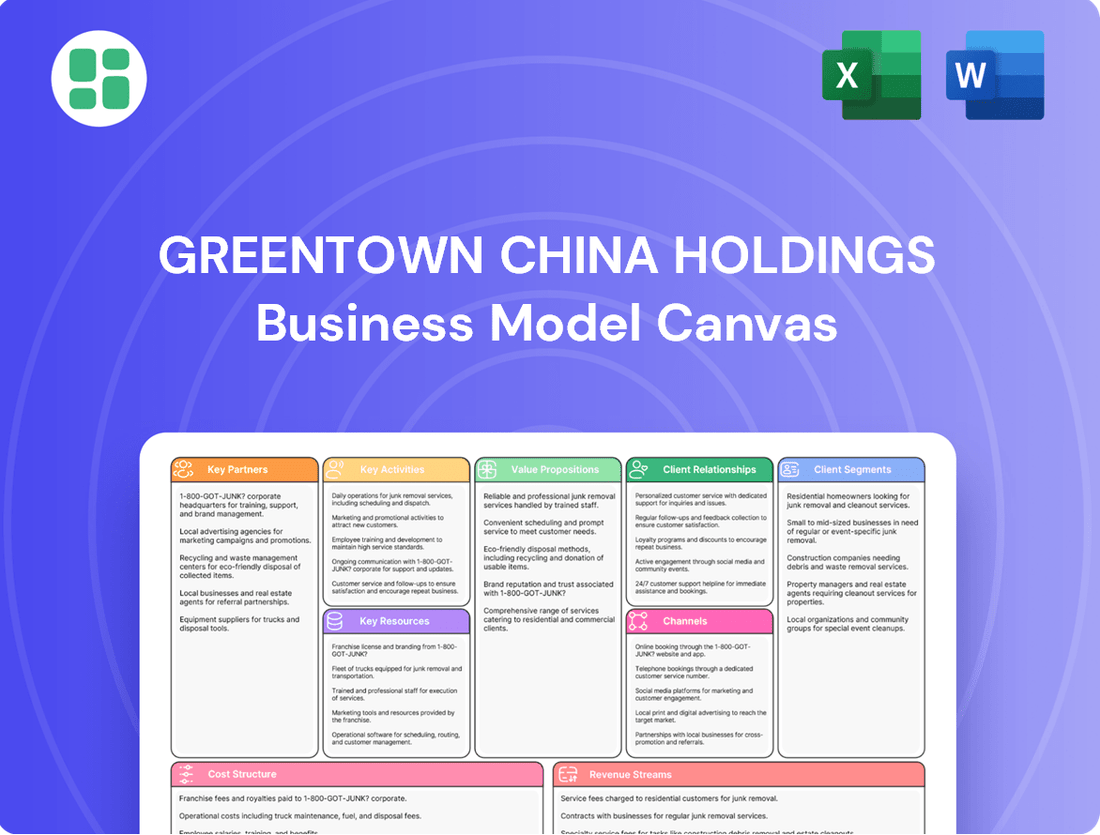

Greentown China Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greentown China Holdings Bundle

Unlock the full strategic blueprint behind Greentown China Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Greentown China's engagement with government bodies and state-owned enterprises is a cornerstone of its operational strategy, particularly in urban development. These collaborations are vital for accessing land resources and navigating the complex approval processes essential for large-scale construction and urban renewal projects. For instance, in 2024, the company continued to secure land parcels through government tenders and direct allocations, a critical factor given the competitive land market.

These partnerships also enable Greentown China to participate in significant public infrastructure and affordable housing initiatives, aligning its business objectives with national development priorities. This strategic alignment not only provides a stable pipeline of projects but also enhances the company's reputation and its ability to influence urban planning. The company's participation in government-led projects is a testament to its strong relationships with local and national authorities, facilitating smoother project execution and market access.

Greentown China Holdings actively collaborates with a diverse range of financial institutions and investors. These partnerships are crucial for securing project financing, refinancing existing debt, and effectively managing its capital structure. For instance, in 2024, the company continued to leverage its relationships with major banks and asset management companies to ensure liquidity and fund its ongoing development projects.

These collaborations provide Greentown China with a stable financial foundation, granting it access to the necessary capital for new investments and ensuring the successful completion and delivery of its real estate developments. The support extends to pre-investment risk assessment and post-investment management, vital for navigating the complexities of the property market.

Greentown China frequently enters into joint ventures for its property development projects. These collaborations are crucial for pooling expertise, sharing resources, and distributing risk, which is essential in the competitive real estate market.

These partnerships are instrumental in growing Greentown China's land bank and diversifying its project offerings. For instance, in 2024, joint ventures played a significant role in securing new development sites and launching a broader range of properties, directly boosting contracted sales figures.

Suppliers and Construction Partners

Greentown China Holdings relies heavily on a broad network of suppliers for essential construction materials and collaborates with numerous construction partners to ensure efficient project delivery and maintain high quality standards. These relationships are critical for timely execution and upholding Greentown's reputation for superior building quality.

In 2023, Greentown China's commitment to quality and timely delivery was supported by its extensive supply chain. The company actively managed its relationships with key material providers and construction firms to mitigate risks associated with fluctuating material costs and labor availability, which are common challenges in the real estate sector.

- Supplier Network: Access to a diverse range of material suppliers, from concrete and steel producers to interior finishing providers, is crucial for cost management and project timelines.

- Construction Partnerships: Collaborating with specialized construction companies for different phases of development, including foundation work, structural assembly, and finishing, allows for optimized expertise and efficiency.

