China Energy Engineering PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Energy Engineering Bundle

China Energy Engineering operates within a dynamic global landscape, influenced by shifting political mandates, economic fluctuations, and evolving technological advancements. Our comprehensive PESTLE analysis delves into these critical external factors, providing you with the strategic foresight needed to navigate this complex environment. Unlock actionable intelligence to refine your market approach and secure a competitive advantage.

Gain a crucial edge by understanding the political, economic, social, technological, legal, and environmental forces shaping China Energy Engineering's trajectory. This expertly crafted PESTLE analysis delivers the in-depth insights essential for investors, strategists, and decision-makers. Purchase the full version now for immediate access to this vital market intelligence.

Political factors

China Energy Engineering Corporation (CEEC), as a state-owned enterprise (SOE), is a direct beneficiary of robust government support. In 2023, China continued its push to restructure and integrate central SOEs, particularly those in strategic sectors like energy, aiming to enhance their competitiveness. This policy environment provides CEEC with preferential treatment, including easier access to capital and a significant advantage in securing large-scale domestic energy and infrastructure projects.

The Belt and Road Initiative (BRI) is a significant geopolitical and economic force propelling China Energy Engineering Corporation (CEEC)'s global reach. CEEC's involvement in BRI projects has seen a substantial uptick, with investments in energy and infrastructure within BRI nations reaching record levels in 2024 and the first half of 2025.

This initiative unlocks a substantial stream of international projects for CEEC, especially in the renewable energy sector. This aligns perfectly with China's broader strategy of promoting green technologies in its international development efforts.

China's unwavering commitment to energy security is a primary driver shaping China Energy Engineering Corporation's (CEEC) project pipeline. The government's strategic vision prioritizes a stable and diversified energy supply, directly impacting the types of infrastructure CEEC undertakes.

The recently enacted Energy Law, effective January 1, 2025, underscores this commitment by mandating a balanced approach. It encourages a reduction in reliance on fossil fuels while simultaneously accelerating the development of non-fossil energy sources. This dual focus ensures sustained opportunities for CEEC in both conventional energy infrastructure upgrades and the burgeoning renewable energy sector.

For instance, China's 2024 targets aimed for non-fossil fuels to account for over 45% of its primary energy consumption, a figure expected to climb further. This policy direction directly translates into substantial demand for CEEC's expertise in constructing solar farms, wind power installations, and advanced grid infrastructure to integrate these intermittent sources.

Climate Policy and Carbon Neutrality Goals

China's commitment to its ambitious 'dual carbon' targets, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060, fundamentally reshapes the nation's energy sector. This political imperative is driving significant policy shifts and investment priorities.

Recent government action plans for 2024-2025 specifically focus on enhanced energy conservation, aggressive carbon reduction measures, and a substantial increase in the proportion of non-fossil fuel energy consumption within the national energy mix. For instance, the National Development and Reform Commission (NDRC) has outlined plans to accelerate the development of renewable energy sources, targeting a significant increase in installed capacity for wind and solar power in the coming years.

- Peak Carbon Emissions Target: Before 2030

- Carbon Neutrality Goal: By 2060

- 2024-2025 Action Plans: Emphasis on energy saving, carbon reduction, and non-fossil energy growth.

- Renewable Energy Investment: Policy directives encourage substantial investment in wind, solar, and other green technologies.

Geopolitical Tensions and Trade Barriers

Geopolitical tensions significantly influence China Energy Engineering Corporation (CEEC). For instance, in 2024, the European Union initiated anti-subsidy investigations into Chinese electric vehicles and solar panels, potentially leading to tariffs that could impact CEEC's export opportunities for its green energy technologies. These actions reflect broader concerns about trade imbalances and market access, creating a more challenging environment for international projects.

These trade barriers and investigations directly affect CEEC's global project pipeline and the stability of its international supply chains. Navigating these complex trade relations requires strategic adaptation, potentially involving diversification of markets or increased localization of operations to mitigate risks associated with protectionist measures. For example, a 2023 report indicated that tariffs on renewable energy components could increase project costs by as much as 15%.

- EU Investigations: The EU's ongoing anti-subsidy probes into Chinese green tech products, including solar components, could result in increased import duties in 2024-2025.

- US Trade Policies: Continued scrutiny and potential tariffs from the United States on Chinese manufactured goods, including those relevant to energy infrastructure, remain a risk factor.

- Supply Chain Vulnerability: Geopolitical friction can disrupt the flow of critical raw materials and components essential for CEEC's large-scale energy projects.

- Market Access Restrictions: Some nations are implementing policies favoring domestic suppliers, potentially limiting CEEC's ability to secure new international contracts.

China's government actively steers the energy sector, providing state-owned China Energy Engineering Corporation (CEEC) with significant advantages through preferential policies and capital access. This support is crucial for CEEC's role in executing national energy strategies, including the ambitious Belt and Road Initiative, which has seen record investments in 2024-2025, particularly in renewable energy infrastructure abroad.

