China Index Holdings (CIH) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Index Holdings (CIH) Bundle

China Index Holdings (CIH) operates in a dynamic market where the threat of new entrants is moderate, balanced by the capital intensity of data infrastructure. Buyer power is significant, as clients can often switch between data providers with relative ease. The competitive rivalry among existing players is intense, driving innovation and price sensitivity.

The full report reveals the real forces shaping China Index Holdings (CIH)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Index Holdings (CIH) faces potential supplier power if it depends on a limited number of data providers for its core operations. For instance, if a few key data aggregators control unique or highly sought-after real estate or economic data crucial for CIH's index creation and analysis, these suppliers could leverage their position. In 2024, the market for specialized financial data continued to consolidate, with some major providers acquiring smaller competitors, potentially increasing concentration.

China Index Holdings (CIH) leverages unique data sources and proprietary technology for its real estate information services. The distinctiveness of these inputs, often difficult for competitors to replicate, can grant suppliers of specialized data or technological infrastructure significant bargaining power. This leverage can impact CIH's cost structure and its ability to maintain a competitive edge in its service offerings.

China Index Holdings (CIH) would likely face substantial switching costs if it decided to change its primary data or technology suppliers. These costs could include the significant effort and expense involved in migrating vast amounts of data, re-integrating new systems with existing CIH platforms, and potentially retraining staff on new technologies. For instance, if CIH's core business relies on proprietary data formats from a current supplier, the cost and time to convert this data for a new provider could be prohibitive.

Threat of Forward Integration by Suppliers

The threat of forward integration by China Index Holdings' (CIH) suppliers is a key consideration in assessing supplier bargaining power. If CIH's data providers or technology partners possess the capability and motivation to enter the real estate information and analytics market directly, they could become formidable competitors.

For CIH, this means evaluating the likelihood of its core suppliers, such as data aggregators or technology infrastructure providers, leveraging their existing resources and expertise to offer similar analytics and insights to CIH's customer base. A high likelihood of such integration would significantly increase supplier leverage, potentially leading to higher input costs or reduced service quality for CIH.

- Assessing Supplier Capabilities: Consider if CIH's primary data sources or technology partners have the necessary market knowledge and customer relationships to directly compete in the real estate analytics space. For example, a major data provider might already have direct relationships with real estate developers or financial institutions.

- Market Attractiveness: The profitability and growth potential of the real estate information and analytics market will influence a supplier's decision to integrate forward. If the market is highly lucrative, suppliers may be more inclined to pursue this strategy.

- Competitive Landscape: The presence of numerous other players in the analytics market might deter a supplier from entering, as it could lead to intense competition.

Importance of CIH to Suppliers

The significance of China Index Holdings (CIH) to its suppliers is a key factor in determining supplier bargaining power. If CIH constitutes a substantial portion of a supplier's overall revenue, that supplier is likely to be more accommodating in negotiations, potentially offering better pricing or more favorable payment terms. This dependence reduces the supplier's leverage.

For instance, if a data provider or technology service company derives a significant percentage of its income from CIH, they might be hesitant to risk losing that business by demanding unfavorable contract conditions. This dynamic directly impacts CIH's ability to secure competitive pricing and favorable terms from its supply chain.

Consider a scenario where a critical software vendor relies on CIH for over 20% of its annual sales. In such a case, the vendor would likely prioritize maintaining this relationship, making them more amenable to CIH's requests for price reductions or extended payment schedules. This illustrates how CIH's scale can be leveraged to mitigate supplier power.

- Supplier Dependence: The degree to which suppliers depend on CIH for their revenue stream directly influences their bargaining power.

- Negotiating Leverage: When CIH represents a large share of a supplier's business, the supplier has less incentive to impose strict terms, thus reducing their power.

- Cost Impact: Lower supplier bargaining power can translate into reduced input costs for CIH, positively impacting its profitability.

- Strategic Sourcing: CIH's ability to consolidate purchasing or identify alternative suppliers can further diminish the bargaining power of individual suppliers.

China Index Holdings (CIH) faces moderate supplier bargaining power, primarily due to the specialized nature of its data and technology needs. If key data providers consolidate further, as seen in 2024, their leverage over CIH could increase, potentially impacting costs. CIH's reliance on unique data sources also means switching suppliers could incur substantial costs, reinforcing supplier influence.

