China Energy Engineering Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Energy Engineering Bundle

China Energy Engineering faces significant competition, with moderate buyer power and a growing threat from substitutes in the energy sector. Understanding the influence of suppliers and the barriers to new entrants is crucial for navigating its complex market landscape.

The complete report reveals the real forces shaping China Energy Engineering’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Energy Engineering Corporation (CEEC) depends on a global supply chain for specialized equipment and advanced technology vital for its large-scale energy and infrastructure ventures. Suppliers of proprietary technology or those with few competitors can wield considerable bargaining power, impacting CEEC's project costs and timelines. For instance, in 2023, the global market for advanced gas turbines, a key component in power generation, saw significant price increases due to supply chain constraints and high demand, highlighting the leverage these specialized providers can exert.

The availability of highly skilled engineers and specialized labor is a significant factor in China Energy Engineering Corporation (CEEC)'s operations. A scarcity of such talent, especially for emerging sectors like new energy or intricate infrastructure projects, can drive up labor expenses and amplify the bargaining power of skilled workers.

CEEC's success hinges on its capacity to attract and retain premier talent worldwide. For instance, in 2023, the global demand for renewable energy engineers saw a notable increase, potentially impacting recruitment costs for CEEC.

China Energy Engineering Corporation (CEEC) relies heavily on raw material suppliers for its vast construction and manufacturing operations. Key inputs such as steel, cement, and specialized electrical components are critical. For instance, the global steel market saw significant price volatility in 2023, with benchmark rebar prices in China fluctuating by over 15% throughout the year, directly impacting CEEC's project budgets.

Disruptions in these supply chains, a recurring theme in recent years due to events like the COVID-19 pandemic and geopolitical tensions, can amplify the bargaining power of raw material providers. This increased leverage can lead to higher material costs and potential delays, affecting CEEC's ability to meet project deadlines and manage overall expenses effectively. Trade policies and international relations also play a crucial role, with tariffs or export restrictions potentially limiting availability and driving up prices for essential materials.

Access to Financing and Capital

Suppliers of capital, such as banks and investment firms, wield considerable influence, particularly for China Energy Engineering Corporation (CEEC) on its massive, long-term infrastructure undertakings. Their ability to provide or withhold funds directly impacts project viability and CEEC's operational capacity.

While CEEC, as a state-backed entity, benefits from relatively stable domestic financing channels, its international ventures are inherently exposed to global financial market volatility. For instance, in 2024, rising global interest rates could increase the cost of capital for overseas projects, thereby strengthening the bargaining power of international lenders.

- Financing Costs: In 2024, the average interest rate for corporate debt globally saw an increase, impacting the cost of capital for companies like CEEC undertaking large projects.

- Investor Confidence: Investor sentiment towards state-owned enterprises and the infrastructure sector in emerging markets directly influences the terms and availability of capital.

- Access to Diverse Funding: CEEC's reliance on a mix of domestic and international funding sources means its bargaining power with capital suppliers can vary significantly based on geopolitical and economic conditions.

Government Policies and Regulations

Government policies and regulations significantly shape the bargaining power of suppliers for China Energy Engineering Corporation (CEEC). In 2024, China's continued emphasis on energy security and environmental protection means that regulations on raw material sourcing, such as coal and rare earth minerals, can directly impact supplier pricing and availability. For instance, stricter environmental standards for mining operations, a key input for many energy projects, could limit the number of compliant suppliers, thereby increasing their leverage over CEEC.

Furthermore, state-driven industrial policies often favor domestic suppliers, especially for critical components in renewable energy sectors like solar and wind power. This can create a more concentrated supplier base for CEEC, potentially empowering those suppliers. For example, government mandates for localized content in renewable energy projects can bolster the position of domestic component manufacturers, allowing them to negotiate more favorable terms with large buyers like CEEC.

- Regulatory Impact on Inputs: China's environmental protection laws, enforced more stringently in 2024, can increase compliance costs for raw material suppliers, potentially leading to higher prices for CEEC.

- Industrial Policy Favoritism: Government support for domestic renewable energy manufacturers, a key area for CEEC, strengthens the bargaining power of these local suppliers.

