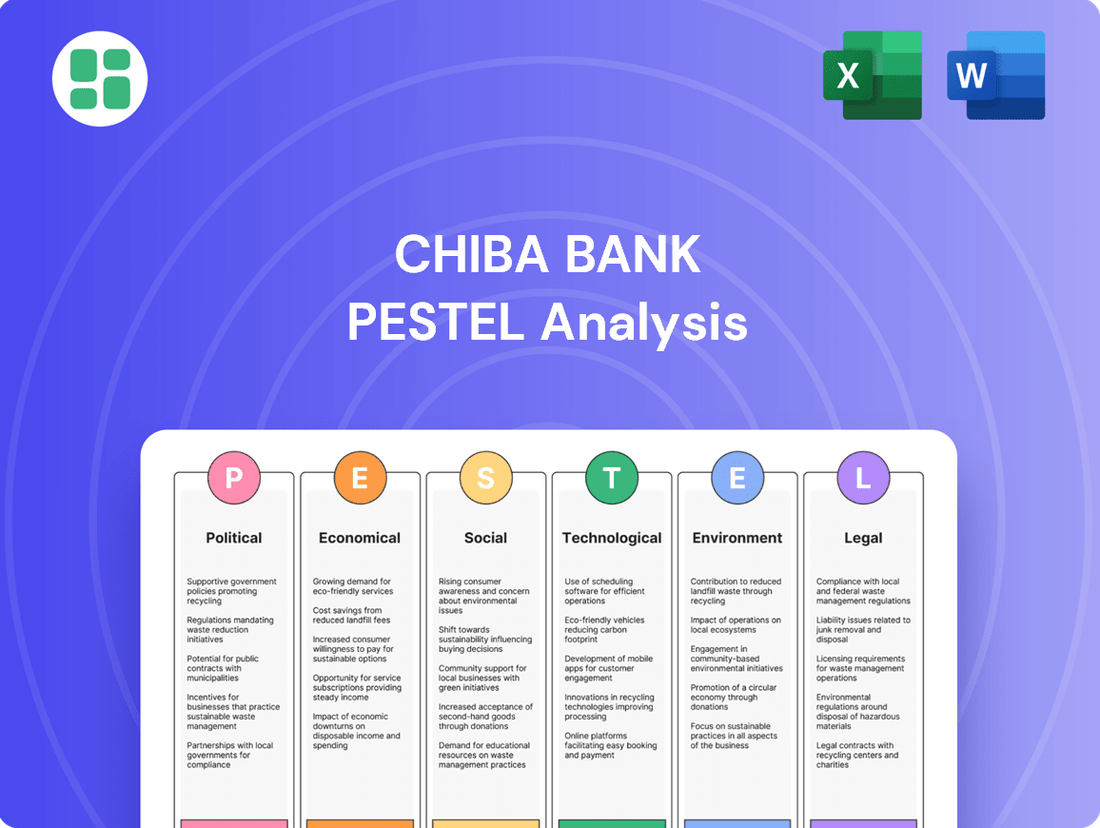

Chiba Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chiba Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Chiba Bank's trajectory. Our comprehensive PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on opportunities in the dynamic Japanese financial landscape. Download the full report now to gain actionable intelligence and sharpen your competitive edge.

Political factors

The Bank of Japan's (BOJ) move away from its ultra-loose monetary policy, including the end of negative interest rates in March 2024, marks a significant shift. This normalization is expected to continue with potential further rate hikes in 2025.

This policy change presents a new landscape for Chiba Bank, potentially boosting its net interest margins as lending rates rise. However, it also introduces challenges like increased funding costs and heightened competition for customer deposits.

The Japanese government, through the Financial Services Agency (FSA), is actively promoting consolidation among regional banks. This policy aims to enhance efficiency and bolster the financial stability of these institutions. For instance, in fiscal year 2024, the government allocated ¥10 billion in subsidies to support regional bank mergers, a clear signal of its commitment to this strategy.

Japan's Financial Services Agency (FSA) is actively refining banking regulations, with a particular focus on strengthening anti-money laundering (AML) and counter-terrorism financing (CTF) protocols. This includes pushing for greater adoption of digital solutions within the financial sector.

Chiba Bank faces the ongoing challenge of adapting to these dynamic regulatory shifts. Ensuring strict adherence to updated legal and supervisory mandates is crucial to prevent penalties and uphold the bank's operational stability, especially as digital innovation accelerates.

Geopolitical Risks and Trade Policies

Global geopolitical tensions, especially between the United States and China, continue to cast a shadow over Japan's economic stability and financial markets. These dynamics can significantly impact corporate investment decisions and foreign exchange rates, areas where Chiba Bank has international exposure.

