Chiba Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chiba Bank Bundle

Chiba Bank navigates a competitive landscape shaped by moderate rivalry and the potential for new entrants, while customer loyalty and the threat of substitutes present distinct challenges. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Chiba Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chiba Bank's reliance on specialized IT infrastructure and software providers for its core banking systems, digital platforms, and cybersecurity presents a significant area of supplier power. The unique and complex nature of these technologies often means a limited number of vendors can offer the required solutions, granting them considerable leverage. This is particularly true when switching costs are substantial, making it difficult and expensive for Chiba Bank to change providers.

For instance, the global IT services market, which includes core banking software and cybersecurity solutions, was projected to reach over $1.3 trillion in 2024. Within this vast market, specialized providers for financial institutions often operate with higher margins due to the specific regulatory and security demands. If Chiba Bank faces a situation where a critical system is provided by a vendor with few alternatives, that supplier's bargaining power is amplified.

This dependency highlights the need for robust vendor relationship management. Chiba Bank must actively cultivate strong partnerships and explore strategies to mitigate this supplier power. One such strategy could involve investing in developing more in-house IT capabilities or seeking multi-vendor solutions where feasible, thereby reducing over-reliance on any single specialized provider.

Skilled financial professionals, especially in data analytics, AI, cybersecurity, and international finance, are crucial 'suppliers' for Chiba Bank. A scarcity of such talent in Japan, exacerbated by an aging demographic, significantly boosts their bargaining power. This translates to higher recruitment expenses and competitive salary demands for the bank.

In 2024, the demand for AI and data science specialists in Japan’s financial sector saw a notable increase, with average salaries for these roles rising by an estimated 10-15% year-on-year according to recruitment firm data. This trend highlights the growing leverage of these highly sought-after professionals.

To counter this, Chiba Bank needs to prioritize robust talent development programs and implement effective retention strategies. This proactive approach is essential for securing and maintaining a stable, skilled workforce capable of driving the bank's future growth and innovation.

Providers of real-time financial data, market intelligence, and credit rating services wield significant influence. Chiba Bank, like many financial institutions, depends heavily on these services for crucial risk assessment, informed investment choices, and meeting stringent regulatory requirements. For instance, the global financial data market was valued at approximately USD 30 billion in 2023 and is projected to grow, indicating the essential nature of these inputs.

The proprietary nature of certain data sets and the industry's established reliance on a limited number of key providers can restrict Chiba Bank's options. This lack of readily available alternatives can translate into higher subscription fees for essential services, directly impacting the bank's operational costs.

Payment Network and Infrastructure Operators

Payment network and infrastructure operators, such as those managing national interbank clearing systems and international messaging services like SWIFT, hold significant bargaining power. Chiba Bank's reliance on these networks for essential transaction processing means operators can influence costs through fee structures. In 2024, the global financial infrastructure landscape continued to consolidate, with a few key players dominating critical payment rails, further concentrating power.

Chiba Bank's participation in these payment networks is a necessity for its core banking functions, effectively making the operators indispensable. This dependence grants these infrastructure providers leverage. For instance, SWIFT, a critical international messaging network, operates on a cooperative model where member banks have a say, but its foundational role gives it inherent influence over operational standards and pricing.

- Essential Reliance: Chiba Bank requires access to national and international payment networks for all its transactional activities.

- Cost Influence: Operators of these networks can impact Chiba Bank's operational costs through their fee schedules.

- Market Structure: The often regulated or quasi-monopolistic nature of these infrastructure providers concentrates bargaining power.

- Operational Impact: The reliability and efficiency of these networks directly affect Chiba Bank's ability to deliver services to its customers.

Real Estate and Branch Network Providers

Chiba Bank, like many regional banks, has historically depended on its physical branch network. This reliance means that landlords and real estate developers in key areas of Chiba Prefecture can hold significant bargaining power, particularly when it comes to securing prime locations for new or relocated branches. For instance, in 2023, the average rent for commercial property in central Tokyo, a benchmark for prime locations, saw an increase, indicating a general upward trend in real estate costs that could impact banks with extensive physical footprints.

