Chemed PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemed Bundle

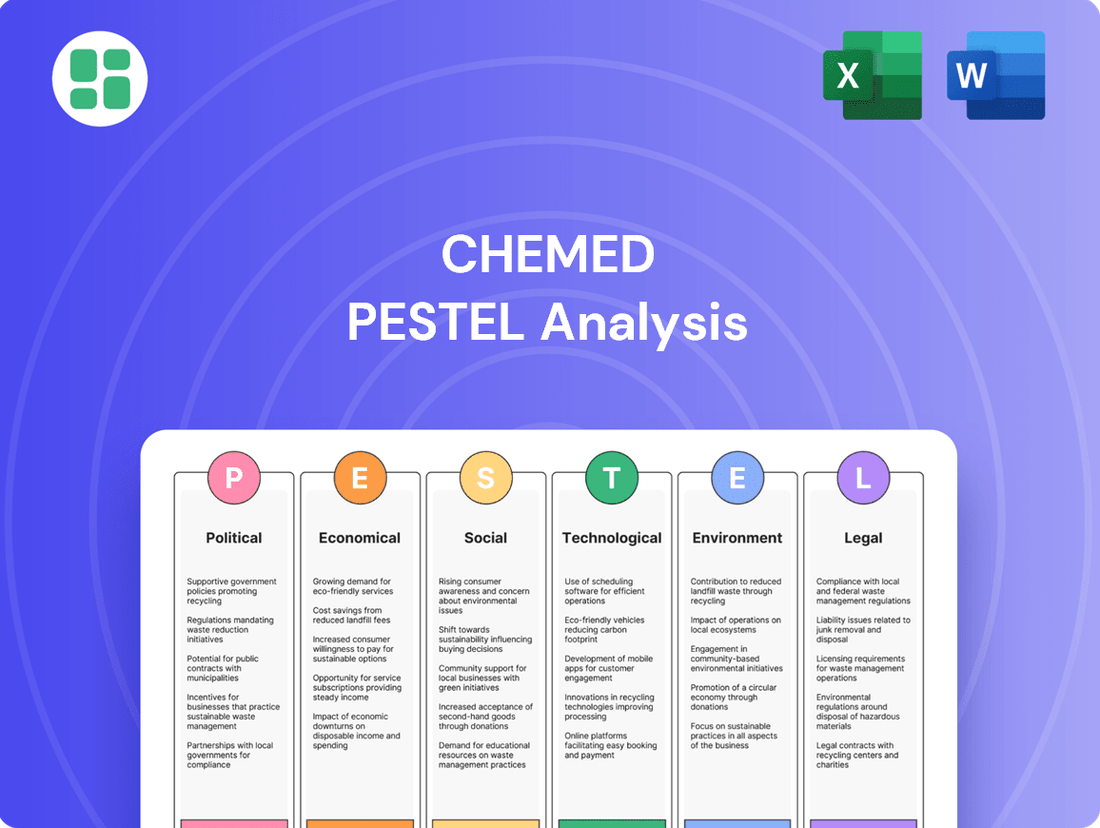

Unlock the critical external factors shaping Chemed's trajectory with our comprehensive PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy and anticipate market shifts. Download the full PESTLE analysis now and gain a decisive advantage.

Political factors

Government healthcare policies, especially those concerning Medicare reimbursement, are a major influence on VITAS Healthcare's financial health and how it operates. These policies dictate how much the company gets paid for its services.

For example, the Centers for Medicare & Medicaid Services (CMS) proposed a 2.6% payment update for Fiscal Year 2025. This update is calculated by taking an estimated market basket update and subtracting a productivity adjustment. Such annual adjustments are vital for ensuring hospice providers can cover the expenses associated with delivering end-of-life care.

The hospice industry faces continuous regulatory shifts designed to enhance patient care and deter fraudulent practices. Chemed, through its VITAS Healthcare segment, must remain agile in responding to evolving Hospice Conditions of Participation and Quality Reporting Requirements.

Recent adjustments, such as those impacting the CAHPS Hospice Survey, directly influence how providers are evaluated and reimbursed, making compliance a critical operational focus for 2024 and beyond.

Chemed's Roto-Rooter segment faces a complex web of local and state regulations impacting plumbing and drain cleaning. These rules often govern everything from wastewater discharge to worker safety, directly affecting operational costs and service capabilities.

