Cenovus Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cenovus Energy Bundle

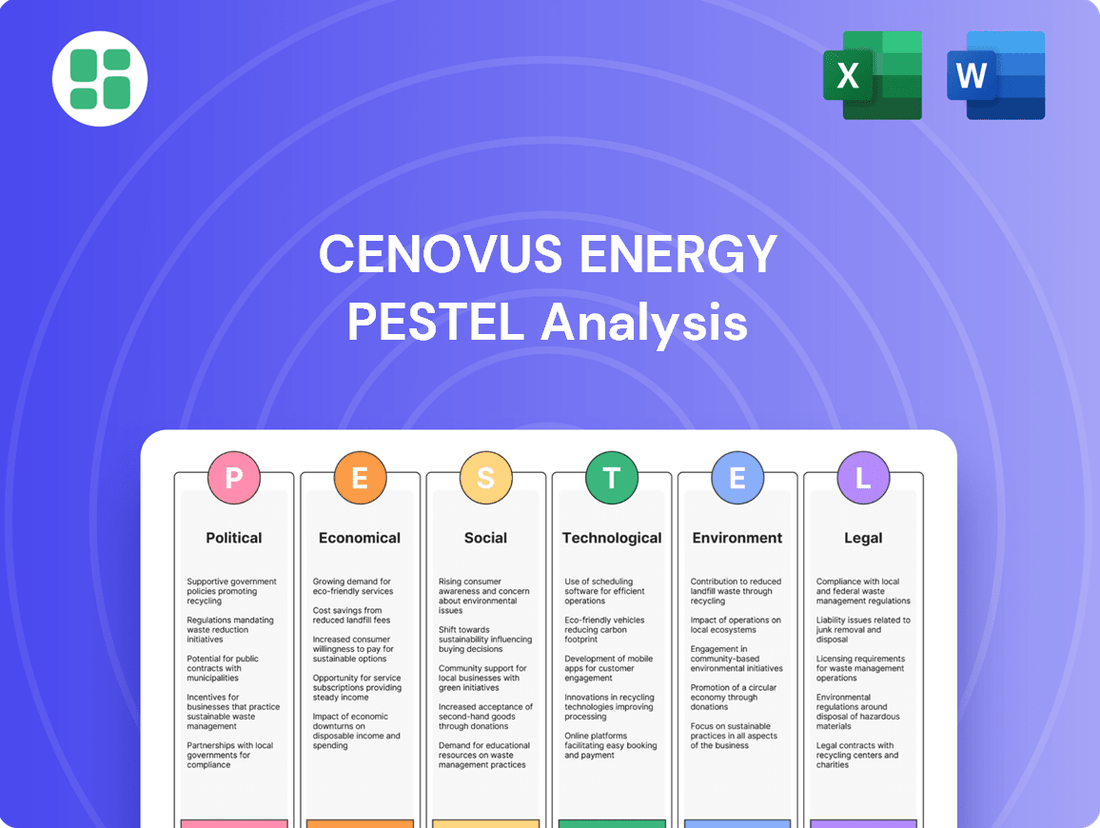

Navigate the complex external landscape impacting Cenovus Energy with our comprehensive PESTLE analysis. Understand how evolving political, economic, social, technological, legal, and environmental factors are shaping the company's future. Gain the strategic foresight needed to identify opportunities and mitigate risks.

Unlock actionable intelligence on Cenovus Energy's operating environment. Our PESTLE analysis provides deep-dive insights into the forces that matter most, from regulatory shifts to technological advancements. Empower your decision-making by purchasing the full version today.

Political factors

The Canadian government is tightening regulations on the oil and gas industry to curb greenhouse gas (GHG) emissions, a move that directly affects Cenovus Energy. These new rules, including the proposed Oil and Gas Sector Greenhouse Gas Emission Cap Regulations, are slated to begin as early as January 1, 2025. This initiative introduces a cap-and-trade system for industrial activities, notably impacting oil sands production.

Compliance with these federal mandates will necessitate substantial investments from Cenovus Energy in advanced emission reduction technologies and strategic operational adjustments. For context, the oil and gas sector is Canada's largest emitter of GHGs, underscoring the significance of these regulatory shifts for the nation's climate goals and for companies like Cenovus.

Canada's carbon pricing system, encompassing a federal fuel charge and the Output-Based Pricing System (OBPS) for industrial emitters, directly impacts Cenovus Energy's operational expenses. For instance, the federal carbon tax rate for 2024 is $80 per tonne of carbon dioxide equivalent, set to rise to $170 per tonne by 2030.

Political discourse surrounding these carbon pricing mechanisms remains active, with opposition parties advocating for their repeal. This creates uncertainty for long-term investment planning within the energy sector, as potential policy shifts could alter cost structures.

