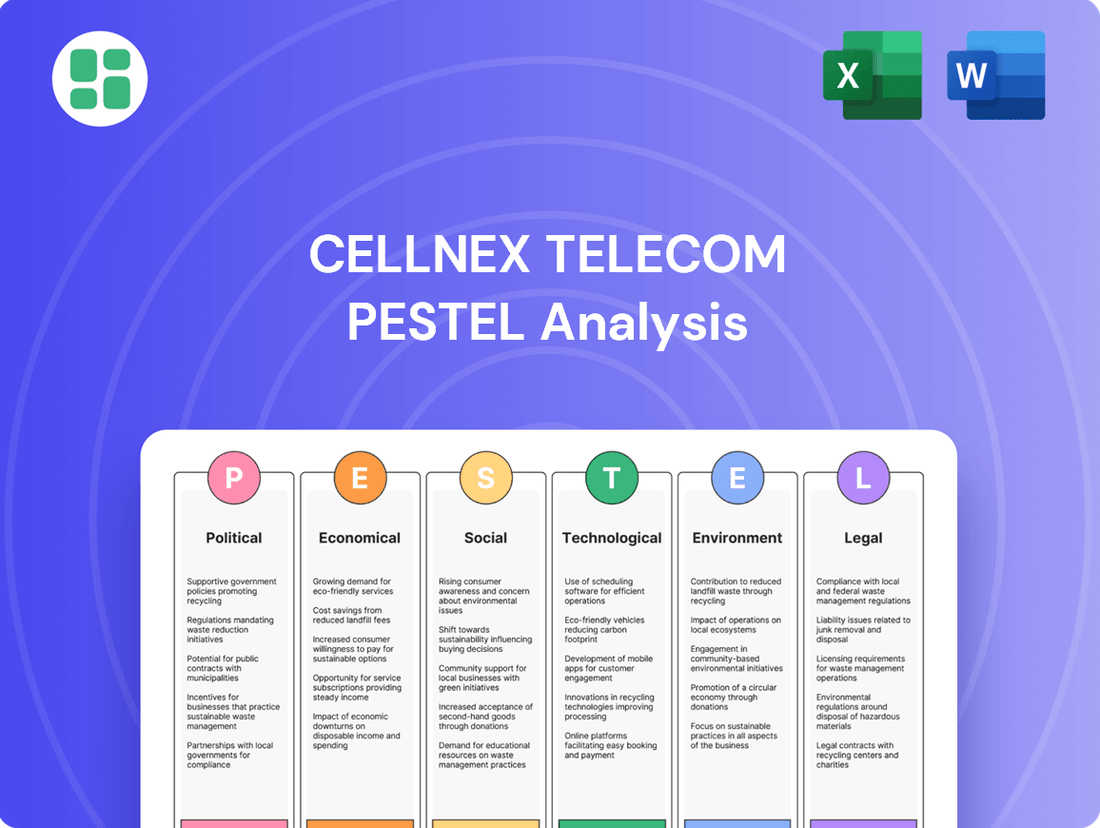

Cellnex Telecom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cellnex Telecom Bundle

Navigate the complex external forces shaping Cellnex Telecom's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting its operations and strategic direction. Gain a critical advantage by downloading the full analysis now and arm yourself with the actionable intelligence needed to make informed decisions.

Political factors

Governments across Europe are actively promoting and funding the expansion of digital infrastructure, including 5G networks, which directly benefits Cellnex Telecom's business model. For example, the European Union's Recovery and Resilience Facility allocated €9 billion to digital infrastructure projects in 2024, with a significant portion earmarked for broadband and 5G deployment.

This support often comes in the form of subsidies, tax incentives, or streamlined permitting processes for new site deployments, accelerating Cellnex's ability to build out its network. Spain, where Cellnex is headquartered, has a national 5G strategy aiming for 90% population coverage by 2025, backed by public funding and regulatory easing.

The political will to bridge the digital divide and ensure high-speed connectivity is a significant driver for Cellnex's growth, as it provides the essential backbone for these initiatives. In 2024, Germany's federal government continued its €4 billion program to expand high-speed internet access, creating demand for tower infrastructure that Cellnex can leverage.

Cellnex Telecom's operations span numerous European markets, making regulatory stability a paramount concern. Inconsistent national telecommunications laws, differing spectrum allocation policies, and varying tower sharing regulations across countries like Spain, Italy, France, and the UK can significantly influence Cellnex's investment strategies and operational costs. For instance, the 2024 spectrum auctions in Germany, while generally predictable, still present nuances in allocation that require careful navigation.

The ongoing geopolitical landscape, marked by trade tensions and international conflicts, directly impacts Cellnex's operational costs and equipment availability. For instance, disruptions stemming from events like the Russia-Ukraine war have highlighted vulnerabilities in global supply chains, potentially increasing the price of essential network components. This instability necessitates a strategic focus on supply chain resilience to ensure Cellnex can continue its expansion and maintenance efforts without significant interruptions.

