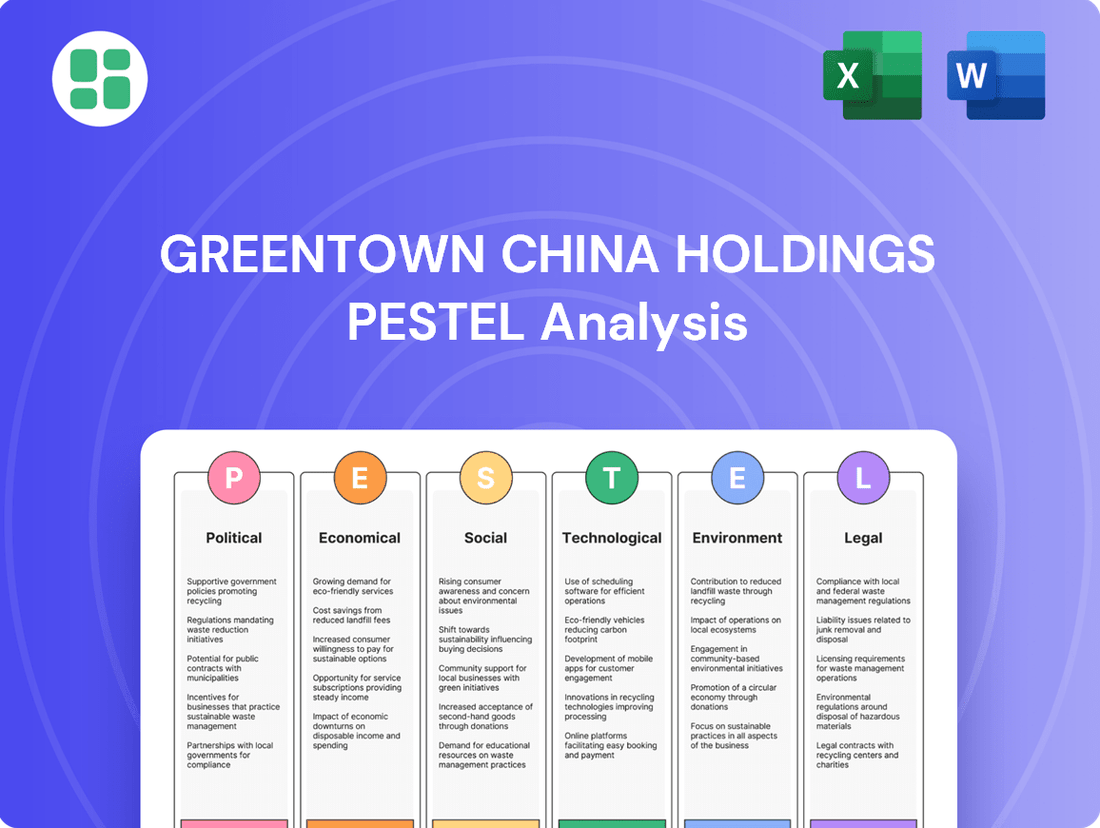

Greentown China Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greentown China Holdings Bundle

Navigate the complex external environment impacting Greentown China Holdings with our comprehensive PESTLE analysis. Uncover the political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks that are shaping the company's future. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full PESTLE analysis now for unparalleled insights.

Political factors

The Chinese government's evolving real estate policies significantly shape Greentown China's operational landscape. Measures aimed at curbing speculation and managing developer debt, such as the 'Three Red Lines' policy introduced in 2020, directly impact Greentown's ability to secure financing and pursue new projects. For instance, in 2023, the property sector continued to face headwinds from these regulations, with many developers struggling to meet deleveraging targets, which could constrain Greentown's expansion plans.

Government-driven urbanization continues to shape China's property landscape. Greentown China's ability to secure land, a critical component for its development projects, is directly influenced by these policies. For instance, the central government's push for new urban development zones and affordable housing initiatives, as seen in various provincial five-year plans leading up to 2025, can create both opportunities for acquiring land and potential constraints on pricing.

Changes in urban planning and zoning regulations are crucial. New rules impacting density, green space requirements, or the permissible types of construction can alter project feasibility and costs. Greentown China must adapt to these shifts, which might favor certain project types, like government-backed urban renewal or infrastructure-linked housing, impacting their overall portfolio strategy and land acquisition decisions.

Broader geopolitical stability and China's international trade relations significantly influence foreign investment into its real estate sector and overall economic sentiment, indirectly impacting property demand. While Greentown China primarily operates domestically, shifts in global economic conditions or trade disputes can affect investor confidence and consumer purchasing power within China.