While carbon pricing aims to encourage emissions reductions and cleaner energy adoption, it simultaneously imposes additional financial obligations on companies like Cenovus. The OBPS, for example, requires facilities to pay for emissions exceeding a certain benchmark, directly influencing profitability and investment in emissions-reducing technologies.

Trade policies between Canadian provinces and with the United States are crucial for Cenovus Energy's operations, affecting how it moves and sells its oil and refined products. For instance, the Trans Mountain Expansion project, nearing completion in 2024, aims to boost capacity, but discussions around potential U.S. tariffs on Canadian energy imports, like the previously floated 10% by the U.S. President, could disrupt these flows and increase costs.

Indigenous Relations and Resource Development

Government policies are increasingly focused on Indigenous consultation and reconciliation in resource development. This means companies like Cenovus Energy must navigate evolving regulatory landscapes that prioritize these relationships. For instance, in 2023, federal investments in Indigenous economic development and reconciliation initiatives reached billions, signaling a strong governmental push for partnership.

Cenovus Energy demonstrates a commitment to engaging with Indigenous communities adjacent to its operational areas. They invest in collaborative partnerships and economic reconciliation efforts, recognizing the importance of mutual benefit. These initiatives often involve training programs, employment opportunities, and community infrastructure support, fostering stronger relationships and shared prosperity.

Adherence to Indigenous land claims and consultation mandates is paramount for securing and sustaining a social license to operate. Failure to comply can lead to significant project delays and operational disruptions. For example, a major project in 2024 faced a six-month setback due to consultation challenges, highlighting the financial and strategic implications of these requirements.

- Government Mandates: Increased emphasis on Indigenous consultation and reconciliation in resource projects.

- Cenovus Engagement: Active partnerships and economic reconciliation initiatives with nearby Indigenous communities.

- Operational Impact: Compliance with land claims and consultation is vital for social license and project continuity.

Political Stability and Investment Climate

The political landscape in Canada, especially within Alberta and British Columbia where Cenovus Energy has substantial operations, directly impacts investment decisions in the energy sector. While there's a degree of optimism for stable capital spending in 2024, ongoing political developments, including provincial approaches to renewable energy initiatives and federal climate change policies, can sway long-term investment appeal. For example, the federal government's commitment to carbon pricing and emissions reduction targets, alongside provincial variations in implementing these policies, creates a complex operating environment.

Government backing for technologies like carbon capture, utilization, and storage (CCUS) is a significant factor. In 2023, Canada announced a CCUS tax credit, aiming to incentivize emissions reductions from industrial sources. This type of support can significantly improve the investment climate for major energy companies like Cenovus, which are looking to decarbonize their operations. The ongoing dialogue and policy evolution around these areas are crucial for forecasting future investment trends.

- Federal Climate Policies: Canada's national climate targets and the associated regulatory framework influence operational costs and investment strategies for energy producers.

- Provincial Energy Stances: Divergent provincial policies on energy development, including oil and gas, and renewable energy projects, create a varied investment landscape across the country.

- Government Support for CCUS: Initiatives like the Investment Tax Credit for CCUS, introduced to encourage emissions reduction, directly impact the financial viability of large-scale decarbonization projects for companies like Cenovus.

Canada's federal government is implementing stricter environmental regulations, including a proposed cap on oil and gas sector greenhouse gas emissions starting January 1, 2025. This regulatory shift, coupled with a rising federal carbon tax rate that will reach $170 per tonne by 2030 from $80 in 2024, directly increases operational costs for Cenovus Energy. Conversely, government support for carbon capture, utilization, and storage (CCUS) through initiatives like the 2023 Investment Tax Credit offers financial incentives for decarbonization efforts.

Political discourse surrounding these climate policies, particularly carbon pricing, introduces uncertainty for long-term energy investments, as policy reversals remain a possibility. Furthermore, evolving government mandates on Indigenous consultation and reconciliation are critical, requiring companies like Cenovus to foster strong partnerships to maintain social license. For example, a significant project in 2024 experienced a six-month delay due to consultation challenges, underscoring the financial and operational impact of these requirements.

| Policy Area | 2024/2025 Impact on Cenovus Energy | Key Data/Facts |

|---|---|---|

| Emissions Regulations | Increased compliance costs, potential operational adjustments | Proposed Oil and Gas Sector Greenhouse Gas Emission Cap Regulations (effective Jan 1, 2025) |

| Carbon Pricing | Higher operational expenses, influencing investment in emissions reduction | Federal carbon tax: $80/tonne (2024), rising to $170/tonne by 2030 |

| Indigenous Relations | Crucial for social license, project continuity, and risk mitigation | Billions invested in Indigenous economic development and reconciliation initiatives (2023); 6-month project delay in 2024 due to consultation issues |

| CCUS Support | Financial incentives for decarbonization projects | Canada's CCUS Investment Tax Credit announced in 2023 |

What is included in the product

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Cenovus Energy, providing a comprehensive overview of the external forces shaping its operations and strategy.

