Greentown China Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greentown China Holdings Bundle

Greentown China Holdings operates in a dynamic real estate market, where buyer power and the threat of substitutes significantly shape its landscape. Understanding these forces is crucial for navigating the competitive pressures and identifying strategic opportunities.

The complete report reveals the real forces shaping Greentown China Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Land suppliers, predominantly local governments in China, wield significant bargaining power due to their exclusive control over land availability. This is particularly true in prime urban areas where developers like Greentown China Holdings concentrate their efforts.

Although developers have scaled back land purchases, leading to reduced land sale income for municipalities, land is still a vital and often limited asset. For instance, in 2023, China's land sales revenue for local governments dropped by 20.5% year-on-year, indicating a shift in market dynamics, yet the strategic importance of land in desirable locations remains undiminished.

The bargaining power of construction material suppliers for developers like Greentown China is generally moderate. While there are numerous individual suppliers for items like steel and cement, large developers’ substantial procurement volumes offer some negotiation leverage.

However, this power is tempered by market dynamics. For instance, a 5-7% decrease in steel prices observed in the first quarter of 2025 highlights how raw material price volatility can still significantly influence a developer’s cost structure, even with bulk purchasing.

Labor suppliers, particularly skilled workers, hold a moderate to high bargaining power in China's real estate sector. While annual wage increases have settled around 3-4%, this upward pressure is driven by demographic shifts and the increasing demand for higher quality construction.

Greentown China, like other developers, must compete for a competent workforce, making labor a significant cost factor. This necessity to secure skilled labor grants these suppliers considerable leverage in negotiations.

Financial Institutions

The bargaining power of financial institutions remains a potent force for real estate developers like Greentown China Holdings. These institutions are the gatekeepers of capital, essential for funding projects through loans and bond issuances. Their leverage stems from their ability to dictate terms, interest rates, and the very availability of funds.

While recent government efforts, such as the 'white list' program, have aimed to direct financial aid to qualifying real estate ventures, thereby improving liquidity for companies like Greentown, the broader economic climate has presented significant hurdles. The downturn in the property market generally has tightened credit availability, amplifying the bargaining power of banks and other lenders. For instance, in late 2023 and early 2024, many developers faced increased scrutiny and stricter lending criteria, reflecting the financial institutions' cautious approach.

- Capital Dependency: Greentown, like other developers, relies heavily on external financing for its operations and expansion.

- Lending Terms: Financial institutions can influence project viability through the interest rates and repayment schedules they offer.

- Market Conditions Impact: A struggling property market strengthens the bargaining position of lenders, as they have more leverage over borrowers.

- Government Support Nuance: While supportive policies exist, their effectiveness in fully mitigating financing challenges is still evolving.

Professional Service Providers

Suppliers of specialized professional services, such as advanced architectural design or niche engineering solutions that Greentown China Holdings may not possess internally, exert moderate bargaining power. This is because while Greentown has robust internal project management, evidenced by Greentown Management's industry-leading position, it still requires external expertise for certain critical functions.

For instance, in 2024, the demand for highly specialized sustainable building design and smart city integration technologies continued to grow, creating opportunities for service providers with unique skill sets. These specialized suppliers can command higher fees due to the limited availability of comparable expertise.

- Moderate Bargaining Power: External providers of specialized architectural, engineering, and project management services hold moderate influence.

- Internal Strengths: Greentown's strong in-house project management capabilities, with Greentown Management being a top-ranked industry player, reduce reliance on external project managers for core operations.

- Need for Specialization: Despite internal strengths, Greentown still requires external specialists for unique or advanced technical requirements.

- Market Trends (2024): Increased demand for sustainable design and smart city tech empowers specialized service providers.

Land suppliers, primarily local governments, maintain significant bargaining power due to their exclusive control over land, especially in prime urban areas where Greentown China focuses. Despite a nationwide 20.5% drop in land sales revenue for local governments in 2023, the strategic value of land in desirable locations ensures continued leverage for these suppliers.

Construction material suppliers generally have moderate bargaining power. While Greentown's large procurement volumes offer some negotiation strength, the volatility of raw material prices, such as the 5-7% decrease in steel prices in Q1 2025, still impacts developer costs.

Skilled labor suppliers hold moderate to high bargaining power, with annual wage increases around 3-4%. This upward pressure, driven by demographics and demand for quality, forces developers like Greentown to compete for talent, increasing labor costs.

Financial institutions wield potent bargaining power, controlling essential capital access. Despite government support programs like the 'white list' in 2024, tighter credit conditions and increased scrutiny in late 2023 and early 2024 amplified lenders' leverage over developers.

