Cellnex Telecom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cellnex Telecom Bundle

Curious about Cellnex Telecom's strategic positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their diverse portfolio. Understand which assets are driving current success and which hold future promise.

Don't miss out on the full strategic blueprint! Purchase the complete Cellnex Telecom BCG Matrix to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product development.

Stars

Cellnex is heavily investing in 5G densification, adding new sites and upgrading existing ones to meet soaring demand for high-speed mobile data. This expansion is particularly concentrated in bustling urban areas and crucial European markets such as France and Poland.

This strategic push directly supports the broader telecom tower industry's growth, fueled by the ongoing global 5G deployment. In 2024, Cellnex continued to be a key player in this infrastructure build-out, aiming to capture market share in these vital regions.

The market for Distributed Antenna Systems (DAS) and small cells is booming, particularly in densely populated urban areas where existing infrastructure struggles to keep up with demand. Cellnex is actively expanding its DAS and small cell network, recognizing their importance in boosting network coverage and capacity in these congested zones. This strategic focus positions Cellnex for substantial growth in a segment where it's building a commanding presence.

Cellnex Telecom's wholesale fiber and connectivity services are a strong performer, showing impressive growth. This is largely due to the ever-increasing demand for high-capacity backhaul, which is essential for the rollout of 5G networks and other vital digital infrastructure. The company’s investments in this segment are directly supporting the expansion and densification of telecommunications networks throughout Europe.

Strategic Expansion in Growth Markets

Cellnex is actively pursuing strategic expansion within key European growth markets, notably France and Poland. These regions are characterized by robust organic growth in telecommunications infrastructure, presenting substantial opportunities for Cellnex to expand its footprint through new site deployments and co-location strategies. This focus allows the company to capitalize on its leading market position and the accelerating rollout of 5G technology.

The company's strategic investments in these high-potential markets are directly translating into accelerated organic growth in its points of presence (PoPs). For instance, in France, Cellnex has been a key player in the deployment of new sites, contributing to the overall densification of mobile networks. Similarly, Poland represents a significant opportunity, with Cellnex actively participating in network upgrades and expansions that fuel its organic growth trajectory.

- France: Cellnex's expansion in France is driven by strong demand for new tower sites to support 5G deployment, with the company aiming to increase its PoPs by a significant percentage over the next few years.

- Poland: The Polish market presents a compelling case for growth, with Cellnex investing in existing infrastructure and new builds to capture a larger share of the expanding telecommunications landscape.

- Organic Growth: Cellnex reported a notable increase in organic revenue growth in its European markets, with France and Poland being key contributors to this positive trend in 2024.

New Build-to-Suit (BTS) Programs and Co-locations

Cellnex's strategic focus on new Build-to-Suit (BTS) programs and co-location initiatives is a significant driver of its growth, particularly evident in key markets like France and Poland. These programs are designed to secure future revenue by constructing new sites tailored to specific tenant needs and maximizing the utilization of existing infrastructure through co-locations.

The company's ability to attract multiple tenants to these new and existing sites is a testament to its strong market position and the increasing demand for network expansion. For instance, in 2024, Cellnex continued to expand its co-location portfolio, adding new tenants to its towers, which directly contributes to its organic growth trajectory and strengthens its market share.

- Secured new BTS sites: Cellnex's ongoing success in securing new build-to-suit sites in 2024 provides a pipeline of committed future revenue streams.

- Increased co-locations: The company actively promotes co-location on its existing infrastructure, enhancing site utilization and generating additional revenue per site.

- Market leadership in France and Poland: These initiatives are particularly prominent in France and Poland, showcasing Cellnex's strong competitive standing in these expanding markets.

- Organic growth driver: The ability to attract multiple tenants to its sites is a key factor in driving Cellnex's organic growth and solidifying its market share.

