Chemed Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chemed Bundle

Chemed's competitive landscape is shaped by the interplay of five key forces, revealing crucial insights into its market dynamics. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is vital for strategic planning.

The complete report reveals the real forces shaping Chemed’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The healthcare industry, especially specialized areas like hospice care, is grappling with a significant shortage of skilled professionals, including nurses and doctors. This persistent scarcity directly amplifies the bargaining power of these essential workers.

For a company like VITAS Healthcare, this translates into increased pressure for higher wages and elevated recruitment expenses as they compete for a limited pool of qualified talent. In 2024, the demand for registered nurses, a critical component of hospice care, remained exceptionally high, with projections indicating continued strain on staffing levels throughout the year.

VITAS's reliance on a consistent supply of pharmaceuticals, medical equipment, and specialized items means that the bargaining power of its vendors is a critical factor. If these suppliers are few in number or provide highly specialized, proprietary products, they can dictate terms and prices, directly affecting VITAS's cost of goods sold and overall profitability.

In 2024, the healthcare supply chain has continued to grapple with consolidation in key sectors like medical devices and pharmaceuticals. For instance, a report from the American Medical Association highlighted that in certain specialized medical equipment categories, the top three manufacturers often control over 70% of the market share, giving them considerable leverage when negotiating with healthcare providers like VITAS.

For companies like Roto-Rooter, the bargaining power of specialized plumbing material suppliers can be a significant factor. If there are only a few regional suppliers for critical items like high-quality pipes, specific valves, or unique fixtures, these suppliers gain considerable leverage. This concentration means Roto-Rooter might have fewer alternatives, allowing suppliers to potentially dictate higher prices or less favorable payment terms, directly impacting the company's cost of goods sold and overall profitability.

Technology and Equipment Providers

Chemed's reliance on technology and equipment suppliers, from electronic health records for its VITAS hospice care segment to specialized drain cleaning tools for Roto-Rooter, highlights a key area of supplier bargaining power. If these essential technologies are proprietary or sourced from a limited number of dominant providers, Chemed faces increased costs and potential disruptions.

For instance, the healthcare technology sector, which includes electronic health records (EHR) systems, has seen significant consolidation. In 2023, the global EHR market was valued at approximately $30 billion, with growth projected to continue. A few major EHR vendors often control a substantial market share, giving them leverage over healthcare providers like VITAS when negotiating contracts for software, implementation, and ongoing support. This concentration can lead to higher subscription fees and less flexibility in system upgrades, directly impacting Chemed's operational expenses.

Similarly, specialized equipment for services like drain cleaning can be concentrated among a few manufacturers. If these tools incorporate unique patented technology, Chemed’s ability to source alternatives or negotiate favorable pricing diminishes. The cost of maintaining and upgrading this equipment is a significant factor in Roto-Rooter’s operational efficiency. For example, advanced diagnostic equipment for pipeline inspection can represent a substantial capital investment, and reliance on a single supplier for maintenance or replacement parts can exert considerable pricing pressure.

- Technology Dependence: Chemed's dual reliance on specialized technology for both VITAS (EHR systems) and Roto-Rooter (drain cleaning equipment) makes it susceptible to supplier power.

- Market Concentration: The EHR market, valued around $30 billion in 2023, is dominated by a few key players, potentially increasing their bargaining power over Chemed's VITAS segment.

- Proprietary Equipment: If Roto-Rooter's advanced drain cleaning tools are based on proprietary technology, it limits Chemed's ability to negotiate pricing and secure competitive maintenance contracts.

- Cost Implications: Increased supplier bargaining power directly translates to higher investment and maintenance costs for Chemed, impacting profitability across its business segments.

Impact of Reimbursement Rates on Supplier Costs

Medicare and other payer reimbursement rates for hospice services directly impact VITAS's operational capacity, influencing how much it can allocate to supplier costs and staff compensation. For instance, if Medicare reimbursement rates for hospice care remain stagnant or decline, VITAS might find it challenging to accommodate rising expenses from its suppliers.