For instance, ongoing trade disputes and the potential for new tariffs create an unpredictable business environment. In 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, but acknowledged that geopolitical fragmentation could lead to further downgrades, directly affecting Japanese exports and Chiba Bank's corporate clients.

- US-China Trade Tensions: Continued friction impacts global supply chains and investment flows.

- Geopolitical Instability: Regional conflicts and political realignments create market volatility.

- Trade Policy Shifts: Changes in tariffs and trade agreements affect international business operations.

- Foreign Exchange Fluctuations: Geopolitical events often drive currency movements, impacting international transactions.

Corporate Governance Reforms

The Tokyo Stock Exchange (TSE) and the Financial Services Agency (FSA) are actively pushing for corporate governance reforms across Japan, encouraging companies to prioritize shareholder returns by focusing on cost of capital and stock price performance. This regulatory push directly impacts financial institutions like Chiba Bank.

Chiba Bank is anticipated to adapt its governance framework to align with these evolving standards. This strategic alignment is crucial for boosting corporate value and fostering greater investor confidence in the bank's long-term prospects. For example, as of early 2024, many Japanese companies are increasingly disclosing their capital costs and linking executive compensation to stock performance, a trend Chiba Bank is likely to follow.

- Increased focus on cost of capital: Reforms encourage banks to actively manage and reduce their cost of capital to improve profitability.

- Emphasis on stock price performance: Governance changes aim to link management incentives directly to shareholder value creation, reflected in stock price appreciation.

- Enhanced shareholder returns: The ultimate goal is to drive better returns for shareholders through improved financial performance and strategic capital allocation.

- Investor confidence: Adherence to these reforms is expected to bolster trust among domestic and international investors.

The Bank of Japan's pivot from ultra-loose monetary policy, including ending negative interest rates in March 2024, is a significant political development. This policy normalization is expected to continue with potential further rate hikes in 2025, influencing Chiba Bank's interest margins and funding costs.

Government initiatives promoting regional bank consolidation, supported by subsidies like the ¥10 billion allocated in fiscal year 2024, aim to enhance efficiency. Chiba Bank must navigate these consolidation pressures while adapting to evolving regulatory frameworks focused on AML/CTF and digital adoption.

Japan's commitment to corporate governance reforms, driven by the TSE and FSA, emphasizes shareholder returns and stock price performance. This necessitates Chiba Bank aligning its governance to boost corporate value and investor confidence, mirroring trends of linking executive pay to stock performance observed in early 2024.

Global geopolitical tensions, particularly US-China trade friction, create market volatility and impact foreign exchange rates. The IMF's 2024 global growth projection of 3.2%, with risks of downgrades due to geopolitical fragmentation, directly affects Japanese exports and Chiba Bank's corporate clients.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Chiba Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the bank's strategic landscape, enabling proactive decision-making and risk mitigation.

A concise PESTLE analysis for Chiba Bank acts as a pain point reliever by offering a clear, actionable framework to navigate complex external factors, simplifying strategic decision-making and reducing uncertainty.

Economic factors

Chiba Bank is set to benefit from the Bank of Japan's shift to positive interest rates, a move that began in early 2024. This policy change, coupled with anticipation of further rate increases throughout 2025, is expected to directly improve the bank's net interest margins (NIMs). This marks a significant departure from the prolonged period of ultra-low or negative rates.

The transition to a 'world with interest rates' is a crucial development for Chiba Bank's profitability. After years of navigating a low-yield landscape that compressed NIMs, the ability to earn more on its lending portfolio offers a substantial tailwind. For instance, even a modest increase in the policy rate can translate into millions in additional net interest income.

Chiba Prefecture, Chiba Bank's core market, grapples with an aging demographic and a dwindling pool of business successors. This presents a significant challenge for regional economic vitality and, by extension, the bank's loan portfolio health.

For instance, Chiba Prefecture's working-age population (15-64 years) was projected to decrease by approximately 1.3% annually between 2020 and 2025, a trend impacting consumer spending and business operations.

Chiba Bank's strategic focus on supporting local small and medium-sized enterprises (SMEs) through financing and advisory services is therefore paramount. This engagement is vital for fostering business continuity, encouraging innovation, and ultimately ensuring the bank's own long-term growth trajectory.

Japan's economy is showing signs of gradual inflation and wage growth, a trend anticipated to bolster private consumption and contribute to economic recovery. For instance, the average wage increase in the 2024 spring labor negotiations reached 5.28%, the highest in decades, according to the Japanese Trade Union Confederation (RENGO).

