China Index Holdings (CIH) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Index Holdings (CIH) Bundle

China Index Holdings (CIH) operates within a dynamic environment shaped by evolving political landscapes in China, economic shifts affecting the real estate sector, and technological advancements in data analytics. Understanding these external forces is crucial for any investor looking to capitalize on CIH's market position.

Gain a competitive edge with our comprehensive PESTLE Analysis of China Index Holdings (CIH). Uncover the intricate political, economic, social, technological, legal, and environmental factors that are currently shaping its trajectory and influencing its future growth potential. This in-depth analysis is your key to unlocking actionable intelligence and making informed strategic decisions.

Don't get left behind in the rapidly changing Chinese market. Our expertly crafted PESTLE Analysis for China Index Holdings (CIH) provides the critical insights you need to navigate risks and identify opportunities. Purchase the full version now to gain a deeper understanding of the external forces impacting CIH and to strengthen your own market strategy.

Political factors

The Chinese government is actively working to stabilize its real estate sector, with a focus on reversing the downturn observed in 2025. This proactive approach involves implementing pro-housing policies, such as lowering mortgage rates and reducing down payment requirements.

These policy shifts are crucial for China Index Holdings (CIH) as they directly impact transaction volumes and overall market confidence. Such factors are fundamental to CIH's data and analytics services, which rely on a healthy and active property market.

For instance, by mid-2025, several major Chinese cities had reported a noticeable uptick in property sales following the introduction of these supportive measures, indicating a potential positive correlation between government intervention and market activity.

China's government is heavily prioritizing affordable housing and urban renewal, aiming to boost the supply of accessible homes and speed up renovations of older urban areas. This policy direction signifies a move towards a more balanced housing market, incorporating both social housing and market-rate properties. For instance, in 2024, the government announced plans to build 2 million units of affordable housing through public-private partnerships.

China Index Holdings (CIH) can capitalize on this by utilizing its extensive data on market trends and property valuations. This expertise can be instrumental in supporting government-led affordable housing projects and urban redevelopment initiatives. CIH could potentially develop new revenue streams by partnering with public sector entities or developers concentrating on these crucial segments of the housing market.

China's 'white list' mechanism, introduced in January 2024, is a significant political factor impacting the real estate sector. This initiative directs financial support to pre-approved real estate projects, aiming to bolster developer liquidity and ensure the completion of stalled developments. By February 2024, over 1.7 trillion yuan in financing had been approved under this program, highlighting its substantial scale and potential to stabilize the market.

This policy directly influences the operational environment for companies like China Index Holdings (CIH), which provides crucial data and risk management tools to the real estate industry. CIH's insights are vital for financial institutions and developers seeking to navigate the criteria and benefits of the 'white list' effectively, thereby supporting market stability and CIH’s business.

Relaxation of Home Purchase Restrictions

Many Chinese cities, including major hubs like Beijing and Shanghai, have eased or completely removed home purchase restrictions. This move is designed to stimulate the property market by encouraging more people to buy homes. For China Index Holdings (CIH), this policy shift is a significant positive, as it broadens the potential customer base for its real estate data and analytics services by increasing market activity and buyer interest.

The relaxation of these rules is already showing results. For instance, in early 2024, cities like Hangzhou and Nanjing saw a notable uptick in property transactions following the easing of purchase limits. This increased market dynamism directly translates into a greater need for CIH's comprehensive market insights and valuation tools, supporting its revenue growth.

- Increased Buyer Pool: Policy easing allows more individuals and families to enter the housing market, expanding CIH's potential client base for property data.

- Higher Transaction Volumes: Relaxed restrictions typically lead to more property sales, boosting demand for CIH's market intelligence and analytics.

- Improved Market Sentiment: Such policy changes signal government support for the property sector, fostering confidence and encouraging investment, which benefits data providers like CIH.

Central Government's Emphasis on Real Estate Stability

The Chinese central government's 2025 government work report marks a significant shift, explicitly prioritizing real estate market stability for the first time. This high-level focus directly addresses concerns about debt defaults and the critical need for timely delivery of housing projects across the nation.

This top-down emphasis on stability offers a more predictable operating environment for companies like China Index Holdings (CIH). It signals sustained policy support, which is crucial for navigating the complexities of the real estate sector and fostering investor confidence.

- Policy Priority: Real estate stability is now a core component of China's national policy framework for 2025.

- Risk Mitigation: The government aims to prevent widespread debt defaults within the property sector.

- Project Completion: Ensuring timely delivery of new housing projects is a key objective.