Inadequate reimbursement rates can significantly constrain VITAS's purchasing power. This limitation effectively amplifies the bargaining power of suppliers, as VITAS becomes more dependent on their goods and services and less able to negotiate favorable terms or seek alternative, lower-cost providers. This dynamic was particularly relevant in 2024 as healthcare providers navigated evolving payment structures.

- Reimbursement Pressure: Medicare's hospice payment rate for 2024 saw an increase, but the actual impact on providers like VITAS depends on whether this rise adequately offsets inflation and increased operational costs.

- Supplier Cost Sensitivity: Higher costs for essential supplies, from medical equipment to pharmaceuticals, put pressure on VITAS's margins, especially when reimbursement rates do not keep pace.

- Negotiating Leverage: When VITAS has less financial flexibility due to reimbursement constraints, its ability to negotiate bulk discounts or secure competitive pricing from suppliers diminishes, thereby strengthening the suppliers' position.

The bargaining power of suppliers for Chemed is amplified when there are few suppliers for critical inputs or when these inputs are highly specialized and difficult to substitute. This leverage allows suppliers to command higher prices, impose unfavorable terms, and potentially limit availability, directly impacting Chemed's cost of goods sold and profitability across both its VITAS and Roto-Rooter segments.

In 2024, the healthcare supply chain, particularly for specialized medical equipment and pharmaceuticals, continued to experience consolidation. For example, reports indicated that in certain categories, the top three manufacturers held over 70% market share, granting them significant pricing power over healthcare providers like VITAS.

Similarly, Roto-Rooter faces supplier power if essential drain cleaning tools or patented technologies are controlled by a limited number of manufacturers. This concentration reduces Chemed's ability to negotiate favorable pricing or secure competitive maintenance contracts for its equipment, impacting operational efficiency.

The dependence on proprietary technology, such as Electronic Health Records (EHR) systems for VITAS, further strengthens supplier positions. The EHR market, valued around $30 billion in 2023, is dominated by a few major vendors, leading to higher subscription fees and less flexibility for healthcare providers.

