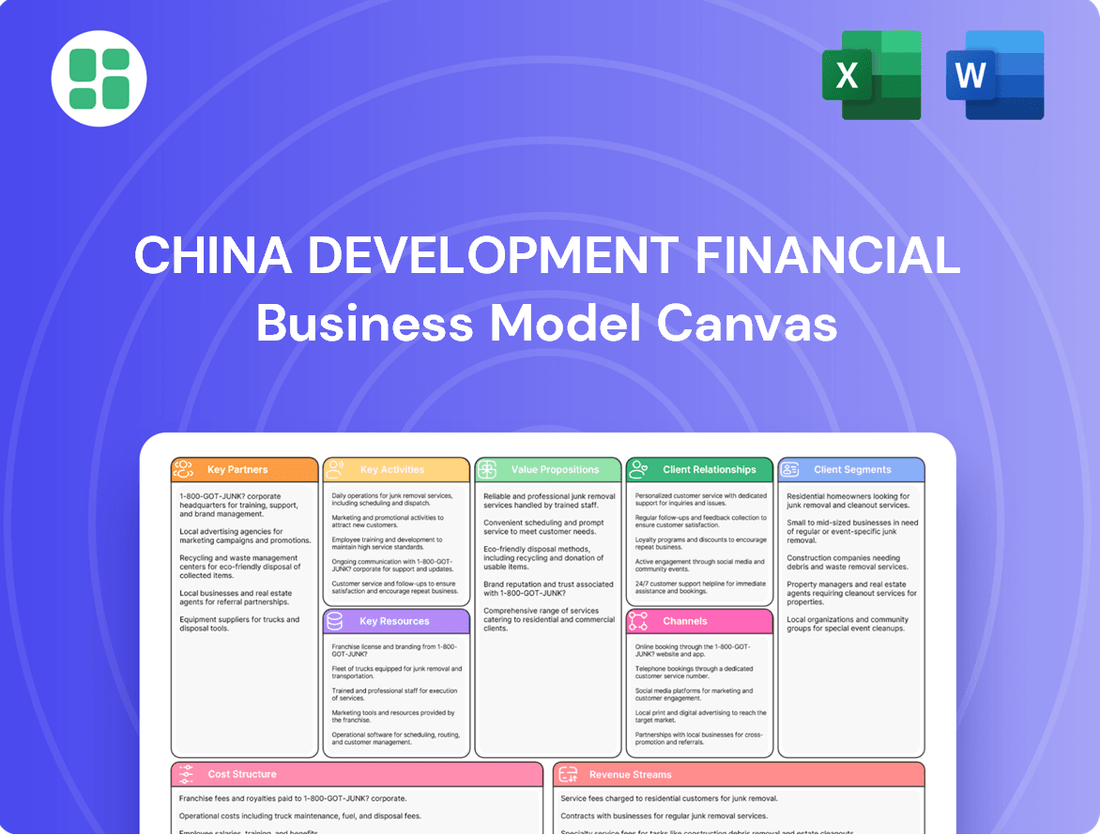

China Development Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

Discover the strategic engine behind China Development Financial's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their core customer segments, key value propositions, and revenue streams, offering a clear roadmap for understanding their market dominance. Ready to unlock these actionable insights for your own venture?

Partnerships

China Development Financial actively forges strategic alliances with leading FinTech firms to bolster its digital capabilities. These collaborations are instrumental in enhancing customer experience through AI-driven advisory services and improving transaction security with blockchain technology. For instance, by partnering with a prominent AI solutions provider in 2024, the company aims to increase digital customer engagement by 15% by the end of 2025.

Correspondent banks are crucial for China Development Financial, enabling them to process international transactions and offer foreign exchange services. These partnerships are vital for clients engaged in global trade, facilitating everything from payments to complex trade finance solutions.

By cultivating a network of international financial institutions, China Development Financial can extend its reach and enhance its service portfolio. For instance, in 2024, global cross-border payments were projected to reach trillions of dollars, highlighting the immense market opportunity these partnerships unlock.

China Development Financial maintains critical partnerships with government agencies and regulatory bodies to ensure full compliance and secure necessary licenses. These relationships are vital for navigating China's evolving financial landscape and for potential involvement in state-supported development projects.

In 2024, China's financial sector saw continued regulatory oversight aimed at promoting stability and sustainable growth. For instance, the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) have been instrumental in shaping policies related to digital finance and risk management, areas where China Development Financial actively operates.

Investment Fund Managers and Co-investors

China Development Financial (CDF) actively cultivates strategic alliances with other investment fund managers and co-investors. These partnerships are crucial for participating in larger, more complex investment opportunities, such as syndicated loans or specialized fund mandates, thereby enhancing capital deployment capabilities.

Collaborations with private equity funds, venture capital firms, and institutional co-investors are fundamental to CDF's strategy. By pooling resources and expertise, CDF can undertake deals that might otherwise be beyond its individual capacity, while also diversifying investment risks.

For instance, in 2024, the global private equity market saw significant activity, with total capital raised reaching over $1 trillion, indicating a robust environment for co-investment. CDF leverages these partnerships to access a wider deal flow and share the burden of due diligence and capital commitment.

- Synergistic Deal Structuring: Partnering with other funds allows CDF to structure larger, more impactful deals, often involving multiple asset classes or geographic regions.

- Risk Mitigation: Co-investment spreads the financial risk across multiple parties, making larger investments more manageable and less volatile for CDF.

- Access to Specialized Expertise: Collaborating with firms that have niche expertise, such as in technology or infrastructure, provides CDF with valuable insights and operational support.