- CIH Benefit: This policy direction suggests a more supportive and stable market for CIH's operations.

Government initiatives to stabilize China's real estate market are a major political factor. Policies like the 'white list' mechanism, which directs financing to approved projects, aim to improve developer liquidity. For instance, by February 2024, over 1.7 trillion yuan had been approved under this program, demonstrating its scale.

Furthermore, many cities have eased or removed home purchase restrictions, directly increasing buyer pools and transaction volumes. This policy shift, evident in cities like Hangzhou and Nanjing seeing upticks in early 2024, benefits CIH by expanding its client base and demand for its data services.

The government's explicit prioritization of real estate stability in its 2025 work report, focusing on risk mitigation and project completion, creates a more predictable environment for CIH. This high-level support is crucial for sustained operations and investor confidence in the sector.

| Policy Initiative | Date Introduced | Impact on Real Estate Market | Relevance to CIH |

|---|---|---|---|

| 'White List' Mechanism | January 2024 | Directs financing to approved projects, boosting developer liquidity. Over 1.7 trillion yuan approved by Feb 2024. | Provides data for financial institutions and developers navigating the program. |

| Easing Home Purchase Restrictions | Ongoing (e.g., early 2024) | Increases buyer pools and transaction volumes. Cities like Hangzhou and Nanjing saw upticks. | Expands CIH's potential client base and demand for analytics. |

| Prioritization of Market Stability | 2025 Government Work Report | Focus on debt default mitigation and project completion. | Creates a more predictable and supportive operating environment for CIH. |

What is included in the product

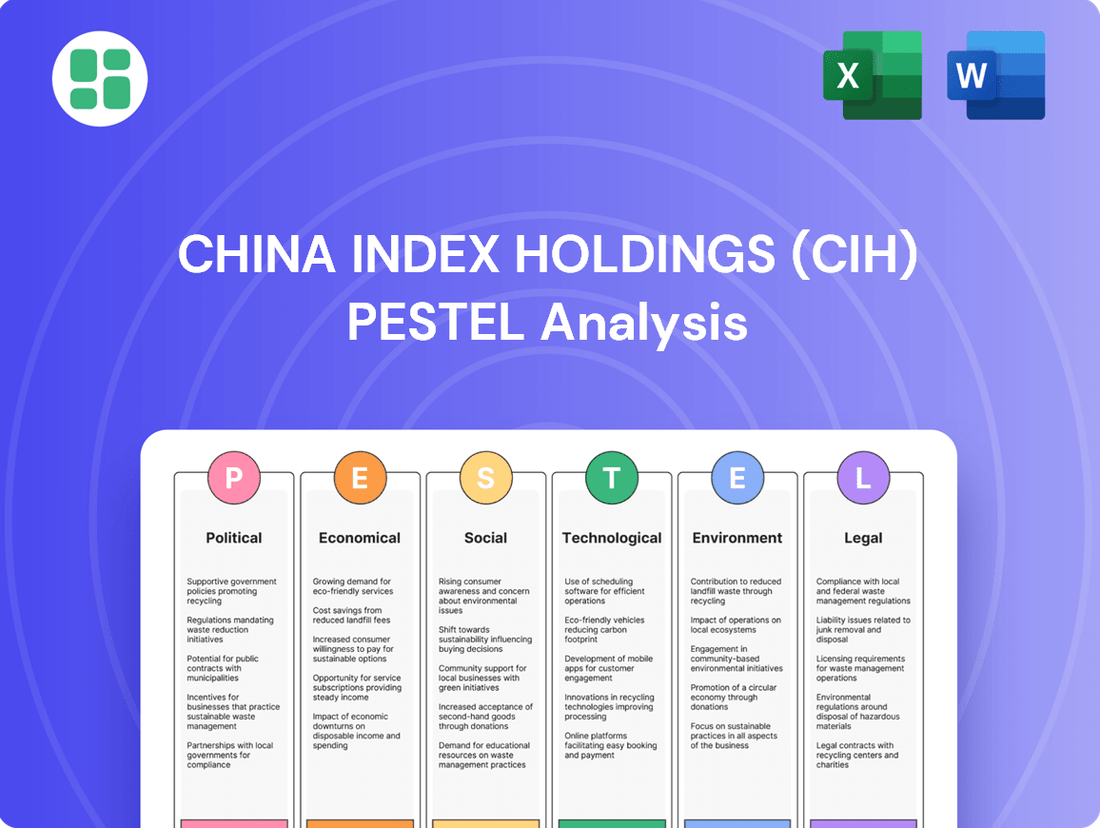

This PESTLE analysis examines China Index Holdings (CIH) by dissecting the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations and strategic positioning.