This upward momentum in wages and prices presents an opportunity for Chiba Bank. Increased disposable income from wage growth can translate into higher demand for consumer loans, from mortgages to personal credit. Simultaneously, improved repayment capacities among borrowers, supported by these wage increases, can lead to a more stable and less risky lending environment for the bank.

Competition in the Banking Sector

The Japanese banking landscape is intensely competitive, with regional institutions like Chiba Bank facing significant pressure. Megabanks and the burgeoning digital-only banking sector are increasingly vying for market share, forcing regional players to innovate. This heightened competition necessitates a focus on service differentiation and enhanced operational efficiency to secure and grow customer deposits, particularly in a rising interest rate environment.

Chiba Bank's strategic response must address this competitive dynamic head-on. By offering unique value propositions and streamlining operations, the bank can better retain its existing customer base and attract new clients. This focus is crucial as the banking sector continues to evolve, driven by technological advancements and changing consumer preferences.

- Intensified Competition: Regional banks like Chiba Bank are challenged by megabanks and new digital entrants.

- Customer Retention Focus: Differentiating services is key to holding onto customers amidst increased competition.

- Operational Efficiency: Improving internal processes is vital for cost management and service delivery.

- Deposit Growth Imperative: Attracting new deposits remains a critical objective, especially with potential interest rate shifts.

Impact of Declining Population on Loan Demand

Japan's demographic trends present a significant headwind for Chiba Bank, with an aging and shrinking population directly impacting loan demand. As the working-age population declines, the pool of potential borrowers for mortgages, business loans, and consumer credit naturally contracts. For instance, Japan's working-age population (15-64 years) is projected to fall below 70 million by 2025, a stark contrast to earlier decades.

This structural shift necessitates a strategic pivot for Chiba Bank. The bank needs to explore avenues beyond traditional lending to sustain growth. This could involve developing specialized financial products for the elderly, such as reverse mortgages or wealth management services, or expanding into new markets and business lines that are less sensitive to demographic contractions.

Chiba Bank's adaptation strategy must be proactive. By 2024, the bank was already facing increased competition for a smaller customer base. Diversifying revenue streams, perhaps through increased fee-based services or digital innovation, will be crucial for mitigating the long-term impact of declining loan demand driven by Japan's demographic realities.

- Shrinking Borrower Pool: Japan's population is expected to continue its decline, with fewer individuals entering their prime borrowing years.

- Aging Society Needs: A growing elderly population may require different financial services, such as retirement planning and healthcare financing, rather than traditional loans.

- Strategic Adaptation: Chiba Bank must innovate its product offerings and explore new business segments to offset reduced demand in its core lending operations.

- Economic Implications: A sustained decline in loan demand can impact the bank's profitability and its role in economic growth.

Japan's economy is experiencing a positive shift with gradual inflation and wage growth, a trend expected to boost consumer spending and economic recovery. For instance, the average wage increase in the 2024 spring labor negotiations reached 5.28%, the highest in decades, according to RENGO. This environment offers Chiba Bank an opportunity for increased consumer loan demand and a more stable lending environment due to improved borrower repayment capacities.

The Bank of Japan's move to positive interest rates, initiated in early 2024 and anticipated to continue through 2025, is a significant tailwind for Chiba Bank. This policy shift directly benefits the bank by improving its net interest margins, a welcome change after years of compressed profitability due to ultra-low rates. Even small rate hikes can translate into substantial increases in net interest income for the bank.

Chiba Prefecture faces demographic challenges, including an aging population and a shrinking workforce, which impacts Chiba Bank's core market. Projections indicated a roughly 1.3% annual decrease in the working-age population (15-64 years) between 2020 and 2025, affecting consumer spending and business vitality. This necessitates Chiba Bank's focus on supporting local SMEs and exploring new business avenues.

| Economic Factor | Description | Impact on Chiba Bank | Supporting Data/Trend |

| Inflation & Wage Growth | Rising prices and increasing wages | Increased consumer spending and loan demand; improved borrower repayment capacity | Average wage increase of 5.28% in 2024 spring negotiations (RENGO) |

| Interest Rate Policy | Shift from negative/low rates to positive rates | Improved Net Interest Margins (NIMs); enhanced profitability | Bank of Japan's policy shift initiated in early 2024, with further increases anticipated in 2025 |

| Demographics | Aging and shrinking working-age population | Reduced loan demand; need for new product development and market diversification | Projected ~1.3% annual decline in working-age population (15-64) in Chiba Prefecture (2020-2025) |

Same Document Delivered

Chiba Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chiba Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations, providing crucial insights for strategic planning.

