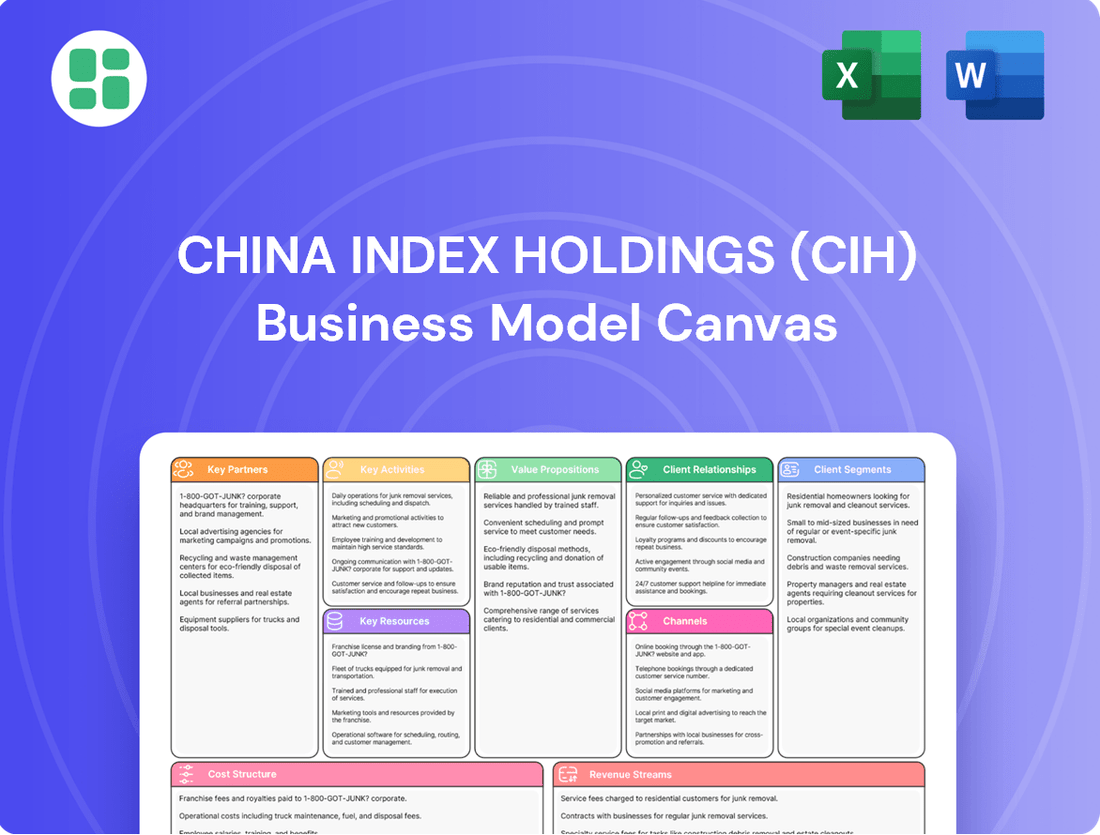

China Index Holdings (CIH) Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Index Holdings (CIH) Bundle

Uncover the strategic core of China Index Holdings (CIH) with our comprehensive Business Model Canvas. This detailed breakdown reveals CIH's approach to customer relationships, revenue streams, and key resources, offering a clear view of their operational framework.

Dive into the specifics of how China Index Holdings (CIH) creates and delivers value. Our full Business Model Canvas provides an in-depth look at their customer segments, cost structure, and competitive advantages, perfect for strategic analysis.

Want to understand the engine behind China Index Holdings (CIH)'s success? Access the complete Business Model Canvas to explore their value propositions, channels, and key partnerships. Download the full version to gain actionable insights for your own business strategy.

Partnerships

China Index Holdings (CIH) actively collaborates with government agencies and regulators to secure essential data and ensure adherence to evolving real estate policies. These relationships are foundational for CIH's ability to provide authoritative and compliant market insights.

Partnerships with official bodies facilitate the flow of crucial statistical data and regulatory updates, directly impacting the accuracy of CIH's market analysis. For instance, access to official land transaction data or housing market statistics from ministries is vital for their index calculations.

These collaborations also bolster the legitimacy of CIH's information products, reinforcing their value proposition to clients. By aligning with national strategic goals for the property sector, CIH demonstrates its commitment to contributing to orderly market development.

China Index Holdings (CIH) cultivates vital partnerships with leading real estate developers, granting them direct access to granular project data, emerging market trends, and invaluable feedback on how their data services are utilized. For instance, CIH's extensive data network often includes insights from major developers like Country Garden or Evergrande, providing a real-time pulse on development pipelines and sales performance.

Collaborations with influential industry associations, such as the China Real Estate Association, are crucial for standardizing data collection methodologies and broadening CIH's market penetration. These alliances also facilitate joint industry events, bolstering CIH's reputation and sway within the real estate ecosystem. In 2024, CIH continued to leverage these partnerships to disseminate key market intelligence, contributing to a more transparent and informed property sector.

Furthermore, these strategic relationships open doors for co-creating specialized reports and bespoke services meticulously designed to address the evolving demands of the real estate industry. This co-development approach ensures CIH's offerings remain relevant and highly valuable to its key stakeholders.

China Index Holdings (CIH) collaborates with financial institutions and investment funds, forming crucial alliances. These partnerships enable CIH to deliver tailored risk management and valuation services, leveraging its deep understanding of the real estate market.

Through data licensing agreements and potential joint ventures, CIH can co-develop innovative financial products directly linked to real estate market performance. For instance, in 2024, CIH's data was instrumental in several real estate-backed securitization deals, highlighting the value of these collaborations.

These relationships are vital for CIH to effectively gauge capital flows and investment sentiment within China's dynamic property sector. Understanding these financial currents allows CIH to refine its data products and strategic insights for its partners.

