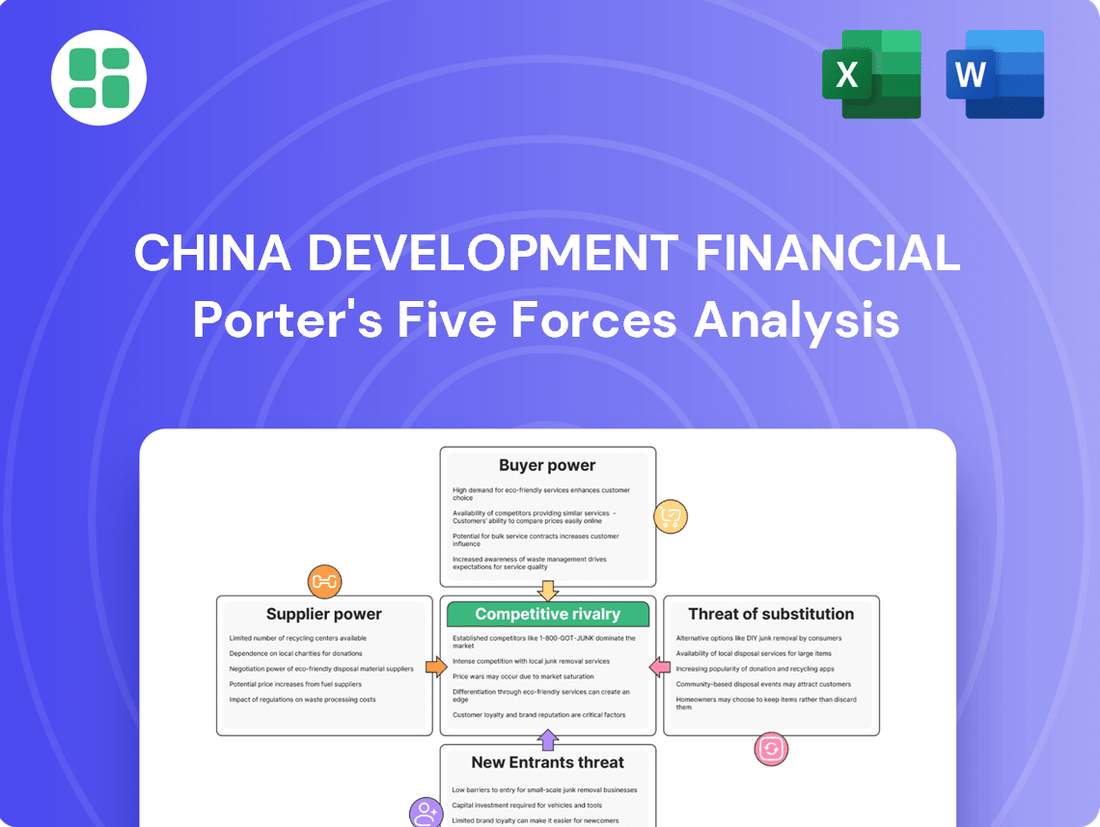

China Development Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

China Development Financial operates in a dynamic environment shaped by intense competition, evolving customer demands, and the constant threat of new market entrants. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping China Development Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of capital suppliers, including depositors and institutional investors, is a significant factor for China Development Financial (CDF). In Taiwan's competitive financial landscape, attracting funds is a constant challenge. This means that while CDF, as a major player, has a strong reputation, individual depositors still have many choices, and larger institutional investors can often negotiate favorable terms for their substantial capital contributions.

For instance, as of Q1 2024, Taiwan's banking sector saw a deposit growth of approximately 4.5% year-on-year, indicating a healthy but competitive market for securing funds. Institutional investors, such as pension funds or asset managers, can leverage their scale to influence interest rates and other conditions, directly impacting CDF's cost of capital.

Furthermore, the broader economic climate and interest rate policies set by the central bank play a crucial role. When interest rates are high, the cost of borrowing increases, and conversely, lower rates can make capital more accessible but potentially reduce returns for depositors, influencing their willingness to supply funds. This dynamic directly affects CDF's flexibility in managing its funding structure and overall financial strategy.

Suppliers of advanced financial technology, such as AI, data analytics, and cybersecurity, are gaining more leverage. As institutions like China Development Financial (CDF) push for digital transformation and integrate AI, their dependence on these specialized tech providers increases.