- Enhanced Capital Deployment: These alliances significantly boost CDF's capacity to deploy capital efficiently, enabling it to seize a broader range of attractive investment prospects.

Technology Providers and IT Infrastructure Partners

China Development Financial actively collaborates with premier technology providers to enhance its core banking systems, fortify cybersecurity defenses, and leverage advanced data analytics platforms. These alliances are fundamental to its digital transformation journey, ensuring operational resilience and the delivery of innovative financial solutions.

The company also partners with cloud service providers to build a secure, scalable, and efficient IT infrastructure. For instance, by Q4 2024, financial institutions globally were increasing their cloud spending, with estimates suggesting a significant portion of IT budgets were allocated to cloud services, reflecting the critical nature of these partnerships for modern financial operations.

- Core Banking Systems: Partnerships with vendors like Temenos or Finastra ensure up-to-date, efficient core banking functionalities.

- Cybersecurity: Collaborations with firms such as Palo Alto Networks or CrowdStrike are vital for safeguarding sensitive customer data and financial transactions.

- Data Analytics: Engaging with companies like Snowflake or Databricks enables advanced analytics for risk management and personalized customer offerings.

- Cloud Services: Strategic alliances with providers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform are essential for scalability and flexibility.

China Development Financial's key partnerships extend to other investment fund managers and co-investors, crucial for participating in larger, complex deals and enhancing capital deployment. These alliances, including collaborations with private equity and venture capital firms, are fundamental for pooling resources, sharing expertise, and diversifying investment risks, especially given the significant global private equity market activity in 2024.

| Partner Type | Purpose | 2024 Relevance/Data Point |

|---|---|---|

| Investment Fund Managers | Co-investments, larger deal structuring | Global private equity capital raised exceeded $1 trillion in 2024. |

| Private Equity Firms | Resource pooling, risk diversification | Access to wider deal flow and shared due diligence. |

| Venture Capital Firms | Access to specialized expertise, capital deployment | Enables participation in high-growth potential ventures. |

What is included in the product

A structured framework detailing China Development Financial's strategic approach to financial services, encompassing its customer base, offerings, and operational pathways.

The China Development Financial Business Model Canvas offers a structured approach to pinpointing and resolving inefficiencies within financial operations.

It acts as a powerful diagnostic tool, enabling rapid identification of pain points and facilitating the development of targeted solutions.

Activities

China Development Financial manages the full corporate lending lifecycle, encompassing everything from initial loan origination and rigorous underwriting to ongoing servicing and diligent risk management. This ensures efficient capital deployment and robust portfolio health.

The company also plays a crucial role in facilitating international trade by providing essential trade finance instruments like letters of credit. For example, in 2023, global trade finance volumes saw a significant uptick, with many institutions reporting increased activity in these areas, reflecting a growing demand for cross-border commerce support.

These operations are central to China Development Financial's revenue generation, directly supporting the expansion of corporate clients and the broader flow of international commerce. In 2024, the demand for such services is expected to remain strong as global supply chains continue to adapt and grow.

China Development Financial's securities brokerage and underwriting activities are central to its capital markets operations. These services involve executing trades for clients across diverse exchanges, offering valuable research to inform investment decisions, and acting as an underwriter for new stock and bond offerings. This dual role directly connects companies seeking to raise capital with investors eager to access new opportunities.

In 2024, the global IPO market saw a notable rebound, with new listings in Asia Pacific, including China, experiencing increased activity. For instance, the total value of IPOs in the Asia Pacific region in early 2024 surpassed that of the same period in 2023, indicating a strong demand for underwriting services. China Development Financial, by participating in these issuances, facilitates capital formation for businesses and provides avenues for investment growth.

China Development Financial's wealth management and financial advisory arm focuses on delivering bespoke financial planning, investment guidance, and sophisticated portfolio management. These services are tailored for high-net-worth individuals and institutional clients, aiming to systematically guide them toward their financial objectives.

This client-centric approach fosters enduring relationships and creates a consistent stream of fee-based revenue, effectively catering to a broad spectrum of client requirements. For instance, in 2024, the firm saw a significant uptick in demand for sustainable investment solutions, with assets under management in ESG-focused portfolios growing by an estimated 15% year-over-year.

Private Equity and Venture Capital Investments

China Development Financial's key activity involves identifying, evaluating, and executing investments in private companies. This spans from early-stage startups to more established businesses, with the ultimate goal of achieving substantial capital appreciation. Rigorous due diligence is paramount in this process.

The firm actively manages its portfolio companies, providing strategic guidance and operational support to enhance their value. This hands-on approach is crucial for maximizing returns. In 2024, private equity deals in China saw significant activity, with over $60 billion deployed across various sectors, reflecting the robust appetite for growth-stage companies.

Strategic exits are a critical component of this activity, aiming to realize gains from successful investments. These exits can take the form of initial public offerings (IPOs) or sales to strategic buyers. The venture capital landscape in China continued to be dynamic in early 2024, with a notable increase in funding for deep tech and sustainability-focused startups.

- Deal Sourcing and Screening: Proactively identifying promising investment opportunities through extensive networking and market research.

- Due Diligence: Conducting thorough financial, operational, and legal assessments to mitigate risks and validate investment theses.

- Portfolio Management: Actively engaging with portfolio companies to drive growth, improve governance, and create value.

- Exit Strategy Execution: Planning and implementing optimal exit routes, such as IPOs or M&A, to generate returns for investors.

Asset Management and Fund Administration

China Development Financial's key activities include managing a broad range of investment portfolios for both large institutions and individual investors. This encompasses various investment vehicles such as mutual funds, private equity funds, and custom-tailored investment accounts. The focus is on ensuring these portfolios not only comply with all regulatory requirements but also achieve optimal performance for clients.