Specialized professional service providers, such as those offering advanced architectural or engineering solutions, exert moderate bargaining power. Greentown's need for unique expertise, like specialized sustainable building design in 2024, allows these niche suppliers to command higher fees.

What is included in the product

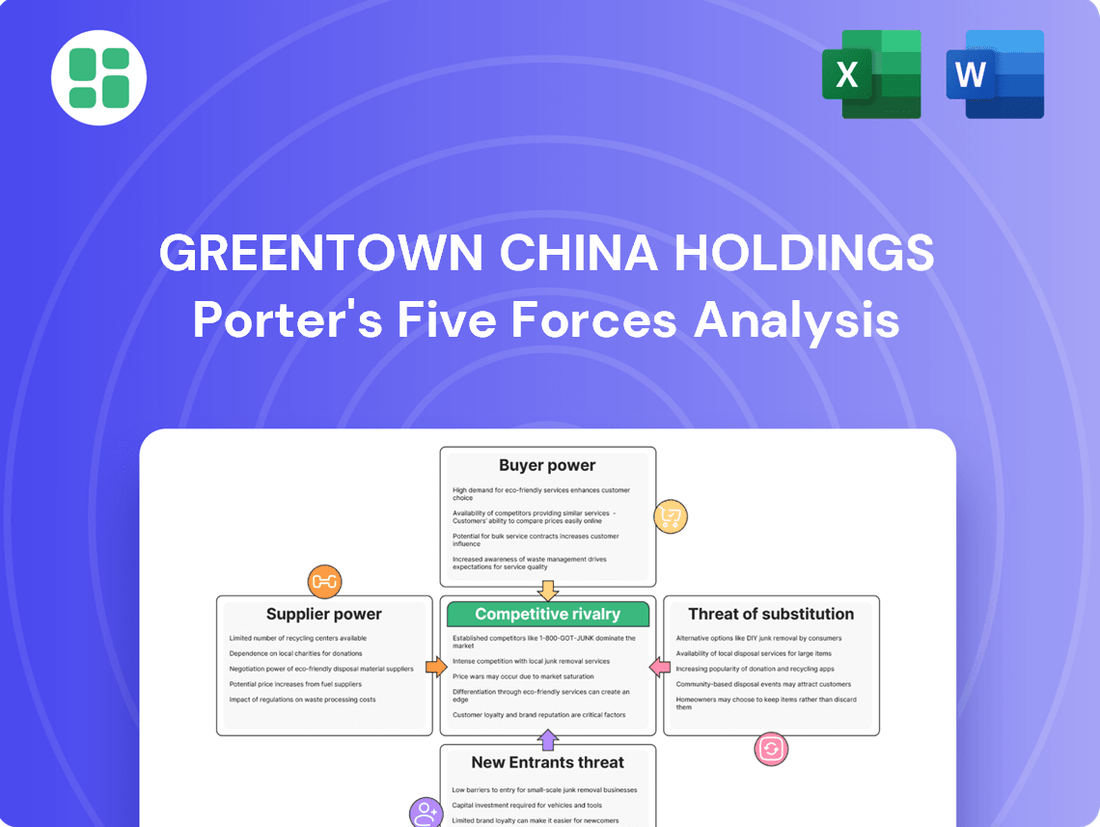

This analysis unpacks Greentown China Holdings' competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

A clear, one-sheet summary of Greentown China Holdings' Porter's Five Forces—perfect for quick decision-making on competitive pressures.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying the complex competitive landscape for Greentown China Holdings.

Customers Bargaining Power

The bargaining power of individual homebuyers in China has surged. This is largely due to the ongoing real estate market slump, marked by falling prices and a significant overhang of unsold properties. For instance, in 2023, property sales volume in China experienced a considerable year-on-year decline.

Buyers are further emboldened by a climate of weak consumer sentiment and elevated household debt. These factors reduce their immediate need to buy and increase the availability of choices, allowing them to negotiate more aggressively on price and terms.

Government entities, particularly those focused on affordable housing and urban renovation, wield significant bargaining power over developers like Greentown China Holdings. These governmental bodies often set stringent project requirements, including specific quality standards, timelines, and pricing structures, directly impacting profitability. For instance, in 2024, many municipal governments across China continued to prioritize social housing initiatives, which typically involve tighter margins for developers compared to market-rate projects.