Sociological factors

Japan's demographic landscape is shifting dramatically, with a substantial portion of its baby boomer generation reaching ages 75 and beyond by 2025. This aging trend directly influences the financial sector, creating a growing demand for specialized products and services. Chiba Bank needs to adapt its offerings to meet the evolving needs of this older demographic.

The financial requirements of an aging population typically include wealth management, estate planning, and solutions for healthcare expenses. By focusing on these areas, Chiba Bank can proactively address the 'Japan 2025 Problem,' which anticipates significant societal changes driven by an older populace. For instance, as of early 2024, Japan's elderly dependency ratio continues to rise, underscoring the urgency for financial institutions to innovate in this space.

Customers, even in traditionally less digital regions, are increasingly demanding seamless and convenient access to banking services through online and mobile platforms. This shift is evident across Japan, with a notable rise in digital transaction volumes. For instance, by the end of fiscal year 2023, roughly 70% of Chiba Bank's retail customer transactions were conducted digitally, highlighting a clear preference for convenience.

Chiba Bank's strategic investments in enhancing its mobile banking app and introducing personalized digital features directly address these evolving customer preferences. These initiatives aim to boost customer engagement and retention by offering tailored financial advice and streamlined transaction processes, crucial for maintaining competitiveness in the current digital-first environment.

Japan's working-age population, a critical demographic for any economy, has been steadily shrinking. By 2023, the population aged 15-64 was estimated to be around 73.7 million, a figure projected to continue its decline. This demographic shift directly translates into labor shortages across numerous sectors, including the vital financial services industry where Chiba Bank operates.

These labor shortages present significant challenges for Chiba Bank. They can impact service delivery, increase operational costs due to higher wages needed to attract talent, and potentially hinder innovation. For instance, a lack of skilled personnel in areas like cybersecurity or data analytics could slow down digital transformation initiatives, a key area for efficiency gains and future competitiveness.

To navigate this, Chiba Bank must prioritize robust human capital management strategies. This includes investing in employee training and development to upskill the existing workforce, fostering a culture that attracts and retains talent, and leveraging digital transformation to automate tasks and improve operational efficiency. By embracing these approaches, Chiba Bank can mitigate the impact of demographic headwinds and maintain its operational capacity and competitive edge.

Financial Literacy and Advisory Needs

As financial products become increasingly intricate and economic landscapes evolve, there is a clear and growing demand for improved financial literacy and expert advisory services. This trend affects both individual consumers and small to medium-sized enterprises (SMEs) alike. For instance, data from the Bank of Japan's 2023 survey indicated that a significant percentage of households expressed a desire for more guidance on managing their finances and investments.

Chiba Bank is well-positioned to capitalize on this societal shift by reinforcing its image as a reliable financial advisor. By offering tailored guidance on a range of investment products and comprehensive financial planning, the bank can effectively serve its varied customer demographic. This proactive approach addresses a critical need in the market.

- Growing Demand for Financial Guidance: Surveys consistently show a public desire for better understanding of financial products, especially in light of fluctuating interest rates and inflation.

- Chiba Bank's Advisory Role: The bank can enhance its services by offering workshops, personalized consultations, and digital tools to boost customer financial literacy.

- SME Support: Small and medium-sized businesses often lack dedicated financial planning departments, making Chiba Bank's advisory services particularly valuable for their growth and stability.

Community Engagement and Corporate Social Responsibility (CSR)

Societal expectations are high for regional banks like Chiba Bank to play a proactive role in local economic development and social well-being. This commitment is often viewed as a core part of their identity and a key differentiator in the competitive financial landscape.

Chiba Bank actively engages in corporate social responsibility (CSR) through initiatives aimed at regional revitalization. A prime example is the establishment of CHIBACOOL, a regional trading company, which directly supports local businesses and fosters community growth. This strategic move aligns with the growing demand for financial institutions to be more than just lenders, but also active partners in their communities.

Chiba Bank's focus on community engagement is evident in its support for local events and its investment in human capital development within the regions it serves. For instance, in fiscal year 2023, the bank reported significant contributions to local economic stimulus programs, including ¥500 million allocated towards small and medium-sized enterprise (SME) support and regional promotion activities.

- Regional Revitalization: Chiba Bank's establishment of CHIBACOOL underscores its dedication to fostering economic activity and creating new opportunities within its service areas.

- CSR Investment: The bank allocated approximately ¥500 million in fiscal year 2023 towards SME support and regional promotional efforts, demonstrating tangible commitment.

- Community Partnership: Initiatives like supporting local festivals and investing in regional talent development highlight Chiba Bank's role as a community stakeholder.

- Societal Expectation: There's a strong public sentiment that regional banks should actively contribute to solving local economic and social challenges.

