Cenovus Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cenovus Energy Bundle

Curious about Cenovus Energy's strategic positioning? Our BCG Matrix analysis highlights which of their assets are market leaders and which might be draining resources. This preview is just the beginning; get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Cenovus Energy's oil sands operations, particularly at Foster Creek with optimization projects and Sunrise with new well pads, are positioned as a strong 'Star' in the BCG matrix. This segment boasts high growth potential and a significant market share.

The company intends to pour substantial capital into these oil sands assets throughout 2025, aiming to fuel continued production expansion. This strategic investment underscores their commitment to leveraging their leading position in the Canadian oil sands market, which is expected to see sustained growth.

Cenovus Energy's oil sands operations are clearly positioned as Stars within its BCG Matrix. The company is channeling significant growth capital, projected between $600 million and $700 million in 2025, directly into these assets. This substantial investment highlights a strong belief in their future performance and market position.

These capital allocations are strategically focused on improving oil recovery and making existing operations more efficient. This approach aims to solidify Cenovus's leadership in what is anticipated to be an expanding oil sands market. The company's forward-looking production estimates reinforce this view.

For 2025, Cenovus forecasts its oil sands production to range between 615,000 and 635,000 barrels per day. This projected output demonstrates the immense scale and established infrastructure of their oil sands business, further solidifying its Star status.

Cenovus Energy is heavily investing in technological integration within its oil sands operations, a key indicator of a Star. For instance, in 2024, the company continued to deploy advanced steam-assisted gravity drainage (SAGD) techniques and digital oilfield technologies to optimize extraction and reduce operational costs. This focus on innovation aims to enhance production efficiency and maintain a strong competitive position in the oil sands market.

Increased Upstream Production Targets

Cenovus Energy is targeting increased upstream production, aiming for 805,000 to 845,000 barrels of oil equivalent per day in 2025. This represents a strategic growth initiative, primarily fueled by their oil sands operations. This production target signifies an approximate 4% increase compared to 2024 levels, underscoring the oil sands segment's role as a significant growth driver.

The company's focus on expanding upstream production, particularly in oil sands, positions this segment as a strong performer within its portfolio. Achieving these ambitious production goals is crucial for maintaining market leadership and ensuring robust future cash flow generation.

- 2025 Upstream Production Target: 805,000 - 845,000 boe/d

- Growth Driver: Oil Sands Operations

- Year-over-Year Increase (approx.): 4% from 2024 levels

- Strategic Importance: Enhances market leadership and future cash generation

Long-Life Resource Base

Cenovus Energy’s oil sands operations are anchored by a robust, low-cost resource base, a key characteristic of a Star in the BCG Matrix. This foundation is crucial for sustained investment and growth.

The company boasts an impressive reserve life, estimated at 29 years, with approximately 8.5 billion barrels of proved reserves as of year-end 2023. This extensive reserve life ensures long-term operational viability and profitability for its core oil sands business.

- Extensive Reserve Life: Cenovus holds reserves sufficient for 29 years of production.

- Vast Resource Potential: The company has access to 8.5 billion barrels of oil.

- Low-Cost Operations: The oil sands assets are characterized by competitive operating costs.

- Sustainable Foundation: This resource base provides a stable platform for future capital allocation and expansion.

Cenovus Energy's oil sands operations are clearly positioned as Stars in the BCG matrix, characterized by high growth and market share. The company is investing significantly, with projected capital expenditures between $600 million and $700 million for 2025 specifically targeting these assets.

This investment aims to boost production, with a 2025 upstream target of 805,000 to 845,000 barrels of oil equivalent per day, an approximate 4% increase from 2024. The company also boasts a substantial reserve life of 29 years, holding 8.5 billion barrels of proved reserves as of year-end 2023, underpinning its Star status.

| Segment | BCG Category | Key Metrics |

|---|---|---|

| Oil Sands Operations | Star | 2025 Production Target: 805,000 - 845,000 boe/d (approx. 4% growth from 2024) |