The Environmental Protection Agency's (EPA) recent directives, such as the mandate for lead service line replacement across the nation within the next decade, present both challenges and opportunities. This initiative, aiming to improve public health, will likely increase demand for specialized plumbing services related to water infrastructure upgrades.

Furthermore, evolving EPA standards for per- and polyfluoroalkyl substances (PFAS) in drinking water are pushing for stricter controls on industrial and residential wastewater. Compliance with these new regulations may require Roto-Rooter to adapt its methods and potentially invest in new technologies to handle contaminated water, influencing service pricing and availability.

Political stability and its impact on consumer spending for home services

Political stability plays a crucial role in consumer confidence, directly influencing discretionary spending on services like those offered by Roto-Rooter. When the political climate is stable, consumers feel more secure about their financial future, leading to increased spending on home improvements and maintenance.

The plumbing industry, including companies like Roto-Rooter, faced headwinds in 2024, but projections for 2025 suggest a recovery. This anticipated upturn is partly linked to the expectation of subsiding inflation, which typically boosts consumer purchasing power and willingness to invest in home services. Furthermore, new opportunities emerging within residential markets are expected to fuel this recovery.

Policy shifts, particularly those related to water management and infrastructure, can significantly impact the home services sector. Changes enacted by different U.S. presidential administrations can alter the regulatory landscape, influencing industry practices and investment priorities. For instance, federal initiatives supporting water conservation or infrastructure upgrades could create new demand for specialized plumbing services.

- Consumer Confidence and Spending: Political stability is a key driver of consumer confidence, which in turn dictates discretionary spending on home services.

- Industry Recovery Projections: The plumbing sector, after a challenging 2024, is anticipated to see a recovery in 2025, aided by moderating inflation and residential market growth.

- Policy Impact: U.S. water policy, subject to changes with presidential administrations, can reshape the regulatory environment and focus areas for companies in the home services industry.

Trade policies and their effect on supply chains for equipment

Shifting trade policies significantly impact the cost and accessibility of vital equipment for Chemed's operations. For example, the 'Build America, Buy America' initiative, embedded within the Bipartisan Infrastructure Law, directly influences water infrastructure projects. This could necessitate adjustments in how Roto-Rooter sources its materials and specialized equipment, potentially increasing costs or altering supplier relationships.

The broader trade landscape, including tariffs and import/export regulations, can create price volatility for essential components. For 2024, the ongoing reassessment of global trade agreements and potential retaliatory tariffs could add an estimated 5-10% to the cost of imported machinery and parts for the plumbing and drain maintenance sector. This necessitates proactive supply chain diversification and careful vendor selection to mitigate financial risks.

- Tariff Impact: Potential for increased equipment costs due to import duties on specialized machinery.

- Supply Chain Resilience: Need to evaluate and potentially diversify suppliers to counter trade policy disruptions.

- Domestic Sourcing: The 'Build America, Buy America' provision may drive demand for domestically manufactured equipment, potentially altering cost structures.

- Regulatory Compliance: Adhering to evolving trade regulations adds administrative overhead and requires continuous monitoring.

Government healthcare policies, particularly Medicare reimbursement rates, directly impact Chemed's VITAS Healthcare segment. The Centers for Medicare & Medicaid Services (CMS) proposed a 2.6% payment update for Fiscal Year 2025, reflecting adjustments for market basket updates and productivity. These regulatory adjustments are critical for hospice providers to manage operational costs.

The political landscape influences consumer confidence, which in turn affects discretionary spending on services like those provided by Roto-Rooter. A stable political environment typically bolsters consumer willingness to invest in home maintenance. Projections for 2025 indicate a recovery in the plumbing sector, partly due to anticipated moderating inflation, which should enhance consumer purchasing power.

Trade policies, such as tariffs and import/export regulations, can affect the cost of essential equipment for Chemed. The 'Build America, Buy America' initiative may also influence sourcing for water infrastructure projects. In 2024, ongoing reassessments of global trade agreements could add an estimated 5-10% to the cost of imported machinery for the plumbing sector.

What is included in the product

This Chemed PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights.

