China Development Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

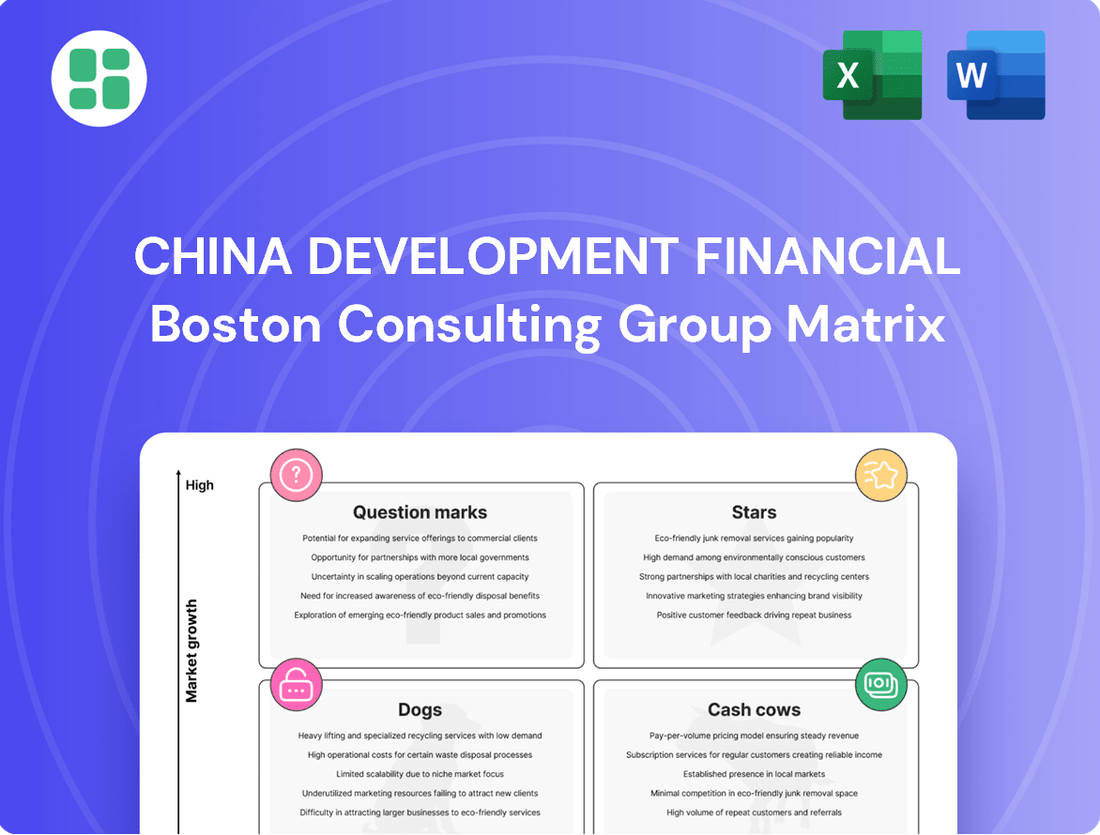

Uncover the strategic positioning of China Development Financial's product portfolio with this insightful BCG Matrix preview. See which segments are poised for growth and which require careful management.

Ready to transform your understanding of China Development Financial's market presence? Purchase the full BCG Matrix to gain detailed quadrant analysis, actionable insights for resource allocation, and a clear path to maximizing profitability.

This is your opportunity to gain a competitive edge. Invest in the complete BCG Matrix report and equip yourself with the knowledge to make informed decisions about China Development Financial's future success.

Stars

China Development Financial (CDFHC), through its KGI Financial operations, is strategically positioned to capture the burgeoning digital wealth management market in China. This sector is experiencing significant growth, driven by China's expanding middle class and their increasing appetite for sophisticated investment products. As of early 2024, China's wealth management market is projected to reach trillions of dollars, with digital channels playing an increasingly dominant role in client acquisition and service delivery.

CDFHC's commitment to integrating cutting-edge digital platforms and prioritizing customer-centric experiences directly addresses the evolving needs of Chinese investors. This focus is crucial in a market where digital savviness and seamless user interfaces are key differentiators. The firm's proactive approach in this area suggests a strong potential for KGI Financial to expand its market share, capitalizing on the shift towards online financial advisory and investment management services.