| 2025 Capital Allocation: $600M - $700M | ||

| Proved Reserves (YE 2023): 8.5 billion barrels | ||

| Reserve Life: 29 years |

What is included in the product

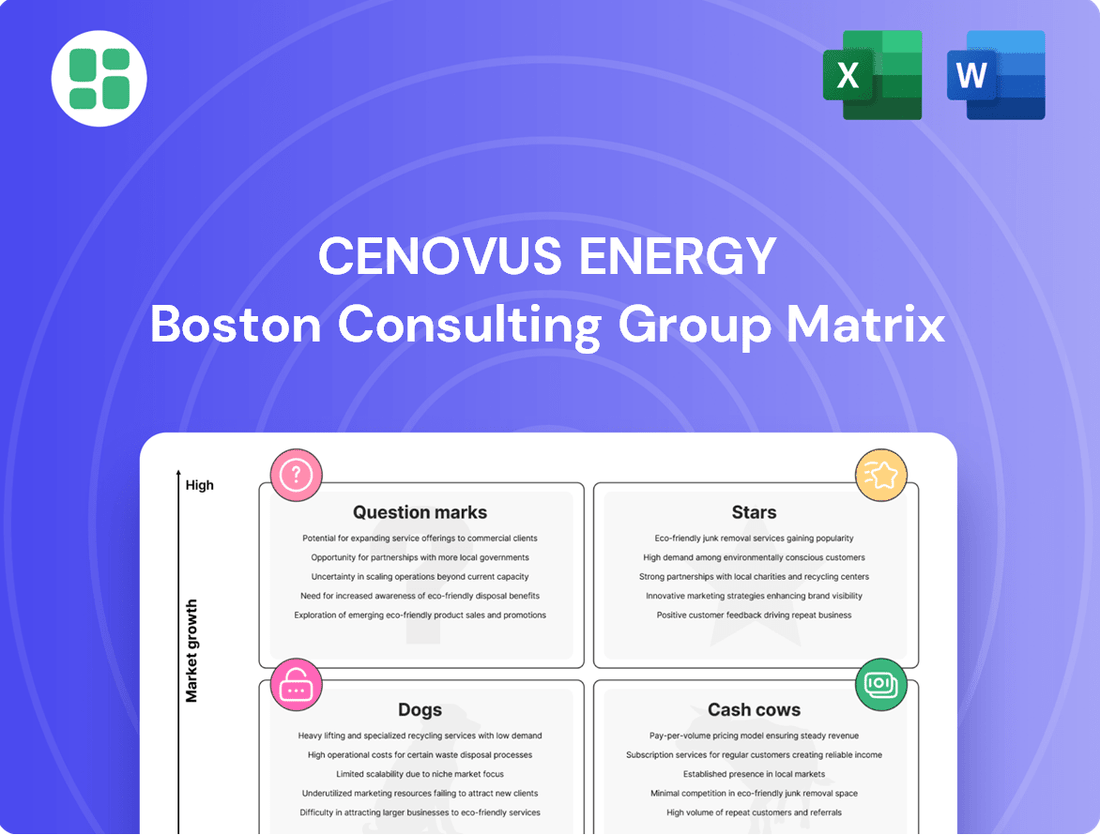

The Cenovus Energy BCG Matrix identifies strategic opportunities by categorizing business units as Stars, Cash Cows, Question Marks, or Dogs, guiding investment decisions.

A clear BCG Matrix visual instantly identifies underperforming assets, relieving the pain of resource misallocation.

Cash Cows

Cenovus Energy's U.S. refining operations are a clear cash cow. In the first quarter of 2025, these facilities achieved an impressive 90% utilization rate, showcasing their operational strength and consistent demand. This segment consistently generates substantial revenue and robust cash flow, even amidst a generally challenging refining market.

The company's strategic focus on enhancing the profitability of its downstream business, which includes these U.S. refineries, underscores their importance as a stable and reliable source of cash. Their established market presence and commitment to efficiency allow them to remain strong performers.

Cenovus Energy's Canadian refining operations are a prime example of a Cash Cow within its BCG matrix. In the first quarter of 2025, these facilities achieved a remarkable record utilization rate of 104%, underscoring their exceptional efficiency and operational strength.

This segment consistently generates robust, high-margin cash flow. Given its established and mature market position, it requires minimal promotional investment, allowing resources to be directed towards essential upkeep and safety improvements.

Investments in this sector are strategically focused on maintaining and enhancing safety, reliability, and overall productivity, ensuring the continued strong performance of these valuable assets.

Cenovus Energy's established oil sands base production, particularly from Christina Lake and Foster Creek, acts as a significant cash cow. These mature assets consistently deliver robust cash flow, forming the financial bedrock for the company.

While the broader oil sands sector sees growth, these specific sites focus on optimizing existing infrastructure and maintaining steady output rather than large-scale expansion. This stability is key to their cash cow status.

In 2024, Cenovus reported strong operational performance from its oil sands segment. For instance, the company's total oil sands production averaged approximately 776,000 barrels per day in the first quarter of 2024, highlighting the consistent output from these established assets.

