China Energy Engineering Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Energy Engineering Bundle

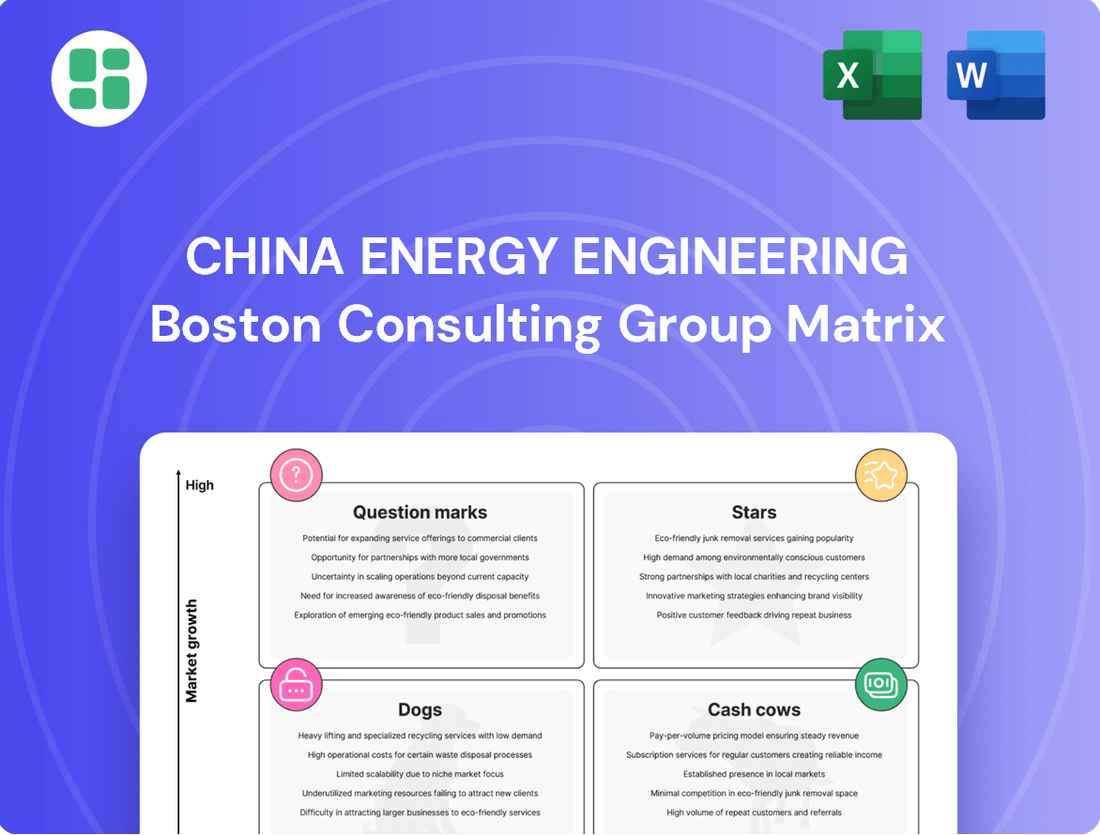

China Energy Engineering's BCG Matrix offers a fascinating glimpse into its diverse portfolio, highlighting areas of rapid growth and established dominance. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is crucial for any investor or strategist looking to navigate this dynamic industry.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for China Energy Engineering.

Stars

China Energy Engineering Corporation (CEEC) is a dominant force in the booming renewable energy sector, a market anticipated to see significant expansion by 2033. CEEC's extensive portfolio of large-scale solar, wind, and hydropower projects, notably in the Asia-Pacific region and via the Belt and Road Initiative, solidifies its substantial market share within this high-growth industry.

The company's international renewable energy contracts represent almost 50% of its total signed agreements, underscoring these global ventures as critical engines for both present and future financial performance.

China's Belt and Road Initiative (BRI) is experiencing a surge in investment, with energy sector involvement hitting record levels in early 2025, primarily due to a focus on green energy. China Energy Engineering Corporation (CEEC), a major state-owned infrastructure company, is a key player in these green infrastructure projects, winning significant construction contracts.

