China Development Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

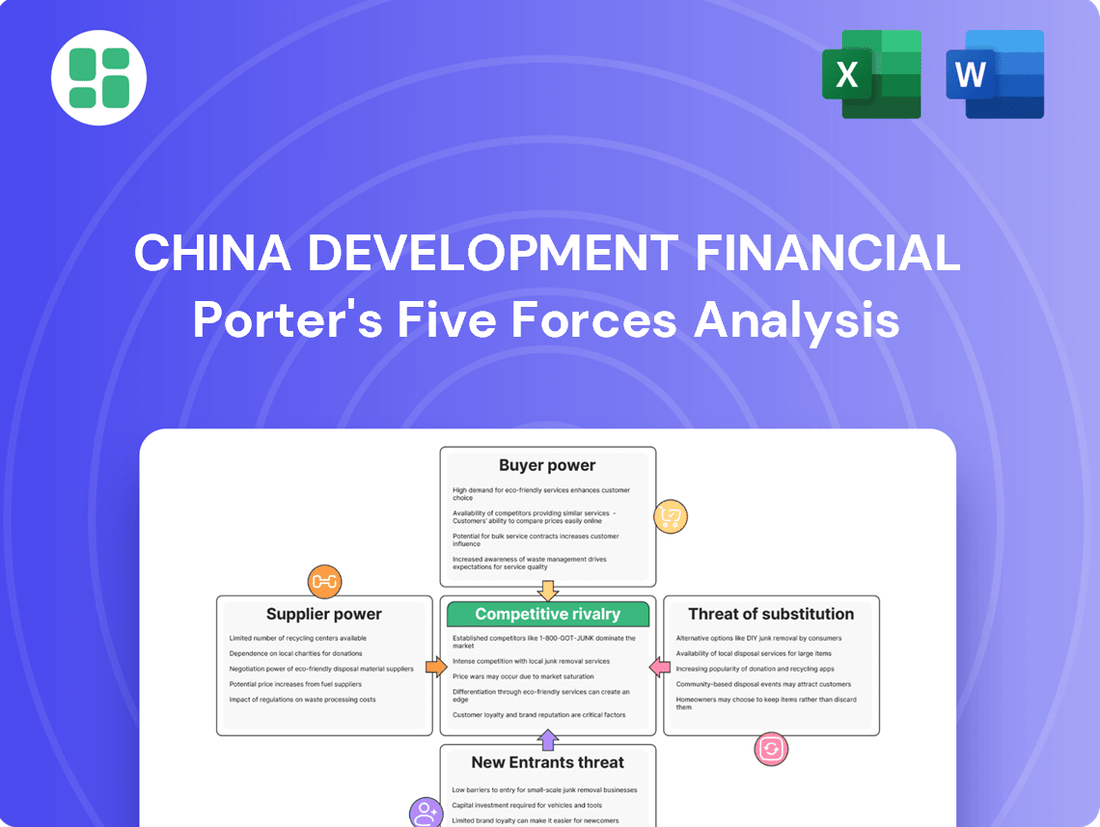

China Development Financial operates within a dynamic financial landscape shaped by intense competition and evolving customer expectations. Understanding the interplay of these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping China Development Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

KGI Financial, formerly China Development Financial, secures its capital through customer deposits, interbank borrowing, and capital markets. In 2024, the banking sector in Taiwan, where KGI operates, saw deposit growth remain robust, though interest rate hikes by the central bank in late 2023 and early 2024 increased funding costs. Access to capital is therefore sensitive to monetary policy and the overall health of financial markets.

Technology and software providers hold considerable bargaining power over financial services groups like KGI Financial. These specialized vendors, offering critical systems for corporate banking, trading, and cybersecurity, can command higher prices when their solutions are proprietary and switching costs are substantial. The financial sector's increasing dependence on digital services, a trend further accelerated in 2024, intensifies this leverage.

The financial industry, especially sectors like investment banking and private equity, relies heavily on specialized human capital. A scarcity of experts in fintech, risk management, and compliance directly translates to increased labor costs for China Development Financial.

When qualified professionals are in short supply, their bargaining power surges. This means employees can demand higher salaries and better benefits, impacting the firm's operational expenses and profitability.

