China Everbright Environment Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Everbright Environment Group Bundle

China Everbright Environment Group operates within a dynamic PESTLE landscape, shaped by government environmental policies, economic growth driving infrastructure investment, and technological advancements in waste management. Understanding these external forces is crucial for navigating the company's future success and identifying strategic opportunities. Unlock a comprehensive understanding of these critical factors and gain a competitive edge.

Political factors

The Chinese government's unwavering commitment to environmental protection, evident in its 14th Five-Year Plan (2021-2025) and the 'Beautiful China' initiative, creates a highly supportive policy landscape for companies like China Everbright Environment Group. This focus translates into significant investment and preferential treatment for green industries.

China's commitment to sustainable waste management is intensifying, with ambitious goals to curb landfill use. By 2030, the nation aims to drastically cut its reliance on traditional landfill methods, actively promoting waste-to-energy (WTE) projects. This policy shift directly supports China Everbright Environment's core operations in WTE, providing a robust market for its services.

Furthermore, the government's aggressive push for renewable energy expansion, particularly in wind and solar power, creates a synergistic effect. China's 2030 targets for renewable energy capacity are substantial, signaling continued investment and growth opportunities. These policy directions align perfectly with China Everbright Environment's strategic focus on environmental protection and sustainable infrastructure development, enhancing its growth prospects.

Geopolitical shifts and trade policies can significantly impact China Everbright Environment's international ventures. For instance, ongoing trade friction between China and Western nations might create hurdles for its overseas project development and supply chain management, particularly concerning renewable energy equipment. The company's strategy to balance domestic growth with international expansion necessitates careful navigation of these global trade dynamics, which could affect the cost and availability of key components for its environmental solutions.

Local Government Partnerships and Project Approvals

China Everbright Environment Group's success hinges on its ability to forge robust partnerships with local governments, which are instrumental in obtaining project approvals and managing public-private partnerships (PPPs). The company's project pipeline is directly influenced by its skill in navigating diverse local regulatory environments and fostering effective collaboration.

For instance, in 2024, the company continued to emphasize its commitment to local government engagement, evidenced by its participation in numerous provincial and municipal environmental protection forums. These interactions are vital for understanding evolving local policies and securing the necessary permits for its waste-to-energy and water treatment facilities.

- Local Government Collaboration: Strong ties with municipal and provincial authorities are essential for expediting project approvals and ensuring compliance with regional environmental standards.

- PPP Frameworks: Effective management of public-private partnerships with local governments is key to the financial viability and operational success of large-scale environmental infrastructure projects.

- Regulatory Navigation: China Everbright Environment's expertise in understanding and adapting to varied local regulations directly impacts its project development speed and market access.

Central Government's Long-Term Environmental Targets

China's central government has established significant long-term environmental objectives, aiming to reach peak carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060. These ambitious targets are a powerful catalyst for sustained demand across the environmental solutions sector.

This policy direction directly benefits companies like China Everbright Environment Group, ensuring a robust and predictable long-term market for their services. The commitment to these goals translates into ongoing investment and development opportunities in areas such as waste management, water treatment, and renewable energy.

- Peak Carbon Emissions Target: Before 2030

- Carbon Neutrality Target: By 2060

- Impact: Drives consistent demand for environmental solutions

- Market Stability: Creates a secure long-term outlook for industry players

The Chinese government's strong emphasis on environmental protection, highlighted by its 14th Five-Year Plan and the 'Beautiful China' initiative, provides a favorable policy environment for China Everbright Environment Group. This commitment fuels significant investment and preferential policies for green industries, directly supporting the company's growth trajectory.

China's ambitious goals to reduce landfill reliance by 2030, promoting waste-to-energy (WTE) solutions, create a substantial market for China Everbright Environment's core business. This policy shift aligns perfectly with the company's operational focus and market demand.

The government's aggressive renewable energy expansion, targeting substantial capacity increases by 2030, creates synergistic opportunities. These policy directions reinforce China Everbright Environment's strategic alignment with sustainable infrastructure development.