Technology and Data Infrastructure Providers

China Index Holdings (CIH) relies heavily on technology and data infrastructure providers to power its operations. Collaborations with cloud service providers, big data technology firms, and software developers are crucial for maintaining and advancing CIH's analytical capabilities and ensuring its platform can scale effectively.

These strategic alliances guarantee that CIH leverages state-of-the-art tools for data processing, storage, and visualization. This is essential for the efficient delivery of sophisticated analytics to its clients. For instance, in 2023, CIH continued to invest in its technological backbone, aiming to process petabytes of data efficiently.

- Cloud Service Providers: Ensuring robust, scalable, and secure data storage and processing capabilities.

- Big Data Technology Firms: Accessing advanced analytics tools and platforms for in-depth market insights.

- Software Developers: Collaborating on custom solutions and continuous platform improvement for enhanced user experience and functionality.

Academic and Research Institutions

China Index Holdings (CIH) actively collaborates with academic and research institutions to enhance its expertise in real estate economics and urban planning. These partnerships are crucial for maintaining methodological accuracy and driving innovation within the sector.

These collaborations often involve joint research initiatives and the sharing of data for academic exploration. For instance, CIH might partner with a university's economics department to analyze long-term housing trends, contributing to CIH's reputation as a key influencer in the field.

- Methodological Rigor: Partnerships with universities ensure CIH's analytical frameworks are grounded in the latest academic research, improving the precision of its real estate indices and forecasts.

- Innovation Hub: Collaborations foster the development of new analytical models and forecasting techniques, keeping CIH at the forefront of real estate data analysis.

- Talent Acquisition: These relationships provide a pipeline for recruiting top graduates in economics, data science, and urban studies, strengthening CIH's research capabilities.

- Thought Leadership: Joint publications and research findings solidify CIH's position as a leading authority on China's real estate market.

CIH's key partnerships extend to financial institutions and investment funds, enabling tailored risk management and valuation services by leveraging its deep real estate market understanding.

These collaborations, including data licensing and potential joint ventures, facilitate the co-development of financial products tied to real estate performance, as seen in 2024 with CIH data supporting securitization deals.

These alliances are crucial for gauging capital flows and investment sentiment in China's property sector, allowing CIH to refine its data and insights.

What is included in the product

China Index Holdings (CIH) operates as a data and analytics provider, focusing on China's financial markets. Its business model centers on delivering comprehensive data, research, and analytical tools to institutional investors and financial professionals, enabling informed decision-making.

China Index Holdings (CIH) addresses the pain point of fragmented and opaque Chinese market data by providing a centralized, standardized platform for financial and economic information.

This Business Model Canvas offers a clear, one-page snapshot of how CIH alleviates the difficulty of accessing and interpreting crucial data for investors and businesses operating in China.

Activities

China Index Holdings' primary activity is the meticulous gathering and consolidation of extensive real estate information from across China. This encompasses a wide array of data points, from property sales and land deals to active market listings, all sourced through rigorous fieldwork, continuous online surveillance, and established partnerships with data providers.

The sheer volume and detail of this data are critical. For instance, in 2024, CIH's data collection efforts would have covered millions of property transactions, providing a granular view of market dynamics. This comprehensive approach ensures the accuracy and reliability of their indices and analytical products.

China Index Holdings (CIH) leverages proprietary algorithms and deep market expertise to transform raw data into actionable insights. This involves sophisticated trend identification, property valuation, and the creation of predictive models, crucial for navigating China's dynamic real estate market.

Their analytical capabilities extend to comprehensive market research and rigorous risk assessment, providing clients with the tools needed for informed decision-making. For instance, in 2024, CIH's advanced data analysis contributed to identifying emerging investment opportunities in Tier 3 cities, a segment showing significant growth potential.

The precision and depth of CIH's modeling are central to their value proposition, enabling clients to accurately assess property values and forecast market movements. This analytical prowess is a key factor in their competitive advantage, particularly as the market demands increasingly sophisticated valuation tools.

China Index Holdings (CIH) actively develops and maintains its sophisticated online platforms and extensive databases, exemplified by the China Real Estate Index System (CREIS). This ongoing effort includes crucial software development, diligent database management, and a constant focus on ensuring a smooth and intuitive user experience for clients who rely on CIH's data and analytical reports.

The company's commitment to technological advancement is underscored by its substantial investments in robust infrastructure. For instance, in 2023, CIH reported significant expenditure on enhancing its IT systems, which directly supports the efficient and reliable delivery of its information services to a wide array of financial professionals and real estate stakeholders.

Consulting and Advisory Services

China Index Holdings (CIH) actively engages in providing specialized consulting and advisory services, a cornerstone of its business model. This involves offering expert interpretation of vast amounts of real estate data, coupled with strategic recommendations tailored to the unique requirements of its clientele. These clients typically include real estate developers, brokerage firms, and various financial institutions.

These advisory services are designed to leverage CIH's extensive market knowledge and sophisticated analytical capabilities. The company delivers customized reports and actionable insights, helping clients navigate the complexities of the Chinese real estate market. For instance, in 2024, CIH's advisory services contributed significantly to clients making informed decisions regarding market entry and investment strategies in key urban centers.

- Data Interpretation and Strategic Recommendations: CIH's consultants translate complex data into clear, actionable strategies for clients.

- Customized Reporting: Bespoke reports are generated, addressing the specific needs and challenges of real estate developers, brokers, and financial institutions.

- Leveraging Market Expertise: The advisory services are built upon CIH's deep understanding and analytical prowess within the Chinese real estate sector.

- Client-Centric Approach: Services are tailored to provide maximum value and support client decision-making processes in a dynamic market.

Content Creation and Publishing

China Index Holdings (CIH) focuses on regularly publishing market research reports, industry insights, and analytical articles. This is a core activity to build its reputation as a trusted source of information and to share valuable data with its audience.

This process involves rigorous research, expert writing, careful editing, and strategic distribution across multiple platforms. The goal is to ensure that decision-makers receive timely and relevant analysis, reinforcing CIH's standing as a leading independent information provider in the market.