National Security Concerns and Critical Infrastructure

Telecommunications infrastructure is increasingly recognized as vital national infrastructure, bringing intense scrutiny to cybersecurity and foreign ownership. Governments are likely to implement more stringent security mandates or scrutinize foreign investments in these critical assets, potentially affecting Cellnex's acquisition plans and operational procedures.

Ensuring infrastructure resilience and compliance with national security directives are paramount political considerations for Cellnex. For instance, in 2024, the European Union continued to emphasize the importance of secure 5G networks, with member states implementing national strategies that often include provisions for vetting foreign infrastructure providers. This heightened awareness translates to direct political risk for companies like Cellnex operating across multiple European jurisdictions.

- Cybersecurity Mandates: Governments are imposing stricter cybersecurity standards on telecom operators, impacting operational costs and compliance requirements.

- Foreign Ownership Scrutiny: Increased political review of foreign investment in critical infrastructure assets can create hurdles for M&A activities.

- National Security Alignment: Cellnex must align its infrastructure development and security protocols with evolving national security priorities across its operating markets.

- Infrastructure Resilience: Political pressure to ensure the resilience of telecommunications networks against threats, both physical and cyber, is a growing concern.

Public Policy on Competition and Consolidation

Government policies directly influence competition within the telecommunications sector, impacting Cellnex's client base and overall market dynamics. While Cellnex operates as a neutral host, significant consolidation among Mobile Network Operators (MNOs) or regulatory mandates promoting infrastructure sharing can alter the demand for its tower services.

Policies aimed at fostering efficient infrastructure utilization or encouraging competition among service providers present a dual-edged sword for independent tower companies like Cellnex. For instance, the European Commission's ongoing scrutiny of potential anti-competitive practices in the digital sector, as seen in ongoing investigations into large tech firms, could indirectly influence MNO strategies and their reliance on neutral hosts.

- Regulatory Scrutiny: Increased regulatory focus on M&A activity within the telecom sector could limit consolidation opportunities for Cellnex's potential clients.

- Infrastructure Sharing Mandates: Government-driven initiatives promoting infrastructure sharing can boost demand for neutral host services as MNOs seek to reduce CAPEX.

- Competition Promotion: Policies that foster a more competitive MNO landscape may lead to a broader client base for Cellnex, but also potentially more price pressure.

Governments are actively investing in digital infrastructure, with the EU's Recovery and Resilience Facility allocating €9 billion in 2024 for digital projects, directly benefiting Cellnex's 5G expansion. Spain's national 5G strategy targets 90% population coverage by 2025, supported by public funds and regulatory easing.

Cellnex must navigate varying national telecom laws and spectrum policies across its European markets, such as Germany's 2024 spectrum auctions, which impact investment and operational costs. Geopolitical instability, like that stemming from the Russia-Ukraine conflict, affects supply chains and equipment costs, necessitating a focus on resilience.

Increased scrutiny on cybersecurity and foreign ownership of critical infrastructure, as emphasized by the EU in 2024, could impact Cellnex's M&A activities and operational procedures. National security directives require Cellnex to align its infrastructure development and security protocols with evolving government priorities.

Policies influencing MNO consolidation and infrastructure sharing create opportunities and challenges for Cellnex. For instance, government-driven infrastructure sharing can boost demand for neutral host services, while regulatory scrutiny of M&A might limit client consolidation.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Cellnex Telecom, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for Cellnex Telecom.

Cellnex Telecom's PESTLE analysis offers a pain point reliever by providing a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Rising inflation poses a direct threat to Cellnex Telecom by increasing operational expenses such as energy, labor, and maintenance. For instance, the Eurozone experienced an average inflation rate of 5.5% in 2023, a significant increase from previous years, impacting these costs.

Higher interest rates, like the European Central Bank's policy rate reaching 4.00% by September 2023, directly escalate Cellnex's financing costs. Given Cellnex's substantial debt, often used for its aggressive acquisition strategy, this rise in borrowing costs can significantly dent profitability and limit future expansion funding.

Cellnex's profitability hinges on its capacity to pass these escalating costs onto its clients through long-term contracts. The company's financial health therefore depends on carefully managing its substantial financial leverage and closely monitoring evolving macroeconomic trends, particularly inflation and interest rate trajectories throughout 2024 and into 2025.

Cellnex Telecom's revenue is significantly tied to the economic well-being of its operating regions. For instance, in 2023, the Eurozone experienced a modest GDP growth of 0.5%, indicating a generally stable, albeit slow, economic environment. This growth supports continued demand for mobile data and network expansion by mobile network operators (MNOs), which directly benefits Cellnex through long-term tenancy agreements.

When economies thrive, businesses and consumers alike tend to increase their spending on digital services, driving higher data usage. This trend encourages MNOs to invest in their networks, often leading to a greater need for Cellnex's passive infrastructure, such as towers and distributed antenna systems. Conversely, a slowdown in economic growth, like the projected 0.9% GDP growth for the Eurozone in 2024, could temper MNOs' capital expenditure plans, potentially moderating Cellnex's growth trajectory.

