Chemed SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemed Bundle

Chemed's SWOT analysis reveals a robust market position driven by its essential services, yet it also highlights potential vulnerabilities in regulatory shifts and competitive pressures. Uncover the full strategic landscape, including detailed financial context and actionable insights, to understand their competitive edge.

Want the complete story behind Chemed's strengths, risks, and growth drivers? Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Chemed Corporation's significant strength lies in the dual market leadership of its key subsidiaries, VITAS Healthcare and Roto-Rooter. VITAS stands as one of the largest providers of end-of-life hospice care in the U.S., a critical and growing segment of the healthcare industry.

Complementing this, Roto-Rooter holds the distinction of being the nation's largest provider of commercial and residential plumbing and drain cleaning services. This commanding presence in two distinct, essential markets grants Chemed a robust competitive edge and broad brand recognition.

Chemed's diversified business model, featuring distinct healthcare (hospice) and home services (plumbing) segments, offers robust risk mitigation. This dual focus ensures stability by not relying on a single market, as both sectors are generally considered essential, providing resilience during economic downturns.

Chemed exhibits robust financial health, underscored by its strong operational cash flow and a well-fortified balance sheet. This financial stability provides significant strategic advantages.

As of the first quarter of 2024, Chemed reported substantial liquidity with $313.4 million in cash and cash equivalents. Crucially, the company maintained zero debt, both current and long-term, offering exceptional financial flexibility for pursuing growth opportunities and rewarding shareholders.

Strategic Growth through Acquisitions and Organic Expansion

Chemed's VITAS Healthcare segment demonstrates significant strength through a dual approach of strategic acquisitions and robust organic growth. For instance, the acquisition of Covenant Health's hospice assets in April 2024 expanded VITAS's reach and service capabilities, a move that directly bolsters its market presence.

This strategic expansion is further amplified by consistent organic growth. VITAS has seen positive trends in key performance indicators, with reported increases in average daily census and admissions, underscoring the effectiveness of its operational strategies in attracting and serving more patients.

- Acquisition Strategy: VITAS Healthcare actively pursues acquisitions to broaden its geographic footprint and service portfolio, exemplified by the April 2024 deal for Covenant Health hospice assets.

- Organic Growth: The company consistently achieves organic growth, evidenced by rising average daily census and patient admissions, indicating strong internal operational performance.

- Balanced Growth Model: Chemed benefits from a balanced growth strategy that combines external expansion through M&A with internal, organic increases in patient volume and service utilization.

Commitment to Shareholder Returns

Chemed Corporation exhibits a strong commitment to enhancing shareholder value, evident in its consistent dividend payouts and strategic share repurchase initiatives. This focus on returning capital directly to investors underscores the company's financial health and management's confidence in its future prospects.

Reinforcing this commitment, Chemed's board authorized an additional $300 million for stock repurchases in August 2025. This significant buyback program not only signals financial strength but also aims to boost earnings per share and increase shareholder equity.

- Consistent Dividend Growth: Chemed has a track record of increasing its dividends, providing a reliable income stream for investors.

- Share Repurchase Programs: The company actively engages in share buybacks, reducing the number of outstanding shares and potentially increasing their value.

- August 2025 Authorization: A $300 million stock repurchase authorization in August 2025 highlights ongoing dedication to shareholder returns.

- Investor Confidence: These actions collectively bolster investor confidence by demonstrating financial discipline and a commitment to rewarding shareholders.

Chemed's dual market leadership through VITAS Healthcare and Roto-Rooter provides a significant competitive advantage. VITAS is a top hospice provider, while Roto-Rooter leads in plumbing services, creating a stable, diversified revenue stream. This diversification acts as a buffer against sector-specific downturns.

Financially, Chemed is exceptionally strong. As of Q1 2024, the company held $313.4 million in cash and equivalents with zero debt, offering substantial financial flexibility. This robust liquidity supports strategic growth and shareholder returns.

VITAS Healthcare's growth strategy, combining acquisitions like the April 2024 Covenant Health deal with organic increases in patient census, demonstrates effective expansion. This balanced approach solidifies its market position.