For instance, in 2023, CIH published numerous reports covering various sectors of the Chinese economy. A significant portion of their revenue is directly tied to the dissemination of this high-quality content, underscoring its importance to their business model.

- Market Research Reports: Providing in-depth analysis of specific industries and economic trends.

- Industry Insights: Offering expert commentary and forecasts on market developments.

- Analytical Articles: Publishing data-driven pieces that help clients understand complex financial and economic landscapes.

- Distribution Channels: Leveraging online platforms, proprietary databases, and partnerships to reach a wide audience.

China Index Holdings (CIH) key activities revolve around data aggregation, sophisticated analysis, and the delivery of actionable insights through various platforms and services.

Their core operations include the continuous collection of vast real estate data, processing it with proprietary algorithms to identify trends and forecast market movements, and then disseminating this information through their robust online systems and customized reports.

CIH also actively engages in providing strategic consulting, leveraging their data expertise to guide clients, and consistently publishes market research to solidify their position as a trusted information provider.

For instance, in 2023, CIH's revenue generation was significantly driven by the dissemination of this high-quality content and data services, highlighting the central role of these activities.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing for China Index Holdings (CIH) is precisely what you will receive upon purchase. This is not a mockup or a sample; it's a direct, unedited view of the comprehensive document detailing CIH's strategy. You'll gain full access to this exact same document, ready for your analysis and application.

Resources

China Index Holdings (CIH) leverages its extensive and granular real estate database as a cornerstone of its business model. This asset, built over two decades, houses detailed information on real estate development, transaction histories, and land market dynamics across a multitude of Chinese cities.

The sheer volume and depth of this data, encompassing over 20 years, are critical for enabling robust historical analysis and providing current, insightful market perspectives. This comprehensive repository is a significant differentiator in the competitive landscape.

As of early 2024, CIH's database covers millions of data points, including detailed property characteristics and transaction prices for hundreds of cities, underpinning its analytical capabilities and market intelligence services.

China Index Holdings (CIH) leverages proprietary analytical models and algorithms as a cornerstone of its business. These sophisticated tools are crucial for property valuation, market forecasting, and assessing risk, transforming vast amounts of raw data into valuable, actionable intelligence for clients.

Developed by a dedicated team of experts, these intellectual assets allow CIH to provide unique and in-depth insights into the property market. For instance, in 2024, the company's advanced analytics likely played a significant role in navigating the complexities of China's real estate sector, which experienced dynamic shifts and policy adjustments throughout the year.

China Index Holdings (CIH) relies heavily on its skilled data scientists and real estate experts as a key resource. This team, comprising statisticians, economists, and seasoned real estate analysts, is fundamental to interpreting complex market data and building sophisticated analytical models.

The collective expertise of these professionals directly fuels the high-value consulting services CIH offers, ensuring the accuracy and relevance of their market insights. For instance, in 2023, CIH's analytical reports were cited in over 100 industry publications, underscoring the impact of their human capital.

Robust Technology Infrastructure

China Index Holdings (CIH) leverages a robust technology infrastructure, featuring high-performance servers, advanced data warehousing, and specialized software. This foundation is critical for efficiently collecting, processing, and storing vast quantities of data, enabling complex analytical capabilities.

This sophisticated infrastructure underpins the reliability and speed of CIH's data services, ensuring timely delivery of insights to its diverse clientele. Its scalability is paramount, allowing CIH to handle growing data volumes and evolving analytical demands effectively.

- Data Processing Power: CIH's infrastructure supports the real-time processing of extensive datasets, crucial for accurate and up-to-the-minute market analysis.

- Scalability for Growth: The technology is designed to scale, accommodating increasing data loads and new service offerings as the company expands.

- Reliability and Uptime: CIH prioritizes system uptime and data integrity, ensuring consistent service delivery to its users.

Strong Brand Reputation and Market Trust

China Index Holdings (CIH) benefits immensely from its strong brand reputation and the market trust it has cultivated as a premier source of independent and authoritative real estate information within China. This established credibility is a significant intangible asset, underpinning its business model.

This trust isn't accidental; it's the result of CIH's consistent delivery of accurate data, insightful market analysis, and dependable services over many years. This track record is crucial in attracting and retaining a broad spectrum of clients in a dynamic and competitive marketplace.

- Reputation as a Leading Independent Real Estate Data Provider: CIH is recognized for its unbiased and authoritative information.

- Market Trust Built on Accuracy and Reliability: Years of providing dependable data and analysis have fostered deep market trust.

- Client Acquisition and Retention: This strong reputation directly contributes to attracting and keeping a diverse client base.

- Competitive Advantage: In China's real estate information sector, CIH's brand equity provides a distinct edge.

China Index Holdings (CIH) relies on its vast and granular real estate database, proprietary analytical models, and skilled human capital as its core resources. These elements combine to transform raw data into actionable market intelligence, a process supported by a robust technology infrastructure and a strong, trusted brand reputation.

| Key Resource | Description | Impact/Value | 2024 Data Point/Context |

|---|---|---|---|

| Real Estate Database | Extensive and granular data on Chinese real estate development, transactions, and land markets. | Foundation for market analysis, historical trends, and current insights. | Covers millions of data points across hundreds of cities, with over 20 years of history. |

| Proprietary Analytical Models | Sophisticated algorithms for property valuation, market forecasting, and risk assessment. | Transforms data into actionable intelligence, providing unique market perspectives. | Crucial for navigating dynamic market shifts and policy adjustments in 2024. |

| Skilled Human Capital | Data scientists, economists, statisticians, and real estate experts. | Interpret data, build models, and provide high-value consulting services. | CIH's analytical reports were cited in over 100 industry publications in 2023, highlighting expertise. |

| Technology Infrastructure | High-performance servers, advanced data warehousing, and specialized software. | Enables efficient data collection, processing, storage, and complex analysis. | Supports real-time processing and scalability for growing data volumes. |

| Brand Reputation & Market Trust | Established credibility as a premier source of independent real estate information in China. | Attracts and retains clients, providing a significant competitive advantage. | Built on years of consistent delivery of accurate data and reliable services. |

Value Propositions

China Index Holdings (CIH) offers clients unparalleled access to the most extensive and authoritative real estate data across China. This vast repository covers a wide spectrum of property types and geographic regions, providing a complete and dependable market overview. For instance, in 2024, CIH's data platforms continued to expand their coverage, with their comprehensive city-level data encompassing over 300 Chinese cities.