It provides a comprehensive understanding of the external landscape, highlighting key trends and their implications for CIH's future growth and risk management.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of China Index Holdings' (CIH) external environment to inform strategic decisions.

Economic factors

China's real estate sector has been navigating a challenging period since 2021, marked by substantial drops in both sales volume and investment activity. Despite a glimmer of hope with positive month-on-month growth in new home sales across key cities in December 2024, the market's path to widespread recovery remains uncertain.

China Index Holdings (CIH) plays a crucial role by offering in-depth data and analytical insights, enabling clients to grasp the complexities of this volatile environment. This information is essential for making sound decisions as the market grapples with persistent price adjustments and elevated inventory levels.

The People's Bank of China has implemented significant policy shifts, notably lowering mortgage rates and reducing minimum down payment requirements for both new and existing homeowners. These actions are designed to ease the financial strain on potential buyers and boost housing market activity.

For China Index Holdings (CIH), these policy changes present a direct opportunity. Their market research capabilities can quantify the impact of these incentives on buyer sentiment and the volume of property transactions, offering crucial data to clients navigating the evolving real estate landscape.

China's government is actively deploying fiscal stimulus, notably through special-purpose bonds allocated to local governments. These funds are earmarked for acquiring commercial properties to bolster affordable housing initiatives and to purchase idle land. This strategy aims to directly address the significant issue of unsold property inventory and shore up the financial health of developers.

CIH is well-positioned to leverage this economic shift. By providing data-driven analysis on how these government interventions influence property values and overall market supply, CIH can help clients pinpoint emerging investment opportunities. For instance, understanding the volume of properties acquired for affordable housing can signal potential shifts in demand and pricing for related commercial real estate.

Impact on Consumer Confidence and Household Debt

Economic uncertainty and rising household debt are significantly dampening consumer confidence, which in turn affects the housing market. This situation creates headwinds for sectors reliant on consumer spending and property transactions.

While the Chinese government has implemented policy easing measures to bolster confidence, a complete rebound remains uncertain. These policies aim to stimulate economic activity and improve the affordability of housing, but their full impact is still unfolding.

China Index Holdings (CIH) plays a vital role in this environment by tracking shifts in consumer sentiment and affordability. Their market research provides essential data for real estate developers and financial institutions, enabling them to adapt their strategies to the prevailing economic conditions.

- Consumer Confidence Index: While specific monthly figures fluctuate, the overall trend in China's Consumer Confidence Index has shown volatility, reflecting ongoing economic concerns. For instance, in early 2024, reports indicated a cautious sentiment among consumers.

- Household Debt Levels: Household debt as a percentage of GDP in China has been on an upward trajectory, reaching significant levels by the end of 2023, putting pressure on disposable income and spending power.

- Property Market Performance: Key indicators for the property market, such as sales volume and price changes in major cities, have reflected the impact of reduced consumer confidence and debt burdens, with some regions experiencing slowdowns.

Shift to a More Sustainable Development Model

China's real estate sector is transitioning from rapid expansion fueled by debt to a more sustainable, quality-focused approach. This significant shift aims to balance market stability with long-term growth, impacting developers and service providers alike.

The government's policy emphasis is on improving the quality of existing housing stock and exercising tighter control over new commercial property development. This move away from a high-turnover model is designed to reduce systemic financial risks and promote healthier urban development.

China Index Holdings (CIH) is positioned to assist clients navigating this new landscape. Their services can offer crucial data and analysis on emerging sustainable development trends, property quality assessments, and the changing dynamics of supply and demand within the real estate market.

- Policy Shift: Beijing's "dual-track" system prioritizes both market vitality and risk prevention in real estate.

- Focus on Quality: A move from quantity to quality in housing development is a key government directive.

- CIH's Role: Providing analytics on sustainable practices and market shifts to help clients adapt.

- Market Impact: Expect slower but more stable growth in the property sector, with increased demand for renovation and upgrade services.

China's economic landscape continues to be shaped by government efforts to stabilize the property market and boost consumer confidence. Policy easing, including interest rate adjustments and fiscal stimulus through local government bonds, aims to inject liquidity and support affordable housing initiatives. However, persistent economic uncertainty and high household debt levels present ongoing challenges, impacting consumer spending and overall market sentiment.

