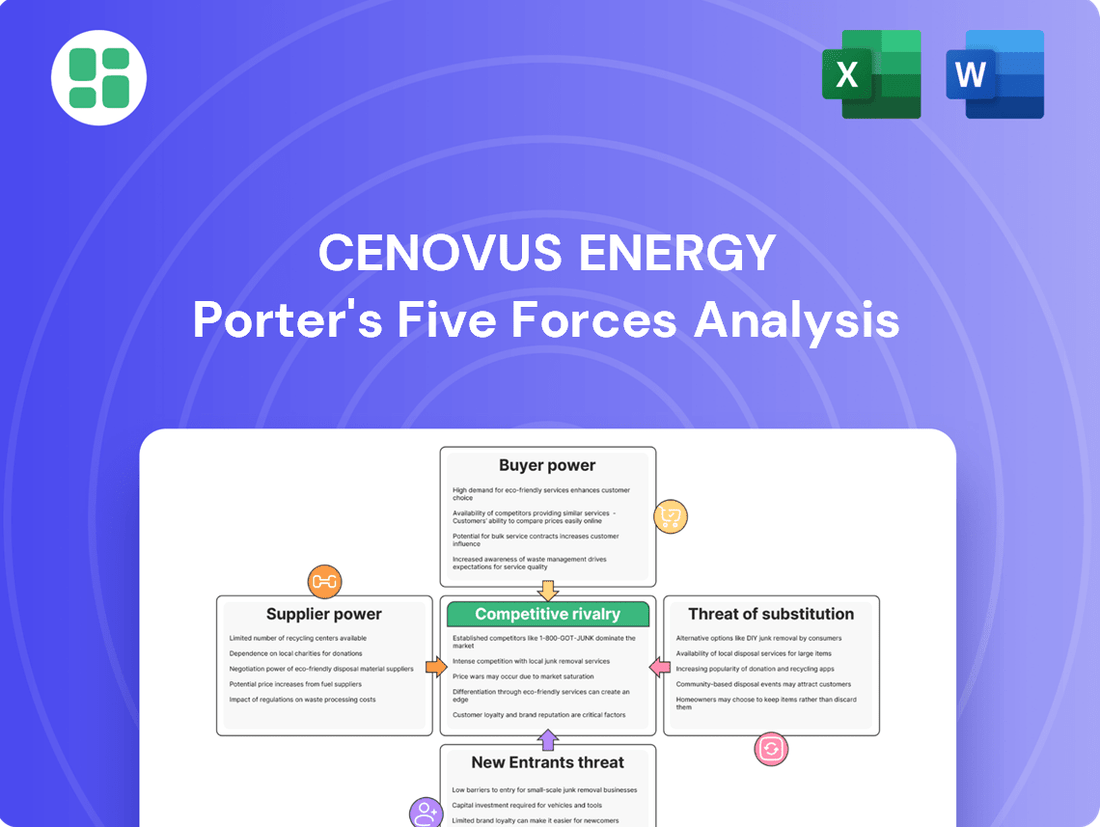

Cenovus Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cenovus Energy Bundle

Cenovus Energy operates within a dynamic energy landscape, where the bargaining power of buyers and suppliers significantly influences profitability. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and established infrastructure.

The intensity of rivalry among existing competitors is a critical factor, as is the constant pressure from substitute products and technologies. Understanding these forces is crucial for strategic planning.

Ready to move beyond the basics? Get a full strategic breakdown of Cenovus Energy’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Cenovus Energy's reliance on specialized equipment and advanced technology for its oil sands operations and refining processes grants significant bargaining power to its suppliers. These suppliers often possess proprietary technology or unique expertise, making it difficult for Cenovus to find readily available alternatives. For instance, suppliers of high-pressure extraction equipment or advanced process control systems can command higher prices due to the limited number of qualified manufacturers and the substantial investment required for Cenovus to switch providers.

