China Everbright Environment Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Everbright Environment Group Bundle

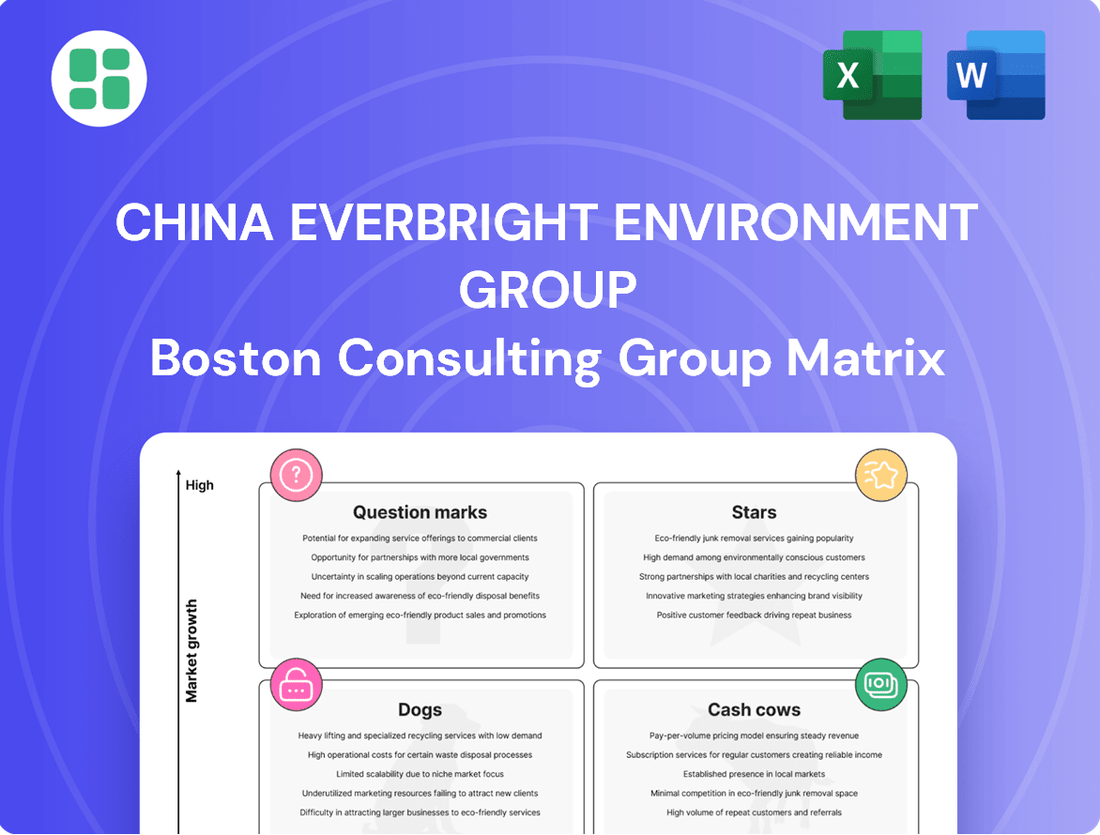

Curious about China Everbright Environment Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's market share and growth potential, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full strategic advantage by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each business unit's performance, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable insights that will drive your own strategic planning. Invest in the full China Everbright Environment Group BCG Matrix today and navigate the competitive landscape with confidence.

Stars

China Everbright Environment Group's Waste-to-Energy (WTE) expansion firmly places it as a Star in the BCG matrix. As the world's leading WTE investor and operator, the company is capitalizing on a high-growth market, especially in the Asia-Pacific region, which is experiencing rapid expansion of WTE facilities. The global WTE market is anticipated to see substantial growth, signaling robust future demand for Everbright's core services.

The company's commitment to new WTE projects and enhancing operational efficiency in 2024 underscores its market leadership and growth trajectory. This strategic focus on WTE continues to be a significant driver of revenue and a key pillar of the Group's overall strategy, reinforcing its position as a market leader.

China Everbright Water is making significant strides in advanced industrial wastewater treatment, a key area for China Everbright Environment Group's BCG classification. In 2024, the company secured new contracts, adding substantial treatment capacity. This expansion is driven by China's heightened emphasis on industrial environmental regulations and water quality enhancements.

This segment offers higher profit margins compared to other water treatment services, reflecting its specialized nature. China Everbright Water's dedication to technological advancement, evidenced by new patents in this field, positions it well to capitalize on the growing demand for sophisticated water solutions.

