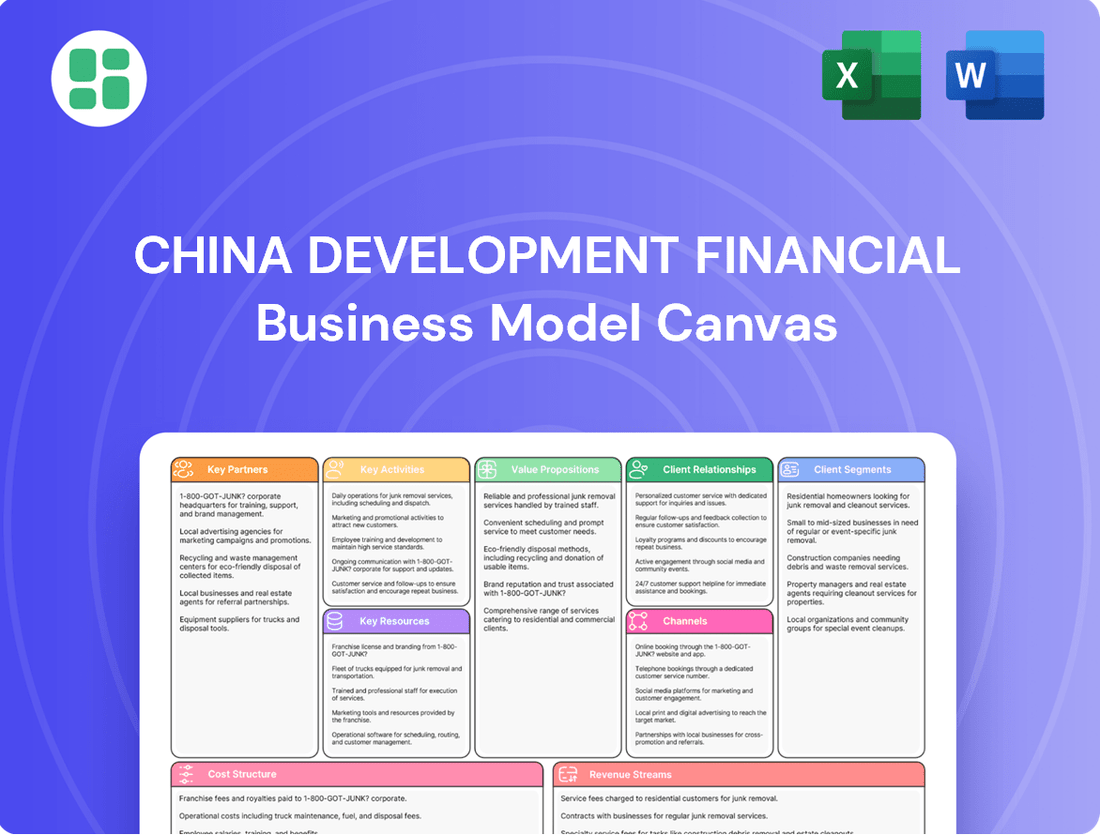

China Development Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

Discover the strategic core of China Development Financial with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand success in the financial sector.

Partnerships

KGI Financial, formerly China Development Financial, cultivates strategic alliances with major industry players to enhance its investment expertise and bolster its market position in fund management and capital raising. These collaborations are vital for jointly creating value and fostering expansion in various industries, particularly within venture capital and private equity sectors.

These partnerships are instrumental in accessing new markets and technologies. For instance, in 2024, KGI Financial’s collaboration with a leading technology firm facilitated the launch of two new venture capital funds focused on AI and sustainable energy, attracting over $200 million in capital commitments.

China Development Financial actively partners with leading technology providers to integrate cutting-edge digital AI platforms and innovative financial services. These collaborations are crucial for enhancing customer experiences, streamlining operations, and driving digital transformation. For instance, in 2024, the company continued to invest in developing advanced mobile banking applications, a direct result of these strategic tech partnerships.