Chemed's commitment to shareholder value is evident in its dividend increases and share repurchases. The August 2025 authorization of an additional $300 million for stock buybacks underscores this dedication.

| Segment | Market Position | Key Financial Metric (Q1 2024) |

|---|---|---|

| VITAS Healthcare | Largest U.S. Hospice Provider | N/A (Segment data not detailed) |

| Roto-Rooter | Largest U.S. Plumbing Provider | N/A (Segment data not detailed) |

| Chemed Corporation | Diversified Holdings | $313.4M Cash & Equivalents; $0 Debt |

What is included in the product

Delivers a strategic overview of Chemed’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Roto-Rooter's financial performance has shown weakness, with revenue and adjusted EBITDA margins declining in recent quarters, including Q1 2024 and projections for Q2 2025. This downturn is partly due to increased internet marketing expenses and a softening consumer outlook, suggesting challenges in maintaining profitability and adapting to market shifts.

VITAS Healthcare faces significant headwinds due to Medicare cap limitations, especially in crucial markets such as Florida. These caps directly restrict revenue generation and impact overall profitability, as evidenced by a $16.4 million reduction in Q2 2025. This recurring financial constraint presents an ongoing challenge for the hospice segment.

Chemed's VITAS segment faces a significant weakness due to its heavy reliance on government reimbursement rates, particularly Medicare. This makes VITAS vulnerable to shifts in government policy and potential funding reductions.

While Medicare reimbursement rates are projected for a 2.9% increase in fiscal year 2025, this rise is a point of concern for hospice industry leaders. They worry that these increases might not be enough to offset escalating operational expenses and the impact of inflation, potentially squeezing VITAS's profitability.

Impact of Economic Conditions on Consumer Spending

While plumbing is a necessity, Roto-Rooter isn't entirely immune to economic downturns. Factors like reduced consumer confidence or elevated interest rates can cause homeowners to postpone significant projects such as bathroom renovations or major fixture upgrades. This hesitation directly impacts revenue streams from these higher-ticket services.

For instance, in late 2023 and early 2024, many households faced increased borrowing costs due to persistent inflation and the Federal Reserve's monetary policy. This economic environment likely contributed to a slowdown in discretionary spending on home improvements across the sector.

- Economic Sensitivity: Roto-Rooter's revenue from non-emergency services, like upgrades and remodels, is susceptible to shifts in consumer spending power and confidence.

- Interest Rate Impact: Higher interest rates can deter customers from financing larger home improvement projects, thereby reducing demand for Roto-Rooter's more extensive service offerings.

- Consumer Sentiment Downturns: A general decline in consumer optimism about the economy can lead to delayed or canceled discretionary home maintenance and improvement projects.

Healthcare Workforce Shortages

Chemed, through its VITAS segment, faces significant headwinds from ongoing skilled labor shortages within the hospice industry. This persistent challenge directly impacts operational efficiency and can escalate labor expenses. For instance, in late 2024, the Bureau of Labor Statistics reported a continued tightness in healthcare employment, with registered nurses, a critical component of hospice care, experiencing elevated demand and wage pressures.

These workforce deficits can strain Chemed's ability to maintain optimal staffing levels, potentially affecting the quality and accessibility of its vital hospice services. The need for continuous investment in robust recruitment and retention initiatives becomes paramount to mitigate these risks and ensure consistent patient care delivery.

- Persistent Skilled Labor Shortages: The hospice sector, including VITAS, continues to struggle with a lack of qualified healthcare professionals.

- Increased Labor Costs: Shortages drive up wages and benefits, impacting profitability. For example, average RN salaries in healthcare saw an approximate 4-5% increase in 2024.

- Operational Strain: Inadequate staffing can lead to longer wait times and reduced capacity for patient admissions.

- Impact on Care Quality: Understaffing can compromise the quality of care and patient experience, a critical factor in hospice.

Chemed's VITAS segment is highly dependent on government reimbursement rates, particularly Medicare, making it susceptible to policy changes and funding cuts. While Medicare rates are projected to increase by 2.9% in fiscal year 2025, this rise may not sufficiently cover rising operational costs and inflation, potentially impacting VITAS's profitability.

The hospice industry, including VITAS, grapples with persistent skilled labor shortages, driving up wages and impacting operational efficiency. For instance, the Bureau of Labor Statistics indicated continued tightness in healthcare employment in late 2024, with registered nurses facing high demand and wage pressures.

Roto-Rooter's revenue from non-essential services, like renovations, is vulnerable to economic downturns, reduced consumer confidence, and higher interest rates. Increased borrowing costs in late 2023 and early 2024 likely slowed discretionary spending on home improvements, affecting revenue from larger projects.