China Development Financial Holding Corporation (CDFHC), through its CDIB Capital Group, strategically deploys capital into high-tech and green energy sectors, aligning with China's national development priorities. These investments are crucial for fostering domestic innovation and sustainability, positioning CDFHC to capitalize on significant growth opportunities. The Chinese government's robust support for new energy vehicles, artificial intelligence, and advanced manufacturing creates a fertile ground for venture capital activity.

CDFHC's commitment to green energy is exemplified by its investment in Kai Hong Energy, a company actively involved in renewable energy projects. This move underscores the financial institution's role in facilitating the transition to a low-carbon economy. In 2024, China continued its aggressive push into green technologies, with significant government subsidies and private investment flowing into solar, wind, and battery storage solutions, indicating a robust market for CDFHC's capital.

China's ongoing capital market liberalization and the surging need for cross-border financial services, particularly in wealth management and investment, position this as a high-growth sector. This expansion aligns with the Stars category in the BCG Matrix, signifying significant market share in a rapidly expanding industry.

China Development Financial Holding Corporation's (CDFHC) strategic focus on international business development is evident. KGI Bank’s robust performance in consumer finance within Mainland China demonstrates their commitment to capturing leadership in these global segments, leveraging their domestic expertise for overseas growth.

AI-driven Fintech Solutions

The integration of AI and fintech is a major growth area, aiming to boost service efficiency and customer confidence. China Development Financial Holding Corporation (CDFHC) is strategically leveraging these technologies to enhance service quality and operational efficiency, positioning itself to gain market share in this dynamic sector.

This focus aligns with China's broader national strategy to accelerate digital transformation across its financial industry. By embracing AI-driven fintech solutions, CDFHC is tapping into a trend that is reshaping financial services globally. For instance, the global AI in fintech market was valued at approximately $10.4 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over $30 billion by 2028.

- AI-driven solutions enhance customer onboarding and fraud detection.

- Fintech integration improves operational efficiency and reduces costs.

- CDFHC's strategy targets increased market share through technological advancement.

- China's national push for digital finance supports this strategic direction.

Specialized Investment Products (e.g., REITs, Retirement FOFs)

The increasing investor appetite for products like Real Estate Investment Trusts (REITs) and Funds of Funds (FOFs) tailored for retirement savings highlights a dynamic growth area in China's wealth management landscape. These specialized offerings cater to a desire for diversification and targeted long-term wealth accumulation.

China Development Financial Holding Corporation (CDFHC), leveraging its robust asset and wealth management capabilities, is well-positioned to capitalize on this trend. By creating and actively marketing these specialized investment vehicles, CDFHC can attract previously untapped investor bases and expand its market presence.

- REITs: As of early 2024, China's public REITs market is still developing but shows significant potential, with new issuances expected to broaden investor access to real estate income streams.

- Retirement FOFs: The push for private pension reform in China is driving demand for retirement-focused investment products, with FOFs offering diversified exposure to various asset classes suitable for long-term growth.

- Market Share Growth: CDFHC's strategic focus on these niches can lead to enhanced market share by meeting specific, growing investor needs.

- Diversification Benefits: These products provide investors with avenues to diversify their portfolios beyond traditional stocks and bonds, potentially improving risk-adjusted returns.

China Development Financial Holding Corporation (CDFHC) is strategically positioned in the rapidly expanding digital wealth management and cross-border financial services sectors. These areas represent Stars in the BCG Matrix due to their high growth potential and CDFHC's strong market presence. The firm's focus on AI-driven fintech solutions and specialized investment products like REITs and FOFs further solidifies its Star status by addressing evolving investor needs and national development priorities.

The wealth management market in China is experiencing substantial growth, with digital channels becoming increasingly vital. CDFHC's investment in KGI Financial's digital platforms aims to capture a significant share of this expanding market. By integrating AI and fintech, CDFHC is enhancing service efficiency and customer engagement, aligning with China's broader digital transformation agenda in finance.

| BCG Category | CDFHC Business Area | Market Growth | CDFHC Market Share | Strategic Implication |

|---|---|---|---|---|

| Stars | Digital Wealth Management | High | Growing | Invest for growth, maintain leadership |

| Stars | Cross-border Financial Services | High | Growing | Expand service offerings, capture new markets |

| Stars | AI-driven Fintech Solutions | High | Emerging | Innovate and integrate to gain competitive edge |

| Stars | Specialized Investment Products (REITs, FOFs) | High | Developing | Develop and market to capture niche demand |

What is included in the product

This BCG Matrix overview details China Development Financial's product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic direction on where to invest, hold, or divest within their business units.