However, the banking landscape is rapidly evolving. The increasing adoption of digital banking services by customers is gradually lessening the absolute necessity of a widespread physical presence. As more transactions and customer interactions shift online, the bargaining power of real estate providers for branch locations may diminish over time. This trend is supported by data showing a consistent rise in mobile banking adoption, with a significant percentage of Japanese bank customers utilizing these services for daily transactions.

- Branch Network Reliance: Chiba Bank's historical dependence on physical branches gives landlords leverage in prime locations.

- Real Estate Market Influence: Rising commercial rents, as seen in major Japanese cities in 2023, can increase costs for branch expansion or retention.

- Digital Shift Impact: Growing customer preference for digital banking services may reduce the long-term bargaining power of real estate providers for branch sites.

- Evolving Needs: As digital channels become more dominant, the strategic importance of physical branch locations might decrease, altering supplier dynamics.

Chiba Bank's reliance on specialized IT infrastructure and software providers for its core banking systems, digital platforms, and cybersecurity presents a significant area of supplier power. The unique and complex nature of these technologies often means a limited number of vendors can offer the required solutions, granting them considerable leverage, especially when switching costs are substantial.

Skilled financial professionals, particularly in areas like AI and cybersecurity, are crucial 'suppliers' for Chiba Bank. A scarcity of such talent in Japan, compounded by demographic shifts, significantly boosts their bargaining power, leading to higher recruitment expenses and competitive salary demands. For instance, demand for AI specialists in Japan's financial sector saw a notable increase in 2024, with average salaries rising by an estimated 10-15%.

Providers of essential financial data and market intelligence also hold considerable influence. Chiba Bank depends on these services for risk assessment and regulatory compliance. The global financial data market, valued at approximately USD 30 billion in 2023, highlights the critical nature of these inputs, and proprietary data sets can further limit options and increase costs.

Payment network operators, managing critical interbank clearing and international messaging services, possess significant bargaining power. Chiba Bank's necessity for these networks for transaction processing means operators can influence costs through their fee structures. The consolidation in the global financial infrastructure landscape in 2024 further concentrated power among key players.

| Supplier Category | Key Dependence for Chiba Bank | Impact of Supplier Power | 2024 Market Trend/Data Point |

|---|---|---|---|

| IT Infrastructure & Software | Core banking, digital platforms, cybersecurity | Limited vendor options, high switching costs | Global IT services market projected over $1.3 trillion |

| Skilled Financial Talent | AI, data analytics, cybersecurity, international finance | Increased recruitment costs, competitive salaries | 10-15% year-on-year salary increase for AI specialists in Japan's finance sector |

| Financial Data Providers | Market intelligence, risk assessment, regulatory compliance | Higher subscription fees, limited alternatives | Global financial data market valued at approx. USD 30 billion in 2023 |

| Payment Network Operators | Transaction processing, interbank clearing, international messaging | Fee structure influence, operational standard setting | Consolidation in global financial infrastructure |

