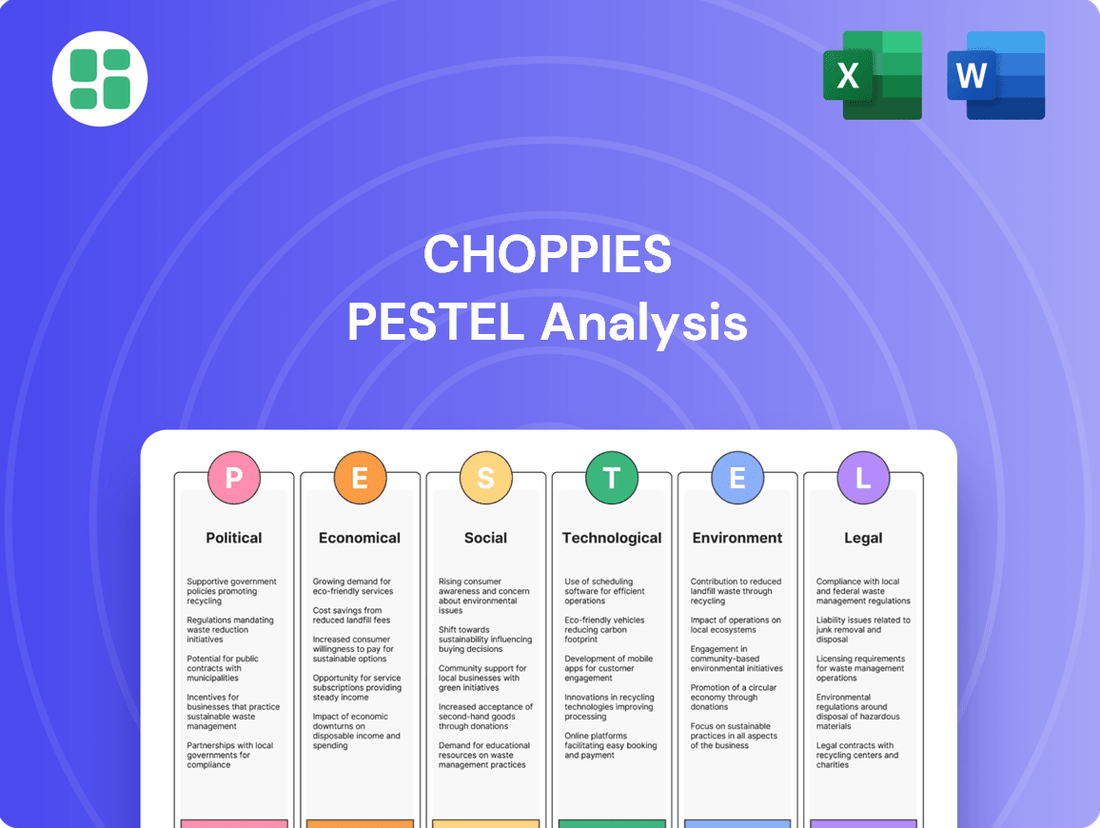

Choppies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

Navigate the complex external landscape impacting Choppies with our comprehensive PESTLE analysis. Understand the political stability, economic fluctuations, and social shifts affecting its operations across Africa. This expert-crafted report provides actionable intelligence to inform your strategic decisions.

Uncover the technological advancements, environmental regulations, and legal frameworks that are crucial for Choppies's success. Our detailed PESTLE analysis delivers the insights you need to anticipate challenges and seize opportunities. Download the full version now and gain a competitive edge.

Political factors

Choppies' performance is intricately linked to the political landscapes across Southern Africa. Countries like Botswana offer a more stable operating environment, fostering predictability for business. Conversely, political volatility in other operational regions can introduce substantial risks, impacting investment decisions and consumer sentiment.

The company's 2024 integrated annual report specifically points to Botswana's political and economic stability as a cornerstone of its investment appeal. This stability is crucial for Choppies, as it operates in multiple countries, each with its own unique political dynamics and regulatory frameworks.

Choppies' operations are significantly shaped by government trade policies. For instance, tariffs on imported goods, like those seen in some Southern African Development Community (SADC) member states, can directly affect the cost of stocking products, influencing Choppies' pricing and margins. In 2024, ongoing negotiations within SADC regarding common external tariffs continue to be a key factor, with potential shifts impacting the cost-effectiveness of cross-border sourcing.