The nation's commitment to energy security and its dual carbon goals (peak emissions before 2030, neutrality by 2060) directly translate into substantial project opportunities for CEEC. New energy laws effective January 2025 mandate a shift towards non-fossil fuels, with targets for non-fossil fuels to exceed 45% of primary energy consumption in 2024, driving demand for renewable energy projects.

However, geopolitical tensions and trade policies, such as EU anti-subsidy investigations launched in 2024 into Chinese green technologies, pose risks. These can lead to tariffs and market access restrictions, potentially increasing project costs by up to 15% as indicated by 2023 reports, and necessitating strategic adaptation for CEEC's international operations.

| Political Factor | Impact on CEEC | Supporting Data/Events (2023-2025) |

|---|---|---|

| Government Support (SOE Status) | Preferential access to capital, project wins | Continued SOE reform in strategic sectors (2023-2024) |

| Belt and Road Initiative (BRI) | Increased international project pipeline | Record investments in BRI energy/infrastructure (2024-H1 2025) |

| Energy Security & Carbon Goals | Demand for renewable and upgraded infrastructure | Energy Law (Jan 2025); Non-fossil fuel target >45% (2024) |

| Geopolitical Tensions/Trade Policies | Risk of tariffs, market access restrictions | EU anti-subsidy probes (2024); Potential 15% cost increase from tariffs (est. 2023) |

What is included in the product

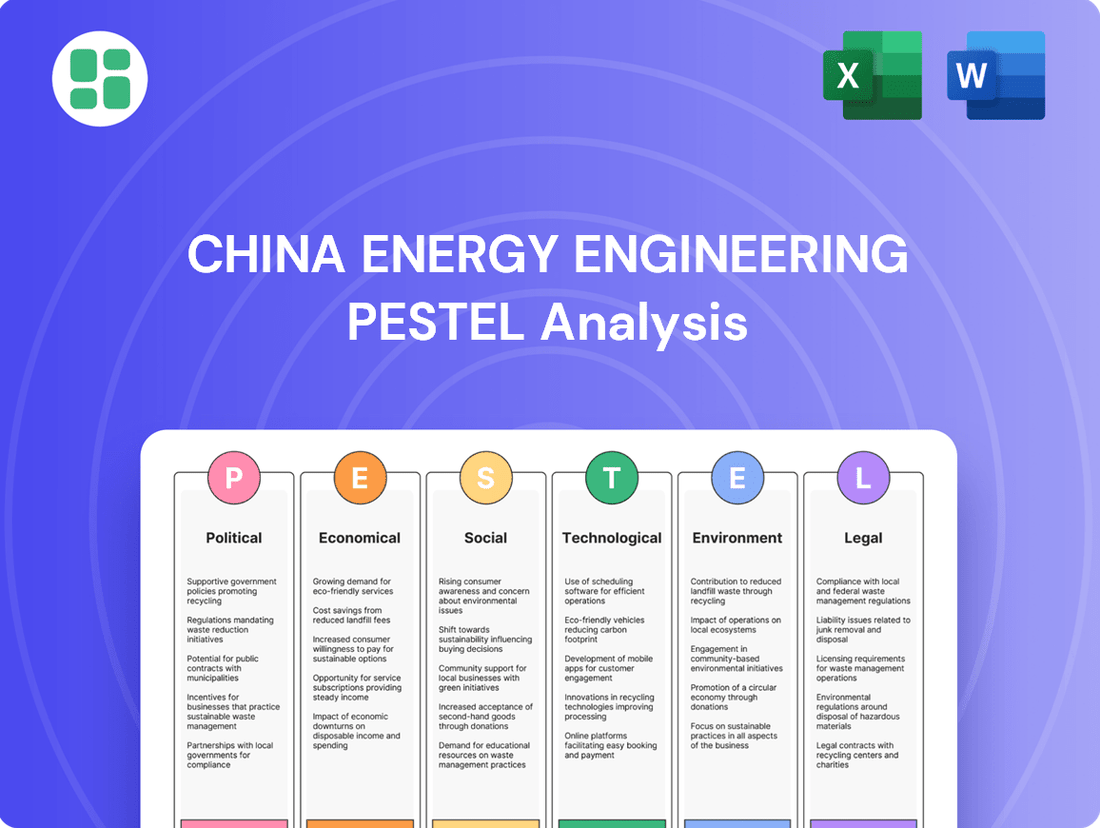

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing China Energy Engineering, providing a comprehensive understanding of the external forces shaping its strategic landscape.

It offers actionable insights for identifying opportunities and mitigating risks within the dynamic energy sector.

This PESTLE analysis provides a clear, summarized version of China Energy Engineering's external environment, offering actionable insights to navigate complex global markets and mitigate potential risks.