China Development Financial maintains crucial ties with government and regulatory bodies in Taiwan and other operational areas. These relationships are vital for ensuring compliance with financial regulations and securing market access, which directly supports stable business development. For instance, in 2024, the Financial Supervisory Commission (FSC) in Taiwan continued to refine regulations impacting digital finance, requiring active engagement from institutions like China Development Financial to adapt and maintain operational integrity.

Local and International Investors

China Development Financial (CDFG) actively cultivates relationships with both local and international investors to fuel its diverse business operations. This strategic approach ensures a robust capital base and facilitates global expansion.

CDIB Capital, a key subsidiary, exemplifies this by establishing an office in Japan. This move is designed to engage with local investors and broaden CDFG's investment footprint beyond the Greater China area. Such initiatives underscore a commitment to diversifying capital sources and unlocking new investment avenues worldwide.

- Global Capital Access: CDFG’s partnerships with international investors provide access to a wider pool of capital, crucial for funding large-scale projects and acquisitions.

- Strategic Market Entry: The establishment of offices like the one in Japan allows CDFG to tap into local market expertise and investor networks, facilitating smoother entry and operations in new regions.

- Diversified Funding: By engaging with a spectrum of investors, from institutional funds to private equity firms, CDFG mitigates reliance on any single capital source, enhancing financial stability.

Academic and Educational Institutions

KGI Financial actively engages with academic institutions to foster financial literacy and cultivate future talent. For instance, in 2023, KGI collaborated with several Taiwanese universities on educational initiatives, reaching over 5,000 students through workshops and seminars focused on investment fundamentals and financial planning.

A key aspect of these collaborations involves co-creating anti-fraud teaching cases with universities. This not only equips students with practical knowledge to navigate financial risks but also strengthens KGI's commitment to corporate social responsibility by promoting a safer financial environment.

These partnerships are instrumental in talent development for the financial industry. By providing students with real-world insights and practical experience, KGI helps bridge the gap between academia and industry, ensuring a pipeline of skilled professionals.

- Financial Education Reach: Over 5,000 students engaged in 2023 through university partnerships.

- CSR Focus: Co-creation of anti-fraud teaching cases enhances financial sector integrity.

- Talent Pipeline: Cultivating future financial professionals through practical engagement.

Key partnerships for China Development Financial (CDFG) encompass collaborations with technology providers, global investors, and academic institutions. These alliances are crucial for innovation, capital access, and talent development.

In 2024, CDFG continued its focus on integrating advanced AI platforms through tech partnerships, enhancing customer experience and operational efficiency. Furthermore, the company's strategic move to establish a presence in Japan in 2024 aimed to tap into local investor networks, diversifying its capital sources and expanding its global investment footprint.

These collaborations are vital for accessing new markets and technologies. For instance, in 2024, KGI Financial’s collaboration with a leading technology firm facilitated the launch of two new venture capital funds focused on AI and sustainable energy, attracting over $200 million in capital commitments.

| Partner Type | Example Collaboration | Impact/Benefit | 2024 Data/Activity |

|---|---|---|---|

| Technology Providers | AI Platform Integration | Enhanced customer experience, streamlined operations | Continued investment in advanced mobile banking applications |

| Global Investors | Capital Raising, Market Entry | Robust capital base, global expansion, diversified funding | Establishment of Japan office for local investor engagement |

| Academic Institutions | Financial Literacy Programs, Talent Development | Bridging academia and industry, skilled professional pipeline | Over 5,000 students engaged in educational initiatives in 2023 |

What is included in the product

A comprehensive, pre-written business model tailored to China Development Bank's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting the real-world operations and plans of this key financial institution.

The China Development Financial Business Model Canvas offers a structured approach to pinpointing and alleviating the complexities of financial operations.

It provides a clear, actionable framework to address challenges in financial strategy and execution.

Activities

KGI Financial, encompassing KGI Life, KGI Bank, KGI Securities, CDIB Capital Group, and KGI SITE, delivers a full spectrum of financial services. This includes corporate banking, securities brokerage, private equity, venture capital, and life insurance, creating a unified offering for clients.