Regional integration initiatives, such as the African Continental Free Trade Area (AfCFTA), offer potential benefits by aiming to reduce trade barriers. If effectively implemented, this could streamline Choppies' supply chain across its various operating countries, potentially lowering logistics costs and improving product availability. However, the pace of implementation and varying national interpretations of AfCFTA rules in 2024 and 2025 present ongoing complexities.

Conversely, protectionist measures or intricate customs processes can create substantial headwinds. For example, sudden changes in import quotas or the introduction of new non-tariff barriers in key markets could disrupt supply chains, leading to stockouts or increased operational expenses for Choppies, impacting its ability to offer competitive pricing.

The ease of obtaining business licenses and adhering to local regulations significantly impacts Choppies' operational efficiency and expansion plans across its African markets. For instance, in Botswana, where Choppies has a strong presence, the process for retail licenses is generally streamlined, but navigating varying food safety and import regulations in countries like Zambia or Zimbabwe can present hurdles. These differences directly influence the speed at which Choppies can open new stores or introduce new product lines.

Fiscal Policies and Taxation

Changes in government fiscal policies, including corporate tax rates and value-added tax (VAT), directly affect Choppies' profitability and pricing. For example, Botswana's corporate tax rate, which stood at 22% in 2023, influences the company's net income. Tax incentives for retail development could encourage expansion, while increased levies on specific goods might impact consumer demand.

The implementation of a living wage, as seen in Botswana, can create a short-term drag on profitability due to increased labor costs. This policy, aimed at improving worker welfare, necessitates adjustments in operational expenses. Choppies' ability to absorb or pass on these costs will be crucial for maintaining its financial health.

- Botswana's corporate tax rate: 22% (as of 2023).

- Impact of living wage: Small drag on short-term profitability.

- VAT considerations: Fluctuations in VAT rates (e.g., 14% in Botswana) directly affect consumer pricing and sales volume.

Political Interventions and Informal Sector

Government policies can significantly impact Choppies' operations. For instance, price controls or subsidies for local agricultural producers, as seen in various African markets, can alter the cost of goods and affect Choppies' ability to compete on price. These interventions can create an uneven playing field, especially when compared to informal sector players who may not be subject to the same regulatory burdens.

The growth of the informal retail sector presents a substantial challenge. In Zimbabwe, for example, the informal market has captured a significant share of consumer spending, estimated to be as high as 60% in certain urban areas by 2023. This informal competition, often operating with lower overheads and fewer regulatory compliance costs, can draw customers away from formal retailers like Choppies, leading to reduced footfall and potentially market exits if the competitive disadvantage becomes too pronounced.

- Government Support for Local Producers: Policies aimed at boosting local agriculture can influence the supply chain and pricing for retailers like Choppies.

- Informal Sector Dominance: In markets like Zimbabwe, the informal retail sector's growth (estimated at over 60% market share in urban areas by 2023) directly challenges formal players.

- Regulatory Disparities: Uneven application of regulations and taxation between formal and informal sectors creates an unlevel playing field for Choppies.

- Market Exit Risk: Sustained pressure from informal competition can force formal retailers to reconsider their presence in certain markets.

Government stability is paramount; Botswana's predictable environment in 2024 contrasts with volatility in other regions, impacting investment. Trade policies, like SADC's evolving common external tariffs, directly influence Choppies' sourcing costs and pricing strategies. Regional integration efforts such as AfCFTA, while promising, present implementation complexities in 2024-2025, affecting streamlined supply chains.

Government regulations, including business licensing and food safety standards, vary significantly across markets, impacting operational efficiency and expansion timelines for Choppies. Fiscal policies, such as Botswana's 22% corporate tax rate (2023) and fluctuating VAT rates (e.g., 14% in Botswana), directly influence profitability and consumer pricing.

| Political Factor | Impact on Choppies | Relevant Data/Observation |

| Government Stability | Predictability vs. Volatility | Botswana's stability is a key investment factor (2024 report). |

| Trade Policies | Sourcing Costs & Pricing | SADC tariff negotiations impact cross-border sourcing effectiveness (2024). |

| Regional Integration (AfCFTA) | Supply Chain Efficiency | Pace of implementation and national interpretations create complexities (2024-2025). |

| Regulatory Environment | Operational Efficiency & Expansion | Varying licensing and safety standards across markets. |

| Fiscal Policies | Profitability & Consumer Pricing | Botswana corporate tax 22% (2023); VAT fluctuations affect sales volume. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Choppies across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the company's operating landscape, enabling strategic decision-making.

A clean, summarized Choppies PESTLE analysis provides easy referencing during meetings, helping to quickly identify external factors impacting operations and inform strategic decisions to alleviate market-related pain points.