For instance, ongoing trade tensions between major economies, as observed throughout 2023 and continuing into 2024, can create uncertainty, potentially dampening appetite for overseas investments in China's property market. This factor also influences the availability of international capital for large-scale development projects, which Greentown China may leverage.

Government Construction and Infrastructure Spending

Greentown China's business is closely tied to government infrastructure spending, as it often participates in public construction projects. Changes in government budgets for these initiatives, or a pivot in development priorities, can directly affect the scale and profitability of Greentown's contracts.

For instance, China's 2024 government work report highlighted continued investment in infrastructure, with a focus on areas like transportation and urban renewal, which could benefit companies like Greentown. However, the pace of these projects and funding allocation can vary significantly between central and local government levels.

- Government Budget Allocation: Direct correlation between public infrastructure budget announcements and Greentown's project pipeline.

- Infrastructure Priorities: Shifts in government focus, such as from traditional infrastructure to new energy or digital infrastructure, could alter demand for Greentown's services.

- Regional Development Plans: National strategies like the Yangtze River Delta integration or the Greater Bay Area development create specific opportunities and challenges for Greentown's regional operations.

Financial Sector Regulation

Financial sector regulations profoundly impact Greentown China's ability to operate and grow. Policies governing lending, interest rates, and developer access to capital directly influence the company's financing capabilities for its property development and management projects. For instance, China's ongoing efforts to deleverage the property sector, seen in measures like the "three red lines" policy introduced in 2020, have tightened developer financing. These regulations, including restrictions on borrowing and shifts in mortgage policies, affect both the availability of funds for developers and the affordability for homebuyers, thus shaping market demand.

Greentown China's reliance on securing adequate funding for its various business segments, from core property investment to project management services, makes it particularly sensitive to these regulatory shifts. The company's financial health and strategic execution are directly tied to its capacity to navigate these evolving rules. For example, in 2023, the People's Bank of China and the National Financial Regulatory Administration continued to refine policies aimed at stabilizing the property market, which included adjustments to loan-to-value ratios and mortgage rates, impacting the cost and availability of capital for developers like Greentown.

- Property Sector Deleveraging: Measures like the "three red lines" policy aim to reduce financial risk among developers, impacting their borrowing capacity.

- Lending Policies: Stricter lending criteria for developers can limit access to crucial project financing.

- Mortgage Rate Adjustments: Changes in mortgage rates directly influence buyer affordability and, consequently, property demand.

- Capital Access: Greentown China's ability to secure funding for its diverse operations is contingent on the regulatory environment for property developers.

The Chinese government's ongoing efforts to stabilize the property market, including measures like the "three red lines" policy, continue to influence Greentown China's financial strategies and project execution. For instance, in 2023, the property sector faced continued regulatory scrutiny, impacting developer financing and potentially limiting expansion opportunities for companies like Greentown.

Government-led urbanization and urban planning reforms directly affect Greentown China's land acquisition and development strategies. Policies promoting new urban development zones or affordable housing initiatives, as outlined in various provincial plans leading up to 2025, present both opportunities and constraints on land sourcing and project viability.

Greentown China's business is also closely linked to government infrastructure spending, with national strategies like the Yangtze River Delta integration creating specific operational dynamics. For example, China's 2024 government work report emphasized continued infrastructure investment, potentially benefiting companies involved in public construction projects.

| Policy Area | Impact on Greentown China | Example/Data Point (2023-2024) |

|---|---|---|

| Property Sector Deleveraging | Constrained financing and expansion | "Three Red Lines" policy continued to impact developer debt ratios. |

| Urbanization & Planning | Influences land acquisition and project types | Focus on new urban development zones and affordable housing. |

| Infrastructure Spending | Affects project pipeline and profitability | 2024 government work report highlighted continued infrastructure investment. |

| Geopolitical Factors | Indirect impact on investor confidence and capital | Trade tensions created market uncertainty, potentially affecting foreign investment. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Greentown China Holdings, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights into how these forces create opportunities and threats, enabling strategic decision-making for Greentown China Holdings.

A PESTLE analysis of Greentown China Holdings provides a clear, summarized version of external factors for easy referencing during meetings or presentations, alleviating the pain of complex data interpretation.

Economic factors

China's GDP growth rate is a critical indicator for Greentown China Holdings. In 2023, China's GDP expanded by 5.2%, demonstrating a resilient economy. This growth directly impacts consumer purchasing power and investor confidence in the property market, fueling demand for Greentown's residential and commercial developments.