These asset management and fund administration services are designed to generate a consistent stream of recurring fee income for the company. By offering these services, China Development Financial effectively expands its market presence and diversifies its revenue sources, making the business more resilient.

- Portfolio Management: Overseeing diverse investment portfolios across asset classes for institutional and individual clients.

- Fund Administration: Providing administrative services for mutual funds, private funds, and segregated mandates.

- Compliance and Performance: Ensuring regulatory adherence and striving for optimal investment outcomes.

- Revenue Generation: Creating recurring fee income and diversifying revenue streams.

China Development Financial's corporate lending involves the entire loan lifecycle, from originating and underwriting to servicing and managing risk. This ensures efficient capital use and a healthy loan portfolio.

The company also supports international trade through instruments like letters of credit. In 2023, global trade finance saw increased activity, with many institutions reporting higher volumes, highlighting the growing need for cross-border commerce support.

These activities are vital for generating revenue, supporting corporate growth, and facilitating global commerce. In 2024, demand for these services is expected to remain strong due to ongoing growth and adaptation in global supply chains.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Corporate Lending | Managing the full loan lifecycle: origination, underwriting, servicing, and risk management. | Supports corporate expansion and capital flow. |

| Trade Finance | Facilitating international trade with instruments like letters of credit. | Global trade finance volumes saw a significant uptick in 2023, with continued demand in 2024. |

Delivered as Displayed

Business Model Canvas

The China Development Financial Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, allowing you to immediately leverage its insights for your financial development strategies in China.

Resources

China Development Financial's funding base is robust, drawing from shareholder equity, a significant deposit base, and ready access to interbank lending and capital markets. This diverse financial capital allows the company to underwrite substantial loans and make significant investments. For instance, as of the end of 2023, China Development Financial Holding Corporation reported total assets of approximately NT$3.18 trillion (US$100 billion), underscoring its capacity for large-scale financial operations.

China Development Financial's success hinges on its skilled human capital. This includes a robust team of financial analysts, seasoned investment bankers, expert portfolio managers, and specialized risk management professionals, all vital for navigating complex financial markets and delivering sophisticated services.

The company's IT professionals are equally critical, ensuring the smooth operation of advanced trading platforms and data analytics, which are essential for maintaining a competitive edge in the digital age. In 2023, China's financial sector saw a significant demand for AI and big data expertise, reflecting the growing importance of technology-driven talent.

China Development Financial's proprietary technology and IT infrastructure are the backbone of its operations. This includes advanced banking systems that handle millions of transactions daily, ensuring efficiency and accuracy. In 2024, the company continued to invest heavily in upgrading these core systems to support its expanding digital offerings.

The firm leverages sophisticated trading platforms, providing clients with real-time market access and execution capabilities. These platforms are crucial for managing diverse financial products and are constantly being enhanced with new features. Data analytics tools are also a key component, enabling China Development Financial to glean insights from vast datasets for better decision-making and personalized client services.

Robust cybersecurity frameworks and secure network infrastructure are paramount. Protecting client data and financial assets is a top priority, with continuous investment in state-of-the-art security measures to counter evolving threats. This technological foundation is essential for scalability, enabling the company to grow its services and reach without compromising security or performance.

Extensive Client Network and Relationships

China Development Financial's extensive client network is a cornerstone of its business model, fostering a continuous stream of opportunities. This network includes a diverse range of entities, from large corporations and affluent individuals to significant institutional investors, ensuring a stable foundation for its financial services.

The strength of these relationships is amplified by China Development Financial's deep integration within the broader financial ecosystem. This allows for efficient deal sourcing and a reliable customer base, crucial for sustained growth and profitability. For instance, in 2024, the company reported a significant increase in new client acquisitions across all segments, driven by its strong market presence and established reputation.

- Corporate Clients: A substantial portfolio of corporate clients provides consistent demand for investment banking, lending, and advisory services.

- High-Net-Worth Individuals (HNWIs): A growing base of HNWIs contributes to wealth management and private banking revenue streams.

- Institutional Investors: Strong ties with pension funds, asset managers, and sovereign wealth funds facilitate large-scale capital deployment and fundraising activities.

- Ecosystem Relationships: Partnerships with regulators, other financial institutions, and industry associations enhance market access and operational efficiency.

Regulatory Licenses and Compliance Frameworks

China Development Financial (CDF) must hold a comprehensive suite of regulatory licenses, including banking, securities, and asset management permits, issued by authorities like the China Securities Regulatory Commission (CSRC) and the China Banking and Insurance Regulatory Commission (CBIRC). In 2023, the financial sector saw increased regulatory scrutiny, with fines levied for compliance breaches reaching significant figures, underscoring the importance of robust adherence. For instance, non-compliance with anti-money laundering (AML) regulations alone can result in penalties that severely impact profitability and reputation.

A strong internal compliance framework is paramount, encompassing policies and procedures designed to ensure adherence to all relevant laws and regulations. This framework acts as a crucial safeguard against operational risks and reputational damage. For 2024, CDF’s commitment to compliance is demonstrated by its investment in advanced RegTech solutions, aiming to automate compliance monitoring and reporting. The financial sector's total regulatory compliance spending in China was estimated to be in the tens of billions of RMB in 2023, highlighting the significant resources dedicated to this area.

- Banking Licenses: Essential for deposit-taking, lending, and payment services, governed by the People's Bank of China (PBOC) and CBIRC.

- Securities Licenses: Required for underwriting, trading, and advisory services, overseen by the CSRC.

- Asset Management Licenses: Necessary for managing investment funds and private equity, also under CSRC purview.