It offers actionable insights for stakeholders to navigate industry challenges and capitalize on emerging opportunities within the energy sector.

Offers a concise overview of Cenovus Energy's PESTLE factors, simplifying complex external influences for strategic decision-making and reducing the burden of sifting through extensive data.

Economic factors

Global crude oil and natural gas prices are critical to Cenovus Energy's financial performance. For 2024, Brent crude oil is projected to average around $82 per barrel, with forecasts for 2025 settling near $79 per barrel, though some analyses suggest potentially lower figures.

Natural gas prices are anticipated to see a recovery in early 2025, moving away from the low levels seen in 2024. The Henry Hub spot price is expected to average approximately $3.79 per million British thermal units (MMBtu) for the entirety of 2025.

Cenovus Energy's downstream refining segment is highly sensitive to refining margins, often called crack spreads. These margins, which represent the difference between the cost of crude oil and the selling price of refined products, saw a downturn in 2024. This decline was driven by a combination of softer demand for refined fuels and an increase in global refining capacity, which consequently impacted the downstream earnings of integrated oil companies like Cenovus.

Looking ahead, the U.S. refining capacity is projected to shrink by approximately 3% by the close of 2025. This reduction in capacity could offer some support and potentially stabilize refining margins. However, the broader outlook for the refining sector remains somewhat subdued, with persistent concerns about sluggish demand and the ongoing issue of oversupply continuing to pose challenges.

Capital expenditures in Canada's upstream oil and gas sector are projected to hit $40.6 billion in 2024, a modest rise from the previous year according to the Canadian Association of Petroleum Producers. This indicates a sustained, albeit cautious, investment environment.

Cenovus Energy is actively deploying capital into significant upstream projects, including the West White Rose development, which is slated for production commencement in 2026. Such strategic investments are vital for maintaining and expanding production capacity.

However, the success and scale of these capital investments are inherently linked to fluctuating market dynamics and the prevailing sentiment among investors. A positive outlook on commodity prices and regulatory stability is key to realizing these growth ambitions.

Foreign Exchange Rates

Foreign exchange rates are a crucial economic factor for Cenovus Energy, a Canadian company with substantial U.S. refining operations and international sales. Fluctuations in the Canadian dollar (CAD) against the U.S. dollar (USD) directly influence the company's financial results. For instance, during 2024, the CAD/USD exchange rate has seen volatility, impacting how U.S. dollar earnings translate back into Canadian dollars.

A stronger Canadian dollar can diminish the reported value of U.S. dollar revenues for Cenovus, potentially affecting profitability and competitiveness in the Canadian market. Conversely, a weaker Canadian dollar can boost the value of those same U.S. dollar earnings when converted. This currency exposure is a persistent element in managing the company's overall financial performance and strategic planning.

- Impact on Revenue: In Q1 2024, Cenovus reported that a 1-cent change in the CAD/USD exchange rate could impact its net earnings by approximately $30 million.

- Competitive Landscape: Exchange rate shifts can alter the cost competitiveness of Cenovus's products in different markets.

- Hedging Strategies: The company actively uses financial instruments to hedge against adverse currency movements, a key strategy in managing this economic factor.

- U.S. Asset Valuation: The value of Cenovus's U.S. refining assets is also subject to translation effects when reported in Canadian dollars.

Global Economic Growth and Energy Demand

Global economic expansion is a primary driver for energy consumption, particularly for crude oil and natural gas. Despite continued growth in global petroleum demand, the pace is moderating. Projections show an increase of 1.4 million barrels per day (b/d) in 2024, followed by a slightly slower 1.2 million b/d rise in 2025.

This deceleration in demand growth is linked to several key trends. The increasing uptake of electric vehicles (EVs) and the implementation of more stringent energy efficiency policies are contributing factors. These shifts suggest a potential leveling off of oil demand towards the close of the current decade.

- Global petroleum consumption growth: 1.4 million b/d in 2024, 1.2 million b/d in 2025.

- Factors influencing demand: Increased EV adoption and energy efficiency policies.

- Outlook: Potential plateauing of oil demand by the end of the decade.

Cenovus Energy's financial health is intrinsically tied to commodity prices. Brent crude is expected to average around $82/barrel in 2024 and $79/barrel in 2025, while natural gas prices are anticipated to recover in 2025, with Henry Hub averaging approximately $3.79/MMBtu.