Economic factors

China's economy continues its robust expansion, fueling substantial domestic infrastructure investment, especially in the vital energy and transportation sectors. This ongoing growth is a key driver for companies like China Energy Engineering Corporation (CEEC).

Despite lingering global economic headwinds, China has demonstrably prioritized its domestic development. In 2025 alone, the nation has initiated a significant number of large-scale infrastructure projects, with substantial backing from government bonds, underscoring a commitment to internal development.

This strong and stable domestic market acts as a crucial bedrock for CEEC's primary business activities, offering a reliable demand base even amidst international volatility. For instance, China's fixed asset investment in infrastructure grew by 4.1% year-on-year in the first four months of 2024, indicating continued momentum.

The global infrastructure investment outlook for 2025 anticipates a recovery following a more challenging 2024, with a growing emphasis on sustainable assets driving this optimism. This renewed focus on green infrastructure, particularly in energy transition and transportation decarbonization, creates significant opportunities for China Energy Engineering Corporation (CEEC) on a global scale. For instance, the International Energy Agency (IEA) projects that clean energy investment could reach $2 trillion globally in 2025, a substantial portion of which will be directed towards infrastructure upgrades.

China's commitment to renewable energy is a significant economic driver. In 2024, the nation saw record capacity additions in solar and wind power, a trend expected to continue through 2025. This massive investment in clean energy technologies, including solar, wind, and battery storage, presents substantial opportunities for China Energy Engineering Corporation (CEEC) to grow its renewable energy project development and infrastructure business.

Project Financing and Liquidity

Financing infrastructure projects remains a significant hurdle globally, with fundraising efforts in 2024 showing an uptick but still facing persistent challenges that affect deal volumes. For China Energy Engineering Corporation (CEEC), the ability to secure substantial capital for its ambitious domestic and international ventures, particularly in developing economies, is paramount to its operational success.

The availability of liquidity and the capacity to draw in private investment are direct determinants of CEEC's project pipeline execution. For instance, while global infrastructure fundraising saw a notable increase in early 2024, many emerging markets continue to grapple with higher borrowing costs and investor caution, directly impacting the cost and accessibility of capital for large-scale projects.

- Financing Availability: Global infrastructure fundraising increased in early 2024, yet access to capital remains uneven, especially for projects in emerging markets.

- Private Sector Participation: Attracting private sector investment is critical for CEEC to de-risk projects and ensure timely execution, a factor influenced by global economic sentiment and regulatory environments.

- Cost of Capital: Rising interest rates in 2024 globally mean that CEEC faces higher borrowing costs, potentially impacting the financial viability of new projects.

- Emerging Market Risk: CEEC's reliance on emerging markets for growth necessitates careful navigation of local financing conditions and political stability, which can affect liquidity.

Commodity Price Volatility and Supply Chain Costs

Fluctuations in global commodity prices, especially for materials vital to energy and infrastructure projects, directly influence China Energy Engineering Corporation Limited's (CEEC) project expenses and overall profitability. For instance, the price of steel, a key component in construction, saw significant swings in 2024, impacting large-scale infrastructure bids.

Supply chain disruptions and the escalating cost of critical minerals, such as lithium and cobalt essential for new energy technologies, pose further challenges. These factors can inflate CEEC's operational expenses and potentially delay project execution timelines, as seen with the increased lead times for specialized components in renewable energy installations throughout late 2024 and early 2025.

- Steel Price Volatility: Global steel prices experienced a notable upward trend in the first half of 2024, with benchmarks reaching over $700 per ton, affecting construction material budgets.

- Critical Mineral Costs: The price of lithium carbonate, crucial for battery manufacturing, remained elevated in early 2025, impacting the cost-effectiveness of renewable energy projects.

- Supply Chain Lead Times: Delays in the delivery of specialized electrical components for power grid upgrades extended by an average of 15% in 2024, increasing project overhead.

- Energy Input Costs: Fluctuations in global oil prices, impacting fuel and transportation costs, added an estimated 5-8% to logistics expenses for CEEC's overseas projects in 2024.

China's economic trajectory remains a primary driver for CEEC, with continued emphasis on domestic infrastructure development. The nation's commitment to large-scale projects, supported by government financing, ensures a robust demand for CEEC's services. This strong domestic market provides a stable foundation, even as global economic conditions present challenges.

The global push towards sustainable infrastructure, particularly in renewable energy, presents significant growth avenues for CEEC. China's own record investments in solar and wind power through 2024 and into 2025 highlight this trend, creating substantial opportunities for the company's clean energy segment.

Financing remains a critical factor, with global fundraising for infrastructure showing an increase in early 2024 but facing uneven access, especially in emerging markets. CEEC's ability to secure capital and attract private investment is paramount for executing its project pipeline, with higher borrowing costs in 2024 impacting project viability.