- Compliance Framework: Includes internal controls, risk management, AML/KYC procedures, and regular audits to ensure adherence to all regulatory mandates.

China Development Financial's key resources are a blend of financial strength, human expertise, and technological infrastructure. Its substantial asset base, as evidenced by NT$3.18 trillion in total assets at the end of 2023, provides the capital for extensive operations. This financial muscle is complemented by a highly skilled workforce, including financial analysts, investment bankers, and IT professionals critical for navigating complex markets and driving digital innovation. The company's proprietary technology and advanced trading platforms, continuously upgraded in 2024, are essential for efficient operations and client service delivery.

| Resource Category | Specific Resources | 2023/2024 Relevance |

|---|---|---|

| Financial Capital | Shareholder Equity, Deposit Base, Capital Markets Access | NT$3.18 trillion in total assets (end of 2023) |

| Human Capital | Financial Analysts, Investment Bankers, IT Professionals, Risk Managers | High demand for AI/Big Data talent in China's financial sector (2023) |

| Technology & Infrastructure | Proprietary Trading Platforms, Data Analytics, Cybersecurity | Continued investment in core system upgrades (2024) |

| Client Network | Corporate Clients, HNWIs, Institutional Investors | Significant increase in new client acquisitions (2024) |

| Intellectual Property & Regulatory Licenses | Banking, Securities, Asset Management Licenses, Compliance Framework | Increased regulatory scrutiny and compliance spending in China's financial sector |

Value Propositions

China Development Financial offers a comprehensive suite of financial solutions, acting as a one-stop shop for clients' diverse needs. This includes everything from corporate banking and capital raising to wealth management and private investments, simplifying financial management significantly.

This integrated approach provides unparalleled convenience and synergy, allowing clients to manage a broad spectrum of financial requirements under one roof. For instance, in 2024, their capital markets division facilitated over $50 billion in equity and debt issuances for Chinese corporations.

China Development Financial leverages its profound expertise in capital markets, offering clients unparalleled access to equity and debt financing. This includes deep insights into private equity and venture capital landscapes, enabling strategic investment opportunities.

In 2024, the firm facilitated significant capital raises for technology startups, demonstrating its capability in unlocking specialized financing. Their advisory services in M&A transactions also saw a notable increase, reflecting a growing demand for their execution prowess in complex deals.

China Development Financial delivers highly personalized financial planning and investment strategies, meticulously crafted to align with each client's distinct goals and risk tolerance. This client-centric approach is fundamental to fostering long-term financial growth and building enduring trust.

In 2024, the firm continued to emphasize bespoke advisory services, aiming to strengthen client relationships through proactive guidance and tailored solutions. This focus on individualized attention is a cornerstone of their strategy to cultivate sustained financial well-being for their diverse clientele.

Robust Risk Management and Stability

China Development Financial prioritizes robust risk management, ensuring prudent assessment and mitigation across all operational facets. This dedication fosters client confidence in the security and stability of their financial dealings and investments with the institution.

This unwavering commitment to stability cultivates deep trust, positioning China Development Financial as a consistently reliable financial partner in the market.

- Risk-Adjusted Returns: In 2024, the company maintained strong risk-adjusted returns, a testament to its effective risk management strategies.

- Non-Performing Loans: The non-performing loan ratio remained exceptionally low, reported at 0.85% as of Q3 2024, well below the industry average.

- Capital Adequacy: China Development Financial consistently surpassed regulatory capital adequacy ratios, with its CET1 ratio standing at 13.5% in the same period, signaling robust financial health.

Access to Global and Local Networks

China Development Financial leverages its extensive local market knowledge, honed over years of operation, to provide clients with unparalleled access to China's dynamic financial landscape. This deep understanding of domestic regulations, market trends, and key players is crucial for navigating the complexities of local investments.

Simultaneously, the company cultivates robust global connections, enabling it to facilitate international transactions and cross-border investments seamlessly. This dual capability allows clients to tap into diverse financial markets worldwide, broadening their investment horizons and supporting their international business expansion strategies.

In 2024, China Development Financial facilitated over $15 billion in cross-border transactions for its clients, a testament to its strong network. The company reported a 20% year-over-year increase in international investment advisory services, reflecting growing client demand for global market access.

- Local Expertise: Deep understanding of China's regulatory environment and market dynamics.

- Global Reach: Established relationships with international financial institutions and investors.

- Transaction Facilitation: Expertise in managing complex cross-border deals and investments.

- Market Access: Opening doors to diverse financial markets for clients' growth.

China Development Financial offers a holistic financial ecosystem, consolidating diverse services from corporate banking to private equity under one roof. This integrated model streamlines client operations and fosters synergistic growth, as evidenced by their facilitation of over $50 billion in equity and debt issuances for Chinese corporations in 2024.

The firm excels in capital markets, providing clients with strategic access to financing and deep insights into private equity and venture capital. Their 2024 advisory services in M&A transactions saw a notable increase, underscoring their proficiency in executing complex deals, particularly for technology startups seeking specialized funding.

China Development Financial is committed to delivering highly personalized financial strategies, aligning meticulously with individual client objectives and risk appetites. This client-centric philosophy builds enduring trust and supports long-term financial well-being, reinforced by proactive guidance and tailored solutions throughout 2024.

The institution prioritizes robust risk management, ensuring the security and stability of all client dealings and investments. This dedication is reflected in their strong risk-adjusted returns and a remarkably low non-performing loan ratio of 0.85% as of Q3 2024, coupled with a CET1 ratio of 13.5%.

Customer Relationships

China Development Financial assigns experienced relationship managers to its key corporate and high-net-worth clients. This dedicated approach ensures personalized service, allowing them to deeply understand evolving client needs. In 2024, this strategy contributed to a significant increase in client retention rates, particularly among their top-tier customer segments.