Commercial and institutional investors wield significant bargaining power over Greentown China Holdings, particularly within its property investment and commercial construction sectors. These entities, often managing substantial capital, demand specific financial metrics like high rental yields and predictable investment returns. Their decisions are heavily swayed by macroeconomic trends and overall market stability, allowing them to negotiate favorable terms.

For instance, in 2024, institutional investors continued to prioritize stable income-generating assets amidst a fluctuating global economic landscape. Their ability to deploy large sums means they can often dictate terms, pushing developers like Greentown to offer competitive pricing or enhanced lease agreements to secure these crucial investments.

Project Management Clients

Clients engaging Greentown China Holdings for project management services possess considerable bargaining power. This is amplified by the fact that hundreds of companies are entering the project management sector, offering clients a wide array of choices and increasing competitive pressure on Greentown.

Despite Greentown Management's strong market position and a commendable client satisfaction rate of 96%, the sheer volume of competitors means clients can readily switch providers if terms are not favorable. This dynamic necessitates Greentown to maintain its competitive edge through service quality and pricing to retain its client base.

- Client Choice: The influx of hundreds of companies into the project management market provides clients with numerous alternatives, strengthening their negotiation position.

- Competitive Landscape: A crowded market forces service providers like Greentown to offer compelling value propositions to secure and retain clients.

- Client Retention: Greentown's high client satisfaction rate of 96% is crucial, as it demonstrates an ability to mitigate the bargaining power of customers by fostering loyalty.

Price Sensitivity

Customers are becoming more sensitive to prices. This is happening because home prices are falling, people expect to earn less, and there's general economic worry. For example, China's average home prices saw a decline in many cities throughout 2024, impacting buyer willingness to pay higher amounts.

This heightened price sensitivity means Greentown China Holdings faces challenges in charging premium prices. While their high-quality projects in top cities might still fetch better prices, the broader market is less forgiving of higher costs.

This trend puts pressure on Greentown's profit margins, especially in markets where economic conditions are weaker or competition is intense.

- Price Sensitivity Impact: Declining home prices in China during 2024, coupled with lower income expectations, are making customers more hesitant to pay premium prices.

- Market Segmentation: Greentown's ability to command higher prices is increasingly limited to its premium projects in Tier 1 cities, with less flexibility in other market segments.

- Profitability Pressure: Increased customer price sensitivity directly squeezes profit margins, particularly for developments outside of the most desirable urban locations.

The bargaining power of customers for Greentown China Holdings is significantly amplified by the current downturn in China's real estate market. Falling property prices and a substantial inventory of unsold homes in 2024 have empowered buyers, making them more discerning and less willing to accept premium pricing. This shift is evident as many cities experienced price corrections, forcing developers to offer more competitive terms to attract buyers.

Government entities, particularly those focused on social housing, also exert considerable influence by imposing strict requirements on quality, timelines, and pricing, which can compress developer margins. Similarly, large institutional investors, seeking stable returns in a volatile economic climate, negotiate favorable terms for commercial projects, further limiting developers' pricing flexibility.

The increasing number of project management service providers means clients have a wider array of choices, intensifying competition and strengthening their negotiation position. Greentown's high client satisfaction rate of 96% is a critical factor in retaining business amidst this competitive pressure.

| Customer Segment | Bargaining Power Drivers | Impact on Greentown China Holdings |

|---|---|---|

| Individual Homebuyers | Falling property prices, excess inventory, weak consumer sentiment (2024 market data) | Reduced pricing power, increased negotiation on terms |

| Government Entities (Affordable Housing) | Social housing mandates, stringent quality and timeline requirements | Pressure on profit margins, adherence to specific development standards |

| Institutional Investors | Demand for high rental yields, market stability concerns, large capital deployment | Negotiation of favorable lease agreements and pricing for commercial properties |

| Project Management Clients | High number of competing service providers, price sensitivity | Need for competitive pricing and service differentiation to retain clients |

What You See Is What You Get

Greentown China Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Greentown China Holdings' competitive landscape through an in-depth Porter's Five Forces analysis, covering buyer bargaining power, supplier bargaining power, threat of new entrants, threat of substitutes, and industry rivalry. This analysis will equip you with strategic insights into the forces shaping the real estate development sector in China and Greentown's position within it.

Rivalry Among Competitors

The Chinese real estate sector is characterized by intense competition among a large number of developers. However, this landscape has undergone significant consolidation, with state-owned enterprises notably expanding their market share.

Greentown China Holdings stands out as a major player, securing the third position in contracted sales in 2024. This ranking underscores its robust standing within a highly competitive environment.