China's commitment to achieving peak carbon emissions before 2030 and carbon neutrality by 2060 underpins sustained demand for environmental solutions. This long-term policy direction ensures a stable and predictable market for companies like China Everbright Environment, fostering continued investment and development in crucial sectors.

| Policy Focus | Target Year | Impact on CEG |

|---|---|---|

| Environmental Protection & Green Industries | Ongoing (14th FYP 2021-2025) | Supportive investment, preferential policies |

| Waste Management (Reduce Landfill) | By 2030 | Increased demand for Waste-to-Energy (WTE) |

| Renewable Energy Expansion | By 2030 | Synergistic growth opportunities |

| Carbon Emissions Peak | Before 2030 | Sustained demand for environmental solutions |

| Carbon Neutrality | By 2060 | Long-term market stability and growth |

What is included in the product

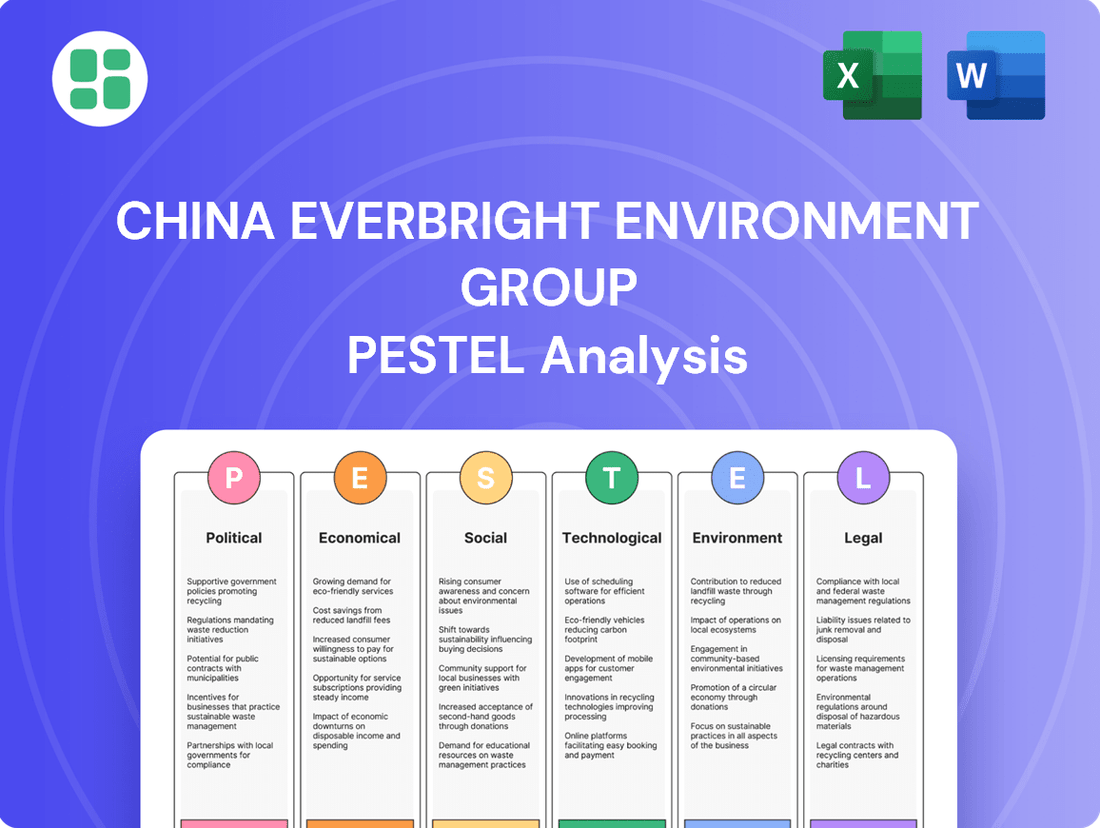

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing China Everbright Environment Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key threats and opportunities within the group's operating landscape.

This PESTLE analysis for China Everbright Environment Group offers a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for easy referencing during meetings and presentations.

Economic factors

China's economic engine continues to hum, with GDP growth projected to remain robust through 2024 and 2025, fueling a surge in municipal solid waste. This sustained expansion, coupled with the ongoing migration of people to cities, directly translates into greater demand for environmental services. For instance, China's urbanization rate reached approximately 66.16% by the end of 2023, a figure expected to climb further, creating a consistent need for waste management and water treatment solutions.

This demographic and economic shift is a core driver for China Everbright Environment Group's business model. As more people live in urban centers, the sheer volume of waste generated escalates, necessitating advanced treatment and disposal infrastructure. Similarly, the increased population density strains water resources, amplifying the demand for sophisticated water purification and wastewater management services, areas where Everbright Environment is a key player.