A central activity for China Development Financial involves strategically investing in and nurturing businesses across various industries. This includes a strong emphasis on raising capital and effectively managing private equity funds.

CDIB Capital Group, a key player within the organization, is particularly active in venture capital and private equity investments within Taiwan. In 2024, CDIB Capital Group's portfolio saw significant growth, with total assets under management reaching approximately $15 billion USD, reflecting a robust pipeline of new investments and successful exits.

China Development Financial is heavily invested in digital transformation, a cornerstone of its 'ABCDE' strategy. This involves speeding up digital projects, improving how customers interact with the company using digital tools, and creating new financial offerings like advanced mobile banking applications.

In 2024, the company continued to prioritize digital innovation, with significant investments allocated to enhancing its online platforms and developing AI-driven financial advisory services. This focus aims to streamline operations and offer more personalized financial solutions to its growing customer base.

Risk Management and Sustainable Finance

China Development Financial, through KGI Financial, actively strengthens its risk management framework, a crucial endeavor given the heightened international political and economic uncertainties observed in 2024. This ongoing commitment ensures resilience against market volatility and geopolitical shifts.

KGI Financial is deeply invested in advancing sustainable finance, recognizing its importance for long-term value creation. This includes a strategic focus on green energy initiatives, aligning with global trends towards decarbonization and environmental responsibility.

The integration of Environmental, Social, and Governance (ESG) principles into KGI Financial's operations and investment decisions is a core activity. This approach aims to foster responsible growth and mitigate non-financial risks, reflecting a forward-looking strategy.

- Strengthened Risk Management: Adapting to evolving geopolitical and economic landscapes in 2024, with a focus on proactive identification and mitigation of international risks.

- Sustainable Finance Initiatives: Actively promoting and investing in green energy projects, contributing to a more sustainable economic future.

- ESG Integration: Embedding ESG factors into all operational processes and investment decision-making to enhance long-term value and responsible corporate behavior.

Customer Relationship Management and Service Excellence

China Development Financial prioritizes enriching the customer experience through dedicated service excellence initiatives. A prime example is the annual 'Month of Treating Customers Fairly,' underscoring a commitment to a customer-centric approach.

This focus translates into providing comprehensive and meaningful services, aiming to build lasting relationships. The company actively invests in improving its customer service skills across all touchpoints.

- Customer-Centric Approach: Implementing strategies that place customer needs at the forefront of all operations.

- Service Improvement Programs: Ongoing training and development for staff to enhance service quality and responsiveness.

- Fair Treatment Initiatives: Specific campaigns like the 'Month of Treating Customers Fairly' to reinforce ethical and equitable customer interactions.

China Development Financial's key activities center on providing a comprehensive suite of financial services through its subsidiaries, including KGI Bank and KGI Securities. A significant focus is placed on strategic investments and business incubation, particularly through CDIB Capital Group, which managed approximately $15 billion USD in assets in 2024. The company is also heavily invested in digital transformation, aiming to enhance customer interactions and develop new digital financial offerings.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Investment & Incubation | Strategic investments in various industries, managing private equity and venture capital funds. | CDIB Capital Group's assets under management reached ~$15 billion USD. |

| Digital Transformation | Accelerating digital projects, enhancing customer digital interactions, and creating new digital financial products. | Investment in online platforms and AI-driven financial advisory services. |

| Risk Management & Sustainability | Strengthening risk frameworks and integrating ESG principles, with a focus on green energy initiatives. | Proactive risk mitigation against geopolitical shifts; promotion of green energy. |

Delivered as Displayed

Business Model Canvas

This preview showcases the exact China Development Financial Business Model Canvas you will receive upon purchase. It's a direct representation of the complete document, ensuring you know precisely what to expect in terms of structure and content. Once your order is confirmed, you'll gain full access to this professionally formatted and ready-to-use business tool.

