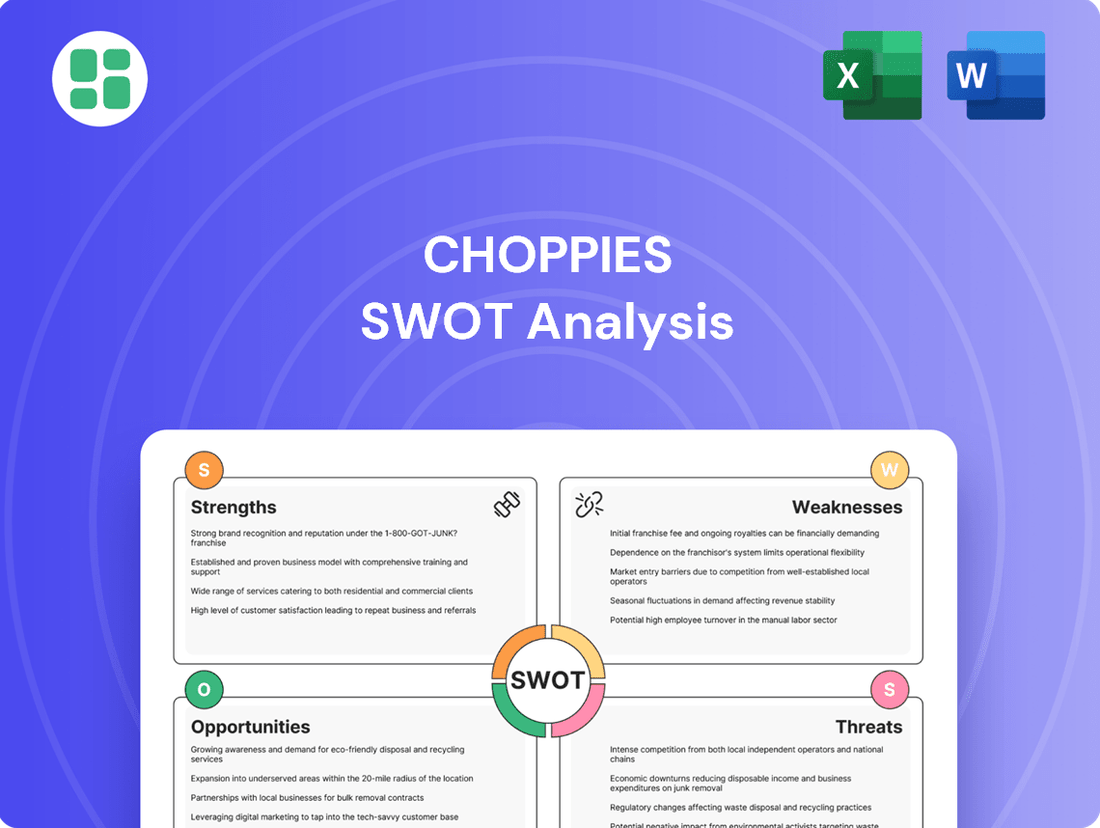

Choppies SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Choppies' strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Choppies' Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for Choppies.

Opportunities

Choppies has a significant opportunity for continued organic growth by strategically opening new stores in its already profitable markets, including Botswana, Namibia, and Zambia. This approach capitalizes on its strong brand recognition and existing distribution infrastructure to reach new customers.

By further penetrating underserved areas within these key countries, Choppies can expand its market share. The company is actively pursuing these expansion plans, with new store openings directly contributing to its sales growth trajectory.

The successful integration of the Kamoso Group into Choppies' operations presents a significant opportunity to broaden its product and service portfolio beyond core grocery items. This strategic move allows Choppies to deepen its penetration in the liquor and hardware sectors, areas where Kamoso already holds a strong market position.

Furthermore, this acquisition opens avenues for vertical integration, potentially enabling Choppies to develop and market its own private label brands, such as maize and sorghum products. This not only diversifies revenue streams but also offers the prospect of cost efficiencies through in-house production, thereby enhancing profitability and competitive pricing.

Choppies is actively pursuing a digital transformation, with a keen eye on e-commerce expansion and fintech advancements, exemplified by its exploration of the Payzana payments platform. This strategic pivot aims to leverage the burgeoning digital commerce landscape across Southern Africa.