The China Development Financial BCG Matrix provides a clear, one-page overview, easing the pain of complex portfolio analysis.

Cash Cows

CDFHC's traditional corporate lending operations are a cornerstone of its financial strength, acting as a reliable cash cow. These established banking services, including term loans and revolving credit facilities, generate consistent income streams for the company.

Despite potentially slower growth in the mature corporate finance sector, CDFHC's deep-rooted client relationships and a diversified corporate credit portfolio, estimated to be in the hundreds of billions of NT dollars as of early 2024, ensure a steady and predictable cash flow. This stability is further bolstered by the concentrated nature of the market, where established institutions like CDFHC command significant market share.

KGI Securities, a key player in China Development Financial's portfolio, exemplifies a cash cow within the BCG matrix. Its significant market share in the mature securities brokerage sector ensures consistent revenue streams. For instance, in 2023, KGI Securities reported a net profit of NT$5.7 billion, underscoring its role as a stable income generator for the group, even amidst market volatility.

China Development Financial Holding Corporation (CDFHC)'s core asset management services, particularly those managing substantial assets for both institutional and individual clients, are firmly positioned as cash cows. These offerings benefit from a mature market characterized by stable, ongoing demand, ensuring a predictable revenue stream.

The consistent fee-based income generated by these services stems from CDFHC's established client relationships and strong market reputation. This allows for a reduced need for aggressive promotional spending, as the existing client base and brand trust drive continued inflows and retention, much like a well-oiled machine.

As of the first quarter of 2024, CDFHC reported significant growth in its asset management segment, with Assets Under Management (AUM) reaching new highs, reflecting the continued trust and reliance of its clients on these core offerings.

Underwriting Services for Stable Industries

China Development Financial Holding Corporation's (CDFHC) underwriting services for stable industries represent a classic Cash Cow within its BCG Matrix. These services, focusing on established sectors, leverage CDFHC's significant market share to generate consistent fee-based income. The predictability of these operations translates into strong cash flow generation, even if the growth prospects are more modest compared to other business segments.

In 2024, the underwriting of debt and equity for mature industries remained a cornerstone of CDFHC's revenue. For instance, the financial services sector, a key area for underwriting, saw continued demand for capital raising activities. CDFHC's established relationships and expertise in these stable sectors allowed it to capture a substantial portion of this market, contributing significantly to its overall profitability.

- Stable Industry Underwriting: CDFHC holds a dominant market share in underwriting for mature and predictable industries, ensuring a consistent revenue stream.

- Fee-Based Income: The primary revenue driver is fees earned from facilitating capital raising, providing a reliable source of cash.

- Strong Cash Generation: Despite lower growth potential, this segment excels at generating substantial cash flow due to its established nature and market position.

- Profitability Contribution: These services are crucial for CDFHC's overall profitability, acting as a stable financial foundation for the group.

Mature Life Insurance Products (KGI Life)

KGI Life, a key player within China Development Financial Holding Corporation (CDFHC), offers a diverse portfolio of life insurance solutions. Despite the generally mature nature of the life insurance sector, KGI Life's established product lines, particularly those catering to protection, retirement planning, and enhanced value-added services, consistently deliver stable premium income and investment returns.

These mature products are characterized by high customer retention, which translates into predictable and reliable cash flows for the parent company, CDFHC. For instance, in 2024, the life insurance segment, largely driven by KGI Life, continued to be a foundational contributor to CDFHC's overall financial performance, demonstrating resilience in a competitive market.

- Stable Premium Generation: KGI Life's established product suite, focusing on protection and retirement, ensures a steady inflow of premiums.

- Consistent Investment Income: The long-term nature of these insurance products allows for stable investment income generation.

- High Retention Rates: Strong customer loyalty in mature product lines leads to high retention, bolstering predictable cash flows.

- Cash Flow Contribution: These factors combine to make KGI Life's mature products a significant and reliable source of cash for CDFHC.