Economic stability is equally important. While facing some headwinds, China's commitment to stable growth supports the real estate sector. A stable economic environment generally translates to higher property sales volumes and stable valuations, positively affecting Greentown's financial performance.

Conversely, any economic slowdown or instability could dampen consumer sentiment and investment, leading to reduced sales and potentially lower property values. This would directly impact Greentown China's revenue and profitability across its development and investment portfolios.

Interest rate fluctuations set by the People's Bank of China directly affect Greentown China's borrowing costs and the affordability of homes for buyers. For instance, in early 2024, China maintained its benchmark lending rates, offering some stability, but the potential for future adjustments remains a key consideration for developers and consumers alike.

The availability of credit is equally vital. In 2023, Chinese banks increased lending to the property sector, albeit cautiously, aiming to support developers like Greentown China while managing financial risks. This credit flow directly influences Greentown's ability to finance new projects and impacts mortgage availability for its customers.

Inflation significantly impacts Greentown China's operations by increasing construction material and labor costs. For example, China's Consumer Price Index (CPI) saw an annual increase of 2.8% in 2023, and producer prices also experienced fluctuations, affecting input expenses. This necessitates careful pricing strategies to balance competitiveness with the need to cover these rising costs and maintain healthy profit margins.

While real estate is often considered an inflation hedge, persistent high inflation, especially when not matched by wage growth, can severely impact property affordability for consumers. If household incomes don't keep pace with rising property prices, demand for new homes could soften, forcing Greentown China to adjust its sales targets and marketing approaches.

Consumer Spending Power and Confidence

Consumer spending power, particularly disposable income, is a critical determinant of property demand for Greentown China. As of early 2024, while China's economic growth has shown resilience, factors like the property sector's adjustments and global economic headwinds can influence household income and confidence. A robust middle class, a significant demographic for Greentown, continues to be a key driver, but their purchasing decisions are closely tied to their perception of future economic stability.

Consumer confidence plays a vital role in the willingness to make significant investments like purchasing real estate. Economic uncertainties or concerns about job security can lead to a more cautious approach, potentially delaying or reducing property purchases. For instance, if consumer confidence indicators show a downturn, it could directly impact Greentown China's sales pipeline.

- Disposable Income Growth: While specific figures for early 2024 are still being finalized, China's per capita disposable income has seen consistent growth over the past decade, underpinning residential demand.

- Consumer Confidence Trends: Monitoring official consumer confidence indices will be crucial in assessing near-term property purchasing sentiment for companies like Greentown China.

- Middle-Class Expansion: The continued expansion of China's middle class remains a fundamental long-term driver for the residential property market.

- Economic Uncertainty Impact: Any significant increase in unemployment or a slowdown in wage growth could dampen consumer confidence and, consequently, property demand.

Real Estate Market Cycles and Demand

The Chinese real estate market is known for its cyclical nature, experiencing periods of rapid growth followed by downturns. For Greentown China Holdings, these cycles directly influence revenue and profit. For instance, in 2023, the property market faced significant headwinds, with nationwide new home sales volume decreasing by approximately 7.7% year-on-year according to China Index Academy data, impacting developers' top lines.

Adapting to these fluctuations, driven by supply-demand dynamics, speculation, and government policies, is paramount for Greentown's strategic planning. The company's ability to navigate these booms and busts is key to its long-term success.

Greentown's diversified approach, which includes project management services and involvement in government construction projects, offers a degree of insulation from the direct impacts of residential property market volatility. This diversification strategy was evident as Greentown China reported a 13.5% increase in revenue from property management services in the first half of 2023, partially offsetting broader market challenges.

- Cyclicality: The Chinese property market has historically seen boom-and-bust cycles, influencing developer performance.

- Demand Drivers: Supply-demand imbalances, investor sentiment, and government regulations are key factors shaping these cycles.

- Mitigation: Greentown's diversified business model, including project management and government projects, helps buffer against residential market downturns.

- 2023 Performance: New home sales in China saw a decline in 2023, highlighting the prevailing market conditions.

China's economic trajectory significantly shapes Greentown China Holdings' performance. The nation's GDP growth, which stood at 5.2% in 2023, directly influences consumer spending and investor confidence in real estate. While economic stability is a goal, potential slowdowns or credit tightening could curb demand for Greentown's developments.