Investments in online shopping portals and digital payment solutions are crucial for enhancing customer engagement and streamlining operations. By embracing these digital avenues, Choppies can effectively tap into the growing online retail market, a trend that saw significant acceleration in 2024.

The company's focus on data analytics further supports this digital push, promising to refine customer experiences and boost operational efficiency. This data-driven approach is vital for navigating the competitive retail environment and capitalizing on evolving consumer behaviors in 2025.

Responding to Consumer Demand for Value and Convenience

Choppies is strategically positioned to meet the growing consumer demand for value and convenience across Southern Africa. As economic pressures encourage more mindful spending, Choppies' established model of offering affordable products in easily accessible locations directly addresses this trend. The company's focus on providing a broad range of essential goods aligns perfectly with consumers seeking efficient shopping experiences.

Capitalizing on this opportunity involves leveraging key consumer preferences. Choppies can further enhance its appeal by expanding its private label offerings, which typically provide better margins and perceived value for shoppers. Promoting bulk buying options and optimizing the 'one-stop-shop' experience will also be crucial in attracting and retaining a customer base that prioritizes both cost savings and time efficiency.

- Private Label Expansion: Increasing the share of private label products can enhance value perception and profitability.

- Bulk Buying Initiatives: Implementing targeted promotions and store layouts that encourage bulk purchases can drive sales volume.

- Convenience Focus: Enhancing store accessibility and checkout efficiency caters directly to the demand for convenience.

Potential Re-entry into and Strategic Growth in South Africa

Choppies has signaled a willingness to explore re-entering the South African market, a move that could unlock significant growth potential. This strategic consideration comes as the company previously exited the region but now sees changing market conditions as potentially favorable.

South Africa represents a substantial retail landscape, and understanding its evolving consumer behaviors is key. A calculated re-entry or a more focused approach within South Africa could allow Choppies to capitalize on lessons learned from its prior operations, aiming for a more successful and sustainable presence.

- Market Size: South Africa's formal retail sector generated an estimated R577 billion (approximately $30 billion USD) in sales in 2023, highlighting its considerable consumer spending power.

- Consumer Trends: Growth in the mid-to-lower income segments and increasing demand for value-for-money offerings present an opportunity for retailers with a strong proposition.

- Lessons Learned: Choppies' prior experience in South Africa provides valuable insights into operational efficiencies, supply chain management, and consumer preferences, which can inform a more robust market entry strategy.

Choppies can leverage its strong brand in Botswana, Namibia, and Zambia for further organic growth by opening new stores in profitable areas, building on its existing infrastructure.

The acquisition of Kamoso Group offers a significant chance to expand into liquor and hardware, and develop private label brands like maize and sorghum for better margins.

Digital transformation, including e-commerce and fintech solutions like Payzana, presents a key opportunity to capture the growing online retail market in Southern Africa, a trend that accelerated in 2024.

Choppies is well-positioned to meet demand for value and convenience, especially as economic pressures encourage more careful spending, by expanding private labels and promoting bulk buying.

Threats

Choppies operates in a fiercely competitive retail environment, contending with established giants like Shoprite, Massmart, and Pick n Pay across South Africa and the broader region. This intense rivalry often triggers price wars, which can significantly squeeze profit margins and necessitate constant adaptation in pricing tactics and customer retention efforts.

Southern African economies face significant macroeconomic challenges, including high inflation and elevated interest rates. For instance, South Africa’s inflation rate hovered around 5.1% in early 2024, while interest rates remained at 8.25%, squeezing household budgets. This environment directly curtails consumer disposable income and spending power.

These persistent economic pressures can dampen consumer confidence, prompting a shift towards more essential goods and services. Consequently, this trend often translates into slower retail sales growth, directly impacting the revenue and profitability of retailers like Choppies, particularly in its core markets.

Choppies faces significant threats from persistent supply chain disruptions impacting the Southern African retail landscape. Logistical inefficiencies, coupled with escalating transport costs, particularly for a company operating in landlocked nations, directly translate to stock shortages and increased operational expenses, hindering consistent product availability for consumers.

Rising fuel prices in 2024, averaging a 15% increase across key Southern African markets, exacerbate these logistics challenges for Choppies. Furthermore, infrastructure limitations in regions where Choppies operates can compound delivery delays, leading to potential revenue loss and a diminished customer experience due to out-of-stock situations.