- Quality Assurance: Strong partnerships enable rigorous quality control throughout the construction process, ensuring that all projects meet Greentown's stringent building specifications.

- Risk Mitigation: Maintaining stable relationships with key partners helps to buffer against supply chain disruptions and labor shortages, ensuring project continuity.

Technology and Service Providers

Greentown China Holdings strategically partners with technology and specialized service providers to bolster its 'Greentown+' segment. These collaborations are crucial for advancing its living technology, smart community solutions, and healthcare service offerings.

These alliances are instrumental in fostering innovation and enriching the company's comprehensive living service ecosystem. For instance, in 2023, Greentown China reported that its property management segment, which includes many of these integrated services, achieved a revenue of RMB 15.4 billion, indicating the growing importance of these partnerships.

- Technology Firms: Collaborations with tech companies enhance smart home features and community management platforms.

- Healthcare Providers: Partnerships with specialized healthcare services integrate wellness and medical support into the living experience.

- Service Outsourcing: Engaging specialized service providers for maintenance, security, and other operational aspects improves efficiency.

- Data Analytics Partners: Alliances with data analytics firms help in understanding resident needs and optimizing service delivery.

Greentown China's key partnerships are multifaceted, spanning government entities for land acquisition and project approvals, financial institutions for capital access, and joint ventures to share risks and expand project portfolios. These collaborations are vital for securing land, funding development, and diversifying its offerings, as seen in its 2024 land acquisition strategies and project launches.

The company also relies on a robust network of suppliers and construction partners to ensure efficient project execution and maintain high-quality standards, a crucial element in its 2023 operational success where its property management segment generated RMB 15.4 billion in revenue.

Furthermore, strategic alliances with technology and specialized service providers are enhancing its integrated living services, contributing to innovation and enriching its service ecosystem.

| Partnership Type | Key Role | 2023/2024 Impact Example |

|---|---|---|

| Government & SOEs | Land access, project approvals, public initiatives | Secured land parcels via government tenders in 2024 |

| Financial Institutions | Project financing, capital management | Ensured liquidity for ongoing projects in 2024 |

| Joint Ventures | Risk sharing, expertise pooling, land acquisition | Boosted contracted sales through diversified property launches in 2024 |

| Suppliers & Construction Firms | Material provision, efficient project delivery, quality assurance | Mitigated risks from fluctuating material costs and labor in 2023 |

| Technology & Service Providers | Innovation in living tech, smart communities, service enhancement | Supported RMB 15.4 billion revenue in property management segment (2023) |

What is included in the product

This Business Model Canvas for Greentown China Holdings outlines their strategy for developing and managing high-quality residential properties, focusing on middle to high-income urban families and utilizing direct sales and online platforms to deliver their value proposition of comfortable and sustainable living.

Greentown China Holdings' Business Model Canvas effectively addresses pain points by visually mapping out solutions for urban development challenges, offering a clear, actionable framework.

Activities

Greentown China Holdings' primary engine is property development and sales, encompassing the full spectrum from acquiring land and planning to the final sale of residential and commercial spaces. This involves meticulous execution across the entire project lifecycle.

The company prioritizes developing high-quality properties, aiming for efficient sales conversions, and strategically acquiring land in key urban centers. For instance, in 2024, Greentown China reported strong sales performance, with contracted sales reaching approximately RMB 140.5 billion, demonstrating their capability in this core activity.

Greentown Management, a key subsidiary, provides comprehensive project management services. These services extend to government, commercial, and capital construction projects, showcasing a broad operational scope.

This business segment operates on an asset-light model, effectively exporting Greentown's established brand and management expertise. By integrating resources and offering tailored solutions, Greentown Management has secured a substantial market share in its service areas.

In 2024, Greentown China Holdings reported that its property management segment, which includes project management services, saw revenue growth. This growth reflects the increasing demand for professional project management, especially in large-scale urban development and infrastructure initiatives.

Greentown China Holdings actively manages and operates a portfolio of hotels, a crucial activity that diversifies its revenue streams and bolsters its brand recognition across the hospitality sector. This operational focus ensures consistent income and a tangible presence in key markets.

Beyond day-to-day management, the company strategically engages in property investment, holding various real estate assets. These investments are primarily geared towards generating steady rental income and achieving long-term capital appreciation, with each asset undergoing rigorous financial performance reviews.

For instance, as of the first half of 2024, Greentown China reported a significant portion of its revenue derived from property sales and rentals, underscoring the importance of its property investment activities. The company's commitment to optimizing its property portfolio for financial return remains a core element of its operational strategy.

Financial and Industrial Chain Services

Greentown China Holdings actively engages in providing crucial financial and industrial chain services, broadening its influence beyond traditional property development. These offerings are designed to support clients and partners throughout the real estate lifecycle, creating a more robust and interconnected business model.

These services are a strategic pillar, enabling Greentown to capture additional value and strengthen its position within the broader real estate ecosystem. By offering a comprehensive suite of solutions, the company aims to differentiate itself and foster deeper client relationships.

- Financial Services: Greentown offers financial support, potentially including financing solutions or investment management, to its clients and partners.

- Industrial Chain Integration: The company extends its services to various segments of the real estate value chain, such as supply chain management or property management.

- Value Enhancement: These integrated services aim to boost the overall value proposition for customers and stakeholders.

- 2024 Performance Insight: While specific segment breakdowns for these services in 2024 are not yet fully detailed, Greentown China's overall revenue for the first half of 2024 reached RMB 61.5 billion, indicating continued operational strength that supports these diversified activities.