China Everbright Environment Group's solar power and energy storage solutions are positioned as a star in its BCG matrix, driven by China's ambitious carbon neutrality goals and a surge in renewable energy adoption. The company is strategically increasing its installed capacity in these segments, directly supporting national clean energy development objectives. This focus places them in a high-growth market where they are actively building significant market share, with solar power capacity alone reaching substantial figures as of 2024.

Integrated Urban Environmental Services

China Everbright Environment Group is making significant strides in integrated urban environmental services, a move that aligns with China's push for smarter, more sustainable cities. This expansion into areas like waste sorting and sanitation integration is a strategic play, capitalizing on robust urbanization and supportive government policies. These services are typically asset-light, presenting a pathway for diversified revenue streams in a market increasingly demanding holistic waste management. For instance, in 2023, the company secured new contracts for integrated urban environmental improvement projects, further solidifying its presence in this domain.

The company's commitment to digitalization is a key differentiator. By implementing smart waste management systems that utilize the Internet of Things (IoT), Everbright Environment is not only optimizing operational efficiency but also creating a more data-driven approach to environmental services. This technological edge is crucial in a sector that is rapidly evolving. Their focus on comprehensive solutions positions them well to capture a larger share of this burgeoning market.

Key aspects of their integrated urban environmental services strategy include:

- Waste Sorting and Resource Utilization: Developing advanced systems for efficient waste segregation and promoting the circular economy.

- Sanitation Integration: Offering end-to-end urban sanitation solutions, from collection to disposal and treatment.

- Environmental Industrial Parks: Creating centralized hubs for various environmental treatment processes, fostering synergy and efficiency.

- Smart Technology Deployment: Leveraging IoT and data analytics to enhance service delivery and operational oversight.

Environmental Remediation Services

Environmental Remediation Services are a growing segment for China Everbright Environment Group. The market is booming due to past pollution issues and stricter environmental laws in China. This sector is crucial for ecological restoration efforts across the country.

Everbright Greentech secured new contracts for environmental remediation in 2024, showing their commitment to this expanding area. The company's involvement highlights the increasing demand for such services.

- Market Growth: China's environmental remediation market is expanding rapidly, driven by a need to address historical pollution and comply with new environmental regulations.

- Everbright's Participation: New contracts awarded to Everbright Greentech in 2024 demonstrate their active engagement and capacity in the environmental remediation sector.

- Future Prospects: This segment holds significant growth potential as China continues to prioritize ecological restoration and sustainable development.

China Everbright Environment Group's Waste-to-Energy (WTE) business is a prime example of a Star in the BCG matrix. As the world's largest WTE investor and operator, the company is leveraging a high-growth market, particularly in Asia-Pacific, where WTE capacity is rapidly expanding. The global WTE market is projected for significant growth, ensuring sustained demand for Everbright's core services.

The company's ongoing investment in new WTE projects and operational enhancements in 2024 solidifies its market leadership and growth trajectory. This strategic focus on WTE continues to be a major revenue driver and a cornerstone of the Group's strategy, reinforcing its dominant market position.

China Everbright Environment Group's solar power and energy storage solutions are also positioned as Stars. This is fueled by China's ambitious carbon neutrality targets and a substantial increase in renewable energy adoption. The company is actively boosting its installed capacity in these areas, directly aligning with national clean energy development goals and capturing significant market share, with solar power capacity reaching considerable levels by 2024.

| Business Segment | BCG Classification | Key Growth Drivers | 2024 Data/Outlook |

|---|---|---|---|

| Waste-to-Energy (WTE) | Star | Global WTE market expansion, Asia-Pacific growth | Continued investment in new projects, operational efficiency |

| Solar Power & Energy Storage | Star | China's carbon neutrality goals, renewable energy adoption | Increasing installed capacity, significant market share growth |

What is included in the product

The China Everbright Environment Group BCG Matrix offers a tailored analysis of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

The China Everbright Environment Group BCG Matrix offers a clear, visual roadmap, relieving the pain of strategic uncertainty by highlighting growth opportunities.

This matrix provides an export-ready design, simplifying the process of integrating strategic insights into executive presentations.

Cash Cows

China Everbright Environment Group's established municipal waste-to-energy (WTE) operations are clear Cash Cows. As the global leader in WTE investment and operation, the company boasts a significant number of mature WTE plants throughout China.