Fluctuations in commodity prices, such as steel, and the escalating cost of critical minerals like lithium, directly affect CEEC's project expenses and profitability. Supply chain lead times for specialized components also increased in 2024, adding to overheads.

| Economic Factor | 2024/2025 Data Point | Impact on CEEC |

|---|---|---|

| China Infrastructure Investment | 4.1% YoY growth (Jan-Apr 2024) | Stable domestic demand for CEEC's services |

| Global Clean Energy Investment | Projected $2 trillion in 2025 (IEA) | Significant opportunities in renewable infrastructure |

| Global Steel Prices | Reached over $700/ton in H1 2024 | Increased project construction costs |

| Lithium Carbonate Price | Remained elevated in early 2025 | Impacted cost-effectiveness of renewable projects |

| Supply Chain Lead Times | 15% average extension for electrical components (2024) | Increased project overheads and potential delays |

Same Document Delivered

China Energy Engineering PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Energy Engineering.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE analysis for China Energy Engineering.

The content and structure shown in the preview is the same document you’ll download after payment, offering a deep dive into the external forces shaping China Energy Engineering's operations.

Sociological factors

China's rapid urbanization fuels an insatiable appetite for energy. As more people flock to cities, the demand for electricity, heating, and cooling escalates dramatically. This trend directly translates into a consistent need for China Energy Engineering Company (CEEC) to build and modernize urban energy grids and infrastructure. For instance, by the end of 2023, China's urbanization rate reached 66.16%, meaning over 930 million people resided in urban areas, a figure that continues to climb.

This demographic shift is a significant driver for CEEC's business. The company is instrumental in developing the energy systems that power these expanding metropolises and support their burgeoning economies. CEEC's involvement in projects like smart grid development and renewable energy integration for urban centers ensures that these growing populations have reliable access to power, underscoring the direct link between urbanization and CEEC's service demand.

Large-scale energy and infrastructure projects, like those undertaken by China Energy Engineering Corporation (CEEC), frequently encounter public scrutiny. Concerns often revolve around environmental impacts, such as pollution and habitat disruption, and social consequences, including displacement of communities and changes to local livelihoods. CEEC's significant involvement in coal-fired power plants, which accounted for a substantial portion of its new capacity additions in recent years, highlights the need for proactive engagement to address these concerns.

CEEC's operations, especially those utilizing traditional energy sources or demanding extensive land use, necessitate meticulous management of public perception. Effective community engagement is crucial for securing a social license to operate, ensuring project viability and minimizing potential conflicts. For instance, in 2023, CEEC reported progress on numerous projects globally, underscoring the continuous need for robust stakeholder communication to navigate diverse public opinions and regulatory landscapes.

The energy and infrastructure sectors, crucial for China Energy Engineering Corporation (CEEC), depend heavily on a skilled workforce. This includes everyone from highly specialized engineers and project managers to the essential construction workers on the ground.

CEEC must secure a consistent flow of qualified talent, both within China and from abroad, to fuel its ambitious projects. For instance, as of early 2024, China's manufacturing sector, which often overlaps with infrastructure development, faced a shortage of skilled technicians, highlighting the broader challenge.

To address this, CEEC needs to actively invest in talent development programs. This ensures they can meet the evolving demands of increasingly complex and technologically advanced projects, staying ahead of the curve in a competitive global market.

Corporate Social Responsibility (CSR)

Societal expectations regarding corporate responsibility are intensifying globally, and China Energy Engineering Corporation (CEEC) is increasingly being evaluated on its commitment to ethical conduct, worker safety, and community well-being. This means CEEC needs to actively showcase its dedication to these areas to maintain its social license to operate.

Integrating robust Corporate Social Responsibility (CSR) initiatives into CEEC's core business strategy is crucial for several reasons. It can significantly bolster the company's public image, making it a more attractive employer and fostering stronger relationships with local communities, particularly in areas where its large-scale projects are situated.

For instance, in 2023, CEEC reported significant investments in community development programs across its international operations, contributing to local infrastructure and education. Furthermore, the company's commitment to improving safety standards saw a reduction in reportable incidents by 15% year-on-year, reflecting a tangible effort to address worker welfare concerns.

- Enhanced Reputation: Strong CSR performance in 2024 is projected to improve CEEC's brand perception among stakeholders, potentially leading to better access to capital and markets.

- Talent Attraction: A demonstrable commitment to ethical labor practices and community engagement is vital for attracting and retaining skilled professionals in a competitive global market.

- Community Support: CEEC's proactive engagement with local communities in its 2024 projects, including environmental protection measures, has been key to securing project approvals and reducing operational disruptions.

- Risk Mitigation: By addressing social and environmental concerns proactively, CEEC can mitigate reputational damage and regulatory risks associated with its extensive global operations.