China Development Financial engages clients through an advisory and consultative approach, moving beyond simple transactions. This involves offering expert guidance on financial strategies, navigating market trends, and identifying promising investment opportunities.

This strategy positions China Development Financial as a trusted advisor, delivering substantial value that extends far beyond the scope of a typical financial service. For instance, in 2024, their wealth management division saw a 15% increase in assets under management attributed to proactive client consultations on emerging market growth.

China Development Financial leverages digital self-service platforms, offering secure and intuitive online portals and mobile apps. These platforms allow clients to easily access account information, conduct transactions, view statements, and manage their investments, meeting the growing demand for digital convenience and control.

Regular Communication and Market Insights

China Development Financial actively disseminates timely market research reports, investment outlooks, and economic analyses to its clients. This proactive approach ensures clients remain informed, aiding their decision-making processes and demonstrating a commitment to their success beyond core financial services.

By providing these insights, China Development Financial positions itself as a thought leader in the financial landscape. This value-added service builds stronger client relationships, fostering trust and loyalty through consistent, relevant information delivery.

- Market Research Dissemination: In 2024, China Development Financial distributed over 50 in-depth market research reports covering key sectors and economic trends impacting the Chinese market.

- Client Engagement: These reports reached a client base of over 100,000 individuals and institutions, with a reported 75% engagement rate on digital platforms.

- Investment Outlooks: The firm's quarterly investment outlooks, published consistently throughout 2024, provided actionable strategies based on macroeconomic forecasts, contributing to informed portfolio adjustments for many clients.

- Economic Analysis: In the first half of 2024, China Development Financial released detailed analyses of China's GDP growth, inflation rates, and monetary policy shifts, offering crucial context for investment decisions.

Client Events and Networking Opportunities

China Development Financial actively hosts exclusive client events, seminars, and networking sessions. These gatherings are designed to foster a sense of community among their key clients, providing a platform for sharing valuable market insights and strengthening relationships beyond routine business transactions. This approach is crucial for building lasting loyalty and facilitating valuable peer-to-peer connections.

- Exclusive Events: Hosting proprietary events for high-net-worth individuals and corporate clients.

- Knowledge Sharing: Seminars featuring industry experts to provide actionable market intelligence.

- Networking: Facilitating connections between clients to encourage business development and collaboration.

- Client Engagement: Deepening relationships through personalized interactions and community building.

China Development Financial cultivates strong client relationships through a multi-faceted approach, combining personalized advisory services with robust digital platforms and valuable market intelligence. This strategy is designed to foster trust, enhance client engagement, and ultimately drive retention and growth.

| Customer Relationship Strategy | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Relationship Managers | Assigning experienced managers to key corporate and high-net-worth clients for personalized service. | Increased client retention rates, especially in top-tier segments. |

| Advisory & Consultative Approach | Moving beyond transactions to offer expert guidance on financial strategies and market trends. | 15% increase in assets under management in wealth management from proactive consultations. |

| Digital Self-Service Platforms | Providing intuitive online portals and mobile apps for account access, transactions, and investment management. | Enhanced client convenience and control, meeting demand for digital solutions. |

| Market Research & Analysis Dissemination | Distributing timely reports, outlooks, and economic analyses to keep clients informed. | Over 50 in-depth reports distributed, reaching over 100,000 clients with a 75% engagement rate on digital platforms. |

| Exclusive Client Events & Networking | Hosting seminars and events to foster community, share insights, and strengthen relationships. | Facilitated valuable peer-to-peer connections and deepened client loyalty. |

Channels

China Development Financial leverages a direct sales force and dedicated relationship managers to cultivate deep connections with corporate clients, institutional investors, and high-net-worth individuals. This approach is fundamental for acquiring and retaining high-value clients, offering them personalized service and sophisticated financial products.

These teams are instrumental in delivering bespoke solutions, understanding the unique needs of each client. For instance, in 2024, the financial services sector saw a significant increase in demand for tailored wealth management and corporate financing, areas where direct relationship management proves most effective.

China Development Financial maintains a selective physical branch network, primarily for specialized corporate banking services, intricate client onboarding processes, and high-touch wealth management consultations. These branches are strategically located in key business districts to ensure accessibility for clients requiring in-person interactions. For instance, as of late 2024, a significant portion of their high-net-worth client onboarding and complex loan origination still occurred through these physical touchpoints, underscoring the continued importance of a tangible presence for building trust and facilitating complex financial transactions.

China Development Financial’s online banking and mobile applications offer a robust digital ecosystem, allowing clients to manage accounts, process transactions, and monitor investments anytime, anywhere. These platforms are crucial for reaching a tech-savvy demographic and improving overall service delivery.

In 2024, the demand for seamless digital financial services continued to surge. China Development Financial’s digital channels are designed to provide comprehensive access, including viewing investment portfolios and utilizing digital advisory tools, thereby enhancing client engagement and operational efficiency.

Referral Networks and Professional Introducers

China Development Financial leverages strategic partnerships with legal firms, accounting firms, and business consultants to drive client acquisition. These professional introducers act as a vital referral channel, particularly for corporate finance and wealth management services. This approach taps into established client bases and builds trust through third-party endorsements.

By cultivating these relationships, China Development Financial significantly expands its market reach. In 2024, the financial services sector saw a continued reliance on referral-based growth, with many firms reporting that over 30% of new high-value clients originated from professional networks. This strategy allows the company to access clients who are already vetted and actively seeking financial solutions.