China Index Holdings (CIH) is instrumental in providing the granular data needed to navigate these economic crosscurrents. Their analysis helps clients understand the impact of policy interventions and consumer behavior on property values and transaction volumes, offering a critical edge in a dynamic market.

The transition towards a quality-focused real estate sector, with tighter controls on new development and an emphasis on existing stock improvement, signals a move towards more sustainable, albeit potentially slower, growth. CIH's insights into these structural shifts are vital for stakeholders adapting to the evolving market dynamics.

| Economic Factor | 2023/2024 Data Point | Implication for CIH Clients |

| Property Investment Growth (YoY) | -9.6% (Jan-Nov 2023) | Highlights need for data on market recovery drivers. |

| Consumer Confidence Index (CCI) | Fluctuating, generally cautious sentiment in early 2024 | CIH data on sentiment shifts is crucial for demand forecasting. |

| Household Debt to GDP Ratio | Approaching 65% by end of 2023 | Indicates reduced disposable income, impacting housing affordability. |

| Special-Purpose Bonds Issued | Significant increase in 2024 for affordable housing/land acquisition | CIH can track asset acquisition impact on property values. |

What You See Is What You Get

China Index Holdings (CIH) PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Index Holdings (CIH).

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE analysis for CIH.

The content and structure shown in the preview is the same document you’ll download after payment, offering deep insights into the external forces shaping CIH's business environment.

Sociological factors

China's rapid urbanization, with over 65% of its population residing in urban areas by the end of 2023, fuels sustained demand for property. However, a declining birth rate and an aging population, projected to see the number of people aged 65 and above reach 400 million by 2035, are reshaping housing needs. This demographic pivot necessitates a strategic understanding of evolving preferences, from smaller, accessible units for seniors to family-oriented dwellings in developing urban centers.

Chinese consumers increasingly desire better living spaces, driving significant "upgrade demand" in the housing market. This trend means many first-time homebuyers are actually trading up from existing properties, seeking larger homes and superior quality. For instance, by late 2024, reports indicated that over 60% of new home purchases in major Tier 1 and Tier 2 cities were from upgraders, not purely first-time buyers.

China Index Holdings (CIH) is well-positioned to capitalize on this by offering granular market research that tracks these evolving preferences. By understanding the specific features and amenities sought by upgraders, CIH can help developers and real estate agents tailor their projects and marketing efforts more effectively. This data-driven approach is crucial as the market shifts from basic housing provision to catering to more sophisticated consumer tastes.

China is significantly boosting its rental housing supply, with plans for millions of new units by 2025. This push highlights a strategic shift towards institutional rental housing, aiming to house a growing urban population, including young professionals and migrant workers.

China Index Holdings (CIH) is well-positioned to support this trend. Its data analytics can monitor rental market dynamics, track vacancy rates, and assess rental yields, providing crucial intelligence for investors and developers targeting this expanding sector.

Affordability Challenges and Intergenerational Disparity

Despite a general trend of lower mortgage rates in China during 2024-2025, housing affordability continues to be a significant hurdle, especially for younger demographics and lower-income families. This situation exacerbates the wealth gap between generations, as older generations often benefit from earlier, more accessible property ownership. China Index Holdings' (CIH) extensive data on housing prices, average incomes, and mortgage affordability indices provides crucial insights into these societal pressures.

CIH's analysis highlights the persistent affordability gap, with key metrics indicating that the dream of homeownership remains out of reach for many. For instance, in major tier-1 cities, the housing price-to-income ratio, a critical affordability benchmark, often exceeds 30x, significantly higher than international norms. This disparity underscores the need for targeted policy interventions.

- Housing Price-to-Income Ratio: Remains critically high in major Chinese cities, exceeding 30x in many instances as of early 2025, far above sustainable levels.

- Intergenerational Wealth Transfer: The ability of younger generations to enter the property market independently is increasingly reliant on parental financial support, widening the wealth disparity.

- Low-Income Household Impact: These groups face the most severe affordability challenges, often priced out of desirable urban locations despite potential policy easing.

- CIH Data Utility: Provides granular data on regional price fluctuations, income growth, and mortgage burdens, enabling policymakers and developers to craft more equitable housing solutions.

Impact of 'Lying Flat' and Reduced Mobility

Societal shifts, like the 'lying flat' movement among Chinese youth, signal a potential recalibration of traditional aspirations, including homeownership. This trend, fueled by intense competition and perceived diminishing returns on effort, could dampen housing demand, particularly in tier-one and tier-two cities. For instance, a 2023 survey indicated a significant portion of young urban professionals expressed a desire for a less demanding work-life balance, potentially impacting their willingness to invest heavily in property.