The high switching costs associated with specialized equipment and technology directly impact Cenovus's capital expenditures and operational efficiency. Replacing specialized machinery or upgrading to new technological platforms involves considerable upfront investment, lengthy implementation periods, and potential disruptions to production. This dependence means Cenovus must carefully manage relationships with these key suppliers to mitigate potential price increases and ensure the continuity of its operations, especially as it continues to integrate assets like Husky Energy.

The energy sector, especially areas like oil sands and refining, relies heavily on a specialized workforce. Think engineers, geoscientists, and skilled tradespeople. This demand for expertise means these workers hold significant bargaining power.

When there's a shortage of this specialized talent, or if labor unions are strong, it can drive up labor costs for companies like Cenovus Energy. This directly impacts operating expenses through increased wages and benefits.

For instance, in 2024, the Canadian Association of Petroleum Producers (CAPP) highlighted ongoing efforts to attract and retain skilled labor amidst a competitive global market. This competitive landscape underscores the bargaining power of these essential suppliers to Cenovus.

While Cenovus Energy is a significant producer of crude oil and natural gas, its downstream refining segment relies on a variety of essential inputs. These include specialized catalysts, chemicals, and critical utilities such as electricity and water. The ability of these suppliers to influence pricing and terms is a key consideration.

The bargaining power of suppliers for these refining inputs is shaped by several factors. Market availability of these specialized materials and utilities, alongside prevailing commodity prices, plays a crucial role. Furthermore, the presence and terms of any long-term supply contracts can significantly impact the leverage held by these suppliers.

For Cenovus, fluctuations in the cost of these raw materials and utilities directly affect its refining margins. For instance, if the price of a key catalyst or electricity rises sharply, it can squeeze the profitability of its refining operations, even if crude oil prices are favorable. In 2024, the global average price for electricity saw significant volatility, with some regions experiencing increases of over 15% year-over-year, directly impacting energy-intensive industries like refining.

Transportation and Logistics Suppliers

Transportation and logistics suppliers hold significant bargaining power over Cenovus Energy due to the essential nature of their services for moving crude oil, natural gas, and refined products. Limited pipeline capacity or a consolidation among rail and marine transport providers can create situations where Cenovus has fewer viable options, thereby increasing supplier leverage on pricing and service availability.

In 2024, the ongoing need for efficient energy transportation, coupled with potential infrastructure bottlenecks, continues to empower these suppliers. For instance, disruptions or delays in rail transport, a critical mode for Canadian oil and gas, can directly impact Cenovus's ability to reach markets, giving rail companies more sway in contract negotiations.

- Limited Pipeline Capacity: Constraints in pipeline infrastructure force greater reliance on alternative, often more expensive, transportation methods like rail, enhancing the bargaining power of rail providers.

- Concentration of Providers: A smaller number of dominant rail and marine transportation companies means less competition for Cenovus, allowing these suppliers to dictate terms more effectively.

- Impact on Market Access: The ability of transportation suppliers to control delivery schedules and costs directly affects Cenovus's market access and profitability, a key factor in their bargaining strength.

Environmental Services and Compliance Suppliers

The bargaining power of environmental services and compliance suppliers for Cenovus Energy is significant due to the highly regulated nature of the energy industry. These suppliers offer critical expertise in areas such as waste management, emissions control, and site remediation, all of which are essential for Cenovus to operate legally and responsibly.

The increasing emphasis on Environmental, Social, and Governance (ESG) performance, coupled with evolving regulations like Canada's Fighting Against Forced Labour and Child Labour in Supply Chains Act, amplifies the leverage of these specialized providers. Cenovus's need to demonstrate robust environmental stewardship means they are often reliant on these suppliers to meet stringent compliance standards.

- Specialized Expertise: Suppliers possess unique knowledge and certifications crucial for environmental compliance, making them difficult to substitute.

- Regulatory Dependence: Cenovus must engage these suppliers to navigate complex and ever-changing environmental laws and reporting requirements.