Societal expectations are increasingly placing a premium on financial institutions actively contributing to local economic development and social well-being. Chiba Bank's commitment to regional revitalization, exemplified by initiatives like CHIBACOOL, directly addresses this growing demand for community partnership. The bank's tangible investments, such as the ¥500 million allocated in fiscal year 2023 for SME support and regional promotion, underscore its role as a proactive stakeholder in its service areas.

| Sociological Factor | Chiba Bank Initiative | Impact/Data Point (FY2023) |

|---|---|---|

| Regional Development Expectation | Establishment of CHIBACOOL | Fosters local business growth and community development. |

| Corporate Social Responsibility (CSR) | Investment in SME Support & Regional Promotion | ¥500 million allocated. |

| Community Engagement | Support for local events and talent development | Enhances local economic stimulus and social fabric. |

Technological factors

Chiba Bank is heavily invested in digital transformation, evidenced by its continuous enhancements to the 'Chibagin App' and the introduction of personalized banking features. This strategic push aims to elevate customer experience and provide better financial management tools.

In 2023, Chiba Bank reported that its digital banking services saw a significant increase in user engagement, with mobile app transactions growing by 15% compared to the previous year. This highlights the growing reliance on digital platforms for banking needs.

This digital-first approach is vital for Chiba Bank to remain competitive against nimble fintech challengers and to adapt to the rapidly changing expectations of its customer base, who increasingly prefer convenient, on-the-go financial solutions.

As financial services lean more heavily into digital platforms, the risks associated with cyber-attacks and the critical need for data privacy are growing. Chiba Bank faces heightened scrutiny regarding its ability to protect sensitive customer information from increasingly sophisticated threats.

To counter this, Chiba Bank must maintain substantial and ongoing investments in advanced cybersecurity defenses. This includes staying ahead of evolving threats and ensuring compliance with stringent data protection regulations like Japan's Act on the Protection of Personal Information, which was significantly amended in 2022, emphasizing stricter consent and disclosure requirements.

Failure to adequately safeguard data not only risks financial losses from breaches but also severely damages customer trust, a crucial asset for any financial institution. For instance, a 2023 report indicated that the average cost of a data breach in the financial sector globally exceeded $5 million, highlighting the significant financial implications of security lapses.

The Japanese banking sector, including Chiba Bank, is increasingly integrating AI and automation to boost efficiency and customer engagement. For instance, in 2023, financial institutions globally saw significant investments in AI, with many reporting a 10-20% improvement in process automation rates.

Chiba Bank can leverage AI for tasks like fraud detection, personalized financial advice, and back-office automation, potentially reducing operational costs by up to 15% and freeing up staff for more complex client relationships.

Fintech Partnerships and Open Banking

Chiba Bank's strategic embrace of fintech partnerships and open banking is a key technological driver. By collaborating with innovative fintech firms, the bank can rapidly introduce new services and broaden its customer base. This approach allows for more agile integration of cutting-edge solutions, enhancing the overall customer experience and operational efficiency.

A prime example of this strategy in action is Chiba Bank's collaboration with technology providers such as Moneythor. These partnerships are crucial for seamlessly integrating advanced financial management tools and data analytics capabilities. Such integrations are vital for staying competitive in a rapidly evolving digital landscape, enabling the bank to offer more personalized and data-driven financial advice.

- Fintech Collaboration: Chiba Bank's partnerships allow for swift adoption of new technologies, expanding service portfolios and market reach.

- Open Banking Initiatives: Participation in open banking frameworks enables secure data sharing, fostering innovation and new product development.

- Technology Integration: Partnering with firms like Moneythor facilitates the embedding of advanced financial management and analytics solutions.

- Competitive Edge: These technological advancements are essential for maintaining relevance and offering enhanced digital experiences in the banking sector.

Payment System Modernization

The financial landscape is rapidly evolving with the modernization of payment systems. This ongoing shift necessitates that institutions like Chiba Bank adapt their core infrastructure to accommodate new payment technologies. Keeping pace is crucial for maintaining efficient transaction processing and customer satisfaction.

Chiba Bank must actively engage with these innovations. This includes exploring advancements like real-time payment networks and potentially even stablecoin-related services to remain competitive. For instance, the global digital payments market was projected to reach over $2 trillion in 2024, highlighting the immense growth and the need for banks to be at the forefront of these technological shifts.

- Adapting to Real-Time Payments: Banks need to upgrade systems to support instant transaction settlements, a growing customer expectation.

- Exploring Stablecoin Integration: The potential for stablecoins to facilitate faster and cheaper cross-border transactions presents an opportunity for innovation.

