Choppies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Choppies Bundle

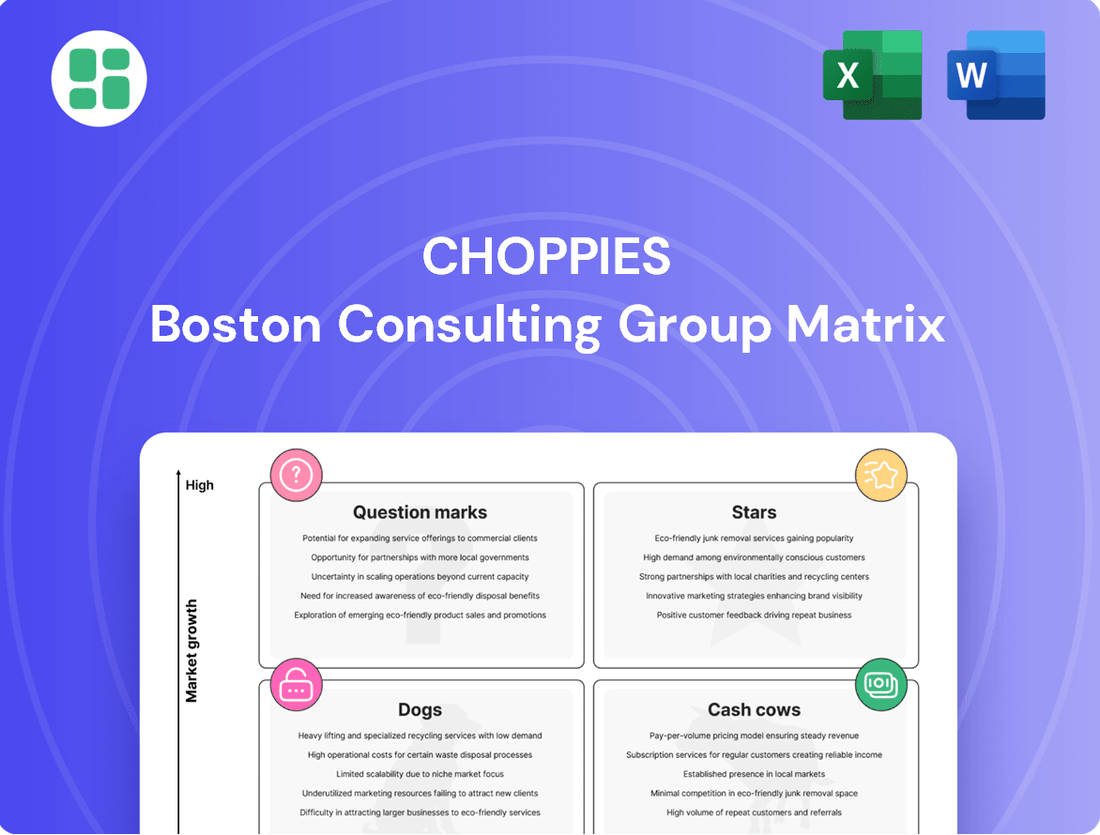

Choppies' current market position is a complex interplay of growth and market share, with some categories showing strong potential and others facing challenges. Understanding which of its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making. Purchase the full Choppies BCG Matrix to unlock a detailed quadrant breakdown and actionable insights that will guide your investment and product development strategies.

Stars

Choppies' aggressive expansion into Namibia and Zambia clearly places these markets in the Stars category of the BCG Matrix. Namibia, for instance, experienced a significant 51% surge in retail sales revenue during the first half of the 2025 financial year, a remarkable turnaround from a previous loss to profitability, underscoring its high-growth potential.

The company's strategic intent to open additional stores in these burgeoning regions signals a strong commitment to capturing increasing market share in environments demonstrating substantial economic and consumer activity.