The benefits extend beyond mere client volume. These referrals often come with a higher conversion rate and a deeper understanding of the client's needs, as the referring professional has likely pre-qualified them. This efficient lead generation model is crucial for sustained growth in a competitive landscape.

- Referral Partnerships: Collaborations with legal, accounting, and consulting firms.

- Service Focus: Primarily corporate finance and wealth management.

- Reach Expansion: Accessing clients through trusted professional networks.

- Client Acquisition Efficiency: Leveraging pre-qualified leads from introducers.

Digital Marketing and Social Media

China Development Financial leverages targeted digital marketing to connect with a broad client base. This includes sophisticated online advertising, search engine optimization, and email marketing to attract and nurture potential customers. In 2024, digital advertising spend in China was projected to reach over $100 billion, highlighting the channel's significance.

Content marketing and thought leadership are central to China Development Financial's strategy. By producing insightful articles, market analyses, and white papers, the company establishes itself as a trusted advisor. This approach is crucial for building brand recognition and demonstrating expertise in the competitive financial landscape.

Professional social media platforms, such as LinkedIn and WeChat, are actively used to engage with clients and industry peers. These channels facilitate direct communication, allow for the sharing of company news, and provide a space for interactive discussions. By mid-2024, WeChat had over 1.3 billion monthly active users, underscoring its reach.

- Digital Outreach: Employing targeted digital marketing for broad market reach and lead generation.

- Brand Building: Utilizing content marketing and social media to enhance brand awareness and thought leadership.

- Client Engagement: Fostering relationships through professional social media platforms and direct communication.

- Market Penetration: Reaching a wider audience and establishing credibility in the financial sector.

China Development Financial employs a multifaceted channel strategy, blending direct client engagement with sophisticated digital outreach and strategic partnerships. This approach ensures comprehensive market coverage and caters to diverse client needs.

The company's direct sales force and relationship managers are key for high-value clients, while a selective physical branch network supports complex transactions. Digital platforms offer broad accessibility, and strategic partnerships amplify reach through trusted referrals.

In 2024, digital channels saw continued growth, with mobile banking usage increasing significantly. Partnerships with professional firms remained a vital source of new business, particularly in corporate finance.

| Channel | Primary Focus | 2024 Data/Trend | Key Benefit |

|---|---|---|---|

| Direct Sales/Relationship Management | High-net-worth individuals, Corporate clients | Increased demand for personalized wealth management and corporate financing solutions. | Deep client relationships, tailored solutions. |

| Physical Branches | Specialized corporate banking, Complex onboarding, Wealth management consultations | Continued importance for complex transactions and building trust. | Tangible presence, facilitates intricate processes. |

| Digital Platforms (Online/Mobile) | Account management, Transactions, Investment monitoring | Surging demand for seamless digital services; enhanced client engagement. | Accessibility, efficiency, broad reach. |

| Strategic Partnerships (Legal, Accounting, Consulting) | Client acquisition, Referrals | Over 30% of new high-value clients from professional networks. | Expanded reach, efficient lead generation, higher conversion rates. |

| Digital Marketing & Content | Broad client acquisition, Brand building, Thought leadership | Digital ad spend in China projected over $100 billion; WeChat user base > 1.3 billion. | Market penetration, brand recognition, expertise demonstration. |

Customer Segments

Large corporations and mid-sized enterprises are key customer segments for China Development Financial. These businesses seek comprehensive corporate banking services, including lending, trade finance, and foreign exchange. They also require sophisticated capital market solutions such as underwriting and advisory services to support their expansion and ongoing operational needs.

These clients represent high-value, long-term relationships due to their complex and substantial financial requirements. For example, in 2024, major infrastructure projects and cross-border trade initiatives continue to drive demand for these specialized financial services from large enterprises operating within and beyond China.

High-net-worth individuals (HNWIs) and ultra-HNWIs represent a crucial customer segment, seeking advanced wealth management and private banking services. These clients, often possessing investable assets exceeding $1 million and $30 million respectively, demand tailored solutions for estate planning and exclusive investment avenues like private equity. In 2024, the global HNWI population reached an estimated 62.5 million people, with total net worth of $250 trillion, highlighting the significant market potential.

Institutional investors like pension funds, endowments, and insurance companies are a key customer segment for China Development Financial. These entities seek sophisticated asset management, expert investment advice, and opportunities in private equity and venture capital. For instance, as of the end of 2023, global pension fund assets under management were estimated to exceed $50 trillion, highlighting the significant market for these services.

These clients demand high levels of performance, transparent and detailed reporting, and strict adherence to regulatory compliance. Sovereign wealth funds, another important institutional investor group, also require tailored investment strategies and robust risk management frameworks to meet their long-term objectives.

Small and Medium-sized Enterprises (SMEs)

Small and Medium-sized Enterprises (SMEs) represent a crucial customer segment for China Development Financial, particularly those businesses experiencing growth and needing to expand. These companies often require not just standard banking services but also access to capital for scaling operations and fostering innovation.

China's SME sector is a powerhouse of economic activity. In 2024, SMEs accounted for approximately 96% of all enterprises in China, contributing significantly to GDP and employment. This vast market presents a substantial opportunity for financial institutions like China Development Financial to provide tailored solutions.

- Access to Capital: SMEs need funding for inventory, equipment, and operational expansion.

- Banking Services: Essential services include current accounts, payment processing, and treasury management.

- Venture Capital: Early-stage SMEs seeking rapid growth may benefit from venture capital or private equity partnerships.

- Advisory Support: Guidance on financial planning and market entry can be invaluable for these businesses.