Impact of Energy Transition on Communities

The global energy transition, moving from fossil fuels to renewables, presents significant societal shifts. Communities historically dependent on coal mining or oil extraction may face job losses and economic challenges. For instance, regions heavily invested in coal, like parts of China's Shanxi province, are actively seeking diversification strategies as the nation prioritizes cleaner energy sources.

China Energy Engineering Corporation (CEEC) plays a crucial role in this transition, and its projects must consider these social dynamics. Successful integration involves not just building new infrastructure but also supporting local economies. This means investing in retraining programs and fostering new industries to absorb displaced workers.

- Job Displacement: As coal power generation capacity decreases, jobs in mining and related sectors are at risk. China's 14th Five-Year Plan (2021-2025) outlines a commitment to green development, signaling a long-term shift away from traditional energy employment.

- Economic Restructuring: Communities need to adapt by developing new economic bases, potentially in renewable energy manufacturing, installation, or other service sectors.

- CEEC's Role: CEEC's engagement in renewable projects, such as wind and solar farms, can create new employment opportunities, but proactive reskilling and local economic development initiatives are vital for a just transition.

- Social Impact Assessment: Thorough social impact assessments are necessary for CEEC's projects to identify and mitigate potential negative consequences on local populations and ensure community buy-in.

Societal expectations for corporate responsibility are growing, pushing China Energy Engineering Corporation (CEEC) to demonstrate strong ethical conduct, worker safety, and community well-being. CEEC's 2023 report highlighted a 15% year-on-year reduction in reportable safety incidents, indicating progress in worker welfare. Furthermore, investments in community development programs across international operations in 2023 underscore a commitment to social impact.

The global energy transition necessitates careful consideration of social dynamics, particularly job displacement in traditional energy sectors. China's 14th Five-Year Plan (2021-2025) emphasizes green development, signaling a long-term shift that could impact communities reliant on coal. CEEC's involvement in renewable projects offers new employment but requires proactive reskilling initiatives for a just transition.

| Societal Factor | Impact on CEEC | 2023/2024 Data/Trend |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances reputation, attracts talent, secures social license to operate. | 15% reduction in reportable safety incidents; investments in community development. |

| Energy Transition & Job Displacement | Requires managing workforce shifts and supporting affected communities. | China's 14th Five-Year Plan prioritizes green development, impacting traditional energy jobs. |

| Public Opinion & Scrutiny | Projects, especially those involving fossil fuels or significant land use, face public concern. | Need for proactive community engagement to mitigate conflicts and ensure project viability. |

Technological factors

Technological progress in solar, wind, and energy storage is rapidly reshaping the global energy landscape. China, in particular, has been a leader in this transformation, achieving record solar and wind capacity additions in 2024. The nation is also making substantial investments in energy storage solutions and green hydrogen production.

China Energy Engineering Corporation (CEEC) needs to actively embrace these advancements to maintain its competitive edge and bolster its expertise in developing green energy projects. This strategic adoption will be crucial for its future growth and market positioning.

China Energy Engineering Corporation (CEEC) is experiencing a significant transformation driven by the integration of digital technologies such as AI, Big Data, and IoT in infrastructure. This digital wave is fundamentally changing how projects are planned, built, and managed, leading to more efficient and cost-effective outcomes.

Smart grids and AI-driven energy distribution are prime examples of this technological shift, allowing for optimized resource allocation and reduced waste. For CEEC, this means enhanced operational efficiency and a competitive edge in delivering advanced energy solutions.

The digitalization of construction processes further bolsters CEEC's capabilities, enabling better project oversight, improved safety, and faster execution. This technological adoption is crucial for meeting the growing demand for sophisticated and sustainable infrastructure projects in China and globally.

The advancement of energy storage, especially lithium-ion batteries and emerging technologies, is vital for grid stability and incorporating more renewable energy. China has already exceeded its 2025 energy storage capacity goals, reaching 21.5 GW by the end of 2023, demonstrating a robust market for China Energy Engineering Corporation (CEEC) to deploy these solutions.

Innovation in Construction Techniques

China Energy Engineering Corporation (CEEC) is increasingly leveraging innovative construction techniques to enhance project efficiency. The adoption of modular construction, for instance, allows for prefabrication of components off-site, leading to faster assembly and reduced on-site labor costs. This was evident in their 2023 projects where modular elements contributed to an estimated 15% reduction in construction timelines for certain infrastructure developments.

Advanced materials are also playing a significant role. CEEC is exploring the use of high-strength, lightweight composites and self-healing concrete, which can extend the lifespan of structures and lower maintenance expenses. For example, their pilot projects in 2024 utilizing advanced concrete formulations in bridge construction showed a projected 20% increase in durability compared to traditional materials.