Reduced mobility, stemming from these changing attitudes and potentially economic pressures, further complicates the housing market outlook. China Index Holdings (CIH) can leverage its localized data analytics to track shifts in consumer sentiment and property transaction volumes, offering crucial insights into how these broader sociological factors influence regional housing demand and long-term residential patterns.

- Youth Aspirations: A growing segment of young Chinese workers are prioritizing work-life balance over rapid career advancement, potentially reducing pressure for immediate homeownership.

- Economic Sentiment: Lingering concerns about economic growth and job security can contribute to a more cautious approach to major financial commitments like real estate purchases.

- Mobility Trends: Changes in lifestyle preferences and economic outlook may lead to decreased inter-city migration, impacting demand in both origin and destination housing markets.

- CIH's Role: CIH's data capabilities are essential for understanding the granular impact of these sociological trends on localized property markets and consumer behavior.

Societal shifts in China are profoundly influencing the housing market, with demographic changes and evolving consumer preferences playing a key role. The aging population, projected to reach 400 million by 2035, is altering housing needs, while a growing desire for better living spaces fuels "upgrade demand," with over 60% of new home purchases in major cities in late 2024 being from upgraders.

Affordability remains a significant challenge, particularly for younger demographics, as evidenced by housing price-to-income ratios exceeding 30x in tier-1 cities by early 2025. Furthermore, the "lying flat" movement among youth signals a potential recalibration of traditional aspirations, including homeownership, potentially dampening demand in key urban centers.

| Sociological Factor | 2024/2025 Data Point | Impact on Housing Market | CIH Data Relevance |

|---|---|---|---|

| Urbanization Rate | Over 65% by end of 2023 | Sustained demand for urban property | Tracking urban growth patterns |

| Aging Population | 400 million aged 65+ by 2035 | Shifting housing needs towards senior-friendly units | Analyzing demand for specialized housing |

| Upgrade Demand | >60% of new purchases in Tier 1/2 cities (late 2024) | Increased demand for higher quality and larger homes | Identifying buyer profiles and preferences |

| Affordability (Tier 1 Cities) | Price-to-income ratio >30x (early 2025) | Homeownership out of reach for many younger/lower-income groups | Monitoring affordability indices |

| Youth Aspirations ('Lying Flat') | Growing segment prioritizing work-life balance | Potential dampening of homeownership demand | Tracking consumer sentiment and lifestyle trends |

Technological factors

China's PropTech market is on a significant growth trajectory, fueled by ongoing urbanization and government pushes for smart city development. Projections indicate a compound annual growth rate (CAGR) of nearly 20% from 2025 to 2035, signaling substantial expansion in this sector.

This rapid growth translates into a heightened demand for advanced real estate solutions. These innovations are crucial for improving property management, streamlining leasing processes, and elevating the overall user experience within the real estate ecosystem.

China Index Holdings (CIH), as a key player in providing real estate information and analytics, is strategically positioned. The company can leverage this burgeoning PropTech market, not only to benefit from its growth but also to actively contribute to its ongoing development.

China's real estate sector is undergoing a significant transformation driven by artificial intelligence (AI) and big data analytics. These technologies are revolutionizing property valuation, making it more precise, and enhancing predictive maintenance, which can reduce operational costs. For China Index Holdings (CIH), whose business is fundamentally data-driven, embracing and advancing AI and big data is paramount. This integration is key to refining its service portfolio and staying ahead in a competitive market.

CIH's reliance on data means that advancements in AI and big data directly impact its ability to offer superior services. For instance, by leveraging AI for more accurate market trend analysis, CIH can provide clients with more insightful property valuations and investment recommendations. The company's commitment to technological innovation positions it to capitalize on these trends, ensuring its continued relevance and growth in the evolving Chinese real estate landscape.

The increasing adoption of digital tools by consumers and businesses is fundamentally reshaping real estate deals, moving away from old-school methods towards technology-driven processes. This shift is evident as more property searches, virtual tours, and even contract signings migrate online.

China Index Holdings (CIH) plays a crucial role in this digital evolution of real estate. Its online platforms and data services are key enablers, providing clients with the tools for more efficient and informed decision-making in a rapidly digitizing market.

For instance, CIH's data analytics capabilities help clients navigate this digital shift, offering insights that were previously difficult to obtain. This is particularly important as the real estate sector in China continues to embrace digital transformation, with online property listings and virtual viewings becoming increasingly common, especially in major urban centers.