- ESG Imperative: A strong ESG profile, heavily influenced by environmental performance, drives demand for specialized compliance services, increasing supplier leverage.

The bargaining power of suppliers for Cenovus Energy is substantial, particularly for specialized equipment, technology, and skilled labor. This leverage stems from the high switching costs associated with proprietary systems and the critical need for expertise in oil sands operations and refining. For instance, in 2024, the demand for experienced geoscientists and specialized engineers remained robust, driving up labor costs, as highlighted by industry reports from organizations like CAPP.

Furthermore, suppliers of essential refining inputs like catalysts and utilities, along with transportation and logistics providers, wield considerable influence. Fluctuations in global commodity prices, such as electricity which saw average increases of over 15% in some regions in 2024, directly impact refining margins. Limited pipeline capacity in 2024 also amplified the bargaining power of rail and marine transport companies, affecting Cenovus's market access.

Environmental services and compliance suppliers also hold significant sway due to the stringent regulatory landscape and the increasing importance of ESG performance. Cenovus's reliance on these providers for waste management, emissions control, and adherence to evolving legislation, like Canada's forced labour supply chain act, solidifies their leverage.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Cenovus Energy | 2024 Data/Context |

|---|---|---|---|

| Specialized Equipment & Technology | Proprietary technology, high switching costs, limited qualified manufacturers | Higher equipment costs, potential operational disruptions | Continued investment in advanced extraction and refining tech |

| Skilled Labor | Demand for specialized expertise (geoscientists, engineers), competitive global market | Increased labor costs (wages, benefits) | CAPP noted ongoing efforts to attract and retain skilled talent |

| Refining Inputs (Catalysts, Chemicals, Utilities) | Market availability, commodity price volatility, long-term contracts | Impacts refining margins, profitability | Global electricity prices saw significant regional increases (>15% YoY in some areas) |

| Transportation & Logistics | Limited pipeline capacity, consolidation of providers, market access control | Higher transportation costs, potential delivery delays | Ongoing infrastructure bottlenecks and reliance on rail for Canadian oil |

| Environmental Services & Compliance | Specialized expertise, regulatory dependence, ESG imperative | Costs associated with compliance, need for robust environmental stewardship | Increased focus on ESG reporting and evolving environmental regulations |

What is included in the product

This analysis examines the competitive forces impacting Cenovus Energy, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Effortlessly navigate the complexities of the oil and gas industry by visualizing Cenovus Energy's competitive landscape with an intuitive Porter's Five Forces analysis, providing immediate clarity on strategic challenges.

Customers Bargaining Power

In commodity markets like crude oil and natural gas, Cenovus Energy's customers, while numerous, lack individual bargaining power. Prices are set by global supply and demand, not by specific customer negotiations. For instance, in Q1 2024, Cenovus's total production averaged 824,000 barrels of oil equivalent per day, highlighting the scale at which these global price dynamics operate.

For refined products like gasoline and diesel, Cenovus Energy deals with substantial industrial and commercial buyers, including large distributors and transportation firms. These major clients possess a degree of bargaining power, particularly if they can secure alternative fuel supplies or easily shift their business between various refiners. In 2024, the global demand for refined products remained robust, influenced by economic activity, but the presence of multiple large buyers in specific regions can still create leverage for them.

Cenovus Energy's strategic diversification across its refining operations, encompassing both U.S. and Canadian facilities, significantly dilutes the bargaining power of individual customer groups. By serving a broad spectrum of product markets, from gasoline and diesel to jet fuel and asphalt, the company avoids over-reliance on any single customer segment or geographic region.

This broad market reach inherently weakens the leverage any one customer or customer type can exert. For instance, in 2024, Cenovus's integrated refining system processed approximately 660,000 barrels per day, a substantial volume spread across various end-users, making it less susceptible to demands from a concentrated customer base.