Disciplined Capital Management

Cenovus Energy’s disciplined capital management, targeting a net debt level around $4.0 billion, highlights the robust cash flow generated by its established operations. This focus on maintaining a specific debt ceiling while allocating 100% of excess free funds flow back to shareholders is a hallmark of effective Cash Cow utilization. In 2024, Cenovus continued to demonstrate this by prioritizing shareholder returns, a strategy enabled by the consistent performance of its mature business segments.

- Net Debt Target: Maintaining net debt near $4.0 billion.

- Shareholder Returns: Committing 100% of excess free funds flow to shareholders.

- Cash Flow Generation: Core operations consistently produce strong cash.

- Financial Framework: Underpinned by growth plans and operational resilience.

Integrated Portfolio Synergy

Cenovus Energy's integrated portfolio, combining upstream oil and gas production with downstream refining, creates significant synergy. This integration allows the company to capture value across the entire energy chain, offering strategic flexibility and a diverse range of cash flow sources.

The established oil sands assets and profitable refining operations function as the company's cash cows. For instance, in 2023, Cenovus reported strong downstream refining margins, contributing significantly to its overall financial performance. These stable, cash-generating segments provide the essential capital needed to fund investments in higher-growth areas and cover operational expenses.

- Upstream Stability: Mature oil sands operations provide a reliable source of crude oil.

- Downstream Profitability: Refining assets generate consistent margins, especially during periods of high demand.

- Cash Generation: These segments are key drivers of free cash flow, enabling reinvestment and debt reduction.

- Strategic Flexibility: The synergy allows Cenovus to optimize its operations and respond effectively to market fluctuations.

Cenovus Energy's U.S. refining operations are a clear cash cow, consistently generating substantial revenue and robust cash flow. In the first quarter of 2025, these facilities achieved an impressive 90% utilization rate, showcasing their operational strength and consistent demand, even in a challenging market.

Similarly, the Canadian refining operations are a prime example, achieving a record 104% utilization rate in Q1 2025. This segment consistently generates high-margin cash flow with minimal promotional investment, allowing focus on essential upkeep and safety.

The company's established oil sands base production, particularly Christina Lake and Foster Creek, also acts as a significant cash cow, forming the financial bedrock. In the first quarter of 2024, total oil sands production averaged approximately 776,000 barrels per day, highlighting consistent output from these mature assets.

Cenovus's disciplined capital management, targeting net debt around $4.0 billion and returning 100% of excess free funds flow to shareholders, is enabled by these strong cash-generating segments. This strategy was evident throughout 2024, prioritizing shareholder returns through the consistent performance of its mature business segments.

| Segment | Q1 2025 Utilization | Q1 2024 Production (Oil Sands) | Key Characteristic |

|---|---|---|---|

| U.S. Refining | 90% | N/A | Consistent revenue and cash flow |

| Canadian Refining | 104% (Record) | N/A | High-margin cash flow, low investment needs |

| Oil Sands (Christina Lake, Foster Creek) | N/A | ~776,000 bbls/day (Avg Q1 2024) | Financial bedrock, stable output |

Delivered as Shown

Cenovus Energy BCG Matrix

The Cenovus Energy BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready document for your strategic planning needs. You can confidently expect to download the exact same comprehensive BCG Matrix for Cenovus Energy, ready for immediate editing, printing, or presentation to stakeholders.

Dogs

Some of Cenovus's older conventional natural gas assets, especially those experiencing production declines, likely fit into the Dogs quadrant of the BCG Matrix. For example, conventional natural gas production averaged 8.9 MMcf per day in 2024, a dip from 9.6 MMcf in 2023.

These assets typically possess a low market share within a low-growth industry segment. Consequently, they are expected to generate minimal returns for the company, requiring careful management to avoid becoming a drain on resources.

Cenovus Energy's conventional oil and gas fields, often categorized as non-core and low-return, represent a segment where the company primarily focuses on maintaining existing production rather than pursuing significant growth. These assets are maintained for their base output, with capital allocation heavily skewed towards essential upkeep and minimal investment in expansion. For instance, in 2023, Cenovus reported that its conventional business segment generated lower margins compared to its oil sands operations, highlighting the differing return profiles.