Cellnex's investments in 5G densification and DAS/small cells in markets like France and Poland position it for strong future growth. These initiatives, coupled with a focus on wholesale fiber and co-location strategies, are key drivers of its organic expansion. The company’s ability to secure new build-to-suit sites and attract multiple tenants reinforces its market leadership and revenue potential.

| Metric | 2023 (Approx.) | 2024 (Target/Projection) | Key Markets |

|---|---|---|---|

| Total Sites (Approx.) | ~147,000 | ~155,000+ | Europe-wide |

| Organic Revenue Growth | ~5-7% | ~6-8% | France, Poland, Italy |

| CAPEX for 5G Densification | €1.5 Billion+ | €1.6 Billion+ | France, Poland, Spain |

What is included in the product

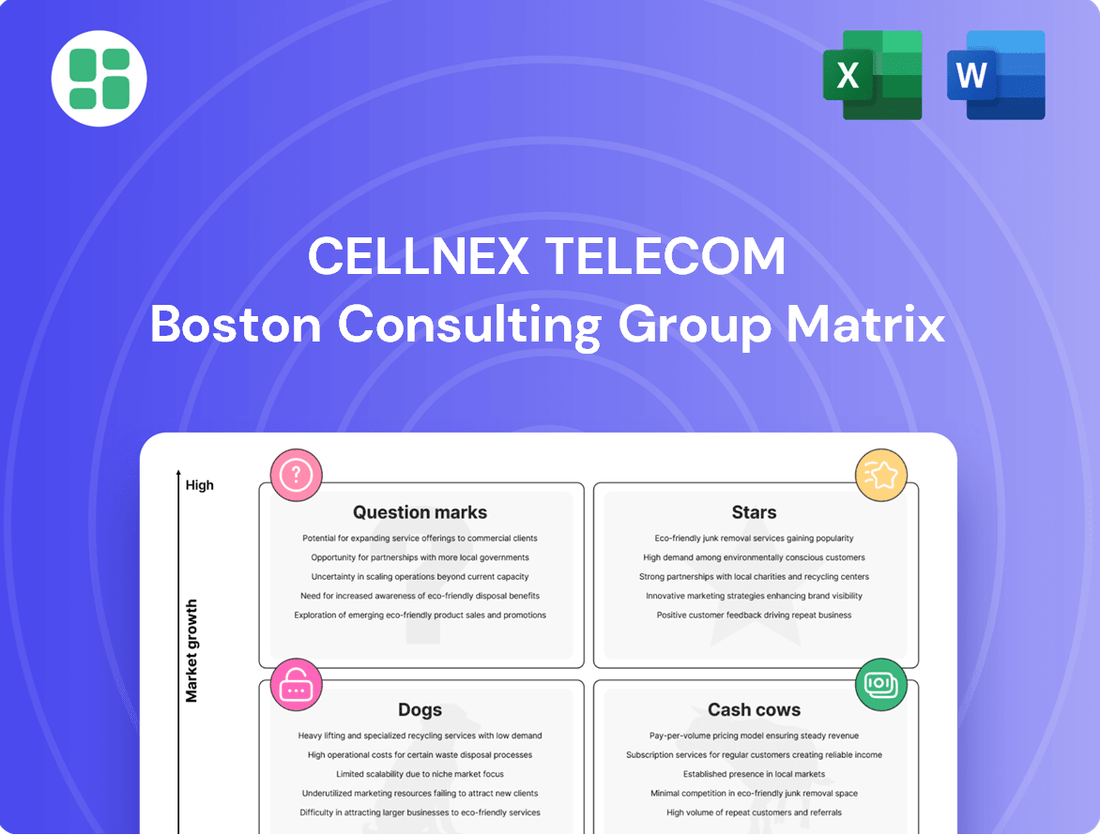

Cellnex Telecom's BCG Matrix analyzes its portfolio, identifying growth opportunities and mature assets.

A clear BCG Matrix visual for Cellnex Telecom simplifies complex portfolio analysis, acting as a pain point reliever for strategic decision-making.

Cash Cows

Cellnex's core macro tower portfolio in mature markets like Spain, Italy, and France represents its Cash Cows. These established assets generate consistent, predictable revenue streams due to their significant market share in stable environments.

In 2023, Cellnex reported a total of 142,000 sites, with a substantial portion located in these mature European territories. The company's strategy focuses on maximizing the cash flow generated by these mature assets to fund growth in other areas.

Cellnex Telecom's long-term Master Service Agreements (MSAs) with major European mobile network operators are a significant strength, acting as a key cash cow. These agreements, often indexed to inflation, provide a predictable and stable revenue stream, insulating the company from economic downturns. For instance, in 2023, Cellnex reported that a substantial portion of its revenue was secured by long-term contracts, highlighting the resilience of this business segment.