- Resource Allocation Control: State control over natural resource allocation can be used to influence supplier pricing and supply chain stability for CEEC's projects.

China Energy Engineering Corporation (CEEC) faces significant supplier bargaining power, particularly from providers of specialized technology and critical raw materials. In 2023, price hikes for advanced gas turbines and volatility in steel markets underscored this leverage, directly impacting CEEC's project costs and timelines. The availability of skilled labor also presents a challenge, with rising global demand for renewable energy engineers in 2023 potentially increasing recruitment expenses for CEEC.

Furthermore, capital suppliers, especially international lenders in 2024, can exert considerable influence due to rising global interest rates, affecting the cost of financing CEEC's large-scale projects. Government policies in China, emphasizing energy security and environmental protection, can also empower domestic suppliers by creating more concentrated markets or imposing stricter compliance standards on raw material providers, ultimately influencing pricing and availability for CEEC.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on CEEC (2023-2024) | Example Data/Trend |

|---|---|---|---|

| Specialized Technology Providers | Proprietary technology, few competitors | Increased project costs, potential delays | Advanced gas turbine prices rose in 2023 due to supply constraints. |

| Raw Material Suppliers | Supply chain disruptions, trade policies | Higher material costs, project budget impacts | Global steel prices saw over 15% fluctuation in China in 2023. |

| Skilled Labor | Scarcity of specialized talent | Increased labor expenses, recruitment challenges | Global demand for renewable energy engineers grew in 2023. |

| Capital Suppliers (Lenders) | Global interest rates, investor confidence | Higher financing costs for international projects | Global corporate debt interest rates increased in 2024. |