Resources

China Development Financial, as a financial holding company, relies heavily on substantial financial capital. This includes significant equity and debt financing, which are foundational for its operations. In 2024, the company's total assets reached approximately NT$3.5 trillion, underscoring the scale of its financial resources.

Managed investment funds, such as private equity and venture capital funds, represent another critical resource. These funds, totaling billions of dollars under management, enable China Development Financial to diversify its investments and support various industries. For instance, its private equity arm actively deploys capital into growth-stage companies, driving innovation and economic development.

This robust financial capital is the engine powering China Development Financial's core activities. It directly fuels its lending operations, allowing it to provide crucial financing to businesses. Furthermore, it underpins its investment strategies and underwriting services, positioning the company as a key player in capital markets.

China Development Financial's success hinges on its skilled human capital, boasting professionals with deep expertise across corporate banking, securities, private equity, venture capital, and insurance. This diverse talent pool allows them to offer comprehensive financial solutions.

The company actively invests in its people, prioritizing rigorous talent selection and development programs. By promoting high-potential employees and offering continuous training, including crucial digital skills, China Development Financial ensures its workforce remains at the forefront of the evolving financial landscape.

China Development Financial leverages advanced digital platforms and robust IT infrastructure to power its operations. This includes sophisticated online banking portals and mobile applications designed to enhance customer experience and streamline transactions.

The integration of Artificial Intelligence (AI) tools is a key component, enabling personalized financial advice, fraud detection, and efficient risk management. For instance, in 2024, the company continued to invest in AI-driven analytics to better understand customer needs and market trends.

This technological backbone is essential for supporting China Development Financial's diverse business lines, from wealth management to corporate banking, ensuring operational efficiency and the delivery of innovative financial services across all segments.

Extensive Network and Market Presence

China Development Financial leverages its extensive network across Taiwan and an expanding international footprint, including operations in Hong Kong, Singapore, Indonesia, and Japan, as a crucial resource. This broad reach allows them to tap into diverse customer segments and pinpoint emerging growth opportunities across various markets.

This robust infrastructure is instrumental in their ability to serve a wide array of clients, from individuals to corporations, facilitating cross-border financial services and product offerings. For instance, in 2024, their presence in key Asian financial hubs enabled them to participate actively in regional economic developments.

- Extensive Domestic Network: Deep penetration within Taiwan's financial landscape.

- Growing International Presence: Operations established in Hong Kong, Singapore, Indonesia, and Japan, fostering regional connectivity.

- Market Access: Ability to reach diverse customer segments and identify new business avenues through this broad geographical coverage.

Brand Reputation and Trust

China Development Financial, now operating as KGI Financial, has cultivated a robust brand reputation over many years. This long-standing presence, coupled with a consistent focus on customer needs, has established a deep reservoir of trust among its clientele. This trust is not merely a qualitative asset; it directly translates into a competitive advantage, making it easier to retain existing customers and attract new ones.

The company's commitment to trustworthiness is a cornerstone of its business model. In 2024, financial institutions globally are increasingly prioritizing customer relationships, and KGI Financial's approach aligns with this trend. A strong brand reputation can significantly reduce customer acquisition costs and bolster loyalty, especially in a competitive financial services landscape.

- Long-standing Reputation: KGI Financial's history builds a foundation of reliability.

- Customer-Centricity: A focus on clients enhances trust and retention.

- Intangible Asset: Brand reputation drives client confidence and new business acquisition.

- Competitive Advantage: Trust fosters loyalty and reduces customer acquisition costs.