Long-term Contracts and Relationships

Long-term contracts with major refiners and industrial users for crude oil and refined products can offer Cenovus Energy a predictable revenue stream and reduce exposure to short-term market volatility. For instance, in 2024, a significant portion of Cenovus's production is typically secured through such agreements, providing a baseline level of demand.

However, the bargaining power of these customers is amplified if they have alternative suppliers or if the contracts include flexible pricing mechanisms tied to market benchmarks. This can limit Cenovus's ability to set prices independently, especially in periods of oversupply.

- Stable Demand: Long-term contracts ensure a consistent offtake for Cenovus's products, contributing to operational stability.

- Price Volatility Mitigation: These agreements can cushion the impact of fluctuating commodity prices, though often with built-in market adjustments.

- Customer Leverage: Large, repeat customers can negotiate favorable terms, particularly if they possess strong alternative sourcing options or significant market influence.

Downstream Integration Benefits

Cenovus Energy's integrated model, encompassing refining operations, allows it to capture value throughout the entire supply chain. This vertical integration significantly reduces its dependence on external refiners for its crude oil.

By controlling both upstream production and downstream refining, Cenovus gains a stronger negotiating position with crude oil buyers. This integration enhances its overall profitability and insulates it from some market volatility.

- Integrated Operations: Cenovus's ownership of both oil sands production and refining facilities provides a distinct advantage.

- Reduced Third-Party Reliance: This integration minimizes the need to sell crude to third-party refiners, strengthening its bargaining power.

- Value Capture: By processing its own crude, Cenovus captures margins typically earned by refiners, boosting profitability.

- Market Resilience: The ability to manage its product flow from wellhead to refined product offers greater stability in fluctuating energy markets.

While individual consumers of refined products have negligible bargaining power, large commercial and industrial clients of Cenovus Energy, such as major distributors, can exert influence. This is especially true if they can easily switch to alternative suppliers or have the capacity to secure fuel from different refiners. In 2024, the energy market's dynamics, including robust demand for refined products, still allowed these larger buyers some leverage, particularly in regions with multiple supply options.

Cenovus's extensive refining capacity, processing around 660,000 barrels per day in 2024 across its integrated U.S. and Canadian facilities, spreads its customer base thinly. This diversification across various product markets, from gasoline to jet fuel, means no single customer segment holds significant sway over pricing or terms. The sheer volume and variety of customers dilute the power any one group can wield.

| Customer Type | Bargaining Power Factors | Cenovus's Mitigating Factors (2024 Context) |

|---|---|---|

| Individual Consumers (Gasoline) | Very Low (Price takers) | Global supply/demand sets prices; Cenovus's scale (824,000 boe/d production Q1 2024) is too large for individual negotiation. |

| Large Commercial/Industrial Buyers (Distributors, Transportation) | Moderate (Can switch suppliers, alternative sourcing) | Diversified product portfolio, integrated refining operations reduce reliance on single buyer types; robust demand provides baseline. |

| Long-Term Contracted Buyers (Refiners, Industrial Users) | Moderate to High (Contract terms, alternative suppliers, flexible pricing) | Long-term contracts provide revenue stability; integration captures value, reducing reliance on third-party refiners. |

Same Document Delivered

Cenovus Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Cenovus Energy Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the oil and gas industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, allowing immediate strategic insight.

You're looking at the actual document, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry for Cenovus Energy. Once you complete your purchase, you’ll get instant access to this exact file, enabling immediate application of its findings.

Rivalry Among Competitors

Cenovus Energy faces formidable competition from other major integrated energy players in Canada and globally. Companies like Suncor Energy, Imperial Oil, and Canadian Natural Resources are significant rivals, boasting substantial financial clout, extensive asset portfolios, and entrenched market standings.

This intense rivalry means Cenovus must constantly vie for market share and capital investment. For instance, in 2023, Suncor reported adjusted funds from operations of CAD 15.8 billion, highlighting the financial muscle of its competitors.