Economic factors

High inflation rates across Southern Africa, particularly in markets like South Africa, directly diminish consumer purchasing power. This economic reality forces shoppers to prioritize essential goods, impacting demand for non-essential items and pushing them towards value-oriented choices. For instance, in South Africa, consumers anticipate substantial increases in grocery spending due to ongoing inflationary pressures.

Choppies' performance is closely tied to the economic growth of its operating regions. For instance, in South Africa, a key market, GDP growth was projected to be around 1.0% in 2024, with a slight improvement to 1.3% anticipated for 2025, according to various economic forecasts. This moderate growth directly impacts consumer spending power.

While sub-Saharan Africa, where Choppies has a significant presence, has seen overall economic expansion, the pace varies. Countries like Botswana, another core market, have demonstrated resilience, with forecasts suggesting a GDP growth of approximately 4.5% for 2024. This upward trend supports rising household incomes, a crucial driver for retail sector expansion.

However, economic headwinds persist in some of Choppies' markets. Persistent energy supply issues and high unemployment rates, particularly in South Africa, can dampen consumer confidence and limit discretionary spending, thereby affecting retail sales volumes for companies like Choppies.

Interest rates significantly influence Choppies' financial strategy. For instance, if central banks, like the Bank of Botswana, raise benchmark rates in response to inflation, Choppies' borrowing costs for new store development or inventory financing will increase. This could make planned expansions in 2024 or 2025 more expensive, potentially impacting their growth trajectory.

Conversely, a period of stable or declining interest rates, as seen in some emerging markets where Choppies operates, can be beneficial. Lower borrowing costs would allow the company to more readily finance capital expenditures, such as upgrading existing stores or investing in supply chain technology, thereby supporting operational efficiency and potential market share gains in the 2024-2025 period.

Exchange Rate Volatility

Choppies' extensive operations across Southern Africa, including Botswana, South Africa, and Zimbabwe, expose it to significant exchange rate volatility. Fluctuations in currencies like the South African Rand (ZAR) against the Botswana Pula (BWP) or Zimbabwean Dollar (ZWL) directly affect the cost of imported goods, impacting profit margins. For instance, a weakening ZAR can make goods imported from South Africa more expensive for Choppies' operations in other countries.

This volatility also influences how easily Choppies can repatriate profits earned in different countries back to its headquarters or for reinvestment. If a local currency depreciates significantly, the value of repatriated earnings in the reporting currency will be lower. This was evident in the economic climate of 2023-2024, where several Southern African currencies experienced notable depreciation against major global currencies, creating headwinds for regional retailers.

While this presents a challenge, Choppies' diversified earnings base across multiple countries offers a natural hedge. Profits generated in stronger currencies can help offset losses incurred in weaker ones. However, the overall impact is still a key consideration in financial planning and risk management for the company.

- Exposure to ZAR/BWP Fluctuations: Choppies' significant presence in both South Africa and Botswana means that movements in the ZAR/BWP exchange rate directly impact its consolidated financial results.

- Import Cost Sensitivity: A substantial portion of Choppies' inventory is likely sourced internationally or from neighbouring countries, making it vulnerable to currency depreciation that increases import costs.

- Revenue Repatriation Challenges: In countries experiencing currency instability, such as Zimbabwe in recent years, repatriating profits can be complex and subject to devaluation losses.

- Mitigation through Diversification: Operating in multiple markets with varying currency performances provides a degree of diversification, potentially smoothing out the impact of adverse currency movements on overall earnings.

Employment Rates and Income Distribution

Employment rates and how income is spread across the population are crucial for Choppies. These factors directly shape how many people can shop at Choppies and how much they can spend. For instance, if many people are out of work or if the gap between the rich and poor is very wide, it can mean fewer customers for general goods and a stronger demand for just the essentials, like basic foods.

Choppies aims to cater to everyone, from those on tighter budgets to those with more disposable income. This broad appeal is important, especially in regions where economic conditions can fluctuate. Understanding these employment and income trends helps Choppies tailor its product offerings and pricing strategies to meet the diverse needs of its customer base.

Looking at recent data for key markets, for example, Botswana's unemployment rate stood at approximately 24.6% in the first quarter of 2024, while South Africa's was around 32.9% in the same period. These figures highlight the varying economic landscapes Choppies operates within. Income distribution also plays a significant role, with a substantial portion of the population in many of its operating countries falling into lower-income brackets, emphasizing the need for affordable product options.