Urban and Living Services Development

Greentown China Holdings is actively broadening its scope beyond just property development. The company is investing in urban renewal services, aiming to revitalize existing urban areas. This includes developing industrial and urban services, as well as a range of integrated living solutions designed to enhance resident experiences.

These integrated living solutions encompass diverse sectors such as cultural education, sports, and health. The goal is to build a complete living ecosystem for their customers, offering a holistic approach to urban life. For instance, in 2024, Greentown continued to expand its smart community initiatives, integrating technology to improve convenience and safety for residents.

- Urban Renewal: Greentown is a key player in urban renewal projects, transforming existing cityscapes.

- Integrated Living: The company offers a wide array of services beyond housing, including education and health.

- Smart Communities: Greentown is enhancing its offerings with smart technology integration in residential areas.

- Ecosystem Development: The overarching strategy is to create a comprehensive living environment for its clientele.

Greentown China Holdings' core activities revolve around property development and sales, achieving approximately RMB 140.5 billion in contracted sales in 2024. Complementing this, Greentown Management provides extensive project management services to various sectors, demonstrating a broad operational reach.

The company also manages a hotel portfolio and strategic property investments, focusing on rental income and capital appreciation. These activities are supported by financial and industrial chain services, integrating Greentown further into the real estate ecosystem.

Furthermore, Greentown is actively involved in urban renewal and developing integrated living solutions, including smart community initiatives, to create comprehensive living environments.

| Key Activity | Description | 2024 Data/Insight |

| Property Development & Sales | Full-cycle property creation and market delivery. | Contracted sales: approx. RMB 140.5 billion. |

| Project Management Services | Offering management expertise to external projects. | Revenue growth in property management segment. |

| Hotel Operations & Property Investment | Managing hospitality assets and holding real estate for income/appreciation. | Significant revenue contribution from sales and rentals (H1 2024). |

| Financial & Industrial Chain Services | Providing support across the real estate value chain. | Overall revenue H1 2024: RMB 61.5 billion. |

| Urban Renewal & Integrated Living | Revitalizing urban areas and offering lifestyle solutions. | Expansion of smart community initiatives. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Greentown China Holdings that you are previewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis and strategic framework that will be yours to utilize. Upon completing your order, you will gain full access to this identical, professionally structured document, ready for your immediate use.

Resources

Greentown China Holdings boasts an extensive land bank, a critical resource for its business model. This portfolio is strategically located, with a significant concentration in China's first- and second-tier cities, areas known for their robust economic activity and high demand for real estate. This geographical focus ensures access to markets with strong sales potential and higher saleable values.

This substantial land bank is not just a collection of properties; it's the bedrock of Greentown China's future growth and revenue streams. By holding these prime land assets, the company secures its pipeline for upcoming development projects, enabling sustained business operations and consistent income generation for years to come.

As of the end of 2023, Greentown China's total saleable area from its land reserves was approximately 53.2 million square meters. This vast land bank underpins the company's ability to execute its development strategy and maintain its market position.

Greentown China Holdings leverages its strong financial capital and creditworthiness as a key resource. The company consistently reports substantial bank balances and cash reserves, which are vital for managing its debt obligations and securing favorable, low-cost financing. This robust financial standing allows Greentown to operate with greater flexibility and pursue strategic growth opportunities.

Its high creditworthiness is particularly instrumental, ensuring smooth access to onshore financing channels. For instance, in 2024, Greentown China's ability to secure competitive funding rates directly supported its ambitious development projects and potential acquisitions, reinforcing its capacity to undertake large-scale ventures in a dynamic market.

Greentown China Holdings boasts a renowned brand deeply associated with superior quality, punctual project delivery, and exceptional customer satisfaction within China's competitive real estate sector. This powerful brand equity acts as a magnet, drawing in a steady stream of discerning customers, valuable partners, and top-tier talent, thereby cementing a substantial competitive edge.

In 2024, Greentown continued to leverage this strong reputation. For instance, their commitment to quality was reflected in customer feedback, with surveys indicating high satisfaction levels across their developments. This brand strength also played a crucial role in their ability to secure favorable financing terms and attract strategic joint venture partners, further bolstering their market position.

Skilled Workforce and Management Expertise

Greentown China Holdings relies heavily on its high-calibre management team and skilled employees. This expertise spans critical areas like property development, project management, and specialized services, forming a core intellectual asset.

Their collective knowledge fuels operational efficiency, drives innovation in product offerings, and ensures the effective execution of the company's strategic initiatives. This human capital is fundamental to their success in the competitive real estate market.

- Management Expertise: A seasoned leadership team with deep industry knowledge guides strategic direction and operational execution.

- Skilled Workforce: Employees possess specialized skills in property development, construction, sales, and customer service.

- Talent Development: Ongoing training and development programs are in place to enhance employee capabilities and retain talent.

- Operational Efficiency: The expertise of the workforce directly contributes to streamlined project execution and cost management.

'Good House' Product System and Green Building Technology

Greentown China Holdings' 'Good House' product system and its integration of green building technologies represent a core competency. This system emphasizes quality and sustainability, incorporating elements like prefabricated construction. This strategic focus not only elevates product value but also resonates with growing consumer preferences for environmentally responsible living and adheres to Environmental, Social, and Governance (ESG) imperatives.

The company's dedication to these principles is a significant asset. For instance, by 2024, Greentown China had significantly increased its adoption of green building practices across its developments, with a substantial portion of its new projects meeting stringent environmental certifications. This commitment is crucial for differentiating its offerings in a competitive market and attracting a discerning customer base.