Choppies' strategic push into digital transformation, exemplified by its farmers' app and e-commerce exploration, positions these ventures as Stars in its BCG Matrix. These initiatives are designed to harness technology for enhanced efficiency and future expansion, tapping into new customer engagement channels and broader market access within the dynamic retail sector.

While these digital efforts are still in their early stages, their significant growth potential and strategic value suggest they could secure substantial future market share. For instance, Choppies reported a 15% increase in digital sales channels in their 2024 financial year, indicating early traction.

Choppies' strategic expansion of its Builders Mart hardware stores, particularly targeting Namibia in FY2025 following the Kamoso acquisition, positions this segment for potential Star status. This move capitalizes on the growing construction and home improvement markets across Africa. For instance, Namibia's construction sector experienced a growth of 4.5% in 2023, indicating a favorable environment for such expansion.

Growth of Stand-Alone Liquor Stores (Chill Brand)

Choppies' strategic expansion into stand-alone liquor stores under the 'Chill' brand, following the Kamoso acquisition, signals a deliberate move into a high-growth segment. This initiative is designed to capitalize on evolving consumer preferences and the potentially higher profit margins available in specialized retail environments.

If these 'Chill' branded liquor stores achieve rapid market penetration and secure substantial market share in their operating regions, they would be classified as Stars within the BCG Matrix. This classification reflects their strong growth potential and current market position.

- Market Growth: The global alcoholic beverages market is projected to grow, with specific segments like ready-to-drink (RTD) cocktails showing significant upward trends. For example, the RTD market was valued at approximately $26.1 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of over 7% through 2030.

- Strategic Rationale: By establishing dedicated 'Chill' stores, Choppies aims to capture a larger share of this growing market, leveraging the brand's focus on convenience and a curated selection of alcoholic beverages.

- Acquisition Synergy: The Kamoso acquisition provides a foundational base, allowing Choppies to integrate existing operations and potentially accelerate the rollout of the 'Chill' brand, thereby enhancing market presence and revenue streams.

Strategic Ventures in Underserved Rural Areas

Choppies' strategic focus on expanding into underserved rural areas, where competition is often limited and demand is high, positions these ventures as potential Stars within its portfolio. This approach aims to establish dominant market share by being an early entrant or a significant player in these growth-oriented regions.

This strategy directly supports Choppies' mission to offer accessible and affordable goods, meeting the needs of communities that may have previously lacked convenient shopping options. For instance, by mid-2024, Choppies had announced plans to open several new stores in rural Botswana, targeting areas with populations exceeding 5,000 that had limited formal retail presence.

- Focus on Rural Expansion: Choppies' commitment to opening new stores in underserved rural areas is a key driver for its Star classification.

- Market Dominance Potential: These ventures aim to capture leading market positions due to less competition and high unmet demand.

- Alignment with Value Proposition: The strategy reinforces Choppies' core offering of affordable products and convenient access, particularly in regions with fewer retail alternatives.

- Growth Opportunities: Rural expansion taps into high-potential growth markets, contributing to the company's overall market share and revenue growth.

Choppies' ventures in Namibia and Zambia, along with its digital transformation initiatives and expansion of its Builders Mart and 'Chill' liquor store brands, are all positioned as Stars. These segments exhibit high market growth potential and a strong strategic focus by Choppies to capture significant market share.

The company's aggressive expansion into rural areas, aiming to establish early market dominance, also qualifies these efforts as Stars, reflecting their high growth prospects and strategic importance.

| Initiative | Market Growth | Choppies' Market Share Potential | Key Data Point (2024/2025) |

|---|---|---|---|

| Namibia & Zambia Expansion | High (e.g., Namibia retail sales up 51% H1 FY25) | High (aggressive store opening strategy) | 51% surge in Namibia retail sales revenue (H1 FY25) |

| Digital Transformation (Apps, E-commerce) | High (growing digital retail sector) | High (new customer engagement channels) | 15% increase in digital sales channels (FY24) |

| Builders Mart Expansion | High (growing construction markets) | High (targeting favorable environments) | Namibia construction sector grew 4.5% in 2023 |

| 'Chill' Liquor Stores | High (global alcoholic beverages market growth) | High (specialized retail focus) | RTD market valued at $26.1 billion (2023), CAGR >7% |

| Rural Area Expansion | High (underserved markets with high demand) | High (early entrant advantage) | Plans for new stores in rural Botswana (mid-2024) |

What is included in the product

This Choppies BCG Matrix analysis categorizes its business units, guiding strategic decisions on investment and resource allocation.