Cellnex's business model is built around maximizing the use of its existing tower sites by allowing multiple mobile network operators to co-locate their equipment. This approach significantly boosts profitability because the cost of adding a new tenant to a site is very low, as the core infrastructure is already in place.

The company's focus on high co-location ratios directly contributes to its status as a Cash Cow. For instance, in 2024, Cellnex reported an average co-location ratio of approximately 1.8x across its European portfolio, demonstrating efficient asset utilization and strong revenue generation from its established sites.

Broadcasting Infrastructure Services

Cellnex Telecom's broadcasting infrastructure services, while a smaller part of its overall revenue, act as a reliable Cash Cow. This segment benefits from a mature market where demand is consistent, ensuring a predictable cash flow without the need for substantial new capital infusions. In 2023, Cellnex reported that its broadcasting services continued to be a stable contributor to its diversified revenue streams.

This business line typically operates with high utilization rates for its existing assets, generating steady profits. The mature nature of broadcasting infrastructure means that competition is often established, and growth is more about optimizing existing operations than rapid expansion. Cellnex's focus here is on maintaining and efficiently managing these assets.

- Stable Revenue: Broadcasting infrastructure provides a consistent and predictable income stream.

- Mature Market: Operates in an established market with consistent demand.

- Low Investment Needs: Requires minimal new capital expenditure to maintain profitability.

- Diversification: Adds to Cellnex's overall revenue base, reducing reliance on other segments.

Operational Efficiency and Land Lease Optimization

Cellnex Telecom's focus on operational efficiency and land lease optimization is a key driver for its cash cow assets. By actively renegotiating land contracts and streamlining maintenance, the company boosts the profitability of its established tower infrastructure. These programs are designed to unlock significant recurring savings, reinforcing the cash-generating capacity of these mature businesses.

These initiatives directly translate into improved financial performance for Cellnex's mature tower portfolio. For instance, in 2023, Cellnex reported that its operational efficiency programs had already achieved €100 million in cumulative savings, with further potential identified. The company's strategic approach to land lease management, including consolidating leases and seeking more favorable terms, is crucial for maximizing the cash flow generated by these stable assets.

- Operational Efficiency Programs: Aim to reduce costs associated with tower maintenance and site operations.

- Land Lease Optimization: Involves renegotiating existing agreements and consolidating leases to achieve better terms.

- Impact on Profitability: These efforts directly enhance the cash flow generated by mature tower assets.

- Projected Savings: Cellnex anticipates substantial recurring savings from these ongoing initiatives, reinforcing its cash cow status.

Cellnex's core macro tower portfolio in mature markets like Spain, Italy, and France represents its Cash Cows, generating consistent, predictable revenue streams due to significant market share in stable environments.

In 2023, Cellnex reported a total of 142,000 sites, with a substantial portion in these mature European territories, and the company's strategy focuses on maximizing cash flow from these assets to fund growth elsewhere.

Long-term Master Service Agreements (MSAs) with major European mobile network operators, often inflation-indexed, provide a predictable and stable revenue stream, insulating the company from economic downturns, as evidenced by a substantial portion of 2023 revenue being secured by these contracts.

Cellnex's business model maximizes existing tower site usage through co-location, significantly boosting profitability as adding new tenants incurs minimal costs. In 2024, Cellnex reported an average co-location ratio of approximately 1.8x across its European portfolio, highlighting efficient asset utilization.

| Segment | Key Characteristics | 2023 Data/Status |

| Mature Tower Portfolio (Spain, Italy, France) | High Market Share, Stable Demand, Long-Term Contracts | 142,000 total sites; Significant portion in mature markets; Average co-location ratio of 1.8x (2024 est.) |

| Broadcasting Infrastructure | Mature Market, Consistent Demand, Low Investment Needs | Stable contributor to revenue; High utilization rates |

| Operational Efficiency Initiatives | Cost Reduction, Land Lease Optimization | €100 million cumulative savings reported (2023); Ongoing focus on recurring savings |

Full Transparency, Always

Cellnex Telecom BCG Matrix

The Cellnex Telecom BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks, no demo content, and no surprises—just a professionally designed, analysis-ready document ready for immediate strategic application.

What you see here is the actual, complete Cellnex Telecom BCG Matrix file that will be delivered to you after your purchase. It's a meticulously crafted report, designed for strategic clarity and ready to be integrated into your business planning and decision-making processes without any further revisions.