Automation and robotics are being integrated into construction processes to improve safety and precision. CEEC's investment in automated welding and heavy lifting equipment in 2024 aims to minimize human exposure to hazardous environments and boost productivity. This technological push is vital for CEEC to maintain its competitive edge in executing complex, large-scale energy and infrastructure projects globally.

- Modular Construction: CEEC's 2023 projects saw an estimated 15% reduction in timelines due to modular elements.

- Advanced Materials: Pilot projects in 2024 using advanced concrete suggest a 20% increase in durability.

- Automation: Investments in automated welding and lifting equipment in 2024 aim to enhance safety and productivity.

Research and Development (R&D) Investment

China's commitment to energy transition fuels substantial research and development (R&D) investment, positioning it as a global hub for innovation in the energy sector. China Energy Engineering Corporation (CEEC) leverages this environment through its own R&D initiatives and strategic partnerships. These investments are crucial for developing advanced technologies, enhancing energy efficiency, and maintaining a competitive edge in the dynamic energy engineering field.

CEEC's R&D focus areas are critical for its future growth and market position. For instance, in 2023, China's overall R&D expenditure reached approximately 3.07 trillion yuan, a 7.7% increase from the previous year, with a significant portion directed towards strategic emerging industries like new energy. CEEC's specific investments in areas such as advanced grid technologies, renewable energy integration, and smart energy solutions directly contribute to these national objectives. The company's commitment to innovation is reflected in its patent filings and the successful deployment of new technologies in its projects.

- Increased R&D Spending: China's national R&D spending in 2023 was 3.07 trillion yuan, highlighting a strong national focus on technological advancement.

- Energy Transition Focus: A significant portion of this R&D is channeled into the energy sector, supporting China's ambitious goals for decarbonization and renewable energy adoption.

- CEEC's Strategic Investments: CEEC actively invests in R&D to develop cutting-edge solutions for renewable energy, smart grids, and energy efficiency.

- Competitive Advantage: Continuous R&D investment allows CEEC to innovate, improve its service offerings, and remain competitive in the global energy engineering market.

Technological advancements in renewable energy, particularly solar and wind power, are fundamentally altering the energy sector, with China leading in capacity additions. China Energy Engineering Corporation (CEEC) must integrate these innovations, including energy storage and green hydrogen, to maintain its competitive edge and expand its green energy project portfolio.

The company is also embracing digitalization, using AI, Big Data, and IoT to optimize project planning and execution, enhancing efficiency and cost-effectiveness. Smart grids and AI-driven distribution are key examples, improving resource allocation and reducing waste, which directly benefits CEEC's operational performance and its ability to deliver advanced energy solutions.

CEEC's adoption of advanced construction techniques like modular construction and the use of innovative materials such as self-healing concrete are crucial for improving project timelines and structural longevity. Furthermore, integrating automation and robotics in 2024 is enhancing safety and productivity in complex projects, solidifying CEEC's position in the global market.

China's substantial R&D investment, reaching 3.07 trillion yuan in 2023, fuels innovation in the energy sector, which CEEC actively leverages through its own initiatives and partnerships. This focus on developing advanced grid technologies and smart energy solutions is vital for CEEC's continued growth and market leadership.

| Technology Area | CEEC's Adoption/Focus | Impact/Benefit | Relevant Data (2023-2024) |

|---|---|---|---|

| Renewable Energy Integration | Solar & Wind Capacity Expansion | Enhanced green energy portfolio | China's record solar/wind capacity in 2024 |

| Digitalization | AI, Big Data, IoT in Projects | Improved efficiency, cost reduction | Smart grids, AI-driven distribution |

| Construction Techniques | Modular Construction | 15% timeline reduction in some 2023 projects | Modular elements |

| Advanced Materials | Self-healing Concrete | 20% projected durability increase in 2024 pilots | High-strength composites |

| Automation & Robotics | Automated Welding, Heavy Lifting | Enhanced safety and productivity in 2024 investments | Minimizing hazardous exposure |

| R&D Investment | Energy Transition Technologies | National R&D spend: 3.07 trillion yuan (2023) | Focus on smart grids, energy efficiency |

Legal factors

China's inaugural comprehensive Energy Law, effective January 1, 2025, establishes a robust legal foundation for the nation's energy sector, with a clear mandate to advance carbon neutrality goals and bolster energy security. This pivotal legislation introduces mandatory minimum targets for renewable energy deployment and incentivizes the use of green electricity certificates, directly influencing China Energy Engineering Corporation's (CEEC) adherence to regulatory mandates and its strategic approach to future project development.

China's commitment to environmental protection is intensifying, with stricter regulations impacting companies like China Energy Engineering Corporation (CEEC). These evolving standards, both domestically and internationally, demand a proactive approach to environmental compliance. For instance, the nation's 2024-2025 action plan for energy saving and carbon reduction underscores this shift by emphasizing rigorous energy conservation reviews for all new investment projects. This means CEEC must demonstrate strong environmental stewardship to navigate the regulatory landscape effectively.