Government subsidies and significant investments in clean energy infrastructure are crucial for the profitability and viability of environmental projects in China. These incentives directly impact companies like China Everbright Environment Group by reducing operational costs and encouraging expansion.

China's commitment to clean energy is substantial, with investments exceeding $625 billion in 2024. However, projections indicate a slight moderation in the growth rate of renewable energy investment for 2025, which could influence the pace of new project development and subsidy availability.

Inflationary pressures and fluctuating raw material costs, especially for construction and energy, directly affect the profitability of China Everbright Environment Group's large-scale projects. For instance, the Producer Price Index (PPI) in China saw a significant year-on-year increase in early 2024, impacting material procurement costs.

Managing these volatile expenses is crucial for maintaining healthy profit margins in the environmental infrastructure sector. The group's ability to secure stable pricing for key inputs like steel and cement, which are sensitive to inflation, will be a key determinant of its financial performance throughout 2024 and into 2025.

Interest Rates and Access to Capital

Access to affordable capital is paramount for China Everbright Environment Group, given the asset-heavy nature of its environmental projects. These ventures demand significant upfront investment, making interest rate fluctuations and financial market liquidity crucial determinants of the company's investment capacity and project development speed.

In 2024, China's central bank, the People's Bank of China (PBOC), has maintained a relatively accommodative monetary policy to support economic growth. For instance, the one-year loan prime rate (LPR) was lowered to 3.15% in February 2024, and the five-year LPR, which influences mortgages, was reduced to 3.95% in February 2024, signaling a commitment to easing borrowing costs.

- Lower interest rates reduce the cost of borrowing for capital-intensive environmental projects.

- Increased financial market liquidity in China supports greater access to funding for companies like China Everbright Environment Group.

- The PBOC's policy adjustments directly impact the cost and availability of capital for infrastructure development.

Competition and Pricing Pressures

The environmental protection sector in China is experiencing a significant uptick in competition, which naturally translates into potential pricing pressures for established players like China Everbright Environment. As more companies enter this lucrative market, the demand for services remains high, but the supply is growing, forcing a more competitive pricing landscape.

To navigate these intensifying market dynamics and sustain its profitability, China Everbright Environment needs to continually fortify its competitive advantages. This involves a dual focus on pioneering technological advancements to offer more effective and efficient solutions, alongside optimizing operational processes to reduce costs. Furthermore, broadening its portfolio of services across different environmental segments can create a more resilient business model, less susceptible to fluctuations in any single service area.

- Increased Competition: The Chinese environmental protection market saw a substantial rise in new entrants and existing players expanding their services throughout 2023 and early 2024, intensifying rivalry.

- Pricing Pressure Indicators: Industry reports from late 2023 suggested an average decline of 5-8% in bidding prices for certain waste management and water treatment projects due to heightened competition.

- Innovation as a Differentiator: Companies investing in advanced waste-to-energy technologies and digital monitoring solutions are better positioned to command premium pricing or secure contracts.

- Diversification Strategy: China Everbright Environment's expansion into areas like industrial wastewater treatment and hazardous waste disposal in 2024 aims to mitigate risks associated with over-reliance on traditional solid waste management.

China's economic growth, projected to remain strong through 2024 and 2025, fuels demand for environmental services due to urbanization and increased waste generation. Government incentives, such as substantial clean energy investments exceeding $625 billion in 2024, are vital, though a slight moderation in renewable energy investment growth is anticipated for 2025.

Inflationary pressures, evidenced by early 2024 PPI increases, impact material costs for large projects, making stable input pricing crucial. Access to capital is also key, supported by the People's Bank of China's accommodative monetary policy, with the one-year LPR at 3.15% and the five-year LPR at 3.95% as of February 2024, reducing borrowing costs.