However, CIH's own significance to certain suppliers can mitigate this power. If CIH represents a substantial portion of a supplier's revenue, the supplier is incentivized to maintain a favorable relationship, offering better terms. This dynamic is crucial for CIH in managing its supply chain costs and ensuring operational stability.

| Factor | Impact on CIH | 2024 Context |

|---|---|---|

| Data Uniqueness & Concentration | Increases supplier power; potential for higher costs | Market consolidation observed in specialized data sectors. |

| Switching Costs | High costs limit supplier flexibility for CIH | Migrating proprietary data formats remains a significant hurdle. |

| CIH's Significance to Suppliers | Reduces supplier power; potential for favorable terms | CIH's scale can be leveraged in negotiations. |

| Forward Integration Threat | Potential for suppliers to become competitors | Market attractiveness influences supplier strategic decisions. |

What is included in the product

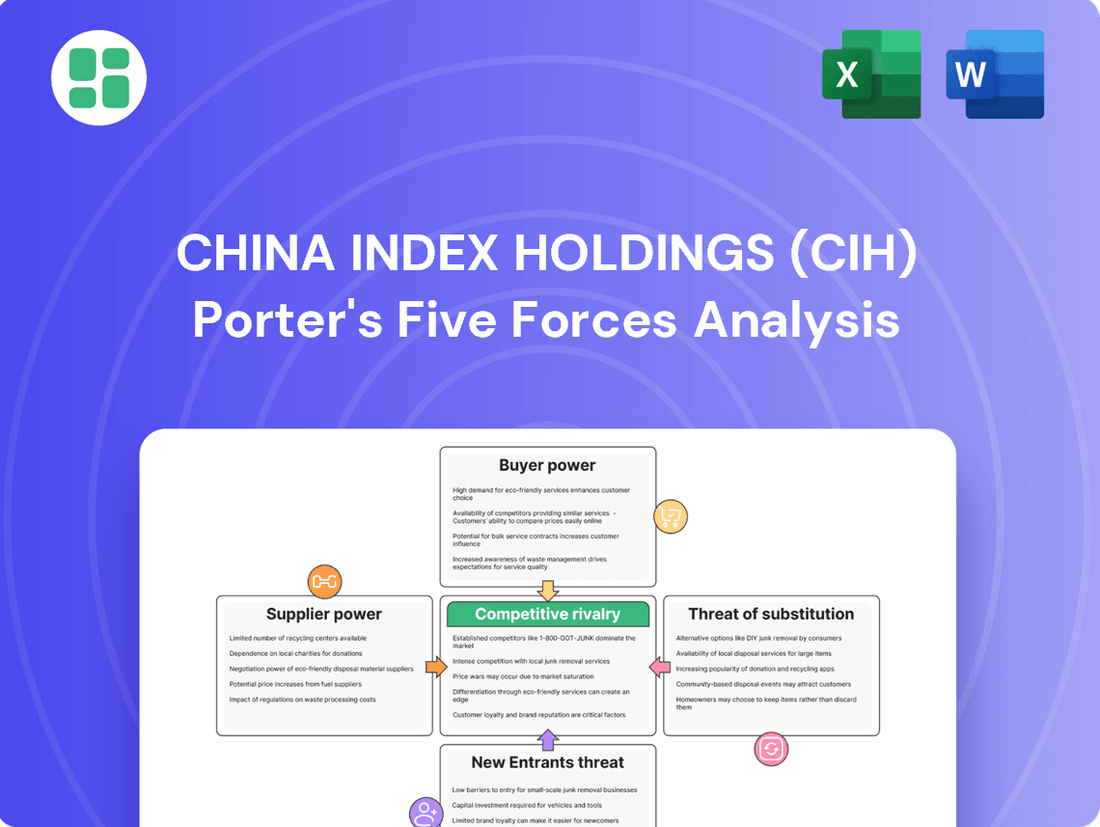

This Porter's Five Forces analysis for China Index Holdings (CIH) meticulously examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, providing a strategic roadmap for CIH's competitive positioning.