- 'Good House' Product System: A standardized approach to property development focusing on quality, comfort, and health.

- Green Building Technology: Implementation of energy-efficient designs, sustainable materials, and eco-friendly construction methods.

- Prefabricated Technology: Utilization of off-site construction for enhanced efficiency, reduced waste, and improved quality control.

- ESG Alignment: Commitment to environmental protection, social responsibility, and good corporate governance, enhancing brand reputation and long-term value.

Greentown China's key resources include its substantial land bank, strong financial backing, recognized brand, skilled workforce, and innovative product systems. The company's extensive land reserves, particularly in prime urban locations, provide a robust foundation for future development and revenue. Its financial strength and high creditworthiness facilitate access to capital, enabling strategic growth and operational stability.

The company's brand equity, built on quality and customer satisfaction, attracts customers and partners, while its management expertise and skilled employees drive operational excellence. Furthermore, Greentown's 'Good House' product system and embrace of green building technologies differentiate its offerings and align with market trends towards sustainability.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Land Bank | Strategically located land reserves for development. | Approx. 53.2 million sqm saleable area (end of 2023). |

| Financial Capital & Creditworthiness | Strong cash reserves and ability to secure favorable financing. | Secured competitive funding rates in 2024. |

| Brand Reputation | Association with quality, punctuality, and customer satisfaction. | High customer satisfaction levels indicated in 2024 surveys. |

| Human Capital | Expertise in property development, management, and specialized services. | Core intellectual asset driving operational efficiency. |

| Product System & Technology | 'Good House' system and green building technologies, including prefabrication. | Increased adoption of green building practices across developments by 2024. |

Value Propositions

Greentown China is celebrated for its superior residential developments, consistently delivering meticulously crafted homes that often redefine market standards. This dedication to exceptional quality and aesthetic appeal is a cornerstone of their value proposition, attracting buyers who prioritize premium living experiences.

In 2024, Greentown China continued to solidify its reputation by focusing on projects that emphasize sophisticated design and high-end finishes. Their commitment to exquisite craftsmanship ensures that each property offers a unique and desirable living environment, differentiating them in a competitive real estate landscape.

Greentown China's project management segment is a cornerstone of its business, offering clients unparalleled expertise in construction and delivery. This focus ensures projects are completed to the highest quality standards and on time, fostering deep client trust and achieving development objectives.

In 2023, Greentown China reported a robust performance in its property development segment, which is intrinsically linked to its project management capabilities. The company's commitment to delivery excellence underpins its ability to manage complex projects efficiently, contributing to its overall financial health and market reputation.

Greentown China goes beyond just building homes by offering comprehensive urban and living services through its Greentown+ platform. This segment provides smart community management, healthcare access, and educational opportunities, creating a more convenient and enriched lifestyle for its residents.

In 2024, Greentown China continued to emphasize its integrated service solutions, aiming to capture a larger share of the value chain beyond traditional property sales. This focus is crucial as the company navigates a dynamic real estate market, seeking to build stronger customer loyalty and recurring revenue streams.

Reliable and Financially Stable Partner

Greentown China Holdings presents itself as a reliable and financially stable partner, a crucial value proposition for stakeholders navigating the complexities of the property market. This stability is underpinned by a robust financial position, actively managed debt structures, and consistently strong creditworthiness, which collectively reassure partners and investors of the company's enduring capacity.

The company's financial health translates directly into project continuity and a secure investment climate, particularly vital during periods of market volatility. For instance, as of the first half of 2024, Greentown China reported a cash and cash equivalents balance of RMB 49.8 billion, demonstrating significant liquidity. Furthermore, the company maintained a healthy gearing ratio, reflecting prudent financial management.

- Financial Strength: Greentown China's commitment to optimizing its debt structure and maintaining strong credit ratings provides a bedrock of reliability.

- Project Continuity: The company's stable financial footing ensures that projects remain on track, offering partners peace of mind.

- Investment Security: In an unpredictable market, Greentown China's financial stability creates a secure environment for investors.

- Market Confidence: This financial discipline fosters confidence among partners and investors, solidifying Greentown China's reputation as a dependable entity.

Commitment to Green and Healthy Development

Greentown China Holdings actively embeds Environmental, Social, and Governance (ESG) principles into its core operations, championing green building standards and sustainable development methodologies across its portfolio. This commitment translates into tangible value for customers who prioritize environmentally conscious living spaces.

The company's focus on eco-friendly construction and resource efficiency appeals to a growing segment of the market. For instance, in 2024, Greentown continued to emphasize its green building certifications, aiming for higher standards in energy efficiency and material sourcing, which directly addresses consumer demand for healthier and more sustainable homes.

- Green Building Integration: Greentown China Holdings prioritizes the integration of green building practices, such as energy-efficient designs and sustainable material selection, across its residential projects.

- Customer Value Proposition: This commitment offers significant value to customers seeking eco-friendly and healthy living environments, aligning with increasing consumer awareness of environmental impact.

- Stakeholder Appeal: The company's dedication to ESG principles also attracts stakeholders, including investors, who are increasingly focused on sustainable investment opportunities and corporate responsibility.

- Market Differentiation: By championing green and healthy development, Greentown differentiates itself in a competitive real estate market, building brand loyalty and a reputation for responsible development.

Greentown China Holdings excels in creating high-quality, aesthetically pleasing residential developments that cater to discerning buyers. Their commitment to superior craftsmanship and innovative design sets them apart, offering premium living experiences. This focus on excellence ensures properties are not just homes, but desirable living environments.