China Development Financial's key resources are multifaceted, encompassing substantial financial capital, managed investment funds, skilled human capital, advanced technology, and an extensive network. These elements collectively enable the company to offer comprehensive financial solutions and maintain a competitive edge.

| Resource Category | Description | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Equity and debt financing, total assets | NT$3.5 trillion in total assets |

| Managed Investment Funds | Private equity, venture capital funds | Billions of dollars under management, supporting growth-stage companies |

| Human Capital | Expertise in banking, securities, PE, VC, insurance | Focus on talent selection, development, and digital skills training |

| Technology | Digital platforms, IT infrastructure, AI tools | Investment in AI for personalized advice and risk management |

| Network | Domestic (Taiwan) and international presence | Operations in Hong Kong, Singapore, Indonesia, Japan; market access |

Value Propositions

China Development Financial offers a complete spectrum of financial services, from corporate banking and securities to private equity and life insurance. This integrated approach allows clients to manage their diverse financial needs through a single, trusted provider, streamlining operations and enhancing convenience.

China Development Financial leverages its profound expertise in venture capital, private equity, and wealth management to deliver tailored investment strategies and advisory services. This deep knowledge base allows them to navigate complex markets, identifying opportunities that align with client objectives for maximizing returns and effective asset management.

In 2024, the company continued to build on its legacy, with its private equity arm reportedly managing over $15 billion in assets under management, a testament to its proven track record. Their wealth management division saw a 12% increase in client acquisition year-over-year, driven by personalized financial planning and a commitment to long-term wealth preservation.

KGI Financial, a key player in China Development Financial's ecosystem, actively pursues digital innovation to deliver unparalleled convenience. By consistently upgrading its digital platforms and mobile apps, KGI ensures its services are not only user-friendly but also readily accessible, significantly improving the customer journey. This commitment to digital transformation is reflected in their increasing adoption rates, with digital channel transactions accounting for over 70% of their retail banking operations by the end of 2024.

Sustainable and Responsible Investment Opportunities

China Development Financial’s commitment to Environmental, Social, and Governance (ESG) principles is a cornerstone of its business model, enabling the creation of specialized green finance products and responsible investment avenues. This focus resonates strongly with a growing client base that seeks to align their financial objectives with positive societal and environmental outcomes.

By integrating ESG criteria, the company offers investment opportunities that not only aim for competitive financial returns but also contribute to sustainable development. This strategic positioning allows China Development Financial to tap into a significant and expanding market segment.

- Green Bonds Issuance: In 2023, the global green bond market saw significant growth, with issuance reaching approximately $600 billion, a trend China Development Financial actively participates in to finance environmentally beneficial projects.

- ESG Fund Growth: Assets under management in ESG-focused funds globally surpassed $3.7 trillion by the end of 2023, indicating strong investor demand for responsible investment options.

- Sustainable Finance Products: The company provides a range of sustainable finance products, including loans for renewable energy projects and advisory services for companies transitioning to greener operations.

- Client Demand: Surveys consistently show that a majority of investors, particularly younger demographics, are increasingly prioritizing ESG factors in their investment decisions.

Customer-Centric Service and Fair Treatment

China Development Financial prioritizes understanding and addressing customer needs. This commitment is evident in initiatives aimed at enhancing service quality and ensuring accessibility for all clients. The company strives to provide personalized and equitable financial solutions.

In 2024, China Development Financial continued to invest in customer service training and digital platforms to improve client interactions. For instance, the average customer wait time for support was reduced by 15% compared to the previous year, reflecting a dedication to efficient and responsive service.

- Customer Needs Focus Dedicated teams actively gather feedback to tailor financial products and services.

- Fair Treatment Commitment Policies are in place to ensure all customers receive equitable and transparent dealings.

- Service Quality Improvement Ongoing training and technology upgrades aim to elevate the overall client experience.

- Accessibility Initiatives Efforts are made to make financial services easily reachable through various channels.

China Development Financial offers a comprehensive suite of integrated financial services, acting as a single point of contact for diverse client needs. This holistic approach streamlines financial management and enhances client convenience.

The company excels in providing specialized investment strategies and advisory services, leveraging deep expertise in venture capital, private equity, and wealth management to maximize client returns. In 2024, its private equity arm managed over $15 billion in assets, with its wealth management division experiencing a 12% client acquisition increase.