What is included in the product

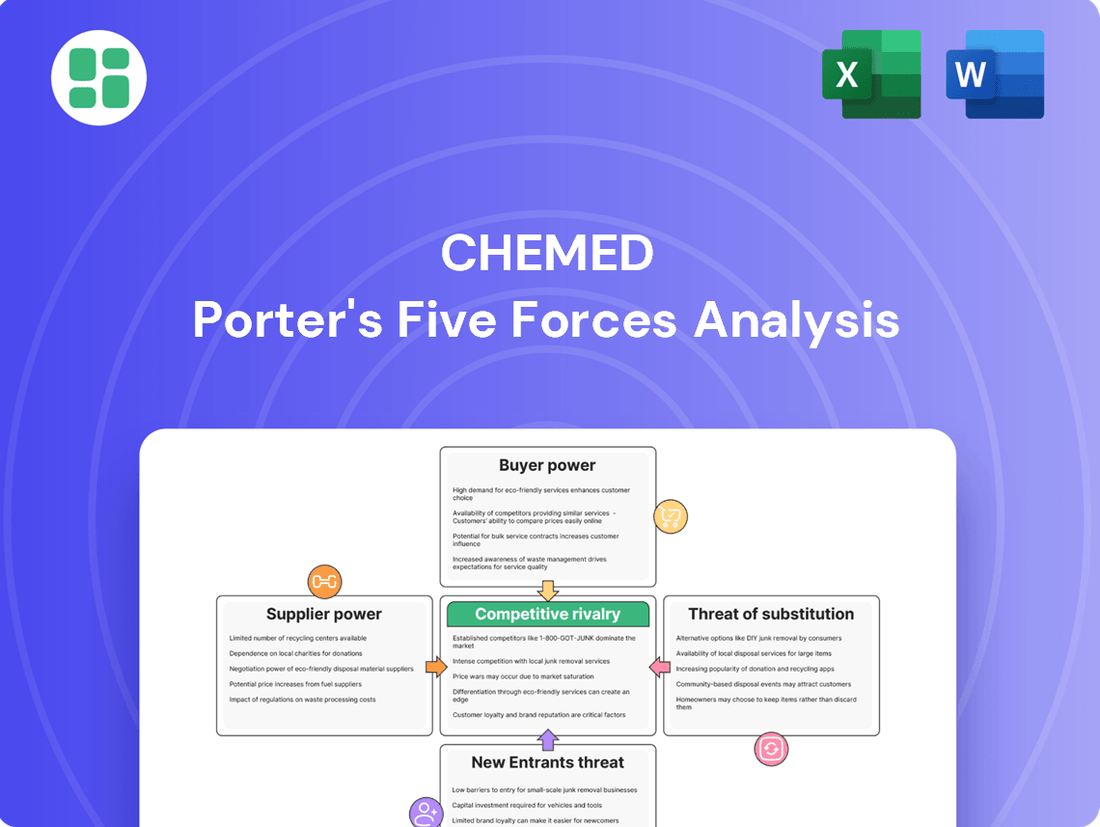

Chemed's Porter's Five Forces analysis dissects the competitive intensity within its operating industries, evaluating threats from new entrants, the power of buyers and suppliers, and the availability of substitutes.

Chemed Porter's Five Forces Analysis provides a clear, visual representation of competitive pressures, helping you pinpoint and address key market challenges with ease.

Customers Bargaining Power

Medicare and Medicaid are the primary financiers for hospice care, meaning they hold significant sway over providers like VITAS Healthcare. In 2024, these government programs continue to dictate reimbursement rates, which directly impacts the revenue VITAS can generate from a substantial portion of its patient base. Their ability to set these rates and implement policy changes means they possess considerable bargaining power.

The growing patient preference for home-based care significantly influences the bargaining power of customers in the hospice sector. Families increasingly seek comfort and familiarity, driving demand for providers who can deliver high-quality hospice services within their own homes. This trend empowers patients and their loved ones to select providers that best align with their desire for convenient and comprehensive at-home support.

In 2024, the demand for home healthcare services continued its upward trajectory, with a significant portion of hospice patients opting for care in familiar surroundings. This preference grants patients and their families greater leverage in choosing providers that offer robust in-home care solutions. Companies like Chemed Corporation, through its VITAS Healthcare segment, must demonstrate a strong capacity to meet these evolving patient needs to maintain a competitive edge and secure patient loyalty.

Roto-Rooter's residential customers, particularly those needing routine drain cleaning or minor repairs, exhibit noticeable price sensitivity. They seek immediate solutions but are also mindful of costs.

The plumbing service market is fragmented with numerous local competitors, and the rise of DIY solutions for simpler tasks means customers have viable alternatives. This competition directly impacts Roto-Rooter's ability to dictate prices, as customers can easily compare rates and opt for cheaper services or attempt fixes themselves.

Commercial Customer Negotiation

Roto-Rooter's commercial clientele, characterized by substantial and consistent service demands, often wield significant negotiation leverage. These clients may solicit proposals from various service providers or have pre-existing vendor relationships, compelling Roto-Rooter to present competitive pricing and tailored service agreements to win and retain their business.

For instance, large hospitality chains or industrial facilities requiring regular plumbing maintenance and emergency services can command better terms due to the volume and predictability of their needs. In 2023, the commercial plumbing services sector saw continued demand, with businesses prioritizing reliable maintenance to avoid costly downtime. This environment amplifies the bargaining power of larger commercial customers who can easily switch providers if service or pricing expectations aren't met.

- Volume Discounts: Commercial clients often negotiate lower per-service rates based on the sheer volume of work they provide.