CEEC's substantial involvement in BRI's green infrastructure aligns perfectly with a major national strategy and targets high-growth international markets. This strategic positioning, backed by record energy engagement in the first half of 2025, firmly places CEEC's BRI Green Infrastructure efforts in the Star quadrant of the BCG matrix.

Large-scale energy storage solutions represent a significant growth area for China Energy Engineering (CEEC). The energy storage market in China is booming, with new installations jumping more than 50% in the first five months of 2025. CEEC's substantial 25 GWh lithium iron phosphate (LFP) battery system tender in June 2025 underscores its commitment and leadership in this rapidly expanding sector. These systems are crucial for managing the intermittent nature of renewable energy sources and facilitating the global energy transition.

Integrated Green Hydrogen Projects

Integrated green hydrogen projects represent a burgeoning high-growth sector vital for industrial decarbonization, and China Energy Engineering Corporation (CEEC) is positioning itself strategically. The company is investing significantly in this area, notably with what is slated to be the world's largest integrated green hydrogen-ammonia-methanol project, scheduled to commence operations in September 2025.

This substantial early commitment by CEEC in a rapidly expanding and strategically crucial market segment, while still in its developmental stages, is designed to establish a robust market presence. Such initiatives are key for companies aiming to lead in the global energy transition and meet future industrial demands for cleaner energy sources.

- Sector Growth: The green hydrogen market is experiencing significant expansion, driven by global decarbonization efforts.

- CEEC's Investment: CEEC is making substantial strategic investments in integrated green hydrogen projects.

- Project Scale: CEEC is developing the world's largest integrated green hydrogen-ammonia-methanol project, expected to begin operations in September 2025.

- Market Positioning: This early and large-scale commitment aims to secure a strong market position in a strategically important and rapidly growing sector.

International Power Transmission & Distribution (T&D) Projects

International Power Transmission & Distribution (T&D) Projects represent a significant growth area for China Energy Engineering (CEEC) within the BCG framework. As nations worldwide, particularly those in emerging markets, invest heavily in upgrading and expanding their power grids to accommodate renewable energy sources and improve overall grid stability, the need for robust T&D infrastructure is escalating. CEEC's substantial track record and current involvement in global power grid development, frequently tied to the commissioning of new power generation facilities, firmly establish its leading market position in this expanding international sector.

The global T&D market is experiencing robust growth, driven by the energy transition and the need for grid modernization. For instance, projections indicated the global T&D market could reach approximately $300 billion by 2025, with significant contributions from emerging economies. CEEC is well-positioned to capitalize on this, having secured contracts for major T&D projects across Asia, Africa, and Latin America. These projects often involve high-voltage transmission lines and advanced distribution networks, crucial for integrating intermittent renewable energy sources like solar and wind power.

- Market Growth: The global T&D market is expanding, with significant investment in grid modernization and renewable energy integration.

- CEEC's Position: CEEC holds a strong market share due to its extensive experience and ongoing international projects in grid development.

- Key Drivers: Demand is fueled by the need for increased reliability, the integration of renewables, and the expansion of power infrastructure in emerging economies.

- Project Scope: CEEC's projects typically involve high-voltage transmission lines and sophisticated distribution systems, supporting the energy transition.

CEEC's BRI Green Infrastructure efforts are firmly positioned as Stars within the BCG matrix. These initiatives benefit from high market growth, driven by global decarbonization trends and significant investment surges in early 2025, particularly in green energy projects. CEEC's substantial contracts within the Belt and Road Initiative, focused on green infrastructure, underscore its leading role in this expanding sector.

What is included in the product

This BCG Matrix analysis offers a tailored view of China Energy Engineering's portfolio, identifying units for investment, divestment, or holding.

A clear BCG Matrix visualizes China Energy Engineering's portfolio, relieving the pain of strategic uncertainty.

This BCG Matrix offers a streamlined view, easing the burden of complex portfolio analysis for decision-makers.