What is included in the product

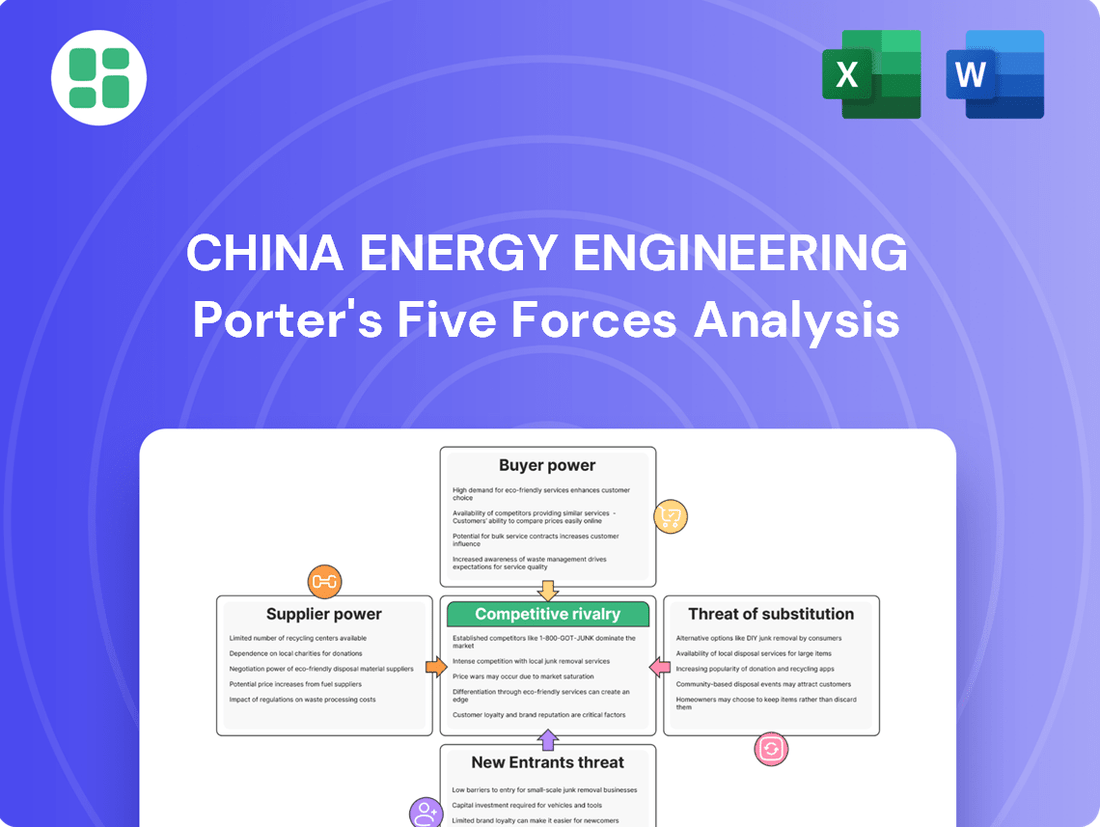

This analysis of China Energy Engineering dissects the competitive forces shaping its industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for China Energy Engineering.

Customers Bargaining Power

China Energy Engineering Corporation (CEEC) frequently engages with government bodies and state-owned enterprises (SOEs) for its major projects. These significant clients, by virtue of the immense scale and national importance of their undertakings, wield considerable leverage. For instance, in 2023, CEEC secured contracts for numerous large infrastructure projects, many of which were government-backed, highlighting the reliance on such clientele.

China Energy Engineering Corporation (CEEC) engages with a diverse international clientele, encompassing national governments and private sector developers. The ability of these customers to negotiate favorable terms is influenced by factors such as the scale of the project, local legal frameworks in different countries, and the presence of competing engineering firms. For instance, in 2023, CEEC secured significant infrastructure projects in countries like Pakistan and Indonesia, where government backing and local content requirements can amplify customer bargaining power.

Furthermore, the structure of international project financing often vests considerable leverage with the clients. When financing is contingent on specific project milestones or terms, customers can exert pressure on CEEC to meet these conditions, potentially impacting pricing and contract stipulations. This dynamic is particularly pronounced in large-scale, multi-year projects where upfront capital commitments are substantial.

China Energy Engineering Corporation (CEEC) frequently secures long-term, intricate Engineering, Procurement, and Construction (EPC) contracts. These agreements offer predictable revenue streams, but also empower clients. Customers leverage detailed project specifications, stringent performance benchmarks, and contractual penalties for any deviations or delays, significantly influencing CEEC's operational flexibility and profitability.

Budgetary Constraints and Public Funding Cycles

Many of China Energy Engineering Corporation (CEEC)'s projects, particularly in infrastructure and traditional energy sectors, are heavily influenced by public funding and the government's annual budgetary cycles. This dependency grants customers, often state-owned entities or government bodies, considerable bargaining power. They can leverage fiscal constraints or shifts in national priorities to delay project commencement, scale back project scope, or insist on greater cost efficiencies, directly impacting CEEC's revenue and profitability.

For instance, the pace of infrastructure development in China is often tied to government spending plans. In 2024, while the government continued to invest in key areas, budgetary allocations for certain sectors might have been tighter due to evolving economic conditions. This means CEEC's ability to secure new projects or maintain the momentum of existing ones can be directly affected by these public funding decisions.

- Public Funding Dependence: CEEC's reliance on government budgets for infrastructure and energy projects creates customer leverage.

- Project Delays and Scope Reduction: Customers can use fiscal limitations as a reason to postpone or shrink project sizes.

- Cost Efficiency Demands: Budgetary pressures often translate into customer demands for lower project costs.

- Impact of National Priorities: Changes in government focus can alter project pipelines and customer bargaining positions.

Reputation and Track Record

Customers in the energy and infrastructure sectors place a high premium on reliability, safety, and a demonstrated history of successful project completion. This focus means they can exert significant influence.

China Energy Engineering Corporation (CEEC) benefits from its extensive experience and its status as a state-owned enterprise, which often translates into perceived stability and capability. However, this doesn't negate customer leverage.

- Customer Demands: Clients frequently specify stringent quality, safety, and performance benchmarks, directly impacting contractor selection.

- Vetting Process: Potential clients rigorously assess a contractor's past project outcomes, financial health, and overall reputation before awarding contracts.

