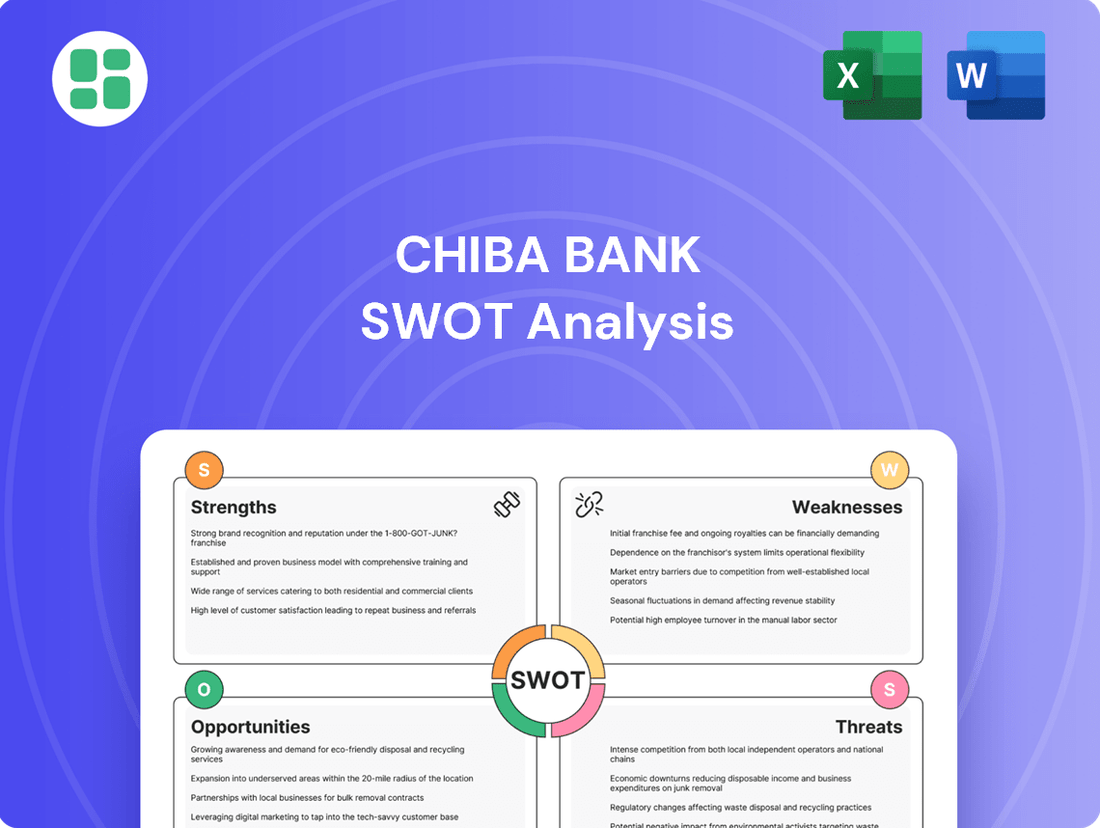

Chiba Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chiba Bank Bundle

Chiba Bank demonstrates strong regional presence and customer loyalty, but faces increasing competition and evolving digital banking demands. Understanding these dynamics is crucial for navigating its future.

What you've seen is just the beginning. Gain full access to a professionally formatted, investor-ready SWOT analysis of Chiba Bank, including both Word and Excel deliverables. Customize, present, and plan with confidence.

Strengths

Chiba Bank commands a formidable presence in Chiba Prefecture, boasting a deeply entrenched customer base and an expansive branch network. Approximately 60% of the prefecture's population are account holders, underscoring its dominant regional market share.

This robust local footprint translates into a significant competitive edge, cultivating strong customer loyalty and a nuanced understanding of the regional economy. The bank's enduring relationships with local businesses and residents ensure a stable foundation of deposits and consistent demand for loans.

Chiba Bank demonstrated robust financial performance in fiscal year 2024. Ordinary income and profit attributable to owners saw substantial increases.

The bank achieved a record high net income for the third consecutive year. Consolidated ROE for FY2024 reached 7.34%, surpassing its mid-term plan target a year early.

Further highlighting this strength, Chiba Bank reported an 8.7% rise in Q1 profit attributable to owners of the parent in August 2025, indicating continued positive momentum.

Chiba Bank's proactive approach to digital transformation is a significant strength. The bank is investing ¥10 billion in digital initiatives for 2024, demonstrating a strong commitment to modernizing its services.

This investment is already yielding results, with the launch of personalized banking features in October 2024. These new features, powered by Moneythor, offer tailored insights and recommendations within the Chibagin App, enhancing customer engagement.