Cash Cows

China Energy Engineering's domestic traditional power grid construction and upgrades represent a classic Cash Cow. In China's vast and mature energy market, this sector demands ongoing investment for maintenance, modernization, and essential expansion to guarantee grid stability and operational efficiency.

CEEC, a significant state-owned entity, commands a substantial portion of this market. This translates into consistent and predictable revenue streams, characterized by robust profitability despite modest growth prospects. For instance, in 2023, China's investment in power grid infrastructure reached approximately 515.4 billion yuan, highlighting the scale and stability of this sector for CEEC.

Established Domestic Coal-Fired Power Plant Maintenance represents a significant Cash Cow for China Energy Engineering (CEEC). Despite the global energy transition, China's vast existing coal power infrastructure necessitates continuous maintenance and upgrades. CEEC's deep experience and substantial market share in this sector ensure a reliable, albeit low-growth, revenue stream.

In 2024, China's coal power capacity remained substantial, with ongoing investments in retrofitting older plants for environmental compliance. CEEC's established domestic maintenance operations, leveraging decades of expertise, capitalize on this stable demand. This segment provides a predictable financial foundation for the company.

China's vast road and highway network, a foundational element of its economic growth, continues to require substantial investment. While the bulk of construction is complete, ongoing needs for maintenance, repair, and strategic expansion, especially to link burgeoning urban centers, represent a consistent demand.

China Energy Engineering Corporation (CEEC) holds a dominant position in this sector. Its extensive experience and established capabilities translate into a secure, high market share for domestic road and highway projects. This translates to a steady, predictable stream of work, even if the growth rate for new large-scale construction has moderated.

In 2024, China's Ministry of Transport reported that the total operating mileage of highways in China reached approximately 6.5 million kilometers. CEEC's involvement in maintaining and upgrading this extensive network is crucial, ensuring its continued functionality and safety for millions of users daily.

Conventional Hydropower Engineering & Construction (Mature Regions)

In mature regions where significant new large-scale hydropower development is scarce, China Energy Engineering Corporation (CEEC)'s conventional hydropower engineering and construction services function as a cash cow. This segment benefits from CEEC's extensive experience in upgrading, rehabilitating, and expanding existing hydropower infrastructure. These projects, while not groundbreaking, offer consistent, high-margin revenue streams due to the established demand for maintaining and optimizing aging power systems.

CEEC's deep expertise in conventional hydropower engineering and construction in mature markets translates into a stable and predictable revenue base. The focus shifts to efficiency improvements and life extensions for existing assets, a segment where CEEC holds a strong competitive advantage. For instance, in 2024, CEEC continued to secure contracts for refurbishment projects on hydropower plants in developed nations, contributing significantly to its overall profitability.

- Stable Revenue: Mature regions provide consistent demand for hydropower upgrades and maintenance.

- High Margins: CEEC's specialized expertise allows for profitable execution of these projects.

- Proven Capabilities: Leverage of decades of experience in conventional hydropower engineering and construction.

- Project Focus: Emphasis on rehabilitation, upgrades, and smaller-scale additions to existing facilities.

Standardized Power Equipment Manufacturing & Supply

Standardized Power Equipment Manufacturing & Supply within China Energy Engineering (CEEC) likely represents a significant Cash Cow. This division probably focuses on producing and supplying standard components and equipment for established energy and infrastructure sectors. Its strength lies in leveraging economies of scale and well-developed supply chains to maintain a high market share, thereby generating steady cash flows with minimal need for substantial innovation investment.

In 2024, CEEC's equipment manufacturing segment is expected to continue its role as a reliable cash generator. This business unit benefits from the mature nature of many energy infrastructure markets, where demand for standardized equipment remains robust. The company’s established presence and operational efficiencies allow it to capture a substantial portion of this market, translating into consistent profitability.

- Market Dominance: CEEC's standardized power equipment division likely holds a commanding market share in its key product categories due to its extensive manufacturing capacity and established distribution networks.

- Consistent Cash Flow: The mature nature of the target markets ensures a predictable and stable demand for standardized equipment, leading to consistent cash flow generation for the company.