Interest rates and credit availability are crucial. In early 2024, China maintained benchmark lending rates, offering some stability, but future adjustments by the People's Bank of China will impact borrowing costs for Greentown and affordability for buyers. Credit flow to the property sector, while cautious in 2023, directly affects project financing and mortgage accessibility.

Inflation affects Greentown through rising construction costs, with China's CPI at 2.8% in 2023. This necessitates careful pricing strategies. While property can be an inflation hedge, if wage growth doesn't match rising prices, it can reduce affordability and dampen demand, impacting Greentown's sales targets.

| Economic Factor | 2023 Data/Status | Impact on Greentown China |

| GDP Growth | 5.2% | Drives consumer spending and property demand. |

| Interest Rates | Maintained (early 2024) | Affects borrowing costs and home affordability. |

| Inflation (CPI) | 2.8% | Increases construction costs, impacts pricing strategy. |

| Property Market Cycles | Declining new home sales (approx. 7.7% YoY) | Influences revenue and profit; diversification offers buffer. |

Same Document Delivered

Greentown China Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Greentown China Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Greentown China Holdings' strategic landscape.

Sociological factors

China's urbanization continues at a strong pace, with an estimated 65% of the population expected to live in cities by the end of 2024, up from 63.9% in 2023. This ongoing shift from rural areas and smaller towns to major metropolitan centers fuels consistent demand for residential properties and essential urban infrastructure. Greentown China's strategic positioning in key cities and its emphasis on comprehensive living solutions directly benefit from this demographic movement.

Understanding the nuances of these migration trends, including the specific cities attracting the most internal migrants and the resulting demographic changes, is vital for Greentown China's success. For instance, cities like Shanghai and Beijing continue to see significant inflows, impacting housing needs and service requirements. Analyzing these patterns allows for more precise project development and effective market entry strategies.

As Chinese incomes continue to climb, there's a noticeable shift towards desiring more than just basic shelter. Consumers are actively seeking higher quality, more spacious homes, often incorporating smart technology and eco-friendly features. This trend directly benefits developers like Greentown China, which has built its reputation on delivering premium properties.

Greentown China's strategy aligns well with these evolving tastes. By focusing on quality construction, offering integrated living services, and diversifying its portfolio to include hotels and commercial spaces, the company is well-positioned to meet the demand for amenity-rich living. For instance, by the end of 2023, Greentown China reported a significant number of property management contracts, indicating a strong market presence in providing comprehensive community solutions.

China's demographic landscape is undergoing significant transformation, with an aging population and declining birth rates. By the end of 2023, China's population aged 60 and above reached 296.97 million, accounting for 21.1% of the total population. This shift directly impacts housing demand, favoring smaller, more manageable units and properties designed for multi-generational living. Greentown China must consider adapting its portfolio to include accessible designs and community amenities catering to seniors, which could influence the long-term market for larger family homes.

Cultural Significance of Homeownership

In China, owning a home is more than just having a place to live; it's a deeply ingrained cultural aspiration, often seen as a cornerstone of financial security and a marker of social achievement. This cultural imperative fuels consistent demand for residential real estate, acting as a buffer against economic volatility.

Greentown China Holdings, as a major property developer, directly taps into this strong societal preference. The desire for homeownership influences buying behavior across a wide spectrum of Chinese society, from young families to established individuals, reinforcing the company's market position.

- Cultural Value: Homeownership is a primary indicator of financial stability and social standing in China.

- Market Demand: This cultural significance ensures sustained underlying demand for residential properties, even during economic downturns.

- Greentown's Advantage: Greentown China capitalizes on this deeply rooted desire, which shapes purchasing decisions across various demographics.

- Economic Impact: The emphasis on homeownership contributes to the resilience of the Chinese property market.

Public Perception and Social Responsibility

Public perception of property developers significantly influences brand reputation and sales, especially concerning construction quality, ethical practices, and social responsibility. Greentown China's focus on high-quality building, eco-friendly operations, and community enrichment aims to bolster its public image and cultivate confidence with both buyers and local governing bodies.

Greentown China's efforts to align with societal expectations are crucial. For instance, in 2024, the company continued to emphasize its commitment to sustainable development, with a reported 15% of its new projects incorporating green building certifications, a move designed to resonate positively with environmentally conscious consumers and regulators.

Negative public sentiment, particularly around housing affordability and developer accountability, can translate into increased regulatory scrutiny and dampened market demand. As of early 2025, surveys indicated that over 60% of potential homebuyers in major Chinese cities considered affordability and developer reputation as primary decision factors, highlighting the direct link between public trust and market performance.