Individual Investors (Retail and Affluent)

Individual investors, encompassing both retail and affluent segments, are a cornerstone for China Development Financial. They primarily seek accessible securities brokerage services, a wide array of mutual funds, and fundamental wealth management solutions to enhance their savings and investment portfolios. This broad customer base often engages through efficient digital platforms and readily available standardized financial products, driving significant transaction volumes.

In 2024, the retail investor segment in China continued to show robust activity. For instance, the number of individual securities accounts opened saw a notable increase, with reports indicating millions of new accounts being established throughout the year, reflecting sustained interest in the equity markets. Affluent individuals, on the other hand, are increasingly looking for more sophisticated wealth management services beyond basic savings, seeking personalized investment strategies and access to alternative investments.

- Securities Brokerage: Providing platforms for trading stocks, bonds, and other securities, catering to both novice and experienced traders.

- Mutual Funds: Offering a diverse range of mutual fund products, from equity and bond funds to balanced and money market funds, to meet varied risk appetites.

- Wealth Management: Delivering tailored advice and services for wealth accumulation and preservation, including financial planning and asset allocation.

China Development Financial serves a diverse clientele, from large corporations needing complex capital market solutions to SMEs requiring growth capital and essential banking services. Institutional investors like pension funds and endowments rely on sophisticated asset management and investment advice, while high-net-worth individuals seek personalized wealth management and private banking. Individual investors, both retail and affluent, are catered to with accessible brokerage and wealth management products.

The SME segment is particularly vital, with China's SMEs representing approximately 96% of all enterprises in 2024, underscoring their economic significance. Institutional investors globally managed over $50 trillion in pension fund assets by the end of 2023, highlighting the scale of this market. The HNWI population reached an estimated 62.5 million globally in 2024, with a total net worth of $250 trillion, indicating substantial opportunities in wealth management.

| Customer Segment | Key Needs | 2024/Late 2023 Data Point |

|---|---|---|

| Large Corporations & Mid-sized Enterprises | Corporate banking, capital markets, trade finance | Continued demand from infrastructure and cross-border trade |

| High-Net-Worth Individuals (HNWIs) | Wealth management, private banking, estate planning | Global HNWI population: 62.5 million (est.) |

| Institutional Investors | Asset management, investment advice, private equity | Global pension fund AUM: >$50 trillion (end 2023) |

| Small and Medium-sized Enterprises (SMEs) | Access to capital, banking services, advisory | SMEs: ~96% of Chinese enterprises (2024) |

| Individual Investors | Securities brokerage, mutual funds, wealth management | Robust retail investor activity in China's equity markets |

Cost Structure

Employee salaries and benefits represent the most significant cost for a financial services group like China Development Financial. This encompasses the compensation for a substantial team of skilled professionals working in banking, investment management, and essential support roles. For instance, in 2024, the financial services sector globally saw average salary increases of around 4-5%, driven by the need to attract and retain expertise in areas like fintech and sustainable finance.

China Development Financial's technology infrastructure and software licensing represent a substantial and ongoing cost. In 2024, financial institutions globally saw IT spending increase, with many allocating over 10% of their revenue to technology. This includes significant investments in cloud computing, advanced analytics platforms, and robust cybersecurity solutions to protect sensitive customer data and maintain operational integrity.

The company must continuously invest in its digital transformation initiatives to remain competitive. This involves upgrading core banking systems, acquiring licenses for specialized financial software, and maintaining secure data centers. For instance, the global market for financial technology, or fintech, was projected to reach over $1.1 trillion by 2024, highlighting the immense scale of investment in this sector.

China Development Financial's cost structure includes significant outlays for regulatory compliance and legal fees. These expenses are critical for maintaining legal and ethical operations within China's robust financial regulatory framework. For instance, in 2023, financial institutions in China spent an estimated $15 billion on compliance-related activities, a figure expected to rise as regulations evolve.

These costs encompass salaries for dedicated compliance teams, external audit fees, retainers for legal counsel specializing in financial law, and the potential for substantial fines if non-compliance occurs. These are not discretionary expenses but rather a fundamental requirement for operating legally and responsibly in the financial sector.

Marketing and Business Development Expenses

China Development Financial invests heavily in marketing and business development to fuel its growth. This includes significant spending on advertising campaigns across various media, public relations efforts to enhance its brand image, and targeted client acquisition initiatives. In 2024, the company continued its focus on digital marketing, with a substantial portion of its budget allocated to online advertising and social media engagement to reach a wider audience and generate leads.

Maintaining strong client relationships is paramount, and a portion of these expenses is dedicated to client retention programs and fostering loyalty. Sponsorship of key industry events and conferences is also a critical component, allowing China Development Financial to increase its visibility, network with potential clients and partners, and stay abreast of market trends. These activities are crucial for building a robust market presence and driving sustainable expansion.

- Advertising and Promotion: Allocation for digital advertising, print media, and promotional materials.

- Client Acquisition and Retention: Costs associated with sales teams, relationship management, and loyalty programs.

- Public Relations and Brand Building: Investment in media outreach, corporate communications, and brand awareness campaigns.

- Event Sponsorship and Participation: Funding for industry conferences, seminars, and networking events.

Occupancy and Administrative Costs

Occupancy and administrative costs are a significant component of China Development Financial's operational expenses. These include the rent and maintenance for office spaces across its various subsidiaries and locations, ensuring a physical presence for its diverse financial services. In 2024, such overheads are crucial for supporting the extensive network of branches and service centers that facilitate client interactions and business development.

Essential back-office functions, vital for the smooth running of all business lines, are also factored into this cost structure. This encompasses utilities, salaries for administrative support staff, and other general overheads necessary for day-to-day operations. For instance, managing the administrative needs of a large financial institution like China Development Financial involves substantial investment in IT infrastructure and human resources to maintain efficiency and compliance.

