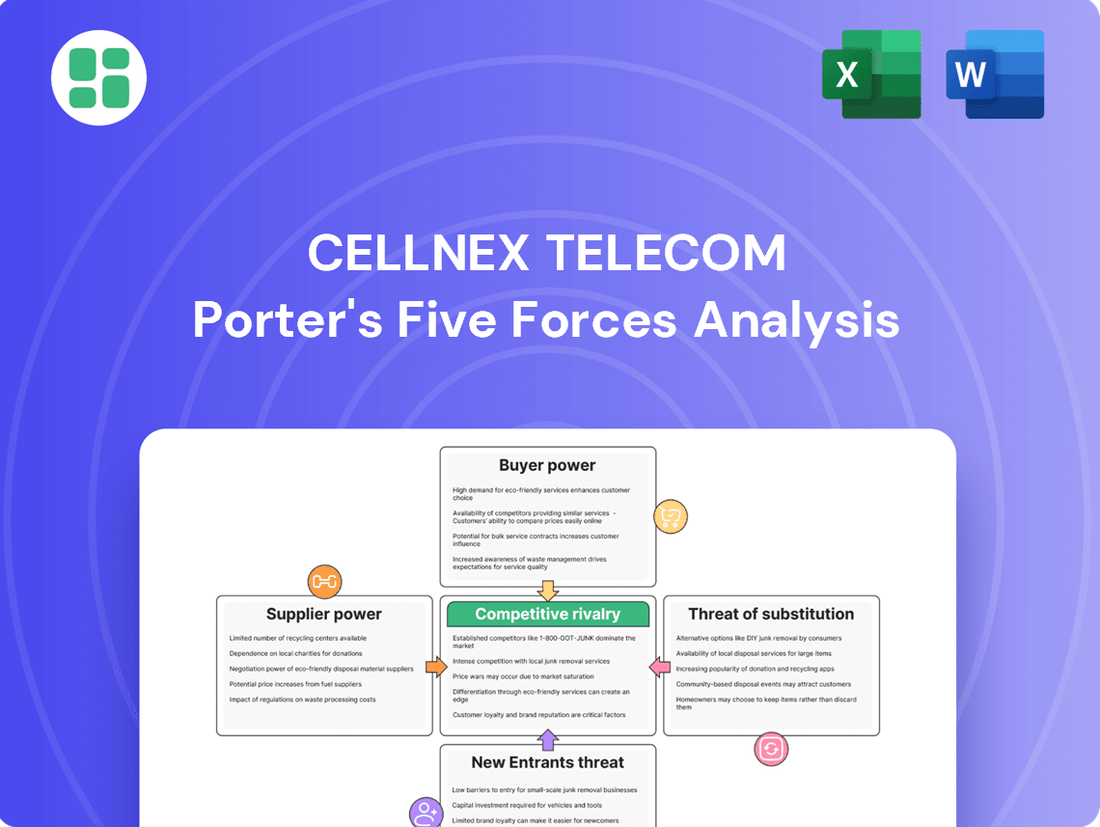

Cellnex Telecom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cellnex Telecom Bundle

Cellnex Telecom operates in a dynamic infrastructure market, where the bargaining power of buyers and the threat of substitutes are significant considerations. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Cellnex Telecom’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cellnex Telecom relies on specialized equipment manufacturers and construction firms, whose concentration directly impacts their leverage. When a few key suppliers dominate, they can command higher prices for critical network components and infrastructure deployment services.

For instance, the telecommunications infrastructure sector often sees a limited number of high-quality antenna and base station manufacturers. This scarcity can amplify their bargaining power, especially for advanced 5G equipment. Cellnex's substantial procurement volume, however, provides a counterbalancing force, enabling them to negotiate more favorable terms than smaller players.

Switching costs for Cellnex concerning its major equipment suppliers are significant. The deep integration of existing infrastructure and the requirement for highly compatible technologies mean that changing suppliers can be complex and expensive, potentially disrupting network operations.