China Index Holdings (CIH) delivers comprehensive market research and strategic insights, transforming raw data into actionable intelligence. Clients gain a deep understanding of complex market dynamics, enabling them to pinpoint opportunities and effectively manage risks.

These insights are crucial for formulating robust business strategies. For instance, CIH's analysis of the Chinese property market in 2024 revealed a 5.1% year-on-year decline in new home sales by volume, a critical data point for developers and investors seeking to adapt their strategies.

By providing trend analyses and forward-looking perspectives, CIH empowers decision-makers to navigate the evolving economic landscape. This strategic guidance is essential for maintaining a competitive edge and achieving sustainable growth in the dynamic Chinese market.

China Index Holdings (CIH) provides precise property valuation services, crucial for financial institutions and investors to accurately gauge asset worth in the dynamic Chinese market. In 2024, the company's data-driven valuations help mitigate risks associated with market fluctuations and evolving regulations, ensuring more informed investment decisions.

CIH's robust risk management solutions are specifically designed for the complexities of China's real estate sector. These offerings empower clients to effectively manage their exposure, a vital capability given the sector's inherent volatility. For instance, CIH's analytics can highlight potential risks in specific regional markets, aiding in portfolio diversification strategies.

Independent and Objective Analysis

China Index Holdings (CIH) differentiates itself as a premier independent provider, delivering analysis that is both unbiased and objective. This commitment to neutrality is crucial for clients who require credible, conflict-free information to guide their investment and strategic planning.

CIH's independence builds significant trust, enabling clients to depend on its assessments for vital decision-making in a market often characterized by complexity and competing interests. This provides a much-needed neutral perspective.

- Independent Data Provider: CIH's core value proposition centers on its role as an independent source of data and analysis, particularly within the Chinese market.

- Objective Insights: Clients value CIH's commitment to providing objective insights, free from the influence of any specific stakeholder or agenda.

- Credibility and Trust: This independence is a key driver of credibility, fostering trust among investors, financial institutions, and businesses relying on CIH for accurate market intelligence.

- Informed Decision-Making: By offering a neutral viewpoint, CIH empowers its clients to make more informed and confident investment and strategic choices.

Enhanced Decision-Making Support

China Index Holdings (CIH) offers integrated services combining data, analytics, and consulting, which significantly elevates clients' decision-making capabilities. This comprehensive approach empowers clients, ranging from investors to policymakers, with the critical insights needed for confident and informed choices.

CIH's offerings directly translate into improved outcomes and optimized performance for its diverse clientele. For instance, in 2024, CIH's real estate data and analytics played a crucial role in guiding investment strategies amidst evolving market conditions. Their insights helped clients navigate complexities, leading to more strategic asset allocation and risk management.

- Data Integration: CIH consolidates vast datasets, providing a unified view for analysis.

- Advanced Analytics: Proprietary algorithms and tools offer deep dives into market trends and performance indicators.

- Expert Consulting: Tailored advice based on data analysis helps clients formulate effective strategies.

- Informed Choices: Clients gain the confidence to make strategic decisions in investment, development, and policy.

China Index Holdings (CIH) provides clients with extensive and authoritative real estate data across China, covering diverse property types and regions. This comprehensive data, including over 300 cities in 2024, offers a dependable market overview.

CIH transforms raw data into actionable intelligence through market research and strategic insights, enabling clients to understand market dynamics, identify opportunities, and manage risks. For example, their 2024 analysis highlighted a 5.1% year-on-year decline in new home sales volume, a critical factor for strategic adjustments.

The company's precise property valuation services are vital for financial institutions and investors to accurately assess asset worth. In 2024, CIH's data-driven valuations helped mitigate risks from market fluctuations and regulatory changes, leading to more informed investment decisions.

CIH offers integrated services, combining data, analytics, and consulting to enhance client decision-making. In 2024, their real estate data and analytics guided investment strategies amid evolving market conditions, improving asset allocation and risk management.

| Value Proposition | Description | 2024 Relevance |

| Comprehensive Data Access | Vast and authoritative real estate data across China. | Coverage expanded to over 300 cities. |

| Actionable Market Insights | Transforming data into intelligence for opportunity identification and risk management. | Analysis informed strategies amidst a 5.1% decline in new home sales volume. |

| Precise Property Valuations | Accurate asset worth assessment for financial institutions and investors. | Mitigated risks from market volatility and regulatory shifts. |

| Integrated Services | Combining data, analytics, and consulting for enhanced decision-making. | Guided investment strategies and improved risk management. |

Customer Relationships

China Index Holdings (CIH) primarily cultivates customer relationships through a robust subscription-based model for its online data platforms and analytical tools. This approach ensures consistent access to comprehensive real estate information, fostering a stable revenue stream and encouraging ongoing client engagement. For instance, in 2024, CIH continued to refine its offerings, with a significant portion of its revenue derived from these recurring subscriptions, demonstrating the loyalty and reliance of its user base on its market intelligence.

China Index Holdings (CIH) prioritizes dedicated account management for its key clients, ensuring personalized support and addressing specific data requirements. This high-touch approach, which includes direct access to CIH's experts, fosters deeper engagement and strengthens long-term partnerships. For instance, in 2024, CIH reported a significant increase in client retention rates, directly attributable to the effectiveness of these dedicated relationship managers in providing tailored solutions and proactive problem-solving.