Cellnex Telecom's financial performance is closely tied to the capital expenditure (capex) decisions of its mobile network operator (MNO) clients. These MNOs are the primary drivers of demand for Cellnex's infrastructure services, including new tower sites, distributed antenna systems (DAS), and small cells.

The ongoing rollout of 5G technology and anticipated future network enhancements are crucial investment cycles for MNOs. These upgrades directly translate into increased demand for Cellnex's passive and active infrastructure solutions, underpinning its revenue streams and growth potential.

Factors such as broader economic health, government incentives for digital infrastructure, and intense competition among MNOs significantly shape their capex strategies. For instance, in 2024, many European MNOs are prioritizing 5G densification and fiber backhaul investments, directly impacting Cellnex's project pipeline and long-term business outlook.

Currency Exchange Rate Fluctuations

Cellnex Telecom's extensive operations across Europe mean it's significantly exposed to currency exchange rate fluctuations, especially for revenues and costs not in Euros. For instance, a strengthening Euro against the British Pound could reduce the Euro-denominated value of its UK revenues. This volatility directly affects reported earnings and the profitability of its non-Eurozone activities.

The company must actively manage this foreign exchange risk to maintain financial stability. Strategies such as hedging can be employed to mitigate the impact of adverse currency movements. For example, in 2024, Cellnex's exposure to currencies like the Swiss Franc and British Pound, which are not part of the Eurozone, presents ongoing challenges and opportunities.

- Exposure to non-Eurozone currencies like GBP and CHF impacts reported financial results.

- Significant exchange rate shifts can alter the profitability of operations in countries such as the UK and Switzerland.

- Effective foreign exchange risk management is crucial for Cellnex's financial health and strategic planning.

- Hedging strategies are vital to protect against potential losses arising from currency volatility.

Competition in the Tower Industry

Cellnex Telecom, despite its leading position as an independent tower operator, navigates a competitive landscape. It contends with other significant independent players and Mobile Network Operators (MNOs) that continue to manage their own infrastructure assets.

The intensity of this competition directly impacts Cellnex's pricing power and its capacity to secure new colocation and build-to-suit contracts. For instance, in 2024, the average tenancy ratio for European tower companies hovered around 1.6x, a figure that can be pressured by aggressive pricing from competitors seeking to gain market share.

The continuous trend of MNOs divesting their passive infrastructure creates dual effects. While it opens avenues for Cellnex to acquire new assets, it also intensifies competition among potential bidders. This dynamic can influence the valuation of these assets and the terms of acquisition deals, potentially impacting profitability and growth strategies.

- Increased Bidding Wars: MNO divestments, such as Vodafone's planned sale of its European towers in 2024, can trigger multiple bidding rounds, driving up acquisition prices.

- Pricing Pressure: The presence of numerous independent tower companies and MNOs retaining infrastructure can lead to downward pressure on tower lease rates, affecting revenue growth.

- Market Consolidation: While divestments offer acquisition opportunities, they also highlight the ongoing consolidation within the industry, where larger players like Cellnex may face challenges from equally well-capitalized competitors.

The economic landscape significantly influences Cellnex Telecom's financial performance and growth prospects. Modest GDP growth in its operating regions, such as the projected 0.9% for the Eurozone in 2024, supports continued demand for digital services and network expansion by mobile network operators (MNOs), directly benefiting Cellnex through tenancy agreements.

However, rising inflation, with the Eurozone averaging 5.5% in 2023, escalates Cellnex's operational costs for energy, labor, and maintenance. Simultaneously, higher interest rates, with the ECB policy rate reaching 4.00% by September 2023, increase Cellnex's financing costs, impacting its substantial debt load and future expansion capabilities.

Cellnex's revenue streams are closely linked to MNOs' capital expenditure decisions, driven by 5G rollout and network upgrades. For instance, MNOs' 2024 focus on 5G densification directly impacts Cellnex's project pipeline. Furthermore, currency fluctuations, particularly with GBP and CHF, affect reported earnings, necessitating active foreign exchange risk management through hedging strategies.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | Impact on Cellnex Telecom |

|---|---|---|---|

| GDP Growth (Eurozone) | 0.5% | 0.9% | Stable demand for infrastructure services. |

| Inflation (Eurozone Average) | 5.5% | Projected to moderate but remain elevated. | Increased operational costs. |

| ECB Policy Rate | Reached 4.00% (Sep 2023) | Expected to remain high or increase. | Higher financing costs on debt. |

| Currency Exposure | Significant exposure to GBP, CHF. | Continued volatility expected. | Impacts reported earnings and profitability of non-Eurozone operations. |

Preview Before You Purchase

Cellnex Telecom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cellnex Telecom PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

You will gain a thorough understanding of the external forces shaping Cellnex Telecom's business environment, including regulatory changes, market trends, and competitive pressures. This detailed report provides actionable insights for strategic planning and risk management.