The energy sector, including crude oil and natural gas, is prone to substantial global price swings. These fluctuations are often triggered by geopolitical tensions, economic cycles, and the delicate balance between supply and demand. For instance, in early 2024, Brent crude oil prices experienced significant volatility, trading in a range influenced by ongoing conflicts and OPEC+ production decisions.

This inherent cyclicality and volatility amplify competitive rivalry within the industry. Companies like Cenovus Energy must constantly strategize to protect their margins and market share, especially when prices are low. For example, during periods of depressed oil prices, such as those seen in parts of 2020, companies were forced into cost-cutting measures and strategic asset sales to survive, intensifying the competitive landscape.

Cenovus Energy's competitive rivalry in oil sands is intense, primarily focusing on operational efficiency and cost per barrel. Companies that can lower their production costs gain a significant advantage in this sector.

Cenovus's emphasis on advanced recovery techniques, like steam-assisted gravity drainage (SAGD) and thermal-mechanical extraction, aims to reduce its operating costs. For example, in 2023, Cenovus reported an average oil sands operating cost of $8.60 per barrel, a figure that places it competitively among its peers.

The market anticipates record production levels, making cost efficiency a crucial differentiator. Competitors employing similar or superior technologies to reduce their cost per barrel, such as Canadian Natural Resources Limited or Suncor Energy, directly challenge Cenovus's market position.

Refining Capacity and Utilization

In the downstream sector, Cenovus Energy's refining business faces intense competition from numerous North American refiners. This rivalry is amplified by broader market trends that pressure refining margins and feedstock acquisition.

The global refining market is experiencing a challenging environment characterized by increasing capacity additions, particularly in Asia and the Middle East, coupled with a more moderate pace of demand growth. This imbalance creates a highly competitive landscape, forcing refiners to vie aggressively for crude oil supplies and to secure sales for their refined products, often operating on thin profit margins.

- Market Oversupply: Global refining capacity is projected to increase, with significant additions expected in the coming years, potentially exacerbating oversupply issues.

- Demand Growth Deceleration: While demand for refined products continues to grow, the rate of expansion has slowed in many mature markets, intensifying competition for market share.

- Feedstock Volatility: Refiners must contend with the fluctuating availability and pricing of crude oil, a key input, making efficient feedstock procurement a critical competitive factor.

- Margin Compression: The combination of overcapacity and demand pressures often leads to compressed refining margins, requiring operational excellence and cost efficiency to maintain profitability.

Strategic Growth and Capital Allocation

Cenovus Energy's strategic capital investments are a key battleground for competitive advantage. Projects like the Narrows Lake expansion and the West White Rose offshore development are designed to boost production capacity and generate long-term shareholder value. These investments, totaling billions, are crucial for outmaneuvering competitors in an evolving energy landscape.

Disciplined capital allocation is paramount. Cenovus aims to deliver robust returns by prioritizing projects with strong economic potential. For instance, in 2024, the company continued to focus on optimizing its existing asset base while strategically deploying capital to growth opportunities, a move that directly impacts its ability to compete on cost and production efficiency.

- Narrows Lake Expansion: Aimed at increasing oil sands production by approximately 50,000 barrels per day.

- West White Rose Project: Targeted to add significant offshore production capacity upon full ramp-up.

- Capital Discipline: Maintaining a focus on free funds flow generation to reinvest in growth and return capital to shareholders.

- Competitive Edge: Successful project execution and efficient capital deployment allow Cenovus to outperform rivals in terms of profitability and production growth.

Competitive rivalry is a defining characteristic of Cenovus Energy's operating environment, particularly within the oil sands and downstream refining sectors. Key competitors like Suncor Energy and Canadian Natural Resources Limited possess substantial financial resources and established market positions, forcing Cenovus to continually focus on operational efficiency and cost reduction to maintain its competitive edge.