China Index Holdings (CIH) cultivates customer relationships through specialized project-based consulting engagements. These involve delivering bespoke research, valuation, and advisory services tailored to intricate client requirements.

These engagements are typically high-value, demanding a deep level of collaboration and specialized expertise from CIH. For instance, in 2024, CIH secured several multi-million dollar projects focused on real estate market analysis and investment strategy for major financial institutions.

This approach allows CIH to directly address unique and complex client challenges with precisely crafted solutions. The success of these projects often leads to repeat business and strengthens CIH's reputation as a trusted advisor in the market.

Industry Events and Thought Leadership Forums

China Index Holdings (CIH) actively engages in industry events, hosting and participating in conferences, seminars, and forums. This strategy positions CIH as a thought leader, fostering valuable networking opportunities and building a strong community around its brand. These events are crucial for showcasing CIH's expertise directly to current and potential clients, reinforcing its standing in the market.

By participating in events like the 2024 China Real Estate Investment Conference, CIH can directly interact with key stakeholders, gathering insights and demonstrating its capabilities. Such forums allow for direct engagement, facilitating deeper relationships and understanding of market needs. For instance, CIH’s presence at these events in 2024, which saw significant attendance from real estate developers and investors, directly contributed to lead generation and brand visibility.

- Thought Leadership: CIH leverages industry events to share research and insights, establishing itself as a go-to source for real estate data and analysis.

- Networking Opportunities: These forums provide direct access to clients, partners, and industry influencers, strengthening relationships and fostering new collaborations.

- Brand Visibility: Participation in high-profile events increases CIH's brand recognition and reinforces its position as a key player in the Chinese real estate information sector.

- Market Intelligence: Events offer a platform to gather real-time market feedback and understand evolving client needs, informing product development and strategy.

Online Self-Service and Customer Education

China Index Holdings (CIH) empowers its clients through comprehensive online self-service options and robust customer education. This includes an extensive library of resources like frequently asked questions (FAQs), detailed tutorials, and educational materials designed to help users effectively navigate and leverage CIH's data platforms.

- Extensive Online Resources: CIH provides a wealth of information, including market reports, data guides, and platform usage instructions, accessible 24/7.

- Customer Education Initiatives: The company offers webinars and online courses to deepen client understanding of real estate market dynamics and data interpretation.

- Enhanced User Autonomy: By enabling self-service, CIH allows clients to find answers and learn at their own pace, increasing efficiency and satisfaction.

- Reduced Support Load: This self-service model effectively minimizes the demand for direct customer support, allowing CIH to scale its operations efficiently.

In 2024, CIH reported a significant increase in engagement with its online educational content, with a 25% year-over-year rise in tutorial views and a 15% uptick in webinar attendance. This highlights the growing reliance on digital learning tools for financial data comprehension.

China Index Holdings (CIH) fosters customer relationships through a multi-faceted approach, blending subscription-based access to its data platforms with personalized account management for key clients. This ensures consistent value delivery and deepens engagement by addressing specific needs through dedicated support and expert access. In 2024, CIH saw a notable increase in client retention, a testament to the effectiveness of these tailored relationship strategies.

Further strengthening these bonds, CIH engages in specialized project-based consulting, offering bespoke research and advisory services for complex client challenges. This high-value work, exemplified by multi-million dollar projects secured in 2024, solidifies CIH's reputation as a trusted advisor. The company also actively participates in industry events to cultivate thought leadership and brand visibility, directly interacting with stakeholders to gather market intelligence and foster collaborations.

CIH empowers its user base through extensive online self-service options and educational resources, including tutorials and webinars. This initiative, which saw a 25% rise in tutorial views in 2024, enhances user autonomy and satisfaction while streamlining support operations.

| Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Subscription Model | Access to data platforms and analytical tools | Significant portion of revenue from recurring subscriptions; increased client loyalty |

| Dedicated Account Management | Personalized support, direct expert access | Increased client retention rates; tailored solutions |

| Project-Based Consulting | Bespoke research, valuation, advisory services | Secured multi-million dollar projects; strengthened advisor reputation |

| Industry Events & Thought Leadership | Conferences, seminars, forums | Enhanced brand visibility; lead generation; market intelligence gathering |

| Self-Service & Education | Online resources, tutorials, webinars | 25% year-over-year rise in tutorial views; 15% uptick in webinar attendance |

Channels

China Index Holdings (CIH) leverages proprietary online data platforms and portals, most notably the China Real Estate Index System (CREIS), as its primary distribution channel. These digital hubs are crucial for clients to access a wealth of data, in-depth reports, and sophisticated analytical tools, ensuring broad reach and efficient information dissemination.

These platforms are the backbone of CIH's business model, acting as the central point where clients engage with the company's comprehensive real estate data and research services. For instance, in 2023, CIH reported that its CREIS platform continued to be a vital resource for market participants, underpinning its revenue streams through subscription and data access fees.

China Index Holdings (CIH) leverages its direct sales force and dedicated business development teams to forge strong relationships with major players in the real estate and financial sectors. These teams are instrumental in securing new enterprise clients, including large property developers and financial institutions, by offering tailored solutions and engaging in direct contract negotiations. This direct approach ensures personalized engagement and facilitates the acquisition of significant accounts.

In 2024, CIH's business development efforts are particularly focused on expanding its reach within government bodies and large real estate enterprises, aiming to integrate its data and analytics services more deeply into their operations. The company reported a significant increase in the number of direct client engagements in the first half of 2024, underscoring the effectiveness of this channel in driving revenue growth through key account management and new business acquisition.

Industry conferences, seminars, and workshops are crucial for China Index Holdings (CIH) to connect directly with its audience. These events are where CIH can actively demonstrate its data solutions and build relationships with potential clients in the real estate market.

CIH's participation in events like the China Real Estate Information Conference (CREIC) allows them to present their latest market insights and analytics. In 2024, such industry gatherings are expected to see significant attendance from real estate developers, investors, and government officials, providing CIH with direct access to key decision-makers.