- Contractual Leverage: Long-term service contracts can be a powerful tool for customers to secure favorable pricing and service level agreements.

- Alternative Provider Scrutiny: The availability of numerous plumbing service companies means commercial clients can readily compare offers and switch if a better deal arises.

- Customized Service Needs: Larger clients may require specialized services or response times that necessitate unique pricing structures, giving them a stronger hand in negotiations.

Brand Reputation and Service Quality

Roto-Rooter's established brand reputation and consistent service quality significantly influence customer bargaining power. A strong brand image, built over years of reliable service, can reduce a customer's inclination to switch providers based solely on price. For instance, in 2024, customer satisfaction surveys consistently placed Roto-Rooter among the top providers for plumbing and drain cleaning services, reinforcing this brand loyalty.

However, this advantage is not absolute. A perceived or actual decline in service quality, coupled with negative online reviews, can rapidly shift power back to the customer. In the competitive landscape of 2024, where multiple service providers are readily available, customers can easily compare options and switch if dissatisfaction arises, potentially impacting Roto-Rooter's market share and pricing flexibility.

- Brand Recognition: Roto-Rooter's name is a household term, fostering trust and reducing the perceived risk for customers.

- Service Reliability: A history of dependable and effective service makes customers less sensitive to minor price variations.

- Customer Reviews: Negative feedback, especially concerning timeliness or technician skill, can quickly erode brand equity and empower customers to seek alternatives.

- Competitive Landscape: The presence of numerous local and national competitors in 2024 means customers have readily available alternatives if Roto-Rooter's service falters.

In the hospice sector, Medicare and Medicaid are major payers, giving them substantial bargaining power. These government programs set reimbursement rates, directly impacting providers like VITAS Healthcare's revenue. Their ability to adjust policies and rates means they hold considerable sway.

The increasing preference for in-home care empowers patients and their families. This trend allows them to select providers that meet their desire for convenient, high-quality care at home, giving them more leverage in choosing services.

Roto-Rooter's residential customers are price-sensitive, seeking affordable solutions for immediate needs. The fragmented market and DIY alternatives mean customers can easily compare prices and switch providers, limiting Roto-Rooter's pricing power.

Large commercial clients, with their consistent demand, possess significant negotiation power. They often solicit multiple bids or have existing relationships, pushing Roto-Rooter to offer competitive pricing and customized agreements to secure their business.

| Customer Segment | Bargaining Power Factors | Impact on Roto-Rooter |

|---|---|---|

| Residential (Routine Services) | Price Sensitivity, DIY Alternatives, Fragmented Market | Limits pricing flexibility, requires competitive pricing |

| Commercial (High Volume) | Negotiation Leverage, Contractual Terms, Provider Scrutiny | Requires tailored proposals and competitive pricing to retain business |

Preview Before You Purchase

Chemed Porter's Five Forces Analysis

This preview displays the complete Chemed Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape and strategic factors influencing Chemed's market position. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

The U.S. hospice market, though expanding due to an aging demographic, is characterized by its fragmentation, featuring a multitude of smaller, independent providers alongside larger entities. This structure means competition is often localized but intense.

A significant trend shaping this landscape is ongoing consolidation. For instance, major players like VITAS Healthcare have been actively acquiring smaller hospice agencies. This strategic move aims to increase market share and achieve economies of scale, thereby intensifying the competitive pressure on remaining independent providers.

The hospice care market is experiencing a surge in competition, fueled by an aging population and increased awareness of palliative services. This heightened rivalry means that companies like Chemed, through its VITAS Healthcare segment, must focus on delivering superior patient care and operational efficiency to stand out. For instance, the number of individuals aged 65 and older in the U.S. is projected to reach over 80 million by 2040, a significant driver for hospice demand.