The Taiwanese Financial Supervisory Commission (FSC) released guidelines for AI use in June 2024, focusing on governance and accountability. This regulatory push is likely to drive demand for compliant and robust technology solutions, further strengthening the bargaining power of these critical tech vendors.

The availability of highly skilled professionals in areas like fintech, AI, risk management, and cybersecurity is a crucial supplier factor for China Development Financial (CDF). A shortage of specialized talent, especially in rapidly evolving fintech sectors, can significantly amplify the bargaining power of these employees.

CDF, like its peers, must prioritize investments in attracting and retaining top-tier talent to effectively execute its digital transformation initiatives and sustain a competitive advantage in the market.

Regulatory Compliance Services

Providers of regulatory compliance, legal, and auditing services wield significant bargaining power in Taiwan's financial sector. This is driven by the complex and constantly changing regulatory landscape. For instance, the new regulations for Virtual Asset Service Providers (VASPs) are set to take effect in November 2024, demanding specialized expertise. Similarly, emerging guidelines for AI applications require up-to-date knowledge.

China Development Financial (CDF) must engage these expert services to ensure strict adherence to these evolving rules. Failure to comply can result in substantial penalties and damage to operational integrity. The cost of engaging specialized legal and compliance firms reflects their critical role in navigating these intricate requirements.

- Expertise is scarce: The specialized knowledge required for Taiwan's financial regulations is not widely available, increasing the value of compliance service providers.

- High switching costs: CDF faces significant costs and disruption in switching to new compliance service providers due to the need for extensive knowledge transfer and integration with existing systems.

- Regulation complexity: The sheer volume and intricacy of financial regulations, including those for VASPs and AI, necessitate reliance on external experts, bolstering their bargaining power.

Information and Market Data Providers

Suppliers of crucial financial market data, credit ratings, and economic intelligence are essential for China Development Financial (CDF) in its investment and risk management operations. The availability of high-quality, real-time data is a fundamental requirement for making informed decisions across CDF's diverse business segments, including securities brokerage, private equity, and venture capital.

The bargaining power of these suppliers can be significant, particularly when the market for specific data is concentrated. For instance, in 2024, major financial data terminals like Bloomberg and Refinitiv continued to dominate the market, offering comprehensive real-time data and analytics. Their established infrastructure and the sheer volume of data they aggregate grant them considerable leverage over financial institutions like CDF that rely on these services for competitive market insights and operational efficiency.

- Concentration of Key Data Providers: A limited number of dominant players in financial data provision can exert substantial influence.

- Essential Nature of Data: CDF's core functions in investment, risk management, and decision-making are critically dependent on the data supplied.

- Cost of Switching: The integration of data services into CDF's existing systems can make switching providers costly and complex, further strengthening supplier power.

- 2024 Market Dynamics: The continued dominance of established financial data platforms in 2024 underscored the ongoing bargaining power of these essential suppliers.

The bargaining power of suppliers for China Development Financial (CDF) is multifaceted, encompassing capital, technology, talent, regulatory expertise, and data. In 2024, the increasing reliance on specialized fintech and AI providers, coupled with a scarcity of skilled professionals in these areas, significantly amplified their leverage. Furthermore, the complex regulatory environment in Taiwan, with new rules for VASPs and AI, strengthened the position of compliance and legal service providers.

CDF's dependence on key financial data providers like Bloomberg and Refinitiv, who continued their market dominance in 2024, also grants these suppliers considerable bargaining power. The essential nature of this data for CDF's operations and the high costs associated with switching providers further solidify their influence.

| Supplier Category | Key Factors Influencing Bargaining Power | 2024 Market Context |

|---|---|---|

| Capital Suppliers (Depositors, Investors) | Competition for funds, investor scale, economic climate | Taiwan's banking sector saw ~4.5% YoY deposit growth in Q1 2024, indicating a competitive but healthy market. |

| Technology Providers (Fintech, AI) | Digital transformation needs, specialization, regulatory compliance demand | Taiwan FSC guidelines for AI in June 2024 likely increased demand for compliant tech solutions. |

| Human Capital (Fintech, AI Talent) | Talent scarcity, demand for specialized skills | Shortages in fintech and AI expertise amplify the bargaining power of skilled professionals. |

| Regulatory & Legal Services | Complexity of regulations, need for specialized expertise | New VASP regulations (Nov 2024) and AI guidelines require specialized knowledge, increasing provider leverage. |

| Financial Data & Intelligence | Data concentration, essential nature of data, switching costs | Dominance of providers like Bloomberg and Refinitiv in 2024 maintained their strong bargaining position. |

What is included in the product

China Development Financial's Porter's Five Forces analysis reveals the intense rivalry within the financial services sector, the significant bargaining power of its customers, and the substantial barriers to entry that protect established players.