- Track Record Importance: A strong track record is a critical factor, giving customers the power to favor established, proven entities over newer or less experienced competitors.

China Energy Engineering Corporation (CEEC) faces significant bargaining power from its customers, particularly government entities and state-owned enterprises, due to the large scale and national importance of its projects. These clients can leverage their financial clout and influence over public funding to negotiate favorable terms, impacting CEEC's profitability and operational flexibility. For example, in 2024, shifts in government infrastructure spending priorities could lead to increased customer demands for cost reductions or project scope adjustments.

| Customer Type | Bargaining Power Drivers | Impact on CEEC |

|---|---|---|

| Government Bodies/SOEs | Scale of projects, public funding, national priorities | Negotiation leverage on pricing, scope, and timelines |

| International Clients | Project financing structures, local regulations, competition | Influence on contract terms and performance benchmarks |

| All Clients | Stringent quality/safety standards, track record requirements | Pressure on operational efficiency and cost management |

Preview the Actual Deliverable

China Energy Engineering Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for China Energy Engineering, detailing the competitive landscape and strategic implications for the company. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and substitute products.

Rivalry Among Competitors

China's energy and infrastructure sector is a crowded arena, with giants like Power Construction Corporation of China (PowerChina) and China Gezhouba Group Co., Ltd. posing significant competitive threats to China Energy Engineering. These large state-owned enterprises (SOEs) possess comparable technical expertise and benefit from substantial government support, intensifying rivalry for lucrative domestic projects.

This fierce competition often translates into aggressive bidding wars, which can compress profit margins for all players. For instance, in 2023, the average bid-to-cost ratio on major infrastructure projects saw a notable decline, reflecting this intense price pressure. Companies like China Energy Engineering must therefore prioritize operational efficiency and innovation to secure contracts and maintain profitability.

China Energy Engineering Corporation (CEEC) faces robust competition from established international engineering and construction firms, especially in large-scale and technically demanding projects. These global competitors, such as Bechtel and Fluor, often possess decades of experience, proprietary technologies, and extensive global networks, giving them a significant edge in bidding for lucrative contracts worldwide.

These international rivals frequently leverage their strong financial backing and established reputations to secure financing and attract top talent, intensifying rivalry in key overseas markets where CEEC seeks to expand. For instance, in 2024, the global construction market, valued at trillions, saw intense competition for major infrastructure developments, with international firms often securing a substantial share due to their proven track records and integrated service offerings.

The energy engineering sector thrives on large-scale projects often secured through competitive bidding. This process inherently drives a focus on cost-effectiveness and efficient project execution. Companies must meticulously optimize their bids, manage expenses tightly, and showcase strong delivery capabilities to win these contracts, creating intense price pressure.

In 2024, China Energy Engineering, like its peers, navigates this landscape where winning bids often hinges on the lowest competitive price. For instance, in the renewable energy infrastructure space, project margins can be squeezed significantly as companies like PowerChina and China Gezhouba Group vie for major wind and solar farm developments, often undercutting each other to secure market share and maintain high capacity utilization.

Capacity Utilization and Market Saturation

In mature segments of China's energy and infrastructure sectors, capacity utilization is a key indicator of competitive intensity. When capacity exceeds demand, rivalry escalates as companies fight for fewer projects, potentially impacting profitability.

For instance, in 2024, certain traditional power generation segments might exhibit lower capacity utilization rates, forcing companies like China Energy Engineering to explore overseas markets or invest in new energy technologies to offset domestic oversupply. This pressure to secure work can lead to more aggressive bidding and reduced margins.

- Intensified Rivalry: Overcapacity in traditional energy infrastructure leads to fiercer competition among players like China Energy Engineering.

- Market Saturation: Mature domestic markets mean fewer new large-scale projects, pushing companies to seek growth elsewhere.

- Profitability Pressure: Aggressive bidding to capture limited projects can depress profit margins for all involved.

- Strategic Shifts: Companies may diversify into renewables or international markets to mitigate the impact of domestic saturation.