A clear Choppies BCG Matrix visualizes underperforming units, relieving the pain of inefficient resource allocation.

Cash Cows

Choppies' core supermarket operations in Botswana are a classic example of a Cash Cow within the BCG Matrix. This segment consistently generates the lion's share of the company's revenue and profits, underscoring its maturity and stability.

Despite operating in a well-established market, Botswana's retail sector demonstrates remarkable resilience, with Choppies maintaining a commanding market presence. This enduring strength translates into predictable and substantial sales volumes.

The consistent cash flow generated by these operations is vital, serving as the financial backbone for Choppies to invest in and nurture its other, potentially higher-growth, business ventures.

Choppies' well-established private label products are a clear Cash Cow. These items, known for their value proposition, attract a significant segment of the consumer base. In 2024, private label sales across the retail sector continued to grow, often outpacing national brands, indicating strong consumer preference for cost-effective options.

The profitability of these private label lines is notably robust. They typically command higher gross margins compared to branded goods due to reduced marketing costs and direct sourcing. This contributes substantially to Choppies' overall financial health, especially within the stable, mature grocery market where predictable demand exists.

Customer loyalty to Choppies' own brands is a key driver of their Cash Cow status. This loyalty translates into consistent sales volumes and predictable revenue streams, reinforcing the segment's stability. By offering reliable quality at competitive prices, Choppies solidifies its customer base and ensures ongoing financial contributions from these established product lines.

Choppies' optimized distribution infrastructure, a key strength in its primary markets, acts as a significant Cash Cow. This efficiency translates directly into lower operating costs and healthier profit margins, ensuring steady cash generation without the need for heavy reinvestment.

The company's robust supply chain management allows it to support high sales volumes across its extensive store network. For instance, in the fiscal year ending June 2023, Choppies reported a revenue of BWP 11.4 billion, demonstrating the scale at which this infrastructure operates and contributes to its financial stability.

Established Customer Base and Footfall

Choppies' established customer base and consistent footfall, especially in its core market of Botswana, firmly position it as a Cash Cow within the BCG matrix. This strong market presence is evidenced by an impressive weekly customer engagement, with around 2.5 million shoppers visiting its 277 stores. This high volume of traffic directly translates into predictable and substantial revenue streams, a hallmark of a mature and successful business unit.

The retailer's strategic focus on providing value and convenience has cultivated a loyal customer following. This loyalty ensures a steady demand for its products, contributing to the consistent sales performance that defines a Cash Cow. The ability to attract and retain such a large customer base across its operational footprint underscores its market maturity and operational efficiency.

- Botswana Dominance: Choppies holds a significant market share in Botswana, its primary operational region.

- Weekly Customer Traffic: Approximately 2.5 million customers visit Choppies stores weekly.

- Extensive Store Network: The company operates 277 stores, facilitating widespread customer access.

- Loyalty Drivers: A commitment to value and convenience fuels customer retention.

Profitable Kamoso Milling and Manufacturing Operations

The milling and manufacturing operations acquired through Kamoso represent significant cash cows for Choppies. These segments have demonstrated robust performance, with surging sales and improved profitability. For instance, in the fiscal year ending June 30, 2023, Choppies reported a substantial increase in revenue from its manufacturing and milling segments, contributing positively to the group's overall financial health.