What is included in the product

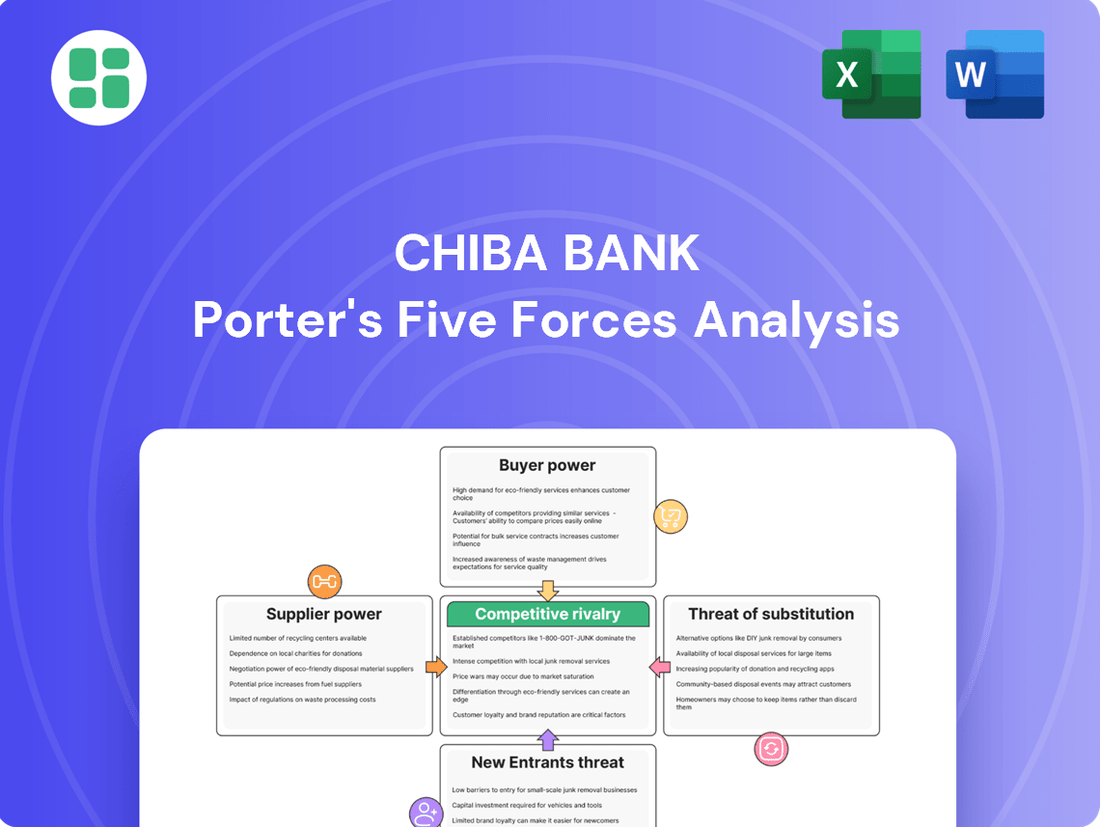

This analysis of Chiba Bank's competitive environment examines the bargaining power of its customers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

Instantly identify and address competitive threats with a clear, actionable overview of Chiba Bank's Porter's Five Forces, simplifying strategic planning.

Customers Bargaining Power

Chiba Bank's diverse customer base, ranging from individual retail clients to large corporations, significantly influences its bargaining power. While individual customers typically hold less sway due to their smaller transaction volumes, major corporate clients and institutional investors can exert considerable pressure. For instance, in 2023, large corporate loans often involve substantial sums, allowing these entities to negotiate more favorable interest rates and terms, directly impacting the bank's profitability on those deals.

For many basic banking services, like opening a savings account or taking out a small personal loan, retail customers in Japan can switch banks with relative ease. This is largely due to the increasing prevalence of digital banking platforms, which streamline the account opening and transfer processes. In 2023, a significant portion of new account openings for major Japanese banks occurred through online channels, highlighting this trend.

This low barrier to switching significantly boosts the bargaining power of individual customers. It means Chiba Bank must constantly strive to offer attractive interest rates, superior customer service, and user-friendly digital tools to keep its retail customers from moving to a competitor. For instance, in early 2024, several Japanese banks adjusted their savings account interest rates upwards in response to market competition, directly reflecting this customer power.

Chiba Bank's strategy to counteract this involves leveraging its strong regional presence and deep community ties. By fostering loyalty through personalized service and local engagement, the bank aims to retain customers based on relationships and trust, not just on transactional convenience or rates. This community focus is a key differentiator in a market where digital alternatives are readily available.

Customers today have unprecedented access to information thanks to digital tools. Online comparison sites and banking apps allow consumers to easily check interest rates, fees, and the full range of services offered by different banks. This makes it much harder for any single bank to command premium pricing without offering superior value. For instance, in 2023, the average number of financial comparison websites visited per user in Japan increased by 15%, highlighting this trend.

This heightened transparency directly fuels price competition. Customers can quickly identify which banks offer the best terms, putting pressure on institutions like Chiba Bank to offer competitive rates and fees. Failing to do so means customers will simply move their business elsewhere. In 2024, consumer surveys indicated that over 60% of individuals consider fees and interest rates as the primary factors when choosing a bank.