China Development Financial Holding Corporation's (CDFHC) traditional corporate lending and KGI Securities are prime examples of cash cows within its BCG Matrix. These segments benefit from significant market share in mature sectors, generating consistent fee-based income and steady cash flow for the group.

CDFHC's asset management services and KGI Life's established insurance products also function as cash cows. Their predictable revenue streams, driven by strong client relationships and high retention rates in mature markets, contribute reliably to the company's overall financial stability.

These cash cow businesses, including corporate lending and asset management, are vital for funding CDFHC's investments in other areas and maintaining its strong financial position. For instance, CDFHC's corporate lending portfolio, a key cash cow, was estimated to be in the hundreds of billions of NT dollars as of early 2024, providing a solid financial bedrock.

KGI Securities, another cash cow, reported a net profit of NT$5.7 billion in 2023, clearly demonstrating its role as a consistent income generator for CDFHC, even in fluctuating market conditions.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Corporate Lending | Cash Cow | Mature, stable income, high market share | Portfolio in hundreds of billions NTD (early 2024) |

| KGI Securities | Cash Cow | Mature brokerage, consistent revenue | NT$5.7 billion net profit (2023) |

| Asset Management | Cash Cow | Stable fee-based income, strong client retention | Record AUM in Q1 2024 |

| KGI Life (Mature Products) | Cash Cow | Predictable premiums, stable investment income | Foundational contributor to CDFHC performance (2024) |

Full Transparency, Always

China Development Financial BCG Matrix

The China Development Financial BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you get the complete strategic analysis without any watermarks or placeholder content, ready for immediate application in your business planning.

Dogs

Outdated traditional banking services, those slow to embrace digital advancements or evolving customer expectations, often find themselves in the Dogs quadrant of the China Development Financial BCG Matrix. These offerings, marked by stagnant or declining growth and a shrinking market presence, might involve heavily manual operations or specialized products that no longer resonate with current market needs. For instance, as of late 2024, a significant portion of legacy banking infrastructure still relies on paper-based processes, contributing to higher operational costs and slower transaction times compared to digital-first competitors.

Segments within securities brokerage that are highly commoditized and face intense price competition, leading to low profit margins and limited growth, could be considered dogs in China Development Financial's (CDFHC) BCG Matrix. For instance, basic online stock trading platforms, where differentiation is minimal and fees are aggressively undercut, often fall into this category. In 2023, the average commission rate for retail stock trading in many developed Asian markets hovered around 0.1% or even lower, squeezing profitability.

If CDFHC's KGI Securities has significant exposure to such low-margin, highly saturated segments without a clear differentiation strategy, these business units might become cash traps. This means they consume capital for operations and maintenance but generate minimal returns, hindering investment in more promising areas. For example, if KGI's market share in a highly competitive, fee-driven segment remains stagnant despite substantial marketing spend, it indicates a potential cash trap scenario.

Underperforming legacy investments within a China Development Financial BCG Matrix framework would represent the 'Dogs' quadrant. These are typically private equity or venture capital holdings that have failed to gain traction, struggling with low growth prospects and minimal market share. For instance, a legacy tech investment in a sector facing rapid obsolescence, unable to secure a profitable exit by mid-2024, would fit this category.

Such 'Dogs' are characterized by their inability to generate satisfactory returns, often consuming valuable capital without contributing to overall portfolio growth. By the end of 2023, reports indicated that a significant portion of venture capital funds were holding onto legacy assets that had not seen a liquidity event in over seven years, tying up substantial amounts of capital.

The strategic imperative for these 'Dogs' is clear: divestment or restructuring. Failing to address these underperformers can drag down the entire portfolio's performance, as seen in some diversified investment funds where legacy stakes in declining industries represented a drag on overall returns, impacting net asset value growth by as much as 1-2% annually.

Inefficient Back-Office Operations

Inefficient back-office operations within China Development Financial Holding Corporation Limited (CDFHC) can be categorized as Dogs in the BCG Matrix. These are segments characterized by high operational costs and low efficiency, failing to contribute significantly to the company's competitive edge. For instance, manual data processing or outdated IT systems in areas like loan application processing or customer onboarding could exemplify these inefficient units.

These operations often suffer from a low market share in terms of operational speed and accuracy, while consuming substantial resources without generating proportional output. In 2024, financial institutions globally have been investing heavily in digital transformation to streamline back-office functions. CDFHC's back-office, if lagging in this adoption, would represent a classic Dog, consuming capital without promising future growth or profitability.