Sociological factors

Societal reliance on constant digital access is driving unprecedented growth in mobile data consumption. This surge, fueled by video streaming, remote work, and the proliferation of Internet of Things (IoT) devices, directly translates into a heightened need for advanced telecommunications infrastructure. For instance, global mobile data traffic is projected to grow significantly, with some estimates suggesting a near tripling between 2023 and 2028, reaching hundreds of exabytes annually.

This increasing demand for mobile connectivity and data fundamentally benefits companies like Cellnex Telecom. It necessitates a continuous expansion and densification of their network infrastructure, including more towers, Distributed Antenna Systems (DAS), and small cells to ensure reliable service. The societal shift towards ubiquitous connectivity therefore creates a direct and sustained market opportunity for Cellnex's core business.

Global urbanization continues to accelerate, with the UN projecting that 68% of the world's population will live in urban areas by 2050. This increasing population density in cities directly fuels the demand for robust and high-capacity wireless networks. Cellnex's business model is intrinsically linked to this trend, as urban environments require specialized infrastructure like small cells and Distributed Antenna Systems (DAS) to ensure seamless connectivity in densely populated areas.

The societal shift towards urban living creates a concentrated need for reliable mobile and data services. This necessitates the deployment of more network points, often in challenging urban landscapes, to overcome signal obstruction and manage increased user traffic. Cellnex's focus on providing neutral host infrastructure solutions positions it to capitalize on these specific infrastructure requirements driven by urban development.

Public acceptance of telecommunications infrastructure, especially new tower constructions, presents a significant sociological hurdle. Concerns often stem from aesthetic objections or worries about potential health impacts, commonly referred to as NIMBYism. Cellnex must proactively engage with local communities, addressing these anxieties and clearly communicating the essential societal advantages of improved connectivity, such as better mobile services and digital inclusion.

Positive public sentiment is crucial for Cellnex's operational efficiency. It directly influences the ease of acquiring new sites and significantly minimizes delays in rolling out network expansions. For instance, in 2024, the company continued to emphasize community outreach programs across its European markets, aiming to foster understanding and support for its infrastructure development projects, which are key to its strategic growth objectives.

Digital Inclusion and Bridging the Digital Divide

Societal initiatives aimed at digital inclusion present significant opportunities for Cellnex. As governments and communities prioritize universal broadband access, particularly in underserved regions, Cellnex's neutral host model becomes crucial. By providing shared infrastructure, Cellnex directly supports efforts to bridge the digital divide, fostering greater connectivity for all citizens.

These efforts are gaining momentum globally. For instance, in the European Union, the Digital Decade policy aims to ensure that 100% of households have gigabit connectivity by 2030, with significant public funding allocated to infrastructure deployment. This push for universal access creates a substantial market for neutral host providers like Cellnex, who can efficiently deploy and manage essential network infrastructure.

- Expanding Connectivity: Initiatives like the EU's Gigabit connectivity targets by 2030 drive demand for infrastructure deployment in areas lacking high-speed internet.

- Neutral Host Advantage: Cellnex's ability to offer shared infrastructure to multiple operators reduces deployment costs and accelerates the rollout of broadband services.

- Societal Impact: Bridging the digital divide enhances access to education, healthcare, and economic opportunities, aligning with Cellnex's role in building a more connected society.

- Infrastructure Investment: Significant public and private investment is being channeled into digital infrastructure, creating a favorable environment for neutral host providers.

Changing Work and Lifestyle Patterns (e.g., Remote Work)

The increasing adoption of remote and hybrid work models, a significant sociological shift, directly fuels demand for dependable connectivity. This trend means people need strong internet and mobile service not only in city centers but also in their homes and other locations, placing new pressures on network infrastructure. For instance, a 2024 report indicated that over 30% of the global workforce was engaged in hybrid or fully remote work, a substantial increase from pre-pandemic levels.

Cellnex is well-positioned to capitalize on this by providing the essential infrastructure upgrades and expansions required to support these changing work and lifestyle patterns. The company's investments in expanding its network coverage and capacity are crucial for meeting the heightened demand for seamless connectivity from a dispersed workforce. By 2025, it's projected that the demand for mobile data traffic will continue its upward trajectory, driven by these flexible working arrangements.

- Increased reliance on home and mobile connectivity due to remote/hybrid work.

- Greater demand for network capacity and reliability beyond traditional business areas.

- Cellnex benefits by facilitating necessary network upgrades and expansions.

- Societal shift towards flexible work models directly impacts infrastructure needs.

Societal trends like the increasing demand for digital connectivity and the rise of remote work directly benefit Cellnex. As more people rely on mobile data for everything from streaming to working from home, the need for robust telecommunications infrastructure grows. This societal reliance translates into a sustained market opportunity for Cellnex's core business of providing tower and network services.