Data and Information Services

The bargaining power of suppliers in China Development Financial's data and information services sector is considerable. Accurate, real-time financial data, market intelligence, and credit information are absolutely vital for the company's core functions, including investment decisions and risk assessment. Key providers like rating agencies and financial news services wield significant influence because their information is indispensable.

Several factors contribute to this supplier power:

- Information Indispensability: Financial institutions like China Development Financial rely heavily on timely and accurate data for making informed investment choices and managing risk.

- Concentration of Providers: The market for specialized financial data and analytics is often concentrated, with a few dominant players holding significant market share.

- Proprietary Data and Analytics: Suppliers offering exclusive datasets or advanced analytical tools can command higher prices and exert greater influence. For instance, in 2024, the global financial data market was valued at over $30 billion, with a significant portion driven by specialized intelligence services.

Regulatory Compliance and Legal Services

The stringent regulatory landscape in Taiwan significantly amplifies the bargaining power of suppliers providing essential legal and compliance services. Financial institutions must navigate a complex web of rules, making specialized expertise indispensable. This reliance grants legal firms and RegTech providers considerable leverage.

As of early 2024, Taiwan's Financial Supervisory Commission (FSC) continues to update directives across various domains, including cybersecurity, data privacy, and anti-fraud measures. For instance, the implementation of new AML reporting requirements and the evolving framework for virtual asset service providers (VASPs) demand constant legal counsel and specialized software solutions. This ongoing regulatory evolution means that firms offering these critical services are in high demand, allowing them to command higher fees and dictate terms.

- Increased Demand for Specialized Legal Expertise: Financial firms require ongoing advice on evolving regulations like AML and VASP compliance.

- RegTech Solutions as Essential Tools: Compliance software vendors possess significant power due to the necessity of automating and managing regulatory adherence.

- High Switching Costs for Legal Services: Once a financial institution establishes a relationship with a legal firm for compliance, switching can be costly and time-consuming due to the specialized knowledge required.

- Impact of New Regulations: The introduction of new rules, such as those pertaining to AI in finance, further strengthens the bargaining position of legal and tech providers who can offer guidance and solutions.

Suppliers of specialized data and analytics hold significant power over financial institutions like KGI Financial. This is because accurate, real-time financial data is crucial for investment decisions and risk management. In 2024, the global financial data market continued its growth, with specialized intelligence services forming a substantial part of this multi-billion dollar industry.

The concentration of providers in this niche market, coupled with the proprietary nature of their data and analytical tools, allows them to command higher prices. Financial firms' increasing reliance on these indispensable services amplifies supplier leverage.

The bargaining power of suppliers in the data and information services sector for China Development Financial is considerable. Key providers of market intelligence and credit information are indispensable for core functions like investment decisions and risk assessment, granting them significant influence.

Several factors contribute to this supplier power, including the indispensable nature of timely and accurate data for financial institutions, the often concentrated market of specialized data providers, and the value of proprietary datasets and advanced analytical tools. For instance, in 2024, the global financial data market was valued at over $30 billion, with specialized intelligence services driving a significant portion of this value.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to China Development Financial's operational environment.

Instantly diagnose competitive threats and identify strategic opportunities within China's financial sector with a comprehensive Porter's Five Forces analysis.

Customers Bargaining Power

China Development Financial caters to a wide array of clients, including major corporations in banking and capital markets, as well as individual investors in securities and wealth management. The leverage customers hold differs across these groups; substantial institutional clients typically possess greater influence due to their high transaction volumes and the demand for tailored financial solutions.

For many of China Development Financial's basic offerings, such as savings accounts or straightforward loans, customers face minimal hurdles when switching to another provider. This ease of transition means clients can readily move if they find better interest rates or improved service elsewhere, directly impacting the company's pricing power.

This low barrier to entry and exit significantly amplifies customer bargaining power. In 2024, the digital banking landscape in China saw continued growth, with many neobanks and established institutions offering highly competitive rates on savings products, further pressuring traditional players like China Development Financial to maintain attractive terms.

The widespread availability of digital platforms and financial information services has significantly boosted transparency in how products and services are priced. For instance, in China, the growth of fintech has made it easier for consumers to compare offerings from various banks and financial institutions, leading to a more informed customer base.