The company's integrated service model, exemplified by its Greentown+ platform, extends value beyond property sales. By offering comprehensive urban and living services, including smart community management and access to healthcare and education, Greentown fosters enriched lifestyles. This strategy aims to build lasting customer relationships and secure recurring revenue streams.

Greentown China's robust financial management and stability are key value propositions. Maintaining a strong liquidity position, as evidenced by RMB 49.8 billion in cash and cash equivalents by mid-2024, and prudent debt management reassure partners and investors. This financial discipline ensures project continuity and fosters market confidence.

The company's dedication to ESG principles, particularly green building standards, appeals to environmentally conscious consumers. By prioritizing energy efficiency and sustainable materials, Greentown offers healthy living spaces and strengthens its market differentiation. This commitment aligns with growing investor interest in responsible corporate practices.

| Value Proposition | Description | 2024 Focus/Data Point |

|---|---|---|

| Superior Residential Developments | Meticulously crafted homes with exceptional quality and aesthetic appeal. | Continued focus on sophisticated design and high-end finishes. |

| Integrated Urban & Living Services | Comprehensive services via Greentown+ for enriched lifestyles. | Emphasis on capturing value chain beyond sales, building loyalty. |

| Financial Strength & Stability | Reliable partner with strong liquidity and prudent financial management. | RMB 49.8 billion cash & equivalents (H1 2024); healthy gearing ratios. |

| Commitment to ESG & Sustainability | Championing green building standards and environmentally conscious living. | Increased focus on green building certifications and energy efficiency. |

Customer Relationships

Greentown China Holdings places a premium on cultivating robust customer relationships, a cornerstone of its business model. The company consistently achieves high customer satisfaction ratings, a testament to its commitment to quality developments, dependable project timelines, and proactive after-sales support. These efforts translate directly into strong customer loyalty.

This focus on customer satisfaction fuels repeat business and positive word-of-mouth referrals, significantly reducing customer acquisition costs. For instance, in 2024, Greentown China reported a notable increase in repeat purchase rates among its existing client base, underscoring the success of its relationship-building strategies.

Greentown China Holdings excels in delivering tailored solutions and personalized services, particularly for project management and specialized offerings. They craft bespoke strategies to precisely match the unique requirements of government bodies, commercial enterprises, and financial institutions, ensuring client goals are met with exceptional expertise.

Greentown China Holdings actively cultivates a sense of belonging by organizing diverse community events and cultural activities within its developments. This focus on lifestyle enhancement, including integrated living services, aims to create a strong connection between residents and their living environment.

In 2024, the company continued its commitment to community building, with a notable emphasis on enriching resident experiences. This strategic approach is designed to foster loyalty and differentiate Greentown's offerings in a competitive market.

Transparent Investor Relations and Communication

Greentown China Holdings prioritizes transparent investor relations, fostering trust through consistent and clear communication. This commitment is demonstrated through comprehensive annual reports, investor presentations, and dedicated investor relations platforms, ensuring stakeholders are kept abreast of the company's financial health and strategic direction.

- Regular Updates: Greentown provides detailed annual reports and interim financial statements, offering a clear view of its operational and financial performance.

- Direct Engagement: The company actively engages with investors through results presentations, conference calls, and dedicated investor relations channels, facilitating direct dialogue and addressing queries.

- Strategic Clarity: By clearly articulating its strategy and outlook, Greentown empowers investors to make informed decisions, reinforcing confidence in its long-term vision.

Digital Platforms for Customer Interaction

Greentown China Holdings leverages digital platforms as a cornerstone of its customer relationship strategy. By utilizing online channels, the company enhances customer engagement, provides efficient service delivery, and actively collects valuable feedback. This digital-first approach is crucial for maintaining strong connections in today's market.

The company's digital intelligence capabilities allow for personalized interactions and tailored service offerings. In 2024, Greentown reported a significant increase in online customer inquiries and service requests, demonstrating the growing reliance on these platforms. This digital transformation not only improves accessibility but also streamlines the management of customer relationships, leading to greater satisfaction.

- Digital Engagement: Greentown actively uses its online portals and mobile applications to interact with customers, offering property information, sales updates, and after-sales support.

- Service Efficiency: Digital platforms enable faster processing of service requests, maintenance bookings, and payment transactions, improving operational efficiency.

- Feedback Mechanisms: Online surveys and direct messaging features allow Greentown to gather real-time customer feedback, informing service improvements and future development.

- Data-Driven Insights: The company analyzes digital interaction data to understand customer preferences and behavior, enabling more targeted marketing and personalized service.

Greentown China Holdings prioritizes building lasting connections with its customers through a multi-faceted approach. This includes a strong emphasis on quality, timely project delivery, and responsive after-sales service, which in 2024 continued to drive high customer satisfaction and repeat business. The company also fosters community engagement through events and lifestyle enhancements within its developments, aiming to create a sense of belonging.

Leveraging digital platforms is key to their strategy, enabling enhanced customer interaction, efficient service, and valuable feedback collection. This digital focus allows for personalized experiences and data-driven insights into customer behavior, as evidenced by a notable increase in online inquiries and service requests in 2024.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Customer Satisfaction & Loyalty | High satisfaction through quality, timely delivery, and after-sales support. | Drives repeat business and positive referrals. |

| Community Engagement | Organizing events and lifestyle enhancements within developments. | Fosters resident belonging and strengthens brand connection. |

| Digital Engagement & Service | Utilizing online platforms for interaction, service, and feedback. | Increased online inquiries and service requests, improving efficiency. |

Channels

Direct Sales Centers and Project Showrooms are the backbone of Greentown China Holdings' customer engagement strategy, serving as the primary conduit for property transactions. These physical spaces are crucial for allowing prospective buyers to immerse themselves in the tangible quality and architectural vision of Greentown's developments.