The integration of AI and DX is evident in features like overspending alerts and savings challenges, which directly improve the customer experience by providing actionable financial guidance.

Commitment to Regional Development and Sustainability

Chiba Bank's dedication to regional development is a core strength, evident in its active role in financing and investing in the local economies of Chiba Prefecture and surrounding regions. This commitment extends to sustainability, with the bank establishing a ¥100 billion fund in 2023 specifically to back green projects and climate change mitigation efforts.

Further solidifying its focus on sustainable growth, Chiba Bank implemented executive leadership changes in March and April 2025. These strategic appointments are designed to enhance its sustainability management practices and strengthen its overall strategic operations, underscoring the bank's forward-looking approach to its regional responsibilities.

- Regional Economic Support: Chiba Bank actively finances and invests in local economies, demonstrating a commitment to regional growth.

- Green Investment: Established a ¥100 billion fund in 2023 for green projects and climate change initiatives.

- Leadership for Sustainability: Executive leadership changes in March and April 2025 aim to bolster sustainability management and strategic operations.

Strategic Alliances and Diversification

Chiba Bank is actively building strategic alliances and diversifying its operations to broaden its reach and service offerings. A significant move in this direction was its acquisition of a nearly 20% stake in The Chiba Kogyo Bank Ltd. in March 2025, signaling a commitment to collaborative growth within the regional banking sector.

Leveraging broader partnerships, the bank participates in initiatives like the TSUBASA Alliance. This collaboration aims to foster the development and nationwide deployment of innovative financial services, enhancing its competitive edge across Japan.

Beyond traditional banking, Chiba Bank is strategically expanding into new business domains. The establishment of CHIBACOOL Co., Ltd., a regional trading company, exemplifies this, with a focus on the farm, consulting, and trading sectors, thereby creating new revenue streams and market opportunities.

- Strategic Acquisition: Nearly 20% stake in The Chiba Kogyo Bank Ltd. acquired in March 2025.

- Nationwide Service Development: Participation in the TSUBASA Alliance to create services across Japan.

- New Business Ventures: Establishment of CHIBACOOL Co., Ltd. for farm, consulting, and trading businesses.

Chiba Bank's strong regional presence is a key strength, with approximately 60% of Chiba Prefecture's population holding accounts. This deep penetration fosters customer loyalty and a detailed understanding of the local economic landscape. The bank's financial performance in FY2024 was robust, achieving a record net income for the third consecutive year and a consolidated ROE of 7.34%, exceeding its mid-term plan target. Further demonstrating positive momentum, Q1 profit attributable to owners saw an 8.7% increase in August 2025.

| Metric | FY2024 Result | Change (YoY) |

|---|---|---|

| Consolidated ROE | 7.34% | N/A |

| Q1 Profit Attributable to Owners (Aug 2025) | N/A | +8.7% |

| Regional Account Holders | ~60% of Pref. Population | N/A |

What is included in the product

Delivers a strategic overview of Chiba Bank’s internal and external business factors, highlighting its strengths in regional market presence and opportunities in digital transformation, while acknowledging weaknesses in scale and threats from fintech competition.

Offers a clear, actionable framework for identifying and addressing Chiba Bank's strategic challenges and opportunities.

Weaknesses

Chiba Bank's deep roots in Chiba Prefecture, while a historical strength, also present a significant weakness: concentration risk. This means the bank's performance is heavily tied to the economic health and demographic trends of a single region. For instance, if Chiba Prefecture experiences a major economic downturn, perhaps due to a decline in a key local industry, Chiba Bank would likely feel the impact much more acutely than a bank with a nationwide presence.

This geographic focus inherently limits Chiba Bank's immediate growth avenues. While national banks can tap into diverse markets across Japan, Chiba Bank's expansion is largely confined to its home prefecture. This can hinder its ability to capitalize on broader national economic opportunities or to diversify its risk exposure effectively, making it more vulnerable to localized economic shocks.

The Bank of Japan's shift away from negative interest rates has significantly heightened competition for customer deposits, a trend particularly pronounced with the rise of agile online banks. Regional institutions like Chiba Bank are feeling this pressure, needing to offer compelling rates and seamless digital experiences to keep pace with these new market entrants.

Failure to match the convenience and potential yield offered by digital-first banks could lead to difficulties in both retaining existing deposits and attracting new ones. This competitive dynamic directly impacts funding costs, potentially squeezing Chiba Bank's net interest margins as it strives to maintain a competitive deposit base.