- Low Investment Needs: As a Cash Cow, this segment requires limited capital expenditure for research and development or market expansion, as its products are well-established and technologically stable.

- Contribution to Group: The profits generated by this division are crucial for funding other strategic initiatives within CEEC, such as investments in high-growth areas or debt reduction.

China Energy Engineering's domestic traditional power grid construction and upgrades represent a classic Cash Cow. In China's vast and mature energy market, this sector demands ongoing investment for maintenance, modernization, and essential expansion to guarantee grid stability and operational efficiency.

CEEC, a significant state-owned entity, commands a substantial portion of this market. This translates into consistent and predictable revenue streams, characterized by robust profitability despite modest growth prospects. For instance, in 2023, China's investment in power grid infrastructure reached approximately 515.4 billion yuan, highlighting the scale and stability of this sector for CEEC.

Established Domestic Coal-Fired Power Plant Maintenance represents a significant Cash Cow for China Energy Engineering (CEEC). Despite the global energy transition, China's vast existing coal power infrastructure necessitates continuous maintenance and upgrades. CEEC's deep experience and substantial market share in this sector ensure a reliable, albeit low-growth, revenue stream.

In 2024, China's coal power capacity remained substantial, with ongoing investments in retrofitting older plants for environmental compliance. CEEC's established domestic maintenance operations, leveraging decades of expertise, capitalize on this stable demand. This segment provides a predictable financial foundation for the company.

China's vast road and highway network, a foundational element of its economic growth, continues to require substantial investment. While the bulk of construction is complete, ongoing needs for maintenance, repair, and strategic expansion, especially to link burgeoning urban centers, represent a consistent demand. China Energy Engineering Corporation (CEEC) holds a dominant position in this sector. Its extensive experience and established capabilities translate into a secure, high market share for domestic road and highway projects. This translates to a steady, predictable stream of work, even if the growth rate for new large-scale construction has moderated. In 2024, China's Ministry of Transport reported that the total operating mileage of highways in China reached approximately 6.5 million kilometers. CEEC's involvement in maintaining and upgrading this extensive network is crucial, ensuring its continued functionality and safety for millions of users daily.

In mature regions where significant new large-scale hydropower development is scarce, China Energy Engineering Corporation (CEEC)'s conventional hydropower engineering and construction services function as a cash cow. This segment benefits from CEEC's extensive experience in upgrading, rehabilitating, and expanding existing hydropower infrastructure. These projects, while not groundbreaking, offer consistent, high-margin revenue streams due to the established demand for maintaining and optimizing aging power systems. CEEC's deep expertise in conventional hydropower engineering and construction in mature markets translates into a stable and predictable revenue base. The focus shifts to efficiency improvements and life extensions for existing assets, a segment where CEEC holds a strong competitive advantage. For instance, in 2024, CEEC continued to secure contracts for refurbishment projects on hydropower plants in developed nations, contributing significantly to its overall profitability.

Standardized Power Equipment Manufacturing & Supply within China Energy Engineering (CEEC) likely represents a significant Cash Cow. This division probably focuses on producing and supplying standard components and equipment for established energy and infrastructure sectors. Its strength lies in leveraging economies of scale and well-developed supply chains to maintain a high market share, thereby generating steady cash flows with minimal need for substantial innovation investment. In 2024, CEEC's equipment manufacturing segment is expected to continue its role as a reliable cash generator. This business unit benefits from the mature nature of many energy infrastructure markets, where demand for standardized equipment remains robust. The company’s established presence and operational efficiencies allow it to capture a substantial portion of this market, translating into consistent profitability.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Data/Context |

| Domestic Traditional Power Grid Construction & Upgrades | Cash Cow | High market share, stable demand, consistent revenue, moderate growth. | China's power grid investment in 2023 was ~515.4 billion yuan. |

| Domestic Coal-Fired Power Plant Maintenance | Cash Cow | Established expertise, reliable revenue, low growth, essential services. | Continued investment in retrofitting older plants for environmental compliance in 2024. |

| Domestic Road & Highway Maintenance/Upgrades | Cash Cow | Dominant market position, predictable work, stable cash flow, mature market. | China's highway network reached ~6.5 million km operating mileage in 2024. |

| Conventional Hydropower Engineering (Mature Markets) | Cash Cow | Strong experience, high margins, focus on upgrades/rehabilitation, stable demand. | CEEC secured refurbishment contracts for hydropower plants in developed nations in 2024. |

| Standardized Power Equipment Manufacturing & Supply | Cash Cow | Economies of scale, established supply chains, steady cash flows, low R&D needs. | Robust demand for standardized equipment in mature energy infrastructure markets in 2024. |