Economic factors

The U.S. hospice market is on a solid growth trajectory, with an estimated value of $29.92 billion in 2024 and a projected $31.21 billion by 2025, reflecting a compound annual growth rate of 4.61% through 2030. This expansion presents a favorable environment for companies like VITAS Healthcare.

Despite this market growth, reimbursement rates, particularly from Medicare, which accounted for $25.7 billion in hospice payments in 2023, have faced challenges keeping pace with inflation. This dynamic can create financial pressures and impact profitability.

The home service sector, encompassing areas like plumbing and drain cleaning, is showing signs of recovery following a somewhat subdued 2024. This resurgence is largely attributed to an uptick in consumer spending and a healthier housing market.

Evidence from late 2024 indicates a rise in consumer confidence, pointing towards a stronger demand for services like those offered by Roto-Rooter in 2025. For instance, the U.S. Commerce Department reported a 0.6% increase in retail sales for November 2024, suggesting consumers are more willing to spend on discretionary services.

Both VITAS Healthcare and Roto-Rooter are grappling with rising costs. For VITAS, wage inflation and general economic price increases are putting a strain on their financial health, a common issue in the healthcare industry.

Roto-Rooter, however, has been more successful in navigating these challenges. They've managed to keep their revenue strong by strategically increasing prices and the average size of their customer invoices, effectively offsetting the higher expenses for labor and materials.

Interest rates and their effect on Chemed's capital expenditures and financing

Fluctuating interest rates significantly influence Chemed's capital allocation and financing strategies. When rates rise, the cost of borrowing for acquisitions and major capital projects increases, potentially slowing down expansion plans. For instance, higher interest rates in 2023 and early 2024 were a contributing factor to a noticeable slowdown in merger and acquisition (M&A) activity within the hospice sector, a key area for Chemed.

Conversely, anticipated interest rate cuts throughout 2024 and into 2025 present a more favorable environment. These reductions in borrowing costs can reignite M&A opportunities by making deals more financially attractive. Furthermore, lower interest rates often stimulate consumer spending, which could benefit Chemed's home and family services segment as discretionary spending power increases.

Key impacts on Chemed include:

- Increased Cost of Capital: Higher interest rates directly increase the expense of debt financing for new investments and acquisitions.

- M&A Activity Slowdown: The period of elevated rates in 2023 and 2024 demonstrably cooled the market for hospice and home service company acquisitions.

- Potential for Revitalization: Expected rate cuts in 2024 and 2025 are poised to lower financing costs, encouraging renewed M&A interest and potentially boosting Chemed's growth through strategic purchases.

- Consumer Spending Boost: Lower rates generally lead to increased consumer confidence and spending, which can positively impact Chemed's service revenues.

Disposable income levels influencing elective home maintenance

Higher disposable income levels directly fuel consumer spending on non-essential home services, such as elective maintenance and upgrades. As homeowners feel more financially secure, they are more likely to invest in projects that improve their living spaces beyond immediate needs.

Record-high home values and expanding home equity in 2024 and early 2025 are incentivizing homeowners to channel their increased financial capacity into repairs, renovations, and aesthetic improvements. This growing pool of accessible equity provides a financial cushion for such discretionary spending.

This economic backdrop is a significant tailwind for companies like Roto-Rooter, bolstering demand for their services beyond critical emergency repairs. Homeowners are increasingly viewing plumbing and related services as investments in their property's long-term value and comfort.

- Disposable Income Growth: In the US, real disposable income saw a notable increase through late 2024, supporting discretionary spending.

- Home Equity: US homeowners' equity reached record levels in early 2025, providing a substantial financial resource for home improvements.

- Consumer Confidence: Surveys in late 2024 indicated a positive outlook on personal finances, encouraging spending on home services.

- Home Improvement Spending: Projections for 2025 suggested a continued robust market for home improvement and repair services, driven by equity and disposable income.

Economic factors significantly shape Chemed's operating environment, influencing both its hospice and home service segments. Rising inflation and wage pressures, evident in the healthcare sector, can impact profitability for companies like VITAS Healthcare, despite a growing market. Conversely, increased consumer confidence and disposable income, supported by factors like strong retail sales figures in late 2024, are beneficial for Roto-Rooter's service demand.