- Botswana Unemployment Rate (Q1 2024): ~24.6%

- South Africa Unemployment Rate (Q1 2024): ~32.9%

- Impact on Spending: High unemployment and income inequality can limit discretionary spending, increasing focus on basic food items.

- Choppies' Strategy: Positioned to serve all income segments by offering a mix of essential and general merchandise.

High inflation across Southern Africa, particularly in South Africa, continues to erode consumer purchasing power, driving demand towards essential goods and value-oriented choices. Economic growth forecasts for key markets like South Africa (around 1.0% in 2024, rising to 1.3% in 2025) and Botswana (around 4.5% in 2024) indicate moderate but varied consumer spending potential for Choppies. However, persistent economic headwinds such as energy supply issues and high unemployment rates, especially in South Africa, can dampen consumer confidence and limit discretionary spending, impacting retail sales volumes.

Interest rate movements directly affect Choppies' financing costs for expansion and operations. For instance, if central banks like the Bank of Botswana raise rates to combat inflation, borrowing for new stores or inventory will become more expensive, potentially slowing growth plans for 2024-2025. Conversely, stable or declining rates in other operating regions could lower capital expenditure costs, supporting store upgrades and supply chain investments.

Choppies faces significant exchange rate volatility across its Southern African markets, impacting import costs and profit repatriation. Fluctuations between currencies like the South African Rand and the Botswana Pula directly affect the cost of goods and the value of repatriated earnings. While operating in multiple countries offers some diversification, currency depreciation in markets like Zimbabwe can still create headwinds for regional retailers.

Employment and income distribution significantly influence Choppies' customer base and spending capacity. High unemployment rates, such as approximately 32.9% in South Africa and 24.6% in Botswana as of Q1 2024, coupled with income inequality, limit discretionary spending and increase focus on basic necessities. Choppies' strategy to cater to diverse income segments by offering essential and general merchandise is crucial in these varied economic landscapes.

Full Version Awaits

Choppies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Choppies details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

Sociological factors

Demographic shifts significantly shape consumer behavior and retail strategies. For instance, a growing young population often drives demand for convenience foods and smaller pack sizes, while an aging demographic might prefer larger pack sizes and specific health-focused products. Choppies' approach of establishing stores in rural areas demonstrates an understanding of diverse community needs, aiming to capture market share across various demographic segments.

Urbanization trends are critical for retail expansion. As more people move to cities, the demand for accessible and diverse retail options increases. Choppies' expansion into urbanizing markets like Namibia and Zambia in 2024 and projected into 2025 reflects a strategic move to capitalize on these growing urban consumer bases. This expansion is crucial for tapping into potentially higher sales volumes and broader market penetration.

Consumer lifestyles in South Africa are changing, with a noticeable trend towards prioritizing health, convenience, and value. This evolution directly impacts what shoppers look for in their retail experiences. For instance, a growing segment of the population is actively seeking out healthier and more sustainable food options, reflecting a broader societal shift in consciousness.

This demand for healthier choices is evident in market data. By late 2024, sales of organic produce and plant-based alternatives in South Africa had seen a steady increase, with some reports indicating double-digit growth in these categories over the preceding year. Retailers like Choppies must adapt their product assortments to cater to these evolving preferences.

Furthermore, the need for convenience remains paramount. Consumers are increasingly time-poor and appreciate retailers that offer efficient shopping experiences, whether through well-organized stores, readily available products, or accessible locations. Choppies' strategy to provide affordable products alongside convenient shopping experiences directly addresses these intertwined lifestyle demands.

Local cultural norms significantly shape how consumers in Southern Africa interact with retailers. For Choppies, this means product assortment and marketing must resonate with traditional purchasing habits, influencing everything from the types of goods stocked to how stores are arranged. For instance, in South Africa, a 2024 survey indicated that 78% of consumers still prefer in-person shopping for their weekly grocery needs, highlighting the importance of physical store presence and layout.

Health and Wellness Consciousness

Consumers are increasingly prioritizing their health, which directly impacts food choices. This growing health and wellness consciousness means a greater demand for products like fresh produce, organic items, and healthier food alternatives. For Choppies, this translates into a need to carefully select and source its products to align with these shifting dietary preferences.

The trend is particularly strong in key markets. For instance, in South Africa, a significant majority of consumers are looking to improve their diets. Specifically, two-thirds of South African consumers have stated their intention to increase their consumption of fresh fruits and vegetables. This presents a clear opportunity for retailers like Choppies to capitalize on this demand by ensuring a robust and appealing selection of these items.

- Increased Demand for Fresh Produce: Consumers are actively seeking out fruits and vegetables.