- High operational costs: Manual processes and legacy systems increase labor and error correction expenses.

- Low efficiency: Slow processing times and bottlenecks hinder overall productivity.

- Minimal competitive advantage: Outdated systems do not support agility or superior customer service.

- Resource drain: Significant investment in maintaining inefficient operations diverts funds from growth areas.

Niche, Stagnant Personal Credit Products

Niche personal credit products, particularly those with limited market appeal or facing obsolescence, represent a challenging quadrant in the BCG Matrix. For instance, specialized secured loans for antique vehicle collections or certain types of co-signer backed student loans might fall into this category. These products often struggle with low adoption rates as consumer preferences shift towards more flexible and digital-first alternatives offered by fintech companies. Intense competition further erodes market share for traditional offerings.

If CDFHC's KGI Bank possesses a minimal stake in these stagnant segments, the financial returns are likely to be negligible. For example, a product with less than 1% market share in a declining credit category would generate minimal revenue. This situation necessitates a thorough strategic review, potentially leading to divestment or a complete overhaul of the product to align with current market demands and competitive landscapes.

- Stagnant Personal Credit Products: Examples include specialized, low-volume loans like those for rare collectibles or niche educational programs with declining enrollment.

- Low Adoption & High Competition: These products often see limited uptake as consumers gravitate towards digital banking solutions and readily available, broader credit lines.

- KGI Bank's Market Share: If KGI Bank holds a small percentage, say under 2%, in these specific, underperforming credit lines, profitability will be minimal.

- Strategic Re-evaluation: Such segments require a strategic decision: either exit the market, divest the product line, or invest in innovation to revitalize its appeal and competitiveness.

Dogs in the China Development Financial BCG Matrix represent business units or products with low market share and low growth potential. These are often characterized by declining demand, intense competition, or outdated business models, consuming resources without generating significant returns. For instance, by mid-2024, certain legacy insurance products with minimal customer uptake and facing pressure from digital disruptors would fit this description.

Such offerings, like underperforming investment funds or commoditized trading desks, often require significant capital to maintain operations but yield minimal profits. In 2023, some traditional brokerage segments saw profit margins shrink to below 0.5% due to intense competition and fee compression.

The strategic approach for these 'Dogs' typically involves divestment or liquidation to free up capital for more promising ventures. For example, a financial institution might sell off a struggling regional branch network that consistently underperforms, as seen in some European banks divesting non-core assets throughout 2024.

These segments drain resources, hindering the company's ability to invest in growth areas. By the end of 2023, it was estimated that companies with a high proportion of 'Dog' assets could see their overall profitability reduced by as much as 5-10% annually.

| Business Unit/Product | Market Growth Rate | Relative Market Share | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Securities Trading Platform | Low (<2%) | Low (<5%) | Negative to Low | Divest or Restructure |

| Niche Personal Loan Product | Declining (-3%) | Very Low (<1%) | Negative | Exit or Revitalize |

| Outdated Back-Office Processing | Stagnant (0%) | Low (operational inefficiency) | High Cost, Low Output | Automate or Outsource |

Question Marks

Emerging fintech ventures, both internal initiatives and external investments by China Development Financial Holding Corporation (CDFHC), are being strategically positioned within the BCG matrix. These ventures, often focusing on high-growth sectors such as blockchain applications in finance or sophisticated AI-driven analytics, currently represent nascent market shares. For instance, CDFHC's exploration into digital yuan infrastructure could be seen as a question mark, given its early stage and the evolving regulatory landscape in China.

These emerging fintech areas demand substantial capital infusion to cultivate market presence and validate their business models. CDFHC's commitment to these segments reflects a forward-looking strategy, aiming to capture future market leadership. In 2023, the global fintech market was valued at over $1.5 trillion, with significant growth projected in areas like AI and blockchain, underscoring the potential for these question mark ventures to become stars.

China Development Financial Holding Corporation (CDFHC) may explore new international markets that are experiencing rapid growth in financial services, even if its current presence is minimal. These strategic moves, like expanding into emerging Southeast Asian fintech hubs or specific European digital banking sectors, require significant upfront investment for establishing operations and brand recognition. The potential for substantial future returns, however, is considerable, mirroring the growth trajectories seen in markets like Vietnam or Indonesia where digital financial services adoption is soaring.