For less integrated services, such as routine maintenance or construction, Cellnex likely faces lower switching costs. This offers greater flexibility in sourcing these services, allowing for competitive bidding and potential cost savings.

Cellnex is strategically addressing these costs by centralizing its procurement operations. This move aims to consolidate purchasing power and optimize relationships with a core group of suppliers, thereby managing and potentially reducing overall expenditure in 2024. For example, in 2023, Cellnex reported a 4% increase in its revenue, reaching €3.46 billion, indicating successful operational management despite infrastructure complexities.

Cellnex's substantial European presence and continuous network build-outs make it a key client for major global telecom equipment suppliers. This scale grants Cellnex leverage, as these vendors value maintaining strong ties with such a prominent tower operator. For instance, in 2023, Cellnex continued its expansion, solidifying its position as a significant buyer in the market.

Availability of Substitute Inputs

While many general construction and maintenance tasks for Cellnex Telecom's infrastructure can be sourced from numerous providers, the availability of substitute inputs for highly specialized telecom equipment is more limited. This scarcity can increase the bargaining power of suppliers for these critical components. For instance, the ability to substitute different types of tower structures or adopt alternative new energy solutions could potentially broaden Cellnex's supplier options and mitigate this power.

Cellnex's strategic investments in energy efficiency and renewable energy sources are actively working to diversify its supplier base. By exploring and integrating solutions like solar power for its sites, the company aims to reduce reliance on traditional energy suppliers and potentially secure more favorable terms. This proactive approach is crucial in managing the bargaining power of suppliers in a rapidly evolving technological landscape.

- Limited Substitutes for Specialized Equipment: High-tech telecom components often have few direct alternatives, giving their suppliers leverage.

- Impact of Alternative Technologies: The feasibility of substituting tower designs or adopting new energy sources can shift supplier power dynamics.

- Cellnex's Diversification Strategy: Investments in renewables and energy efficiency aim to broaden Cellnex's supplier options.

Impact of Landowners

Landowners from whom Cellnex Telecom leases tower sites are a key supplier group. Their individual bargaining power can fluctuate based on the desirability and scarcity of their land. Cellnex actively manages these relationships and costs through its extensive portfolio and strategic land efficiency initiatives.

Cellnex's ability to consolidate leases and optimize land usage across its vast network helps to temper the bargaining power of individual landowners. By focusing on strategic site acquisition and efficient contract management, the company aims to maintain favorable leasing terms.

- Landowner Influence: Landowners act as suppliers by providing essential locations for Cellnex's telecommunication towers.

- Negotiating Leverage: The power of these landowners can vary significantly depending on the specific location, local market conditions, and the availability of alternative sites.

- Cellnex's Mitigation Strategies: Cellnex employs strategies like portfolio consolidation and land efficiency programs to manage lease costs and terms, thereby reducing the impact of individual landowner bargaining power.

Cellnex Telecom faces varying supplier power depending on the nature of the input. Specialized equipment suppliers, due to limited substitutes and high switching costs, often wield significant influence. For instance, the scarcity of advanced 5G equipment manufacturers in 2024 means Cellnex must carefully negotiate terms with these critical providers.

Conversely, for more commoditized services like general construction or maintenance, Cellnex benefits from a broader supplier base, which dilutes individual supplier power. The company's scale, evidenced by its €3.46 billion revenue in 2023, allows it to leverage its purchasing volume to secure better pricing from its key partners.

Cellnex's strategy of centralizing procurement in 2024 aims to further consolidate its buying power, mitigating the impact of dominant suppliers and managing costs effectively across its extensive European operations.

| Supplier Type | Bargaining Power Factors | Cellnex's Mitigation Strategies |

| Specialized Equipment Manufacturers | Limited substitutes, high switching costs | Centralized procurement, strategic partnerships, leveraging scale |

| Landowners (Leasing Sites) | Location desirability, site scarcity | Portfolio consolidation, land efficiency initiatives, contract negotiation |

| General Construction/Maintenance Providers | Numerous providers, lower switching costs | Competitive bidding, supplier diversification |

What is included in the product

This analysis delves into the competitive forces impacting Cellnex Telecom, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the telecom infrastructure sector.