The strategy for these fields involves investing primarily for maintenance, ensuring operational stability without committing substantial capital to boost production. This approach acknowledges that these assets may tie up capital without offering substantial future upside, a common characteristic of mature, conventional reserves. Cenovus's 2024 capital expenditure plans, as outlined in their investor presentations, continue to reflect this focus on maintenance for conventional assets, with only a small portion allocated to growth initiatives in these areas.

Marginal legacy assets, often acquired through past mergers, could be considered dogs within Cenovus Energy's portfolio if they don't align with its core strategy of large-scale oil sands and integrated refining. These might be smaller, isolated conventional assets demanding operational spending without significant growth contribution. For instance, in 2023, Cenovus divested some mature, non-core assets, a common practice for energy companies managing diverse portfolios.

Inefficient Minor Operations

Inefficient minor operations within Cenovus Energy's portfolio might include smaller, legacy production assets that consistently incur higher operating costs per barrel or struggle to maintain market share compared to their larger, more integrated counterparts. These segments, lacking substantial growth prospects, could be candidates for divestiture if they do not align with strategic priorities.

For instance, if a particular legacy oil sands facility in 2024 reported operating costs of $25 per barrel, significantly above the company's average of $18 per barrel, and its production volume remained stagnant or declining, it would fit this category. Such assets, if not contributing to core strategic growth areas like their Christina Lake or Foster Creek operations, might be considered for optimization or sale to redeploy capital more effectively.

- Higher Operating Costs: Legacy assets with operating costs exceeding the company average, potentially due to aging infrastructure or lower-than-average production efficiency.

- Low Market Capture: Segments that have a diminishing share of their respective markets, indicating a lack of competitive advantage or strategic focus.

- Limited Growth Potential: Operations not aligned with Cenovus's core growth strategies, such as expansion in heavy oil or offshore, and therefore unlikely to see significant investment.

- Divestiture Candidates: Minor operations that become a drain on resources and do not offer a clear path to improved profitability or strategic alignment are typically considered for divestiture.

Underperforming Smaller Partnerships

Underperforming smaller partnerships within Cenovus Energy's portfolio, particularly those where the company holds minor stakes, are categorized as Dogs in the BCG Matrix. These ventures often fail to meet market expectations or internal performance benchmarks. For instance, if a joint venture in a mature oilfield shows declining production and limited upside potential, it would likely fall into this category.

These partnerships may not warrant continued capital allocation, especially if they operate in markets with dim growth prospects or where increasing market share is improbable. Cenovus's strategic objective is to concentrate on optimizing its core, advantaged assets to maximize shareholder value.

- Underperforming smaller partnerships: These are joint ventures or minor stake holdings that consistently lag behind market performance or internal targets.

- Low growth, low market share: Such entities typically operate in mature or declining sectors with little opportunity for expansion.

- Strategic review: Cenovus would likely evaluate divesting or restructuring these underperforming assets to reallocate capital to more promising ventures.

- Focus on optimization: The company prioritizes enhancing the value of its core portfolio, which includes its integrated refining and upgrading operations and its Western Canadian oil sands assets.

Cenovus Energy's older, conventional natural gas assets, particularly those with declining production, are likely positioned as Dogs in the BCG Matrix. These assets typically operate in low-growth segments and hold a minor market share, generating limited returns. For example, conventional natural gas production in 2024 averaged 8.9 MMcf per day, a decrease from 9.6 MMcf in 2023, illustrating a mature production profile.

These segments require careful management to avoid becoming a drain on company resources. Cenovus's strategy for such assets often involves prioritizing maintenance over significant growth investments, reflecting their mature lifecycle and lower return potential compared to core oil sands operations.

The company's approach to these "Dog" assets often involves a focus on operational stability with minimal capital allocation for expansion. This strategy acknowledges that these assets may tie up capital without offering substantial future upside, a common characteristic of mature, conventional reserves.

Cenovus Energy's divestiture of certain mature, non-core assets in 2023 exemplifies the management of these "Dog" categories, aiming to redeploy capital more effectively into its core, higher-return businesses.

| Asset Type | BCG Category | Key Characteristics | 2023/2024 Data Point Example |

| Older Conventional Natural Gas Assets | Dogs | Low market share, low growth, declining production | 2024 Avg. Production: 8.9 MMcf/day (vs. 9.6 MMcf/day in 2023) |

| Mature, Non-Core Conventional Oil Fields | Dogs | Low margins, focus on maintenance, limited growth potential | Lower margins compared to oil sands operations (2023) |

Question Marks

The West White Rose offshore project, a significant undertaking for Cenovus Energy, is currently classified as a Question Mark in the BCG Matrix. This designation stems from its substantial capital requirements during the development phase, which precede its ability to generate significant revenue or market share.