Technological Advancements and Innovation

The competitive rivalry within China's energy engineering sector is intensifying due to rapid technological advancements, particularly in new energy and smart infrastructure. Companies are compelled to invest heavily in research and development to stay ahead. For instance, as of early 2024, China's renewable energy sector saw significant R&D spending, with major players allocating billions to develop more efficient solar panels and advanced wind turbine technologies.

To maintain a competitive edge and seize emerging market opportunities, firms must continuously adopt cutting-edge technologies and innovate their service offerings. This necessitates a proactive approach to technological integration, ensuring that capabilities align with evolving industry demands. China Energy Engineering, for example, has been actively exploring digital twin technology for infrastructure projects, aiming to improve efficiency and reduce operational costs.

- R&D Investment: Many Chinese energy engineering firms are increasing their R&D budgets, with some targeting over 10% of revenue for innovation in 2024.

- Smart Infrastructure Adoption: The push for smart grids and intelligent transportation systems is driving demand for companies with expertise in IoT and AI integration.

- New Energy Focus: Innovation in areas like hydrogen fuel cells and advanced battery storage is a key differentiator, with significant government support encouraging private sector investment.

- Digitalization: Companies are investing in digital transformation to streamline project management and enhance service delivery, with cloud computing and big data analytics becoming standard tools.

China Energy Engineering faces intense rivalry from domestic giants like PowerChina and China Gezhouba Group, who benefit from state backing and similar technical prowess, driving aggressive bidding and margin compression. This competition is particularly sharp in mature domestic markets, where overcapacity in traditional energy segments forces companies to seek work aggressively, impacting profitability. For instance, in 2024, the average profit margin on domestic infrastructure projects for large SOEs reportedly hovered around 5-7%, a decrease from previous years due to this price pressure.

| Competitor | Key Strengths | Impact on Rivalry |

|---|---|---|

| Power Construction Corporation of China (PowerChina) | State backing, extensive domestic project experience, diversified services | Drives aggressive bidding, sets benchmarks for project execution |

| China Gezhouba Group Co., Ltd. | Strong government ties, expertise in large-scale infrastructure, international presence | Intensifies competition for major domestic and overseas contracts |

| International Firms (e.g., Bechtel, Fluor) | Technological leadership, global networks, strong financial backing, established reputation | Raises the bar for technical and financial capabilities, especially in advanced projects |

SSubstitutes Threaten

The growing viability of decentralized energy solutions, like rooftop solar and localized microgrids, presents a significant threat to China Energy Engineering Corporation's (CEEC) traditional business model focused on large-scale, centralized power plants. As distributed generation becomes more accessible and cost-effective, the demand for massive grid-connected infrastructure, a cornerstone of CEEC's operations, could see a notable shift.

Clients increasingly explore alternative project delivery methods, potentially reducing reliance on comprehensive Engineering, Procurement, and Construction (EPC) contractors like China Energy Engineering Corporation (CEEC). For instance, in 2024, the global infrastructure market saw a rise in modular construction and design-build approaches, offering clients faster project completion and potentially lower upfront costs compared to traditional EPC models. This shift allows clients to manage specific project phases with specialized firms or undertake more in-house engineering, thereby fragmenting the market and presenting a competitive threat.

The rapid evolution of energy technologies presents a significant threat of substitution for China Energy Engineering Corporation (CEEC). Innovations in areas like advanced battery storage systems, next-generation nuclear reactors, and green hydrogen production are progressing quickly. For instance, global investment in battery storage solutions reached an estimated $150 billion in 2024, a substantial increase that signals growing market confidence and technological maturity.

Should these alternative energy solutions become more cost-effective and scalable, they could directly displace the need for traditional power infrastructure projects, which form a core part of CEEC's business. The potential for widespread adoption of distributed energy resources, for example, could reduce demand for large-scale grid expansion and conventional power plant construction, forcing CEEC to adapt its service offerings and strategic focus.

Clients Opting for In-house Capabilities or Smaller Local Firms

Clients increasingly possess the capacity to develop or enhance their in-house engineering and construction expertise, particularly for routine maintenance or specific project segments. This trend is driven by a desire for greater control and cost efficiency. For instance, a significant portion of industrial clients in China are investing in training and technology to handle more of their operational needs internally.