Understand the competitive landscape for Cellnex Telecom by clearly visualizing the impact of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Cellnex's main clients are mobile network operators (MNOs), broadcasters, and government bodies. While Europe has many MNOs, industry consolidation is reducing their number. This trend means that fewer, larger MNOs are emerging, which significantly boosts their individual ability to negotiate terms with tower providers like Cellnex.

For Mobile Network Operators (MNOs), moving from one tower infrastructure provider to Cellnex involves substantial financial and operational hurdles. These long-term contracts are deeply integrated with existing network operations, making a switch a complex undertaking.

Cellnex's business model thrives on these high switching costs. Many of their agreements feature ‘all or nothing’ clauses, meaning MNOs commit to all services or none, and have limited provisions for customer churn. This structure effectively locks in customers, as demonstrated by Cellnex's consistent revenue streams from its established MNO client base.

Cellnex provides critical passive infrastructure, allowing Mobile Network Operators (MNOs) to offer their services without the need to build and maintain vast tower networks. This shared infrastructure is vital for MNOs to lower entry costs and enhance their service delivery, making Cellnex's assets indispensable for their operations.

Customer Price Sensitivity

Mobile Network Operators (MNOs) are indeed sensitive to pricing due to fierce competition in the retail telecom sector. This sensitivity can translate into pressure on infrastructure leasing costs. However, Cellnex's strategy of securing long-term, inflation-linked contracts offers a degree of insulation against aggressive price demands, ensuring revenue stability.

While price remains a factor, MNOs are increasingly shifting their focus towards service quality to differentiate themselves. This emphasis on network performance and customer experience can lessen the impact of purely price-driven negotiations in infrastructure leasing.

- Price Sensitivity: MNOs experience significant price competition, making them inclined to seek cost reductions on infrastructure leasing.

- Contractual Safeguards: Cellnex's long-term agreements often include inflation-linked escalators, protecting revenue from pure price erosion.

- Quality as a Differentiator: The growing MNO focus on service quality can reduce the leverage of customers on price alone.

Threat of Backward Integration by Customers

The threat of backward integration by customers, primarily Mobile Network Operators (MNOs), is a key factor in Cellnex Telecom's competitive landscape. Historically, MNOs managed their own infrastructure, but a significant shift has occurred. This trend involves MNOs divesting their tower assets to independent companies like Cellnex. For instance, in 2023, European MNOs continued to explore tower sales, with some deals valued in the billions of euros, aiming to unlock capital. This strategic move allows MNOs to concentrate on their core business of providing mobile services and investing in new technologies like 5G.

The substantial capital investment and the intricate operational expertise required to build and maintain a nationwide tower network present formidable barriers for MNOs considering a return to owning their infrastructure. Building a comparable network to Cellnex’s extensive European footprint, which comprised over 100,000 sites by early 2024, would necessitate billions in new investment and years of development. This makes backward integration a highly improbable and financially unappealing option for most MNOs.

- MNOs divesting towers: A global trend allowing MNOs to focus on core services and capital allocation.

- High capital barriers: Building and managing extensive tower networks requires significant financial commitment.

- Operational complexity: The expertise needed for tower portfolio management deters MNOs from re-integration.

While mobile network operators (MNOs) are price-sensitive due to market competition, Cellnex's strong contractual terms, including inflation-linked escalators, mitigate direct price pressure. The increasing MNO focus on service quality rather than just cost also limits the bargaining power of customers based solely on price.

The threat of MNOs developing their own infrastructure is low. The significant capital expenditure and operational expertise required to replicate Cellnex's extensive European network, which had over 100,000 sites by early 2024, make backward integration financially unviable for most operators.