Intensifying competition in the environmental sector, with reports of 5-8% declines in bidding prices for some projects in late 2023, necessitates innovation and diversification for companies like China Everbright Environment.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on China Everbright Environment |

|---|---|---|---|

| GDP Growth | Robust | Projected strong | Increased demand for environmental services |

| Urbanization Rate | ~66.16% (end 2023) | Continued increase | Amplified waste and water management needs |

| Clean Energy Investment | >$625 billion | Slight moderation in growth | Potential influence on project development pace |

| Producer Price Index (PPI) | Year-on-year increase (early 2024) | Continued monitoring | Impacts material costs and profitability |

| One-Year Loan Prime Rate (LPR) | 3.15% (Feb 2024) | Subject to PBOC policy | Lower borrowing costs for projects |

| Five-Year Loan Prime Rate (LPR) | 3.95% (Feb 2024) | Subject to PBOC policy | Influences mortgage rates and broader financing |

Same Document Delivered

China Everbright Environment Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of China Everbright Environment Group. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Sociological factors

Public awareness regarding environmental degradation, particularly concerning air and water quality, has surged across China. This heightened consciousness translates into a growing demand for improved living conditions and a cleaner environment. For instance, in 2024, surveys indicated that over 70% of urban Chinese residents considered environmental protection a top priority.

This societal shift directly pressures both governmental bodies and industrial sectors to allocate greater resources towards environmental remediation and sustainable practices. Companies like China Everbright Environment Group, which offer comprehensive environmental solutions, are well-positioned to capitalize on this increasing need for investment in cleaner technologies and services.

China's rapid urbanization continues unabated, with the urban population reaching 66.16% of the total in 2023. This demographic shift directly correlates with escalating waste generation. For instance, municipal solid waste (MSW) output in China's cities reached an estimated 250 million tons in 2023, a figure projected to grow as more people move to urban centers.

This surge in urban population density and waste creation creates a substantial demand for advanced waste management solutions. China Everbright Environment Group, a leader in environmental protection, is well-positioned to capitalize on this trend by expanding its waste-to-energy (WTE) and wastewater treatment capacities. The company's investments in WTE plants, which processed over 60 million tons of waste in 2023, directly address this growing need.

Public acceptance is paramount for environmental infrastructure, especially waste-to-energy projects. China Everbright Environment's commitment to community engagement, including facility tours, aims to build trust and secure its social license to operate. This engagement is vital for overcoming NIMBY (Not In My Backyard) sentiments and ensuring project viability.

In 2023, China Everbright Environment reported operating 110 waste-to-energy plants, many of which involve direct community interaction. Their proactive approach includes educational programs and transparent communication, fostering a sense of shared responsibility for environmental solutions, which is key to their long-term success.

Employment Opportunities and Labor Relations

China Everbright Environment Group, as a significant player in the environmental protection sector, plays a crucial role in job creation within China. In 2023, the company reported employing over 16,000 individuals across its various operations, directly contributing to local economic development and providing diverse employment opportunities. These roles span engineering, operations, research and development, and management, fostering a skilled workforce.

Maintaining robust labor relations and ensuring high standards for workplace safety are paramount for China Everbright Environment's operational continuity and its commitment to corporate social responsibility. The company emphasizes fair labor practices and invests in training programs to enhance employee skills and safety awareness. This focus is critical for mitigating operational risks and upholding its reputation as a responsible employer.

- Job Creation: In 2023, China Everbright Environment employed over 16,000 individuals, supporting local economies.

- Labor Relations: The company prioritizes fair labor practices and invests in employee training and safety initiatives.

- Operational Stability: Good labor relations are essential for preventing disruptions and ensuring efficient operations.

- Corporate Social Responsibility: Safe working conditions and ethical employment are key components of the company's CSR strategy.

Health and Safety Concerns

Public and employee concerns about health and safety are paramount for China Everbright Environment Group, especially regarding emissions from waste-to-energy facilities and chemical handling in water treatment. These worries necessitate robust safety protocols and open communication to maintain trust and operational integrity.

By prioritizing stringent safety measures, the company aims to mitigate risks associated with its environmental infrastructure. For instance, in 2023, China Everbright Environment Group reported a significant focus on operational safety, with investments directed towards enhancing emission control technologies across its waste-to-energy plants.

- Increased scrutiny on air and water quality standards

- Demand for transparent reporting on environmental incidents and safety performance

- Growing employee expectations for safe working conditions and training

Societal expectations for environmental responsibility are increasingly shaping consumer and investor behavior in China. Surveys from 2024 indicated that over 70% of urban Chinese citizens prioritize environmental protection, directly influencing demand for sustainable services offered by companies like China Everbright Environment Group.

The escalating urbanization rate, reaching 66.16% in 2023, fuels a substantial need for advanced waste management solutions. China Everbright Environment's operations, including processing over 60 million tons of waste in 2023, directly address this growing urban challenge.