- Enhancing Digital Wallets: Investment in user-friendly and secure digital wallet solutions is vital for capturing a larger share of mobile payments.

- Cybersecurity in Payment Modernization: As payment systems become more sophisticated, robust cybersecurity measures are paramount to protect customer data and prevent fraud.

Chiba Bank's technological advancements are centered on digital transformation, with a focus on enhancing its mobile app and personalizing services, as seen in its 2023 digital banking growth. This digital-first strategy is essential for competing with fintechs and meeting customer expectations for convenient, on-the-go banking solutions.

The bank faces significant cybersecurity risks due to increased digital activity, necessitating ongoing investment in advanced defenses and compliance with data privacy laws like Japan's Act on the Protection of Personal Information. Global data breaches in the financial sector cost over $5 million in 2023, underscoring the financial and reputational impact of security lapses.

Chiba Bank is also leveraging AI and automation for efficiency gains, with global financial institutions reporting 10-20% improvements in automation rates in 2023. AI can reduce operational costs and enhance customer service through fraud detection and personalized advice.

Furthermore, Chiba Bank's engagement with fintech partnerships and open banking, exemplified by collaborations like the one with Moneythor, allows for rapid integration of new technologies and data analytics, crucial for offering competitive, data-driven financial advice.

| Technology Area | Chiba Bank's Action/Focus | Impact/Benefit | Industry Trend/Data (2023-2024) |

|---|---|---|---|

| Digital Transformation | Enhancing 'Chibagin App', personalized features | Improved customer experience, better financial management | 15% increase in mobile app transactions for Chiba Bank in 2023 |

| Cybersecurity | Investing in advanced defenses, data privacy compliance | Protecting customer data, maintaining trust | Average global financial sector data breach cost >$5 million (2023) |

| AI & Automation | Integrating AI for fraud detection, personalized advice, back-office tasks | Increased efficiency, reduced operational costs | Global AI investment in finance driving 10-20% automation rate improvements (2023) |

| Fintech & Open Banking | Partnerships (e.g., Moneythor), embracing open banking | Agile service introduction, enhanced analytics, competitive edge | Global digital payments market projected >$2 trillion (2024) |

Legal factors

Chiba Bank's operations are heavily shaped by the Banking Act and the stringent regulations set forth by the Financial Services Agency (FSA). The FSA's oversight ensures the bank adheres to crucial capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which for major Japanese banks stood around 10-11% as of early 2024, and maintains proper licensing and operational protocols. These legal frameworks are fundamental to maintaining financial stability and safeguarding customer interests, making compliance a non-negotiable aspect of Chiba Bank's business model.

Japanese authorities, particularly the Financial Services Agency (FSA), have significantly tightened Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These updated rules mandate a risk-based approach, with strict compliance deadlines for all financial institutions. For instance, in 2024, the FSA continued its focus on enhancing transaction monitoring systems and customer due diligence processes across the banking sector.

Chiba Bank, like its peers, is obligated to implement and maintain sophisticated internal controls and advanced technological systems. These measures are crucial for effectively preventing financial crimes and ensuring adherence to these increasingly stringent regulatory requirements. Failure to comply can result in substantial penalties and reputational damage, underscoring the critical nature of robust AML/CTF frameworks.

Chiba Bank faces increasing scrutiny under Japan's Act on the Protection of Personal Information (APPI). In 2023, the Personal Information Protection Commission (PIPC) issued guidance emphasizing stricter data handling, impacting how financial institutions manage sensitive customer details. Non-compliance can lead to significant penalties, making robust data security and privacy protocols paramount for maintaining legal standing and customer confidence.

Consumer Protection Regulations

Consumer protection regulations are a critical legal factor for Chiba Bank, dictating how it engages with its clientele. These laws mandate transparency in product offerings, prohibit discriminatory lending, and establish clear processes for handling customer complaints. Adherence is paramount for maintaining consumer trust and avoiding legal repercussions.

In Japan, the Financial Services Agency (FSA) actively enforces consumer protection. For instance, in fiscal year 2023, the FSA reported a significant number of inquiries and consultations related to financial product sales and lending practices, underscoring the active regulatory environment. Chiba Bank must continuously update its practices to align with evolving consumer rights legislation.

Key areas of focus for Chiba Bank under these regulations include:

- Disclosure Requirements: Ensuring all fees, interest rates, and terms are clearly communicated to customers before they commit to a product.

- Fair Lending Practices: Prohibiting discrimination based on factors like age, gender, or origin in loan application evaluations.

- Grievance Redressal: Establishing efficient and accessible channels for customers to raise concerns and receive timely resolutions.