Greentown China Holdings operates in a challenging environment where the overall real estate market is contracting. This shrinking market size, evidenced by declining real estate investment and sales volumes among the top 100 developers, significantly heightens competitive rivalry.

As the pie gets smaller, developers like Greentown are forced to compete more fiercely for a diminishing pool of buyers. This intense competition pressures companies to prioritize destocking and efficiently managing their existing property inventories to maintain market share and cash flow.

Government policies are a major force influencing competition in China's real estate sector. For instance, purchase restrictions aimed at cooling the market and adjustments to mortgage rates directly impact demand and developer sales volumes. In 2023, these policies led to a notable slowdown in many cities.

The introduction of 'white list' financing mechanisms, designed to support developers with viable projects, creates a tiered competitive environment. Developers who can meet the criteria for these supportive policies gain a significant advantage in accessing capital, which is crucial for project completion and continued development. This policy-driven access to finance is a key differentiator.

Focus on Quality and Product Differentiation

The Chinese real estate market is undergoing a significant transformation, moving away from a volume-driven approach to one that prioritizes quality and product differentiation. This shift marks a new era of competition focused on existing inventory, where superior quality becomes the key differentiator. Greentown China Holdings is strategically positioned to thrive in this evolving landscape, given its long-standing reputation for developing high-quality residential properties and adhering to rigorous 'Good House' construction standards.

Greentown China's commitment to quality is not just a marketing slogan; it's embedded in their operational DNA. For instance, in 2023, the company continued to emphasize its premium product offerings, which often command higher price points and attract a discerning customer base. This focus on quality helps mitigate the intense rivalry by carving out a niche less susceptible to price wars common in the lower-quality segments of the market.

- Industry Shift: The Chinese property sector is transitioning from a 'quantity' to a 'quality' focus, emphasizing 'competition within existing inventory, where quality prevails.'

- Greentown's Position: Greentown China is well-positioned due to its established reputation for high-quality residential products and 'Good House' practices.

- Strategic Advantage: This focus on quality differentiates Greentown from competitors and allows it to cater to a segment of the market prioritizing value and durability over sheer volume.

Financial Health and Liquidity Challenges

Competitive rivalry in the Chinese property sector is intensified by widespread liquidity constraints and debt burdens among developers. This environment fuels industry consolidation, with several firms facing difficulties in meeting their debt obligations.

Greentown China Holdings, however, demonstrates a more robust financial standing. Its comparatively strong cash reserves and a net gearing ratio of 56.6% as of 2024 position it favorably against more financially strained competitors.

- Financial Strain: Many developers grapple with tight liquidity and significant debt, leading to increased consolidation.

- Debt Repayment Issues: Some firms are struggling to meet their debt repayment schedules.

- Greentown's Advantage: Greentown China maintains a strong cash position and a lower net gearing ratio of 56.6% (2024).

- Competitive Edge: This financial strength offers a distinct advantage over peers facing greater financial stress.

Competitive rivalry in China's real estate sector remains high, exacerbated by a contracting market and government policies. Greentown China Holdings, as the third-largest developer by contracted sales in 2024, navigates this intense environment by focusing on quality and product differentiation, a strategy that helps it stand out amidst broader industry consolidation.

| Metric | Greentown China Holdings (2024) | Industry Trend |

|---|---|---|

| Contracted Sales Ranking | 3rd | Intense rivalry, consolidation |

| Market Focus | High-quality residential properties | Shift from quantity to quality |

| Net Gearing Ratio | 56.6% | Many developers facing liquidity constraints |

SSubstitutes Threaten

Renting presents a substantial threat to Greentown China Holdings, particularly as rental inflation in China has cooled significantly, even experiencing negative growth in recent years. This trend makes renting a more financially appealing option for many potential homebuyers.

Furthermore, government initiatives promoting affordable housing, including public rental housing programs, directly compete with traditional property ownership. These programs are especially attractive to new residents and younger demographics, further strengthening the substitute threat posed by renting.

The secondary housing market presents a significant threat of substitution for Greentown China Holdings' primary offerings. As new home prices potentially stabilize, the slower recovery anticipated in secondhand housing prices makes these properties more attractive to budget-conscious buyers. This affordability gap directly challenges Greentown's ability to attract and retain customers for its new developments.

The rise of government-subsidized and affordable housing presents a significant threat of substitution for commercial property developers like Greentown China Holdings. These initiatives, which include public rental housing and shared ownership programs, directly compete with traditional market-rate housing, especially for lower and middle-income segments of the population. For instance, in 2024, many local governments continued to expand their affordable housing pipelines, aiming to meet growing demand and social equity goals.