CIH's Porter's Five Forces analysis offers a pain point reliever by providing a clear, one-sheet summary of all five forces, perfect for quick decision-making.

This analysis acts as a pain point reliever by enabling users to customize pressure levels based on new data or evolving market trends, ensuring strategic relevance.

Customers Bargaining Power

China Index Holdings (CIH) faces potential customer concentration risks. A small number of large clients, like major real estate developers or financial institutions, hold significant sway. For instance, in 2023, CIH's top ten customers accounted for a substantial portion of its revenue, putting pressure on pricing and service agreements.

China Index Holdings (CIH) provides crucial data, analytics, and consulting services that are deeply integrated into its customers' operational and strategic decision-making processes. These services are often indispensable for real estate developers, financial institutions, and government bodies needing accurate market insights and risk assessments.

For instance, CIH's comprehensive property data and market trend analysis empower clients to make informed investment, development, and pricing decisions, reducing uncertainty in a dynamic market. This high degree of reliance on CIH's specialized offerings significantly diminishes the bargaining power of individual customers, as switching to an alternative provider would likely incur substantial costs and disruption.

Customers switching from China Index Holdings (CIH) would face significant hurdles. These include the expense and time required to retrain personnel on new platforms, the complexity of migrating extensive historical data, and the potential disruption to ongoing operations. For instance, if a client uses CIH's proprietary analytics tools extensively, adopting a competitor's system might necessitate a complete overhaul of their data analysis processes.

Customer Price Sensitivity

China Index Holdings (CIH) faces significant customer price sensitivity, particularly given the volatility in China's real estate market. As economic conditions tighten, customers, including developers and property buyers, become more focused on cost-effectiveness, pushing for lower prices or enhanced value propositions from CIH's data and analytics services.

This heightened sensitivity means that CIH must carefully balance its pricing strategies with the perceived value of its offerings. A challenging real estate environment, like the one observed in 2024 with ongoing property sector adjustments, directly impacts the purchasing power and willingness to spend of CIH's client base. For instance, if developers are facing lower margins, they will likely scrutinize the costs associated with data providers more closely.

- Developer Margins: In 2024, many Chinese property developers experienced squeezed profit margins, leading to increased pressure on all operational expenses, including data services.

- Market Demand Shifts: A slowdown in property transactions, a trend evident through much of 2024, reduces the overall demand for real estate-related services, amplifying price competition.

- Value-Added Services: Customers are increasingly seeking more than just raw data; they expect actionable insights and tailored solutions, making the perceived value of CIH's services crucial in justifying its price points.

- Competitive Landscape: The presence of alternative data providers and in-house analytics capabilities among larger clients means CIH must continuously demonstrate its competitive advantage to retain customers without significant price concessions.

Threat of Backward Integration by Customers

The threat of backward integration by customers for China Index Holdings (CIH) is a significant consideration. This involves assessing whether CIH's clients, primarily real estate developers and financial institutions, could realistically build their own in-house capabilities for real estate information and analytics. If they can effectively replicate CIH's services, this would directly increase their bargaining power.

Many of CIH's clients operate in a highly competitive and data-intensive environment. The ability to access and analyze real estate data, market trends, and property valuations is crucial for their operations. If the cost and complexity of developing these internal systems are perceived as manageable, clients might choose to bring these functions in-house, thereby reducing their reliance on CIH and potentially negotiating lower prices or seeking alternative providers.

- Assessing Customer Capability: Many of CIH's institutional clients already possess significant internal data science and analytics teams, making the development of proprietary real estate information systems a feasible, albeit resource-intensive, undertaking.

- Cost-Benefit Analysis: The decision for a customer to integrate backward hinges on a cost-benefit analysis. If the long-term cost savings and control over data outweigh the investment in technology and talent, backward integration becomes a more attractive option.

- Market Data Dependence: While clients can develop internal analytics, the proprietary nature of some of CIH's data sources and the breadth of their aggregated information present a barrier to complete self-sufficiency.