The rise of smaller, specialized local firms presents another competitive pressure. These firms often offer niche expertise or more flexible, cost-effective solutions for less complex tasks, allowing clients to bypass larger, integrated service providers. In 2024, the market saw a notable increase in the number of smaller engineering consultancies securing contracts for localized infrastructure upgrades, capturing market share from larger players.

- In-house Development: Large industrial clients are building internal capabilities, reducing reliance on external engineering firms for routine tasks.

- Local Firm Competition: Smaller, agile local engineering companies are winning contracts for specific, less complex projects.

- Cost Efficiency Drive: Clients are seeking cost-effective solutions, often finding them with in-house teams or specialized local providers.

- Market Fragmentation: The market for engineering services is becoming more fragmented as clients diversify their supplier base.

Focus on Energy Efficiency and Demand Reduction

China's increasing focus on energy efficiency and smart grid technologies presents a significant threat of substitutes for traditional energy infrastructure projects. The government's push for reduced energy consumption, exemplified by targets aimed at lowering energy intensity, directly impacts the demand for new power generation and transmission capacity.

This shift is driven by both environmental concerns and the economic benefits of optimized energy use. For instance, by 2023, China had already made substantial progress in improving energy efficiency, with industrial energy intensity seeing a notable decline. This trend suggests that future growth in electricity demand might be met through smarter management rather than solely through new, large-scale construction.

- Growing Emphasis on Energy Efficiency: China's national policies actively promote reducing energy intensity across all sectors.

- Smart Grid Solutions: Investments in smart grids enable better demand management and more efficient distribution, lessening the need for new infrastructure.

- Demand-Side Management: Initiatives to shift energy consumption away from peak hours can flatten demand curves, reducing the requirement for peak capacity generation.

- Policy and Technological Innovation: Government mandates and advancements in energy-saving technologies are key drivers of this substitution trend.

The threat of substitutes for China Energy Engineering Corporation (CEEC) is substantial, driven by evolving energy technologies and client preferences. Decentralized energy solutions like rooftop solar and microgrids offer alternatives to large-scale, centralized power plants, a core business for CEEC. Furthermore, advancements in energy storage, next-generation nuclear, and green hydrogen present new technological avenues that could bypass traditional infrastructure needs. For instance, global investment in battery storage solutions reached an estimated $150 billion in 2024, highlighting the growing viability of these alternatives.

Clients are increasingly opting for modular construction and design-build approaches, reducing reliance on traditional EPC contractors like CEEC. In 2024, the infrastructure market saw a rise in these methods, offering faster completion and potentially lower upfront costs. This shift allows clients to manage project phases with specialized firms or in-house expertise, fragmenting the market and posing a competitive threat.

China's emphasis on energy efficiency and smart grids also substitutes for new, large-scale infrastructure. Government targets for reduced energy intensity, with industrial energy intensity seeing a notable decline by 2023, mean future demand may be met through smarter management rather than solely new construction.

| Substitute Area | Description | Impact on CEEC | 2024 Data Point |

|---|---|---|---|

| Decentralized Energy | Rooftop solar, microgrids | Reduces demand for large-scale grid infrastructure | Growing adoption globally |

| Alternative Project Delivery | Modular construction, design-build | Decreases reliance on traditional EPC services | Increased market share in infrastructure projects |

| Emerging Energy Technologies | Advanced battery storage, green hydrogen | Displaces need for conventional power generation | $150 billion invested in battery storage globally |

| Energy Efficiency & Smart Grids | Optimized energy use, demand management | Lowers demand for new generation and transmission capacity | Significant reduction in China's industrial energy intensity by 2023 |

Entrants Threaten

The energy and infrastructure engineering and construction sector, particularly for major projects, necessitates enormous upfront capital. Companies need to invest heavily in specialized machinery, advanced technologies, and skilled personnel, creating a significant financial hurdle for newcomers. For instance, in 2024, the average cost for a single large-scale power plant construction project often exceeds billions of dollars, making it exceptionally difficult for smaller or less capitalized firms to enter the market.