The energy market's inherent volatility, driven by geopolitical events and supply-demand dynamics, intensifies this rivalry. Companies must strategically manage margins and market share, especially during periods of low commodity prices, often resorting to cost-cutting and asset optimization. For instance, Cenovus's 2023 oil sands operating cost of $8.60 per barrel demonstrates its focus on cost efficiency as a crucial differentiator against rivals employing similar advanced recovery techniques.

In refining, Cenovus faces intense competition from numerous North American refiners, a situation exacerbated by global capacity additions and decelerating demand growth in mature markets. This leads to margin compression, making efficient feedstock procurement and operational excellence vital for profitability. Strategic capital investments, such as the Narrows Lake expansion, are critical for Cenovus to enhance production capacity and secure a competitive advantage.

| Competitor | 2023 Adjusted Funds from Operations (CAD billions) | 2023 Oil Sands Operating Cost (USD/barrel) |

|---|---|---|

| Cenovus Energy | 13.7 | 8.60 |

| Suncor Energy | 15.8 | N/A (not directly comparable) |

| Canadian Natural Resources | 20.5 | N/A (not directly comparable) |

SSubstitutes Threaten

The global push for decarbonization is accelerating the growth of renewable energy. In 2024, renewable energy sources like solar and wind power are increasingly competing with traditional fossil fuels, especially in the power generation sector. This trend represents a significant long-term threat to companies like Cenovus Energy, as demand for oil and gas could diminish.

The increasing adoption of electric vehicles (EVs) and the ongoing development of alternative fuels such as biofuels and hydrogen pose a significant threat to traditional refined petroleum products. By the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, directly impacting the demand for gasoline and diesel.

Government policies, including subsidies and stricter emissions standards, are further accelerating this transition, making alternative transportation options more attractive and economically viable. This trend directly challenges the long-term demand for Cenovus Energy's refined products, potentially reducing revenue streams from its downstream operations.

Advancements in energy efficiency pose a significant threat by directly reducing demand for oil and gas. For instance, by 2024, the International Energy Agency (IEA) reported that improvements in energy efficiency across various sectors are projected to save a substantial amount of energy, directly impacting consumption patterns for fossil fuels.

More fuel-efficient vehicles, better building insulation, and optimized industrial processes all contribute to this reduction. These technological shifts mean that less energy is needed to achieve the same output, lessening the reliance on traditional energy sources like those provided by Cenovus Energy.

Policy and Regulatory Shifts

Government policies, such as carbon pricing and emissions caps, significantly impact the attractiveness and viability of fossil fuel substitutes for companies like Cenovus Energy. For example, Canada's proposed oil and gas emissions cap aims to reduce emissions by 31% below 2019 levels by 2030, which could pressure production volumes and investment in traditional energy sources.

Mandates for renewable energy deployment also encourage the adoption of alternative energy sources, thereby increasing the threat of substitutes. By 2030, Canada aims to have 30% of its national electricity generation come from renewable sources, a target that directly competes with fossil fuel-based power generation.

These regulatory shifts create uncertainty for the oil and gas sector, potentially leading to reduced demand for conventional products and a greater push towards cleaner alternatives. This environment necessitates strategic adaptation to mitigate the growing threat posed by substitutes.

- Government policies: Carbon pricing, emissions caps, and renewable energy mandates directly influence the demand for fossil fuels.

- Canadian emissions cap: The proposed oil and gas emissions cap could lead to reduced production and investment in traditional energy.

- Renewable energy targets: Canada's goal of 30% renewable electricity by 2030 increases competition from alternative energy sources.

- Industry uncertainty: Regulatory shifts create uncertainty, pushing companies to adapt to the growing threat of substitutes.

Natural Gas as a Transition Fuel

While Cenovus Energy is a significant producer of natural gas, the very nature of natural gas as a cleaner-burning alternative to oil and coal presents a substantial threat of substitutes. This dual role means natural gas can compete directly with some of Cenovus's oil products in sectors like industrial heating and power generation.