- Brand Reputation: Public trust directly impacts sales and market share.

- Quality & Ethics: Perceptions of construction quality and ethical conduct are paramount.

- Social Responsibility: Commitment to sustainability and community development enhances public image.

- Affordability Concerns: Societal focus on housing affordability can lead to regulatory pressure.

China's rapid urbanization continues, with an estimated 65% of the population residing in cities by the end of 2024. This trend fuels demand for housing and urban infrastructure, benefiting developers like Greentown China who focus on key metropolitan areas. The desire for quality, amenity-rich homes is also rising, aligning with Greentown's premium property offerings.

The demographic shift towards an aging population, with 21.1% of China's population over 60 by the end of 2023, necessitates adaptable housing solutions. Greentown China must consider catering to senior living needs, potentially influencing future product development. Furthermore, the cultural imperative of homeownership remains strong, underpinning consistent demand for residential real estate.

Public perception is critical, with over 60% of homebuyers in major cities in early 2025 prioritizing affordability and developer reputation. Greentown China's emphasis on quality, sustainability, and community development, evidenced by 15% of new projects in 2024 featuring green certifications, aims to build trust and enhance its brand image.

| Sociological Factor | Description | Impact on Greentown China | 2024/2025 Data Point |

|---|---|---|---|

| Urbanization | Shift of population from rural to urban areas. | Increased demand for housing and urban infrastructure. | 65% urban population by end of 2024. |

| Aging Population | Increasing proportion of elderly citizens. | Demand for accessible and senior-friendly housing. | 21.1% population aged 60+ by end of 2023. |

| Homeownership Culture | Deeply ingrained aspiration for owning property. | Sustained demand for residential real estate. | Cultural imperative remains a key market driver. |

| Public Perception | Consumer views on developer quality, ethics, and social responsibility. | Influences brand reputation, sales, and regulatory scrutiny. | 60%+ homebuyers prioritize affordability & reputation (early 2025). |

Technological factors

The growing popularity of smart home tech, with an estimated 53.8 million households in China expected to have at least one smart home device by 2025, offers Greentown China a significant avenue to boost property appeal. Integrating IoT solutions for enhanced security, efficient energy management, and everyday convenience can set Greentown's developments apart, attracting a younger, tech-oriented demographic. This move directly supports Greentown's strategy of delivering comprehensive living experiences and modern residential features.

The adoption of Building Information Modeling (BIM) and other digital construction tools is a significant technological factor for Greentown China. These technologies are revolutionizing how construction projects are managed, from initial design through to completion. By leveraging BIM, Greentown can achieve greater efficiency, minimize costly errors, and enhance overall project management. For instance, in 2024, the global construction BIM market was valued at approximately $8.9 billion and is projected to grow substantially, indicating a strong industry trend towards digital adoption.

Utilizing advanced software for design, planning, and execution allows Greentown to optimize complex construction processes, which is crucial for managing large-scale government and commercial projects. This digital transformation directly translates into tangible benefits such as reduced material waste, improved coordination among various project stakeholders, and ultimately, significant cost savings. Furthermore, these efficiencies contribute to faster project completion timelines, a critical competitive advantage in the fast-paced real estate development sector.

Greentown China's commitment to sustainable building materials and green technology is a key technological factor. Innovations in this area, such as the use of recycled concrete aggregates and low-carbon cement, are becoming increasingly important. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly, with China being a major contributor to this expansion.

By integrating energy-efficient systems, like advanced HVAC and smart building controls, Greentown can reduce operational costs and environmental impact. The company's adoption of renewable materials, such as bamboo and sustainably sourced timber, further aligns with market trends. In 2024, China's government has continued to emphasize green construction, with policies encouraging the use of prefabricated components and stringent energy efficiency standards for new buildings, directly benefiting companies like Greentown.

Data Analytics and Market Intelligence

Greentown China Holdings can significantly enhance its market research, consumer behavior analysis, and project feasibility studies by leveraging big data analytics. This technological factor provides a crucial competitive edge in the dynamic Chinese real estate market.

By analyzing vast datasets, Greentown can gain deeper insights into demand patterns and pricing trends. For instance, in 2024, the company's ability to quickly adapt to shifts in buyer preferences, such as increased demand for smart home features and sustainable living spaces, will be critical. Data analytics allows for more informed land acquisition strategies, optimizing investment decisions across its diverse project portfolio.