Refining margins, or crack spreads, are sensitive to the difference between crude oil costs and refined product prices. These margins experienced a dip in 2024 due to softer demand and increased global refining capacity, though a projected 3% shrinkage in U.S. refining capacity by the end of 2025 could offer some stabilization.

The company's profitability is also influenced by foreign exchange rates, particularly the CAD/USD. A 1-cent shift in this rate can impact Cenovus's net earnings by about $30 million, as seen in Q1 2024, necessitating active hedging strategies.

Global economic expansion drives energy demand, though its pace is moderating. Petroleum demand growth is projected at 1.4 million b/d in 2024 and 1.2 million b/d in 2025, influenced by EV adoption and efficiency policies, potentially leading to a demand plateau by decade's end.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Cenovus |

|---|---|---|---|

| Brent Crude Oil Price | ~$82/barrel | ~$79/barrel | Directly impacts upstream revenue and profitability. |

| Henry Hub Natural Gas Price | Lower than 2025 | ~$3.79/MMBtu | Affects natural gas segment earnings and overall cash flow. |

| U.S. Refining Capacity Change | Stable/Slightly Down | ~-3% | Influences refining margins and downstream segment performance. |

| CAD/USD Exchange Rate | Volatile | Volatile | Affects translation of U.S. dollar earnings and asset valuations. |

| Global Petroleum Demand Growth | 1.4 million b/d | 1.2 million b/d | Underpins overall sales volumes and market stability. |

Preview the Actual Deliverable

Cenovus Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cenovus Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company’s operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Cenovus Energy's business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination of each PESTLE element, offering actionable insights for stakeholders.

Sociological factors

Public perception in Canada regarding the energy transition presents a nuanced picture. While a majority of Canadians express support for climate action and prioritize clean energy initiatives, a substantial segment also views oil and gas as vital for the nation's economic future. This duality creates a complex social landscape for companies like Cenovus Energy, which heavily relies on oil sands operations.

Cenovus navigates this environment by emphasizing responsible development and economic contributions. For instance, in 2024, the company continued to highlight its investments in emissions reduction technologies, aiming to address environmental concerns. Their commitment to economic stability is often underscored by job creation figures and tax revenues generated from their operations in regions like Alberta.

Societal momentum towards an energy transition directly influences Cenovus, shaping investment flows, regulatory landscapes, and consumer choices. A recent trend shows a decline in public willingness to pay a premium for expanded non-emitting electricity generation, coupled with an increase in acceptance of skeptical viewpoints regarding the energy transition. This shift could potentially slow the pace of decarbonization efforts and diminish public backing for initiatives within established energy companies like Cenovus.

Cenovus Energy has prioritized Indigenous reconciliation as a core part of its environmental, social, and governance (ESG) strategy, actively engaging with Indigenous communities situated near its operational sites. This engagement is crucial for maintaining a social license to operate and ensuring long-term, positive relationships.

The company has demonstrated this commitment through substantial financial investments, directing significant spending towards Indigenous-owned businesses. For instance, in 2023, Cenovus reported spending over $200 million with Indigenous businesses, a notable increase from previous years. Initiatives like the Indigenous Housing Initiative and dedicated internship programs further underscore this dedication, aiming to build trust and foster mutual benefits.

Workforce Dynamics and Talent Attraction

The Canadian energy sector, including companies like Cenovus, grapples with a shrinking pool of skilled labor and the challenge of attracting new talent, particularly as the industry pivots towards lower-emission technologies. This dynamic necessitates a strategic focus on workforce development and retention to meet evolving operational demands.

Cenovus must secure expertise for both its existing conventional oil and gas operations and emerging areas such as carbon capture, utilization, and storage (CCUS). For instance, as of early 2024, the demand for specialized engineers in CCUS projects is projected to rise significantly, creating a competitive talent market.

- Talent Gap: The Canadian Association of Petroleum Producers (CAPP) has highlighted concerns about potential labor shortages in the coming years, impacting the ability to staff both traditional and new energy infrastructure.

- Skills Transition: Companies need to upskill their existing workforce and attract individuals with expertise in areas like digital technologies, data analytics, and environmental engineering to support energy transition initiatives.

- Indigenous Engagement: Cenovus's Indigenous Internship Field Programs are crucial for building a pipeline of skilled workers and fostering stronger relationships with Indigenous communities, contributing to a more inclusive and capable workforce.