China Index Holdings (CIH) benefits from high customer switching costs and the specialized nature of its data and analytics services. Clients' deep integration of CIH's offerings into their strategic decision-making, coupled with the expense and disruption of migrating to alternative systems, significantly limits their bargaining power. This reliance makes it difficult for customers to demand substantial price concessions or dictate terms.

| Factor | Impact on CIH Customer Bargaining Power | Evidence/Data Point (2023-2024) |

|---|---|---|

| Switching Costs | Lowers bargaining power | Significant investment in training and data migration required for alternative platforms. |

| Customer Dependence | Lowers bargaining power | CIH's data is critical for clients' investment, development, and pricing decisions. |

| Price Sensitivity | Increases bargaining power | Squeezed developer margins in 2024 led to increased scrutiny of data service costs. |

| Backward Integration Threat | Potentially increases bargaining power | Clients with existing analytics teams may consider developing in-house capabilities. |

Same Document Delivered

China Index Holdings (CIH) Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details China Index Holdings' (CIH) Porter's Five Forces Analysis, offering a comprehensive look at competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products within the data and analytics sector.

Rivalry Among Competitors

The Chinese real estate information and analytics market is characterized by a moderate number of competitors, with China Index Holdings (CIH) facing rivalry from both large, established players and smaller, specialized firms. This competitive landscape means CIH must constantly innovate and differentiate its services to maintain its market position.

While specific market share data for 2024 is still emerging, reports from late 2023 indicated that CIH held a significant, though not dominant, share of the property data services market in China. Competitors like E-House China and various regional data providers vie for market share, often through aggressive pricing and tailored service offerings.

The presence of these varied competitors, ranging from broad-based real estate service groups to niche analytics firms, intensifies rivalry. This forces CIH to focus on the quality and comprehensiveness of its data, as well as the sophistication of its analytical tools, to stand out.

The Chinese real estate data and analytics market is experiencing a significant slowdown, directly impacting competitive rivalry. As the property market faces a downturn, companies like China Index Holdings (CIH) are likely to see intensified competition as players vie for a shrinking pool of market share.

China Index Holdings (CIH) differentiates itself through its comprehensive data analytics and information services, particularly in the real estate sector. While competitors may offer similar data points, CIH's strength lies in its integrated platform and specialized insights, which are crucial for navigating China's complex property market.

The extent of CIH's differentiation is evident in its ability to provide granular data and analytical tools that go beyond basic property listings. For instance, CIH's focus on real estate indices and research reports offers unique value to investors and developers, reducing direct price wars with less specialized providers.

In 2024, CIH's continued investment in technology and data science allows for deeper market segmentation and predictive analytics, further setting its offerings apart. This advanced capability makes its services less commoditized, thereby mitigating the intensity of competitive rivalry.

Exit Barriers

China Index Holdings (CIH) operates within a market characterized by significant exit barriers, particularly within the Chinese real estate data and analytics sector. These barriers can trap even underperforming companies, intensifying competition.

The costs and difficulties associated with exiting the Chinese real estate data and analytics market are substantial. Specialized technology, proprietary data sets, and established client relationships represent significant sunk costs. For instance, developing and maintaining the sophisticated analytical platforms required in this industry demands considerable upfront investment and ongoing expenditure, making a complete divestment or pivot financially challenging.

Furthermore, long-term contracts with developers, government agencies, and financial institutions create additional exit impediments. These agreements often involve penalties for early termination or require significant transition support for clients, thereby increasing the financial burden on companies looking to withdraw. The interconnectedness of data platforms also means that a company’s departure could disrupt the operations of numerous partners, leading to reputational damage and potential legal entanglements.

- Specialized Assets: High investment in proprietary data infrastructure and analytical software.

- Long-Term Contracts: Binding agreements with key industry players that are costly to break.

- Client Relationships: Established trust and integration with a broad client base in the real estate ecosystem.

- Regulatory Hurdles: Navigating Chinese regulations for data handling and market exit can be complex and time-consuming.

Market Structure and Regulatory Environment

China Index Holdings (CIH) operates within a unique market structure characterized by significant government influence and evolving regulations. The Chinese government actively shapes the competitive landscape through policies impacting data access, market entry, and the operations of technology and information service providers. For instance, data localization requirements and cybersecurity laws can create barriers for foreign competitors and favor domestic players.