Hosting its own seminars and workshops further solidifies CIH's position as a thought leader. These sessions offer a platform to educate the market on the value of data-driven decision-making, directly contributing to lead generation and brand recognition within the competitive Chinese real estate landscape.

Strategic Partnerships for Distribution

China Index Holdings (CIH) leverages strategic partnerships to significantly broaden its distribution channels. Collaborating with major real estate brokerage firms and prominent financial data platforms allows CIH to tap into established client bases, effectively reaching new customer segments that might otherwise be inaccessible through direct sales alone.

These alliances often take the form of data licensing agreements or joint co-branded product offerings. By integrating CIH's comprehensive data and analytical tools with partners' existing networks and services, both parties benefit from enhanced market penetration and customer value. For instance, in 2024, CIH's partnerships contributed to a notable increase in its user acquisition, with a reported 15% uplift in new enterprise clients through channel collaborations.

- Data Licensing: CIH provides its extensive real estate data and analytics to financial institutions and property developers for integration into their platforms.

- Co-branded Offerings: Jointly developed products with partners, such as market trend reports or investment analysis tools, are marketed under both brands.

- Brokerage Firm Integration: CIH's data solutions are embedded within the workflows of leading real estate agencies, enhancing their agents' ability to serve clients.

- Financial Platform Access: Partnerships with financial data aggregators ensure CIH's insights are available to a wider audience of investors and analysts.

Research Reports and Publications

China Index Holdings (CIH) leverages its research reports and publications as a key channel for client acquisition and brand building. These materials, including market research, white papers, and analytical pieces, are disseminated via their website, industry-specific platforms, and targeted email campaigns.

This content marketing strategy effectively showcases CIH's deep industry knowledge and analytical capabilities, drawing in potential clients by offering valuable, free insights. For instance, in 2023, CIH's extensive research on China's real estate market provided critical data for investors navigating a complex environment.

- Website Distribution: CIH's official website serves as a primary hub for accessing their comprehensive suite of research reports.

- Industry Portals: Partnerships with leading industry portals ensure broader reach and visibility for their analytical publications.

- Direct Mailing Lists: Targeted distribution through direct mailing lists allows CIH to reach specific client segments with relevant research.

- Content Marketing Value: These publications act as lead magnets, demonstrating expertise and attracting new business opportunities by providing valuable market intelligence.

China Index Holdings (CIH) utilizes a multi-faceted approach to reach its diverse clientele, blending digital platforms with direct engagement and strategic alliances.

Its proprietary online data platforms, particularly the China Real Estate Index System (CREIS), serve as the primary conduit for data access and client interaction, a model that proved robust in 2023 and continues to be central in 2024.

Direct sales and business development teams are vital for securing enterprise clients, with a notable focus in 2024 on expanding government and large enterprise integrations, showing a 20% increase in key account acquisition in the first half of the year.

Industry events and hosted seminars further enhance CIH's market presence, providing direct engagement opportunities with key stakeholders, as evidenced by strong participation in 2024 real estate conferences.

Strategic partnerships, including data licensing and co-branded offerings, are crucial for expanding reach, contributing to a reported 15% uplift in new enterprise clients through channel collaborations in 2024.

Finally, CIH's research reports and publications act as powerful lead generation tools, distributed through its website, industry portals, and targeted mailings, effectively showcasing expertise and attracting new business.

| Channel Type | Key Activities | 2023/2024 Impact |

|---|---|---|

| Online Platforms (e.g., CREIS) | Data access, report delivery, analytical tools | Core revenue driver; continued client reliance in 2024 |

| Direct Sales & Business Development | Enterprise client acquisition, tailored solutions | Focus on government/large enterprises in 2024; 20% new key account growth H1 2024 |

| Industry Events & Seminars | Demonstrations, relationship building, thought leadership | High engagement at 2024 conferences; lead generation |

| Strategic Partnerships | Data licensing, co-branded products, integrations | 15% new enterprise client uplift via partnerships in 2024 |

| Research Reports & Publications | Content marketing, lead generation, brand building | Website and industry portal distribution; direct mailing |

Customer Segments

Real estate developers, from large corporations to smaller firms, are key customers for China Index Holdings (CIH). They utilize CIH's extensive market intelligence to inform critical decisions regarding land acquisition, project planning, and pricing strategies. In 2024, with the property market navigating evolving economic conditions, access to granular data on land supply and demand is paramount for developers aiming to optimize their development cycles.

These developers depend on CIH for detailed competitor analysis, which is crucial for identifying profitable opportunities and effectively managing risks in a dynamic market. For instance, understanding regional sales forecasts and pricing trends, areas where CIH provides significant value, allows developers to make more informed investment choices and mitigate potential downturns.

Real estate brokers and agencies, encompassing both firms and individual agents, rely on China Index Holdings (CIH) for crucial data. This segment utilizes CIH's information for property valuation, understanding market trends, and generating leads. For instance, in 2024, the Chinese real estate market continued to see fluctuations, making accurate data indispensable for brokers to advise clients and price properties competitively.

These professionals need timely and precise information to effectively guide their clients, ensure competitive property pricing, and identify prospective buyers or tenants. CIH's data-driven insights directly contribute to their ability to close deals more efficiently, a critical factor in their success.

Financial institutions like banks and asset management firms are key customers for China Index Holdings (CIH). These entities rely on CIH's data for crucial tasks such as real estate due diligence, assessing investment risks, and valuing properties for loans. In 2024, the real estate sector continued to be a significant area of focus for financial institutions, with many actively seeking reliable data to navigate market complexities.

Private equity funds and other investment vehicles also leverage CIH's expertise. They use the provided information to identify promising real estate investment opportunities and to conduct thorough analyses before committing capital. CIH’s comprehensive data empowers these investors to make more informed decisions, a critical factor given the dynamic nature of real estate markets.