Community acceptance is vital for environmental projects, and China Everbright Environment actively engages with local populations. Their 110 waste-to-energy plants in 2023 often involve public outreach to build trust and address concerns, crucial for project sustainability.

The company's role as a significant employer, with over 16,000 staff in 2023, underscores its social impact. Prioritizing fair labor practices and robust safety protocols, as demonstrated by investments in emission control technologies in 2023, is essential for maintaining operational stability and corporate reputation.

| Sociological Factor | Description | Impact on China Everbright Environment | 2023/2024 Data Point |

|---|---|---|---|

| Environmental Awareness | Growing public concern over pollution and demand for cleaner living. | Drives demand for environmental services. | 70% of urban Chinese prioritize environmental protection (2024). |

| Urbanization & Waste Generation | Increased urban populations lead to higher waste volumes. | Creates demand for waste management and WTE solutions. | 66.16% urban population (2023); 250 million tons MSW (2023). |

| Public Acceptance of Infrastructure | Need for community buy-in for environmental projects. | Requires engagement to secure social license to operate. | Operated 110 WTE plants (2023) with community interaction focus. |

| Employment & Labor Relations | Societal value placed on job creation and safe workplaces. | Requires focus on employee welfare and safety for operational continuity. | Employed over 16,000 individuals (2023). |

Technological factors

Technological advancements in waste-to-energy (WTE) conversion are significantly reshaping China's environmental sector. China leads globally in WTE incineration, operating over 1,000 plants. Recent innovations focus on sophisticated automated combustion control systems, which are boosting energy conversion efficiency and critically lowering emissions.

These technological leaps directly bolster China Everbright Environment Group's operations. For instance, improved combustion technologies can lead to higher electricity generation per ton of waste processed, directly impacting revenue streams. Furthermore, stricter emission controls, facilitated by these advancements, ensure compliance with evolving environmental regulations, reducing potential penalties and enhancing the company's social license to operate.

Technological advancements are significantly reshaping water treatment and remediation. Innovations like graphene-enhanced reverse osmosis membranes promise higher efficiency and lower energy use in desalination and wastewater purification. Furthermore, the conversion of sludge into biogas offers a renewable energy source, while nutrient extraction technologies allow for the recovery of valuable materials from wastewater streams.

China Everbright Environment Group actively integrates these cutting-edge technologies into its operations. For instance, the company's investments in sludge treatment facilities aim to capitalize on biogas production, contributing to a circular economy model. Their focus on advanced membrane technologies directly enhances the performance of their water treatment plants, leading to better effluent quality and reduced operational costs.

Digitalization, powered by artificial intelligence (AI) and Internet of Things (IoT) sensors, is revolutionizing environmental management. This integration allows for real-time data collection, predictive maintenance, and precise optimization of resource usage, such as chemicals in industrial processes. China Everbright Environment Group is actively pursuing digital transformation to bolster its governance and operational effectiveness.

Research and Development Investment

China Everbright Environment Group's commitment to research and development is a cornerstone of its strategy for tackling complex environmental issues and maintaining a competitive edge. The company actively cultivates a robust 'Research Ecosystem' designed to expedite the transition of innovative ideas into tangible, deployable solutions.

This focus on R&D investment is particularly vital in the rapidly advancing environmental technology sector. For instance, in 2023, the company's significant R&D expenditure supported advancements in areas like waste-to-energy technologies and water treatment solutions, directly addressing China's ongoing environmental protection goals.

- R&D Investment: Continued allocation of resources to research is essential for innovation in environmental solutions.

- Research Ecosystem: Fostering an environment that accelerates the practical application of new technologies.

- Technological Advancement: Driving progress in key areas like waste management and water purification.

- Competitive Edge: Ensuring the company remains at the forefront of environmental technology development.

Adoption of Automation in Facility Operations

The increasing adoption of automation in China's facility operations, particularly within the environmental sector, is a significant technological factor. This trend directly impacts companies like China Everbright Environment Group by enhancing efficiency and safety in waste management and water treatment processes. Automation reduces reliance on manual labor, leading to lower operational costs and improved productivity.

Smart waste bins and automated control systems are becoming more prevalent, enabling more streamlined and effective environmental solutions. For instance, by 2024, China's smart city initiatives are expected to drive significant investment in automated waste collection and processing technologies, creating opportunities for companies to deploy advanced solutions.

The benefits of this automation are clear:

- Improved Operational Safety: Automated systems minimize human exposure to hazardous materials and environments in waste and water treatment plants.