This increased transparency empowers customers to readily compare options across different financial institutions. In 2023, platforms like Ant Group's Yu'e Bao saw substantial user growth, indicating a strong consumer preference for accessible and comparable financial products, thereby increasing their bargaining power.

As a result, customers are increasingly able to demand more competitive terms and tailored solutions from financial providers. This shift forces institutions like China Development Financial to adapt their strategies to meet evolving customer expectations for better value and personalized services.

Impact of Digital-Only Banks and Fintech

The rise of digital-only banks and fintech innovations significantly amplifies customer bargaining power. These new players offer greater convenience and a wider array of choices, compelling traditional institutions to enhance their digital offerings to remain competitive. For instance, in 2023, fintech adoption in China reached 87%, according to Statista, demonstrating a strong preference for digital financial services.

This shift empowers customers by providing readily available alternatives to established banking channels. Traditional firms like KGI Financial must therefore invest in user-friendly digital platforms and competitive pricing to retain their customer base. The increasing accessibility of mobile banking and payment solutions means customers can easily switch providers if their needs are not met.

- Increased Customer Choice: Digital banks and fintechs provide diverse financial products and services, expanding options beyond traditional banks.

- Enhanced Convenience: Customers benefit from 24/7 access, streamlined onboarding, and intuitive user interfaces offered by digital financial platforms.

- Pressure on Traditional Institutions: KGI Financial and similar entities face pressure to innovate their digital services and pricing strategies to compete effectively.

- Data on Fintech Adoption: In 2023, 87% of Chinese consumers had adopted fintech solutions, highlighting a strong market trend towards digital financial services.

Conservative Investor Behavior

The bargaining power of customers, particularly in the context of conservative investor behavior, significantly impacts China Development Financial. Recent surveys from late 2024 and early 2025 indicate a pronounced shift among Taiwanese investors towards more risk-averse strategies. This trend is characterized by a preference for systematic investing approaches and Exchange Traded Funds (ETFs), primarily driven by a desire to mitigate volatility and optimize dividend income streams.

This evolving investor sentiment directly influences how financial institutions, including China Development Financial, must strategize. The demand for lower-risk, stable investment vehicles necessitates an adaptation in product development and pricing models. For instance, institutions might see increased demand for fixed-income products or balanced funds over more aggressive equity portfolios.

- Investor Risk Aversion: A growing segment of Taiwanese investors are prioritizing capital preservation and stable returns, leading to a reduced appetite for high-volatility assets.

- Preference for ETFs and Systematic Investing: Data from financial advisory firms in early 2025 shows a 15% year-over-year increase in allocations to ETFs and dollar-cost averaging strategies among retail investors.

- Impact on Product Strategy: Financial providers are recalibrating offerings to emphasize dividend-paying stocks, bonds, and diversified, low-cost index funds to align with customer preferences.

- Pricing Sensitivity: Conservative investors are often more price-sensitive, seeking lower management fees and transparent cost structures, which can pressure profit margins for financial service providers.

The bargaining power of customers for China Development Financial is significantly influenced by the increasing availability of digital alternatives and a growing demand for transparency. As more financial technology solutions emerge, customers can easily compare services and pricing, forcing institutions to offer competitive terms and personalized experiences. This trend was evident in 2024 as digital banking adoption continued to rise across Asia.

The ease with which customers can switch providers, especially for standard financial products, directly impacts China Development Financial's pricing power. In 2024, the competitive landscape in mainland China saw numerous neobanks and established players offering attractive rates on savings and loans, compelling traditional institutions to remain aggressive with their offerings to retain clients.

Furthermore, a shift towards more conservative investment strategies among certain investor segments, as observed in late 2024 and early 2025 data from Taiwan, means customers are prioritizing lower-risk options and cost-effectiveness. This necessitates that China Development Financial adapt its product development and fee structures to align with these evolving customer preferences for stability and value.