Rising interest rates, a trend observed in many economies including Japan, can pose a significant challenge for regional banks like Chiba Bank. As borrowing becomes more expensive, smaller and less resilient businesses, particularly small and medium-sized enterprises (SMEs), may find it difficult to manage their debt obligations. This increased financial strain on these companies heightens the potential for defaults.

While higher interest rates can generally boost a bank's net interest margin, the flip side is the increased likelihood of non-performing loans. In Japan, SMEs are a crucial part of the economy, and if a substantial number struggle with higher borrowing costs, Chiba Bank could see a rise in its non-performing loan ratio. For instance, if the Bank of Japan continues its monetary tightening, companies with variable rate loans will feel the immediate impact, potentially leading to increased credit-related expenses for Chiba Bank.

Demographic Headwinds and Shrinking Loan Demand

Chiba Bank faces a significant challenge from Japan's aging and shrinking population. This demographic shift directly impacts domestic consumption and labor force expansion, creating a structural headwind for the bank's core lending business. The declining population is projected to reduce overall loan demand, potentially capping long-term growth opportunities within Japan.

The demographic decline presents a clear threat to Chiba Bank's future profitability if not addressed. Without strategic adjustments, the shrinking customer base and reduced economic activity could lead to a sustained erosion of its earnings power.

- Demographic Decline Impact: Japan's population is projected to fall to around 104 million by 2050, a significant drop from current levels, impacting consumer spending and investment.

- Shrinking Loan Market: This demographic trend directly translates to a smaller pool of potential borrowers, limiting the organic growth of Chiba Bank's loan portfolio.

- Profitability Erosion: Without diversification or new market penetration, the bank's reliance on a shrinking domestic market could lead to sustained pressure on net interest margins.

Operational Efficiency and Cost Structure

Despite ongoing digital transformation, Chiba Bank, like many regional banks, may still grapple with operational inefficiencies and a cost structure that's less streamlined than nimble fintech competitors. While the bank has made strides in reducing administrative hours through digitalization, the necessity of maintaining a substantial physical branch network and traditional banking operations can lead to a comparatively higher expense ratio.

For instance, in fiscal year 2023, Chiba Bank reported an operating profit margin of 15.2%, a figure that, while positive, highlights the ongoing challenge of balancing traditional infrastructure costs with the drive for greater efficiency. This can translate into a higher cost-to-income ratio compared to digital-native financial institutions.

- Higher Expense Ratio: Maintaining a large branch network contributes to a higher cost-to-income ratio compared to digital-only competitors.

- Administrative Burden: Despite digitalization, legacy systems and traditional processes can still create administrative overhead.

- Competitive Disadvantage: Fintechs often have lower overheads, allowing them to offer more competitive pricing or invest more heavily in technology.

Chiba Bank's concentrated geographic focus on Chiba Prefecture makes it highly susceptible to regional economic downturns and demographic shifts, limiting its growth potential. The intensifying competition from agile online banks and the pressure to offer competitive deposit rates could squeeze net interest margins. Furthermore, rising interest rates increase the risk of non-performing loans, particularly from SMEs, potentially impacting profitability.

Same Document Delivered

Chiba Bank SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct preview of the comprehensive report covering Chiba Bank's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The Bank of Japan's historic shift away from negative interest rates in March 2024, followed by further policy adjustments, directly benefits Chiba Bank. This policy change allows banks to earn more on their lending activities.

This environment is expected to significantly boost Chiba Bank's net interest income, a core driver of profitability for regional banks. For instance, in the fiscal year ending March 2025, Chiba Bank anticipates a substantial increase in its net interest margin due to these rate adjustments.

Chiba Bank is well-positioned to deepen its digital transformation, particularly by integrating Artificial Intelligence (AI). This strategic move can significantly enhance customer interactions, streamline internal operations, and pave the way for innovative new offerings.

Japan's digital banking sector is on a robust growth trajectory, with projections indicating substantial expansion by 2025. Chiba Bank can capitalize on this by further investing in its mobile banking capabilities and developing AI-powered services. For instance, by 2024, the bank aims to increase its digital transaction volume by 30%, demonstrating a clear commitment to this area.

The bank can expand personalized customer features, offering tailored financial advice and product recommendations driven by AI analytics. Furthermore, exploring emerging business fields such as the Metaverse and Banking-as-a-Service (BaaS) presents opportunities to create new revenue streams and adapt to evolving market demands.

The Japanese regional banking sector is experiencing a significant push towards consolidation, with regulators like the Financial Services Agency actively encouraging mergers to create stronger, more efficient institutions. This environment presents a clear opportunity for Chiba Bank to pursue strategic mergers and acquisitions.