Corporate Social Responsibility (CSR) and ESG Expectations

Societal expectations for corporate behavior are shifting, with a growing emphasis on Environmental, Social, and Governance (ESG) factors. Investors and the public are increasingly scrutinizing companies' impact beyond just financial returns. Cenovus Energy has responded by embedding ESG principles into its core business strategy, setting concrete goals for areas like Indigenous reconciliation and environmental stewardship. For instance, by 2025, Cenovus aims to increase its spending with Indigenous businesses by 25% compared to 2019 levels.

This focus on responsible energy development, safety protocols, and active community engagement is no longer optional; it's vital for maintaining a positive corporate reputation and attracting investment in today's socially aware market. In 2023, Cenovus reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas intensity compared to its 2019 baseline, demonstrating tangible progress in its environmental commitments.

Key aspects of Cenovus's CSR and ESG approach include:

- Commitment to Indigenous Reconciliation: Setting measurable targets for partnerships and procurement with Indigenous communities, aiming for a 25% increase in spending with Indigenous businesses by 2025.

- Environmental Performance: Implementing strategies to reduce greenhouse gas emissions, with a 10% reduction in Scope 1 and 2 intensity achieved by 2023.

- Safety and Operational Excellence: Maintaining a strong focus on workplace safety, with a Total Recordable Injury Frequency Rate of 0.58 in 2023.

- Community Investment: Engaging with and supporting the communities where it operates through various social and economic initiatives.

Public sentiment in Canada regarding the energy transition is mixed, with strong support for climate action coexisting with recognition of oil and gas's economic importance. Cenovus navigates this by highlighting responsible development and economic contributions, such as investments in emissions reduction technologies in 2024. Societal shifts, including a potential slowdown in decarbonization acceptance noted in early 2024, directly influence the company's operational and investment landscape.

Cenovus prioritizes Indigenous reconciliation, demonstrated by over $200 million spent with Indigenous businesses in 2023, alongside initiatives like the Indigenous Housing Initiative. This focus is crucial for maintaining social license to operate and fostering long-term community relationships.

The energy sector faces a shrinking skilled labor pool, requiring Cenovus to focus on workforce development for both existing operations and emerging areas like carbon capture. By 2025, demand for CCUS engineers is projected to rise significantly, intensifying the talent competition.

Societal expectations for strong ESG performance are increasing, prompting Cenovus to embed these principles into its strategy, aiming for a 25% increase in spending with Indigenous businesses by 2025. The company achieved a 10% reduction in Scope 1 and 2 greenhouse gas intensity by 2023.

| Sociological Factor | Cenovus Energy Action/Impact | Data Point/Year |

|---|---|---|

| Public Opinion on Energy Transition | Balancing climate action support with oil & gas economic importance | Mixed sentiment observed throughout 2024 |

| Indigenous Reconciliation | Significant investment in Indigenous businesses and partnerships | Over $200 million spent with Indigenous businesses in 2023; 25% spending increase target by 2025 |

| Skilled Labor Availability | Addressing talent gaps for both traditional and new energy technologies | Projected rise in demand for CCUS engineers in early 2024 |

| ESG Expectations | Integrating ESG into core strategy and reporting progress | 10% reduction in Scope 1 & 2 GHG intensity by 2023 |

Technological factors

Cenovus Energy's commitment to technological advancement in oil sands extraction, particularly in-situ methods like steam-assisted gravity drainage (SAGD), is crucial for enhancing efficiency and sustainability. These innovations directly impact operational costs and environmental footprint, aiming for reduced energy intensity per barrel. For instance, by Q1 2024, Cenovus reported record oil sands production, showcasing the effectiveness of their implemented technologies.

Carbon Capture, Utilization, and Storage (CCUS) technologies are increasingly crucial for industrial emitters like Cenovus Energy to curb greenhouse gas emissions. The Canadian government, through initiatives like the investment tax credit for CCUS, and Alberta's supportive regulatory environment, are actively encouraging these developments.

Cenovus is a key participant in the Pathways Alliance, a significant industry collaboration aiming to deploy CCUS infrastructure to decarbonize oil sands operations, with a goal of achieving net-zero emissions. This collective effort underscores the industry's commitment to technological advancements in emissions reduction, particularly as regulatory and market pressures for sustainability intensify through 2024 and into 2025.

Cenovus Energy is increasingly leveraging digitalization and automation to boost efficiency and safety across its operations. For instance, the company's investment in advanced analytics and digital twins aims to optimize production and minimize downtime in its upstream assets. This focus on technological integration is crucial for maintaining a competitive edge in the evolving energy landscape.

Refining Technology Upgrades

Cenovus Energy's downstream segment significantly benefits from ongoing upgrades to its refining technologies. These enhancements allow the company to process a wider variety of crude oil feedstocks and produce higher-value refined products with greater efficiency. For instance, in the first quarter of 2024, Cenovus reported improved refinery utilization rates, a direct outcome of these technological investments and operational improvements.