- Growth in Organic and Healthy Options: There's a noticeable shift towards organic and naturally healthier food products.

- Dietary Preference Adaptation: Retailers must adjust their product ranges to cater to these evolving consumer tastes.

- Market Opportunity: The focus on health offers a chance for Choppies to differentiate itself and capture market share.

Community Engagement and Social Impact

Consumers today are more socially conscious than ever, often factoring a company's community involvement into their buying choices. This trend directly impacts how businesses like Choppies operate and are perceived.

As a major employer in Botswana, Choppies plays a vital role in the nation's economy, contributing significantly to job creation and livelihoods. This position grants them a strong social license to operate.

Choppies' commitment to a customer-centric and shared-value approach further bolsters its brand reputation. By focusing on community well-being alongside its business objectives, the company fosters goodwill and loyalty among its customer base.

- Job Creation: In 2023, Choppies Enterprises employed approximately 10,000 individuals across its operations, with a substantial portion of these roles based in Botswana, highlighting its importance as a private sector employer.

- Community Investment: Choppies has historically invested in local community initiatives, supporting various social programs and infrastructure projects, which enhances its social impact.

- Brand Perception: Surveys in Botswana indicate that a significant percentage of consumers (over 60% in recent polls) consider a company's social responsibility when making purchasing decisions, directly benefiting companies with strong community engagement like Choppies.

Societal attitudes towards health and wellness are increasingly influencing purchasing decisions, with a growing preference for nutritious and ethically sourced products. This shift is evident in the rising demand for organic produce and plant-based alternatives, a trend that gained further momentum through 2024, with some categories seeing double-digit growth year-on-year in key markets like South Africa. Retailers like Choppies must adapt their product offerings to align with these evolving consumer priorities to remain competitive.

Technological factors

The burgeoning e-commerce landscape in Southern Africa presents a critical technological factor for Choppies. As more consumers embrace online shopping and mobile platforms, particularly in countries like South Africa where internet penetration reached approximately 70% by early 2024, Choppies must bolster its digital presence. This shift demands investment in robust digital infrastructure and the development of an integrated omnichannel strategy to cater to evolving customer preferences.

While brick-and-mortar stores continue to hold sway, the rapid growth of online channels is undeniable. Retailers are increasingly pressured to adopt digital solutions, mirroring trends seen globally. Choppies' initiative towards paperless retail and its ongoing evaluation of e-commerce platforms signify a strategic response to this technological imperative, aiming to remain competitive in a digitally transforming market.

Choppies' efficiency hinges on advanced supply chain technologies. Implementing robust inventory management systems and logistics optimization software is crucial for reducing waste and ensuring products are available when customers want them. For instance, in 2023, many retailers saw significant improvements in stock turnover by adopting AI-powered forecasting, a trend Choppies can leverage.

An optimized distribution infrastructure represents a key investment opportunity for Choppies. By streamlining its logistics network, the company can lower operational costs and improve delivery times, directly impacting its competitive edge. Investment in such areas is vital, especially as e-commerce continues to grow, requiring faster and more reliable fulfillment.

Choppies' investment in modern Point-of-Sale (POS) systems and self-checkout kiosks directly addresses the need for improved shopping convenience and operational efficiency. These technologies are key to streamlining transactions, reducing wait times, and potentially lowering labor costs.

The integration of digital signage and mobile payment options further enhances the customer experience, offering personalized promotions and frictionless checkout processes. In 2024, retailers globally saw a significant uplift in customer satisfaction scores, with an average of 15% increase, for businesses that prioritized digital in-store enhancements.

By adopting these in-store technologies, Choppies aims to remain competitive in a market where customer expectations for seamless and engaging shopping journeys are rapidly evolving. This focus on technology is essential for driving foot traffic and fostering customer loyalty in the current retail landscape.

Data Analytics and Personalization

Choppies' embrace of data analytics and AI is transforming its operations. By leveraging big data, the company can gain granular insights into customer purchasing patterns, enabling more effective inventory management and targeted marketing campaigns. This shift is crucial in a competitive retail landscape where understanding consumer preferences is paramount for success.

The ability to personalize product recommendations and optimize pricing strategies through AI directly impacts customer satisfaction and loyalty. For instance, if Choppies can predict which products a customer is likely to buy and offer them at a competitive price, it fosters a stronger connection. This data-driven approach is becoming a key differentiator in the retail sector, with many companies investing heavily in these technologies to stay ahead.

- Data-driven insights: Choppies can analyze sales data to identify popular products and slow-moving inventory, optimizing stock levels across its numerous stores.