VITAS, as a major player, faces intensified pressure from both established healthcare providers expanding into hospice and new entrants attracted by market growth. This competitive landscape demands continuous innovation in service delivery models and a strong emphasis on patient and family satisfaction to retain market share. In 2023, the U.S. hospice market was valued at approximately $40 billion, signaling its attractiveness and the intensity of competition within it.

Roto-Rooter faces intense competition from both national plumbing franchises and a multitude of local, independent service providers. This fragmented market requires Roto-Rooter to differentiate itself through strong brand recognition and a reputation for reliable service, while also needing to remain competitive on pricing and responsiveness against smaller, agile local businesses.

The plumbing industry saw significant activity in 2024, with many local plumbers leveraging digital marketing to gain visibility and attract customers. National brands like Roto-Rooter, however, benefit from established trust and widespread advertising, which is crucial in a sector where immediate need often dictates choice. For instance, the U.S. plumbing market was valued at an estimated $135 billion in 2024, highlighting the sheer volume of players vying for market share.

Impact of Declining Demand on Roto-Rooter's Market Share

Roto-Rooter's market share in drain cleaning and plumbing services faced pressure in early 2024 due to declining demand. This downturn signals an intensifying competitive landscape where rivals are likely vying for a larger slice of a shrinking market. The company’s need to adapt pricing and pursue strategic growth initiatives underscores the aggressive nature of this rivalry.

The competitive rivalry is evident as Roto-Rooter, a significant player, must react to market shifts. For instance, during 2023, Chemed Corporation, Roto-Rooter's parent company, reported revenue growth that, while positive, may not fully offset the impact of potentially softer demand in specific segments as observed in early 2024. This environment necessitates a sharp focus on customer retention and operational efficiency to maintain or grow market share against competitors.

- Intensified Competition: Declining demand in early 2024 suggests competitors are aggressively seeking customers, potentially through price cuts or enhanced service offerings.

- Strategic Adjustments: Roto-Rooter's response, including pricing adjustments and strategic initiatives, highlights the pressure to differentiate and retain market position.

- Market Share Vulnerability: A slowdown in demand makes it harder to grow and easier for competitors to gain ground, directly impacting Roto-Rooter's market share.

- Industry Dynamics: The plumbing and drain cleaning sector, while essential, can be susceptible to economic fluctuations, amplifying competitive pressures during downturns.

Staffing Shortages and Regulatory Scrutiny

Chemed's hospice and home care segments operate in a highly competitive landscape. This rivalry is intensified by persistent staffing shortages across the healthcare industry, particularly impacting the availability of skilled nurses and caregivers. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a significant need for registered nurses, with demand expected to grow much faster than the average for all occupations.

Furthermore, evolving regulatory scrutiny from bodies like the Centers for Medicare & Medicaid Services (CMS) adds another layer of complexity. These regulations, which can change frequently, often require increased compliance measures and can impact reimbursement rates, placing additional pressure on providers to maintain operational efficiency and quality of care. This dual challenge of staffing and regulation makes it difficult for Chemed and its competitors to differentiate and succeed.

- Staffing Shortages: In 2024, the demand for healthcare professionals, especially nurses, continued to outpace supply, increasing labor costs and operational challenges for providers like Chemed.

- Regulatory Environment: Increased scrutiny from CMS and other regulatory bodies in 2024 led to higher compliance costs and potential adjustments in reimbursement models for hospice and home care services.

- Competitive Intensity: The combination of staffing issues and regulatory pressures exacerbates competitive rivalry, forcing companies to invest more in talent acquisition and compliance to maintain market position.

Competitive rivalry within the U.S. hospice market remains intense, driven by an aging population and the increasing demand for palliative care. For instance, the U.S. hospice market was valued at approximately $40 billion in 2023, attracting numerous players. This heightened competition forces providers like Chemed’s VITAS Healthcare to focus on service quality and operational efficiency to retain market share against both established companies and emerging local agencies.