Dogs

Cellnex Telecom's strategic review has led to the divestment of its Austrian operations, anticipated in late 2024. This move signals that Austria was deemed a non-strategic asset, likely due to its sub-scale nature and limited contribution to Cellnex's core growth ambitions. The company is also planning a similar divestment of its Irish business in early 2025.

These divestments are designed to streamline Cellnex's portfolio, focusing resources on markets and operations that offer greater potential for profitable expansion. By shedding these less strategic assets, Cellnex aims to reduce complexity and improve overall operational efficiency, allowing for a sharper focus on its more promising ventures.

Certain older or less efficient legacy infrastructure, particularly in remote or declining areas, may represent assets with low market share and limited growth prospects for Cellnex Telecom. These sites might not attract new co-locations and could incur disproportionately high maintenance costs relative to the revenue they generate. For instance, by the end of 2023, Cellnex had identified approximately 2,000 sites across its European portfolio that were considered non-core or underperforming, with a focus on optimizing their contribution or considering divestment.

Non-core businesses from past acquisitions, particularly those acquired during Cellnex Telecom's aggressive expansion, often fall into the 'Dog' category of the BCG Matrix. These are assets that haven't integrated well or met tenancy targets, such as certain smaller tower portfolios in less strategic markets. For instance, while Cellnex reported a consolidated revenue of €3.9 billion in 2023, some acquired entities might be underperforming relative to their initial investment, impacting overall portfolio efficiency.

Assets with Stagnant or Declining Demand

Assets with stagnant or declining demand in Cellnex Telecom's portfolio would represent infrastructure in markets or serving technologies experiencing a slowdown. This means fewer new installations are happening, and the renewal of existing contracts might not be as profitable. For instance, if a specific region Cellnex operates in sees a significant drop in mobile data usage or a shift away from older network technologies, the towers and related infrastructure in that area would fall into this category.

These assets typically exhibit low growth potential. They contribute minimally to the company's overall profitability because their revenue streams are either shrinking or not expanding. Consequently, they become less attractive for further investment, as the returns are unlikely to justify the capital expenditure required for upgrades or expansion.

In 2024, Cellnex has been actively managing its portfolio to address such underperforming assets. The company's strategy often involves divesting or consolidating infrastructure in mature or declining markets to focus resources on higher-growth areas. For example, a market segment seeing a decline in 3G services would house assets that fit this description.

- Low Growth Potential: Infrastructure in markets with minimal new deployments and potential contract non-renewals.

- Minimal Profitability Contribution: Assets that generate little to no significant profit for the company.

- Reduced Investment Attractiveness: These assets are not ideal candidates for future capital allocation or development.

- Strategic Divestment Focus: Cellnex may consider selling or consolidating these assets to reallocate capital to more promising ventures.

High Cost-to-Serve Assets

High Cost-to-Serve Assets within Cellnex Telecom's portfolio represent infrastructure that demands substantial ongoing investment relative to the income they produce. These can include remote tower locations with challenging logistical requirements or older sites needing frequent, expensive upgrades. For instance, a 2024 analysis might highlight that certain legacy fiber optic networks, while still operational, incur disproportionately high maintenance costs due to their age and complexity, impacting overall profitability.

These assets can act as capital traps, tying up resources that could be better deployed elsewhere. Factors contributing to this high cost-to-serve include:

- Difficult Site Access: Locations requiring specialized transport or extensive infrastructure development to reach and maintain.

- Aging Equipment: Older technology that necessitates frequent repairs, replacements, and higher energy consumption.

- Complex Regulatory Environments: Sites subject to stringent environmental, safety, or zoning regulations that increase compliance costs.

Cellnex Telecom's 'Dogs' are assets with low growth potential and minimal profitability contribution, often stemming from older or less efficient legacy infrastructure. These sites may not attract new co-locations and incur high maintenance costs relative to revenue generated. For example, by the end of 2023, Cellnex identified approximately 2,000 non-core or underperforming sites across its European portfolio.

Question Marks

Cellnex is actively investigating the burgeoning market for private network solutions tailored for enterprises. This segment represents a high-growth opportunity, though Cellnex's current penetration and market share are likely still in their nascent stages, positioning these ventures as potential Stars or Question Marks in a BCG matrix analysis.