Greentown China Holdings itself participates in this segment through its government project management services, indicating an awareness of this competitive landscape. This dual involvement means the company is both a potential beneficiary and a direct competitor to its own commercial development efforts when it comes to serving a broad range of housing needs.

Alternative Investment Vehicles

For investors, alternative investment vehicles outside of real estate, such as stocks, bonds, or other financial products, can act as substitutes for property investments. The perceived risks and uncertainties in the property market, particularly for developers like Greentown China Holdings, coupled with weak consumer confidence, may steer capital towards other sectors. For instance, as of early 2024, global equity markets have shown resilience, with major indices like the S&P 500 experiencing notable gains, potentially drawing investment away from less stable real estate markets.

The availability of these alternatives presents a significant threat. When investors can achieve comparable or even better returns with lower perceived risk elsewhere, the appeal of real estate diminishes. This is especially relevant in 2024, a year marked by ongoing economic adjustments and shifting investor sentiment globally.

- Diversification Benefits: Stocks and bonds offer diversification opportunities that might not be as readily available or as appealing in a struggling property market.

- Yield Potential: In certain economic climates, dividend yields from equities or coupon payments from bonds can provide a more attractive and predictable income stream than property rentals.

- Liquidity: Financial markets typically offer higher liquidity compared to real estate, allowing investors to enter and exit positions more easily.

- Market Performance: For example, in 2023, while China's property market faced headwinds, the Hang Seng Index, representing Hong Kong equities, saw fluctuations but offered avenues for capital deployment.

Changing Consumer Preferences

Shifting consumer preferences represent a significant threat of substitutes for Greentown China Holdings. As buyer tastes evolve, they might increasingly favor smaller, more budget-friendly housing units. This trend could divert demand from Greentown's typical offerings towards alternative housing solutions.

Furthermore, a growing preference for properties with specific amenities or in particular locations means consumers might explore options outside of new commercial developments. This includes considering renovated older properties or participating in urban village renewal projects, which offer distinct value propositions.

- Evolving Tastes: Consumers may increasingly seek smaller, more affordable homes, impacting demand for larger new builds.

- Amenity-Driven Choices: Preferences for specific amenities or locations can lead buyers to consider alternatives like renovated older properties.

- Urban Renewal Appeal: Urban village renewal projects present a substitute option that may attract buyers looking for different living environments.

The threat of substitutes for Greentown China Holdings is multifaceted, encompassing rental markets, the secondary housing market, government-subsidized housing, and alternative investments. Cooling rental inflation in China makes renting a more attractive option, directly competing with homeownership. Government initiatives promoting affordable housing, such as public rental programs, further siphon demand from traditional developers, especially among younger demographics. In 2024, many local governments continued to expand affordable housing options, underscoring this trend.

The secondary housing market also poses a significant substitution threat. As new home prices potentially stabilize, the slower anticipated recovery in secondhand property prices makes these more budget-friendly options appealing. This affordability gap challenges Greentown's ability to attract buyers to its new developments. For instance, in early 2024, the gap between new and existing home prices in many Tier 1 and Tier 2 cities remained a key consideration for buyers.

Beyond housing itself, alternative investments like stocks and bonds can substitute for property investments. In 2023, while China's property market faced challenges, global equity markets, such as the S&P 500, showed resilience, potentially drawing capital away from real estate. This is driven by factors like diversification benefits, potential yield, and greater liquidity offered by financial markets compared to real estate.

Shifting consumer preferences also contribute to the threat of substitutes. Buyers may increasingly favor smaller, more affordable units or seek properties with specific amenities, leading them to consider alternatives like renovated older homes or urban renewal projects. This evolving demand landscape means Greentown must adapt to changing tastes to remain competitive.

| Substitute Type | Impact on Greentown | Key Drivers (2024 Focus) | Example Data/Trend |

|---|---|---|---|

| Rental Market | Decreased demand for new home purchases | Cooling rental inflation, government rental housing programs | Rental price growth in major cities remained subdued or negative in early 2024. |

| Secondary Housing Market | Reduced attractiveness of new builds due to price | Price stabilization of new homes, slower recovery in secondhand prices | Price-to-price ratios between new and existing homes favored secondhand properties in many regions. |

| Government-Subsidized Housing | Direct competition for lower to middle-income buyers | Expansion of affordable housing pipelines, social equity goals | Increased investment in public rental housing projects by local governments. |

| Alternative Investments (Stocks, Bonds) | Diversion of capital away from real estate | Perceived property market risks, weak consumer confidence, equity market performance | Resilient performance in global equity markets (e.g., S&P 500 gains in early 2024) drew investor attention. |

Entrants Threaten

The threat of new entrants for Greentown China Holdings is significantly mitigated by the high capital requirements inherent in China's real estate development sector. Acquiring land, funding construction projects, and managing ongoing operations demand substantial financial resources, effectively creating a formidable barrier for aspiring companies.