These operations likely reside in mature markets where Choppies holds a strong market share, allowing them to generate consistent and substantial cash flow. This steady income stream is crucial for funding other business areas, including investments in growth opportunities or debt reduction. The company’s backward integration strategy is specifically designed to enhance the value and efficiency of these cash-generating assets.

- Kamoso Acquisition's Profitability: Milling and manufacturing divisions are identified as key profit drivers.

- Sales Growth: These segments have experienced surging sales, indicating strong market demand.

- Market Position: Operating in mature markets with a high market share ensures steady cash flow generation.

- Strategic Reinvestment: Generated cash can be strategically reinvested to support other business units or expansion.

Choppies' established private label products are a prime example of a Cash Cow. These items, favored for their value, consistently attract a large customer base. In 2024, private label sales across the retail sector continued their upward trend, often outperforming national brands, highlighting a strong consumer preference for cost-effective choices.

The profitability of these private label lines is notably robust, typically offering higher gross margins than branded goods due to reduced marketing expenses and direct sourcing. This significantly bolsters Choppies' overall financial health, especially within the stable, mature grocery market characterized by predictable demand.

Customer loyalty to Choppies' own brands is a critical factor in their Cash Cow status, translating into consistent sales volumes and predictable revenue streams. This loyalty reinforces the segment's stability, ensuring ongoing financial contributions from these well-established product lines.

| Segment | Market Share (Botswana) | Revenue Contribution (FY23) | Profitability |

| Core Supermarkets (Botswana) | Dominant | Largest Share | High & Stable |

| Private Label Products | Strong & Growing | Significant | Higher Margins |

| Milling & Manufacturing (Kamoso) | Strong in Niche | Growing Contribution | Improving |

What You See Is What You Get

Choppies BCG Matrix

The BCG Matrix preview you see is the exact, fully completed document you will receive upon purchase, offering a comprehensive strategic analysis of Choppies' business units. This preview showcases the final report, meticulously crafted to provide clear insights into Choppies' Stars, Cash Cows, Question Marks, and Dogs, enabling informed decision-making. Upon purchase, you will gain immediate access to this professionally formatted BCG Matrix, ready for immediate application in your strategic planning and business development efforts. Rest assured, the document you are reviewing is the complete, unwatermarked, and analysis-ready BCG Matrix for Choppies, delivered instantly after your transaction.

Dogs

Choppies' divestment of its Zimbabwean operations in December 2024 firmly places this segment in the Dog category of the BCG matrix. This strategic exit was driven by a persistent challenging economic climate in Zimbabwe, which led to negative volume growth for the company's operations there.

The decision to sell was further underscored by a significant impairment of goodwill associated with the Zimbabwean segment, signaling a low-growth, low-market-share position. This segment was demonstrably draining resources without generating sufficient returns, making divestiture a necessary step to improve overall company performance and focus on more profitable ventures.

The discontinuation of the Kamoso general merchandise business in June 2024 firmly places it in the Dogs quadrant of the BCG Matrix. This segment likely suffered from both a low market share and minimal growth potential within the broader retail landscape.

Choppies' decision to exit Kamoso, a move that aligns with strategic divestments seen in the retail sector throughout 2024, suggests that this business was not contributing effectively to the company's overall performance. Such exits are common for businesses that drain resources without offering significant returns, allowing companies to reallocate capital and focus management expertise on more profitable areas.

The discontinuation of Choppies' Kamoso South African liquor business in June 2024 firmly places it in the Dog quadrant of the BCG matrix. This strategic move signals that Kamoso was a low-growth, low-market-share segment, likely burdened by significant operational challenges and intense market competition within the South African liquor industry.

Choppies' decision to divest Kamoso reflects a commitment to shedding underperforming assets. In 2023, the retail sector in South Africa faced economic headwinds, with consumer spending constrained by inflation and interest rate hikes, directly impacting discretionary purchases like liquor, thus contributing to Kamoso's likely poor financial performance and justifying its exit.