Cellnex's customers, primarily MNOs, face high switching costs due to the deep integration of Cellnex's passive infrastructure into their operations. Many contracts also feature clauses that lock in clients, making it difficult and costly for them to move to alternative providers.

| Factor | Impact on Cellnex | Supporting Data/Context |

|---|---|---|

| Price Sensitivity of MNOs | Moderate | MNOs face retail competition, but Cellnex's long-term, inflation-linked contracts provide revenue stability. |

| Switching Costs for MNOs | Low | High financial and operational hurdles for MNOs to change infrastructure providers due to contract integration. |

| Backward Integration Threat | Very Low | Billions in capital and extensive expertise are needed to build a network comparable to Cellnex's over 100,000 sites (as of early 2024). |

Full Version Awaits

Cellnex Telecom Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Cellnex Telecom, detailing the competitive landscape and strategic positioning of the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing in-depth insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications infrastructure sector.

Rivalry Among Competitors

The European telecom tower market is a dynamic landscape with several substantial players vying for market share. Cellnex Telecom, while currently the largest independent operator in Europe, faces robust competition from established entities like American Tower, Vantage Towers, Inwit, Phoenix Tower International, and TOTEM.

This competitive intensity is evident across the various European markets where Cellnex operates, necessitating a keen awareness of competitor strategies and market dynamics. For instance, Vantage Towers, a subsidiary of Vodafone, boasts a significant portfolio across Europe, and American Tower has been actively expanding its European footprint through acquisitions, further intensifying the rivalry.

The European telecom tower market is thriving, with significant growth fueled by the ongoing rollout of 5G networks and the ever-increasing consumption of mobile data. This expansion creates a more favorable environment for companies like Cellnex Telecom.

This robust industry growth, projected to continue at a healthy pace through 2024 and beyond, can temper the intensity of competitive rivalry. When the pie is getting bigger, companies are less inclined to engage in cutthroat price wars to steal market share.

While the fundamental offering of tower space can appear similar across competitors, Cellnex distinguishes itself through the sheer breadth and high quality of its network infrastructure. This includes a significant number of sites and advanced deployment of technologies like Distributed Antenna Systems (DAS) and small cells, which cater to specific coverage needs.

Operational efficiency and the provision of these value-added services are key differentiators, allowing Cellnex to offer more than just passive infrastructure. Building and maintaining strong, long-term relationships with major mobile operators, often secured by lengthy contracts, also solidifies its competitive position and reduces churn.

Exit Barriers

Cellnex Telecom, like other tower companies, faces substantial exit barriers. The sheer scale of investment required to build and maintain telecommunications infrastructure means that once a company is in the market, it's very difficult and costly to leave. These high capital expenditures, often spanning decades for the lifespan of the assets, lock companies into the sector.

These barriers directly fuel competitive rivalry. Because exiting is so challenging, existing players are incentivized to stay and compete vigorously for market share rather than seeking to divest. This dynamic ensures that the competitive landscape remains intense as companies focus on optimizing their operations and expanding their portfolios to justify their continued presence.

Cellnex's own financial structure illustrates this. With a significant asset base and a substantial debt load associated with its infrastructure acquisitions, the company is deeply committed to the long-term operation and development of its tower network. This financial commitment makes a swift or easy exit highly improbable, reinforcing the sustained rivalry within the industry.

- High Capital Intensity: Building and maintaining telecom towers requires massive upfront investment, making it difficult for companies to recoup their costs if they decide to exit.

- Long-Term Nature of Investments: Infrastructure assets have very long operational lives, obligating companies to remain invested for extended periods, thus limiting flexibility.

- Asset Base and Debt Structure: Companies like Cellnex have large physical asset bases and significant debt financing, creating strong financial incentives to stay in the market and generate returns.

- Sustained Rivalry: The difficulty of exiting the market means competitors are likely to remain, intensifying competition as they vie for market share and operational efficiency.

Strategic Acquisitions and Consolidation

The European telecommunications infrastructure sector has experienced substantial consolidation, with mergers and acquisitions reshaping the competitive arena. Cellnex itself has been a prominent player in this trend, actively pursuing strategic acquisitions to expand its portfolio and market reach.