Technological advancements have also played a crucial role in reducing operating expenses within Cenovus's refining operations. The company's strategic pipeline connections between its refineries further bolster logistical efficiency, ensuring a smoother flow of materials and finished products. This integrated approach, driven by technological optimization, contributed to a strong financial performance in its downstream segment during the early part of 2024.

- Refinery Optimization: Upgraded technologies enhance feedstock flexibility and product yield in Cenovus's refineries.

- Operational Efficiency: Technological enhancements directly contribute to improved refinery utilization rates and reduced operating costs.

- Logistical Integration: Pipeline networks connecting refineries improve the overall efficiency of the downstream supply chain.

- Financial Impact: These technological factors have positively impacted Cenovus's downstream segment performance in early 2024.

Renewable Energy Integration and Alternative Fuels

While Cenovus Energy remains a significant player in fossil fuels, the global push towards decarbonization is a key technological factor influencing its strategy. This includes exploring how renewable energy can power its operations, such as using wind or solar for its facilities. For instance, as of early 2024, many energy companies are evaluating the feasibility of incorporating renewable electricity into their grid-connected operations to meet sustainability goals.

Furthermore, Cenovus is likely considering investments in alternative fuels. This could manifest as exploring biofuel co-processing within its existing refining infrastructure. Such initiatives aim to reduce the carbon intensity of its refined products and align with evolving market demands for cleaner energy sources. The company's 2023 sustainability report highlighted ongoing research into lower-emission fuel pathways.

The increasing public and political momentum behind clean energy technologies acts as a significant driver for Cenovus to adapt. This technological shift necessitates a forward-looking approach to energy production and consumption, pushing companies like Cenovus to diversify their portfolios and explore new avenues for growth and emissions reduction.

Technological factors are pivotal for Cenovus Energy, driving efficiency in oil sands extraction through advanced in-situ methods like SAGD, which contributed to record production in Q1 2024. The company is heavily invested in Carbon Capture, Utilization, and Storage (CCUS) technologies, aligning with industry collaborations like the Pathways Alliance to meet net-zero goals by 2050, supported by government incentives.

Digitalization and automation are enhancing operational efficiency and safety, with investments in advanced analytics and digital twins optimizing upstream assets. Downstream, refinery upgrades are improving feedstock flexibility and product yield, leading to better utilization rates and reduced operating costs, as seen in early 2024 performance.

The global shift towards decarbonization is pushing Cenovus to explore renewable energy integration for its operations and invest in alternative fuels like biofuels, as highlighted in its 2023 sustainability report. This technological evolution is crucial for adapting to market demands for cleaner energy and reducing its carbon footprint.

Legal factors

Cenovus Energy navigates a complex legal landscape shaped by environmental regulations. The Canadian government's proposed Oil and Gas Sector Greenhouse Gas Emission Cap Regulations, set to impact reporting from 2026, represent a significant legal challenge. These regulations establish a cap-and-trade system expected to be operational by 2025, directly influencing Cenovus's operational compliance strategies.

Legal frameworks governing Indigenous rights, land claims, and consultation are paramount for Cenovus's operations, particularly in Alberta and British Columbia where significant projects are located. These laws, stemming from Section 35 of the Constitution Act, 1982, mandate that the Crown, and by extension companies like Cenovus, must consult with and, where appropriate, accommodate Indigenous peoples when decisions may impact their rights. For instance, the process for obtaining regulatory approvals for new pipelines or expansions often involves extensive consultation periods, which can influence project timelines and costs.

The legal duty to consult and accommodate is not merely a procedural step; it's a fundamental requirement that shapes project approvals, land access, and ongoing operational practices. Failure to adequately consult can lead to legal challenges, project delays, and reputational damage. In 2023, for example, several energy projects across Canada faced scrutiny and legal action due to alleged deficiencies in Indigenous consultation processes, highlighting the critical nature of this legal obligation for companies in the sector.

Cenovus's commitment to proactive engagement and establishing benefit agreements with Indigenous communities is therefore crucial. These agreements, often including employment opportunities, training programs, and economic participation, are vital for ensuring legal compliance and maintaining a social license to operate. By fostering strong relationships and addressing community concerns through these agreements, Cenovus can mitigate legal risks and build trust, which is essential for long-term operational success in resource-rich regions.

Cenovus Energy, as a major industrial player, operates under stringent health and safety regulations in both Canada and the United States. These rules are designed to safeguard employees, contractors, and the general public from potential hazards inherent in oil sands operations, refining processes, and the transportation of dangerous goods.