Delivered as Shown

China Energy Engineering BCG Matrix

The China Energy Engineering BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive report, free from watermarks or demo content, offers a detailed strategic analysis of China Energy Engineering's business units, ready for immediate application in your planning and decision-making processes.

Dogs

China Energy Engineering Corporation (CEEC) might be operating outdated manufacturing facilities for equipment crucial to industries experiencing a significant downturn. This could include machinery for older forms of energy generation where demand is rapidly diminishing, offering little room for competitive advantage.

These legacy product lines likely represent a small fraction of CEEC's total revenue and could be a drain on capital, yielding minimal returns. For instance, if CEEC still manufactures equipment for coal-fired power plants that are being phased out, these operations would fit this description.

China Energy Engineering Corporation (CEEC) has largely transitioned its focus to renewable energy, yet any lingering involvement in new overseas coal power plant construction, particularly in riskier markets, falls into the question mark or potentially even the dog category of the BCG matrix. These ventures are characterized by low growth potential and significant risk due to global policy shifts.

The People's Republic of China's official policy, announced in 2021, to cease new overseas coal-fired power plant construction directly impacts CEEC's ability to secure and complete such projects. This policy significantly heightens the risk of cancellations and reduces the overall market for new coal power developments.

Niche or underperforming regional consulting services within China Energy Engineering (CEEC) represent small-scale operations focused on specific, fragmented local markets where CEEC doesn't hold a dominant position or a robust project pipeline. These ventures often yield low revenue and demand significant resources relative to their potential, hindering overall growth compared to CEEC's more established business lines.

For instance, CEEC's regional consulting efforts in less developed provinces might show minimal revenue contribution, potentially less than 0.5% of the company's total revenue in 2024, while consuming disproportionate management attention. Their limited growth prospects are further highlighted by a projected CAGR of only 2-3% for these specific services over the next five years, a stark contrast to the double-digit growth seen in CEEC's core infrastructure and engineering segments.

Marginal Participations in Highly Competitive Civil Works

Marginal participations in highly competitive civil works, particularly in commoditized segments like small-scale general construction, represent a challenge for China Energy Engineering Corporation (CEEC). In these areas, CEEC may not fully utilize its core strengths in large-scale infrastructure or its advantages as a state-owned enterprise. This often results in a low market share and minimal profitability due to the sheer intensity of competition.

These types of projects typically offer low returns on the investment of time and resources. For instance, in 2024, the average profit margin for small general contractors in many developed markets hovered around 2-5%, a stark contrast to the higher margins seen in specialized or large-scale projects. CEEC's involvement in such segments, if any, would likely fall into this category, yielding little strategic or financial benefit.

- Low Market Share: CEEC's participation in highly competitive, commoditized civil works segments often means it holds a small percentage of the overall market.

- Minimal Profitability: Intense competition drives down prices and profit margins, making these ventures financially unrewarding.

- Resource Misallocation: Engaging in these projects may divert resources from more strategic, high-return opportunities where CEEC possesses a competitive advantage.

- Low Return on Effort: The effort required to secure and execute these small-scale contracts often outweighs the financial gains.

Projects in Politically Unstable or Economically Stagnant Regions

Projects in politically unstable or economically stagnant regions represent China Energy Engineering Corporation's (CEEC) 'Dogs' in the BCG matrix. These ventures are typically situated in areas with significant geopolitical risk, economic slowdowns, or outright instability. CEEC's presence in these locations is often limited and not strategically core to its operations.