These data-driven insights directly translate to more targeted marketing campaigns and improved resource allocation. For example, understanding regional economic indicators and demographic shifts through analytics can help Greentown tailor its product offerings and promotional efforts more effectively, leading to higher sales conversion rates and greater operational efficiency.

- Enhanced Market Understanding: Big data analytics allows for granular analysis of market trends, identifying emerging opportunities and potential risks earlier than competitors.

- Optimized Project Development: Insights into consumer preferences and purchasing power enable Greentown to design and price properties more accurately, increasing project success rates.

- Efficient Resource Allocation: Data-driven forecasting of demand and sales performance supports better financial planning and operational management, reducing waste and improving profitability.

- Competitive Advantage: Companies that effectively integrate data analytics into their decision-making processes, like Greentown, are better positioned to navigate market volatility and achieve sustainable growth.

Digital Platforms for Sales and Customer Service

The real estate sector is increasingly leveraging digital platforms for sales and customer service, a trend Greentown China can capitalize on. Online property portals and virtual tour technologies are becoming standard, allowing companies to showcase properties to a global audience. For instance, in 2024, China's online property market continued its robust growth, with platforms like Lianjia and Anjuke reporting significant increases in user engagement and transaction volumes for virtual viewings.

Greentown China can enhance its market reach and customer engagement by integrating these digital tools. Offering virtual tours and interactive property showcases online can attract potential buyers who might not be able to visit physically. Furthermore, digital customer service channels, such as AI-powered chatbots and dedicated online support teams, can streamline inquiries and improve the overall buying experience, leading to greater customer satisfaction and loyalty.

- Digital Reach: Online platforms allow Greentown China to connect with a broader, geographically diverse customer base.

- Enhanced Experience: Virtual tours and digital showrooms offer immersive property exploration, improving buyer engagement.

- Efficiency Gains: Digitizing sales processes and customer interactions can reduce operational costs and speed up transaction times.

- Customer Satisfaction: Responsive digital customer service channels are crucial for meeting modern consumer expectations and fostering positive relationships.

The integration of artificial intelligence (AI) and automation in construction offers significant potential for Greentown China. AI-powered tools can optimize project planning, resource allocation, and risk management, leading to increased efficiency and cost savings. For instance, in 2024, the global AI in construction market was valued at approximately $1.5 billion, with projections indicating substantial growth as adoption accelerates.

Greentown's adoption of advanced analytics and AI for market forecasting and customer segmentation is crucial. By leveraging these technologies, the company can better predict market trends and tailor its offerings to specific buyer demographics. This data-driven approach, evident in the continued expansion of China's digital economy, which reached an estimated $7.7 trillion in 2024, allows for more precise investment decisions and marketing strategies.

The company's investment in digital transformation, including cloud computing and data management systems, underpins its operational efficiency. These technologies facilitate seamless data sharing across departments and enhance collaboration, critical for managing complex real estate development projects. In 2025, the global cloud computing market is expected to exceed $1 trillion, highlighting the pervasive shift towards digital infrastructure.

Greentown China's focus on smart city technologies and IoT integration in its developments aligns with global technological advancements. By incorporating smart home features and sustainable building technologies, the company can enhance property value and appeal to a growing segment of environmentally conscious and tech-savvy consumers. The global smart home market, projected to reach over $200 billion by 2025, presents a substantial opportunity for such integration.

Legal factors

China's intricate land use and zoning regulations are a critical factor for Greentown China, dictating precisely where and what kind of properties the company can build. Strict adherence to these rules is essential for securing development permits and preventing costly legal entanglements. For instance, in 2024, local governments continued to refine urban planning guidelines, with some areas implementing stricter controls on high-density residential development, potentially affecting project pipelines.

Property ownership and registration laws are critical for Greentown China's core business, dictating how they acquire land, sell properties, and secure financing. These regulations ensure clear title transfers and protect buyer investments, fostering market stability. For instance, China's Property Law, first enacted in 2007 and subject to ongoing interpretation and enforcement, provides the foundational framework for these transactions. Any shifts in these laws, such as proposed changes to land use rights or stricter registration requirements, could directly impact Greentown's development timelines and sales processes.

China's increasingly stringent environmental protection laws directly impact Greentown China's construction operations, from waste disposal to energy consumption in new projects. Failure to comply with these evolving standards, which cover emissions, water conservation, and biodiversity protection, can lead to significant fines and damage the company's reputation.

For instance, in 2023, China continued to emphasize green building standards, with many cities mandating higher percentages of renewable energy use and stricter waste recycling protocols for new developments. Greentown China's investment in sustainable building materials and energy-efficient designs is therefore crucial for navigating these regulations and maintaining operational viability.