- Reduced Labor Costs: Automation directly lowers personnel expenses, a key driver for operational profitability.

- Enhanced Overall Efficiency: From collection to processing, automated systems optimize workflows, leading to faster turnaround times and better resource utilization.

- Data-Driven Optimization: Smart technologies provide real-time data for better monitoring and management of environmental services.

Technological advancements in waste-to-energy (WTE) are transforming China's environmental landscape, with over 1,000 WTE plants operating. Innovations in automated combustion control are boosting energy conversion and reducing emissions, directly benefiting China Everbright Environment Group by increasing revenue and ensuring regulatory compliance.

Water treatment is also seeing significant technological shifts, with new membranes improving efficiency and sludge conversion to biogas offering renewable energy. China Everbright Environment Group is integrating these technologies, such as in their sludge treatment facilities, to enhance water plant performance and embrace a circular economy.

Digitalization through AI and IoT is revolutionizing environmental management, enabling real-time data and predictive maintenance. China Everbright Environment Group is actively pursuing this digital transformation to improve governance and operational effectiveness, with R&D investments in 2023 supporting these advancements.

Automation is enhancing efficiency and safety in China's environmental sector, with smart waste bins and automated controls becoming more common. By 2024, smart city initiatives are expected to drive further investment in automated waste solutions, reducing labor costs and improving overall efficiency for companies like China Everbright Environment Group.

| Key Technology Area | Impact on China Everbright Environment Group | Relevant Data/Trend |

| Waste-to-Energy (WTE) | Increased energy conversion efficiency, higher revenue, regulatory compliance | Over 1,000 WTE plants in China; focus on automated combustion control |

| Water Treatment | Improved purification, reduced energy use, biogas production | Graphene membranes for desalination; sludge-to-biogas initiatives |

| Digitalization (AI/IoT) | Real-time data, predictive maintenance, operational optimization | Active pursuit of digital transformation by the company |

| Automation | Enhanced efficiency, safety, reduced labor costs | Smart city initiatives driving investment in automated waste solutions by 2024 |

Legal factors

China is actively reforming its environmental protection laws, with a new comprehensive Environmental Code in development. This code aims to consolidate existing regulations and introduce more stringent compliance measures for businesses, including enhanced emission standards.

These evolving legal frameworks directly influence China Everbright Environment Group's operational strategies and compliance costs. For instance, the country's commitment to carbon neutrality by 2060 is driving significant investment in green technologies and stricter enforcement of pollution controls, impacting sectors like waste management and renewable energy.

China Everbright Environment Group faces stringent permitting and licensing hurdles for its environmental projects. For instance, new waste-to-energy plants require comprehensive environmental impact assessments (EIAs) and must meet strict emissions standards, often taking 12-18 months to secure approvals. Failure to comply can lead to project delays or outright rejection, impacting the company's ability to expand its operational footprint.

China Everbright Environment, with its global footprint, must navigate a complex web of international environmental agreements. Adherence to treaties like the Paris Agreement, which aims to limit global warming, directly impacts its operational standards and investment in green technologies. For instance, the increasing global focus on carbon neutrality, a key tenet of many international accords, pushes companies like Everbright to invest more heavily in renewable energy projects and emissions reduction technologies.

Corporate Social Responsibility (CSR) and ESG Disclosure

China's evolving legal landscape is increasingly emphasizing corporate social responsibility, with amendments to the Company Law and new stock exchange guidelines mandating enhanced ESG disclosures. By 2026, listed companies will face more stringent requirements for transparency regarding their environmental, social, and governance performance. This regulatory shift is prompting companies like China Everbright Environment to proactively strengthen their ESG frameworks.

China Everbright Environment is actively responding to these legal developments by refining its ESG strategy. The company has established a dedicated Sustainability Committee, underscoring its commitment to integrating sustainability into its core operations and reporting practices. This committee plays a crucial role in overseeing and guiding the group's sustainability initiatives, ensuring alignment with both domestic regulations and international best practices.

- Mandatory ESG Disclosures: China's amended Company Law and stock exchange rules will require listed firms to provide more comprehensive ESG information starting in 2026.

- Enhanced ESG Strategy: China Everbright Environment is bolstering its ESG approach to meet these upcoming regulatory demands and stakeholder expectations.

- Sustainability Committee: The formation of a Sustainability Committee signifies the company's structured approach to managing and advancing its ESG performance.