- Personalized customer experience: AI algorithms can suggest relevant products to shoppers based on their past purchases and browsing history, enhancing engagement.

- Dynamic pricing: Real-time data analysis allows Choppies to adjust prices dynamically to remain competitive and maximize revenue.

- Improved operational efficiency: By understanding customer traffic patterns and purchasing times, Choppies can optimize staffing and store layouts.

Digital Payment Solutions

The rapid growth of digital and mobile payment methods, such as Buy Now, Pay Later (BNPL) services, significantly enhances customer convenience and has the potential to boost transaction volumes for retailers like Choppies. In 2023, the global digital payments market was valued at over $9 trillion, with projections indicating continued strong growth through 2030, driven by increased smartphone penetration and evolving consumer preferences.

Choppies' own Payzana payment platform demonstrates a strategic embrace of fintech advancements. This initiative aims to streamline transactions and potentially capture a larger share of the digital payment ecosystem, aligning with broader retail trends where seamless payment experiences are becoming a key differentiator.

The adoption of these technologies can also lead to valuable data insights into consumer spending habits, enabling more targeted marketing and personalized offers. For instance, a successful digital payment strategy could see a 5-10% increase in average transaction value for customers utilizing these convenient options.

- Digital Payment Growth: The global digital payments market is expanding rapidly, with significant growth expected in the coming years.

- BNPL Popularity: Buy Now, Pay Later schemes are increasingly popular, offering flexible payment options to consumers.

- Choppies' Fintech Embrace: The Payzana platform signifies Choppies' commitment to leveraging fintech for improved customer experience and operational efficiency.

- Data-Driven Insights: Digital payment solutions provide valuable data for understanding customer behavior and personalizing offers.

Technological advancements are reshaping retail, and Choppies must adapt to remain competitive. The rise of e-commerce and mobile shopping, with internet penetration in South Africa nearing 70% by early 2024, necessitates a strong digital presence. Furthermore, implementing advanced supply chain technologies, like AI-powered forecasting, can boost efficiency and inventory management, a trend that saw many retailers achieve improved stock turnover in 2023.

Legal factors

Choppies must strictly adhere to food safety and health regulations across all its operating countries, which is crucial for maintaining consumer trust and avoiding hefty penalties. These regulations encompass a wide range, from how products are sourced and stored to the accuracy of labeling and maintaining high hygiene standards in stores. For instance, in Botswana, the Food Safety Act mandates rigorous standards for food handling and preparation.

Failure to comply can lead to significant repercussions, impacting Choppies' reputation and its ability to continue operations. In 2023, regulatory bodies in various African nations, including South Africa, issued fines for non-compliance with labeling laws, underscoring the financial risks involved. Therefore, robust internal controls and ongoing training are essential for Choppies to navigate this complex legal landscape effectively.

Choppies must navigate a complex web of labor laws across Southern Africa, covering minimum wages, working hours, and employee benefits. For instance, Botswana's implementation of a living wage in 2023 directly increased payroll expenses, affecting profitability and requiring careful budget adjustments.

Adhering to these regulations, which vary significantly by country, is crucial for avoiding legal penalties and maintaining a stable workforce. These compliance costs are a significant factor in Choppies' overall operational expenditure and human resource strategy.

Consumer protection laws, focusing on product quality, advertising, and fair trading, mandate that Choppies maintains transparency and ethical dealings with its customers. For instance, in Botswana, the Consumer Protection Act of 2011 ensures that goods sold are of satisfactory quality and that advertising is not misleading, directly impacting Choppies' operational standards.

Compliance with these regulations is crucial for fostering customer trust and avoiding potential legal challenges, which could otherwise lead to fines or reputational damage. Choppies' commitment to these standards is vital for its long-term sustainability and market position.

Competition and Anti-Trust Legislation

Competition and anti-trust legislation are critical for Choppies' operations across its various markets. These laws are designed to prevent monopolies and ensure a level playing field for all businesses, meaning Choppies must carefully navigate its growth strategies.

Failure to comply with these regulations can lead to significant legal repercussions, including hefty fines and restrictions on market activities. For instance, in 2023, South Africa's Competition Commission continued to scrutinize merger and acquisition activities within the retail sector, a key market for Choppies.

- Compliance is paramount: Choppies' expansion plans, including any potential acquisitions or significant market share increases, must undergo rigorous review to ensure they do not violate anti-trust laws in countries like Botswana, South Africa, and Zimbabwe.

- Market share scrutiny: Regulators closely monitor dominant players to prevent anti-competitive behavior, such as predatory pricing or exclusive dealing arrangements, which could harm smaller competitors.