The plumbing sector, where Roto-Rooter operates, also experiences significant rivalry. With the U.S. plumbing market valued at an estimated $135 billion in 2024, competition is fierce from national franchises and independent local businesses alike. Roto-Rooter must leverage its brand recognition and service reliability, while also adapting to market dynamics such as increased digital marketing by smaller competitors seeking to capture market share, especially during periods of softer demand observed in early 2024.

| Market Segment | Key Competitors | Competitive Dynamics |

|---|---|---|

| U.S. Hospice Market | VITAS Healthcare, smaller independent agencies, established healthcare providers expanding into hospice | Intense rivalry due to aging demographics and demand for palliative care; consolidation trends are also a factor. |

| U.S. Plumbing & Drain Cleaning Market | Roto-Rooter, national plumbing franchises, local independent service providers | Fragmented market with strong competition from local players leveraging digital marketing; brand reputation and service reliability are key differentiators. |

SSubstitutes Threaten

For companies like VITAS, which provides comprehensive hospice care, substitutes represent a significant threat. These alternatives include palliative care services delivered outside the formal hospice benefit structure, as well as general home health care providers. Many patients and their families may choose these options if they are seeking more aggressive treatment modalities or are not yet prepared to commit to end-of-life care.

In 2024, the demand for home-based healthcare services continued to surge, with the U.S. home healthcare market projected to reach over $200 billion. This growth indicates a strong preference among consumers for care delivered in familiar settings, directly impacting the market share available for specialized hospice providers if they cannot adequately differentiate their services or adapt to evolving patient preferences.

Family and informal caregiving presents a significant substitute for professional hospice services, particularly for patients desiring to stay in their own homes. While hospice care often includes support for these family caregivers, the direct involvement of loved ones can decrease the demand for external, formal care. In 2024, data suggests that a substantial portion of elder care, estimated to be around 75% in some regions, is provided by unpaid family members, highlighting the scale of this substitute.

The threat of substitutes for Roto-Rooter is significant, primarily from DIY plumbing solutions. Homeowners are increasingly empowered to handle minor repairs themselves, driven by readily available online tutorials and more accessible plumbing tools. This trend directly impacts the demand for professional services.

In 2024, the DIY home improvement market continued its robust growth, with many consumers opting for self-sufficiency to save costs. For instance, major home improvement retailers reported strong sales of plumbing parts and tools, indicating a sustained interest in DIY projects. This accessibility means fewer calls for simple fixes like leaky faucets or clogged drains.

Emergence of Technology-Driven Plumbing Solutions

Technological advancements are increasingly presenting alternative ways for consumers to address plumbing needs, thereby acting as a substitute threat. For instance, mobile applications now offer detailed, step-by-step guides for common DIY plumbing tasks or even virtual consultations with plumbing experts. These digital solutions provide consumers with convenience and the potential for cost savings compared to engaging traditional plumbing services, directly challenging established business models.

The accessibility of these tech-driven alternatives is growing. In 2024, it's estimated that over 60% of households have access to a smartphone, a key enabler for these substitute solutions. This widespread adoption means more consumers can readily access DIY guides or virtual support, potentially bypassing the need for a professional plumber for simpler issues. This trend could lead to a reduction in demand for certain types of plumbing services.

- DIY Guides and Virtual Consultations: Mobile apps and online platforms provide accessible, often free, instructions for basic repairs.

- Cost-Effectiveness: Consumers perceive these tech solutions as cheaper alternatives to professional call-outs.

- Convenience Factor: Immediate access to information and advice offers a level of convenience traditional services may struggle to match.

- Increasing Adoption: The growing reliance on smartphones and digital platforms facilitates the uptake of these substitute offerings.

General Contractors and Handymen for Minor Repairs

For less specialized plumbing tasks, general contractors and handymen can indeed act as substitutes for dedicated plumbing services. Customers might opt for these professionals when undertaking integrated home repair projects, where plumbing is just one component, or when aiming to reduce costs on simpler, non-emergency jobs. For instance, a homeowner might hire a general contractor to remodel a bathroom, and that contractor would then subcontract or perform the minor plumbing work themselves.