The presence of state-backed entities and the emphasis on national champions within the Chinese economy also intensify competitive rivalry. These entities often benefit from preferential treatment, including access to resources and government contracts, which can put privately held companies like CIH at a disadvantage. This dynamic is evident in sectors where information services are critical for national economic planning and development.

In 2024, the regulatory environment continued to be a key factor. China's efforts to strengthen data governance and antitrust enforcement, as seen in crackdowns on major tech firms, underscore the government's assertive role. This creates an environment where CIH must remain agile, adapting its strategies to comply with new directives while navigating the competitive pressures from both domestic and international players operating under these distinct rules.

- Government Regulations: China's data governance and cybersecurity laws, including data localization mandates, significantly influence market entry and operational strategies for information service providers.

- State-Backed Entities: The presence of state-backed enterprises often provides them with advantages in resources and market access, intensifying competition for companies like CIH.

- Market Structure: The Chinese market is characterized by a blend of domestic champions and international firms, with government policies playing a crucial role in shaping competitive dynamics and favoring national interests.

- Regulatory Evolution: Ongoing regulatory shifts, such as antitrust enforcement and data privacy enhancements in 2024, require continuous adaptation from companies operating within China's information services sector.

The competitive rivalry within China's real estate information and analytics sector is substantial, with China Index Holdings (CIH) facing pressure from both established giants and nimble niche players. This dynamic is amplified by a market slowdown in 2024, forcing companies to intensely compete for a reduced market share. CIH distinguishes itself through sophisticated data analytics and integrated platforms, offering granular insights and predictive tools that go beyond basic listings, thereby mitigating commoditization and direct price wars.

SSubstitutes Threaten

The threat of substitutes for China Index Holdings (CIH) is moderate. Customers seeking real estate insights can turn to general market research firms or even undertake internal data collection. For instance, in 2023, the global market research industry was valued at approximately $81 billion, indicating a significant number of alternative providers.

The threat of substitutes for China Index Holdings (CIH) is influenced by the price-performance trade-off available from alternative data and analytics providers. If competitors offer similar or better insights at a lower cost, CIH's market position could be challenged. For instance, if a new platform emerges offering real-time property data at a significantly reduced subscription fee compared to CIH's offerings, it presents a substantial threat.

Customers switching from China Index Holdings (CIH) specialized data and analytics services to substitutes would face significant switching costs. These include the financial outlay for new data subscriptions, the time and resources needed to integrate alternative data sources into their existing workflows, and the potential loss of historical data continuity. For instance, a real estate developer accustomed to CIH's detailed market reports would need to invest in new analytical tools and retraining staff to utilize a competitor's platform, a process that could easily cost tens of thousands of dollars and several weeks of operational disruption.

Evolving Data Accessibility

The increasing availability of public and open-source data, coupled with advancements in AI-driven analytics, presents a significant threat of substitution for specialized data providers like China Index Holdings (CIH). As more data becomes freely accessible or easily processed by readily available tools, the unique value proposition of dedicated data services can be eroded.

New technologies are democratizing data analysis. For instance, advancements in natural language processing (NLP) allow for the extraction of insights from unstructured text data, a domain previously requiring specialized expertise. This means that even complex datasets might become more manageable for a wider range of users, reducing reliance on premium data services.

The rise of alternative data sources, such as satellite imagery, social media sentiment, and web scraping, further amplifies this threat. These sources, often available at lower costs or even for free, can provide valuable market intelligence that might have traditionally been the purview of data aggregators. For example, by mid-2024, the use of AI in analyzing publicly available financial news and reports has become commonplace, potentially reducing the need for curated data feeds for basic sentiment analysis.

- Growing Open Data Initiatives: Governments and international bodies are increasingly making datasets publicly available, covering economic indicators, demographics, and market trends.

- AI-Powered Analytics Tools: The proliferation of user-friendly AI platforms allows businesses to conduct sophisticated data analysis without relying on specialized third-party providers.

- Democratization of Alternative Data: Sources like social media, geolocation data, and web traffic are becoming more accessible and analyzable, offering competitive insights.

- Cost-Effectiveness: Free or low-cost data sources and AI tools offer a compelling alternative to the subscription fees associated with specialized data providers.