Compliance with these legal frameworks, such as those enforced by Alberta's Occupational Health and Safety Act and the U.S. Occupational Safety and Health Administration (OSHA), is non-negotiable. For instance, in 2023, Canadian energy sector workplaces reported a lost-time injury frequency rate of 1.2 per 200,000 hours worked, underscoring the critical nature of these regulations.

Maintaining a robust safety record is not just a legal obligation but also a cornerstone for uninterrupted operations and maintaining public trust. Cenovus's commitment to continuous improvement in safety performance directly impacts its license to operate and its overall financial stability.

Pipeline and Infrastructure Approval Processes

Cenovus Energy faces significant legal hurdles in Canada and the U.S. due to the intricate and time-consuming approval processes for constructing and operating pipelines and other energy infrastructure. These procedures mandate thorough environmental impact assessments, public consultations, and engagement with Indigenous communities, all of which can introduce delays and uncertainty into project timelines.

In Alberta, the Alberta Energy Regulator (AER) plays a crucial role, overseeing pipeline performance and responding to incidents. The AER's focus on safety and responsible resource development means that companies like Cenovus must adhere to stringent regulations and demonstrate a commitment to environmental stewardship and operational integrity. For instance, in 2023, the AER reported on its ongoing efforts to enhance pipeline safety regulations, reflecting the continuous legal scrutiny the industry faces.

The legal landscape also requires companies to navigate a patchwork of federal, provincial, and state regulations. These can vary significantly, adding complexity to multi-jurisdictional projects. For example, recent legislative changes in both Canada and the U.S. concerning environmental protection and Indigenous rights continue to shape the requirements for infrastructure permitting, impacting project feasibility and cost.

- Regulatory Complexity: Navigating diverse federal, provincial, and state environmental and land-use regulations in both Canada and the U.S.

- Indigenous Consultation Mandates: Legal requirements for meaningful consultation and accommodation with Indigenous peoples, impacting project timelines and scope.

- Environmental Assessment Rigor: Stringent environmental impact assessments are mandatory, often involving extensive public review periods and potential legal challenges.

- Provincial Oversight: Specific provincial bodies like the Alberta Energy Regulator (AER) impose detailed safety and operational standards for infrastructure within their jurisdictions.

International Trade and Investment Laws

Cenovus Energy's significant refining presence in the United States subjects it to U.S. trade and investment legislation, complementing Canadian regulatory frameworks. This dual exposure means shifts in U.S. trade policies, such as potential tariffs on refined products or crude oil, could directly impact its cross-border business. For instance, in 2023, the U.S. continued to evaluate trade relationships, with energy imports and exports remaining a key focus. Maintaining compliance with international trade accords and investment pacts is crucial for ensuring continued market access and operational stability for Cenovus.

Cenovus Energy operates under a complex web of environmental regulations, including Canada's proposed Oil and Gas Sector Greenhouse Gas Emission Cap Regulations, expected to influence reporting from 2026 and potentially implement a cap-and-trade system by 2025. The company's adherence to Indigenous consultation mandates, rooted in Section 35 of the Constitution Act, 1982, is critical for project approvals and operational continuity, with past instances in 2023 showing energy projects facing legal action due to inadequate consultation. Furthermore, stringent health and safety regulations in both Canada and the U.S., enforced by bodies like OSHA, are paramount, as evidenced by the 2023 lost-time injury frequency rate of 1.2 per 200,000 hours worked in Canadian energy sector workplaces.

Environmental factors

Cenovus Energy, a prominent oil and gas producer, is a significant contributor to Canada's greenhouse gas (GHG) emissions, a sector that represented 31% of national emissions in 2022. The company faces mounting regulatory pressure to curb these emissions, with federal goals set for net-zero by 2050 and specific emission reduction targets for the oil and gas industry.

In response to these environmental demands, Cenovus is actively participating in the Pathways Alliance, a collaboration focused on reducing oil sands emissions, and is investing in carbon capture, utilization, and storage (CCUS) technologies. These initiatives highlight the company's strategic moves to address climate change challenges and comply with evolving environmental standards.

Cenovus Energy's oil sands operations are inherently water-intensive, utilizing substantial volumes for bitumen extraction. In 2023, the company reported using approximately 140 million cubic meters of water across its oil sands facilities, with a significant portion being recycled. This high demand places Cenovus under considerable environmental scrutiny and subject to stringent regulations in Alberta regarding water withdrawal, consumption, and the treatment of wastewater.

Responsible water management is paramount for Cenovus, not only for environmental stewardship but also for maintaining regulatory compliance and social license to operate. The company is actively investing in and implementing advanced water recycling technologies, aiming to reduce its reliance on freshwater sources. For instance, Cenovus has set targets to further decrease its freshwater intensity, with a goal of reducing it by a further 10% by 2025 compared to 2022 levels.