Chemed's financial performance shows weakness, with declining revenue and adjusted EBITDA margins in recent quarters, including Q1 2024 and projections for Q2 2025, partly due to increased marketing expenses and a softening consumer outlook.

| Segment | Weakness | Impact | Data Point |

|---|---|---|---|

| VITAS Healthcare | Reliance on Government Reimbursement | Vulnerability to policy changes and funding reductions | Projected 2.9% Medicare rate increase for FY2025 may not offset costs |

| VITAS Healthcare | Skilled Labor Shortages | Increased labor costs and operational strain | RN wage pressures reported in late 2024 |

| Roto-Rooter | Economic Sensitivity (Non-Essential Services) | Reduced revenue from discretionary projects | Higher interest rates in late 2023/early 2024 impacted home improvement spending |

| Chemed (Overall) | Declining Profitability Metrics | Pressure on overall financial performance | Revenue and adjusted EBITDA margins declined in Q1 2024 and projected for Q2 2025 |

Preview the Actual Deliverable

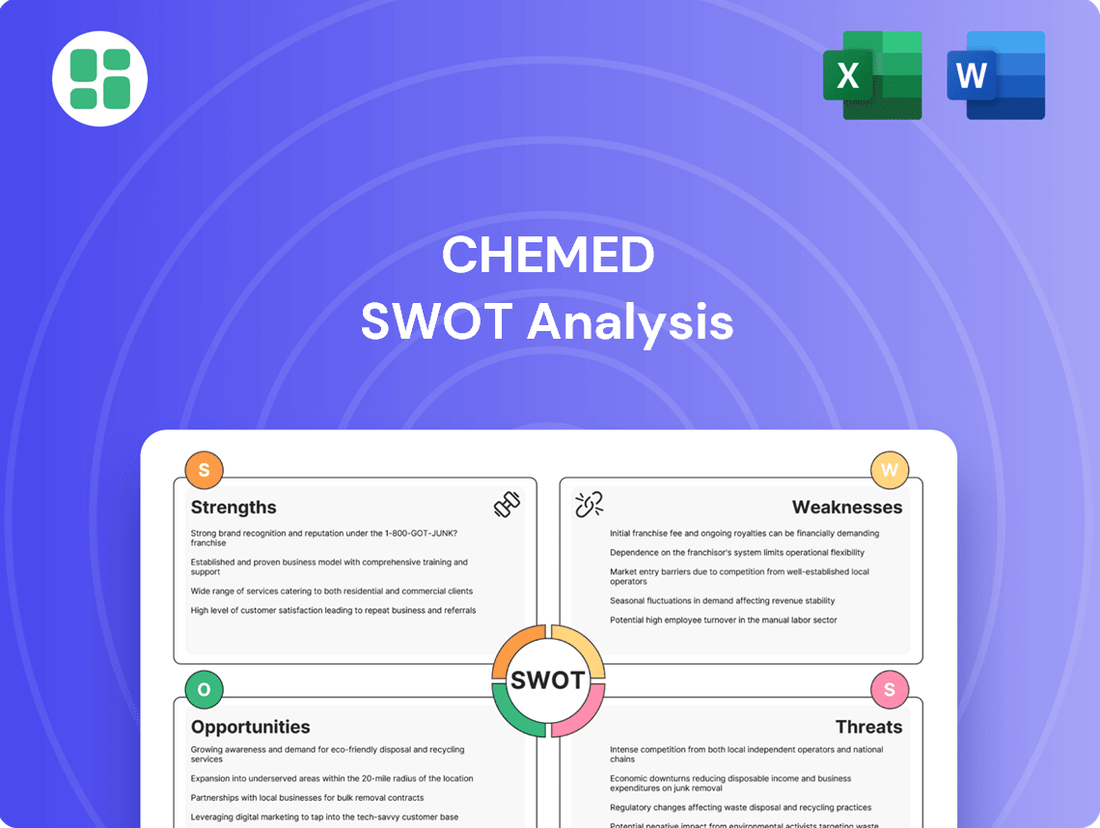

Chemed SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You'll find the same comprehensive breakdown of Chemed's Strengths, Weaknesses, Opportunities, and Threats that you see here. This ensures you receive exactly what you expect, ready for your strategic planning.

Opportunities

The hospice care market is on a strong upward trajectory, fueled by a global population that's getting older and a rise in chronic illnesses. This trend is particularly beneficial for VITAS, as it aligns with a growing desire for in-home end-of-life care. In 2023, the U.S. hospice market alone was valued at approximately $150 billion, with projections indicating continued expansion.