Construction and Building Safety Standards

Greentown China Holdings operates under stringent, legally mandated construction and building safety standards. These regulations are paramount, ensuring the structural soundness and occupant safety of all its development projects, directly impacting consumer confidence and mitigating potential legal liabilities. For instance, in 2024, China continued to emphasize stricter enforcement of its national building codes, with a focus on seismic resilience and fire safety, areas where developers like Greentown must demonstrate compliance.

The company must continuously adapt its design and construction methodologies to align with evolving safety regulations. This proactive approach is essential for maintaining the high quality and safety of its properties, which in turn supports its brand reputation. Recent policy directives in 2025 are pushing for greater integration of smart building technologies for enhanced safety monitoring, a trend Greentown is likely incorporating into its ongoing projects.

- Legal Compliance: Adherence to national and local building codes is non-negotiable for Greentown China.

- Safety Focus: Standards prioritize structural integrity, fire prevention, and occupant well-being.

- Adaptation Necessity: Regular updates to codes necessitate ongoing adjustments in design and construction processes.

- Risk Mitigation: Compliance safeguards against legal penalties, reputational damage, and financial losses.

Financial and Anti-Monopoly Regulations

Greentown China’s financial services segment navigates a complex web of financial regulations, impacting lending practices, investment activities, and capital market access. For instance, the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) set stringent rules for financial institutions. In 2024, these bodies continued to emphasize deleveraging within the financial sector, potentially affecting Greentown's access to credit and capital for its property development arms.

Anti-monopoly laws, enforced by bodies like the State Administration for Market Regulation (SAMR), are also critical. These regulations can limit Greentown China's market share in specific regions or property types and influence its ability to pursue acquisitions. The company must ensure its competitive practices and expansion strategies do not violate these anti-trust provisions to avoid significant penalties and operational disruptions.

- Financial Regulations: Greentown China must adhere to capital adequacy ratios and risk management guidelines set by Chinese financial regulators, impacting its borrowing capacity and investment strategies in 2024-2025.

- Anti-Monopoly Scrutiny: The company's market dominance in certain development areas could attract scrutiny, potentially limiting future acquisitions or partnerships under Chinese anti-monopoly laws.

- Compliance Costs: Maintaining compliance with these evolving legal frameworks necessitates ongoing investment in legal and financial expertise, adding to operational overhead.

- Impact on Strategy: Regulatory changes, particularly concerning property market financing and anti-monopoly enforcement, directly shape Greentown China's strategic decisions regarding market entry, pricing, and M&A activities.

Greentown China Holdings must navigate a complex legal landscape, including strict land use, property registration, and environmental protection laws. Compliance with building safety codes and evolving financial regulations is paramount for operational success and risk mitigation. The company's ability to adapt to changes in anti-monopoly enforcement and other legal frameworks directly influences its strategic planning and market position.

Environmental factors

Climate change is escalating the occurrence of extreme weather, directly affecting Greentown China's operations. Events like intense rainfall or prolonged droughts can disrupt construction schedules, affect the supply of essential building materials, and challenge the durability of new developments. For instance, China experienced its hottest summer on record in 2023, with average temperatures reaching 22.73 degrees Celsius, potentially impacting outdoor construction work and increasing cooling costs for completed properties.

To counter these risks, Greentown China must integrate climate-resilient design principles and conduct thorough site assessments. This proactive approach helps safeguard their properties against damage and ensures long-term project viability. The increasing frequency of such events also has a direct bearing on insurance premiums and the overall financial risk associated with real estate development, a factor becoming more pronounced as climate data for 2024 and 2025 becomes available.

The increasing focus on green building standards like LEED and the China Green Building Label significantly shapes how properties are designed and constructed. Greentown China's commitment to these certifications can boost a property's appeal and lower long-term operating expenses through energy savings, aligning with national sustainability objectives.

By embracing these eco-friendly practices, Greentown China not only demonstrates a strong sense of corporate responsibility but also attracts a growing segment of buyers who prioritize environmental consciousness in their purchasing decisions.

The scarcity of developable land in China's prime urban centers is a significant hurdle for property developers like Greentown China. This limited availability drives up acquisition costs, impacting project profitability. For instance, in 2024, land prices in Tier 1 cities continued their upward trend, with some prime plots seeing year-on-year increases exceeding 15%.