Discontinued Kamoso Mediland Business

The Kamoso Mediland business, discontinued in Choppies' June 2024 financial year, fits the description of a Dog in the BCG matrix. This strategic divestment indicates that the business likely held a low market share within a stagnant or declining market segment for Choppies.

The decision to discontinue Kamoso Mediland was driven by its poor performance and the company's objective to optimize its overall business structure.

- Discontinued Operations: Kamoso Mediland was divested during the June 2024 financial year.

- Market Position: Classified as a Dog, implying low market share and low market growth.

- Strategic Rationale: Divestment aimed at streamlining operations and focusing on more profitable ventures.

Underperforming Older Stores

Underperforming older stores within Choppies' portfolio would likely be classified as Dogs in a BCG Matrix. These are established locations that have seen better days, possibly due to increased competition, changing consumer preferences, or simply the natural lifecycle of a retail outlet. While specific store-level data isn't always public, a general trend of declining footfall or sales in certain mature markets would indicate this category.

These stores operate in markets that are either stagnant or in decline, meaning the overall demand for their products isn't growing. Consequently, Choppies would have a low market share within these specific, less dynamic local economies. The key characteristic is that they consume valuable resources, such as staffing, inventory, and operational costs, without generating sufficient returns to justify their continued existence.

- Low Market Share: These stores struggle to capture a significant portion of sales in their local, often saturated, markets.

- Stagnant or Declining Markets: The overall economic environment or consumer demand in the areas where these stores operate is not expanding, or is shrinking.

- Resource Drain: They represent an inefficient use of capital and operational effort, yielding minimal profits or even losses.

- Rationalization: Choppies' strategy has historically involved closing such underperforming outlets to reallocate resources to more promising ventures.

The divestment of Choppies' Zimbabwean operations in December 2024, coupled with the discontinuation of the Kamoso general merchandise and liquor businesses in South Africa during the June 2024 financial year, firmly places these segments in the Dog category of the BCG matrix. These businesses likely suffered from low market share in stagnant or declining markets, draining resources without sufficient returns.

Underperforming older stores also fall into this category, characterized by low market share in saturated local economies and a tendency to consume resources inefficiently. Choppies' strategic decisions to exit these segments in 2024 reflect a broader trend of shedding underperforming assets to optimize operations and focus on more profitable ventures, a common strategy in a challenging retail environment marked by inflation and constrained consumer spending.

| Segment | BCG Category | Rationale | Key Actions (2024) |

|---|---|---|---|

| Zimbabwe Operations | Dog | Challenging economic climate, negative volume growth, goodwill impairment. | Divested in December 2024. |

| Kamoso (General Merchandise, SA) | Dog | Low market share, minimal growth potential, not contributing effectively. | Discontinued in June 2024. |

| Kamoso (Liquor, SA) | Dog | Low market share, likely burdened by operational challenges and competition. | Discontinued in June 2024. |

| Kamoso Mediland | Dog | Poor performance, low market share in a stagnant segment. | Discontinued in June 2024. |

| Underperforming Older Stores | Dog | Low market share in stagnant/declining markets, resource drain. | Ongoing rationalization and potential closure. |

Question Marks

Choppies' new cash & carry wholesale stores, with the first planned for Lobatse in the first half of FY2025, are positioned as Question Marks in the BCG Matrix. This new venture enters a market with substantial growth potential, but Choppies currently holds a negligible share within it.

The success of these stores hinges on significant capital investment to build brand recognition and capture market share. Given the nascent stage of this initiative for Choppies, the return on these investments remains uncertain, characteristic of a Question Mark's profile.

Choppies' foray into e-commerce and online retail expansion positions it as a Question Mark within its business portfolio. This segment is experiencing significant global growth, with the online retail market projected to reach $7.0 trillion by 2024. However, Choppies' current presence in this arena is likely nascent, necessitating considerable investment in digital infrastructure, supply chain optimization, and targeted digital marketing campaigns to establish a competitive foothold and capture market share.