To counter this, Chiba Bank needs to go beyond just competing on price. Communicating its unique value proposition, whether through exceptional customer service, innovative digital solutions, or specialized financial advice, becomes crucial. Differentiating itself in ways that matter to customers, beyond just the cost of services, is key to retaining and attracting business in this transparent environment.

Availability of Alternative Financial Institutions

Customers in Japan have a broad spectrum of financial institutions to choose from, including large city banks, other regional banks, credit unions, and the growing number of online-only banks. This extensive selection significantly amplifies customer bargaining power.

With so many alternatives readily available, customers can easily switch to a competitor if Chiba Bank's products or services are perceived as less competitive. For instance, in 2023, the number of financial institutions in Japan continued to consolidate, yet the diversity of options remained substantial, with over 200 regional banks operating alongside major national players and digital challengers.

- Abundant Choices: Customers can select from major city banks, regional banks, credit unions, and online banks.

- Ease of Switching: Customers can readily move their business if Chiba Bank's offerings are not competitive.

- Competitive Pressure: The wide availability of alternatives forces Chiba Bank to maintain competitive pricing and service quality.

Growing Sophistication of Corporate Clients

Large corporate and institutional clients are increasingly sophisticated, often possessing in-house financial expertise. This allows them to bypass regional banks like Chiba Bank by accessing capital markets directly, for instance, through issuing their own bonds. In 2023, Japanese corporate bond issuance reached ¥41.5 trillion, demonstrating this trend.

This growing self-sufficiency significantly enhances their bargaining power. They can negotiate for highly customized services, preferential interest rates, and more flexible financing terms. For example, a major corporation might leverage its strong credit rating to secure a lower borrowing cost than a regional bank can offer independently.

To retain these valuable clients, Chiba Bank must move beyond traditional lending. Offering specialized advisory services, such as M&A support or international expansion strategies, becomes crucial. Providing value-added, non-financial solutions is key to differentiating and maintaining relationships in a competitive landscape.

- Sophisticated Clients: Large corporations possess advanced financial knowledge.

- Direct Capital Access: Companies increasingly issue bonds directly, bypassing regional banks.

- Negotiating Power: Clients demand tailored services, lower rates, and flexible terms.

- Chiba Bank's Response: Offering specialized advisory and non-financial solutions is vital.

Chiba Bank faces significant customer bargaining power due to the increasing ease of switching, a wide array of choices, and a growing demand for personalized services from sophisticated clients.

The digital transformation in Japanese banking, with online platforms facilitating account transfers, has lowered switching costs for retail customers. In 2023, a substantial portion of new bank accounts were opened digitally, underscoring this trend.

Furthermore, the availability of numerous financial institutions, including major city banks, other regional banks, and online banks, intensifies competition. This forces Chiba Bank to offer competitive rates and superior service quality to retain its customer base.

Large corporate clients, armed with financial expertise and direct access to capital markets, can negotiate more favorable terms and seek specialized advisory services, putting pressure on regional banks to offer value beyond traditional lending.

| Factor | Impact on Chiba Bank | 2023/2024 Data Point |

|---|---|---|

| Ease of Switching (Retail) | Increases customer bargaining power. | Digital account openings rose significantly in 2023. |

| Availability of Alternatives | Forces competitive pricing and service. | Over 200 regional banks operate in Japan alongside national and digital players. |

| Customer Information Access | Drives price competition. | Visits to financial comparison sites increased by 15% in 2023. |

| Sophistication of Corporate Clients | Leads to demand for specialized services and direct capital access. | Japanese corporate bond issuance reached ¥41.5 trillion in 2023. |

What You See Is What You Get

Chiba Bank Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Chiba Bank, offering an in-depth examination of competitive forces within the Japanese banking sector. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any alterations or placeholders.

Rivalry Among Competitors

The Japanese banking sector is a mature and saturated landscape, marked by sluggish growth and a substantial presence of established institutions, including megabanks and numerous regional banks. This intense saturation fuels fierce competition for market share, especially in core areas like lending and deposit acquisition.