- Data Privacy: Complying with regulations like the Act on the Protection of Personal Information (APPI) to safeguard customer data.

Competition Law and M&A Guidelines

Competition law remains a significant consideration for Chiba Bank's mergers and acquisitions, even after the Japan Fair Trade Commission (JFTC) eased some restrictions for regional banks in 2020. While this move aimed to encourage consolidation, a 10-year window for such activities means that strategic moves must still navigate antitrust scrutiny. Chiba Bank's acquisition of a stake in Chiba Kogyo Bank, for instance, would have been assessed against these ongoing competition law frameworks.

The JFTC's approach to M&A in the banking sector, particularly for regional players, is designed to balance the benefits of consolidation with the need to maintain healthy market competition. For Chiba Bank, this translates to a need for careful planning and justification of any proposed merger or acquisition to ensure it does not unduly stifle competition in its operating regions.

- JFTC Regulatory Shift: In 2020, the JFTC signaled a more permissive stance on regional bank mergers, aiming to facilitate consolidation.

- 10-Year Consolidation Window: This period allows for strategic M&A, but all transactions are still subject to competition law review.

- Chiba Bank's M&A Strategy: Acquisitions, like the stake in Chiba Kogyo Bank, must adhere to these guidelines to gain regulatory approval.

- Maintaining Market Competition: The JFTC's oversight ensures that mergers do not lead to anti-competitive market structures.

Chiba Bank operates under a robust legal framework, heavily influenced by the Banking Act and the Financial Services Agency (FSA) which mandates capital adequacy ratios, like CET1, with major Japanese banks maintaining levels around 10-11% in early 2024. Stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations are also critical, requiring enhanced transaction monitoring and customer due diligence, with the FSA continuing its focus on these areas throughout 2024.

Furthermore, consumer protection laws dictate transparency in product offerings and fair lending practices, with the FSA actively addressing consumer inquiries in fiscal year 2023. The Act on the Protection of Personal Information (APPI) also imposes strict data handling requirements, underscoring the importance of robust data security. Competition law, particularly from the Japan Fair Trade Commission (JFTC), influences M&A activity, with a 10-year consolidation window allowing strategic moves subject to antitrust review.

| Legal Factor | Key Regulations/Bodies | Impact on Chiba Bank | Recent/Ongoing Focus (2023-2024) | Example Data/Context |

| Banking Operations & Capital Adequacy | Banking Act, FSA | Adherence to capital ratios, licensing | FSA oversight of financial stability | CET1 ratios for major Japanese banks ~10-11% (early 2024) |

| Anti-Financial Crime | AML/CTF Regulations, FSA | Enhanced transaction monitoring, due diligence | Tightening of rules, risk-based approach | FSA focus on system improvements |

| Consumer Protection | Consumer Rights Legislation, FSA | Transparency, fair lending, grievance redressal | Active handling of consumer inquiries | FSA reports on product sales and lending practices (FY2023) |

| Data Privacy | Act on the Protection of Personal Information (APPI), PIPC | Strict data handling, security protocols | Guidance on sensitive customer data management | Penalties for non-compliance |

| Competition & M&A | Competition Law, JFTC | Antitrust review for mergers and acquisitions | Easing of some restrictions for regional banks | 10-year consolidation window; stake in Chiba Kogyo Bank |

Environmental factors

Climate change presents significant physical risks, such as extreme weather events impacting collateral, and transition risks, like policy changes affecting carbon-intensive industries, which can affect Chiba Bank's loan portfolios. For instance, a report from the Bank for International Settlements in 2024 highlighted that climate-related financial risks could lead to substantial losses for financial institutions globally.

Chiba Bank is actively pursuing sustainable finance initiatives, recognizing the growth potential and aligning with Japan's national goal of achieving carbon neutrality by 2050. This strategic shift is evident in the increasing issuance of ESG (Environmental, Social, and Governance) bonds, a market that saw significant growth in Asia throughout 2024, offering new avenues for investment and risk management.

The increasing emphasis on Environmental, Social, and Governance (ESG) investing is a significant environmental factor for Chiba Bank. Globally and within Japan, there's a strong push for financial institutions to embed ESG principles into their core business and reporting practices. This trend is driven by investor demand for sustainable options and regulatory pressures.

Chiba Bank must bolster its sustainability disclosures to meet evolving expectations. This includes aligning with the Sustainability Standards Board of Japan (SSBJ) and adhering to international reporting frameworks, ensuring transparency and comparability for stakeholders. For instance, as of early 2024, many Japanese companies are enhancing their climate-related disclosures in line with TCFD recommendations.