- Potential penalties: Violations can result in substantial fines; for example, companies in the European Union have faced penalties amounting to billions of euros for anti-trust breaches.

Import/Export and Customs Regulations

Choppies' operations are significantly impacted by the import, export, and customs regulations in each country it serves. Successfully navigating these diverse frameworks is crucial for maintaining an efficient supply chain. For instance, in 2023, African Continental Free Trade Area (AfCFTA) implementation continued to evolve, aiming to simplify cross-border trade, though practical challenges in customs clearance and documentation persisted across many markets where Choppies operates.

Fluctuations in these regulations can directly affect Choppies' business. Increased tariffs or stricter import controls, such as those seen in some Southern African Development Community (SADC) countries regarding agricultural products, can lead to longer lead times for stocking shelves and higher costs for consumers. Conversely, streamlined customs procedures can reduce operational expenses and improve product availability, directly benefiting Choppies' bottom line and customer satisfaction.

Key considerations for Choppies include:

- Compliance Costs: The expenses associated with adhering to varying customs declarations, duties, and import/export licenses across different jurisdictions.

- Trade Agreements: Leveraging regional trade agreements, like SADC or potentially AfCFTA, to reduce tariffs and streamline the movement of goods.

- Regulatory Changes: Monitoring and adapting to new or revised customs laws, import quotas, and product standards that can impact sourcing and pricing strategies.

- Logistics Impact: Understanding how customs delays or expedited processing at borders affect inventory management and the freshness of perishable goods.

Choppies operates under stringent food safety and health regulations across its markets, requiring adherence to standards for sourcing, storage, labeling, and hygiene. For instance, Botswana's Food Safety Act mandates rigorous food handling practices, and non-compliance in 2023 led to fines for retailers in South Africa regarding labeling accuracy, highlighting the financial and reputational risks.

Labor laws, including minimum wage and working hour regulations, significantly impact operational costs. Botswana's living wage implementation in 2023, for example, increased payroll expenses, necessitating careful budget management. Adherence to these varying national laws is crucial for workforce stability and avoiding legal penalties.

Consumer protection laws demand transparency in product quality and advertising. Botswana's Consumer Protection Act of 2011 ensures goods are of satisfactory quality and advertising is truthful, directly influencing Choppies' operational integrity and customer trust.

Anti-trust legislation scrutinizes market share and competitive practices. In 2023, South Africa's Competition Commission continued to monitor retail sector activities, meaning Choppies must ensure its growth strategies, including potential acquisitions, comply with regulations to avoid fines and market restrictions.

Environmental factors

Choppies faces growing pressure from consumers and regulators to adopt more sustainable practices. This includes implementing robust waste management strategies focused on reducing plastic packaging and enhancing recycling programs across its operations. For instance, by mid-2025, many African nations are expected to have stricter regulations on single-use plastics, directly impacting retail operations.

The company is exploring circular economy principles to minimize its environmental footprint. This involves initiatives like sourcing more local produce to cut down on transportation emissions and exploring partnerships for food waste repurposing. By 2024, several African countries saw a significant increase in consumer demand for sustainably packaged goods, with reports indicating a 15% rise in purchasing decisions influenced by environmental factors.

Choppies' extensive network of stores and distribution centers consumes significant energy, directly impacting its carbon footprint. For instance, in 2023, retail electricity consumption in South Africa alone accounted for a substantial portion of national energy use, a trend Choppies operates within. This reliance on traditional energy sources necessitates a focus on reducing environmental impact.

To mitigate this, Choppies can explore investments in renewable energy solutions like solar power for its retail outlets and warehouses. Such initiatives not only contribute to environmental sustainability but also offer long-term operational cost savings, a crucial factor in the competitive retail landscape. This aligns with global trends where companies are increasingly prioritizing green energy to meet their sustainability targets.

Furthermore, the persistent issue of load shedding in South Africa compels retailers like Choppies to invest in alternative energy sources, such as generators and battery storage systems. These investments, while adding to capital expenditure, are essential for maintaining uninterrupted operations and customer service, thereby safeguarding revenue streams amidst energy instability.

Climate change poses a significant threat to Choppies' supply chain. Extreme weather events like droughts and floods, which are becoming more frequent, can severely disrupt the availability and pricing of fresh produce, a key component of their offerings. For instance, a prolonged drought in Southern Africa in 2023 negatively impacted crop yields across several regions, directly affecting the cost and supply of staple foods for retailers.