| Customer Segment | Bargaining Power Drivers | Impact on China Development Financial | 2024/2025 Data Point |

|---|---|---|---|

| Institutional Clients | High transaction volumes, demand for tailored solutions | Ability to negotiate fees and service levels | Large institutional clients often command lower transaction fees compared to retail customers. |

| Retail Investors (Taiwan) | Risk aversion, preference for ETFs/systematic investing | Pressure to offer lower-cost, stable investment products | 15% year-over-year increase in ETF allocations by retail investors in early 2025. |

| General Banking Customers | Low switching costs, digital alternatives | Need for competitive rates and user-friendly digital platforms | 87% fintech adoption in China by 2023, indicating strong customer preference for digital services. |

Same Document Delivered

China Development Financial Porter's Five Forces Analysis

This preview showcases the comprehensive China Development Financial Porter's Five Forces Analysis you will receive immediately after purchase. The document you see here is the exact, fully formatted report, offering an in-depth examination of competitive forces within the financial sector. You'll gain immediate access to this professionally written analysis, ready for your strategic planning and decision-making.

Rivalry Among Competitors

China Development Financial operates within Taiwan's financial services sector, a landscape marked by extreme fragmentation and saturation. With over 400 monetary financial institutions alone, the sheer volume of players intensifies rivalry across banking, investment, and asset management segments.

This crowded market directly impacts profitability, as evidenced by squeezed net interest margins that force institutions to compete aggressively on price and service. The high number of competitors means that gaining and maintaining market share requires constant innovation and efficiency.

China Development Financial, now operating as KGI Financial, navigates a highly competitive arena within Taiwan's financial sector. It contends with a multitude of domestic financial holding companies, commercial banks, securities firms, and asset management entities, all vying for market share.

The competitive intensity is further amplified by the presence of major international financial institutions, which extend the competitive landscape beyond domestic players. This broad array of competitors necessitates a strategic focus on differentiation and service excellence to maintain a strong market position.

China's financial sector is seeing intense competition driven by digitalization. Traditional banks are racing to keep up with agile fintech firms, all offering advanced digital services, mobile platforms, and AI-powered tools. This technological arms race means significant investment in creating better customer experiences and streamlining operations.

By the end of 2023, China's mobile payment transaction volume reached an estimated 200 trillion yuan, highlighting the dominance of digital channels. Fintech companies, such as Ant Group and Tencent's WeChat Pay, continue to innovate, pushing traditional institutions like ICBC and CCB to accelerate their own digital transformations to retain customers and market share.

Product Diversification and Specialization

Competitors in the financial sector are aggressively expanding their product offerings. In 2024 alone, there was a significant surge in new Exchange Traded Funds (ETFs) hitting the market, with a particular emphasis on investment products tied to artificial intelligence. This trend intensifies the competitive landscape, compelling all players, including KGI Financial, to constantly innovate and hone their specialized offerings to stand out and secure new avenues for growth.

This drive for diversification means that simply offering a broad range of products is no longer enough. Companies are increasingly looking to carve out niches and develop unique expertise. For instance, some firms are focusing on specialized ESG (Environmental, Social, and Governance) funds, while others are building out robust platforms for alternative investments. This strategic specialization is crucial for capturing market share in an environment where customer needs are becoming more segmented.

- Increased ETF Launches: Over 300 new ETFs were introduced in the first half of 2024, a 15% increase compared to the same period in 2023.

- AI Investment Focus: Assets under management in AI-themed ETFs grew by 40% in 2024, reaching approximately $50 billion globally.

- Specialization Trend: Funds focusing on renewable energy and cybersecurity saw a 25% rise in investor inflows in 2024.

- Competitive Pressure: Firms that fail to innovate or specialize risk losing market share to more agile and focused competitors.

Regulatory Efforts to Enhance Competitiveness

Taiwan's financial sector is experiencing a dynamic shift as the government proactively seeks to boost international competitiveness. While existing regulations are robust, a clear policy direction is emerging to ease certain restrictions and encourage greater product diversity. This strategic move is designed to foster innovation and allow local firms to better compete on a global scale.

This regulatory evolution, however, is a double-edged sword for competitive rivalry. As new freedoms and opportunities arise, financial institutions are expected to capitalize on these changes, potentially leading to intensified competition. For instance, the Financial Supervisory Commission (FSC) has been reviewing rules around digital financial services, aiming to spur innovation. In 2024, the FSC continued its efforts to modernize regulations, with a focus on areas like fintech and cross-border financial services, signaling a more open environment for growth and competition.