These 'Dog' projects frequently encounter substantial hurdles, including project delays, difficulties in securing payments, and even outright project cancellations. Consequently, the returns generated are generally low, and the operational challenges are exceptionally high, straining resources and management attention.

For instance, CEEC's involvement in certain Central Asian infrastructure projects, while potentially offering long-term growth, has in the past been hampered by regional political shifts and economic downturns, impacting timely revenue realization. In 2023, CEEC reported a marginal profit contribution from its operations in regions with high political risk, underscoring the challenges.

- Limited Strategic Importance: CEEC's engagement in these areas is often opportunistic rather than a deliberate strategic expansion.

- High Operational Risk: Projects face elevated risks of delays, payment defaults, and potential abandonment due to unstable environments.

- Low Return on Investment: The combination of challenges leads to significantly reduced profitability and high operational costs.

- Resource Drain: These projects can consume valuable management time and financial resources that could be better allocated elsewhere.

China Energy Engineering Corporation (CEEC) may have legacy manufacturing operations for outdated energy equipment, particularly those tied to declining industries like older power generation technologies. These segments likely contribute minimally to overall revenue and offer little competitive advantage, potentially consuming capital with low returns.

CEEC's involvement in niche, underperforming regional consulting services within China, or marginal participation in highly competitive, commoditized civil works, also fits the 'Dog' category. These ventures typically have low market share, minimal profitability, and represent a misallocation of resources compared to CEEC's core strengths.

Projects in politically unstable or economically stagnant regions are also considered 'Dogs' for CEEC. These ventures face significant operational risks, including delays and payment issues, leading to low returns and high costs, often diverting valuable management attention and financial resources from more strategic opportunities.

| Category | Characteristics | Example for CEEC | 2024 Data/Outlook |

| Dogs | Low market share, low growth, low profitability | Outdated equipment manufacturing, niche regional consulting, marginal civil works, projects in unstable regions | Minimal revenue contribution (<0.5%), low profit margins (2-5%), projected CAGR of 2-3% for niche services, marginal profit contribution from high-risk regions in 2023. |

Question Marks

China Energy Engineering Corporation (CEEC) is making significant strides in AI-driven energy solutions, particularly in digital-energy integrated infrastructure and smart grid technologies. This focus positions them in a high-growth, transformative sector. For instance, global investment in smart grids alone was projected to reach over $100 billion annually by 2024, highlighting the immense market potential.

While CEEC's investment in these cutting-edge AI applications is notable, their current market share in these specialized technological areas is likely still in its formative stages. The rapid evolution and intense competition in AI-powered energy systems mean that establishing a dominant position requires sustained innovation and strategic market penetration.

China Energy Engineering (CEEC) views Carbon Capture, Utilization, and Storage (CCUS) as a pivotal area for environmental protection and a high-growth sector in decarbonization, especially for industrial emissions. While CEEC's current market share in CCUS might be modest, its investment in developing and deploying these advanced technologies positions it for substantial future expansion.

CCUS is crucial for tackling hard-to-abate industrial emissions, a key challenge in China's net-zero ambitions. For instance, China's CCUS capacity reached 1.5 million tonnes per annum by the end of 2023, with significant growth anticipated. CEEC's strategic focus here aligns with national environmental goals and offers a pathway to a lower-carbon industrial future.

China Energy Engineering Corporation (CEEC) might consider niche renewable technologies like geothermal and tidal power as question marks within its BCG matrix. While CEEC excels in established renewables, these specialized areas demand substantial upfront investment to compete with existing niche players and capture market share. The potential for high growth in these emerging sectors is undeniable, but the path to profitability requires careful navigation and strategic resource allocation.

Advanced Smart City Integrated Solutions

Advanced Smart City Integrated Solutions represent a burgeoning, high-potential area for China Energy Engineering Corporation (CEEC) within the BCG framework. China's commitment to smart city development, with significant government backing and investment, positions this segment as a key growth driver. For instance, China's total investment in smart city initiatives was projected to reach over $200 billion by 2025, indicating a substantial market opportunity.