Chemed, through its VITAS segment, is strategically pursuing geographic expansion, aiming to enter at least 12 new states. This growth is particularly focused on Certificate of Need states, where regulatory barriers can limit competition. The company is also diversifying its service offerings by exploring opportunities in adjacent markets such as assisted living facilities, which could significantly broaden its customer base and revenue streams.

Chemed's subsidiaries, VITAS and Roto-Rooter, are poised to benefit from integrating advanced technologies. VITAS can enhance hospice care through telehealth and remote patient monitoring, improving patient outcomes and caregiver efficiency. For instance, in 2024, the telehealth market for healthcare services was projected to reach over $100 billion globally, indicating significant growth potential.

Roto-Rooter can implement smart plumbing systems for proactive maintenance and diagnostics, alongside AI-powered scheduling to optimize technician deployment. The adoption of water-efficient solutions also presents an opportunity to appeal to environmentally conscious consumers. By 2025, the global smart water management market is expected to exceed $30 billion, reflecting increasing demand for such innovations.

Increased Demand for Home Repair and Remodeling

The aging housing stock across the United States is a significant driver for increased demand in home repair and remodeling. Many homes require ongoing maintenance and upgrades, creating a consistent need for services like those offered by Roto-Rooter.

The current economic climate, characterized by higher mortgage rates, has created a 'lock-in effect'. This means homeowners are less likely to move and more inclined to invest in improving their existing properties. This trend is particularly beneficial for plumbing services, as kitchens and bathrooms are frequent targets for renovation.

This sustained demand translates into a steady and growing revenue stream for Roto-Rooter. The company is well-positioned to capitalize on this market trend, as homeowners prioritize essential repairs and upgrades to their plumbing systems.

- Aging Housing Stock: Approximately 40% of U.S. homes were built before 1980, necessitating regular maintenance and upgrades.

- Lock-in Effect: High mortgage rates (often exceeding 6% in late 2023 and continuing into 2024) discourage home sales, encouraging renovations instead.

- Remodeling Spending: Homeowners spent an estimated $150 billion on residential renovations in 2023, with plumbing projects forming a significant portion.

Consolidation in Hospice Sector

The hospice sector is experiencing significant consolidation, creating a fertile ground for strategic acquisitions. VITAS, as a leading player, can leverage this trend to acquire smaller, high-quality hospice providers. This move would not only expand its market share but also unlock substantial operational synergies and economies of scale.

These acquisitions can lead to:

- Increased Market Share: By integrating acquired entities, VITAS can solidify its dominant position in key geographic areas.

- Operational Synergies: Combining back-office functions and streamlining care delivery can reduce costs and improve efficiency.

- Economies of Scale: Larger operational footprints often translate to better purchasing power and more efficient resource allocation.

- Enhanced Service Offerings: Acquiring specialized providers can broaden VITAS's range of services and patient care capabilities.

For instance, the U.S. hospice market was valued at approximately $30 billion in 2023 and is projected to grow, with consolidation being a key driver. Companies that can effectively integrate acquired businesses are poised to benefit significantly from this industry shift.

Chemed's VITAS segment can capitalize on the growing demand for in-home care by expanding its geographic reach, targeting at least 12 new states, particularly those with Certificate of Need regulations that can limit competition. Furthermore, VITAS is exploring adjacent markets like assisted living facilities to broaden its customer base and revenue streams.

Technological integration presents a significant opportunity, with VITAS able to enhance patient care through telehealth and remote monitoring, while Roto-Rooter can leverage smart plumbing systems and AI for optimized operations. The global telehealth market was projected to exceed $100 billion in 2024, highlighting the potential for digital health solutions.

The aging U.S. housing stock, with roughly 40% of homes built before 1980, drives consistent demand for Roto-Rooter's services. This is further amplified by the current economic environment, where high mortgage rates, often above 6% in late 2023 and into 2024, create a homeowner 'lock-in effect', encouraging renovations over moving.

The hospice sector's consolidation trend offers VITAS a chance to acquire smaller providers, increasing market share, achieving operational synergies, and realizing economies of scale. The U.S. hospice market, valued at around $30 billion in 2023, is seeing consolidation as a key growth driver.

Threats

The hospice care and plumbing services sectors are both crowded with many regional and national companies. This fierce rivalry can put pressure on Chemed's pricing, market share, and profit margins for both VITAS and Roto-Rooter. Staying ahead requires constant innovation and making services stand out.