Instantly assess competitive pressures and identify strategic opportunities with a clear, actionable Porter's Five Forces analysis tailored for China's dynamic financial sector.

Customers Bargaining Power

China Development Financial (CDF) caters to a wide range of clients, from large corporations needing sophisticated banking and investment services to individual investors seeking wealth management and securities trading. This broad customer base, encompassing diverse needs and transaction volumes, inherently moderates the bargaining power of any single customer group. For instance, in 2023, CDF reported a significant portion of its revenue derived from its corporate banking segment, but individual wealth management also showed robust growth, indicating no single segment holds overwhelming sway.

Taiwan's financial sector is incredibly crowded, boasting a multitude of domestic banks, securities firms, and insurance providers. This sheer volume of options means customers have a wide array of choices for their financial needs, significantly amplifying their bargaining power.

The competitive landscape is further intensified by the rise of digital-only banks and innovative fintech solutions. These platforms offer greater convenience and often better pricing, making it simple for customers to switch providers if they are unhappy with existing services or costs. For instance, as of early 2024, the number of digital payment users in Taiwan continued to climb, indicating a growing comfort with online financial services and a reduced switching cost.

For many standard financial products offered by China Development Financial (CDF), such as savings accounts, basic brokerage services, and general insurance, customers face minimal hurdles when switching providers. This low barrier to entry significantly amplifies their bargaining power.

The ongoing advancements in digital financial services, coupled with regulatory pushes like Taiwan's initial Open Banking framework implemented in 2022, have further streamlined the process for customers to migrate their funds and services. This ease of transition directly pressures CDF to maintain competitive pricing and deliver exceptional service quality to retain its client base.

Increased Digital and Financial Literacy

The growing financial and digital savvy of Taiwanese consumers significantly bolsters their bargaining power. With 81.6% of Taiwanese consumers utilizing digital payments in 2024, they are well-equipped to research and compare offerings from various financial institutions. This ease of access to information allows them to readily identify and demand better value and greater transparency.

This heightened consumer sophistication translates directly into increased pressure on financial firms. A 2025 survey revealed a notable shift towards conservative investment approaches, with a preference for Exchange Traded Funds (ETFs). Consequently, financial service providers must adapt by offering more stable, accessible, and competitively priced products to attract and retain these informed customers.

- Digital Payment Adoption: 81.6% of Taiwanese consumers used digital payments in 2024.

- Consumer Sophistication: Increased ability to compare products, demand transparency, and seek value.

- Investment Trends: Rise in conservative strategies favoring ETFs observed in 2025 surveys.

- Market Pressure: Financial institutions are compelled to offer stable and accessible products.

Customer Focus Initiatives

China Development Financial (CDF) explicitly recognizes the significance of customer power through its ABCDE strategy, which prominently features Customer Focus. This strategic pillar demonstrates CDF's proactive approach to understanding and catering to customer needs, aiming to foster stronger relationships and reduce customer churn.

By investing in customer experience and developing integrated financial solutions, CDF seeks to differentiate itself in a competitive market. For instance, in 2024, financial institutions globally saw a significant increase in customer expectations for personalized digital services, with reports indicating that over 70% of consumers prefer digital channels for routine banking transactions. CDF's focus on integrated solutions directly addresses this trend.

- Customer-Centric Strategy: CDF's ABCDE strategy highlights Customer Focus, signaling a commitment to enhancing customer satisfaction and loyalty.

- Integrated Solutions: The company aims to provide a comprehensive suite of financial services, reducing the need for customers to seek solutions from multiple providers.

- Market Trends: In 2024, the financial sector observed a strong demand for personalized digital experiences, a trend CDF's customer focus initiatives are designed to meet.

- Competitive Advantage: By prioritizing customer needs, CDF seeks to build stronger customer relationships and mitigate the bargaining power of customers who might otherwise switch to competitors.