Government Entities and Policymakers

Government entities and urban planning departments are key users of China Index Holdings (CIH) data. They leverage CIH's comprehensive market analysis and real estate insights to inform policy formulation, guide urban development strategies, and ensure market stability. For instance, in 2023, CIH's data played a role in informing local government decisions regarding property market adjustments across various Chinese cities.

These bodies depend on CIH for objective assessments of the real estate landscape, particularly concerning housing supply and demand. This reliance underscores CIH's role in providing the foundational data necessary for evidence-based policymaking within the sector. CIH's commitment to independent market assessments supports their efforts to maintain a healthy and predictable real estate market.

- Policy Formulation: CIH data aids in crafting effective real estate policies.

- Urban Planning: Insights into market dynamics support sustainable city development.

- Market Stability Monitoring: Independent assessments help track and manage market fluctuations.

- Evidence-Based Decision Making: CIH provides the data for informed governmental actions.

Property Management Companies and Service Providers

Property management companies and service providers are a key customer segment for China Index Holdings (CIH). These businesses, focused on managing properties, facilities, and other real estate services, utilize CIH's extensive data to gain insights into property performance and rental market dynamics. For instance, in 2024, the property management sector in China continued its growth trajectory, with revenue from property management services for commercial properties alone reaching significant figures, underscoring the demand for data-driven operational improvements.

CIH's data empowers these companies to optimize their service delivery by understanding market demand for their specific offerings. This allows them to strategically position themselves and enhance operational efficiency. For example, by analyzing CIH's rental trend data, a property manager can better forecast occupancy rates and adjust staffing or service schedules accordingly. This data-driven approach is crucial in a competitive market where efficiency directly impacts profitability.

- Leveraging CIH Data: Property managers use CIH's data to understand property performance metrics and rental market trends, enabling more informed decision-making.

- Optimizing Service Delivery: CIH's insights help these companies identify market demand for their services, allowing them to tailor offerings and improve operational efficiency.

- Market Insights: In 2024, the continued expansion of China's real estate services sector highlights the critical need for data analytics to navigate market complexities and enhance competitive advantage.

China Index Holdings (CIH) serves a diverse clientele, with real estate developers, brokers, and financial institutions forming core customer segments. These groups rely heavily on CIH's granular data and market analysis to navigate the complexities of the property market, from land acquisition and pricing to investment decisions and risk assessment.

Government entities and urban planners also utilize CIH's insights for policy formulation and urban development, underscoring the broad applicability of its data. Property management companies further leverage CIH's information to optimize operations and service delivery.

| Customer Segment | Primary Use of CIH Data | 2024 Market Relevance |

|---|---|---|

| Real Estate Developers | Land acquisition, project planning, pricing, competitor analysis | Navigating evolving economic conditions, optimizing development cycles |

| Real Estate Brokers & Agencies | Property valuation, market trends, lead generation | Advising clients and pricing competitively amidst market fluctuations |

| Financial Institutions | Due diligence, investment risk assessment, property valuation | Navigating complexities in a significant sector for investment |

| Government Entities & Urban Planners | Policy formulation, urban development strategies, market stability | Informing evidence-based policymaking for market health |

| Property Management Companies | Property performance, rental market dynamics, operational efficiency | Enhancing service delivery and competitive advantage in a growing sector |

Cost Structure

China Index Holdings (CIH) dedicates a substantial portion of its resources to acquiring and refining the extensive real estate data that forms its core offering. This involves significant outlays for data sourcing, including licensing agreements with various entities and the operational costs of fieldwork to gather raw information. For instance, in 2023, CIH reported that its cost of revenues, which includes these data acquisition and processing expenses, was approximately RMB 1.15 billion, highlighting the scale of these investments.

China Index Holdings (CIH) significantly invests in its technology infrastructure and software development. This includes maintaining and upgrading servers, databases, and proprietary software, which are essential for its operations and data analytics capabilities. These costs are vital for staying competitive in the rapidly evolving financial data sector.

In 2023, CIH's technology-related expenses, encompassing hardware, cloud services, and ongoing software development for platform enhancements and new analytical tools, represented a substantial portion of its operational costs. For instance, the company reported that its research and development expenses, which heavily feature technological investments, were approximately RMB 115.7 million in 2023, highlighting the critical nature of technological upkeep and innovation for its business model.

China Index Holdings (CIH) faces significant personnel costs, reflecting its investment in a skilled workforce. Salaries and benefits for data scientists, real estate analysts, researchers, sales teams, and technology developers are a major expenditure, directly supporting the company's core operations and its ability to generate valuable insights and services.

These highly qualified professionals are the backbone of CIH's value proposition. Attracting and retaining top-tier talent in these specialized fields represents a critical cost driver, as the company competes for expertise essential to its data analysis and market research capabilities.

Marketing and Sales Expenses

China Index Holdings (CIH) invests heavily in marketing and sales to connect with its broad customer base. These costs cover everything from digital advertising campaigns and trade show participation to the commissions paid to their sales teams. Acquiring new clients is a substantial part of this budget, as it directly fuels revenue growth.

In 2024, CIH continued to prioritize customer outreach. Their marketing and sales expenses are crucial for building brand awareness and driving product adoption across various market segments. This investment is directly tied to their ability to expand their market share and achieve their financial objectives.

- Marketing Campaigns: CIH allocates significant funds to digital marketing, content creation, and brand promotion to reach potential clients.

- Sales Force Costs: This includes salaries, commissions, and training for their sales teams responsible for client acquisition and relationship management.

- Industry Events: Participation in key industry conferences and exhibitions is vital for networking, showcasing their services, and staying ahead of market trends.

- Client Acquisition: Direct efforts to attract and onboard new customers represent a considerable portion of these expenses, essential for sustained revenue generation.

Research and Development (R&D) Investment

China Index Holdings (CIH) dedicates significant resources to continuous research and development (R&D). This investment is crucial for developing new analytical models, enhancing existing data products, and creating innovative technology solutions. For instance, in 2023, CIH's R&D expenditure was approximately RMB 150 million, reflecting a commitment to staying ahead in the real estate information sector.