The development and deployment of private enterprise networks demand considerable upfront capital expenditure and the cultivation of strategic alliances with technology providers and industry players. These investments are critical for Cellnex to effectively compete and build a strong foothold in this evolving landscape, which is characterized by rapid technological advancements and increasing enterprise demand for dedicated, secure connectivity solutions.

IoT infrastructure deployments represent a burgeoning sector, driven by smart city initiatives and industrial automation. Cellnex, with its extensive network infrastructure, is well-positioned to capitalize on this growth, though its current direct market share in specialized IoT solutions might be modest. For instance, the global IoT market was projected to reach over $1.1 trillion by 2025, with a significant portion dedicated to infrastructure and connectivity.

To elevate its standing in this category, Cellnex needs strategic investments and targeted market penetration plans. The company's existing fiber and tower assets provide a strong foundation, but success hinges on developing and promoting specific IoT connectivity solutions. By 2024, the number of connected IoT devices was estimated to exceed 29 billion globally, highlighting the immense opportunity for infrastructure providers.

Cellnex's greenfield expansion into new, competitive markets represents a strategic move into potential high-growth areas. These ventures, while offering significant upside, are characterized by intense existing competition and require substantial upfront investment to establish infrastructure and secure initial customers.

For instance, Cellnex's ongoing expansion efforts in markets like France or Italy, where established players are already present, exemplify this. These greenfield projects demand considerable capital expenditure to build new towers and fiber networks, aiming to capture market share in a dynamic environment. The immediate returns are often uncertain due to the need to attract anchor tenants and build scale.

Development of Edge Computing Infrastructure

The edge computing infrastructure market is a burgeoning sector, poised for substantial expansion due to the increasing need for real-time data processing and reduced latency. This presents a significant growth avenue for companies like Cellnex Telecom.

Cellnex's engagement in edge computing infrastructure is currently in its formative phase. While its market share in this nascent area is relatively low, the rapid development and adoption of edge technologies suggest a strong potential for it to evolve into a market leader, a Star in the BCG matrix.

- Nascent Market Growth: The global edge computing market was valued at approximately USD 12.05 billion in 2023 and is projected to reach USD 110.56 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 37.4% during this period.

- Cellnex's Early Stage: Cellnex's strategic investments and potential partnerships in edge data centers and connectivity solutions place it at the beginning of this growth trajectory.

- Future Star Potential: By capitalizing on the demand for low-latency applications in areas like 5G, IoT, and AI, Cellnex is well-positioned to capture significant market share and become a dominant player.

New Strategic Partnerships for Innovative Services

Cellnex Telecom is actively pursuing new strategic alliances to develop innovative services that extend beyond its core infrastructure offerings. These ventures, aimed at tapping into high-growth revenue potential, are still in their nascent stages of development and market penetration.

While these partnerships represent a forward-looking strategy, their current impact on Cellnex's overall market share is minimal. The success and scalability of these new service models are still under evaluation.

- Exploratory Ventures: Partnerships focusing on areas like edge computing or private networks are in early implementation, contributing minimally to current revenue.

- Unproven Markets: The revenue streams from these innovative services are not yet substantial enough to significantly alter Cellnex's market position.

- Future Growth Potential: Success in these partnerships could unlock significant future revenue, but this remains a long-term prospect.

- Resource Allocation: Cellnex's investment in these areas reflects a strategic bet on future market trends, aligning with a 'Question Mark' positioning in the BCG matrix.

Cellnex's ventures into new, competitive markets, such as greenfield expansion in countries like France and Italy, are classified as Question Marks. These initiatives require substantial capital investment to build infrastructure and attract customers in established markets, with uncertain immediate returns.

The development of private enterprise networks also falls into this category. While offering high growth potential, Cellnex's current market penetration is nascent, necessitating significant upfront expenditure and strategic alliances to compete effectively in this rapidly evolving sector.

| Category | Description | Market Growth | Cellnex Position | Strategic Implication |

| Greenfield Expansion | Entry into new, competitive markets | High | Nascent Market Share | High Investment, Uncertain Returns |

| Private Networks | Enterprise-focused connectivity solutions | High | Low Penetration | Capital Intensive, Partnership Dependent |

BCG Matrix Data Sources

Our Cellnex Telecom BCG Matrix is constructed using a blend of financial disclosures, industry growth forecasts, and competitor performance data to provide a robust strategic overview.