Interest rate fluctuations present a dual impact: higher rates in 2023-2024 increased borrowing costs and slowed M&A, while anticipated cuts in 2024-2025 are expected to stimulate investment and consumer spending. Record home equity levels in early 2025 also provide a financial cushion, encouraging homeowners to invest in home improvements, a direct positive for Chemed's service offerings.

| Economic Factor | Impact on Chemed | Data Point (2024/2025) |

|---|---|---|

| Inflation & Wage Growth | Increased operating costs for VITAS Healthcare | Medicare hospice payments were $25.7 billion in 2023; wage inflation is a concern. |

| Consumer Spending | Boosted demand for Roto-Rooter services | U.S. retail sales increased 0.6% in November 2024. |

| Interest Rates | Affects M&A activity and borrowing costs | Anticipated rate cuts in 2024-2025 expected to lower financing costs. |

| Disposable Income & Home Equity | Drives discretionary spending on home services | US homeowners' equity reached record levels in early 2025. |

Same Document Delivered

Chemed PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Chemed PESTLE Analysis provides a comprehensive overview of the external factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment. It details Political, Economic, Social, Technological, Legal, and Environmental influences on Chemed's operations.

Sociological factors

The aging global population is a significant factor driving demand for hospice and end-of-life care. By 2050, it's projected that 22% of the world's population will be aged 60 and over, a substantial increase that directly translates to a greater need for specialized medical services like those offered by VITAS Healthcare.

This demographic trend means more individuals will require long-term care for chronic conditions, bolstering the market for hospice providers. The increasing prevalence of age-related illnesses directly supports the sustained growth potential for companies focused on palliative and end-of-life support.

Consumers are increasingly prioritizing convenience and digital integration when seeking home services. This shift is evident in the growing adoption of online platforms for booking, communication, and payment. By 2024, almost half of all home service transactions were digital, a figure projected to exceed 50% in 2025, highlighting a clear move away from traditional cash-based exchanges.

The tech-savviness of homeowners plays a crucial role in this evolution. They actively leverage online resources not only to find and vet service providers but also to gather inspiration for their home improvement projects. This digital-first approach to home services signifies a fundamental change in how consumers interact with and procure these essential offerings.

Public perception and trust are paramount for both VITAS Healthcare and Roto-Rooter. For VITAS, fostering open communication about advance care planning and end-of-life preferences can significantly enhance patient empowerment and satisfaction. In 2024, surveys indicated that over 60% of individuals who had discussed their end-of-life wishes felt more confident in their care decisions.

Roto-Rooter's success hinges on a robust brand reputation built on consistent reliability and high-quality service. Customer trust translates directly into loyalty and valuable word-of-mouth referrals. In 2024, customer satisfaction scores for Roto-Rooter consistently exceeded 90%, a testament to their dependable service delivery.

Workforce availability and demographic shifts in healthcare and skilled trades

Chemed's operations are significantly impacted by workforce availability, with both VITAS (hospice care) and Roto-Rooter (plumbing services) facing critical labor shortages. VITAS is particularly affected by a shortage of qualified nurses and healthcare professionals, a situation expected to worsen with substantial shortfalls projected by 2025.

Roto-Rooter, on the other hand, contends with an aging plumbing workforce and a persistent scarcity of skilled technicians. This demographic challenge necessitates ongoing investment in recruitment and comprehensive training programs to ensure a steady supply of qualified personnel.

- Healthcare Shortage: Projections by the U.S. Bureau of Labor Statistics indicated a need for over 1.1 million new registered nurses by 2022, highlighting the scale of the challenge VITAS faces.

- Skilled Trades Gap: The plumbing industry, like many skilled trades, faces a significant pipeline issue. For instance, the Plumbing-Heating-Cooling Contractors Association (PHCC) has reported that roughly 75% of their members are struggling to find qualified workers.

- Demographic Trends: An aging workforce across many sectors, including skilled trades, means a substantial portion of experienced workers are nearing retirement, exacerbating existing shortages.

Awareness and acceptance of end-of-life care options

Public understanding of end-of-life care, including hospice and palliative services, is growing, leading to increased physician referrals and overall usage. This heightened awareness is crucial for healthcare providers like Chemed to align their services with patient needs.

Despite this progress, a significant challenge persists: less than 30% of people worldwide actively engage in advance care planning. This statistic highlights a critical area where Chemed can contribute by promoting discussions and resources for end-of-life decision-making.