China Development Financial (CDFHC) is increasingly focusing on specialized private equity funds to penetrate nascent sectors. These funds, launched in 2024, are designed to capture early-stage growth in areas like advanced AI and synthetic biology, where market validation is still developing but future potential is immense.

These high-risk, high-reward ventures require significant capital infusion. For instance, a recent CDFHC initiative committed $150 million to a deep tech fund, aiming for substantial market share in a sector projected to grow by over 30% annually through 2028.

The strategy acknowledges that while the market for these innovative sectors is expanding, CDFHC's current footprint is minimal. By backing specialized funds, CDFHC aims to become a dominant player, leveraging early capital to secure leadership positions.

Advanced Digital Banking Features (e.g., Hyper-personalized Advisory)

China Development Financial Holding Corporation (CDFHC) is exploring advanced digital banking features, including hyper-personalized advisory services. While the demand for tailored financial guidance is increasing, CDFHC's success in capturing significant market share for these sophisticated digital tools is still in its early stages.

The adoption rate for such complex, personalized digital offerings is a key factor in determining their strategic placement. CDFHC's ability to integrate AI and data analytics to deliver truly unique financial advice will be crucial for differentiating itself in a competitive digital landscape.

- Market Growth: The global personalized financial services market is projected to reach over $3 trillion by 2027, indicating substantial potential for digital advisory.

- CDFHC's Focus: CDFHC is investing in AI-driven platforms to offer customized investment strategies and financial planning, aiming to enhance customer engagement.

- Adoption Challenge: While many consumers express interest in personalized advice, actual uptake of advanced digital solutions can be slower due to trust, data privacy concerns, and the need for user education.

Green Finance Products for Untapped Segments

China Development Financial Holding Corporation (CDFHC) is exploring innovative green finance products to tap into emerging segments of the green economy. These initiatives, while aligned with Environmental, Social, and Governance (ESG) principles, currently represent a smaller market share for CDFHC, indicating a need for substantial investment to secure future growth.

CDFHC's strategy involves developing tailored financial solutions for sectors like sustainable agriculture technology, circular economy startups, and green building materials. For instance, in 2024, CDFHC launched a pilot program offering specialized green bonds for companies developing advanced recycling technologies, aiming to foster a more resource-efficient economy.

- Targeting Emerging Green Sectors: CDFHC is focusing on high-growth potential but less mature segments like carbon capture technology and green hydrogen production.

- Investment in Future Growth: These ventures currently hold a low market share, requiring significant capital infusion to establish a strong foothold and capitalize on anticipated market expansion.

- Product Innovation: Development of green loans with tiered interest rates based on environmental performance and green insurance for climate-vulnerable infrastructure projects are key offerings.

- Market Penetration Strategy: CDFHC plans to partner with research institutions and industry associations to identify and support promising green ventures, aiming to increase its market share in these nascent areas.

Question Marks in CDFHC's BCG matrix represent new ventures with low market share but high growth potential. These are often innovative fintech solutions, international market expansions, or specialized private equity investments in nascent industries. Significant capital is required to develop these areas, with the hope of them becoming future market leaders.

| Venture Area | Current Market Share | Projected Market Growth | Capital Requirement | Strategic Goal |

|---|---|---|---|---|

| Emerging Fintech (e.g., Digital Yuan Infrastructure) | Low | High | Substantial | Future Market Leadership |

| New International Markets (e.g., Southeast Asian Fintech) | Minimal | Rapid | Significant Upfront Investment | Establish Operations & Brand Recognition |

| Specialized Private Equity Funds (e.g., Deep Tech) | Nascent | Immense | High | Dominant Player Status |

| Advanced Digital Banking Features (e.g., Hyper-Personalized Advisory) | Early Stages | Increasing | Key for Differentiation | Capture Significant Market Share |

| Innovative Green Finance Products (e.g., Green Bonds for Recycling Tech) | Smaller Market Share | High Potential | Substantial Investment | Secure Future Growth |

BCG Matrix Data Sources

Our China Development Financial BCG Matrix is built on a robust foundation of official government statistics, economic forecasts, and leading financial publications, ensuring comprehensive and accurate market representation.