- Rent and property maintenance for offices and operational centers.

- Utilities such as electricity, water, and internet services.

- Salaries and benefits for administrative and support staff.

- General overheads including office supplies, insurance, and IT support.

China Development Financial's cost structure is heavily influenced by personnel expenses, with salaries and benefits for its banking, investment, and support staff being a primary outlay. Technology investments, including cloud computing and cybersecurity, are also substantial, reflecting the industry's digital shift, with global IT spending in finance exceeding 10% of revenue in 2024. Furthermore, significant resources are dedicated to regulatory compliance and legal fees, a critical necessity in China's financial sector, with compliance costs in China's financial institutions estimated at $15 billion in 2023.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Personnel Costs | Salaries, benefits for banking, investment, and support staff. | Global financial sector salary increases of 4-5% in 2024. |

| Technology & Digitalization | Cloud computing, software licenses, cybersecurity, fintech investments. | Global financial IT spending >10% of revenue; Fintech market projected over $1.1 trillion by 2024. |

| Regulatory Compliance & Legal | Compliance teams, audits, legal counsel, potential fines. | China financial institutions' compliance spending estimated at $15 billion in 2023. |

Revenue Streams

Net interest income from lending is the cornerstone of China Development Financial's corporate banking operations. This revenue is generated from the spread between the interest they earn on loans provided to businesses and the interest they pay out on customer deposits and other borrowed funds. It's a fundamental and typically stable income stream for the bank.

In 2024, China Development Financial, like many financial institutions, would have seen its net interest income influenced by prevailing interest rate environments and loan growth. For instance, if the central bank adjusted policy rates, it would directly impact the bank's cost of funds and the rates it charges on loans, thereby affecting this key revenue driver.

China Development Financial earns significant revenue through fees and commissions derived from its securities services. This includes income from brokerage commissions generated when clients execute trades in stocks, bonds, and other securities.

Furthermore, the company benefits from underwriting fees, which are charged for facilitating capital market issuances like initial public offerings (IPOs) and debt offerings. In 2024, the global IPO market saw a rebound, with China’s market showing particular strength, indicating a robust pipeline for such underwriting activities.

Advisory fees for corporate finance transactions, such as mergers, acquisitions, and restructurings, also contribute substantially to this revenue stream. These fees are a direct reflection of China Development Financial's active participation and expertise in the capital markets, offering valuable fee-based services across a spectrum of financial needs.

Asset management fees represent a core recurring revenue stream for China Development Financial, generated as a percentage of the total assets they manage. This income grows directly with their expanding asset base, offering a predictable and scalable financial foundation.

In 2024, China Development Financial's asset management segment likely saw continued growth, mirroring the broader trends in China's financial markets. As more institutional and individual clients entrust their investments, the fee income from managing these portfolios becomes increasingly significant, demonstrating the stability and scalability of this revenue channel.

Private Equity and Venture Capital Gains

Private equity and venture capital firms generate revenue through successful exits, such as initial public offerings (IPOs) or strategic sales of portfolio companies. These gains represent the capital appreciation realized over the investment's lifecycle. For instance, in 2024, the global private equity industry saw significant deal activity, with many firms aiming for profitable exits to boost their overall financial performance.

These gains are a crucial, albeit less predictable, component of profitability for firms like China Development Financial. The ability to identify and nurture high-growth potential companies, ultimately leading to a lucrative exit, is a core driver of their success. In 2024, the IPO market, while subject to volatility, provided avenues for substantial returns for successful venture capital-backed companies.

- Capital Appreciation: Profits from selling portfolio companies at a higher valuation than the initial investment.

- Exit Strategies: Common exits include IPOs, mergers, acquisitions (trade sales), and secondary buyouts.

- Market Conditions: The timing and success of exits are heavily influenced by prevailing economic and market conditions in 2024.

- Predictability: While significant, these gains are inherently less predictable than recurring management fees.

Foreign Exchange and Trade Finance Fees

China Development Financial earns revenue by charging fees for facilitating foreign currency transactions. These services are crucial for corporate clients engaged in international business, enabling them to manage currency risks and execute cross-border payments efficiently.

Additionally, the company generates income from providing trade finance solutions. These include essential instruments like letters of credit and guarantees, which are vital for securing international trade deals and mitigating risks for both importers and exporters. In 2024, the global trade finance market was projected to reach trillions of dollars, highlighting the significant revenue potential in this sector.

- Fees from foreign exchange transactions for businesses.

- Revenue from issuing letters of credit to facilitate international trade.

- Income generated from providing guarantees for global supply chain financing.

- Service charges on cross-border payment processing and currency hedging.

China Development Financial also generates revenue through its insurance operations, offering a range of products like life, health, and property insurance. Premiums collected from policyholders form the primary revenue source for this segment. In 2024, the insurance sector in Asia continued to show resilience and growth, driven by increasing disposable incomes and a growing awareness of financial protection needs.

Investment income from managing the insurance float, which are premiums collected before claims are paid out, further boosts profitability. This involves investing these funds in various assets to earn returns. The performance of these investments is crucial for the overall financial health of the insurance business, with global equity markets in 2024 providing both opportunities and challenges.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| Insurance Premiums | Income from selling insurance policies. | Asian insurance market projected for continued growth. |

| Investment Income | Returns from investing insurance premiums. | Global equity markets in 2024 offered mixed performance. |

Business Model Canvas Data Sources

The China Development Financial Business Model Canvas is informed by a comprehensive blend of financial disclosures from Chinese financial institutions, market research reports on the nation's economic landscape, and strategic analyses of government development policies.