In 2023, the net interest income for Japanese banks generally saw an uptick due to rising interest rates, but overall loan growth remained modest. For instance, while specific figures for Chiba Bank's market share are proprietary, the broader industry trend shows intense competition, with major players like Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group holding significant sway.

Chiba Bank, as a prominent regional player, constantly navigates this environment, facing persistent pressure to distinguish its offerings and embrace innovation to maintain and grow its customer base amidst this crowded market.

Chiba Bank faces intense competition from Japan's major megabanks, such as MUFG, SMBC, and Mizuho. These giants possess substantial financial resources, extensive nationwide branch networks, and a comprehensive suite of financial products, allowing them to exert significant competitive pressure even in regional markets like Chiba Prefecture.

The sheer scale and diverse offerings of megabanks enable them to potentially provide more attractive interest rates and a wider array of services, directly challenging regional banks like Chiba Bank. For instance, as of the fiscal year ending March 2024, the combined total assets of MUFG, SMBC, and Mizuho exceeded ¥600 trillion, underscoring their formidable market presence and capacity to compete aggressively.

Chiba Bank operates in a Japanese regional banking landscape marked by significant consolidation. Demographic shifts, increasing technology investment needs, and the recent shift away from negative interest rates are accelerating mergers and acquisitions. This trend means Chiba Bank faces a dynamic competitive environment where larger, more powerful regional entities may emerge, or smaller banks might be compelled to merge or adopt niche strategies to survive.

Fintech and Digital Disruptors

Fintech and digital disruptors are significantly intensifying competitive rivalry for Chiba Bank. Companies like SBI Sumishin Net Bank and Rakuten Bank, for instance, have been steadily gaining market share in Japan. In 2023, SBI Sumishin Net Bank reported a net profit of ¥113.7 billion, showcasing their growing financial strength and ability to compete effectively.

These agile new entrants often leverage innovative technologies to offer streamlined, user-friendly digital services, particularly in areas like consumer lending and payment solutions. This pressure compels established players like Chiba Bank to accelerate their own digital transformation efforts, as seen in Chiba Bank's stated commitment to digital innovation.

- Fintechs offer specialized, often lower-cost digital services.

- Digital-only banks are rapidly expanding their customer bases.

- Traditional banks must invest heavily in technology to keep pace.

- Customer expectations for digital convenience are rising.

Interest Rate Environment Shift

The Bank of Japan's historic decision in March 2024 to end its negative interest rate policy has reshaped the competitive landscape for banks like Chiba Bank. This pivot away from ultra-loose monetary policy is expected to boost net interest margins, a key profitability metric for financial institutions. For instance, a 0.1% increase in the policy rate can translate to a significant uplift in a bank's net interest income, depending on its balance sheet structure.

However, this shift also fuels more intense rivalry for customer deposits. As interest rates rise, banks are compelled to offer more appealing savings account rates to attract and retain funding. This competition can compress margins if not managed effectively. Furthermore, higher borrowing costs can strain financially weaker businesses, potentially leading to increased default rates and impacting regional banks disproportionately.

- Increased Deposit Competition: Banks must offer higher rates to attract and retain deposits, intensifying competition for funding.

- Net Interest Margin Improvement: The move away from negative rates offers potential for improved profitability through wider net interest margins.

- Credit Risk Escalation: Higher interest rates may increase bankruptcies among weaker companies, posing a credit risk challenge for banks.

Competitive rivalry for Chiba Bank is intense, stemming from both large megabanks and agile fintechs. The Japanese banking sector's maturity means established players like MUFG, with over ¥300 trillion in total assets as of March 2024, exert considerable pressure through scale and broad service offerings.

Fintechs, such as SBI Sumishin Net Bank, which reported a net profit of ¥113.7 billion in 2023, are rapidly gaining traction with digital-first strategies. This forces traditional banks like Chiba Bank to invest heavily in technology to remain competitive and meet evolving customer expectations for seamless digital experiences.