Technological factors

The continuous expansion of 5G infrastructure is a major technological force impacting Cellnex. This rollout necessitates a denser network architecture, meaning more small cells and enhanced fiber optic backhaul, which directly boosts the demand for Cellnex's tower and infrastructure services. For instance, by the end of 2023, Europe saw significant 5G deployment progress, with many countries exceeding 50% population coverage in key urban areas.

Looking ahead, the development of 6G technology presents both opportunities and challenges. While still in its early research phases, 6G is expected to offer even higher speeds, lower latency, and greater capacity, potentially requiring further densification and different types of infrastructure. Cellnex's ability to adapt its existing portfolio and invest in new solutions will be crucial for maintaining its competitive edge as these next-generation networks materialize, with initial 6G research focusing on terahertz frequencies and AI integration.

Technological progress in small cell and distributed antenna systems (DAS) is vital for meeting the escalating capacity demands in densely populated urban environments and high-traffic venues. These advancements enable more precise and efficient network densification, offering a superior alternative to relying solely on traditional, larger macro towers. For instance, the global market for DAS is projected to reach approximately $12.5 billion by 2027, indicating significant growth potential.

Cellnex's demonstrated expertise in the deployment and ongoing management of these sophisticated small cell and DAS solutions strategically positions the company to leverage the burgeoning demand for hyper-localized and high-performance wireless connectivity. This capability is particularly relevant as mobile network operators continue to invest heavily in 5G rollouts, which inherently require denser network infrastructure.

As energy costs continue their upward trend and environmental consciousness intensifies, the drive for more energy-efficient network equipment and infrastructure is crucial for companies like Cellnex. This push is directly impacting operational strategies, pushing for the integration of sustainable solutions across their portfolio.

Cellnex is actively exploring and implementing renewable energy sources for its tower sites, aiming to reduce reliance on traditional power grids. Furthermore, the adoption of advanced, energy-saving cooling systems for data centers and equipment housing is a key focus. These technological shifts are not just about environmental stewardship; they represent a tangible opportunity to lower operational expenditures.

In 2023, the European Union set ambitious targets for renewable energy integration, with a significant portion of energy consumption expected to come from renewable sources by 2030. For instance, the EU aims for at least 42.5% of its energy to be from renewables by 2030, a goal that directly influences infrastructure providers like Cellnex to invest in solar, wind, and other green energy solutions for their sites. This strategic adoption of sustainable technologies directly contributes to reducing overall operational expenses and reinforces Cellnex's commitment to its corporate sustainability objectives, aligning with broader industry and regulatory trends.

Edge Computing and Infrastructure Convergence

The increasing adoption of edge computing, a trend that processes data closer to where it's generated, presents significant growth avenues for Cellnex. This shift allows for faster data analysis and reduced latency, crucial for applications like IoT and real-time analytics.

Cellnex’s vast network of tower sites are perfectly positioned to host these new edge data centers. This strategic placement facilitates a powerful convergence of telecommunications infrastructure and cloud computing capabilities, effectively turning passive tower assets into active computing hubs.

By utilizing its existing physical footprint for edge computing demands, Cellnex can unlock novel revenue streams. For instance, the company could offer colocation services for edge servers, enhancing the overall utility and financial return of its extensive tower portfolio.

- Edge Computing Growth: The global edge computing market was valued at approximately $13.1 billion in 2022 and is projected to reach $110.5 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 30.7% during the forecast period (Source: MarketsandMarkets, 2023).

- Infrastructure Convergence: Cellnex's strategy aligns with the broader trend of telco infrastructure providers diversifying into data center services, a move supported by increasing demand for low-latency processing.

- New Revenue Streams: By offering space and power for edge nodes at its tower locations, Cellnex can tap into this burgeoning market, potentially adding significant value to its existing asset base.

Cybersecurity and Network Resilience Innovations

Cybersecurity and network resilience are paramount as telecommunications infrastructure is recognized as critical. Cellnex must actively invest in advanced security technologies to safeguard its managed networks against increasingly sophisticated cyber threats. This commitment ensures the integrity, availability, and confidentiality of its services, which is vital for maintaining client trust and operational continuity.

The evolving threat landscape necessitates continuous adaptation. For instance, the European Union Agency for Cybersecurity (ENISA) reported in its 2024 threat landscape that ransomware and DDoS attacks remain significant concerns for critical infrastructure. Cellnex's proactive approach to adopting cutting-edge solutions, such as AI-driven threat detection and zero-trust architectures, is therefore essential.

- AI-Powered Threat Detection: Implementing machine learning algorithms to identify and neutralize threats in real-time, reducing response times and minimizing potential damage.

- Zero-Trust Architecture Adoption: Moving beyond traditional perimeter security to a model where every access request is rigorously verified, enhancing protection against internal and external breaches.

- Network Segmentation: Dividing the network into smaller, isolated segments to contain the impact of a security incident, thereby improving overall resilience.