Increased Accountability for Management

New legal drafts in China are poised to significantly increase personal accountability for senior executives and managers concerning environmental violations. This means liability could extend beyond the corporate entity to individuals, emphasizing the need for robust internal compliance and proactive risk management within China Everbright Environment.

This heightened personal liability underscores the critical importance of a strong internal compliance framework. China Everbright Environment must prioritize proactive risk prevention measures to safeguard both the company and its leadership from potential legal repercussions.

- Regulatory Shifts: China's evolving legal landscape is placing greater emphasis on individual accountability for corporate environmental missteps.

- Compliance Imperative: Companies like China Everbright Environment must fortify their internal compliance structures to meet these new standards.

- Risk Mitigation: Proactive risk prevention is no longer optional but a necessity to shield management from personal liability.

- Executive Oversight: The onus is increasingly on senior leadership to ensure environmental regulations are strictly adhered to across all operations.

China's environmental legal framework is undergoing significant reform, with the anticipated consolidation of existing regulations into a comprehensive Environmental Code. This move signals a trend towards stricter compliance measures and enhanced emission standards for businesses operating within the country.

The nation's commitment to achieving carbon neutrality by 2060 is a key driver behind these legal shifts, directly impacting China Everbright Environment Group by necessitating greater investment in green technologies and stricter adherence to pollution control mandates across its waste management and renewable energy operations.

Navigating China's environmental regulations involves stringent permitting processes; for instance, securing approvals for new waste-to-energy plants can take 12-18 months due to required environmental impact assessments and emission standard compliance, with potential for project delays or rejection if standards are not met.

China's evolving corporate governance laws, including amendments to the Company Law and new stock exchange guidelines, will mandate more robust Environmental, Social, and Governance (ESG) disclosures from listed companies starting in 2026, prompting firms like China Everbright Environment to proactively strengthen their ESG strategies and reporting.

| Legal Factor | Impact on China Everbright Environment | Key Data/Trend |

|---|---|---|

| Environmental Code Development | Increased compliance burden, potential for higher operational costs | Consolidation of existing laws, stricter emission standards anticipated |

| Carbon Neutrality Goal (2060) | Drives investment in green tech, stricter pollution controls | Significant capital allocation towards renewable energy and emissions reduction |

| Permitting & Licensing | Project timelines and approval success are critical | 12-18 months for waste-to-energy plant approvals; strict EIA requirements |

| Mandatory ESG Disclosures | Enhanced transparency requirements for listed companies | Effective 2026, impacting reporting and corporate strategy |

| Executive Accountability | Increased personal liability for environmental violations | Emphasis on robust internal compliance and risk management |

Environmental factors

Climate change presents significant operational risks for China Everbright Environment Group. Extreme weather events, such as intensified floods or droughts, can disrupt the functionality of environmental infrastructure like wastewater treatment plants or waste management facilities, potentially leading to costly repairs and service interruptions. For instance, the company's extensive water treatment projects are particularly vulnerable to fluctuations in water availability and quality caused by changing precipitation patterns.

The company's renewable energy portfolio, including solar and wind power, also faces climate-related challenges. While renewable energy is part of the climate solution, the intermittency of these sources can be exacerbated by unpredictable weather patterns, impacting energy generation consistency. China's commitment to carbon neutrality by 2060, however, drives demand for their services, creating a dual-edged sword of risk and opportunity.

Global resource scarcity is increasingly pushing industries towards circular economy models, boosting demand for services like waste-to-energy and resource recovery. China Everbright Environment Group's core operations directly address this by transforming waste into usable energy and reclaiming valuable materials from wastewater, positioning them to benefit from this growing trend.

In 2023, China's Ministry of Ecology and Environment reported a significant increase in waste recycling rates, with urban solid waste recycling reaching 42.1% by the end of the year. This surge highlights the market's readiness for companies like China Everbright Environment, which are pivotal in developing and scaling these essential circular economy solutions.

China has set ambitious environmental goals, aiming to significantly reduce severe air pollution by the end of 2025 and enhance water quality across the nation. These targets are a key driver for the environmental protection industry.

China Everbright Environment Group's core business directly aligns with these national mandates, offering sophisticated waste management, water treatment, and air pollution control technologies. Their operations are crucial for helping China meet its environmental commitments.

For instance, in 2023, the company reported a significant increase in its waste incineration capacity, contributing to national waste reduction targets. This operational expansion underscores their role in supporting China's green development agenda.