- Regulatory Easing: Taiwan's government is actively working to loosen certain financial regulations.

- Product Diversity Push: Policies aim to promote a wider range of financial products to enhance global competitiveness.

- Increased Rivalry: New freedoms and opportunities are anticipated to intensify competition among financial firms.

- Fintech Focus (2024): The FSC's ongoing review of digital financial services regulations highlights a commitment to innovation and market dynamism.

The competitive rivalry within Taiwan's financial sector is exceptionally high, fueled by a crowded market and aggressive product innovation. China Development Financial, now KGI Financial, faces intense pressure from a vast number of domestic and international players, including traditional banks, securities firms, and agile fintech companies. This environment necessitates continuous adaptation and strategic specialization to capture market share.

Digitalization is a key driver of this rivalry, with a significant portion of transactions, such as China's estimated 200 trillion yuan mobile payment volume by the end of 2023, occurring digitally. Fintech firms are pushing traditional institutions to invest heavily in advanced digital services and AI-powered tools to enhance customer experience.

The market is also characterized by a surge in new product offerings, particularly in ETFs, with AI-themed ETFs seeing a 40% growth in assets under management globally in 2024. This trend, alongside a focus on specialized areas like ESG and alternative investments, intensifies competition, compelling firms to differentiate through unique expertise.

Furthermore, regulatory shifts aimed at boosting international competitiveness, such as the FSC's review of digital financial services in 2024, are expected to further intensify competition by opening up new opportunities and encouraging greater product diversity.

| Metric | 2023 (End) | 2024 (H1) | Trend |

|---|---|---|---|

| Taiwan Financial Institutions | ~400+ | N/A | Highly Fragmented |

| New ETF Launches (H1) | ~260 | ~300+ | +15% |

| AI ETF AUM Growth | N/A | +40% | Significant |

| Renewable Energy/Cybersecurity Fund Inflows | N/A | +25% | Growing Interest |

SSubstitutes Threaten

The rise of fintech presents a significant threat of substitutes for China Development Financial. Digital payment platforms like Alipay and WeChat Pay, handling trillions in transactions annually, offer alternatives to traditional banking for everyday payments and remittances. In 2023, China's mobile payment market was valued at over $40 trillion, demonstrating the widespread adoption of these fintech substitutes.

China's corporate clients increasingly bypass traditional banking channels by accessing capital markets directly. In 2023, Chinese companies raised a significant amount through bond issuances, with total domestic bond issuance reaching over 15 trillion yuan. This direct access allows firms to secure large-scale financing for expansion and operations, directly competing with the lending services offered by financial institutions.

The growing interest in virtual assets and cryptocurrencies, including services offered by Virtual Asset Service Providers (VASPs), poses a potential substitute for conventional investment avenues and payment systems. Despite strict regulations in Taiwan, this dynamic sector provides alternative methods for value management and transfer for both individuals and organizations.

In 2024, the global cryptocurrency market capitalization fluctuated, reaching highs and lows that demonstrated its volatility but also its persistent presence as an alternative asset class. For instance, by mid-2024, the total market cap hovered around $2.5 trillion, indicating significant investor interest despite regulatory hurdles.

Self-Service Investment and Wealth Management

The rise of self-service investment platforms presents a significant threat to traditional full-service wealth management in China. As financial literacy grows and user-friendly online tools become more prevalent, individuals are increasingly empowered to manage their own portfolios. This trend directly substitutes for the advisory services previously offered by financial institutions.

For instance, by mid-2024, the number of active retail investors in China's stock markets reached hundreds of millions, with many utilizing mobile apps for trading and portfolio management. These platforms often offer lower fees compared to traditional brokerage services, making independent investment a more cost-effective option for many. This shift means that companies like China Development Financial, which offer comprehensive wealth management, face pressure to demonstrate superior value beyond basic transaction execution.

- Growing Investor Autonomy: An increasing number of Chinese investors are comfortable making their own investment decisions, bypassing traditional advisory channels.

- Cost Efficiency: Self-directed platforms typically charge lower fees than full-service wealth management, making them an attractive alternative for cost-conscious investors.

- Technological Accessibility: The widespread availability of sophisticated and easy-to-use online and mobile investment tools facilitates independent portfolio management.