The ongoing expansion of 5G networks continues to be a primary technological driver for Cellnex, necessitating denser infrastructure like small cells and enhanced fiber backhaul. Europe's 5G coverage in urban areas exceeded 50% in many locations by the close of 2023, directly fueling demand for Cellnex's services.

Emerging 6G technology, while in early research, promises higher speeds and lower latency, potentially requiring further infrastructure densification and new solutions. Cellnex's adaptability and investment in next-generation network technologies are key to maintaining its competitive position.

Advancements in small cell and distributed antenna systems (DAS) are crucial for meeting escalating capacity demands in urban areas. The global DAS market is projected to reach approximately $12.5 billion by 2027, highlighting significant growth opportunities that Cellnex is well-positioned to capture.

The increasing adoption of edge computing, which processes data closer to its source, presents substantial growth avenues for Cellnex. The global edge computing market was valued at approximately $13.1 billion in 2022 and is projected to reach $110.5 billion by 2030, with Cellnex's tower sites ideally located to host these new edge data centers.

| Technology Trend | Market Growth Projection | Cellnex Relevance |

|---|---|---|

| 5G Expansion | Significant ongoing deployment across Europe | Drives demand for towers and small cells |

| 6G Development | Early research phase, focus on terahertz and AI | Opportunity for future infrastructure innovation |

| Small Cell & DAS | Global market ~$12.5B by 2027 | Addresses urban capacity needs, enhances network densification |

| Edge Computing | $13.1B in 2022 to $110.5B by 2030 (30.7% CAGR) | Leverages tower sites for new revenue streams, enables low-latency processing |

Legal factors

Cellnex operates under a stringent regulatory environment, governed by national and European Union directives covering aspects like tower sharing, access to passive infrastructure, and the rollout of new networks. For instance, the EU's European Electronic Communications Code, implemented in member states, sets common rules for licensing and infrastructure access, directly influencing Cellnex's ability to secure sites and expand its portfolio.

Compliance with these licensing stipulations and regulatory frameworks is absolutely critical for Cellnex's day-to-day business and its strategic growth initiatives. Failure to meet these requirements can lead to significant penalties and operational disruptions.

Any shifts in these regulations, such as the introduction of mandatory infrastructure sharing mandates or streamlined permitting processes for new deployments, could profoundly reshape Cellnex's operational strategies and its financial performance. For example, in 2024, several European countries were reviewing their digital infrastructure strategies, which could lead to updated national regulations impacting passive infrastructure access.

Cellnex Telecom's expansion strategy, heavily reliant on mergers and acquisitions within the European tower sector, places it directly under the watchful eye of antitrust and competition regulators across numerous countries. For instance, the European Commission's approval process for significant deals, such as those involving national tower operators, often includes detailed reviews of market concentration and potential impacts on competition. Failure to comply with these stringent regulations can lead to substantial penalties, mandated divestitures of assets, or even outright blocking of crucial growth transactions, as seen in past merger reviews across various industries.

Navigating these complex legal landscapes is paramount for Cellnex to ensure its continued growth trajectory and avoid operational disruptions. The company must meticulously plan and execute its M&A activities, demonstrating to regulatory bodies that proposed consolidations will not unduly harm market competition or consumer choice. This often involves providing extensive data on market share, potential synergies, and commitments to maintain a competitive environment post-acquisition, a process that requires significant legal and economic expertise.

The deployment of telecommunications infrastructure, from new towers to small cells, is heavily regulated by environmental permitting and local land use zoning laws. These regulations are not uniform; they differ significantly across municipalities and countries, directly influencing how quickly and at what cost Cellnex can acquire sites and proceed with construction. For instance, in Spain, a key market for Cellnex, obtaining permits can involve lengthy approval processes at regional and local levels, impacting project timelines.

Navigating this complex legal landscape is paramount for Cellnex's ability to execute its expansion strategies efficiently. Delays in securing necessary permits can add substantial costs and slow down the rollout of new services and network upgrades. In 2024, Cellnex continued to focus on streamlining these processes, engaging with local authorities to anticipate and address potential regulatory hurdles.

Data Protection and Privacy Regulations (e.g., GDPR)

Data protection and privacy regulations, such as the General Data Protection Regulation (GDPR), significantly influence Cellnex Telecom's operational landscape. While Cellnex focuses on passive infrastructure, its services enable the transmission and storage of data, making it crucial to support client compliance with these stringent laws. Failure to do so could lead to reputational damage and potential legal repercussions for both Cellnex and its clients.

Cellnex's commitment to facilitating client adherence to data privacy standards is paramount. This includes ensuring its infrastructure is robust enough to handle data securely and in line with evolving privacy requirements. For instance, the increasing volume of data processed by mobile networks, estimated to grow significantly by 2025, underscores the importance of secure infrastructure in maintaining privacy compliance.

- Infrastructure Support: Cellnex must ensure its tower and network infrastructure can support clients' data handling needs in compliance with privacy laws.

- Client Compliance: Indirectly, Cellnex's operations are tied to its clients' ability to meet data protection obligations, especially concerning data transmitted over their networks.