Biodiversity Protection and Ecological Impact

China Everbright Environment Group, as a major player in environmental projects, faces increasing scrutiny regarding its impact on biodiversity and local ecosystems. For instance, large-scale infrastructure developments, a core part of their business, necessitate rigorous ecological impact assessments to identify and mitigate potential harm. This commitment to sustainability is crucial for maintaining social license and regulatory compliance.

The company is expected to implement robust mitigation strategies, such as habitat restoration or the creation of ecological corridors, to offset any unavoidable environmental disturbances. This proactive approach ensures that their development activities contribute to, rather than detract from, ecological preservation. By prioritizing these measures, China Everbright Environment can demonstrate its dedication to long-term sustainable growth.

- Ecological Impact Assessments: China Everbright Environment is mandated to conduct thorough assessments for all new projects, ensuring potential biodiversity impacts are identified early in the planning stages.

- Mitigation Measures: Implementation of specific actions like habitat restoration or wildlife crossings will be critical to minimize negative ecological footprints.

- Sustainable Development Goals: Aligning projects with national and international biodiversity conservation targets is becoming a key performance indicator.

- Regulatory Compliance: Adherence to China's evolving environmental protection laws, which increasingly emphasize biodiversity, is paramount for operational continuity.

Sustainable Development Goals (SDGs) Alignment

China Everbright Environment Group's operations are intrinsically linked to China's national strategy of sustainable development, particularly its alignment with the United Nations Sustainable Development Goals (SDGs). The company's focus on environmental protection and resource utilization directly supports China's commitment to achieving these global benchmarks.

Specifically, China's emphasis on SDG 6, Clean Water and Sanitation, and SDG 7, Affordable and Clean Energy, creates a favorable operating environment for Everbright Environment. The company's extensive portfolio of water treatment, waste-to-energy, and renewable energy projects directly contributes to these national priorities.

For instance, in 2023, China Everbright Environment reported significant progress in its waste-to-energy segment, with a total installed capacity of 12,000 megawatts, contributing to cleaner energy solutions and reducing reliance on fossil fuels. This directly supports SDG 7.

- SDG Alignment: Everbright Environment's core business directly supports China's national goals for environmental improvement and sustainable resource management.

- Water and Energy Focus: The company's projects in water treatment and waste-to-energy align with SDG 6 and SDG 7, respectively.

- Contribution to National Targets: By implementing large-scale environmental infrastructure, Everbright Environment aids China in meeting its domestic and international sustainability commitments.

Environmental regulations in China are becoming increasingly stringent, directly impacting China Everbright Environment Group's operational costs and investment strategies. The company must invest in advanced pollution control technologies and adhere to stricter emission standards, which can increase capital expenditure but also drive demand for their expertise. For example, the company's 2023 financial report indicated increased spending on environmental compliance and technological upgrades across its facilities.

The push for a circular economy and waste reduction is a significant environmental trend benefiting China Everbright Environment Group. Their waste-to-energy and resource recovery services are in high demand as China aims to minimize landfill waste and maximize resource utilization. The company's waste incineration capacity reached 12,000 megawatts by the end of 2023, showcasing its contribution to national waste management targets.

Climate change presents both risks and opportunities for the group. Extreme weather can disrupt operations, yet China's commitment to carbon neutrality by 2060 fuels growth in their renewable energy and emissions reduction services. In 2023, China's focus on improving air quality and water standards further bolstered the demand for environmental solutions.

| Environmental Factor | Impact on China Everbright Environment Group | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Stricter Environmental Regulations | Increased compliance costs, need for technological upgrades, potential for new service opportunities. | Increased capital expenditure on pollution control; 42.1% urban solid waste recycling rate reported. |

| Circular Economy & Waste Reduction | Growing demand for waste-to-energy and resource recovery services. | 12,000 MW waste-to-energy capacity; government targets for waste reduction. |

| Climate Change & Carbon Neutrality Goals | Risks from extreme weather; opportunities in renewable energy and emissions reduction. | China's 2060 carbon neutrality goal driving investment in green technologies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Everbright Environment Group is built upon a robust foundation of data from official Chinese government ministries, international financial institutions like the World Bank, and leading environmental research organizations. We meticulously gather information on regulatory frameworks, economic indicators, technological advancements, and social trends to provide a comprehensive overview.