These well-established facilities represent a stable, high-market-share segment of Everbright Environment's business. They are designed to generate substantial and consistent cash flow, underpinning the group's financial strength.

The strategic emphasis for these Cash Cows is on maximizing the efficiency and revenue generation of existing assets. This means focusing on operational improvements and cost optimization rather than pursuing new, large-scale expansion projects in this segment.

In 2023, China Everbright Environment Group reported that its WTE segment generated a significant portion of its revenue, with a large number of operational WTE plants contributing to this stable income stream.

China Everbright Environment Group's traditional municipal wastewater treatment plants are firmly positioned as Cash Cows within its BCG Matrix. These operations benefit from a high market share in an essential, mature service sector, consistently providing stable cash flow.

The company's extensive portfolio of long-standing projects has cultivated significant competitive advantages. For instance, in 2023, Everbright Water reported that its wastewater treatment segment contributed a substantial portion of its revenue, showcasing the maturity and consistent performance of these assets.

Recent tariff adjustments for several of these plants, implemented to reflect operational costs and investment, are expected to further bolster their profitability and cash generation capabilities throughout 2024 and beyond.

Standardized Hazardous and Solid Waste Treatment is a Cash Cow for China Everbright Environment Group. In 2024, the company's Greentech segment, which includes these services, continued to show robust performance, driven by consistent demand and long-term contracts. This segment is a cornerstone, providing stable and predictable revenue streams within China's evolving environmental regulatory landscape.

Everbright Environment's significant market share in hazardous and solid waste treatment, evidenced by its extensive project portfolio, solidifies its Cash Cow status. These operations benefit from recurring income due to the essential nature of waste management, often secured through government concessions and service agreements that ensure predictable cash flows, a hallmark of a strong Cash Cow.

Operation & Maintenance (O&M) Services

China Everbright Environment Group's Operation & Maintenance (O&M) services for its extensive portfolio of environmental protection projects, such as waste-to-energy (WTE) and water treatment facilities, function as a significant cash cow. These services offer a predictable and recurring revenue stream, requiring less capital investment than developing new projects. The sheer scale of their installed base guarantees consistent demand for O&M, solidifying its position as a reliable generator of cash.

The O&M segment is crucial for Everbright Environment's financial stability. For instance, in 2023, the Group reported significant revenue contributions from its environmental services segment, which largely encompasses O&M. This segment demonstrated robust performance, underscoring the dependable nature of these recurring income streams. The continuous operation and upkeep of their numerous facilities, including over 100 WTE plants and numerous water treatment facilities, ensure a steady flow of earnings.

- Stable Revenue: O&M services provide consistent, recurring income, unlike the lumpy investments in new project development.

- Low Capital Intensity: Compared to building new facilities, O&M requires significantly less capital expenditure, boosting free cash flow.

- Large Installed Base: Everbright Environment's extensive network of operational environmental facilities creates a captive market for its O&M expertise.

- Operational Efficiency: Optimized O&M contributes to the overall profitability and longevity of the Group's asset portfolio.

Heat and Steam Supply from WTE & Biomass Projects

China Everbright Environment Group's Waste-to-Energy (WTE) and biomass projects are more than just electricity generators. Many of these facilities also produce and supply heat and steam to nearby industrial and residential customers. This creates a valuable, stable revenue stream by utilizing existing infrastructure in a well-established utility market.

This synergistic approach significantly enhances the financial performance of the WTE and biomass segments. The ability to provide heat and steam leverages the core operations, turning a byproduct into a profitable offering. This diversification within a mature market adds resilience and predictability to earnings.

The contribution from heat and steam supply is growing robustly. For instance, in 2024, China Everbright Environment Group reported a substantial increase in the volume of heat and steam supplied. This indicates a strong demand and successful expansion of this business line.

- Synergistic Revenue: Heat and steam supply from WTE & biomass projects leverages existing infrastructure for additional, stable income.

- Mature Market: This segment operates in a well-established utility market, providing predictable revenue.

- Growth in 2024: A significant increase in heat and steam supply volume in 2024 highlights the segment's expanding contribution.

China Everbright Environment Group's established municipal waste-to-energy (WTE) operations are clear Cash Cows, characterized by high market share and stable cash flow. These mature facilities, a significant portion of the company's business, focus on operational efficiency rather than new expansion.

The Group's traditional municipal wastewater treatment plants also function as Cash Cows, benefiting from a high market share in a mature, essential service sector. Recent tariff adjustments in 2024 are expected to boost their profitability and cash generation.