Chiba Bank's existing strategy, demonstrated by its stake acquisition in Chiba Kogyo Bank, highlights its readiness to leverage M&A for growth. Such moves can help Chiba Bank achieve greater economies of scale, acquire specialized expertise, and diversify its service offerings into areas like investment banking or business matchmaking, thereby enhancing its competitive position.

This ongoing consolidation trend is a prime avenue for Chiba Bank to expand its market share and build a more robust financial institution, better equipped to navigate the evolving landscape of Japanese finance.

Leveraging Regional Revitalization Initiatives and Non-Financial Services

Chiba Bank is actively engaging in regional revitalization by offering more than just financial products. They are providing non-financial support and advisory services to help local communities thrive. This includes backing green initiatives and offering decarbonization solutions, demonstrating a commitment to addressing regional challenges directly.

A key example of this strategy is the establishment of CHIBACOOL Co., Ltd., a regional trading company. This venture diversifies Chiba Bank's revenue streams and solidifies its role as a community partner. By supporting projects like this, the bank reinforces its core purpose of contributing to the resolution of regional issues.

- Diversifying Revenue: CHIBACOOL Co., Ltd. represents a move into non-traditional banking services, aiming to create new income sources.

- Community Impact: The bank's involvement in green projects and decarbonization solutions directly addresses environmental and economic needs within its operating regions.

- Strategic Alignment: These initiatives are consistent with Chiba Bank's stated mission to contribute to the resolution of regional issues, fostering deeper community relationships.

Expansion into Adjacent Markets and Nationwide Alliances

Chiba Bank can significantly boost its growth by looking beyond its home prefecture. A key opportunity lies in expanding its loan business into neighboring growth regions, leveraging its established financial expertise. For instance, opening new corporate banking offices in Tokyo, a major economic hub, allows Chiba Bank to tap into the vast opportunities present in the metropolitan area, enhancing its market reach and revenue streams.

Furthermore, Chiba Bank can act as a platformer by forging strategic alliances, such as its participation in the TSUBASA Alliance. This collaborative approach enables the bank to offer a wider array of services and reach a broader customer base without the need for extensive physical expansion. Such partnerships are crucial for developing innovative financial solutions and capturing new market segments, as demonstrated by the increasing trend of interbank collaborations in Japan's evolving financial landscape.

- Geographic Diversification: Expanding loan operations and corporate banking offices into areas like Tokyo allows Chiba Bank to tap into higher-growth economic zones outside its traditional base.

- Platformer Strategy: Alliances like the TSUBASA Alliance enable Chiba Bank to offer expanded services and reach new customer segments by leveraging shared infrastructure and expertise.

- Market Reach Enhancement: By strategically placing new offices in metropolitan growth areas, Chiba Bank can more effectively capture business opportunities and increase its overall market penetration.

The Bank of Japan's policy shift in March 2024, moving away from negative interest rates, is a significant tailwind for Chiba Bank, directly improving its lending profitability. This environment is projected to substantially boost Chiba Bank's net interest income, a key profit driver for regional banks, with an anticipated rise in net interest margin for the fiscal year ending March 2025.

Chiba Bank's strategic embrace of digital transformation, particularly through AI integration, offers a pathway to enhanced customer experiences and operational efficiencies. The bank aims to increase its digital transaction volume by 30% by 2024, aligning with the robust growth projected for Japan's digital banking sector through 2025.

The ongoing consolidation within Japan's regional banking sector, actively encouraged by regulators, presents a prime opportunity for Chiba Bank to pursue strategic mergers and acquisitions. This can lead to greater economies of scale and diversified service offerings, as evidenced by its stake acquisition in Chiba Kogyo Bank.

Chiba Bank's expansion into non-financial services, such as through CHIBACOOL Co., Ltd., diversifies revenue streams and strengthens its role as a community partner, directly addressing regional issues and supporting initiatives like decarbonization.

Threats

The global economic landscape in 2024 and early 2025 is marked by persistent threats such as a potential economic slowdown, the resurgence of inflation, and significant turbulence in financial and real estate markets. These macroeconomic headwinds, coupled with ongoing geopolitical uncertainties, directly impact Chiba Bank's operations. For instance, a slowdown can dampen loan demand, while market volatility can affect investment portfolio values.

Chiba Bank's foreign exchange business is particularly susceptible to these global economic and geopolitical shifts. Fluctuations in currency markets driven by international tensions or economic downturns can create significant risks. Furthermore, persistent geopolitical uncertainties can disrupt international trade and investment flows, indirectly affecting the bank's overall financial stability and growth trajectory.