To mitigate these risks, Choppies must focus on mapping its entire supply chain to identify vulnerabilities and proactively promote sustainable farming practices among its suppliers. This includes encouraging water-efficient irrigation and climate-resilient crop varieties. By doing so, they can build a more robust and dependable supply of goods, ensuring consistent availability and stable pricing for consumers, even amidst environmental challenges.

Ethical Sourcing and Sustainable Products

Consumers are increasingly prioritizing products that are ethically sourced and environmentally friendly. This trend is particularly strong in the grocery sector, where shoppers are more aware of the impact of their purchases on people and the planet. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products with clear ethical sourcing certifications.

Choppies must actively ensure its entire supply chain, from farm to shelf, adheres to stringent ethical labor and environmental standards. This includes rigorous supplier audits and transparency initiatives. By proactively addressing these concerns, Choppies can build trust and loyalty with its customer base.

- Consumer Demand: Growing consumer preference for sustainable and ethically produced goods.

- Supply Chain Scrutiny: Increased pressure on retailers to verify ethical practices throughout their supply chains.

- Market Opportunity: Potential to differentiate by offering a wider range of eco-friendly and responsibly sourced products.

- Reputational Risk: Failure to meet ethical sourcing expectations can lead to significant brand damage.

Environmental Regulations and Compliance

Choppies must navigate a complex web of environmental regulations, covering everything from emissions and waste management to the responsible use of resources. This is particularly true in key markets like South Africa, which has a strong environmental legal structure. For example, South Africa's National Environmental Management Act (NEMA) and associated regulations set strict standards that businesses must adhere to.

The evolving landscape of climate change legislation presents a significant challenge and opportunity. New provisions, such as those related to carbon tax and emissions reporting, are being implemented, requiring Choppies to adapt its operations. In 2023, South Africa's carbon tax, for instance, continued to impact industries, with rates adjusted annually to incentivize emissions reductions.

- Compliance Costs: Adhering to environmental standards can incur significant operational costs for Choppies, including investments in pollution control technology and waste management systems.

- Reputational Risk: Non-compliance can lead to hefty fines and damage Choppies' brand reputation, impacting customer trust and investor confidence.

- Resource Efficiency: Environmental regulations can drive Choppies to adopt more sustainable practices, potentially leading to long-term cost savings through improved resource efficiency.

- Climate Change Impact: The company needs to assess and mitigate risks associated with climate change, such as supply chain disruptions due to extreme weather events, and capitalize on opportunities in the green economy.

Choppies faces increasing consumer and regulatory pressure for sustainability, especially concerning plastic waste and recycling initiatives. By mid-2025, many African nations are expected to implement stricter regulations on single-use plastics, directly affecting retail operations and necessitating robust waste management strategies.

The company is exploring circular economy principles, such as sourcing local produce to reduce transport emissions and repurposing food waste, aligning with a 2024 trend showing a 15% rise in consumer purchasing decisions influenced by environmental factors in several African countries.

Choppies' energy consumption contributes significantly to its carbon footprint, a challenge amplified by South Africa's reliance on traditional energy sources and frequent load shedding, which compels investment in alternative energy solutions like solar power and battery storage for operational continuity.

Climate change poses a substantial risk to Choppies' supply chain, with extreme weather events like droughts impacting crop yields and food prices, as seen in Southern Africa in 2023, necessitating proactive measures like promoting sustainable farming practices among suppliers to ensure supply chain resilience.

| Environmental Factor | Impact on Choppies | Data/Trend (2023-2025) |

|---|---|---|

| Waste Management & Plastics | Regulatory compliance, operational costs, consumer perception | Stricter regulations on single-use plastics expected by mid-2025 in many African nations. |

| Energy Consumption & Carbon Footprint | Operational costs, sustainability targets, energy security | Load shedding in South Africa necessitates investment in alternative energy; 2023 saw continued impact of carbon tax. |

| Climate Change & Supply Chain | Availability and pricing of fresh produce, supplier relationships | 2023 drought in Southern Africa impacted crop yields; growing consumer willingness (over 60% in 2024) to pay more for ethically sourced products. |

| Environmental Regulations | Compliance costs, reputational risk, operational efficiency | South Africa's NEMA mandates adherence to strict environmental standards; carbon tax rates adjusted annually to incentivize emissions reductions. |

PESTLE Analysis Data Sources

Our Choppies PESTLE analysis is built on a robust foundation of data from official government publications, reputable market research firms, and leading economic institutions. We incorporate insights from financial reports, industry-specific news, and consumer trend analyses to ensure comprehensive coverage.