Within these centers, dedicated sales professionals interact directly with clients, offering in-depth property details and guiding them through the purchasing process. This direct engagement fosters trust and facilitates smoother transactions, a key element in Greentown's sales model.

In 2024, Greentown China Holdings continued to leverage these physical channels to drive sales, with their extensive network of sales centers playing a vital role in achieving their revenue targets. For instance, their commitment to showcasing product quality through these showrooms contributed to their sustained market presence.

Greentown China Holdings heavily leverages online marketing and digital platforms to connect with its audience. Their company website serves as a primary hub for showcasing projects, offering detailed information, and facilitating customer inquiries.

Social media channels are actively used for brand building and broader outreach, allowing Greentown to engage with potential buyers and share company updates. This digital presence is vital for reaching a wider customer base in today's market.

Greentown China Holdings actively collaborates with a vast network of real estate agencies and brokers. This strategic alliance is crucial for extending their sales reach and ensuring properties are marketed effectively to a wider audience. In 2023, the company continued to leverage these partnerships to tap into diverse customer segments.

These extensive networks offer invaluable access to a broader customer base, often reaching buyers who might not directly engage with Greentown's own sales channels. Furthermore, these partners provide specialized market insights, helping Greentown understand local demand and tailor their offerings more precisely.

Investor Relations and Corporate Communications

Greentown China Holdings utilizes dedicated investor relations channels to foster transparency and engagement with its stakeholders. These channels, including its official website, quarterly and annual financial reports, and investor presentations, are crucial for disseminating information to shareholders, financial analysts, and the broader investment community. This proactive communication strategy aims to build trust and attract capital.

In 2024, Greentown China Holdings continued to prioritize clear and consistent communication. The company's investor relations efforts are designed to provide timely updates on its financial performance, strategic initiatives, and market outlook. This commitment to open dialogue is essential for maintaining investor confidence and supporting the company's valuation.

Key aspects of Greentown China Holdings' investor relations and corporate communications include:

- Official Investor Relations Website: A central hub for all investor-related information, including press releases, financial statements, and corporate governance documents.

- Financial Reporting: Regular publication of audited financial results, adhering to international accounting standards, offering detailed insights into the company's operational and financial health.

- Investor Presentations and Webcasts: Providing platforms for management to discuss performance, strategy, and answer questions from investors and analysts, often accompanied by detailed presentation materials.

- Analyst Briefings and Meetings: Engaging directly with financial analysts to ensure a thorough understanding of the company's business and prospects, facilitating accurate market coverage.

Government Tenders and Commercial Bidding Processes

Greentown China Holdings actively participates in government tenders and commercial bidding processes to secure contracts for large-scale construction and infrastructure projects. This channel is a cornerstone for its project management and capital construction operations, allowing the company to leverage its expertise in developing significant urban and commercial developments.

In 2024, the Chinese government continued to invest heavily in infrastructure and urban renewal, creating a robust market for companies like Greentown. For instance, the Belt and Road Initiative and domestic urbanization plans fuel demand for construction services. Greentown's success in these bidding processes directly translates into revenue streams and project pipelines.

- Government Tenders: Greentown bids on public infrastructure, affordable housing, and urban development projects initiated by various levels of government.

- Commercial Bidding: The company also competes for contracts from large private developers and corporations for commercial complexes, industrial parks, and mixed-use developments.

- Contract Value: Winning these bids provides substantial revenue, with individual projects often valued in the hundreds of millions or even billions of yuan, contributing significantly to Greentown's top-line growth.

- Project Pipeline: Successful bidding ensures a steady flow of projects, underpinning the company's long-term operational planning and resource allocation.

Greentown China Holdings utilizes a multi-channel approach for sales and customer engagement, combining direct interaction with broad digital outreach. Their physical sales centers and showrooms are vital for showcasing property quality and facilitating transactions, with these physical touchpoints playing a key role in their 2024 sales performance.

Complementing their physical presence, Greentown actively engages customers through online marketing and social media platforms, extending their brand reach and facilitating inquiries. Strategic partnerships with real estate agencies and brokers further amplify their sales efforts, accessing a wider customer base and valuable market insights.

Investor relations are managed through a dedicated website, financial reports, and investor presentations, ensuring transparency and building confidence with stakeholders. The company also actively pursues government tenders and commercial bids, securing substantial contracts that fuel its project pipeline and revenue growth, particularly in the infrastructure and urban development sectors.

Customer Segments

Mid-to-high-end individual homebuyers represent a crucial segment for Greentown China, characterized by their pursuit of premium residential properties, particularly in major urban centers. These buyers, often affluent families, prioritize sophisticated architectural design, exceptional construction quality, and integrated lifestyle amenities like green spaces and advanced community facilities. In 2024, the demand for high-quality housing in Tier 1 and key Tier 2 cities remained robust, with developers like Greentown China focusing on projects that cater to these discerning tastes.

Government entities and public sector clients represent a significant customer segment for Greentown China Holdings. These clients, including various levels of government bodies and public institutions, contract Greentown for critical infrastructure development, urban renewal initiatives, and large-scale government construction projects. They prioritize partners with a proven track record of reliability and the capacity to execute projects with substantial social impact.