Further consolidation among existing tower companies or even mergers between Mobile Network Operators (MNOs) and tower infrastructure providers could significantly heighten competitive rivalry. This would likely lead to the emergence of larger, more dominant entities with greater bargaining power and a more entrenched market position.

For instance, in 2023, the industry continued to see significant deal-making. While specific figures for Cellnex's acquisition activity in late 2023 and early 2024 are still emerging, the broader trend indicates a market where scale is increasingly important. Competitors like American Tower and Vantage Towers have also been active, creating a dynamic environment where strategic moves by any major player can alter the competitive balance.

- Industry Consolidation: Significant M&A activity has occurred, altering the competitive landscape.

- Cellnex's Role: Cellnex has been a key acquirer, expanding its operations through strategic purchases.

- Potential Intensification: Further consolidation, including MNOs acquiring infrastructure, could create larger, more formidable competitors.

- Market Dynamics: The ongoing consolidation trend means that increased rivalry is a persistent factor for Cellnex.

The competitive rivalry within the European telecom tower market is intense, driven by a few large, established players and a growing number of specialized operators. Cellnex Telecom, as the largest independent player, contends with formidable rivals like American Tower and Vantage Towers, both actively expanding their European presence. This rivalry is amplified by high capital intensity and long-term investment horizons, which create significant exit barriers, compelling existing companies to compete vigorously rather than withdraw.

The market's robust growth, fueled by 5G deployment and data consumption, helps to temper outright price wars, but strategic acquisitions and operational efficiency remain key differentiators. Cellnex's competitive edge lies in its extensive, high-quality network and its ability to offer value-added services, supported by long-term contracts with mobile operators. The ongoing trend of industry consolidation, including potential MNO acquisitions of infrastructure, is expected to further shape the competitive landscape, potentially leading to larger, more dominant entities.

| Competitor | European Footprint | Key Strategy |

|---|---|---|

| Cellnex Telecom | Largest independent operator across Europe | Network expansion via M&A, operational efficiency, value-added services |

| American Tower | Significant and growing presence across Europe | Aggressive expansion through acquisitions, focus on emerging markets |

| Vantage Towers | Substantial portfolio across multiple European countries | Leveraging Vodafone's network, strategic partnerships, infrastructure sharing |

| Inwit | Leading operator in Italy | Focus on Italian market, 5G infrastructure development |

| Phoenix Tower International | Growing presence in select European markets | Acquisition of tower portfolios, focus on emerging markets and specific geographies |

SSubstitutes Threaten

A significant threat comes from mobile network operators (MNOs) potentially building their own passive infrastructure instead of leasing from independent tower companies. This would bypass the need for services offered by entities like Cellnex.

However, the prevailing trend across Europe, including in markets where Cellnex operates, is the opposite. MNOs are actively divesting their tower assets. For instance, in 2023, the European tower market saw significant M&A activity as operators sought to unlock capital and streamline operations, a trend expected to continue into 2024.

This divestment strategy allows MNOs to concentrate on their core business of providing mobile services and improving network quality, rather than managing the capital-intensive passive infrastructure. This strategic shift reduces the likelihood of MNOs opting for self-build solutions, thereby mitigating the threat of substitutes for Cellnex.

Emerging technologies such as satellite internet, exemplified by Starlink, and sophisticated mesh networks pose a potential long-term threat by offering alternative connectivity pathways that bypass conventional tower infrastructure. These solutions are particularly relevant for underserved rural or geographically challenging regions.

While these alternatives are developing, they currently do not represent direct, widespread substitutes for the high-density mobile network coverage required in urban environments. For instance, as of early 2024, satellite internet services are still establishing their capacity and latency to fully compete with terrestrial 5G networks in densely populated areas.