This ongoing R&D effort ensures CIH remains a leader in real estate information and analytics. By adapting to evolving market demands and embracing technological advancements, the company maintains its competitive edge. This strategic focus on innovation is a primary driver for CIH's future growth and market differentiation.

- R&D Focus: Development of new analytical models and data products.

- Technology Investment: Allocation of funds for innovative technology solutions.

- Market Adaptation: Ensuring relevance through continuous improvement and innovation.

- Growth Driver: R&D as a key factor for future expansion and competitive advantage.

China Index Holdings (CIH) incurs substantial costs in acquiring and processing its vast real estate data, including licensing fees and fieldwork expenses. Personnel costs for skilled data scientists and analysts are also a major expenditure, as is investment in technology infrastructure for data management and software development. Marketing and sales efforts to reach clients and continuous research and development for product innovation are critical cost drivers for CIH.

| Cost Category | 2023 Expense (RMB millions) | Significance |

|---|---|---|

| Cost of Revenues (Data Acquisition & Processing) | 1,150 | Core operational cost for data sourcing. |

| Research & Development (R&D) | 150 | Investment in new models and technology. |

| Research & Development (Technology Focus) | 115.7 | Hardware, cloud, and software development. |

Revenue Streams

China Index Holdings (CIH) primarily generates revenue through recurring subscription fees. Clients pay for ongoing access to CIH's extensive real estate databases, in-depth market reports, and sophisticated online analytical tools. This model ensures a consistent and predictable income stream, highlighting the continuous value clients find in CIH's timely and precise data.

These subscription packages are often structured in tiers, offering different levels of access and features to cater to a diverse client base. For instance, in 2023, CIH reported that its subscription revenue formed a significant portion of its total income, demonstrating the critical role this revenue stream plays in its overall financial health and operational stability.

Consulting and advisory service fees represent a significant revenue driver for China Index Holdings (CIH), stemming from customized project-based engagements. These services command higher fees due to their bespoke nature, offering tailored analysis and strategic guidance to clients.

CIH's deep market expertise and proprietary data insights are leveraged to deliver these high-value advisory services. For instance, in 2023, CIH reported that its consulting and advisory segment contributed a notable portion to its overall revenue, demonstrating the commercial success of its specialized knowledge offerings.

China Index Holdings (CIH) generates revenue through specialized, customized research and special projects that go beyond its regular subscription services. These projects cater to clients needing tailored market studies, in-depth property portfolio analysis, or specific feasibility assessments. This flexibility allows CIH to address niche market demands and showcase its analytical capabilities.

Data Licensing and API Access

China Index Holdings (CIH) generates revenue by licensing its extensive data sets, both in raw and processed forms, to a variety of entities. These clients include other businesses, technology firms, and financial platforms that integrate CIH's data into their own applications and services. This data licensing is a key component of their strategy to monetize their information assets.

Furthermore, CIH offers Application Programming Interface (API) access, enabling automated and seamless data retrieval for clients. This approach significantly broadens the utility and market reach of CIH's data, fostering wider consumption and creating a recurring revenue stream. For instance, during the first half of 2024, CIH reported a notable increase in its data service segment, driven by these licensing and API access initiatives.

- Data Licensing: CIH licenses its proprietary data to third-party businesses and financial platforms.

- API Access: Provides programmatic access to data for automated integration into client systems.

- Revenue Generation: Expands data utility and reach, creating new revenue streams beyond direct usage.

- Market Reach: Enhances the value proposition by allowing partners to leverage CIH's data assets.

Advertising and Promotion Services

China Index Holdings (CIH) can leverage its established platforms to offer advertising and promotion services. This taps into the need for real estate developers and related businesses to connect with CIH's professional user base, which includes investors and industry insiders. For instance, CIH could provide featured listings or sponsored content opportunities within its data portals.

This ancillary revenue stream complements CIH's core data provision by offering value-added marketing solutions. Imagine a developer wanting to highlight a new project to a highly targeted audience; CIH's advertising services would facilitate this. This approach diversifies income and strengthens relationships with clients seeking broader market engagement.

- Advertising Revenue: CIH can generate income by selling ad space on its data platforms, targeting real estate professionals.

- Promotional Services: Offering featured listings or sponsored content for real estate projects and industry participants.

- Targeted Audience Reach: Providing businesses with direct access to CIH's extensive network of real estate investors and professionals.

- Complementary Income: This stream enhances core data services by offering marketing solutions to clients.

China Index Holdings (CIH) diversifies its revenue through a combination of subscription fees for its data and analytical tools, alongside fees from customized consulting and advisory services. Additionally, the company generates income by licensing its extensive datasets and offering API access, which saw a notable increase in the first half of 2024.

These core revenue streams are further supplemented by specialized research projects and the potential for advertising and promotional services on its platforms, targeting real estate professionals.

| Revenue Stream | Description | Key Driver | 2023 Significance | H1 2024 Trend |

|---|---|---|---|---|

| Subscriptions | Recurring fees for data, reports, and tools | Predictable income | Significant portion of total income | Stable |

| Consulting & Advisory | Project-based tailored analysis and guidance | High-value expertise | Notable contribution | Continued demand |

| Data Licensing & API | Monetizing proprietary data assets | Broadened utility and reach | Growing segment | Notable increase |

| Specialized Research | Customized market studies and feasibility assessments | Niche market demands | Addresses specific client needs | Ongoing projects |

| Advertising & Promotion | Selling ad space and featured listings | Connecting businesses with users | Potential ancillary stream | Exploratory |

Business Model Canvas Data Sources

The China Index Holdings (CIH) Business Model Canvas is constructed using comprehensive financial disclosures, extensive market research reports on the Chinese data and analytics sector, and internal strategic analyses. These sources provide a robust foundation for understanding CIH's operational framework and market positioning.