- Legal Liability: Adherence to these legal frameworks helps Cellnex and its customers avoid fines and maintain trust in the digital ecosystem.

Health and Safety Regulations for Site Operations

Operating and maintaining telecommunications towers and sites presents inherent health and safety risks for both workers and the public. Cellnex Telecom is therefore obligated to rigorously adhere to national and international occupational health and safety regulations. These regulations encompass crucial areas such as managing electromagnetic field (EMF) emissions, ensuring secure site access protocols, and implementing safe equipment maintenance procedures.

Compliance with these health and safety mandates is not merely a legal obligation but a fundamental necessity for Cellnex. It directly contributes to safeguarding personnel from potential harm, preventing workplace accidents, and crucially, avoiding significant legal penalties and reputational damage. For instance, in 2024, the European Agency for Safety and Health at Work (EU-OSHA) reported that workplace accidents continue to pose a significant challenge across various sectors, underscoring the importance of robust safety frameworks.

Key legal factors influencing Cellnex Telecom's operations include:

- Adherence to EMF Exposure Limits: Compliance with national and EU directives on electromagnetic field exposure limits, such as those set by the International Commission on Non-Ionizing Radiation Protection (ICNIRP), is paramount. For example, the 2024 review of EMF guidelines continues to emphasize public safety around telecommunications infrastructure.

- Worker Safety Standards: Strict adherence to regulations concerning working at height, electrical safety, and the use of personal protective equipment (PPE) for all site personnel is mandatory. Many countries, including the UK, have specific legislation like the Work at Height Regulations 2005, which are regularly updated.

- Public Access and Site Security: Implementing and maintaining measures to prevent unauthorized public access to tower sites and ensuring the structural integrity of all installations are critical legal requirements. Site audits in 2024 highlighted the ongoing need for vigilance in this area.

- Environmental Health and Safety (EHS) Management Systems: Maintaining certified EHS management systems, such as ISO 45001 for occupational health and safety, demonstrates a commitment to best practices and regulatory compliance. Cellnex's ongoing certifications reflect this dedication.

Cellnex operates within a complex web of legal and regulatory frameworks that significantly shape its business. These include EU directives like the European Electronic Communications Code, which standardizes licensing and infrastructure access across member states, directly impacting Cellnex's expansion and site acquisition strategies.

Antitrust and competition laws are critical, particularly given Cellnex's reliance on mergers and acquisitions. Regulatory bodies scrutinize deals to prevent market monopolization, as evidenced by ongoing reviews of significant telecom infrastructure consolidations in Europe during 2024. Environmental and land-use zoning laws also present hurdles, with varying local regulations affecting permitting timelines and deployment costs for new infrastructure.

Furthermore, data protection laws such as GDPR necessitate that Cellnex ensures its infrastructure supports client compliance with privacy standards, given the increasing data volumes processed by mobile networks. Finally, stringent health and safety regulations govern worker safety and public protection, requiring adherence to EMF exposure limits and secure site management practices.

| Legal Factor | Impact on Cellnex | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| EU Electronic Communications Code | Standardizes licensing and infrastructure access, influencing site acquisition and expansion. | Implementation of the code in member states continues in 2024, impacting national regulatory approaches. |

| Antitrust & Competition Law | Governs M&A activities, requiring regulatory approval to prevent market dominance. | European Commission reviews of major tower deals in 2024 highlight the scrutiny on market concentration. |

| Environmental & Zoning Laws | Affects permitting processes and deployment costs for new infrastructure. | Lengthy local permitting in key markets like Spain can delay projects, with ongoing efforts in 2024 to streamline processes. |

| Data Protection (GDPR) | Requires infrastructure to support client data privacy compliance. | Mobile data traffic growth by 2025 underscores the need for secure infrastructure to maintain privacy. |

| Health & Safety Regulations | Mandates adherence to EMF limits, worker safety, and site security. | EU-OSHA's 2024 focus on workplace safety reinforces the importance of robust EHS management systems. |

Environmental factors

The energy consumption of telecommunications infrastructure, especially towers and data centers, significantly contributes to carbon emissions. Cellnex, like its peers, is under growing pressure from regulators, investors, and customers to shrink its environmental impact. For instance, the telecommunications sector's energy use is a major focus for climate action plans globally, with many countries setting targets for emissions reductions in this area.

Investors and stakeholders increasingly demand detailed ESG reporting, pushing companies like Cellnex Telecom to be more transparent about their environmental impact. This includes detailed breakdowns of energy consumption, carbon emissions, and waste reduction efforts.

For Cellnex, robust ESG compliance is becoming a critical factor in attracting capital. In 2024, a significant portion of new investment funds are being directed towards companies with strong sustainability credentials, making Cellnex's commitment to these standards vital for its financial health and reputation.

Climate change poses a significant threat to telecommunications infrastructure, with extreme weather events like severe storms and heatwaves increasingly disrupting network services. Cellnex must proactively assess these climate-related risks to bolster the resilience of its sites.