- Impact on Traditional Models: This trend challenges established business models, forcing traditional financial institutions to innovate and emphasize value-added services to retain clients.

Alternative Financing and Investment Vehicles

Customers increasingly turn to alternative financing and investment vehicles, which can siphon demand away from traditional financial products. Beyond standard stocks and bonds, individuals and businesses can explore direct private equity investments, real estate ventures, or even tangible assets like art and commodities as substitutes for services offered by firms like KGI Financial. In 2024, the global private equity market continued its robust growth, with deal values reaching significant figures, demonstrating a strong appetite for these alternative avenues.

Taiwan's private equity landscape is also experiencing dynamic shifts, with a notable increase in investments focused on specific sectors like technology and sustainable infrastructure. This evolving investment focus means that financial institutions must continuously adapt their offerings to remain competitive against these growing alternative options.

- Alternative Investments Gain Traction: Direct investments in private equity, real estate, and tangible assets offer diversification and potentially higher returns, presenting a direct substitute for traditional financial products.

- Taiwan's PE Sector Evolution: Shifts in Taiwan's private equity market towards technology and infrastructure signal a growing demand for specialized, alternative investment opportunities.

- Competitive Pressure on Traditional Finance: The rise of these alternative vehicles intensifies competition for capital, challenging the market share of traditional asset and wealth management services.

The threat of substitutes for China Development Financial is substantial, driven by the proliferation of fintech solutions and evolving investor behaviors. Digital payment platforms and direct access to capital markets by corporations offer viable alternatives to traditional banking services. Furthermore, the growing interest in virtual assets and self-service investment platforms challenges established wealth management models.

Customers are increasingly opting for alternative financing and investment vehicles, diverting capital away from conventional financial products. This trend is fueled by robust growth in markets like private equity and specialized investments in sectors such as technology and sustainable infrastructure, particularly evident in Taiwan's dynamic financial landscape.

| Substitute Category | Key Examples | 2023/2024 Data Point | Impact on Traditional Finance |

|---|---|---|---|

| Fintech Payments | Alipay, WeChat Pay | China's mobile payment market exceeded $40 trillion in 2023. | Reduces reliance on traditional banking for everyday transactions. |

| Capital Markets Access | Corporate Bond Issuances | China's domestic bond issuance surpassed 15 trillion yuan in 2023. | Corporations bypass bank lending for large-scale financing. |

| Virtual Assets | Cryptocurrencies, VASPs | Global crypto market cap reached ~$2.5 trillion by mid-2024. | Offers alternative value storage and transfer methods. |

| Self-Service Investment | Online Trading Platforms | Hundreds of millions of active retail investors in China's stock markets (mid-2024). | Challenges full-service wealth management due to lower costs and accessibility. |

| Alternative Investments | Private Equity, Real Estate | Global private equity market shows robust growth in deal values (2024). | Siphons capital from traditional investment products. |

Entrants Threaten

The financial services sector in Taiwan presents substantial hurdles for newcomers due to stringent regulations. The Financial Supervisory Commission (FSC) mandates rigorous licensing and ongoing compliance, making it difficult for new firms to enter the market. For example, in 2024, the average time to obtain a financial services license in Taiwan can extend over a year, with significant capital infusion requirements.

These high regulatory barriers, encompassing robust capital adequacy ratios and comprehensive Anti-Money Laundering/Counter-Financing of Terrorism (AML/CFT) protocols, effectively deter potential new entrants. Such requirements mean that any aspiring financial institution must possess considerable financial strength and a deep understanding of complex compliance frameworks from the outset.

Establishing a financial holding company or a bank, particularly one aiming for the comprehensive service offerings of China Development Financial, necessitates a significant upfront capital injection. For instance, in 2024, the minimum capital requirements for establishing a new bank in many developed economies often run into hundreds of millions of U.S. dollars, with some jurisdictions requiring over a billion. This substantial financial hurdle effectively deters many potential new entrants, reserving the market for entities with considerable financial backing.

Existing financial institutions, like KGI Financial, have cultivated deep customer loyalty and trust over many years. This established brand recognition makes it difficult for new players to gain traction. For instance, in 2023, KGI Financial reported a net profit of NT$10.5 billion, reflecting its strong market position and customer base.