- Growing Awareness: Increased public knowledge of hospice and palliative care benefits.

- Low Planning Rates: Under 30% global engagement in advance care planning.

- Bridging the Gap: Initiatives like National Healthcare Decisions Day aim to improve end-of-life wish fulfillment.

Societal attitudes towards aging and end-of-life care are evolving, with a growing appreciation for quality of life and personalized support. This shift benefits hospice providers like VITAS, as more individuals seek dignified and comfortable care options. Public awareness campaigns are improving understanding, yet a significant gap remains in proactive end-of-life planning, with less than 30% globally engaging in advance care discussions.

Technological factors

Technological advancements, especially in telehealth and remote monitoring, are significantly reshaping hospice care. These innovations allow for continuous patient oversight and the development of highly personalized care plans, ensuring patients receive timely support and enhanced comfort, even in geographically dispersed locations. VITAS Healthcare, for instance, leverages these technologies to improve patient outcomes.

The integration of telemedicine for end-of-life consultations represents a major shift, facilitating more accessible and immediate communication between patients, families, and care providers. This not only improves care delivery but also offers greater convenience and peace of mind during a critical time. By 2024, the adoption of such remote care solutions in the healthcare sector saw a substantial increase, with telehealth visits projected to grow significantly in the coming years.

The plumbing sector is increasingly adopting smart technologies to enhance diagnostics and repair efficiency. Companies like Roto-Rooter are integrating advanced leak detection systems, smart water heaters, and comprehensive home water monitoring solutions to proactively identify and address issues.

Artificial intelligence is proving invaluable in swiftly and accurately diagnosing complex plumbing problems, reducing guesswork and improving service delivery. For instance, AI-powered diagnostic tools can analyze sensor data from plumbing systems to pinpoint the root cause of leaks or blockages with remarkable precision.

Data analytics and AI are transforming operational efficiency. For instance, in the plumbing sector, AI can predict inventory needs, optimize delivery routes, and automate routine customer inquiries via chatbots, reducing overhead. Chemed likely leverages these technologies to manage its extensive service network more effectively.

In palliative care, advanced data analytics are indispensable for managing complex patient histories and ensuring seamless, coordinated care. This allows for more personalized treatment plans and better resource allocation, critical for a sector focused on patient well-being.

Digital marketing and customer engagement platforms for both segments

Digital marketing and a strong online presence are paramount for customer engagement across Chemed's segments. For Roto-Rooter, a mobile-first approach, localized search engine optimization (SEO), and consistent social media activity are vital. This is because a significant portion of home service searches, estimated to be over 60% in 2024, originate from mobile devices, making it crucial for efficient customer acquisition and service booking.

These digital strategies enable Roto-Rooter to connect with a wider audience and respond promptly to customer needs. By leveraging platforms like Google My Business and engaging on social media, the company can build trust and provide accessible information. This direct engagement can lead to increased appointment scheduling and improved customer loyalty.

- Mobile-First Strategy: Over 60% of home service searches occur on mobile devices, necessitating a seamless mobile experience for booking and information.

- Localized SEO: Targeting local search terms ensures Roto-Rooter appears prominently when customers in specific geographic areas search for plumbing and drain services.

- Social Media Engagement: Active participation on platforms like Facebook and Instagram allows for direct customer interaction, promotion of services, and reputation management.

- Digital Advertising: Targeted online ads can reach potential customers actively seeking plumbing solutions, driving lead generation and conversions.

Emerging technologies for sustainable plumbing solutions

The plumbing sector is experiencing a significant shift towards sustainability, fueled by growing environmental awareness among consumers and businesses. This trend presents opportunities for companies like Roto-Rooter to integrate eco-friendly practices and materials into their service offerings.

Key technological advancements supporting this transition include the use of recycled materials for pipes, the installation of low-flow fixtures to conserve water, and the adoption of water-efficient appliances. These solutions not only reduce environmental impact but also offer long-term cost savings for end-users.

Furthermore, innovative systems like greywater recycling, which repurposes water from sinks and showers for non-potable uses like irrigation, and energy-efficient water heaters are becoming increasingly popular. For instance, the global market for water-efficient fixtures was valued at approximately $25 billion in 2023 and is projected to grow significantly in the coming years.