Implementing adaptation strategies is crucial; this involves designing infrastructure to withstand harsher conditions and developing comprehensive disaster recovery plans to ensure service continuity. For instance, the European Environment Agency reported a 20% increase in extreme weather events impacting critical infrastructure across Europe between 2010 and 2020, a trend Cellnex will need to factor into its 2024-2025 planning.

Waste Management and Circular Economy Principles

The lifecycle of telecommunications equipment, from its initial deployment to eventual decommissioning, inevitably generates electronic waste. Cellnex, like many in the industry, faces growing pressure to integrate circular economy principles. This means a stronger emphasis on minimizing waste, maximizing the reuse of components, and efficiently recycling materials.

Adopting robust waste management practices and actively seeking opportunities for equipment refurbishment are crucial steps for Cellnex. These actions directly address increasing environmental expectations from regulators, investors, and consumers. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive sets ambitious targets for collection and recycling rates, with member states aiming for 65% of average annual placements by weight by 2022, and 85% by 2025.

- E-waste Generation: Telecommunication infrastructure deployment and upgrades contribute to the growing global challenge of electronic waste.

- Circular Economy Adoption: Cellnex is increasingly expected to embed circular economy principles, prioritizing waste reduction, component reuse, and material recycling.

- Responsible Practices: Implementing responsible waste management and exploring equipment refurbishment are key to meeting evolving environmental standards and stakeholder demands.

Biodiversity and Land Use Impact of Site Development

Cellnex Telecom's site development activities can significantly affect local biodiversity and land use, especially in ecologically sensitive areas. For instance, the expansion of 5G infrastructure, a core business for Cellnex, often involves new tower construction or upgrades to existing sites, which can alter natural habitats. In 2024, Cellnex continued to emphasize its commitment to environmental stewardship, with a stated goal of minimizing its footprint. This includes careful site selection processes to avoid areas of high ecological value.

To address these concerns, Cellnex is mandated to perform comprehensive environmental impact assessments (EIAs) before commencing any new development. These EIAs help identify potential risks to flora and fauna and inform the implementation of mitigation strategies. For example, during 2024, the company focused on best practices such as using less intrusive construction methods and restoring disturbed land post-construction. Adherence to stringent environmental protection laws, such as those governing protected species and land conservation, is paramount.

Sustainable infrastructure development hinges on responsible site selection and proactive engagement with local communities. Cellnex's approach in 2024 involved consulting with environmental agencies and local stakeholders to ensure that development plans align with conservation objectives. Key considerations include:

- Minimizing habitat fragmentation: Selecting sites that reduce the division of natural landscapes.

- Protecting sensitive species: Implementing measures to safeguard local wildlife during construction and operation.

- Land restoration: Committing to restoring the ecological integrity of sites after development is complete.

- Compliance with regulations: Ensuring all projects meet or exceed national and international environmental standards.

Cellnex Telecom faces increasing scrutiny regarding its environmental footprint, particularly concerning energy consumption and carbon emissions from its extensive network infrastructure. The company is actively working to reduce its impact, with a focus on renewable energy sources and energy efficiency improvements across its sites to meet ambitious sustainability targets set for 2025. This commitment is crucial for attracting investment, as evidenced by the growing trend of ESG-focused funds in 2024, which often prioritize companies demonstrating strong environmental performance.

The company must also manage the significant challenge of electronic waste (e-waste) generated by the lifecycle of its equipment. By embracing circular economy principles, Cellnex aims to minimize waste, promote component reuse, and enhance recycling efforts, aligning with stringent EU regulations like the WEEE directive, which targets high collection and recycling rates by 2025.

Furthermore, Cellnex's site development activities necessitate careful consideration of biodiversity and land use. The company is committed to minimizing habitat fragmentation and protecting sensitive species through rigorous environmental impact assessments and responsible site selection, ensuring compliance with conservation laws and fostering positive community relations.

| Environmental Factor | Key Considerations for Cellnex | Relevant Data/Targets |

|---|---|---|

| Energy Consumption & Emissions | Reducing carbon footprint, increasing renewable energy use. | Targeting significant reductions in Scope 1 & 2 emissions by 2025. Focus on energy efficiency in data centers and towers. |

| Electronic Waste (E-waste) | Implementing circular economy principles, responsible disposal and recycling. | EU WEEE directive targets 85% collection rate by 2025. Cellnex actively seeking refurbishment and recycling partners. |

| Biodiversity & Land Use | Minimizing impact on natural habitats, responsible site selection. | Conducting Environmental Impact Assessments (EIAs) for new developments. Commitment to land restoration post-construction. |

PESTLE Analysis Data Sources

Our Cellnex Telecom PESTLE Analysis is grounded in data from official regulatory bodies, telecommunications industry reports, and economic forecasting agencies. We incorporate insights from market research firms and technology trend analyses to ensure a comprehensive understanding of the external environment.