In 2024, the Chinese government continued its focus on urbanization and infrastructure upgrades. Greentown's involvement in public projects is crucial for realizing these national goals. For instance, government spending on infrastructure projects in China reached trillions of yuan in recent years, highlighting the scale of opportunities within this segment.

Greentown China Holdings serves commercial developers and corporate clients by offering specialized project management for their commercial construction endeavors. These clients, often other real estate firms or large corporations, rely on Greentown's proven track record for efficiency and high-quality outcomes, especially in intricate development projects.

In 2024, Greentown China's commitment to quality and project execution remained a key differentiator for its commercial development services. The company's ability to manage complex projects, such as large-scale commercial complexes or integrated business parks, directly appeals to corporate clients looking to outsource development risks and ensure timely, budget-conscious delivery.

Capital Owners and Financial Institutions

Capital owners and financial institutions, including asset management companies, are key customers for Greentown China Holdings' project management services. These entities are primarily interested in robust pre-investment risk assessment and diligent post-investment management for their real estate portfolios. Their core objective is to mitigate potential financial risks while simultaneously maximizing the value of their assets.

In 2024, the real estate investment landscape continued to emphasize risk management. For instance, the total assets under management by global real estate funds experienced significant growth, underscoring the demand for specialized services that ensure capital preservation and enhanced returns. Greentown's ability to provide these critical functions directly appeals to this segment.

- Risk Mitigation: Financial institutions require comprehensive due diligence and ongoing monitoring to safeguard investments.

- Value Creation: These clients seek strategies that optimize property performance and asset appreciation.

- Portfolio Management: Expertise in managing diverse real estate assets is crucial for institutional investors.

- Regulatory Compliance: Adherence to financial and real estate regulations is a paramount concern for this customer segment.

Existing Property Owners (C-end Owners)

Existing property owners, referred to as C-end Owners, represent a crucial customer segment for Greentown China Holdings as it expands into living technology and home renovation services. These homeowners are actively looking for ways to enhance their living spaces through smart home solutions and integrated lifestyle offerings.

This segment is particularly important for Greentown’s ‘Greentown+’ initiatives, which aim to provide a more comprehensive and technologically advanced living experience. For instance, by 2024, Greentown has been focusing on upgrading its existing property portfolio to incorporate smart home features, directly catering to the evolving needs of these owners.

- Targeted Upgrades: Existing Greentown property owners are the primary audience for home renovation services, including aesthetic improvements and functional enhancements.

- Smart Home Integration: This segment shows increasing demand for smart home technology, such as automated lighting, security systems, and energy management solutions.

- Lifestyle Services: Greentown+ services aim to offer integrated lifestyle solutions, from property management enhancements to community-based services, all designed to appeal to existing homeowners.

- Revenue Diversification: By serving this segment with new offerings, Greentown diversifies its revenue streams beyond initial property sales.

Greentown China Holdings caters to a diverse customer base, with mid-to-high-end individual homebuyers prioritizing premium properties in major cities being a core segment. Government entities and public sector clients represent another vital group, engaging Greentown for infrastructure and urban renewal projects. Additionally, commercial developers and corporate clients leverage Greentown's expertise for their construction needs, while capital owners and financial institutions seek sophisticated project management to mitigate risk and enhance asset value.

Cost Structure

Greentown China Holdings' cost structure heavily features land acquisition and development expenses, representing a substantial initial capital investment for its asset-heavy business model. These costs encompass securing land parcels and the crucial early-stage planning and design phases for new property ventures.

Construction and material costs represent a significant expenditure for Greentown China Holdings, encompassing everything from concrete and steel to the skilled labor and specialized subcontractors needed to bring properties to life. In 2024, managing these expenses effectively is paramount for maintaining healthy profit margins in a competitive real estate market.

For instance, fluctuations in global commodity prices directly impact the cost of raw materials. Greentown's ability to secure favorable pricing for key inputs, combined with efficient project management to minimize waste and optimize labor utilization, directly influences its bottom line.

Financing and interest expenses are a significant component of Greentown China Holdings' cost structure, reflecting the capital-intensive nature of the real estate sector. In 2023, the company reported interest expenses of approximately RMB 4.8 billion, highlighting the substantial cost associated with its borrowings.

Greentown actively works to manage its debt profile, aiming to optimize financing costs and ensure robust cash flow. This strategic approach to debt management is crucial for maintaining financial stability and supporting ongoing development projects.

Operational and Administrative Overheads

Operational and administrative overheads are a significant component of Greentown China Holdings' cost structure, covering the day-to-day running of their hotel and property management businesses, as well as central corporate functions. These costs are essential for maintaining service quality and managing the extensive portfolio.

These expenses include salaries for hotel staff, property managers, and administrative personnel, alongside essential utilities, ongoing maintenance for properties, and general office supplies and expenses. In 2023, Greentown China Holdings reported significant operating expenses, reflecting the scale of its operations across various segments.

- Staff Salaries and Benefits: Covering personnel across hotel operations, property management, and corporate offices.

- Utilities and Maintenance: Costs for electricity, water, gas, and upkeep of all managed properties.

- General and Administrative Expenses: Including office rent, supplies, IT support, and other corporate overheads.

- Property Management Fees: Costs associated with managing third-party properties.

Sales, Marketing, and Brand Promotion Costs

Greentown China Holdings allocates significant resources to its Sales, Marketing, and Brand Promotion Costs. These expenditures are crucial for attracting customers and driving sales volume. The company invests in various marketing campaigns, sales commissions, and the operation of showrooms to enhance customer engagement and product visibility.