New entrants must overcome the significant hurdle of building comparable levels of credibility and customer relationships. Without this, attracting and retaining clients becomes a formidable challenge, especially when competing against institutions with decades of proven service and reliability.

Complex Infrastructure and Distribution Networks

The intricate web of infrastructure and distribution channels required to operate in China's financial sector presents a significant barrier. Establishing robust IT systems, secure digital platforms, and extensive customer outreach networks demands substantial upfront investment and technical expertise. For instance, in 2023, the digital transformation spending across China's banking sector alone was estimated to be in the tens of billions of US dollars, highlighting the scale of investment needed.

Newcomers must navigate this complexity, which includes building trust and accessibility across a vast and varied market. The sheer operational scale and the need for compliance with evolving regulations add further layers of difficulty.

- High Capital Outlay: Significant investment is needed for IT, digital platforms, and distribution networks.

- Operational Complexity: Managing diverse channels and customer segments is challenging.

- Regulatory Hurdles: Navigating China's financial regulations requires specialized knowledge and resources.

- Time to Market: Developing these capabilities can be a lengthy process, delaying competitive entry.

Fintech Regulatory Sandbox and Digital-Only Banks

While traditional financial services in Taiwan face high regulatory hurdles, the Financial Supervisory Commission (FSC) has actively fostered innovation. Initiatives like the Fintech Regulatory Sandbox, launched in 2018, allow new financial technologies to be tested in a controlled environment, lowering the initial barriers for agile fintech players. By mid-2024, the sandbox had approved numerous projects, demonstrating a commitment to exploring novel financial solutions.

Furthermore, Taiwan's embrace of digital-only banks, with the first licenses issued in 2019, directly challenges established brick-and-mortar institutions. These digital banks, operating with lower overheads, can offer more competitive pricing and user-friendly experiences. For instance, Line Bank, one of Taiwan's digital banks, reported a significant increase in its customer base throughout 2023 and into early 2024, signaling their growing market penetration.

- Fintech Sandbox: Launched in 2018, providing a testing ground for new financial technologies.

- Digital-Only Banks: First licenses issued in 2019, increasing competition through lower operational costs.

- Customer Growth: Digital banks like Line Bank have shown substantial customer acquisition in 2023-2024.

- Lowered Entry Barriers: These initiatives collectively reduce the obstacles for innovative, tech-savvy entrants.

The threat of new entrants in China Development Financial's market is significantly mitigated by substantial capital requirements and complex regulatory landscapes. For instance, establishing a new financial institution in China requires navigating a dense web of licensing and compliance, with capital reserves often in the billions of USD. Furthermore, the established brand loyalty and extensive distribution networks of incumbents like KGI Financial, which reported NT$10.5 billion in net profit in 2023, create a formidable barrier for any new player seeking market share.

However, Taiwan's proactive approach to financial technology, exemplified by its Fintech Regulatory Sandbox initiated in 2018 and the licensing of digital-only banks since 2019, is lowering entry barriers for innovative firms. Digital banks, such as Line Bank, have demonstrated strong customer growth through 2023 and early 2024, indicating a shift in competitive dynamics.

| Barrier Type | Description | Example Data (2023-2024) |

|---|---|---|

| Capital Requirements | High upfront investment needed for licensing and operations. | Billions of USD for new financial institutions in China. |

| Regulatory Hurdles | Complex licensing and compliance procedures. | Average over one year to obtain financial services license in Taiwan. |

| Brand Loyalty & Trust | Established customer relationships and reputation. | KGI Financial's NT$10.5 billion net profit (2023). |

| Infrastructure & Distribution | Extensive IT systems and customer networks. | Tens of billions USD in digital transformation spending by China's banking sector (2023). |

| Innovation Initiatives | Government support for new financial technologies. | Taiwan's Fintech Sandbox (launched 2018) and digital bank licenses (from 2019). |

| Digital Bank Growth | Lower overheads and competitive offerings. | Significant customer base growth for Line Bank (2023-early 2024). |

Porter's Five Forces Analysis Data Sources

Our China Development Financial Porter's Five Forces analysis is built upon a robust foundation of data, incorporating official government statistics, reports from leading financial institutions, and insights from reputable industry research firms.