Standardized Hazardous and Solid Waste Treatment, part of the Greentech segment, is another Cash Cow, driven by consistent demand and long-term contracts. This segment's predictable revenue streams are a cornerstone of the company's financial stability.

Operation & Maintenance (O&M) services for the Group's extensive portfolio of environmental projects are a vital cash cow, offering predictable, recurring income with low capital intensity. In 2023, this segment significantly contributed to the Group's revenue, underscoring its dependable earnings.

Waste-to-Energy (WTE) and biomass projects that also supply heat and steam to customers represent a stable revenue stream, leveraging existing infrastructure in a mature utility market. This synergistic approach, with a substantial increase in heat and steam supply volume reported in 2024, significantly enhances financial performance.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Municipal Waste-to-Energy (WTE) | Cash Cow | High market share, stable cash flow, focus on efficiency | Significant revenue contribution in 2023 |

| Municipal Wastewater Treatment | Cash Cow | High market share, mature service, consistent performance | Substantial revenue contribution in 2023; tariff adjustments expected to bolster profitability in 2024 |

| Hazardous & Solid Waste Treatment | Cash Cow | Consistent demand, long-term contracts, predictable revenue | Robust performance in Greentech segment in 2024 |

| Operation & Maintenance (O&M) | Cash Cow | Recurring income, low capital intensity, large installed base | Significant revenue contribution from environmental services in 2023 |

| WTE/Biomass Heat & Steam Supply | Cash Cow | Synergistic revenue, mature market, leveraging existing infrastructure | Substantial increase in heat & steam supply volume in 2024 |

What You’re Viewing Is Included

China Everbright Environment Group BCG Matrix

The preview you see is the exact China Everbright Environment Group BCG Matrix report you will receive after purchase, offering a comprehensive strategic overview. This document is fully formatted and ready for immediate use, containing no watermarks or demo content. It has been meticulously crafted to provide actionable insights into the company's business units, allowing for informed decision-making. Upon purchase, you will gain access to this professionally designed analysis, perfect for strategic planning and presentations.

Dogs

Underperforming legacy projects within China Everbright Environment Group, when viewed through a BCG matrix lens, would likely fall into the 'Dog' category. These are typically older facilities, perhaps with less advanced technology, that may be experiencing declining efficiency or facing higher operational costs. For instance, a waste-to-energy plant built in the early 2000s might struggle to compete with newer, more efficient facilities that can process larger volumes of waste at a lower cost per ton.

These 'Dog' projects often operate at or near break-even, consuming capital and management attention without generating substantial profits. Their contribution to overall profitability is minimal, and they may even represent a drag on the company's financial performance. While specific financial data for these individual projects isn't publicly available, it's common for large environmental conglomerates to have such assets that require careful management or eventual divestment.

Niche, non-integrated waste collection businesses, if operating solely as basic collection and transportation services without links to advanced waste management or waste-to-energy, often fall into a low-margin, commoditized category. These standalone operations can find it challenging to gain substantial market share or achieve robust profitability unless they develop a unique selling proposition or achieve considerable scale.

China Everbright Environment Group's strategic direction leans towards comprehensive, integrated solutions, implying a reduced focus on fragmented, fundamental collection services. For instance, in 2023, the company's revenue from integrated waste management solutions significantly outpaced revenue from basic collection, highlighting their strategic shift.

Projects in stagnant or declining local markets, particularly those in China's less developed or aging industrial regions, can present significant challenges. For instance, a localized environmental project in a city experiencing a population outflow or a substantial decrease in manufacturing output might struggle to achieve meaningful growth. If Everbright Environment holds projects in such areas where market growth is minimal and their local market share is not dominant, these could be considered Dogs.

Non-strategic or Divested Small-Scale Assets

China Everbright Environment Group, like many large corporations, periodically reviews its portfolio to identify non-strategic or divested small-scale assets. These are typically projects or business units that no longer fit the company's long-term vision or have demonstrated insufficient returns. Such assets often possess a low market share within their respective segments and face limited growth potential, making them prime candidates for divestiture to unlock capital for more promising ventures.

While specific recent divestitures of small-scale assets by China Everbright Environment Group are not publicly detailed in a manner that allows for direct BCG matrix classification, the principle remains a common practice. Companies of this scale often manage numerous smaller, less impactful assets that, over time, may become non-core. For instance, in 2023, the broader environmental services sector saw consolidation, with some players divesting smaller waste management facilities or niche renewable energy projects that didn't achieve critical mass or strategic alignment.