First oil from West White Rose is slated for the first half of 2026, with peak production expected in 2028. Cenovus is actively engaged in installation and commissioning activities throughout 2025, demonstrating tangible progress towards this future production.

The Narrows Lake tie-back project is a prime example of Cenovus Energy's strategic investment in future growth. With first oil anticipated by mid-2025, this venture is positioned as a high-potential, albeit currently low-market-share, asset. Cenovus is channeling significant capital into this project, aiming to leverage its existing infrastructure for efficient integration and expanded production capacity.

Early-stage offshore exploration, like Cenovus's ventures in new geological plays in the Atlantic and Asia Pacific, would be classified as Question Marks in the BCG Matrix. These projects demand significant capital for exploration, with potential for high future growth if discoveries are made, but currently represent a negligible market share and have uncertain outcomes.

Future Decarbonization Technologies (without immediate revenue)

Cenovus Energy's commitment to decarbonization, particularly through initiatives like the Oil Sands Pathways to Net Zero alliance, places its carbon capture projects squarely in the Question Mark quadrant of the BCG matrix. These investments, while vital for future environmental compliance and stakeholder relations, do not currently offer direct revenue streams or expand market share. For instance, Cenovus is a key participant in projects aiming to capture CO2 from oil sands operations, a technology that requires substantial upfront capital with a long payback horizon.

These decarbonization technologies represent a significant investment in the company's future viability. In 2024, Cenovus continued to advance its decarbonization strategy, which includes exploring and investing in carbon capture, utilization, and storage (CCUS) technologies. The company has noted that securing government support is crucial for the economic feasibility of these non-revenue generating, capital-intensive projects. This strategic focus highlights the high investment needs and uncertain future returns characteristic of Question Marks.

- Investment in CCUS: Cenovus is actively involved in developing and investing in carbon capture technologies as part of its net-zero commitments.

- No Immediate Revenue: These decarbonization efforts are not designed to generate direct revenue or immediate profits, aligning with the Question Mark profile.

- Government Support Dependency: The company is seeking government funding and incentives to offset the significant capital expenditures required for these projects.

- Long-Term Strategic Importance: Despite the lack of immediate returns, these technologies are critical for Cenovus's long-term sustainability and social license to operate.

New Conventional Heavy Oil Development in Lloydminster

Cenovus Energy's Conventional Heavy Oil development in Lloydminster represents a strategic investment in growth. These projects, focusing on new well pads and development drilling, are designed to boost production in this key region.

While these ventures are considered high-growth prospects, they may currently constitute a smaller segment of Cenovus's total output. Significant capital is being allocated to expand their market share within the conventional heavy oil sector.

The company's objective with this focus is to generate substantial future free funds flow. For instance, Cenovus reported significant capital expenditures in its oil sands operations, which include conventional heavy oil, in its 2024 guidance, indicating a commitment to these growth areas.

- Investment Focus: New well pads and development drilling in Lloydminster.

- Growth Potential: High-growth prospects aimed at expanding production.

- Market Position: Requires significant investment to gain market share.

- Financial Goal: Drive future free funds flow.

Question Marks in Cenovus Energy's portfolio represent ventures with high growth potential but currently low market share, requiring significant investment. These include early-stage offshore exploration and decarbonization projects like carbon capture, utilization, and storage (CCUS). Cenovus's commitment to these areas, such as the Narrows Lake tie-back project slated for first oil by mid-2025 and ongoing CCUS initiatives, highlights the capital intensity and uncertain returns characteristic of Question Marks.

| Project/Initiative | BCG Category | Key Characteristics | Investment Focus | Expected Outcome |

| West White Rose Offshore | Question Mark | High capital requirements, pre-revenue | Development and commissioning | First oil H1 2026, peak production 2028 |

| Narrows Lake Tie-back | Question Mark | High potential, low current market share | Infrastructure integration, expanded capacity | First oil mid-2025 |

| Early-Stage Offshore Exploration | Question Mark | High risk, high potential reward | Exploration in new plays | Uncertain outcomes, potential future growth |

| CCUS Initiatives (e.g., Oil Sands Pathways to Net Zero) | Question Mark | Vital for sustainability, no direct revenue | Carbon capture technology development | Long-term environmental compliance, stakeholder relations |

BCG Matrix Data Sources

Our Cenovus Energy BCG Matrix is built on robust data, integrating financial statements, industry reports, and market growth projections.