The end of negative interest rates in March 2024 has further intensified rivalry, particularly for customer deposits, as banks compete to offer more attractive rates. This dynamic environment necessitates continuous innovation and strategic differentiation for regional banks to thrive.

SSubstitutes Threaten

Large corporations increasingly bypass traditional bank loans by tapping into direct capital markets. In 2024, global corporate bond issuance reached record highs, with companies like Apple and Microsoft raising hundreds of billions through bond sales, directly competing with bank lending for Chiba Bank's large corporate clients.

This trend forces Chiba Bank to re-evaluate its strategies, potentially shifting focus towards small and medium-sized enterprises (SMEs) and individual clients where direct capital market access is less prevalent. Alternatively, the bank could enhance its advisory services, guiding larger clients through the complexities of capital market navigation.

Non-bank fintech companies present a significant threat of substitutes for Chiba Bank. Digital payment solutions like PayPay and Line Pay offer convenient alternatives to traditional bank transfers and card payments. For instance, PayPay reported over 60 million registered users in Japan by early 2024, demonstrating its widespread adoption and ability to divert transaction volume from banks.

Furthermore, peer-to-peer lending platforms provide alternative financing options, especially for small businesses and individuals seeking loans. These platforms can bypass conventional bank lending processes, potentially reducing Chiba Bank's market share in the lending sector. This erosion of fee income and lending opportunities directly impacts the bank's revenue streams.

For individuals and institutions looking to grow their savings, investment trusts, mutual funds, and direct stock purchases present viable alternatives to traditional bank deposits. These products offer the potential for higher returns, especially as interest rate environments shift.

In Japan, there's a notable trend of a 'shift from savings to investment,' particularly as interest rates begin to rise. This encourages customers to consider moving funds from lower-yielding bank accounts into these alternative investment vehicles, potentially impacting Chiba Bank's deposit base.

For instance, in fiscal year 2023, Japanese households held approximately ¥1,100 trillion in financial assets, with a significant portion still in cash and deposits. However, the push for investment diversification suggests a growing appetite for products that can offer better yields than traditional savings accounts.

Credit Unions and Non-Bank Financial Institutions

Credit unions and a growing number of non-bank financial institutions present a significant threat of substitutes for Chiba Bank. These organizations offer a spectrum of financial products, including loans and deposit accounts, often with competitive rates or specialized services that can attract segments of Chiba Bank's clientele. For instance, fintech lenders and peer-to-peer platforms are increasingly providing alternative financing options, directly competing for loan origination business.

These substitutes often target specific customer needs or geographic areas, creating viable alternatives for certain customer segments. For example, community-focused credit unions might appeal to individuals seeking more personalized service or those prioritizing cooperative ownership models. By mid-2024, the total assets of Japanese credit cooperatives were reported to be around ¥60 trillion, indicating a substantial market presence that offers a real alternative to traditional banking services.

- Niche Specialization: Credit unions and non-bank lenders often focus on specific customer segments or loan types, such as small business loans or mortgages, offering tailored products that may be more attractive than Chiba Bank's broader offerings.

- Competitive Pricing: Some non-bank institutions, particularly those with lower overheads or specialized technology, can offer more competitive interest rates on loans or higher yields on deposits.

- Technological Innovation: Fintech companies are rapidly introducing innovative digital platforms for banking and lending, providing convenient and user-friendly alternatives that can draw customers away from traditional branch-based services.

Crowdfunding and Alternative Funding Models

Crowdfunding and alternative financing models present a growing threat to traditional bank lending. Platforms like Kickstarter and SeedInvest allow businesses, especially startups and SMEs, to secure capital directly from a large number of individuals, bypassing conventional bank requirements. This is particularly relevant for ventures that may not fit the risk profiles of traditional lenders.

In 2023, the global crowdfunding market was valued at approximately $21.4 billion, with projections indicating continued growth. This indicates a significant pool of capital accessible outside of traditional banking channels, directly impacting Chiba Bank's market share for business financing.

- Crowdfunding Platforms: Offer alternative capital sources for businesses unable to secure traditional bank loans.