Emergence of Smart Home Technologies

The smart home device market in China is experiencing rapid growth, with projections indicating hundreds of millions of units sold by 2025. This surge is fundamentally altering traditional property management by introducing new functionalities and data streams.

China Index Holdings (CIH) can leverage this technological shift by integrating data on smart home adoption rates and their correlation with property values and evolving tenant preferences. This integration will allow CIH to provide clients with more nuanced and predictive analytics, reflecting the increasing importance of connected living environments.

- Projected Smart Home Device Sales: Hundreds of millions of units expected by 2025 in China.

- Impact on Property Management: Transformation of traditional practices through integrated technology.

- CIH's Opportunity: Incorporating smart home data for enhanced property analytics and client insights.

- Data Integration Benefits: Understanding tenant preferences and property value impact from smart home adoption.

Demand for Integrated Platforms

The market is increasingly seeking platforms that consolidate property management, leasing, and data analytics. This trend emphasizes a drive for operational efficiency and smarter, data-informed choices within the real estate sector. For China Index Holdings (CIH), this represents a significant opportunity to enhance its existing offerings.

CIH's current suite of services, including property valuation, market research, and risk assessment, is well-positioned to adapt and expand into more integrated solutions. By further developing these capabilities, CIH can directly address the growing demand for end-to-end property technology platforms. For instance, integrating AI-powered analytics into their existing valuation tools could provide clients with predictive insights on leasing trends, further solidifying their value proposition.

- Demand for Integrated Solutions: The real estate technology market shows a clear preference for platforms that streamline multiple functions.

- CIH's Strategic Advantage: CIH's existing data and analytics infrastructure provides a strong foundation for developing these integrated offerings.

- Market Evolution: The shift towards data-driven decision-making necessitates platforms that offer comprehensive insights, not just isolated services.

Technological advancements are rapidly transforming China's real estate sector, with AI and big data analytics driving more precise property valuations and predictive maintenance. China Index Holdings (CIH), as a data-centric entity, must integrate these technologies to refine its services and maintain a competitive edge.

The increasing digitization of real estate transactions, from property searches to contract signings, necessitates robust online platforms and data services, areas where CIH is strategically positioned to support clients through this digital shift.

The burgeoning smart home market, with projected hundreds of millions of unit sales by 2025, presents CIH with an opportunity to incorporate smart home data into its analytics, offering deeper insights into tenant preferences and property value correlations.

The market's demand for consolidated property management, leasing, and analytics platforms creates a clear pathway for CIH to expand its existing data and analytics capabilities into more integrated, end-to-end solutions.

Legal factors

China's real estate sector operates under a complex and frequently updated legal landscape. Recent adjustments to laws concerning land use, urban property management, and civil codes directly impact how real estate transactions are conducted. For China Index Holdings (CIH), staying abreast of these evolving statutes is crucial for maintaining compliance in its data gathering and service provision, especially regarding property rights and sale procedures.

China's Cybersecurity Law, enacted in 2017, and subsequent regulations like the Personal Information Protection Law (PIPL) of 2021, impose stringent requirements on data handling. CIH, processing vast amounts of real estate data, must navigate these laws, which govern how personal and sensitive information can be collected, stored, and transferred. Failure to comply can result in significant penalties, impacting operational continuity and reputation.

China's State Administration for Market Regulation (SAMR) has been actively enforcing anti-monopoly laws, issuing decisions on monopoly agreements across diverse sectors, including real estate, from 2024 through the first quarter of 2025. This heightened regulatory focus means companies like China Index Holdings (CIH), which operate in markets where data dominance or significant market influence can be a factor, face increased scrutiny. For instance, a report from Q1 2025 indicated SAMR investigated over 50 cases related to anti-competitive practices in the digital economy alone.

New Regulations on Property Rentals

New regulations for residential property rentals are scheduled to be implemented in September 2025. These changes are designed to bring more order to rental processes, protect the rights of both tenants and landlords, and ultimately elevate the quality of the rental housing sector.

China Index Holdings (CIH) is well-positioned to assist clients in understanding the ramifications of these new rules. Through its market research capabilities, CIH can offer crucial data on how rental prices, the availability of properties, and overall demand might shift. This insight is vital for stakeholders looking to adapt to the changing rental market dynamics.

- Regulatory Impact: The September 2025 regulations aim to standardize rental contracts and dispute resolution mechanisms.

- CIH's Role: CIH's market intelligence can forecast potential impacts on rental yields and property valuations.