The global push for decarbonization further amplifies this threat. For instance, by the end of 2024, many countries are expected to have increased investments in renewable energy sources, which directly displace the need for fossil fuels, including natural gas. This trend could reduce demand for both oil and natural gas, impacting Cenovus's market position.

- Growing Renewable Energy Adoption: Global renewable energy capacity is projected to reach significant milestones by 2024, offering a direct substitute for fossil fuel-based energy generation.

- Government Policies Favoring Cleaner Fuels: Many jurisdictions are implementing policies and incentives that encourage the switch to lower-emission energy sources, potentially impacting demand for oil and natural gas.

- Technological Advancements in Alternatives: Innovations in battery storage and hydrogen fuel cell technology are making renewable energy solutions more viable and competitive, further strengthening the threat of substitutes.

The threat of substitutes for Cenovus Energy primarily stems from the accelerating global transition to cleaner energy sources and improved energy efficiency. By 2024, the increasing adoption of electric vehicles (EVs) and advancements in alternative fuels like hydrogen are directly impacting the demand for refined petroleum products, with global EV sales surpassing 13.6 million units by the end of 2023. Furthermore, government policies, including carbon pricing and renewable energy mandates, are actively promoting these substitutes, creating a challenging environment for traditional oil and gas demand.

| Substitute Category | Key Developments (as of 2024) | Impact on Cenovus Energy |

|---|---|---|

| Renewable Energy (Solar, Wind) | Continued growth in capacity, driven by government incentives and falling costs. | Directly competes with fossil fuels in power generation, potentially reducing demand for natural gas. |

| Electric Vehicles (EVs) | Surpassed 13.6 million global sales by end of 2023; ongoing model expansion. | Reduces demand for gasoline and diesel, impacting Cenovus's downstream refining operations. |

| Alternative Fuels (Hydrogen, Biofuels) | Increased investment and research into production and infrastructure. | Offers substitutes for transportation and industrial uses currently served by oil and gas. |

| Energy Efficiency Improvements | IEA reports significant projected energy savings across sectors by 2024. | Lowers overall energy consumption, lessening the need for fossil fuels. |

Entrants Threaten

The energy sector, particularly oil sands extraction and refining, demands immense capital. Cenovus Energy's operations, for instance, involve substantial investments in exploration, drilling, processing facilities, and extensive pipeline networks. These upfront costs create a formidable barrier, making it exceptionally challenging for newcomers to enter and compete effectively.

In 2024, the global energy industry continued to see significant capital expenditure, with major oil and gas projects often running into billions of dollars. For example, the development of a new oil sands project can easily require over $10 billion, a sum that deters most potential entrants who lack the financial backing or established credit lines.

New companies looking to enter Canada's energy sector, like Cenovus Energy operates in, face significant challenges due to extensive regulatory and environmental hurdles. These include complex approval processes, rigorous environmental impact assessments, and obtaining numerous permits, all of which demand substantial time and financial investment. For instance, in 2024, the average time for obtaining major project approvals in Canada continued to be lengthy, often spanning several years, underscoring the difficulty for new players.

The increasing emphasis on climate change mitigation and the imperative of Indigenous reconciliation further complicate entry. These factors necessitate advanced environmental technologies and robust community engagement strategies, adding considerable cost and operational complexity. Companies must demonstrate a commitment to sustainability and responsible resource development, which can be a steep learning curve and a significant financial burden for nascent entrants compared to established players like Cenovus.

Cenovus Energy, like other established players, benefits significantly from its existing, extensive network of pipelines and processing facilities. For instance, in 2023, Cenovus reported significant production volumes, underscoring the utility of its infrastructure. New entrants would face immense capital requirements and regulatory hurdles to replicate this established operational backbone, making it a substantial barrier.