- Market Growth: The global crowdfunding market reached $21.4 billion in 2023, demonstrating a substantial alternative to bank financing.

- Niche but Growing Threat: While currently a smaller segment, these models represent an increasing competitive force for Chiba Bank in capital provision.

The threat of substitutes for Chiba Bank is substantial, encompassing direct capital markets, fintech innovations, and alternative financing models. Large corporations increasingly access capital markets directly, bypassing traditional bank loans. For instance, global corporate bond issuance in 2024 saw record highs, with major companies raising significant funds independently.

Fintech companies like PayPay and Line Pay offer convenient digital payment alternatives, diverting transaction volume from banks, with PayPay alone boasting over 60 million users in Japan by early 2024. Furthermore, peer-to-peer lending platforms and crowdfunding sites provide alternative financing, particularly impacting Chiba Bank's loan origination business and fee income.

Individuals are also shifting savings towards investment trusts and direct stock purchases for potentially higher returns, especially as interest rates fluctuate. In fiscal year 2023, Japanese households held around ¥1,100 trillion in financial assets, with a growing appetite for investment diversification beyond traditional bank deposits.

Credit unions and non-bank financial institutions also pose a threat by offering competitive rates and specialized services. The total assets of Japanese credit cooperatives reached approximately ¥60 trillion by mid-2024, representing a significant alternative market presence.

| Substitute Category | Examples | Impact on Chiba Bank | Market Data/Trends |

|---|---|---|---|

| Direct Capital Markets | Corporate Bonds, Equity Offerings | Reduced demand for traditional bank loans from large corporations. | Record high global corporate bond issuance in 2024. |

| Fintech & Digital Payments | PayPay, Line Pay, P2P Lending Platforms | Loss of transaction volume, reduced lending opportunities, erosion of fee income. | PayPay exceeded 60 million users in Japan by early 2024. |

| Alternative Investments | Investment Trusts, Mutual Funds, Direct Stock Purchases | Potential decrease in bank deposits as customers seek higher yields. | Japanese households held ¥1,100 trillion in financial assets in FY2023, with growing investment diversification. |

| Non-Bank Financial Institutions | Credit Unions, Fintech Lenders | Competition for deposit accounts and loan origination, particularly in niche segments. | Japanese credit cooperatives held ~¥60 trillion in assets by mid-2024. |

Entrants Threaten

The banking sector in Japan, overseen by the Financial Services Agency (FSA), presents substantial regulatory hurdles. These include rigorous capital adequacy ratios, complex licensing processes, and extensive compliance mandates. For instance, as of early 2024, Japanese banks are generally required to maintain a Common Equity Tier 1 (CET1) ratio well above the Basel III minimums, often exceeding 10%, a significant capital outlay for newcomers.

These stringent requirements act as a formidable barrier to entry for new players looking to establish a traditional banking presence. The sheer cost and complexity associated with meeting these regulatory obligations effectively limit the number of potential new competitors, thereby shielding incumbent institutions like Chiba Bank from immediate, widespread new threats.

The banking sector, including institutions like Chiba Bank, demands immense capital. For instance, regulatory capital requirements, like those dictated by Basel III, necessitate significant reserves, making it challenging for new players to enter. In 2024, the average capital adequacy ratio for Japanese banks hovered around 13%, illustrating the substantial financial foundation new entrants would need to match.

Beyond capital, cultivating customer trust is paramount for financial services. A new bank must overcome the inherent skepticism customers have towards unfamiliar institutions, especially when entrusting their money. This trust-building process, which involves a proven track record and robust security measures, can take years, creating a significant barrier for potential competitors looking to dislodge established players like Chiba Bank.

The threat of new entrants for Chiba Bank is amplified by the emergence of digital-only banks, or neobanks. These entities operate with significantly lower overhead due to the absence of physical branches, allowing them to potentially offer more competitive pricing or specialized services. For instance, in 2023, the global neobanking market was valued at over $40 billion and is projected to grow substantially, indicating a strong influx of new, digitally-native competitors.