- Market Adaptation: Understanding these legal shifts is critical for investors and property managers to maintain compliance and optimize operations.

Legal Framework for Green Building Standards

China's legal framework for green building is rapidly evolving. By 2025, all new urban construction projects are mandated to adhere to green building standards, a significant policy shift aimed at environmental sustainability. This national mandate is further supported by provincial governments actively offering incentives and subsidies to encourage compliance and the adoption of green building practices.

For China Index Holdings (CIH), these legal developments are critical. Incorporating these environmental regulations into property valuation and market analysis is essential. Green certifications are increasingly becoming a key determinant of property value and marketability, directly impacting CIH's assessment methodologies and client advisory services. For instance, a study by the China Academy of Building Research in 2024 indicated that certified green buildings can command rental premiums of 5-10% compared to conventional structures.

- Mandatory Green Building Standards: All new urban buildings must comply by 2025.

- Provincial Incentives: Governments offer subsidies and tax breaks for green construction.

- Impact on Valuation: Green certifications are influencing property values and market appeal.

- CIH's Adaptation: Need to integrate these regulations into property analysis and valuation models.

China's legal landscape significantly impacts real estate operations, with evolving property laws and urban management regulations directly affecting transactions and rights. Stringent data protection laws, such as the Cybersecurity Law and PIPL, necessitate careful handling of information, posing compliance challenges for data-driven firms like CIH. Increased enforcement of anti-monopoly laws by SAMR, with over 50 digital economy cases investigated in Q1 2025, signals heightened scrutiny on market dominance.

New rental property regulations, set for September 2025, aim to standardize contracts and protect tenant and landlord rights, influencing rental yields and property valuations. Furthermore, a national mandate starting in 2025 requires all new urban construction to meet green building standards, with provincial incentives supporting adoption; green certifications are already showing a 5-10% rental premium in 2024.

| Legal Area | Key Regulation/Change | Impact on CIH | Relevant Data/Timeline |

|---|---|---|---|

| Property Law | Urban property management, civil codes | Compliance in data gathering, transaction analysis | Ongoing legislative updates |

| Data Protection | Cybersecurity Law, PIPL | Strict data handling protocols, risk of penalties | PIPL effective 2021 |

| Market Regulation | Anti-monopoly enforcement | Scrutiny on market influence, data dominance | 50+ digital economy cases investigated in Q1 2025 |

| Rental Market | New rental property regulations | Forecasting rental price/demand shifts | Implementation September 2025 |

| Green Building | Mandatory green building standards | Integrating environmental factors into valuations | Mandatory by 2025; 5-10% rental premium (2024) |

Environmental factors

China's commitment to environmental sustainability is underscored by its 14th Five-Year Plan, which mandates that all new urban buildings achieve green building standards by 2025. This policy directly fuels a significant demand for eco-friendly construction materials and advanced energy-efficient building designs across the country.

For China Index Holdings (CIH), this presents a strategic opportunity to enhance its valuation models. By incorporating green building certifications and detailed energy performance data, CIH can provide clients with crucial insights for assessing and developing properties that align with these stringent environmental regulations, thereby adding value in a rapidly evolving market.

China's State Council has set forth a clear roadmap with an action plan for energy conservation and carbon emissions reduction covering 2024 to 2025. This plan specifically targets the construction sector, aiming to boost the area of buildings undergoing energy-efficient renovations and enhance overall energy efficiency within the industry.

China Index Holdings (CIH) is well-positioned to assist clients in navigating these new environmental mandates. Their services can provide crucial evaluations of a property's environmental performance, offering insights into the financial impacts associated with meeting these stringent carbon reduction and energy conservation targets.

China's commitment to renewable energy is reshaping its built environment, with new urban buildings mandated to integrate solar photovoltaic panels. This policy, alongside a push for enhanced natural lighting and insulation, directly impacts construction strategies and operational costs.

By 2024, China's installed solar power capacity reached over 600 GW, a significant portion of which is finding its way into new building projects. This trend is expected to drive innovation in building materials and design, potentially increasing initial construction expenses but yielding long-term savings through reduced energy consumption.

For China Index Holdings (CIH), this presents an opportunity to offer data-driven insights into how these green building initiatives affect property valuations and market desirability. Analyzing the adoption rates and impact of renewable energy features can provide valuable intelligence for investors and developers navigating this evolving landscape.