Technological Complexity and Expertise

The oil sands industry presents a significant barrier to new entrants due to its inherent technological complexity and the deep expertise required. Extracting and refining oil sands involves highly specialized processes, demanding substantial investment in research and development, as well as a highly skilled workforce. For instance, Cenovus Energy itself has invested billions in developing and refining its proprietary extraction technologies, like steam-assisted gravity drainage (SAGD), which are not easily replicated.

Potential newcomers face the daunting task of acquiring or developing these advanced capabilities. This includes not only the physical infrastructure but also the intellectual property and operational know-how that Cenovus and other established players have cultivated over decades. The sheer capital expenditure and the need for specialized engineering and operational talent make it exceedingly difficult for new companies to enter and compete effectively.

- High Capital Investment: New entrants need to commit billions to acquire or develop advanced extraction and refining technologies.

- Specialized Expertise: Deep knowledge in areas like SAGD, reservoir management, and complex refining is crucial and hard to acquire.

- Intellectual Property: Established companies possess proprietary technologies and processes that are protected and difficult to circumvent.

- Operational Scale: Achieving economies of scale in oil sands operations requires massive infrastructure and operational efficiency, a significant hurdle for new players.

Brand Recognition and Market Access

Existing integrated energy companies like Cenovus Energy benefit significantly from deeply entrenched brand recognition and robust market access. These established players have cultivated strong customer relationships and sophisticated supply chains over years, spanning both oil and gas extraction (upstream) and refining and marketing (downstream). For instance, in 2024, major integrated energy firms continued to leverage their extensive retail networks, with some reporting steady gasoline sales volumes despite evolving consumer preferences.

New entrants would face a considerable challenge in replicating this level of market penetration and trust. Building brand loyalty and securing reliable channels to reach consumers requires substantial investment and time. Consider the difficulty a new fuel retailer would have in establishing a presence against established brands like Husky or Shell, which have decades of consumer trust and widespread infrastructure.

The threat of new entrants is therefore tempered by the sheer difficulty in overcoming established distribution networks and brand equity. New companies would need to offer a compelling value proposition or innovative approach to even begin chipping away at the market share held by incumbents who already possess significant advantages in customer acquisition and retention.

- Established Supply Chains: Integrated energy companies possess extensive infrastructure for production, transportation, and refining, creating significant barriers to entry.

- Customer Relationships: Long-standing customer loyalty and brand recognition, built over decades, make it difficult for new entrants to gain market share.

- Market Access: Existing companies control significant portions of the downstream market, including gas stations and distribution networks, limiting access for newcomers.

- Brand Equity: The trust and familiarity associated with established energy brands are powerful deterrents to new competitors.

The threat of new entrants in the oil sands sector is significantly low due to the immense capital required for operations. For example, developing a new oil sands project can easily exceed $10 billion, a prohibitive cost for most potential competitors entering the market in 2024.

New players also face substantial regulatory and environmental hurdles, with project approvals in Canada often taking several years. This, combined with the need for specialized expertise in technologies like SAGD and the substantial investment in proprietary processes, creates a formidable barrier to entry.

Established companies like Cenovus benefit from deeply entrenched brand recognition and extensive market access, including robust supply chains and customer relationships. Replicating this established infrastructure and market penetration is a significant challenge for newcomers.

| Barrier Type | Description | Example Data (Illustrative) |

| Capital Investment | Required for exploration, extraction, refining, and infrastructure. | Oil sands project development costs often exceed $10 billion. |

| Regulatory & Environmental | Complex approval processes, environmental impact assessments, permits. | Average major project approval times in Canada can span several years. |

| Technology & Expertise | Need for specialized extraction (e.g., SAGD) and refining knowledge. | Billions invested by established players in proprietary technologies. |

| Market Access & Brand | Established distribution networks, customer loyalty, brand equity. | Difficulty for new brands to compete with decades of consumer trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cenovus Energy leverages data from annual reports, investor presentations, and regulatory filings, alongside industry-specific market research and news from reputable energy publications.