- Recycled Pipe Materials: Utilizing pipes made from post-consumer recycled plastics or metals reduces reliance on virgin resources.

- Low-Flow Fixtures: Toilets, faucets, and showerheads designed to use less water per minute, contributing to substantial water savings.

- Water-Efficient Appliances: Dishwashers and washing machines that optimize water usage, often certified by programs like ENERGY STAR.

- Greywater Recycling Systems: Technologies that collect and filter lightly used water for reuse in tasks like toilet flushing or landscape irrigation.

- Energy-Efficient Water Heaters: Including tankless, heat pump, and solar water heaters that significantly reduce energy consumption compared to traditional tank models.

Technological advancements are driving efficiency and personalization in hospice care, with telehealth and remote monitoring becoming standard. These tools facilitate continuous patient oversight and tailored care plans, improving outcomes and accessibility. The healthcare sector saw a substantial increase in remote care adoption in 2024, with telehealth visits projected for continued significant growth.

Legal factors

VITAS Healthcare, a significant part of Chemed, navigates a complex landscape of healthcare compliance and privacy regulations, notably those concerning Medicare and Medicaid. These federal programs are foundational to hospice reimbursement, and any shifts in their operational or financial rules directly impact VITAS. For instance, the Centers for Medicare & Medicaid Services (CMS) continuously reviews and updates payment models and quality metrics for hospice care, aiming to enhance patient outcomes and fiscal responsibility.

The hospice sector, in particular, is experiencing increased regulatory scrutiny. This tightening oversight is designed to uphold quality standards and deter fraudulent activities, which can range from improper billing to the provision of substandard care. Chemed's financial reporting consistently acknowledges the inherent risk associated with these evolving regulations, highlighting the potential for changes in reimbursement procedures that could affect revenue streams and operational costs.

For example, in 2024, CMS proposed adjustments to the hospice payment rate, reflecting inflation and policy changes aimed at ensuring program sustainability. These proposals, which are subject to public comment and finalization, underscore the dynamic nature of the regulatory environment. Chemed must remain agile, adapting its strategies to comply with new mandates and to capitalize on any favorable adjustments to reimbursement structures.

Chemed navigates a complex web of labor laws impacting its substantial workforce in healthcare and home services. These regulations govern everything from hiring practices to compensation and benefits, directly influencing operational costs and employee relations. For instance, the Fair Labor Standards Act (FLSA) sets minimum wage and overtime standards, critical for managing a diverse hourly workforce.

The persistent shortage of skilled professionals, particularly nurses and plumbing technicians, presents a significant challenge. This scarcity necessitates strict adherence to regulations concerning recruitment, background checks, and licensing, while also driving investment in training and retention programs. As of late 2024, the U.S. Bureau of Labor Statistics projects a 6% growth in healthcare occupations through 2032, underscoring the competitive landscape for qualified personnel.

To combat these shortages, companies like Chemed are increasingly investing in apprenticeship programs. These initiatives not only help fill skill gaps but also ensure compliance with evolving vocational training standards. Industry reports from 2024 indicate a significant uptick in employer-sponsored apprenticeships, with many focusing on essential trades and healthcare support roles.

Both VITAS Healthcare and Roto-Rooter rely heavily on licensed and certified professionals to operate. VITAS requires its healthcare staff, such as nurses and medical directors, to adhere to stringent certification and licensing mandates, which are continually evolving due to regulatory changes.

Similarly, Roto-Rooter's plumbing and drain cleaning technicians must possess specific licenses. The plumbing sector, as of early 2024, continues to grapple with a shortage of qualified and certified individuals, impacting service availability and training costs.

Consumer protection laws affecting service contracts and warranties

Consumer protection laws significantly impact Roto-Rooter's service contracts and warranties. These regulations, varying by jurisdiction, mandate clear disclosures regarding service scope, pricing, and warranty terms. For instance, many states have laws like the Uniform Commercial Code (UCC) that govern warranties on goods and services, ensuring consumers receive what is promised. Failure to comply can lead to penalties and damage to brand reputation.

Ensuring transparency in service contracts and warranties is paramount. This includes providing written estimates, obtaining consent for additional work, and offering clear recourse for disputes. In 2024, reports indicated a rise in consumer complaints related to deceptive service contract practices, highlighting the importance of strict adherence to these legal frameworks. Roto-Rooter's commitment to fair business practices is therefore essential for maintaining customer trust and avoiding costly litigation.