Local Government Incentives for Green Development

Provincial governments across China are actively encouraging green development through various incentives. For instance, Shanghai, Beijing, Guangzhou, Zhejiang, and Jiangsu have rolled out programs offering tax relief and direct cash grants for new construction projects that meet stringent sustainability criteria. These initiatives are designed to make eco-friendly building more economically attractive.

China Index Holdings (CIH) is well-positioned to assist clients in navigating these incentive programs. By helping developers identify and secure these government subsidies and tax breaks, CIH can significantly improve the financial feasibility of their green real estate ventures. This strategic support is crucial for unlocking the full potential of sustainable construction in the Chinese market.

- Tax Relief: Reduced corporate income tax or property tax for certified green buildings.

- Cash Grants: Direct financial subsidies awarded upon project completion and certification.

- Streamlined Approval Processes: Faster permitting for projects adhering to green building standards.

- Preferential Loan Rates: Access to lower interest rates from financial institutions for green projects.

Environmental Impact on Real Estate Investment

China's commitment to environmental protection is reshaping its real estate sector. The government's push for carbon emission reduction, evidenced by ambitious targets for 2030 and 2060, is directly impacting building standards and investment preferences. This focus translates into a growing demand for green buildings and sustainable development practices.

China Index Holdings (CIH) is positioned to help investors navigate these evolving environmental regulations. Their risk management solutions can identify and quantify environmental risks associated with properties, such as flood vulnerability or proximity to industrial pollution. Conversely, these tools also highlight opportunities in energy-efficient buildings or areas slated for green infrastructure development.

- Government Mandates: China aims for peak carbon dioxide emissions before 2030 and carbon neutrality before 2060, driving stricter environmental building codes.

- Green Building Growth: The market for green buildings in China is expanding significantly, with a growing number of certified projects. For instance, by the end of 2023, over 4,000 projects had received China Green Building Three Star certification.

- Investment Shift: Investors are increasingly factoring environmental, social, and governance (ESG) criteria into their real estate decisions, favoring developments with lower environmental footprints.

- CIH's Role: CIH's data analytics and risk assessment tools help clients evaluate the environmental compliance and sustainability of their real estate portfolios, mitigating risks and identifying green investment opportunities.

China's environmental policies are a significant driver for the real estate sector, with mandates for green buildings and energy efficiency shaping new construction and renovations. The nation's commitment to carbon reduction, targeting peak emissions before 2030 and neutrality by 2060, directly influences building standards and investor preferences, fostering a growing demand for sustainable properties.

China Index Holdings (CIH) can leverage these trends by offering robust valuation models that integrate environmental performance data and green building certifications. This allows clients to assess properties against evolving regulations and identify opportunities in energy-efficient designs and renewable energy integration, such as the over 600 GW of solar capacity installed by 2024, which is increasingly incorporated into new urban buildings.

Provincial governments are actively incentivizing green development through tax relief and cash grants, making eco-friendly construction more financially viable. CIH's expertise in navigating these programs can help developers secure these benefits, enhancing the economic feasibility of sustainable projects and aligning with the growing investor focus on ESG criteria, as seen by over 4,000 projects achieving China Green Building Three Star certification by the end of 2023.

CIH's analytical tools are crucial for clients to evaluate environmental compliance, quantify risks like flood vulnerability, and identify opportunities in sustainable real estate. This data-driven approach supports informed decision-making in a market increasingly prioritizing environmental responsibility and long-term energy savings.

| Environmental Factor | China's Policy/Trend | Impact on Real Estate | CIH Opportunity |

|---|---|---|---|

| Green Building Mandates | 14th Five-Year Plan: All new urban buildings to meet green standards by 2025. | Increased demand for eco-friendly materials and designs. | Valuation models incorporating green certifications and energy performance data. |

| Energy Efficiency & Carbon Reduction | Action plan for energy conservation (2024-2025): Targets energy-efficient renovations. | Focus on retrofitting existing buildings and improving overall industry energy efficiency. | Evaluations of property environmental performance and financial impacts of carbon targets. |

| Renewable Energy Integration | Mandate for solar PV integration in new urban buildings. | Innovation in building materials and designs, potential for higher initial costs but long-term savings. | Data-driven insights on the impact of renewables on property valuations and market appeal. |

| Government Incentives | Provincial programs (e.g., Shanghai, Beijing) offer tax relief and cash grants for green projects. | Enhanced financial attractiveness of eco-friendly construction. | Assistance in identifying and securing government subsidies and tax breaks for developers. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Index Holdings is built upon a robust foundation of data from official Chinese government ministries, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting CIH.