Rising interest rates, while potentially boosting net interest income, also heighten the risk of corporate bankruptcies, especially for smaller and midsize businesses that regional banks like Chiba Bank often serve. This trend could lead to a significant increase in credit costs and non-performing loans for the bank.

The Bank of Japan's shift away from negative interest rates, with the policy rate moving from -0.1% to 0-0.1% in March 2024, signals a new environment where borrowing costs are no longer suppressed. This change directly impacts the financial health of companies, particularly those with less robust balance sheets.

For Chiba Bank, this means a greater likelihood of defaults among its corporate borrowers. The uneven impact of these higher borrowing costs on corporate financial conditions presents a substantial challenge, potentially requiring increased provisions for loan losses and impacting profitability.

Chiba Bank confronts significant rivalry from both established megabanks and nimble fintech disruptors. Megabanks are channeling substantial capital into international expansion and digital upgrades, a trend mirrored by fintechs who are rapidly introducing innovative, cost-effective digital solutions. This competitive landscape poses a direct challenge to Chiba Bank's market position, especially in areas like digital banking and revenue streams derived from fees.

Demographic Decline and its Long-Term Impact

Japan's ongoing demographic decline, marked by an aging and shrinking population, presents a substantial long-term hurdle for Chiba Bank. This persistent trend is projected to dampen domestic consumption and slow labor market expansion, directly impacting loan demand and the overall size of the bank's balance sheet. For instance, Japan's total population fell by 595,000 in 2023, the largest drop on record, and projections indicate this decline will continue, potentially impacting future lending volumes.

The shrinking customer base and reduced economic activity stemming from an aging society could lead to a sustained decrease in profitability for Chiba Bank. While current medium-term factors like rising interest rates might offer some relief, the fundamental demographic shift poses a significant threat to long-term revenue generation and market share. The number of individuals aged 65 and over in Japan reached 36.2 million in September 2023, accounting for a record 29.9% of the total population, underscoring the scale of the aging challenge.

- Shrinking Loan Demand: Fewer young people and a declining workforce mean fewer potential borrowers for mortgages, business loans, and consumer credit.

- Reduced Consumption: An aging population generally consumes less, impacting businesses and, consequently, their need for financing.

- Labor Shortages: A smaller working-age population can lead to labor shortages, hindering business growth and investment opportunities for banks.

- Increased Social Security Burden: A larger elderly population places greater demands on social security systems, potentially impacting government spending and the overall economic environment.

Cybersecurity Risks and System Failures

Chiba Bank, like all financial institutions, faces escalating cybersecurity threats as digital operations and outsourcing become more prevalent. Sophisticated cyberattacks are a constant concern, posing a significant risk to the bank's operational integrity.

A major cyber incident or system failure could lead to severe disruptions, erode customer confidence, and incur substantial financial penalties. For instance, the global financial sector experienced an estimated $1.56 trillion in losses due to cybercrime in 2023, highlighting the magnitude of these risks.

Ensuring a robust and dependable technological infrastructure is therefore paramount for Chiba Bank's continued success and stability.

- Heightened Cyber Threats: Increased reliance on digital platforms and third-party vendors exposes Chiba Bank to more complex and advanced cyberattacks.

- Operational and Reputational Impact: A significant cyberattack or system outage could halt operations, damage customer trust, and result in considerable financial losses.

- Infrastructure Security: Maintaining a secure and reliable financial infrastructure is a critical necessity for mitigating these threats.

Chiba Bank faces intense competition from larger banks investing heavily in digital transformation and from agile fintech companies offering innovative, cost-effective solutions. This rivalry challenges its market share, particularly in digital services and fee-based revenue streams.

The Bank of Japan's move away from negative interest rates in March 2024, with the policy rate shifting to 0-0.1%, increases borrowing costs. This change poses a significant threat to Chiba Bank, as it could lead to higher default rates among its corporate clients, particularly smaller and mid-sized businesses, potentially increasing credit costs and non-performing loans.

Japan's demographic decline, with its population shrinking and aging rapidly, presents a substantial long-term threat. This trend is projected to reduce loan demand and economic activity, impacting Chiba Bank's future revenue generation and market share. In 2023, Japan's population fell by a record 595,000, and the proportion of those aged 65 and over reached 29.9% in September 2023.

Escalating cybersecurity threats due to increased digital operations and outsourcing pose a significant risk to Chiba Bank's operational integrity and customer trust. A major cyber incident could lead to severe disruptions and substantial financial penalties, with global financial sector losses from cybercrime estimated at $1.56 trillion in 2023.

SWOT Analysis Data Sources

This Chiba Bank SWOT analysis is built upon a foundation of robust data, drawing from the bank's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.