The bargaining power of customers for China Development Financial (CDF) is notably high due to Taiwan's intensely competitive financial market. With numerous domestic and international institutions, plus emerging fintech players, customers have abundant choices and low switching costs. This environment compels CDF to offer competitive pricing and superior service to retain its client base.

Taiwanese consumers are increasingly digitally savvy and informed, actively comparing financial products and demanding greater transparency and value. This trend is underscored by the fact that 81.6% of Taiwanese consumers utilized digital payments in 2024, indicating a comfort with online platforms and a willingness to explore alternatives. Consequently, CDF must continually innovate and personalize its offerings to meet these evolving expectations.

| Factor | Impact on CDF | Supporting Data (2024-2025) |

|---|---|---|

| Market Competition | Amplifies customer power | High density of financial institutions and fintechs in Taiwan. |

| Switching Costs | Low for standard products | Ease of digital migration and open banking initiatives. |

| Consumer Sophistication | Increases demand for value & transparency | 81.6% digital payment usage (2024); preference for ETFs (2025 surveys). |

| Digital Adoption | Facilitates comparison and switching | Growing comfort with online financial services. |

Full Version Awaits

China Development Financial Porter's Five Forces Analysis

This preview showcases the comprehensive China Development Financial Porter's Five Forces Analysis you will receive instantly upon purchase. You are viewing the exact, professionally formatted document, ensuring no surprises and immediate usability for your strategic planning needs.

Rivalry Among Competitors

Taiwan's financial services landscape is incredibly crowded, with over 400 financial institutions operating as of December 2024. This high degree of fragmentation, particularly within the banking sector, fuels intense rivalry across banking, securities, and insurance. Such a saturated market often leads to compressed profit margins for all players, including China Development Financial (CDF).

Recent years have seen significant consolidation within Taiwan's financial holding companies (FHCs). For instance, Fubon FHC's acquisition of Jih Sun FHC in 2022 and the proposed merger between Taishin FHC and Shin Kong FHC in 2024 highlight this trend. This aggressive M&A activity intensifies rivalry, as larger entities seek market share and economies of scale, creating more formidable competitors for China Development Financial (CDF).

China's financial sector is experiencing intense rivalry driven by digitalization and fintech. Traditional institutions like China Development Financial (CDF) are adapting by adopting AI and digital tools, but they face nimble fintech startups and digital-only banks, many of which launched in 2021 and 2022. This digital transformation is particularly evident in areas like electronic payments and robo-advisory services, forcing continuous innovation across the board.

Product Diversification and Integrated Solutions

China Development Financial (CDF) and its peers are deeply engaged in product diversification, aiming to provide clients with a full spectrum of financial services. This includes everything from corporate banking and securities trading to private equity, venture capital, and insurance offerings. This strategy intensifies competition, as firms battle to become the go-to financial partner for both businesses and individuals. For instance, by the end of 2023, the total assets of Taiwan's financial sector, which includes institutions like CDF, reached approximately NT$110 trillion (US$3.4 trillion), reflecting the scale of the market and the breadth of services offered by major players.

The ability to effectively cross-sell and bundle these diverse financial products is a critical differentiator in this environment. Financial institutions are increasingly focused on creating integrated solutions that cater to the entire financial lifecycle of their clients. This approach not only enhances client loyalty but also creates significant barriers to entry for more specialized competitors. In 2024, many financial groups are investing heavily in digital platforms to facilitate this seamless integration and improve customer experience across all service lines.

- Broad Service Portfolios: CDF and competitors offer corporate banking, securities, private equity, venture capital, and insurance.

- Multi-Front Competition: Firms compete across various financial service segments for client dominance.

- Cross-Selling Advantage: The ability to bundle and cross-sell services is a key competitive edge.

- Integrated Solutions Focus: Emphasis on providing comprehensive financial partnerships for clients.

Regulatory Environment and Strategic Focus

Taiwan's Financial Supervisory Commission (FSC) generally favors a stable financial system, but in 2024, it's actively encouraging international competitiveness and innovation. This dual focus means rivalry intensifies not just on traditional metrics but also on how well firms adopt new technologies and sustainable practices. For instance, the FSC's push for green finance, with significant capital flows directed towards ESG initiatives, creates a competitive battleground for attracting sustainable investments.