The rise of private 5G networks presents a growing threat of substitutes for traditional public network infrastructure, particularly within enterprise and industrial settings. These dedicated networks allow businesses to manage their own connectivity for critical operations, potentially bypassing the need for public mobile network operators in certain scenarios. For instance, a large manufacturing plant might opt for a private 5G network to ensure ultra-reliable, low-latency communication for its automated machinery, thereby substituting the need for public cellular services for that specific application.

Fiber Optic Expansion

The extensive rollout of fiber-to-the-home (FTTH) and robust fiber backbones significantly boosts fixed broadband capabilities. This expansion, while often complementing wireless infrastructure through backhaul, introduces a potential threat by making fixed connectivity the preferred choice for certain applications, thereby diminishing demand for some wireless services.

For instance, in 2024, the global FTTH market continued its strong growth, with projections indicating a compound annual growth rate (CAGR) of over 10% through 2028. This increasing penetration of high-speed fixed internet directly competes with mobile data services for tasks like video streaming and large file downloads, especially in densely populated urban areas where fiber is readily available.

- Fiber's growing dominance in fixed broadband can siphon users away from mobile-centric data consumption.

- The enhanced quality of service from fiber backhaul supports fixed services that may otherwise rely on wireless.

- Increased fiber availability can reduce the perceived value of certain mobile data plans for home or office use.

Technological Advancements in Antennas/Radios

Improvements in antenna technology and radio access network (RAN) efficiency could theoretically reduce the need for new tower deployments by enabling wider coverage or greater capacity from fewer sites. For instance, advancements in beamforming and Massive MIMO in 5G networks allow for more targeted signal delivery, potentially optimizing site utilization. However, the ongoing densification required for 5G, particularly for millimeter-wave frequencies, still necessitates a significant number of new, smaller cell sites, limiting the substitution effect for traditional tower infrastructure.

While technological progress might offer some efficiency gains, the fundamental demand for increased data capacity and lower latency in mobile networks, especially with the rollout of 5G and future 6G technologies, often counteracts the substitution threat. For example, in 2024, global mobile data traffic continued its upward trajectory, driven by video streaming and IoT applications, underscoring the need for expanded network coverage and capacity, which often translates to more physical infrastructure rather than fewer sites.

- Technological Efficiency: Innovations like advanced antenna designs and more efficient radio equipment can improve signal reach and capacity per site.

- 5G Densification: The deployment of 5G, particularly higher frequency bands, inherently requires a denser network of smaller cell sites.

- Data Traffic Growth: Rising mobile data consumption, projected to grow significantly through 2025, necessitates ongoing infrastructure expansion.

- Limited Substitution: Despite technological gains, the need for more points of presence for robust mobile connectivity remains a primary driver.

Emerging technologies like satellite internet and private 5G networks present potential substitutes for traditional tower infrastructure. Satellite services, while growing, are still establishing their capacity and latency for widespread urban use as of early 2024. Private 5G networks offer dedicated connectivity for enterprises, potentially bypassing public networks for specific industrial applications.

The increasing availability of high-speed fiber-to-the-home (FTTH) also acts as a substitute, particularly for data-intensive activities like video streaming, especially in urban areas. Global FTTH market growth, projected at over 10% CAGR through 2028, highlights this trend. While technological advancements in antenna efficiency can improve site utilization, the ongoing densification required for 5G and future 6G networks, coupled with relentless data traffic growth, fundamentally supports the continued need for physical infrastructure like towers.

Entrants Threaten

The telecommunications infrastructure sector demands massive upfront capital. Building or acquiring a robust network of towers, distributed antenna systems (DAS), and small cells requires significant financial commitment, creating a formidable barrier for any aspiring new player.

Cellnex's substantial debt, reported at approximately €16.8 billion as of its latest financial disclosures, underscores the sheer scale of investment involved in this industry. This high capital requirement effectively deters potential new entrants, as they would need to secure comparable funding to compete.

The European telecom market presents a formidable barrier to entry due to its intricate and extensive regulatory landscape. Potential new players must contend with complex licensing procedures, the allocation of scarce radio spectrum, and a web of environmental rules that vary significantly across different European nations. This regulatory complexity, coupled with the substantial capital investment required for spectrum acquisition and infrastructure development, significantly deters new entrants.