For instance, in 2024, major Chinese developers like Greentown continued to invest billions in new projects, underscoring the scale of capital needed. Greentown's established access to low-cost financing and robust cash flow generation provides a distinct competitive advantage, making it difficult for newcomers to match its financial muscle and operational capacity.

The Chinese property market is a minefield of regulations, with rules on land use, financing, sales, and even pricing frequently shifting. For a new company, getting a handle on these ever-changing policies presents a significant hurdle. In 2023, for instance, various local governments implemented new purchase restrictions and down payment requirements, adding layers of complexity for any developer aiming to enter the market.

Established brand loyalty and reputation present a significant barrier for new entrants into the Chinese property market. Greentown China, for instance, has cultivated a strong reputation for quality and reliability, fostering deep customer trust. In 2023, Greentown China reported a revenue of RMB 111.5 billion, underscoring its substantial market presence and the difficulty new players would face in matching this established goodwill and market acceptance.

Access to Land and Financing Networks

New entrants face significant hurdles in acquiring prime land, especially in China's major tier-1 and tier-2 cities. Success in this area often hinges on deep-rooted connections with local government bodies and robust financial resources, which established players like Greentown China Holdings already possess.

The ability to secure desirable land parcels and establish strong financing networks is a critical barrier. For instance, in 2024, the average land acquisition cost for prime residential projects in Shanghai and Beijing continued to escalate, making it difficult for newcomers without established credit lines and government relationships to compete effectively.

- Land Acquisition Challenges: Newcomers struggle to secure premium land in top-tier Chinese cities due to high costs and the need for established government ties.

- Financing Hurdles: Accessing substantial financing for land acquisition and development is more difficult for new entrants compared to established developers with proven track records and banking relationships.

- Competitive Disadvantage: Incumbent developers benefit from long-standing networks and preferential treatment, creating a significant competitive disadvantage for new market participants.

Market Oversupply and Inventory Levels

The threat of new entrants is significantly amplified by persistent market oversupply. Despite some destocking efforts, many Chinese regions still grapple with an excess of unsold housing. For instance, in early 2024, the average days on market for new homes in key Tier 1 and Tier 2 cities remained elevated, indicating a buyers' market. This means any new player entering the scene must contend with a landscape already saturated with available properties, complicating their ability to secure market share and achieve profitable sales volumes.

New entrants would face considerable hurdles in a market characterized by:

- High Existing Inventory: The sheer volume of unsold units across numerous cities means new developments must compete for limited buyer demand.

- Price Sensitivity: Oversupply often leads to downward pressure on prices, making it difficult for new entrants to establish competitive pricing without sacrificing margins.

- Brand Loyalty and Established Networks: Existing developers often benefit from established brand recognition and strong relationships with agents and local authorities, creating barriers for newcomers.

The threat of new entrants for Greentown China Holdings is considerably low due to substantial capital requirements and regulatory complexities in China's real estate sector. For example, in 2024, the cost of land acquisition in major Chinese cities continued to rise, demanding significant financial outlay. Greentown's established access to financing and its strong reputation, evidenced by its RMB 111.5 billion revenue in 2023, create formidable barriers for newcomers seeking market share and customer trust.

| Factor | Impact on New Entrants | Greentown China's Advantage |

|---|---|---|

| Capital Requirements | Very High | Established financing access and robust cash flow |

| Regulatory Environment | Complex and Shifting | Deep understanding and established relationships |

| Brand Reputation | Low for Newcomers | Strong customer trust and market acceptance (RMB 111.5B revenue in 2023) |

| Land Acquisition | Costly and Connection-Dependent | Existing prime land holdings and government ties |

| Market Oversupply | Intensified Competition | Established sales channels and brand loyalty |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Greentown China Holdings leverages data from company annual reports, industry-specific market research from firms like CRIC, and official government statistics on the Chinese real estate sector.

We integrate financial disclosures and investor presentations from Greentown China Holdings with broader economic indicators and real estate market trend reports to assess competitive pressures.