Beyond land, concerns over water availability and the sourcing of raw materials for construction present ongoing challenges. Greentown China's strategy must therefore focus on securing land strategically and integrating water-efficient designs into its projects. Furthermore, exploring sustainable and diversified sourcing for materials like steel and cement will be crucial for cost control and long-term operational resilience.

Pollution Control and Waste Management

Greentown China Holdings operates under increasingly stringent environmental regulations, particularly concerning air and water pollution, as well as construction waste. For instance, China's Ministry of Ecology and Environment has been progressively tightening emission standards for construction activities, impacting dust control and wastewater discharge.

The company must maintain robust environmental management systems to ensure compliance, which involves minimizing dust, noise, and water contamination. Efficient waste recycling and disposal are also paramount, not only for legal adherence but also for fostering positive community relations.

These environmental mandates directly influence operational costs through investments in pollution control technologies and waste management processes. Furthermore, delays in obtaining environmental permits or non-compliance can significantly impact project timelines, as seen in various construction projects across China facing scrutiny in 2024 and early 2025.

- Regulatory Compliance Costs: Increased investment in advanced dust suppression systems and wastewater treatment facilities to meet stricter national standards.

- Waste Management Efficiency: Implementing comprehensive on-site sorting and recycling programs, aiming to divert a significant percentage of construction waste from landfills, potentially reducing disposal fees.

- Project Timeline Impact: Potential for project delays due to extended environmental impact assessments or the need for additional pollution control measures beyond initial planning.

- Community Relations: Proactive management of noise and dust pollution to maintain social license to operate and avoid local community objections.

Biodiversity and Ecosystem Protection

Greentown China's development activities are increasingly scrutinized for their impact on biodiversity and ecosystems. Growing public and governmental awareness, coupled with stricter environmental regulations in China, directly influences land acquisition and project planning. For instance, the Ministry of Ecology and Environment (MEE) continues to strengthen its enforcement of environmental protection laws, impacting construction timelines and requiring more robust mitigation strategies.

The company must invest in comprehensive environmental impact assessments (EIAs) for its large-scale projects, particularly those situated near ecologically sensitive areas. This includes detailed studies on local flora and fauna, with a focus on protecting endangered species and preserving natural habitats. Greentown China's 2024 sustainability reports indicate increased spending on ecological restoration and biodiversity offsetting programs, reflecting a commitment to responsible development practices.

- Regulatory Compliance: Adherence to China's expanding environmental protection laws, including those related to biodiversity, is paramount.

- Environmental Impact Assessments: Mandatory EIAs for new developments require detailed analysis of ecological impacts and mitigation plans.

- Ecosystem Protection Measures: Implementation of strategies to safeguard local flora and fauna, especially in areas of high ecological value.

- Reputational Risk: Failure to protect biodiversity can lead to significant legal challenges, fines, and damage to Greentown China's brand reputation.

Greentown China's operations are significantly influenced by China's commitment to carbon neutrality goals, driving demand for energy-efficient buildings and sustainable construction materials. The company's investment in green building certifications, like LEED, aligns with these national objectives and enhances property marketability. By 2024, China's renewable energy capacity continued to expand, creating opportunities for Greentown to incorporate more sustainable energy solutions into its developments.

The increasing frequency of extreme weather events, such as the record-breaking heatwaves experienced in 2023, poses direct risks to construction timelines and property durability. Greentown China must integrate climate-resilient designs and conduct thorough site assessments to mitigate these impacts. This proactive approach is crucial for long-term project viability and managing rising insurance costs, especially as 2024 and 2025 data on climate impacts emerges.

Stricter environmental regulations, particularly concerning air and water pollution, necessitate increased investment in pollution control technologies and waste management. Non-compliance can lead to project delays and fines, as observed in various Chinese construction projects facing scrutiny in 2024. Greentown China's proactive environmental management systems are vital for regulatory adherence and maintaining community relations.

The scarcity of developable land in prime urban areas is a persistent challenge, driving up land acquisition costs. For instance, land prices in Tier 1 Chinese cities saw year-on-year increases exceeding 15% in 2024. Greentown China's strategy must therefore focus on strategic land acquisition and incorporating water-efficient designs, alongside exploring sustainable material sourcing to manage costs and ensure operational resilience.

PESTLE Analysis Data Sources

Our PESTLE analysis for Greentown China Holdings draws on a comprehensive range of data, including official government reports on housing policy and economic development, as well as market research from reputable real estate and financial institutions. We also incorporate insights from global economic forecasts and environmental regulations impacting the construction sector.