The availability and cost-effectiveness of these substitutes are key considerations. In 2024, the average hourly rate for a handyman in the US hovered around $60-$85, while general contractors might charge $75-$150 per hour or a percentage of the project cost. This can present a compelling alternative to specialized plumbing services, especially for routine maintenance or non-critical repairs where immediate, expert intervention isn't strictly necessary.

- Cost Savings: Handymen often charge less per hour than specialized plumbers, making them an attractive option for minor repairs and non-urgent tasks.

- Project Integration: For larger home improvement projects, general contractors can bundle plumbing services, offering convenience and potentially better overall project pricing.

- Accessibility: The sheer number of general contractors and handymen available in many markets can increase accessibility for customers needing quick, albeit less specialized, solutions.

The threat of substitutes for specialized services like hospice or plumbing is driven by readily available alternatives that offer similar benefits at a lower cost or greater convenience. These can range from informal caregiving and DIY solutions to generalist service providers or technological advancements. The increasing accessibility and perceived cost-effectiveness of these substitutes directly challenge the market share and pricing power of established businesses.

In 2024, the DIY home improvement sector continued its expansion, with consumers actively seeking ways to manage costs. This trend is amplified by readily available online tutorials and accessible tools, allowing individuals to tackle minor repairs themselves. For example, sales of plumbing tools and parts from major retailers saw continued strong performance, indicating a sustained consumer interest in self-sufficiency for basic tasks.

Technological solutions, such as mobile apps offering DIY guides and virtual consultations, are emerging as significant substitutes. With over 60% of households estimated to have smartphone access in 2024, these digital platforms provide convenient and often cost-saving alternatives for consumers. This widespread digital adoption means more people can bypass traditional service providers for simpler issues.

| Substitute Type | Key Drivers | 2024 Market Insight |

|---|---|---|

| Informal Caregiving | Desire for home-based care, family involvement | Estimated 75% of elder care provided by unpaid family members in some regions. |

| DIY Solutions | Cost savings, accessibility of tools and information | Robust growth in DIY home improvement market; strong sales of plumbing parts. |

| General Contractors/Handymen | Project integration, cost-effectiveness for non-specialized tasks | Handyman hourly rates ($60-$85) often lower than specialized plumbers ($75-$150+). |

| Tech-Driven Alternatives | Convenience, immediate access to information/support | Over 60% household smartphone penetration enables DIY guides and virtual consultations. |

Entrants Threaten

The hospice care sector presents a formidable threat of new entrants, largely due to stringent regulatory landscapes. Navigating state-specific licensing, accreditation processes, and in many regions, Certificate of Need (CON) laws, demands significant investment in time, capital, and specialized knowledge. For instance, as of 2024, the average time to obtain all necessary licenses and accreditations for a new hospice provider can extend over a year, representing a substantial upfront commitment that deters many potential competitors.

New hospice providers often struggle to establish the crucial referral networks needed to source patients. Building trust and consistent relationships with hospitals, physicians, and long-term care facilities takes significant time and effort.

Established players like VITAS Healthcare have cultivated deep, long-standing relationships within the healthcare ecosystem. These existing referral channels represent a substantial barrier for newcomers, making it difficult to gain immediate traction and patient volume.

In 2024, the hospice market saw continued consolidation, with larger providers leveraging their established networks to acquire smaller agencies. This trend underscores the importance of these relationships as a competitive advantage, making it harder for new entrants to compete on volume alone.

Starting a plumbing business demands substantial capital for essential tools, service vehicles, and advanced diagnostic equipment. For instance, a well-equipped plumbing van alone can cost upwards of $70,000 to $100,000 in 2024.

Beyond initial equipment, operational costs are considerable. Hiring and retaining certified, experienced plumbers is a significant expense, with average plumber salaries in the US reaching approximately $60,000 annually in 2024.