The regulatory environment is steering competition towards specific strategic areas. The FSC's 2024 initiatives, such as promoting fintech adoption and expanding digital financial services, are compelling financial institutions to invest heavily in technology. Companies that can effectively leverage these regulatory tailwinds to enhance customer experience and operational efficiency will likely outpace rivals. For example, by the end of 2023, Taiwan's fintech sector saw a substantial increase in venture capital funding, signaling this strategic shift.

- FSC's 2024 focus on green finance is driving competition in sustainable investment products.

- Regulatory push for fintech adoption is intensifying rivalry in digital financial services.

- Companies aligning with regulatory priorities, such as financial inclusion, are gaining a competitive edge.

- Taiwan's financial sector saw a 15% year-over-year increase in fintech-related investments by Q3 2024.

Competitive rivalry within Taiwan's financial sector, impacting China Development Financial (CDF), is fierce due to a highly fragmented market with over 400 institutions as of December 2024. This intense competition is further amplified by ongoing consolidation, such as the proposed merger of Taishin FHC and Shin Kong FHC in 2024, leading to larger, more dominant players. CDF and its rivals are actively diversifying services, from banking to private equity, to capture a broader client base, a trend underscored by the sector's NT$110 trillion in total assets by the end of 2023.

| Competitor Type | Key Competitive Actions | Impact on CDF |

|---|---|---|

| Established Banks | Aggressive M&A, digital transformation, product bundling | Pressure on market share and margins |

| Securities Firms | Enhanced trading platforms, wealth management expansion | Competition for investment banking and advisory services |

| Insurance Companies | Cross-selling financial products, digital claims processing | Competition for holistic financial solutions |

| Fintech Startups | Innovative payment solutions, robo-advisory, AI integration | Disruption of traditional revenue streams, need for rapid adaptation |

SSubstitutes Threaten

The threat of substitutes for traditional financial intermediaries like China Development Financial is growing. Platforms offering direct investment and alternative financing, such as crowdfunding and peer-to-peer lending, provide individuals and businesses with ways to manage their money or raise capital outside of conventional banking and venture capital channels. These alternatives can present cost savings and increased flexibility, attracting specific market segments.

For example, the global crowdfunding market was projected to reach over $200 billion by 2024, demonstrating a significant shift towards these alternative funding methods. Similarly, the peer-to-peer lending sector has seen substantial growth, with market sizes in some regions doubling year-on-year, indicating a clear preference among some borrowers and investors for disintermediation.

The increasing availability of self-service and robo-advisory solutions presents a significant threat of substitutes for China Development Financial (CDF). For individual investors, online brokerage platforms and automated investment advisors offer a more accessible and often cheaper alternative to traditional wealth management. This trend is evident globally, with the robo-advisory market projected to reach trillions in assets under management by 2027.

These digital platforms empower individuals to manage their investments directly, reducing their reliance on human financial advisors for basic portfolio management and trading. CDF's KGI Securities and its wealth management divisions face pressure to demonstrate added value beyond mere transaction execution, perhaps through specialized advisory services or highly intuitive digital experiences.

The rise of virtual assets and blockchain technology poses a developing threat to traditional financial services. As of November 2024, Taiwan's Financial Supervisory Commission (FSC) has implemented new Virtual Asset Service Provider (VASP) registration rules, indicating a move towards formalizing this sector. This regulatory shift acknowledges the potential for cryptocurrencies and decentralized finance (DeFi) to offer alternative avenues for value transfer and investment, potentially diverting business from established financial institutions.

Non-Bank Financial Service Providers

The threat of substitutes from non-bank financial service providers is significant for China Development Financial (CDF) and its subsidiary KGI Bank. Companies outside traditional banking are increasingly embedding financial services directly into everyday transactions. For instance, Buy Now, Pay Later (BNPL) options are readily available on e-commerce platforms, and payment solutions from telecommunication giants are widespread.

These non-traditional players bypass traditional banking infrastructure, offering convenience and often lower friction for consumers. This can directly substitute services like credit and payments that KGI Bank provides. In 2023, the global BNPL market was valued at over $200 billion, with substantial growth projected, indicating a strong consumer preference for these alternative payment methods.

- Embedded Finance Growth: Non-banks are integrating financial services into non-financial platforms, creating seamless user experiences.

- BNPL Popularity: Buy Now, Pay Later services have seen rapid adoption, especially among younger demographics, offering an alternative to traditional credit cards.

- E-commerce Integration: Major e-commerce players are increasingly offering their own payment and financing solutions, capturing market share from banks.