Choppies' past considerations of expanding into markets like Tanzania and Kenya represent a classic "question mark" scenario within the BCG matrix. These are potentially high-growth areas, but Choppies would likely enter with a very small market share.

Such an entry would demand substantial investment in marketing, distribution, and local adaptation to build brand recognition and compete effectively against established retailers. For instance, in 2024, the retail sector in Kenya saw continued growth, with a rising middle class driving demand for organized retail, though competition remained intense.

Advanced Fintech Integration (beyond basic services)

Advanced fintech integration, moving beyond basic money transfers, represents a potential Question Mark for Choppies. While the Southern African fintech market is experiencing significant growth, projected to reach over $10 billion by 2025, Choppies likely holds a minimal share in these innovative digital financial solutions.

To elevate this segment from a Question Mark to a Star, Choppies would need to strategically invest in developing and marketing advanced fintech offerings. This could include personalized financial advisory services, integrated digital payment ecosystems, or even blockchain-based solutions for supply chain finance.

- High Growth Potential: The Southern African fintech market shows robust expansion, indicating a favorable environment for new entrants and advanced services.

- Low Market Share: Choppies' current position in advanced fintech is likely nascent, requiring significant effort to gain traction.

- Investment Required: Substantial capital and technological expertise are necessary for developing and deploying sophisticated fintech solutions.

- Strategic Importance: Successful integration could unlock new revenue streams and enhance customer loyalty in an increasingly digital landscape.

New 'One-Stop-Shop' Formats with Diversified Offerings

Choppies' move towards new 'one-stop-shop' formats, integrating groceries with services like electricity, airtime, and money transfers, positions these ventures as Question Marks within its BCG Matrix. This strategy is designed to tap into high-growth potential by offering unparalleled convenience, thereby attracting and retaining a broader customer base.

The success of these fintech-driven, diversified offerings is still largely unproven, demanding substantial investment in technology and operational adaptation. For instance, in 2024, Choppies has been actively piloting these integrated models in select markets, with early feedback indicating a positive customer reception to the bundled service approach.

- Strategic Intent: To create integrated retail experiences offering groceries alongside essential financial and utility services.

- Growth Potential: High, driven by increased customer convenience and potential for cross-selling.

- Market Penetration: Currently unproven, requiring significant investment and market testing.

- Investment Needs: Substantial capital required for technology development, partnerships, and operational integration.

Choppies' expansion into new product categories or service offerings, such as the potential introduction of private label brands or enhanced loyalty programs, can be classified as Question Marks. These initiatives aim to capture untapped market segments or deepen customer engagement, but their success is not guaranteed and requires significant upfront investment.

The company's exploration of new geographic markets, like potential entries into other African nations not currently served, also fits the Question Mark profile. These markets might offer substantial growth opportunities, but Choppies would likely enter with a low market share and face established competitors, necessitating considerable investment to build a presence.

Choppies' strategic investments in technology, including potential upgrades to its enterprise resource planning (ERP) systems or the adoption of advanced data analytics for inventory management, are also considered Question Marks. While these investments promise efficiency gains and improved decision-making, their impact and return are uncertain until fully implemented and tested.

| Initiative | Market Growth | Choppies' Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| New Cash & Carry Stores | High | Negligible | High | Uncertain |

| E-commerce Expansion | High (Global market projected $7.0 trillion by 2024) | Low | High | Uncertain |

| Advanced Fintech Integration | High (Southern African market projected >$10 billion by 2025) | Low | High | Uncertain |

| 'One-Stop-Shop' Formats | High | Unproven | High | Uncertain |

BCG Matrix Data Sources

Our Choppies BCG Matrix is built on robust data, integrating financial disclosures from Choppies, market share analysis from industry reports, and regional growth forecasts to provide a comprehensive view.