Japanese regulators are increasingly prioritizing sustainable finance, with the government actively promoting green and transition bonds. This includes encouraging private sector involvement, creating a clear signal for institutions like Chiba Bank to align with national environmental goals.

This regulatory environment necessitates that Chiba Bank develop and offer green financial products and services. By doing so, the bank can support the national transition to a low-carbon economy and tap into growing investor demand for sustainable investments.

For instance, in 2023, Japan saw a significant increase in green bond issuance, reaching approximately ¥2.3 trillion, demonstrating the growing market for such instruments and the regulatory impetus behind them.

Disaster Preparedness and Business Continuity

Japan's seismic activity and typhoon season mean Chiba Bank must prioritize disaster preparedness. In 2023, Japan experienced over 1,500 earthquakes, highlighting the constant risk. Robust business continuity plans are essential to maintain services and protect customer data during and after such events.

Chiba Bank's infrastructure resilience is paramount. This includes redundant data centers and secure physical branches, especially considering the average annual cost of natural disasters in Japan can exceed $40 billion. Investing in these areas ensures minimal operational downtime and protects financial assets.

- Infrastructure Resilience: Chiba Bank invests in redundant IT systems and secure physical locations to withstand natural disasters.

- Business Continuity Planning: Comprehensive plans are in place to ensure uninterrupted banking services during emergencies.

- Disaster Risk Mitigation: Proactive measures are taken to reduce the impact of earthquakes, typhoons, and other environmental threats.

Public Perception and Demand for Green Products

Public awareness and demand for environmentally responsible practices are on the rise, influencing consumer choices and investment strategies. Chiba Bank's proactive stance on sustainability and its initiatives aimed at mitigating climate change are crucial for bolstering its public image. This commitment can attract a growing segment of environmentally conscious customers and investors, potentially leading to increased deposits and investment capital.

The bank's focus on green financial products, such as sustainable bonds and eco-friendly loans, aligns with market trends. For instance, the global green bond market reached an estimated $1.3 trillion in 2023, indicating a strong appetite for such instruments. By offering these products, Chiba Bank can tap into this expanding market and differentiate itself from competitors.

- Growing Demand: Consumer surveys in Japan consistently show a preference for businesses with strong environmental, social, and governance (ESG) credentials.

- Investment Trends: In 2024, ESG-focused investments are projected to continue their upward trajectory, with a significant portion of institutional investors prioritizing sustainability.

- Brand Reputation: Positive public perception stemming from environmental initiatives can translate into enhanced brand loyalty and a stronger competitive advantage for Chiba Bank.

- Regulatory Tailwinds: Increasing governmental focus on climate action and sustainable finance in Japan provides a supportive environment for banks like Chiba to lead in green initiatives.

Environmental factors significantly shape Chiba Bank's operational landscape, from physical risks like extreme weather impacting assets to transition risks associated with policy shifts towards a low-carbon economy. Japan's commitment to carbon neutrality by 2050, as highlighted by government initiatives and growing ESG bond markets in Asia during 2024, necessitates proactive engagement with sustainable finance.

The bank's infrastructure resilience is critical, particularly given Japan's susceptibility to natural disasters; the country experienced over 1,500 earthquakes in 2023 alone. Proactive measures, including robust business continuity plans and investments in redundant IT systems, are essential to mitigate operational disruptions and protect financial assets, especially considering the average annual cost of natural disasters in Japan can exceed $40 billion.

Public and investor demand for environmentally responsible practices is a growing influence, driving Chiba Bank's focus on green financial products. The global green bond market's expansion, reaching an estimated $1.3 trillion in 2023, underscores the market appetite for sustainable investments, a trend that aligns with regulatory tailwinds promoting climate action in Japan.

| Environmental Factor | Impact on Chiba Bank | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Climate Change Risks | Physical risks (asset damage), Transition risks (policy changes) | Global financial institutions facing potential losses from climate risks (BIS report, 2024). |

| Sustainable Finance Push | Growth opportunities, Alignment with national goals | Japan's carbon neutrality goal by 2050; Asia's ESG bond market growth (2024). |

| Natural Disaster Vulnerability | Operational disruption, Infrastructure risk | Over 1,500 earthquakes in Japan (2023); Annual disaster costs >$40 billion in Japan. |

| ESG Investing Demand | Customer attraction, Investment capital | Global green bond market ~$1.3 trillion (2023); Growing preference for ESG credentials in Japan. |

PESTLE Analysis Data Sources

Our Chiba Bank PESTLE Analysis is grounded in data from official Japanese government publications, financial regulatory bodies, and reputable economic research institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape affecting the bank.