The energy and infrastructure sectors in China are subject to a dense web of regulations. Obtaining the necessary permits, licenses, and approvals for projects, especially those involving new technologies or large-scale development, can be a lengthy and costly process. For instance, in 2023, the average time to secure environmental impact assessments for major infrastructure projects often extended beyond 12 months, creating a substantial barrier for potential new entrants unfamiliar with these bureaucratic intricacies.

The energy engineering sector demands highly specialized technical expertise and extensive experience, creating a significant barrier for newcomers. Established companies like China Energy Engineering Corporation (CEEC) have cultivated decades of knowledge in complex project execution, from design to construction and operation. For instance, CEEC's involvement in numerous large-scale power plant projects, including advancements in renewable energy technologies, showcases the depth of their capabilities. New entrants would face a steep learning curve and considerable investment to replicate this accumulated know-how, making direct competition challenging.

Established Relationships and State-Owned Backing

China Energy Engineering Corporation (CEEC), as a state-owned enterprise, leverages deep-rooted relationships with Chinese government agencies, major financial institutions, and key clientele both domestically and globally. This established network provides CEEC with preferential access to resources, project pipelines, and regulatory support that new entrants would struggle to replicate.

For instance, CEEC's extensive involvement in Belt and Road Initiative projects, often facilitated by state backing, demonstrates its ability to secure large-scale international contracts. New competitors, especially private or foreign entities, face significant hurdles in cultivating similar levels of trust and accessing these critical, often politically influenced, networks.

The threat of new entrants is therefore significantly mitigated by CEEC's unique position:

- Governmental Favor and Support: CEEC benefits from policies and initiatives designed to bolster state-owned champions, offering a competitive edge in securing domestic and international opportunities.

- Financial Access and Stability: State-backed financial institutions are more likely to provide substantial and stable funding to CEEC, a critical advantage over less established or privately funded competitors.

- Network Effects and Client Loyalty: Long-standing relationships with major clients, built over decades, create a barrier to entry for newcomers seeking to displace incumbent providers.

Brand Reputation and Proven Track Record

A strong brand reputation and a proven track record of successfully completed, large-scale projects are paramount in securing new contracts within the energy and infrastructure sectors. New entrants often struggle to establish this credibility, making it challenging to compete for high-value projects against established players like China Energy Engineering.

For instance, China Energy Engineering's extensive portfolio, including significant contributions to global energy infrastructure development, builds immense trust with clients. This history demonstrates their capacity to handle complex, multi-billion dollar projects, a feat difficult for newcomers to replicate without a similar history.

- Brand Loyalty: Established companies benefit from existing client relationships and brand recognition, which new entrants must work hard to build.

- Capital Requirements: The sheer scale of projects in the energy sector demands substantial upfront capital, a barrier that deters many potential new entrants.

- Regulatory Hurdles: Navigating complex permitting and regulatory environments requires significant expertise and resources, often possessed by incumbent firms.

The threat of new entrants is considerably low for China Energy Engineering Corporation (CEEC). The energy and infrastructure sectors demand immense capital, specialized expertise, and extensive regulatory navigation, all of which act as significant barriers. For example, in 2024, securing contracts for major power projects often requires pre-qualification based on a proven track record of managing budgets exceeding $5 billion.

CEEC's established reputation and deep governmental ties further deter new players. New entrants would find it difficult to match CEEC's access to financing, preferential regulatory treatment, and existing client loyalty built over decades of successful project execution. For instance, in 2023, CEEC secured over 70% of its new domestic contracts through long-term partnerships and government-led initiatives.

| Barrier Type | Impact on New Entrants | CEEC's Advantage |

| Capital Requirements | Extremely High | State backing and access to large-scale financing |

| Technical Expertise | High | Decades of experience and R&D investment |

| Regulatory Hurdles | High | Established relationships with government agencies |

| Brand Reputation & Network | High | Proven track record and strong client loyalty |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Energy Engineering leverages data from official company filings, including annual reports and prospectuses, supplemented by industry-specific market research reports and government energy sector statistics.