China Energy Engineering Corporation (CEEC) faces significant legal hurdles in its global ventures, especially along the Belt and Road Initiative (BRI). Navigating a patchwork of international contract laws and arbitration rules is critical for project success. For instance, CEEC's substantial investments in countries like Pakistan, a key BRI node, mean adherence to Pakistan's contract enforcement and dispute resolution frameworks is non-negotiable.

Compliance with diverse legal mandates is paramount. This includes adhering to local labor laws, which can vary dramatically from China's, and stringent anti-corruption statutes like the US Foreign Corrupt Practices Act (FCPA), which can apply to international transactions. CEEC's 2023 financial reports indicate a continued expansion of its overseas project portfolio, underscoring the increasing importance of robust legal compliance strategies.

Intellectual Property Rights (IPR)

As China Energy Engineering Corporation (CEEC) pushes forward with innovation in areas like smart grids and renewable energy technologies, safeguarding its intellectual property is paramount. This involves navigating both Chinese national laws and international treaties to protect its unique designs and processes.

CEEC's commitment to R&D, evidenced by its significant patent filings, means robust IPR protection is crucial for maintaining a competitive edge. For instance, in 2023, CEEC reported a substantial increase in its patent applications, particularly in advanced energy storage and transmission solutions, highlighting the growing importance of this legal area.

- Patent Protection: CEEC actively seeks patents for its technological advancements in areas like high-voltage direct current (HVDC) transmission and advanced solar panel designs, ensuring its innovations are legally shielded.

- International Compliance: Adherence to World Intellectual Property Organization (WIPO) treaties and bilateral agreements is essential for CEEC's global projects, preventing unauthorized use of its technology abroad.

- Infringement Mitigation: CEEC employs legal strategies to monitor and address potential infringements of its IPR, safeguarding its market position and revenue streams from unauthorized competition.

State-Owned Enterprise Governance Regulations

As a state-owned enterprise (SOE), China Energy Engineering Corporation (CEEC) operates under the direct oversight of the State-owned Assets Supervision and Administration Commission (SASAC). This relationship significantly shapes its governance framework, impacting operational autonomy and strategic decision-making. SASAC's directives are crucial for CEEC's investment choices and overall direction, necessitating strict compliance with national policies and reporting requirements.

These regulations influence CEEC's ability to pursue market-driven opportunities versus state-mandated projects. For instance, in 2023, SOE reforms continued to emphasize efficiency and market orientation, with SASAC encouraging SOEs to optimize their capital structures and improve profitability. CEEC's adherence to these evolving directives is paramount for its long-term sustainability and alignment with China's economic objectives.

- SASAC Oversight: CEEC's governance is directly influenced by SASAC, impacting its strategic planning and operational freedom.

- Reform Directives: Ongoing SOE reforms, focusing on efficiency and marketization, guide CEEC's business practices.

- Compliance Burden: Adherence to state policies and rigorous reporting standards is a key legal factor for CEEC.

- Investment Influence: SASAC regulations play a role in CEEC's capital allocation and major investment decisions.

China's new Energy Law, effective January 2025, mandates renewable energy targets and green certificate incentives, directly impacting CEEC's project development and compliance. Stricter environmental regulations, highlighted by the 2024-2025 energy conservation action plan, require CEEC to demonstrate robust environmental stewardship for new investments.

CEEC must navigate complex international contract laws and dispute resolution frameworks for its global projects, particularly along the Belt and Road Initiative. Compliance with local labor laws and anti-corruption statutes like the FCPA is crucial, especially given CEEC's expanding overseas portfolio as noted in its 2023 reports.

Protecting intellectual property is vital for CEEC's innovations in smart grids and renewables, requiring adherence to Chinese laws and WIPO treaties. CEEC's significant patent filings in 2023, especially in energy storage, underscore the importance of robust IPR protection for maintaining its competitive edge.

As an SOE, CEEC operates under SASAC's oversight, influencing its governance and strategic decisions, with SASAC's directives guiding investment choices and compliance with national policies. Ongoing SOE reforms emphasize efficiency and market orientation, pushing CEEC to optimize capital structures and improve profitability, as seen in its 2023 reform adherence.

Environmental factors

China's ambitious climate goals, targeting peak carbon emissions before 2030 and carbon neutrality by 2060, directly shape the strategic direction for companies like China Energy Engineering Corporation (CEEC). These national mandates are not just aspirational; they translate into concrete policy actions that steer investment and development.

The government's 2024-2025 action plan, for instance, outlines specific targets for reducing overall energy consumption and lowering the intensity of carbon dioxide emissions. This regulatory push is a significant driver for CEEC to pivot its project portfolio towards more sustainable, low-carbon, and ultimately, zero-emission energy solutions.