Tech Giants and E-commerce Companies in Finance

The threat of new entrants into the financial services sector, particularly from tech giants and e-commerce players, is significant. These companies possess massive customer bases and sophisticated data analytics, enabling them to potentially disrupt traditional banking models. For instance, by mid-2024, companies like Apple and Google had already established strong footholds in digital payments, processing billions of transactions annually, indicating their growing influence and capability to expand into more complex financial products.

While their current focus remains on payments and specific lending areas, the long-term potential for these tech behemoths to offer core banking services, such as deposits and loans, presents a substantial competitive challenge. Their ability to leverage existing digital infrastructure and customer loyalty could allow for rapid market penetration, potentially eroding market share for established institutions like Chiba Bank.

- Tech giants like Apple Pay and Google Pay are already processing a significant volume of transactions, with global mobile payment transaction value projected to reach over $3 trillion by the end of 2024.

- E-commerce platforms are increasingly integrating financial services, offering buy-now-pay-later options and small business loans, tapping into their vast merchant and consumer data.

- The regulatory landscape is evolving, with some jurisdictions exploring open banking initiatives that could further facilitate entry for non-traditional financial service providers.

Regional Expansion of Other Banks

Chiba Bank's primary focus on Chiba Prefecture presents an opportunity for other regional or city banks to expand into its territory. This expansion would introduce new competitors, intensifying localized competition. For example, if a bank like Shizuoka Bank, which has a strong presence in its home prefecture, were to enter Chiba, it could leverage its existing banking expertise and potentially its established brand recognition from adjacent regions to attract customers.

Such strategic moves by competitors could directly impact Chiba Bank's market share and profitability. In 2023, regional banks in Japan saw varying performance; while some reported increased profits due to higher interest rates, others faced challenges from a competitive landscape. The threat lies in these new entrants bringing fresh capital and potentially innovative services, forcing Chiba Bank to adapt its strategies to maintain its competitive edge.

- Increased Localized Competition: Expansion by other regional banks directly into Chiba Prefecture.

- Leveraging Existing Expertise: New entrants can utilize established banking knowledge and operational efficiencies.

- Brand Recognition Transfer: Banks with strong reputations in neighboring prefectures may find it easier to gain traction.

- Potential for Service Innovation: New players could introduce novel products or digital solutions, disrupting the status quo.

The threat of new entrants for Chiba Bank is moderate, primarily due to high regulatory barriers and substantial capital requirements in Japan's banking sector. Newcomers must navigate complex licensing and compliance, with capital adequacy ratios often exceeding 10% as of early 2024. Building customer trust also presents a significant hurdle, as established banks benefit from proven track records.

Digital-only banks and tech giants pose a growing challenge, leveraging lower overhead and vast customer bases. For instance, global mobile payment transaction value was projected to exceed $3 trillion by the end of 2024, highlighting the increasing digital financial activity that new players can tap into. While these entrants may initially focus on niche services, their potential to expand into core banking functions is a long-term concern.

Localized competition from other regional banks expanding into Chiba Prefecture is also a factor. These entrants can leverage existing expertise and brand recognition from adjacent areas. For example, regional banks in Japan saw varied performance in 2023, with some reporting increased profits, indicating their capacity to invest and compete aggressively.

| Barrier Type | Description | Impact on New Entrants | Example Data (Early 2024) |

| Regulatory Requirements | Rigorous licensing, capital adequacy, compliance | High | CET1 Ratio > 10% |

| Capital Investment | Significant funding needed for operations and reserves | High | Average Capital Adequacy Ratio ~13% |

| Customer Trust | Building credibility and loyalty takes time | High | Years to establish track record |

| Digital Disruption | Neobanks, tech giants entering financial services | Moderate to High | Global Neobanking Market Value > $40 Billion (2023) |

| Localized Competition | Expansion by regional banks into Chiba | Moderate | Regional banks reporting profit growth (2023) |

Porter's Five Forces Analysis Data Sources

Our Chiba Bank Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, annual reports, and official disclosures from Chiba Bank and its competitors. We supplement this with data from reputable industry research firms and financial news outlets to capture current market trends and competitive landscape dynamics.