- Fintech Innovation: Rapid advancements in fintech continue to spawn new, agile competitors that can quickly adapt to changing consumer needs.

Changing Consumer Preferences and Financial Behavior

A significant shift towards more conservative investment strategies poses a substantial threat of substitutes for China Development Financial (CDF). A 2025 survey indicated that a growing number of investors, particularly younger demographics, are favoring Exchange Traded Funds (ETFs) over traditional individual stock picking. This trend directly substitutes demand for actively managed funds and potentially higher-risk investment products that CDF's subsidiaries might offer.

This evolving consumer behavior influences the product mix CDF's various arms can effectively market. For instance, if investor appetite leans towards passive, lower-fee ETFs, the appeal and demand for more complex, higher-fee structured products or active portfolio management services could diminish. This necessitates a strategic adaptation of CDF's service portfolio to remain competitive and relevant in the face of these shifting preferences.

- Shift to ETFs: A 2025 survey revealed a marked preference for ETFs, impacting demand for traditional stocks and active management.

- Product Appeal Reduction: The move towards conservatism can lessen the attractiveness of CDF's higher-risk or more complex financial products.

- Strategic Adaptation: CDF must align its offerings with changing investor preferences to maintain market share and profitability.

The threat of substitutes for traditional financial services is intensifying, driven by digital innovation and changing consumer behavior. Platforms offering direct investment, alternative financing like crowdfunding, and robo-advisory services provide accessible and often lower-cost alternatives to conventional banking and wealth management. Furthermore, the rise of virtual assets and embedded finance solutions from non-traditional players further diversifies the competitive landscape, forcing established institutions like China Development Financial to adapt their strategies and product offerings to remain relevant.

| Substitute Type | Market Trend/Data Point (as of late 2024/early 2025) | Impact on CDF |

|---|---|---|

| Crowdfunding/P2P Lending | Global crowdfunding market projected over $200 billion by 2024. | Offers alternative capital raising and investment avenues, potentially diverting clients. |

| Robo-Advisors | Robo-advisory market projected to reach trillions in AUM by 2027. | Competes with traditional wealth management for retail investors seeking automated solutions. |

| Virtual Assets/DeFi | Taiwan's FSC implementing VASP registration rules (late 2024). | Presents alternative value transfer and investment channels, potentially impacting traditional banking services. |

| Embedded Finance (BNPL) | Global BNPL market valued over $200 billion in 2023, with strong growth. | Directly substitutes credit and payment services offered by banks like KGI Bank. |

| ETFs | Growing investor preference for ETFs over individual stock picking (2025 survey). | Reduces demand for actively managed funds and potentially higher-fee products offered by CDF. |

Entrants Threaten

The financial services sector in Taiwan presents a formidable challenge for new entrants due to extensive regulatory hurdles. The Financial Supervisory Commission (FSC) mandates rigorous licensing and compliance procedures for banking, securities, and insurance activities.

Acquiring the necessary licenses is a capital-intensive and intricate undertaking, effectively deterring many aspiring firms. For instance, in 2023, the FSC continued to emphasize strict capital adequacy ratios and operational risk management, making it difficult for undercapitalized entities to gain a foothold.

The FSC's commitment to financial stability and robust anti-fraud protocols further elevates the compliance burden. This regulatory environment, designed to protect consumers and maintain market integrity, acts as a significant barrier, limiting the threat of new entrants in China Development Financial's operating landscape.

The financial services sector, particularly for a holding company like China Development Financial (CDF), demands immense capital. Setting up a comprehensive operation encompassing banking, securities, and insurance requires billions in upfront investment. For instance, new entrants would need to meet stringent regulatory capital requirements, which can easily run into tens of billions of US dollars, a significant hurdle for any aspiring competitor.

Established players like CDF enjoy substantial economies of scale, allowing them to spread fixed costs over a larger operational base. This cost advantage makes it difficult for newcomers to match the pricing and service offerings of incumbents. In 2024, the average cost-to-income ratio for major financial institutions in Asia remained significantly lower for those with diversified and scaled operations, underscoring this advantage.

This high capital intensity and the benefits of scale act as a powerful deterrent to new entrants. Aspiring financial holding companies face an uphill battle to raise the necessary capital and achieve the operational efficiencies needed to challenge well-entrenched firms like CDF, effectively limiting the threat of new competition.