- Transparency in Service Contracts: Legal requirements often necessitate detailed written contracts outlining all services, costs, and potential additional charges, preventing unexpected expenses for consumers.

- Warranty Protections: Consumer protection statutes ensure that warranties are honored, covering defects in workmanship or materials, and provide avenues for repair, replacement, or refund.

- Dispute Resolution Mechanisms: Laws typically establish procedures for resolving disputes between service providers and consumers, promoting fair outcomes and preventing exploitation.

- Enforcement and Penalties: Regulatory bodies actively enforce these laws, with violations potentially resulting in fines, license suspension, and civil lawsuits, underscoring the financial and reputational risks of non-compliance.

Environmental regulations related to waste disposal and water usage for Roto-Rooter

Roto-Rooter operates under a strict framework of environmental regulations, particularly concerning waste disposal and water usage. Compliance with these rules is paramount for maintaining operational integrity and avoiding penalties. The company's services inherently involve the handling of wastewater and materials that require proper management.

Recent environmental mandates, such as the EPA's final regulations for lead service line replacement, directly influence plumbing practices. Furthermore, the establishment of maximum contaminant levels (MCLs) for per- and polyfluoroalkyl substances (PFAS) in drinking water, as finalized by the EPA in April 2024, adds another layer of complexity. These regulations may mandate specific disposal protocols for removed materials and require the use of certified, compliant plumbing components.

- EPA's PFAS Drinking Water Rule: Sets MCLs for six PFAS chemicals, impacting water quality standards and potentially requiring advanced filtration or treatment technologies in affected areas.

- Lead and Copper Rule Revisions: Mandates lead service line replacement, increasing demand for plumbing services but also requiring careful disposal of lead-containing materials.

- Wastewater Discharge Standards: Local and federal regulations govern the discharge of wastewater from plumbing work, dictating treatment and disposal methods for flushed materials.

- Water Conservation Mandates: Some regions may impose restrictions on water usage during plumbing operations, influencing efficiency and technique.

Legal factors significantly shape Chemed's operations, particularly through healthcare regulations like those from CMS impacting VITAS Healthcare's Medicare and Medicaid reimbursements. These regulations, such as the proposed 2024 hospice payment rate adjustments, demand constant adaptation to ensure compliance and financial stability. Furthermore, labor laws like the FLSA dictate wage and hour standards for Chemed's extensive workforce, influencing operational costs and employee management.

Consumer protection laws, especially those governing service contracts and warranties for Roto-Rooter, necessitate clear disclosures and fair practices to avoid penalties and maintain customer trust. Environmental regulations, including the EPA's 2024 PFAS drinking water standards and lead service line replacement mandates, also directly impact plumbing operations, dictating waste disposal and material usage.

The need for licensed and certified professionals across both VITAS and Roto-Rooter highlights the impact of professional licensing requirements, which are subject to ongoing regulatory changes. As of late 2024, the healthcare sector faces a projected 6% growth in occupations, intensifying the competition for skilled personnel and requiring strict adherence to recruitment and licensing regulations.

Environmental factors

Both VITAS Healthcare and Roto-Rooter, subsidiaries of Chemed, are obligated to manage waste responsibly. While Chemed's specific waste management practices aren't widely publicized, the plumbing sector, represented by Roto-Rooter, is increasingly focused on eco-friendly materials and project execution. This shift is partly driven by evolving environmental regulations.

New EPA regulations classifying PFAS as hazardous substances will significantly impact disposal practices. For instance, the EPA's proposed limits for certain PFAS in drinking water, announced in April 2024, highlight the growing scrutiny on these chemicals, which can be found in various industrial and consumer products, potentially affecting waste streams in both healthcare and plumbing services.

Water conservation is increasingly shaping the plumbing industry, directly influencing demand for sustainable solutions. This trend is evident as consumers and regulators alike push for more efficient water usage, creating opportunities for companies like Roto-Rooter to offer and promote products such as low-flow fixtures and water-saving toilets.

The market for water-efficient plumbing technologies is expanding, with a growing emphasis on systems like greywater recycling. For instance, the global smart water management market, which encompasses water conservation technologies, was projected to reach over $13 billion by 2024, indicating a significant shift towards sustainable practices that Roto-Rooter can leverage.