In-house Capabilities of Customers

The threat of substitutes for China Index Holdings (CIH) is amplified by the in-house capabilities of its customers, particularly large real estate developers and financial institutions. These entities possess the financial resources and technical expertise to develop proprietary data and analytics departments. For instance, major real estate conglomerates in China are increasingly investing in big data platforms and AI-driven insights to manage their vast property portfolios and market research needs internally. This reduces their reliance on external providers like CIH, as they can generate comparable, if not superior, analytical outputs themselves.

The capacity for self-sufficiency among CIH's clientele presents a significant challenge. As these large organizations build out their internal data science teams and invest in advanced analytical software, the perceived value proposition of outsourcing these functions diminishes. This trend is evident in the growing number of in-house data centers and analytics hubs established by leading Chinese property firms. By controlling their data infrastructure and analytical processes, these companies can achieve greater customization, data security, and potentially lower long-term costs compared to relying on third-party services. This internal development directly substitutes the services that CIH offers.

- Increased Investment in Big Data: Major Chinese real estate developers are allocating significant capital towards building their own big data infrastructure and analytics capabilities.

- Development of Proprietary Analytics Tools: Leading firms are developing in-house software and AI models to gain competitive insights, directly competing with external data providers.

- Talent Acquisition in Data Science: Companies are actively hiring data scientists and analysts, creating internal departments that can replicate the functions of external data service providers.

- Cost-Benefit Analysis of Outsourcing: As in-house capabilities mature, the cost-effectiveness of outsourcing data and analytics services to companies like CIH is being re-evaluated by large clients.

The threat of substitutes for China Index Holdings (CIH) is elevated by the increasing accessibility of free and low-cost data sources, coupled with advancements in AI. For instance, by mid-2024, AI tools can analyze publicly available financial news for sentiment, potentially reducing the need for specialized data feeds.

Furthermore, large real estate developers are building in-house data capabilities, investing in proprietary analytics tools and hiring data scientists. This trend reduces their reliance on external providers like CIH, as they can generate comparable insights internally, potentially at a lower long-term cost.

| Factor | Description | Impact on CIH |

| Publicly Available Data | Increasing availability of economic, demographic, and market data from governments and international bodies. | Reduces the unique value of curated data. |

| AI-Powered Analytics | User-friendly AI platforms enable sophisticated data analysis without specialized providers. | Democratizes data insights, lessening reliance on premium services. |

| Alternative Data Sources | Accessibility of social media, geolocation, and web traffic data. | Offers competitive intelligence at lower or no cost. |

| In-House Capabilities | Large clients developing proprietary data departments and analytics. | Directly substitutes CIH's core offerings. |

Entrants Threaten

The capital requirements for entering China's real estate information and analytics market are substantial, acting as a significant barrier. Establishing the necessary data infrastructure, including sophisticated databases, advanced analytics platforms, and secure cloud storage, demands considerable upfront investment. For instance, building a comprehensive data lake for real estate transactions, property characteristics, and market trends would likely cost millions of dollars.

Furthermore, acquiring and retaining specialized talent, such as data scientists, real estate analysts, and IT professionals, adds to the high initial expenditure. Companies need to invest in competitive salaries and ongoing training to attract and keep the expertise required to operate effectively. This financial commitment, coupled with the ongoing costs of data acquisition and technology maintenance, makes it challenging for new players to compete with established firms like China Index Holdings (CIH) without significant backing.

New entrants face substantial hurdles in accessing China's vast real estate data. Established players like China Index Holdings (CIH) have cultivated extensive networks for data collection, often leveraging proprietary technology and long-standing relationships with developers and government agencies. For instance, CIH’s comprehensive data platform, built over years, provides an integrated view of property transactions, prices, and market trends, which is incredibly difficult and costly for newcomers to replicate.

Furthermore, establishing effective distribution channels to reach key clients, such as institutional investors, developers, and financial institutions, presents another significant barrier. CIH benefits from its established brand recognition and existing client base, which facilitates direct sales and partnerships. Newcomers would need to invest heavily in marketing and sales infrastructure to gain traction, a task compounded by the highly competitive and relationship-driven nature of the Chinese real estate information services market.