- Low Market Share: These assets typically operate in niche markets or are geographically dispersed, failing to capture significant market share.

- Limited Growth Prospects: Their growth potential is often constrained by market saturation, technological obsolescence, or a lack of strategic investment.

- Divestiture Rationale: The decision to divest is driven by a need to streamline operations, reduce complexity, and reallocate resources towards core, high-growth business areas.

Unsuccessful Pilot Technologies or Ventures

Innovation is crucial for growth, but not every new idea or pilot project takes off. China Everbright Environment Group, like many forward-thinking companies, likely explores emerging technologies. If some of these experimental ventures, perhaps in areas like advanced waste-to-energy conversion or novel water treatment methods, haven't found significant market acceptance or shown a clear profit potential by mid-2025, they would fall into the Dogs category.

These underperforming pilot technologies or ventures, which may have consumed resources without delivering expected returns, are typically managed by being quietly discontinued or put on hold. For instance, if a pilot for a new type of biodegradable plastic recycling technology, launched in 2023, failed to attract commercial partners or achieve cost-effectiveness by 2024, it would represent a Dog within the group's portfolio.

- Unsuccessful Pilot Technologies: Ventures exploring unproven or niche environmental solutions that struggle with scalability or market demand.

- Low Market Traction: Projects that, despite initial investment, have failed to gain significant adoption by customers or industry partners.

- Commercial Viability Concerns: Technologies or business models that have not demonstrated a clear path to profitability or a sustainable competitive advantage.

- Resource Allocation: Investments in ventures that, as of mid-2025, are not meeting performance expectations and may be candidates for divestment or discontinuation.

Dogs within China Everbright Environment Group's portfolio represent legacy assets or ventures with low market share and limited growth prospects. These could include older waste management facilities struggling with efficiency or pilot projects that haven't gained market traction. For example, a waste-to-energy plant from the early 2000s might face higher operational costs compared to newer, more efficient facilities, potentially operating at break-even. The company's strategic shift towards integrated solutions further sidelines basic collection services that lack a unique selling proposition or scale.

China Everbright Environment Group, like many conglomerates, periodically assesses its assets for divestiture. Projects in stagnant markets or small-scale, non-core assets that no longer align with the company's long-term vision are prime candidates. For instance, in 2023, the broader environmental services sector saw some companies divesting smaller waste management facilities that didn't achieve critical mass. These 'Dogs' often require careful management or eventual divestment to reallocate resources to more promising ventures.

Unsuccessful pilot technologies or ventures that fail to demonstrate commercial viability also fall into the Dog category. If a pilot for a new recycling technology, launched in 2023, did not attract commercial partners or achieve cost-effectiveness by 2024, it would be considered a Dog. Such ventures consume resources without delivering expected returns and may be discontinued or divested.

The company's 2023 financial reports indicated a strong performance in integrated waste management solutions, which significantly outpaced revenue from basic collection, underscoring the strategic move away from potentially commoditized, low-margin services that might be classified as Dogs.

| Asset Type | BCG Category | Rationale | Example Scenario | Potential Action |

| Legacy Waste-to-Energy Plant (Early 2000s) | Dog | Lower efficiency, higher operational costs than newer facilities. | Struggles to compete on cost per ton of waste processed. | Modernization or divestment. |

| Standalone Basic Waste Collection Service | Dog | Low market share, commoditized service, no integration. | Operates in a saturated market with limited differentiation. | Integration into broader services or divestment. |

| Unsuccessful Pilot Technology (e.g., new recycling method) | Dog | Failed to gain market acceptance or achieve cost-effectiveness. | Pilot launched in 2023, no commercial partners by 2024. | Discontinuation or write-off. |

| Environmental Project in Declining Industrial Region | Dog | Limited market growth due to population outflow or reduced manufacturing. | Project in a city experiencing economic downturn. | Divestment or strategic repositioning. |

Question Marks

China Everbright Environment Group's international market expansion, including ventures in Germany, Poland, Vietnam, and Mauritius, positions these as potential Stars or Question Marks in its BCG Matrix. These markets represent significant growth opportunities for environmental solutions, but Everbright's market share is likely nascent compared to its established presence in China.

The company's strategic focus on these regions necessitates substantial investment to build brand recognition and operational capacity. For instance, in 2023, Everbright Environment reported a 13.4% increase in revenue from its overseas businesses, signaling early traction, though specific market share data for these newer territories remains limited.