Shifting Consumer Preferences and Brand Loyalty

Consumer loyalty is becoming more fluid, with shoppers readily switching to more affordable options or discount retailers. This trend presents a significant challenge for retailers like Choppies, even those emphasizing value. For instance, in 2024, a significant percentage of consumers across emerging markets indicated a willingness to try new brands based on price alone.

Choppies must remain agile to evolving consumer demands, such as the growing preference for e-commerce or specific product segments like organic or sustainably sourced goods. Failing to adapt to these shifts, which were particularly pronounced in 2024 and are projected to continue into 2025, could lead to a decline in market share.

- Evolving Consumer Priorities: A 2024 survey revealed that over 60% of shoppers prioritize price and promotions when making purchasing decisions.

- Digital Shift: Online grocery sales saw a substantial year-over-year increase in 2024, highlighting the need for robust digital strategies.

- Product Category Demand: Interest in health-conscious and sustainable products continued to climb throughout 2024, requiring retailers to diversify their offerings.

Increasing Regulatory and Environmental Scrutiny

Choppies, like many retailers, faces increasing regulatory and environmental scrutiny. New legislation focused on sustainability and waste management, such as Extended Producer Responsibility schemes and stricter carbon emission targets, could significantly impact its operations. For instance, in 2024, several African nations intensified their focus on plastic waste reduction, potentially leading to new packaging regulations that Choppies must adhere to.

This heightened focus on ESG initiatives means additional compliance costs and operational complexities. Companies are expected to demonstrate progress in areas like reducing their carbon footprint and improving supply chain transparency. Failure to meet these evolving standards could result in penalties or damage to brand reputation. For example, by the end of 2025, many international markets will see stricter reporting requirements for Scope 3 emissions, which will affect retailers like Choppies that rely on extensive supply chains.

- Increased compliance costs: Adhering to new environmental regulations, such as those related to packaging waste and carbon emissions, will require investment in new processes and materials.

- Operational complexity: Managing supply chains to meet ESG standards, including sourcing sustainable materials and reducing transportation emissions, adds layers of complexity to day-to-day operations.

- Reputational risk: Non-compliance or a perceived lack of commitment to sustainability can lead to negative publicity and loss of consumer trust, impacting sales and market position.

- Potential for new taxes or fees: Governments may introduce environmental taxes or fees on non-compliant practices, directly affecting Choppies' profitability.

Choppies faces intense competition from established retailers, leading to price wars that erode profit margins. Economic headwinds, including high inflation and interest rates in Southern Africa, are dampening consumer spending power. Supply chain disruptions and rising logistics costs, exacerbated by fuel price increases and infrastructure limitations, further challenge the company's operational efficiency and product availability.

Consumer loyalty is waning, with shoppers increasingly prioritizing price and promotions, making it difficult for retailers to retain customers. The growing demand for e-commerce and niche product categories requires Choppies to adapt its strategies quickly. Furthermore, increasing regulatory and environmental scrutiny, coupled with rising ESG compliance costs, presents significant operational and financial challenges.

| Threat Category | Specific Threat | Impact on Choppies | Example Data (2024/2025) |

|---|---|---|---|

| Competitive Landscape | Intense Rivalry & Price Wars | Margin erosion, reduced market share | South Africa's retail market growth projected at 3-4% in 2024, with intense competition keeping margins tight. |

| Macroeconomic Environment | High Inflation & Interest Rates | Reduced consumer disposable income, lower sales volume | South Africa's inflation around 5.1% (early 2024), interest rates at 8.25% impacting consumer spending. |

| Operational Challenges | Supply Chain Disruptions & Rising Logistics Costs | Stock shortages, increased operational expenses | Fuel prices increased by ~15% across key Southern African markets in 2024. |

| Consumer Behavior Shifts | Evolving Consumer Priorities (Price Sensitivity) | Decreased customer loyalty, need for promotional focus | Over 60% of shoppers prioritizing price and promotions in 2024 surveys. |

| Regulatory & ESG Pressures | Increased Compliance Costs & Reputational Risk | Higher operational costs, potential penalties | Stricter ESG reporting requirements expected by end of 2025 impacting supply chain transparency. |

SWOT Analysis Data Sources

This Choppies SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert commentary from industry analysts. These sources provide a robust understanding of both internal capabilities and external market dynamics.