Navigating China's intricate regulatory landscape presents a formidable barrier for potential new entrants in the data services and real estate information sectors. Stringent licensing, evolving data privacy laws like the Personal Information Protection Law (PIPL), and sector-specific policies create significant hurdles. For instance, companies handling sensitive user data must comply with rigorous security assessments and obtain specific approvals, which can be time-consuming and costly, thereby limiting the ease with which new players can enter the market.

Brand Loyalty and Reputation

Brand loyalty and reputation are significant barriers to entry in China's real estate sector. Established players like China Index Holdings (CIH) have cultivated strong trust and recognition over years of operation, making it difficult for newcomers to gain traction. For instance, in 2023, surveys indicated that over 70% of Chinese homebuyers prioritized brand reputation when selecting a developer.

New entrants struggle to replicate the credibility and market presence that incumbents like CIH possess. Building this trust takes considerable time and investment, often requiring extensive marketing campaigns and a proven track record of successful projects. This makes it challenging for new companies to compete effectively, especially in a market where consumer confidence is paramount.

- Established Brand Recognition: CIH's long-standing presence in the Chinese market has fostered significant brand loyalty among consumers.

- Trust and Credibility: New entrants face the arduous task of building trust, often requiring years of consistent performance and positive customer experiences.

- Competitive Disadvantage: Lack of established reputation places new companies at a disadvantage against incumbent firms with proven track records.

- Market Entry Barriers: The high cost and time investment required to build a reputable brand create a substantial barrier to entry for potential competitors.

Economies of Scale and Experience Curve

China Index Holdings (CIH) benefits significantly from economies of scale, allowing it to spread its substantial fixed costs across a vast volume of data processed and analyzed. This scale translates into lower per-unit costs, a significant barrier for newcomers. For instance, in 2024, CIH's extensive data infrastructure and large workforce enable highly efficient operations that would be prohibitively expensive for a startup to replicate from scratch.

The experience curve also plays a crucial role. CIH has honed its data collection, verification, and analytical processes over years of operation, leading to greater efficiency and accuracy. This accumulated expertise allows them to identify trends and deliver insights more effectively than a new entrant could initially. This learning-by-doing effect means CIH can offer competitive pricing while maintaining high-quality services.

- Economies of Scale: CIH's large operational footprint allows for significant cost reductions in data acquisition and processing, making it difficult for smaller players to compete on price.

- Experience Curve Advantages: Years of refining data analysis techniques and building proprietary algorithms give CIH a competitive edge in efficiency and insight generation.

- High Upfront Investment: New entrants face substantial capital requirements for developing comparable data platforms and expertise, creating a high barrier to entry.

- Established Brand Reputation: CIH's long-standing presence and proven track record build trust, which new companies would struggle to achieve quickly.

The threat of new entrants for China Index Holdings (CIH) is significantly mitigated by the immense capital required to establish a comparable data infrastructure and acquire specialized talent. Building out the sophisticated databases, analytics platforms, and secure cloud storage necessary for comprehensive real estate data services demands millions of dollars in upfront investment. Furthermore, attracting and retaining skilled data scientists and real estate analysts adds considerable expense, making it a daunting financial undertaking for newcomers.

Accessing China's vast and often fragmented real estate data is another major barrier. CIH has cultivated extensive data collection networks over years, leveraging proprietary technology and established relationships with developers and government agencies. Replicating this integrated view of property transactions, prices, and market trends is both costly and time-consuming for any new competitor. By 2024, the complexity of data sourcing in China continued to favor incumbents with established operational frameworks.

The intricate regulatory environment in China, including data privacy laws like PIPL and sector-specific policies, presents a formidable challenge for new entrants. Navigating licensing requirements, security assessments, and obtaining necessary approvals can be a lengthy and expensive process. This regulatory complexity, coupled with the need to build brand recognition and trust in a relationship-driven market, acts as a substantial deterrent to new companies seeking to enter CIH's operational space.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Index Holdings (CIH) is built upon a comprehensive review of publicly available information, including CIH's annual reports and SEC filings, alongside industry-specific research from reputable market intelligence firms and data providers.