China Everbright Environment Group's focus on advanced environmental technology R&D, including 'Dark Factory' concepts, positions it for high growth in a rapidly expanding sector. This commitment to innovation fuels the development of cutting-edge solutions designed to address complex environmental challenges.

While these technologies represent significant future potential, their broad commercialization and market penetration are still in nascent stages. Consequently, their current market share remains relatively low, reflecting the early-stage nature of their adoption and scaling.

China Everbright Environment Group is actively developing asset-light business models, such as waste sorting and technical consulting, to complement its traditional asset-heavy operations. This strategic shift aims for balanced growth, with new contracts in these service-oriented areas demonstrating their increasing importance. For instance, in 2023, the Group secured multiple new contracts for its waste sorting and technical consulting services, indicating a growing demand for these specialized, less capital-intensive offerings.

These new business models represent emerging growth frontiers, fueled by the increasing demand for digitalization and operational efficiency across industries. While their market share is still building compared to the Group's established asset-heavy infrastructure projects, their high growth potential is undeniable. The Group’s continued investment and focus on these areas are expected to contribute significantly to its future revenue streams and market positioning.

Emerging Waste Streams Treatment (e.g., Construction & Decoration Waste)

Emerging waste streams, such as construction and decoration waste, are becoming increasingly significant for China Everbright Environment Group. This segment is experiencing rapid growth due to ongoing urbanization and more stringent environmental policies. While Everbright Environment is expanding its presence, its market share in these specialized niches is likely still developing, positioning them as potential stars in the BCG matrix.

- High Growth Potential: The market for treating construction and decoration waste is expanding rapidly, driven by China's extensive infrastructure projects and building renovations.

- Developing Market Share: As a relatively newer focus area, Everbright Environment is still building its capacity and market penetration in this specific waste treatment sector.

- Strategic Expansion: Entry into these emerging waste streams aligns with Everbright Environment's strategy to diversify its solid waste portfolio and capture growth opportunities.

- Regulatory Tailwinds: Stricter environmental regulations and government incentives for resource recovery in construction waste further bolster the attractiveness of this segment.

Integration of AI/IoT in Waste Management Operations

China Everbright Environment Group is actively integrating AI and IoT into its waste management operations, aiming to create smarter, more efficient systems. This digital transformation focuses on optimizing the entire waste lifecycle, from collection to recycling.

The company is developing AI-powered platforms designed to streamline waste collection routes, improve sorting accuracy, and enhance recycling yields. For instance, in 2023, their smart waste management solutions contributed to a significant reduction in operational costs, with early deployments showing up to a 15% increase in sorting efficiency.

This strategic move into intelligent waste management represents a high-growth potential area, offering opportunities for both substantial efficiency gains and the development of innovative new service offerings. The global smart waste management market, valued at approximately USD 2.5 billion in 2023, is projected to grow at a CAGR of over 12% through 2030, highlighting the significant market opportunity.

However, it's important to note that the widespread adoption of these advanced intelligent solutions across the entire waste management industry is still in its nascent stages. China Everbright Environment Group's pioneering efforts position them to capitalize on this evolving market landscape.

- AI-driven route optimization

- IoT sensors for real-time waste level monitoring

- Automated sorting technologies

- Data analytics for process improvement

China Everbright Environment Group's international expansion into markets like Germany and Vietnam, alongside its development of advanced technologies such as AI-driven waste management, presents potential Question Marks. These ventures are in high-growth sectors but likely have a nascent market share for Everbright, requiring significant investment to establish a strong foothold.

The company's strategic investments in these emerging areas are crucial for future growth, even if current market penetration is limited. For instance, their overseas revenue saw a 13.4% increase in 2023, indicating early progress in these new territories.

Similarly, the focus on AI and IoT in waste management, while promising substantial efficiency gains and market growth, is still in its early stages of widespread adoption. The global smart waste management market, projected to grow significantly, highlights the potential, but Everbright's share in this specific segment is still developing.

The company's diversification into asset-light models like waste sorting and technical consulting also falls into the Question Mark category. While these services are experiencing growing demand and securing new contracts, their market share is still building compared to the Group's established asset-heavy operations.

BCG Matrix Data Sources

Our BCG Matrix for China Everbright Environment Group is informed by official company filings, comprehensive industry research, and up-to-date market growth data.