Cellnex benefits from substantial economies of scale, sharing its extensive tower infrastructure across numerous mobile network operators. This co-location strategy significantly lowers per-tenant costs, creating a formidable barrier for new entrants lacking comparable scale. For instance, in 2024, Cellnex continued to expand its European footprint, operating over 100,000 sites, a scale that would be prohibitively expensive for a newcomer to replicate quickly.

Difficulty in Site Acquisition and Permitting

The process of acquiring suitable land and securing the necessary permits for new tower construction is inherently complex, lengthy, and highly dependent on local regulations. This presents a substantial barrier to entry for potential new competitors in the telecom infrastructure sector.

Established companies like Cellnex Telecom benefit from existing relationships with local authorities and a deep understanding of the intricate permitting landscape. This accumulated expertise and established network significantly reduce the time and cost associated with site acquisition, giving them a distinct advantage over newcomers who must navigate these challenges from scratch.

- Complex Permitting Processes: Obtaining planning permission and environmental approvals can take years and vary significantly by region.

- Site Scarcity: Prime locations for tower deployment are often already occupied or subject to strict zoning laws, limiting available options.

- Local Opposition: Community resistance to new tower construction can further complicate and delay site acquisition.

- Capital Investment: The upfront costs associated with site acquisition, legal fees, and initial infrastructure development are considerable, deterring smaller entrants.

Long-Term Customer Contracts

Cellnex Telecom benefits significantly from long-term customer contracts, often spanning 10 to 15 years or even longer. These agreements, frequently indexed to inflation, create a bedrock of stable and predictable revenue for the company. This contractual lock-in with major clients makes it exceedingly difficult for prospective new entrants to gain a foothold and attract a substantial customer base in the tower infrastructure market.

The presence of these extended contracts acts as a formidable barrier to entry. New players would need to overcome the inertia of existing relationships and offer compellingly superior terms or services to entice anchor tenants away from established providers like Cellnex. For instance, in 2023, Cellnex continued to secure and extend these long-term agreements, reinforcing its market position.

- Long-Term Contracts: Cellnex secures agreements typically lasting 10-15 years, providing revenue stability.

- Inflation-Linked: Many contracts include inflation adjustments, protecting revenue from rising costs.

- Customer Lock-in: These extended agreements tie up anchor tenants, hindering new entrants' ability to acquire customers.

- Barrier to Entry: The established contractual relationships create a significant hurdle for new competitors.

The threat of new entrants in the telecom infrastructure sector is significantly mitigated by substantial capital requirements and regulatory complexities. Cellnex's extensive network, built over years with significant financial backing, presents a high barrier. For example, the company operates over 100,000 sites across Europe as of 2024, a scale that is incredibly difficult and costly for newcomers to replicate quickly.

| Barrier Type | Description | Impact on New Entrants | Cellnex Advantage |

|---|---|---|---|

| Capital Intensity | Building or acquiring telecom infrastructure requires billions in investment. | High cost deters new players. | Established scale and access to financing. |

| Regulatory Hurdles | Complex licensing, spectrum allocation, and varying national rules. | Lengthy approval processes and compliance costs. | Experienced in navigating diverse regulatory environments. |

| Economies of Scale | Sharing infrastructure across multiple operators lowers per-site costs. | New entrants cannot match cost-efficiency. | Over 100,000 sites operated as of 2024. |

| Long-Term Contracts | Anchor tenants are locked into lengthy agreements (10-15 years). | Difficult to attract initial customers. | Secured numerous long-term agreements in 2023. |

Porter's Five Forces Analysis Data Sources

Our Cellnex Telecom Porter's Five Forces analysis is built upon a robust foundation of data, including Cellnex's annual reports, filings with regulatory bodies like the CNMC and Ofcom, and industry-specific market research from firms such as Statista and Omdia. This blend of company disclosures and independent market intelligence ensures a comprehensive view of the competitive landscape.