The healthcare sector, particularly hospice care, faces a constantly shifting regulatory landscape. Centers for Medicare & Medicaid Services (CMS) updates to payment rates and quality reporting requirements, such as the HOPE tool, directly influence operational costs and revenue streams. For instance, CMS finalized a 2.1% payment rate increase for hospice agencies for fiscal year 2024, a figure that requires careful forecasting.

Chemed's diverse operations, particularly in healthcare and skilled trades, are feeling the pinch of rising operating and labor costs. For instance, the healthcare sector is grappling with increased supply chain expenses and a persistent shortage of qualified personnel, a trend that continued through 2024 and is projected to persist. These pressures directly impact profitability, necessitating careful cost management and strategic pricing to maintain healthy margins.

Reputational Risks from Industry Issues

The hospice industry has unfortunately seen its share of fraud and misconduct, which casts a shadow over the entire sector. This can translate into heightened public suspicion and a generally negative view of hospice care, even for reputable providers like VITAS. Such industry-wide reputational damage, even if not tied to VITAS directly, could erode patient confidence and invite stricter regulatory attention.

For instance, reports from 2023 highlighted significant government efforts to combat fraud in Medicare, including hospice services, with millions recovered. This ongoing enforcement activity amplifies the general industry risk. Consequently, VITAS might face increased scrutiny from patients, families, and regulators, potentially impacting patient acquisition and operational flexibility.

- Increased Regulatory Scrutiny: Past instances of fraud in the hospice sector could lead to more stringent compliance requirements and audits for all providers, including VITAS.

- Erosion of Public Trust: Negative media coverage or public perception of industry malfeasance, even if unrelated to VITAS, can make potential patients hesitant to engage hospice services.

- Indirect Financial Impact: A damaged industry reputation might indirectly affect VITAS through increased marketing costs to rebuild trust or potential delays in reimbursement due to heightened oversight.

Economic Downturn Impact on Discretionary Spending

A significant economic downturn could dampen consumer and business spending on non-essential plumbing services. For instance, if inflation continues to pressure household budgets, homeowners might postpone upgrades or renovations, impacting Chemed's revenue streams beyond immediate repair needs.

This threat is particularly relevant as discretionary spending often contracts sharply during recessions. Data from the Bureau of Labor Statistics indicated a notable drop in consumer spending on home improvement projects during past economic slowdowns, suggesting a potential impact on Chemed's less critical service offerings.

- Economic Slowdown: Reduced consumer confidence and disposable income can lead to delayed or cancelled non-essential plumbing projects.

- Business Deferral: Commercial clients may cut back on capital expenditures, including plumbing system upgrades or expansions.

- Impact on Growth: A prolonged economic slump could hinder Chemed's ability to expand its service offerings or market share.

The healthcare industry, particularly hospice care, is subject to evolving regulations and potential fraud that can impact Chemed. Increased scrutiny from agencies like CMS, driven by past instances of misconduct, could lead to stricter compliance demands and audits for VITAS. This environment necessitates continuous adaptation to new rules and robust internal controls to mitigate risks.

Economic headwinds pose a significant threat, as downturns can curb consumer and business spending on services like Roto-Rooter's non-essential plumbing projects. A slowdown in discretionary spending, a common occurrence during recessions, could directly affect Chemed's revenue streams. For example, historical data shows a dip in home improvement spending during economic contractions, highlighting the vulnerability of these services.

Chemed faces intense competition in both its hospice and plumbing sectors. This crowded market can pressure pricing and market share for VITAS and Roto-Rooter, requiring ongoing innovation to differentiate services. The ongoing labor shortage and rising operational costs across both segments, particularly in healthcare, also present a persistent challenge to maintaining profitability through 2024 and beyond.

| Threat Category | Specific Risk | Potential Impact on Chemed | Relevant Data/Trend |

|---|---|---|---|

| Regulatory & Compliance | Increased scrutiny due to hospice fraud | Stricter compliance, audits, potential fines for VITAS | CMS fraud enforcement efforts recovered millions in 2023. |

| Economic Conditions | Reduced discretionary spending | Lower revenue for non-essential Roto-Rooter services | Consumer spending on home improvement historically declines in recessions. |

| Market Competition | Crowded markets in hospice and plumbing | Pricing pressure, reduced market share for VITAS and Roto-Rooter | Numerous regional and national players in both sectors. |

| Operational Costs | Rising labor and supply chain expenses | Decreased profit margins for both segments | Persistent labor shortages and increased supply costs noted through 2024. |

SWOT Analysis Data Sources

This Chemed SWOT analysis is built upon a robust foundation of data, drawing from company financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.