Existing financial institutions, including China Development Financial (CDF) and its subsidiaries, have cultivated robust brand recognition and deep customer trust over many years. For instance, CDF's long-standing presence in Taiwan has allowed it to build a solid reputation, a critical asset in an industry where confidence is key.

New entrants find it difficult to lure customers from established players, especially in areas like life insurance and wealth management, where enduring relationships are highly prized. This loyalty is often reinforced by consistent service and a history of reliability, making it a substantial barrier.

In 2023, the financial services sector in Taiwan saw continued consumer preference for established brands, with major banks and insurance providers maintaining significant market share. This trend highlights how deeply ingrained trust in legacy institutions impacts the competitive landscape for newcomers.

Technological Infrastructure and Talent Acquisition

The financial services sector in Taiwan demands significant investment in advanced technological infrastructure. This includes not only robust IT systems and data analytics platforms but also cutting-edge cybersecurity measures to protect sensitive information. New entrants face a considerable barrier in replicating the established technological backbone of incumbent firms like China Development Financial (CDF).

Talent acquisition presents another formidable challenge. The demand for skilled professionals in areas like fintech, artificial intelligence, and data science remains high in Taiwan's competitive labor market. CDF, with its established reputation and resources, is better positioned to attract and retain top talent compared to emerging players.

- Technological Investment: Building sophisticated financial technology infrastructure can cost millions, deterring smaller new entrants.

- Talent Competition: Taiwan's tech talent pool is highly sought after, with average salaries for AI engineers exceeding TWD 1.5 million annually in 2024.

- Incumbent Advantage: CDF's existing infrastructure and experienced workforce provide a significant competitive edge against newcomers.

Emergence of Fintech and Digital-Only Banks

The emergence of fintech and digital-only banks presents a nuanced threat to traditional financial institutions in China. While regulatory bodies like the Financial Supervisory Commission (FSC) have opened doors for digital-only banks and supported fintech through initiatives such as regulatory sandboxes, these new entrants face significant hurdles. The fintech sector in China saw substantial growth, with digital payments alone reaching an estimated $36.7 trillion in 2023, demonstrating the market's potential.

These technologically agile players often target specific niches or adopt digital-first strategies, effectively lowering some traditional barriers to entry. However, they must still navigate stringent Anti-Money Laundering (AML) and Virtual Asset Service Provider (VASP) registration regulations. Consequently, many opt for collaborations with established banks rather than direct, broad-based competition.

- Regulatory Environment: FSC permits digital-only banks and supports fintech via regulatory sandboxes.

- Fintech Growth: China's digital payment market reached an estimated $36.7 trillion in 2023.

- Barriers to Entry: Fintechs face strict AML and VASP registration requirements.

- Competitive Strategy: Many new entrants prefer partnering with traditional institutions.

The threat of new entrants for China Development Financial (CDF) is generally low, primarily due to high capital requirements and significant regulatory barriers in Taiwan's financial sector. Establishing a financial holding company demands substantial upfront investment, often in the billions of US dollars, to meet stringent capital adequacy ratios and licensing demands from the Financial Supervisory Commission (FSC). Furthermore, existing players like CDF benefit from established economies of scale and strong brand loyalty, making it difficult for newcomers to compete on cost or customer trust.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | High upfront investment needed to meet regulatory capital adequacy ratios. | Deters undercapitalized firms. | New entrants may need tens of billions of USD to establish operations. |

| Regulatory Hurdles | Rigorous licensing and compliance procedures mandated by the FSC. | Increases time and cost to market entry. | FSC's focus on operational risk management and anti-fraud protocols in 2023. |

| Economies of Scale | Established players spread fixed costs over larger operations. | Creates cost disadvantages for newcomers. | Lower cost-to-income ratios for scaled Asian financial institutions in 2024. |

| Brand Recognition & Trust | Long-standing presence builds customer loyalty. | Makes customer acquisition difficult. | Continued consumer preference for established brands in Taiwan's financial services in 2023. |

| Technological & Talent Investment | Need for advanced IT infrastructure and skilled professionals. | Requires significant investment and competitive talent acquisition. | Average AI engineer salaries in Taiwan exceeding TWD 1.5 million annually in 2024. |

Porter's Five Forces Analysis Data Sources

Our China Development Financial Porter's Five Forces analysis is built upon a robust foundation of data, drawing from official government reports, financial statements of key industry players, and reputable market research firms specializing in the Chinese economy.