Cenovus Energy's oil sands operations inherently involve significant land disturbance, making effective land reclamation and biodiversity conservation critical environmental considerations. The company is actively engaged in restoring these areas, aiming to return them to a functional ecosystem state. By 2023, Cenovus had reclaimed approximately 2,100 hectares of land, demonstrating a tangible commitment to this process.

Waste Management and Pollution Control

Cenovus Energy's operations, particularly its oil sands extraction and refining processes, inherently generate diverse waste streams. These include significant volumes of tailings from bitumen extraction and various by-products from its refining activities, all of which require careful management to minimize environmental footprints and adhere to stringent regulatory frameworks.

The company's commitment to pollution prevention and control is crucial for mitigating these impacts. This involves comprehensive strategies for managing air emissions, ensuring responsible wastewater discharge, and implementing safe disposal methods for hazardous materials. For instance, in 2023, Cenovus reported reducing its greenhouse gas emissions intensity by 15% compared to its 2019 baseline, a testament to its ongoing efforts in environmental stewardship.

- Tailings Management: Cenovus is investing in technologies to accelerate the dewatering and reclamation of oil sands tailings ponds, aiming to reduce the physical footprint and environmental risk associated with these facilities.

- Air Emissions Control: The company employs advanced technologies to reduce emissions of sulfur dioxide, nitrogen oxides, and particulate matter from its operations, with a focus on meeting or exceeding regulatory standards.

- Water Management: Cenovus utilizes recycled water in its operations and treats wastewater to meet strict discharge quality requirements, minimizing the impact on local water bodies.

- Waste Reduction and Recycling: Efforts are ongoing to reduce the generation of non-hazardous waste and increase recycling rates across its facilities.

Biodiversity and Ecosystem Protection

Cenovus Energy operates in ecologically sensitive areas, particularly in northern Alberta, where biodiversity and ecosystem protection are significant concerns. The company faces pressure to mitigate habitat fragmentation and protect wildlife populations. For instance, in 2023, Cenovus continued its efforts in land reclamation, aiming to restore over 1,500 hectares of disturbed land across its operations, a key component of its biodiversity strategy.

To address these environmental factors, Cenovus implements various strategies:

- Habitat Restoration: Ongoing projects focus on returning land used for operations to a natural or near-natural state.

- Wildlife Protection Measures: Implementing protocols to reduce impacts on local fauna, including wildlife crossings and seasonal operating restrictions.

- Environmental Monitoring: Continuous assessment of ecosystem health and biodiversity indicators to ensure compliance and effectiveness of mitigation efforts.

- Compliance with Regulations: Adhering to stringent environmental regulations set forth by provincial and federal authorities regarding biodiversity conservation.

Cenovus Energy faces significant environmental pressures, particularly concerning greenhouse gas emissions, with the oil and gas sector contributing 31% of Canada's emissions in 2022. The company is actively investing in carbon capture technologies and participating in industry collaborations like the Pathways Alliance to meet net-zero goals by 2050.

Water usage is another critical environmental factor, with Cenovus utilizing approximately 140 million cubic meters of water in its oil sands operations in 2023, necessitating advanced recycling and strict adherence to water management regulations. Land reclamation and biodiversity conservation are also paramount, with the company having reclaimed around 2,100 hectares by 2023 to restore disturbed areas.

Managing diverse waste streams, including tailings and refining by-products, is essential for Cenovus to minimize its environmental footprint and comply with regulations. The company reported a 15% reduction in greenhouse gas emissions intensity by 2023 compared to its 2019 baseline, showcasing progress in environmental stewardship.

Operating in ecologically sensitive regions requires a focus on habitat restoration and wildlife protection, with ongoing projects aiming to restore over 1,500 hectares of disturbed land in 2023 as part of its biodiversity strategy.

| Environmental Factor | Cenovus Energy's 2023 Data/Initiatives | Context/Impact |

| Greenhouse Gas Emissions | Sector represented 31% of Canada's emissions in 2022. Cenovus reduced GHG emissions intensity by 15% (vs. 2019 baseline) in 2023. | Subject to net-zero by 2050 goals and industry-specific reduction targets. |

| Water Usage | Used ~140 million cubic meters of water in oil sands operations. | High demand requires advanced water recycling and compliance with stringent regulations. |

| Land Reclamation | Reclaimed ~2,100 hectares of land by 2023. Aiming to restore over 1,500 hectares in 2023. | Critical for mitigating operational impacts and maintaining social license. |

| Waste Management | Manages tailings and refining by-products. | Requires comprehensive strategies for pollution prevention and control. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cenovus Energy draws from a comprehensive blend of official government publications, reputable financial news outlets, and industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.