Chemed's operations, particularly within its home services segment, face increasing scrutiny regarding energy consumption and carbon footprint. As environmental consciousness grows, consumers are actively seeking providers who offer sustainable solutions. This trend is evident in the rising demand for energy-efficient products such as tankless water heaters and smart thermostats, which directly address concerns about reducing household energy usage and associated emissions.

Impact of climate change on infrastructure and demand for services

Climate change is increasingly manifesting as more frequent and intense extreme weather events, directly impacting critical infrastructure. These disruptions can significantly influence the demand for essential services like those provided by Roto-Rooter. For instance, severe storms and flooding can overwhelm existing drainage and sewage systems, leading to widespread plumbing emergencies and a surge in repair needs.

The U.S. Environmental Protection Agency (EPA) has been emphasizing water resilience and the necessity of upgrading water infrastructure in response to these climate-related challenges. This focus underscores the growing recognition of the link between environmental shifts and the demand for specialized services in maintaining and repairing water and wastewater systems. For example, in 2023, the EPA announced billions in funding for water infrastructure improvements across the nation, partly driven by climate adaptation needs.

- Increased Demand: Extreme weather events like hurricanes and heavy rainfall can cause significant damage to underground pipes and sewer lines, creating an immediate need for emergency plumbing and drain cleaning services.

- Infrastructure Investment: Government initiatives, such as the Infrastructure Investment and Jobs Act of 2021, are allocating substantial funds towards repairing and modernizing water infrastructure, indirectly benefiting companies that offer related services.

- Water Quality Concerns: Climate change can exacerbate water quality issues, potentially increasing demand for services related to water filtration and backflow prevention.

- Resilience Projects: The push for climate resilience means more investment in upgrading systems to withstand extreme weather, creating opportunities for companies involved in infrastructure maintenance and repair.

Regulatory focus on environmentally friendly products and services

Governments worldwide are intensifying their regulatory focus on environmentally friendly products and services, a trend particularly evident in the water sector. This means companies operating in this space, like Roto-Rooter, must increasingly align their offerings with sustainability mandates.

The U.S. Environmental Protection Agency (EPA) is a prime example of this regulatory push. Their ongoing efforts to mandate the replacement of lead pipes in water systems and their stringent regulations on 'forever chemicals' such as PFAS in drinking water highlight a significant commitment to environmental protection. These actions directly influence the demand for advanced water treatment and plumbing solutions.

This heightened regulatory environment acts as a powerful catalyst, encouraging widespread adoption of greener and safer plumbing solutions. Companies that proactively invest in and promote eco-friendly products and services are better positioned to meet compliance requirements and capture market share. For instance, the EPA's Lead and Copper Rule Revisions, implemented in phases, are driving significant investment in lead service line replacement projects across the nation.

- EPA Mandates: Ongoing regulations for lead pipe replacement and PFAS in drinking water.

- Market Driver: Regulatory pressure encourages adoption of sustainable plumbing solutions.

- Investment Focus: Significant capital is being directed towards infrastructure upgrades to meet environmental standards.

- Industry Impact: Companies like Roto-Rooter are influenced to offer and develop greener service options.

Environmental factors significantly shape Chemed's operations, particularly for Roto-Rooter. Increasing water conservation efforts and the demand for efficient plumbing technologies, like greywater recycling, are key trends. The global smart water management market, projected to exceed $13 billion by 2024, illustrates this growing focus on sustainability.

Extreme weather events, amplified by climate change, directly impact infrastructure, boosting demand for Roto-Rooter's services. Government initiatives, such as the Infrastructure Investment and Jobs Act of 2021, are channeling billions into water infrastructure repair, creating a favorable market environment.

Stricter environmental regulations, like the EPA's PFAS rules and lead pipe replacement mandates, are driving the adoption of greener plumbing solutions. Companies that embrace eco-friendly practices are better positioned to comply and gain market share, as seen with the ongoing lead service line replacement projects.

PESTLE Analysis Data Sources

Our Chemed PESTLE Analysis is meticulously constructed using data from reputable sources including government regulatory bodies, international economic organizations, and leading industry research firms. This ensures a comprehensive and accurate understanding of the macro-environmental factors impacting the chemical industry.