These high upfront and ongoing investment requirements create a formidable barrier for potential new entrants aiming to compete with established players like Roto-Rooter.

Brand Recognition and Customer Trust

Brand Recognition and Customer Trust are significant barriers for new entrants in the plumbing services sector, especially for established players like Roto-Rooter. Roto-Rooter has cultivated strong national brand recognition and deep customer trust over many decades of operation. New companies entering this market would need to invest heavily in marketing and advertising, and it would take considerable time to build a similar level of reputation and secure customer loyalty, making it difficult to compete directly.

Consider the marketing spend in the home services industry. In 2024, the digital advertising spend for home services in the US alone is projected to reach over $20 billion, highlighting the significant investment required to gain visibility. For a new entrant to even begin to match Roto-Rooter's established brand presence, they would likely need to allocate a substantial portion of their initial capital to marketing efforts, potentially millions of dollars, to achieve even a fraction of the brand recall Roto-Rooter enjoys.

- Strong Brand Equity: Roto-Rooter's brand is synonymous with plumbing services for many consumers, a hard-won advantage.

- Customer Trust Factor: Decades of reliable service have built a reservoir of trust, reducing perceived risk for customers choosing Roto-Rooter.

- Marketing Investment Hurdle: New entrants face a steep climb in marketing expenditure to achieve comparable brand awareness and trust.

- Time to Build Reputation: Establishing a credible reputation in a service-oriented industry takes years, a luxury not afforded to nascent businesses.

Skilled Labor Shortage as an Entry Barrier

The scarcity of qualified plumbers and healthcare workers acts as a formidable barrier for new businesses entering these sectors. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 4% growth for plumbers, pipefitters, and steamfitters, a rate slower than the average for all occupations, indicating persistent demand. New entrants would face considerable challenges in recruiting and retaining the necessary skilled personnel, directly affecting their ability to deliver consistent service quality and achieve operational scale.

This talent deficit means that even if capital investment and technological access are readily available, a lack of skilled labor can effectively halt expansion. In healthcare, the shortage is particularly acute, with the Association of American Medical Colleges estimating a shortage of up to 124,000 physicians by 2034, a trend that will undoubtedly impact new healthcare providers in 2024 and beyond. Consequently, the inability to staff operations adequately becomes a critical deterrent for potential new market participants.

- Skilled Labor Gap: A significant shortage of trained plumbers and healthcare professionals exists.

- Impact on New Entrants: New companies struggle to find sufficient qualified staff.

- Service Quality and Scalability: Inadequate staffing directly compromises service delivery and growth potential.

- Industry Data: Projections show continued demand and limited supply of these essential workers.

The threat of new entrants in the plumbing sector is substantial, primarily due to the significant capital required for tools, vehicles, and diagnostic equipment. For instance, a fully equipped plumbing van can cost between $70,000 and $100,000 in 2024, a considerable upfront investment.

High operational expenses, including the need to hire and retain certified plumbers, further elevate this barrier. In 2024, the average annual salary for a plumber in the U.S. was around $60,000, adding to the ongoing cost of doing business.

Established brands like Roto-Rooter benefit from decades of built-up customer trust and extensive marketing. New entrants face the challenge of investing heavily in marketing, potentially millions of dollars, to achieve comparable brand awareness, as the home services digital ad spend in the U.S. is projected to exceed $20 billion in 2024.

| Barrier Type | Description | 2024 Data/Example |

| Capital Investment | Essential tools, vehicles, diagnostic equipment | Plumbing van: $70,000 - $100,000 |

| Operational Costs | Salaries for skilled labor | Average plumber salary: ~$60,000/year |

| Brand & Marketing | Building customer trust and recognition | Home services digital ad spend: >$20 billion (US) |

| Skilled Labor Availability | Shortage of qualified plumbers | Projected 4% growth for plumbers (slower than average) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings to provide a comprehensive view of competitive dynamics.