CEEC's strategic advantage lies in its ability to offer comprehensive, integrated solutions that go beyond traditional infrastructure construction. This includes the convergence of digital technologies, energy management, transportation, and public services. While the market share for these advanced, integrated solutions is still developing, the rapid pace of urbanization and technological adoption in China fuels its potential. In 2024, numerous smart city projects were initiated across major Chinese metropolises, focusing on areas like intelligent transportation systems and renewable energy integration.

- High Growth Potential: China's smart city market is experiencing rapid expansion, driven by government policy and technological advancements.

- Integrated Solutions Focus: CEEC's strength in offering end-to-end smart city solutions, encompassing digital and energy infrastructure, differentiates it.

- Developing Market Share: While the sector is promising, CEEC's market share in these advanced integrated solutions is still in its formative stages, suggesting a "question mark" positioning.

- Investment Trends: Significant capital is being channeled into smart city projects, with a notable increase in funding for AI and IoT integration in urban planning during 2024.

Strategic Overseas Expansion into Highly Competitive Developed Markets

China Energy Engineering Corporation (CEEC) aims to deeply integrate into global markets, including highly competitive developed economies. This strategy involves entering mature landscapes where established local competitors dominate, presenting significant challenges for CEEC's initial market penetration.

These developed markets, while offering substantial growth potential, demand considerable investment to gain traction. CEEC's presence in these areas would likely begin with a low market share, necessitating strategic resource allocation to build a competitive position.

For instance, in the European Union, the energy infrastructure sector is characterized by strong incumbents and stringent regulatory frameworks. CEEC's expansion here would require substantial capital for project acquisition and technological alignment, potentially impacting its immediate profitability.

- Market Entry Challenges: Developed markets feature entrenched local players with established supply chains and client relationships.

- Investment Requirements: Achieving meaningful market share necessitates significant upfront investment in technology, local partnerships, and marketing.

- Growth Opportunity: Despite competition, developed economies offer large-scale projects and advanced technology adoption, crucial for CEEC's long-term growth.

- Competitive Landscape: CEEC must differentiate itself through innovation, cost-efficiency, or specialized services to compete with established giants.

Niche renewable technologies, such as geothermal and tidal power, are likely question marks for China Energy Engineering Corporation (CEEC) within its BCG matrix. These sectors, while holding significant future growth potential, require substantial initial investment to compete effectively with established niche players and build market share. CEEC's current market share in these specialized areas is probably modest, reflecting the early stages of development and the need for strategic resource allocation to foster growth.

CEEC's strategic focus on advanced smart city integrated solutions positions it in a high-growth segment. China's strong government backing and investment in smart cities create a substantial market opportunity. For example, China's smart city investment was projected to exceed $200 billion by 2025, underscoring the sector's potential. CEEC's ability to provide comprehensive, integrated solutions, combining digital and energy infrastructure, offers a competitive edge in this rapidly urbanizing landscape.

Entering highly competitive developed markets presents CEEC with question mark opportunities. These markets are characterized by dominant local competitors and stringent regulations, making initial market penetration challenging. CEEC will likely start with a low market share, requiring considerable investment to gain a foothold and build a competitive presence. For instance, the European Union's energy infrastructure sector demands significant capital for project acquisition and technological adaptation.

| CEEC BCG Matrix: Question Marks | Market Growth | Relative Market Share | Strategic Considerations |

|---|---|---|---|

| Niche Renewables (Geothermal, Tidal) | High | Low | Requires significant investment for market entry and growth; potential for future dominance if strategic investments are made. |

| Advanced Smart City Integrated Solutions | High | Low to Medium | Leverages government support and technological integration for expansion; market share is developing, requiring continued innovation. |

| Developed Market Entry (e.g., EU Energy Infrastructure) | High | Low | Faces strong incumbent competition and regulatory hurdles; substantial capital investment needed to build market share and establish presence. |

BCG Matrix Data Sources

Our China Energy Engineering BCG Matrix is built on a foundation of robust data, including publicly available financial statements, comprehensive industry research reports, and authoritative government publications.