In 2024, the company continued to emphasize digital empowerment and marketing transformation. This strategic shift aims to leverage online channels for customer acquisition and retention, optimizing marketing spend and improving reach. The focus on brand building ensures a strong market presence and customer loyalty.

- Marketing Campaigns: Investment in diverse marketing initiatives to reach target demographics.

- Sales Commissions: Performance-based incentives for the sales force to drive revenue.

- Showroom Operations: Costs associated with maintaining physical spaces for product display and customer interaction.

- Brand Promotion: Activities focused on enhancing brand recognition and reputation in the competitive real estate market.

Greentown China Holdings' cost structure is dominated by land acquisition and development, construction, and financing costs. In 2023, interest expenses alone were approximately RMB 4.8 billion, underscoring the capital-intensive nature of its operations. Managing these significant outlays, alongside operational overheads and sales and marketing investments, is key to profitability.

| Cost Category | Description | 2023 Relevance/Impact |

|---|---|---|

| Land Acquisition & Development | Securing land parcels and initial planning/design. | Substantial initial capital investment. |

| Construction & Materials | Concrete, steel, labor, subcontractors. | Directly impacted by commodity prices; efficient management is crucial. |

| Financing & Interest | Costs associated with borrowings. | RMB 4.8 billion in interest expenses in 2023; optimization is ongoing. |

| Operational & Administrative | Staff salaries, utilities, maintenance, G&A. | Essential for service quality and managing extensive portfolios. |

| Sales & Marketing | Campaigns, commissions, showrooms, brand promotion. | Focus on digital transformation in 2024 to optimize spend and reach. |

Revenue Streams

Greentown China's primary revenue source comes from selling the residential and commercial properties it develops through its own investment projects. This segment represents the lion's share of its overall income.

In 2024, Greentown China reported a significant portion of its revenue derived from property sales. For instance, during the first half of 2024, the company achieved a contracted sales value of approximately RMB 55.6 billion, with RMB 43.8 billion of this attributed to self-investment projects, highlighting its core business strength.

Greentown China Holdings generates revenue through project management service fees, offering expertise to government, commercial, and capital construction projects. This approach allows them to operate with an asset-light model, focusing on their management capabilities rather than direct asset ownership.

The fees collected are directly tied to the scope and intricacy of the projects they oversee, ensuring that their compensation reflects the value and complexity of the services provided. For instance, in 2023, Greentown China reported significant revenue streams from these management services, reflecting a growing demand for their project execution capabilities.

Hotel operations represent a key revenue stream for Greentown China Holdings, encompassing income from room bookings, food and beverage sales, and various other hospitality services. This segment diversifies the company's overall income portfolio beyond its core property development activities.

In 2024, the hospitality sector, which Greentown China operates within, continued to show resilience. While specific figures for Greentown's hotel operations in 2024 are not yet fully detailed, the broader industry trend indicated a recovery in travel and leisure spending, suggesting a positive outlook for such revenue streams.

Property Investment Rental Income

Greentown China Holdings generates revenue by leasing out its investment properties, which include office buildings and retail spaces. This strategy provides a consistent and predictable income flow for the company.

This recurring rental income is a key component of their business model, offering stability amidst market fluctuations.

- Property Rental Income: Revenue derived from leasing commercial and residential properties.

- Recurring Revenue Stream: Provides predictable cash flow, enhancing financial stability.

- Portfolio Diversification: Rental income from properties diversifies revenue sources beyond property sales.

Financial and Industrial Chain Service Fees

Greentown China Holdings generates revenue from offering a spectrum of financial and industrial chain services. These services extend beyond traditional property development, catering to clients and partners within the broader real estate sector.

This revenue stream is crucial for diversifying income and leveraging the company's expertise across the entire real estate value chain. For instance, in 2023, Greentown China reported significant income from these specialized services, contributing to its overall financial performance.

- Financial Advisory: Providing expert guidance on real estate financing, investment strategies, and capital raising.

- Supply Chain Management: Offering services related to procurement, logistics, and project management for construction materials and services.

- Property Management and Consulting: Delivering specialized management solutions and strategic advice for property portfolios.

- Technology Integration: Facilitating the adoption of digital solutions within the real estate industrial chain.

Greentown China's revenue streams are diverse, primarily driven by property sales, which formed the core of its business. However, the company also generated income through project management services, hotel operations, property leasing, and a range of financial and industrial chain services.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Property Sales | Revenue from developing and selling residential and commercial properties. | Contracted sales value of approx. RMB 55.6 billion in H1 2024, with RMB 43.8 billion from self-investment projects. |

| Project Management Services | Fees earned for managing construction and development projects for others. | Significant revenue reported in 2023, indicating growing demand for execution capabilities. |

| Hotel Operations | Income from room bookings, F&B, and other hospitality services. | Industry showed resilience in 2024 with recovering travel spending. |

| Property Leasing | Rental income from office buildings and retail spaces. | Provides a consistent and predictable income flow, enhancing financial stability. |

| Financial & Industrial Chain Services | Revenue from financial advisory, supply chain management, and property consulting. | Crucial for diversification and leveraging expertise across the real estate value chain; significant income reported in 2023. |

Business Model Canvas Data Sources

The Greentown China Holdings Business Model Canvas is informed by a blend of financial disclosures, real estate market research, and internal operational data. These sources provide a robust foundation for understanding the company's strategic positioning and market dynamics.