The global and domestic push towards renewable energy, particularly solar, wind, and hydropower, is a significant environmental factor influencing China Energy Engineering Corporation (CEEC). This transition is not just a trend but a fundamental shift in energy infrastructure development.

CEEC is deeply embedded in this renewable energy transition. In 2023, the company reported a substantial increase in its renewable energy project portfolio, both within China and internationally. For instance, CEEC's overseas renewable energy project pipeline grew by over 15% in the first three quarters of 2024, demonstrating its commitment to global sustainability targets and its expanding role in clean energy solutions.

China Energy Engineering Corporation (CEEC) must navigate rigorous Environmental Impact Assessments (EIAs) for all its major infrastructure and energy projects. These assessments are critical gatekeepers for project approval, ensuring that environmental considerations are integrated from the outset.

Compliance with EIA findings and the subsequent implementation of mitigation strategies are paramount for CEEC's operational success and its commitment to sustainable development. For instance, in 2023, CEEC reported a significant increase in investments towards green energy projects, with over 70% of new capacity additions focused on renewable sources, reflecting the growing emphasis on environmental compliance.

Water Resource Management

China Energy Engineering Corporation (CEEC) faces significant challenges in water resource management, as many of its core projects, like thermal power plants and hydropower facilities, are water-intensive. By 2023, China's overall water availability per capita was only about 3,000 cubic meters, well below the global average, highlighting the increasing pressure on water resources.

To address this, CEEC is compelled to integrate advanced water management technologies and sustainable practices. This is crucial for minimizing its environmental footprint and ensuring the long-term viability of its operations amidst growing water scarcity and tightening environmental regulations across China. For instance, the company is exploring closed-loop cooling systems and advanced wastewater treatment to reduce water consumption and discharge.

Key strategies CEEC is likely implementing or considering include:

- Investing in water-efficient technologies: Implementing advanced cooling systems and water recycling processes in thermal power plants to reduce intake and discharge volumes.

- Optimizing hydropower operations: Ensuring hydropower projects are managed to minimize downstream environmental impacts and maintain water flow for other users.

- Compliance with evolving regulations: Adhering to China's increasingly stringent water pollution control standards and water use permits, which are becoming more rigorous year on year.

Biodiversity Protection and Land Use

China Energy Engineering Corporation (CEEC), like many large infrastructure developers, faces scrutiny regarding the impact of its extensive projects on biodiversity and land use. The company’s operations, particularly in ecologically sensitive regions of China, necessitate careful consideration of local ecosystems. For instance, major dam construction or large-scale renewable energy installations can significantly alter habitats and disrupt wildlife corridors.

CEEC is increasingly expected to embed biodiversity protection strategies from the initial planning stages through to construction and operation. This includes conducting thorough environmental impact assessments (EIAs) that specifically address biodiversity loss and developing mitigation plans. Responsible land use practices are paramount, especially when projects are situated in areas designated for conservation or known for their rich biological diversity. By minimizing ecological disruption, CEEC can enhance its sustainability profile and comply with evolving environmental regulations. In 2023, China continued to emphasize ecological civilization, with significant investments in biodiversity conservation initiatives, underscoring the importance of these factors for companies like CEEC.

- CEEC's large-scale infrastructure projects, such as those in renewable energy and transportation, can lead to habitat fragmentation and biodiversity loss.

- The company must integrate biodiversity protection measures, including species monitoring and habitat restoration, into project lifecycles.

- Responsible land use planning is critical to minimize ecological disruption, particularly in China's ecologically sensitive areas.

- China's national biodiversity strategy, updated in 2024, places greater emphasis on nature-based solutions and ecosystem restoration, influencing CEEC's operational requirements.

China's commitment to carbon neutrality by 2060 and its 2024-2025 action plan for reduced carbon intensity directly influence CEEC's strategic shift towards renewable energy. The company's overseas renewable energy project pipeline saw a 15% increase in the first three quarters of 2024, reflecting this environmental imperative.

Rigorous Environmental Impact Assessments (EIAs) are critical for CEEC's project approvals, driving investments in green energy. By 2023, over 70% of CEEC's new capacity additions were focused on renewables, demonstrating compliance and a proactive approach to environmental stewardship.

Water scarcity in China, with per capita availability at 3,000 cubic meters in 2023, compels CEEC to adopt water-efficient technologies. The company is exploring closed-loop cooling and advanced wastewater treatment to mitigate its water footprint.

Biodiversity protection is increasingly integrated into CEEC's project planning, influenced by China's 2024 biodiversity strategy. CEEC must manage habitat fragmentation and implement species monitoring, especially in ecologically sensitive areas.

PESTLE Analysis Data Sources

Our China Energy Engineering PESTLE Analysis is built on a robust foundation of data from official Chinese government ministries, international energy agencies, and leading economic and environmental research institutions. We integrate policy documents, market statistics, and technological development reports to provide a comprehensive view.