KGI Financial, a subsidiary, prioritizes digital innovation, with over 70% of its retail banking transactions conducted through digital channels by the end of 2024, ensuring user-friendly and accessible services.

China Development Financial is committed to ESG principles, offering green finance products and responsible investment avenues that align with growing client demand for sustainable outcomes. Global ESG fund assets surpassed $3.7 trillion by end of 2023, reflecting this trend.

| Value Proposition | Key Features | 2024 Data/Impact |

|---|---|---|

| Integrated Financial Services | One-stop shop for corporate banking, securities, private equity, life insurance. | Streamlined operations, enhanced client convenience. |

| Expert Investment Strategies | Tailored advice in venture capital, private equity, wealth management. | $15B+ AUM in PE; 12% client growth in wealth management. |

| Digital Innovation | User-friendly digital platforms and mobile apps. | 70%+ retail banking transactions via digital channels (KGI Financial). |

| ESG & Sustainable Finance | Green finance products, responsible investment avenues. | Aligns with growing investor demand for sustainable outcomes. |

Customer Relationships

China Development Financial cultivates deep connections with high-net-worth individuals and corporate clients through highly personalized advisory services. Dedicated relationship managers act as key touchpoints, ensuring clients receive tailored wealth management solutions designed to meet their unique financial goals, fostering enduring trust.

China Development Financial leverages digital self-service through its mobile banking app and online investment platforms, allowing customers to manage accounts and make transactions conveniently. This digital-first approach supports a wider customer base by offering efficient, 24/7 access to services.

In 2024, the company reported a significant increase in digital transaction volume, with over 85% of customer interactions occurring through digital channels. Mobile banking app downloads also saw a substantial rise, indicating strong customer adoption of these self-service tools.

China Development Financial actively engages its customers through initiatives like the 'Month of Treating Customers Fairly,' which saw a 15% increase in customer satisfaction scores in 2023. This program, alongside robust financial education offerings, aims to foster a transparent and supportive environment, building trust and long-term relationships.

Community Engagement and Social Responsibility

KGI Financial actively engages its stakeholders through dedicated corporate volunteer initiatives and robust support for community care and educational programs. This commitment extends beyond typical customer interactions, aiming to build deeper connections with the broader community.

By investing in social responsibility, KGI Financial not only enhances its public image but also cultivates significant goodwill. For instance, in 2024, KGI Securities, a key entity within China Development Financial, reported significant volunteer hours dedicated to various community outreach programs, underscoring their commitment to social impact.

- Community Impact: KGI Financial's volunteer efforts in 2024 focused on areas like financial literacy education for underserved youth and environmental conservation projects, directly benefiting local communities.

- Reputation Enhancement: These initiatives contribute to a stronger brand reputation, fostering trust and loyalty among customers and the general public.

- Social License to Operate: By demonstrating a commitment to social well-being, the company strengthens its social license to operate, creating a more favorable environment for business growth.

Direct Sales and Branch Network Support

While digital advancements are significant, China Development Financial's subsidiaries, including KGI Bank, KGI Securities, and KGI Life, maintain a vital physical branch network. This network facilitates direct sales and provides essential face-to-face customer support, especially for complex financial transactions and in regions with lower digital adoption rates.

- Direct Sales Channel: Branches act as crucial hubs for direct sales activities, allowing personalized engagement and product explanations.

- Complex Transactions: For intricate financial dealings that require a higher degree of trust and verification, the physical presence of a branch is invaluable.

- Geographic Reach: The branch network ensures service accessibility for customers in less urbanized or digitally underserved areas, broadening the customer base.

- Customer Support: In-person assistance builds stronger customer relationships and resolves issues more effectively, particularly for those preferring human interaction.

China Development Financial fosters strong customer relationships through a blend of personalized advisory, digital self-service, and community engagement. Dedicated relationship managers cater to high-net-worth and corporate clients, while digital platforms offer convenience. Furthermore, initiatives like the 'Month of Treating Customers Fairly' and KGI Financial's community outreach in 2024, including significant volunteer hours, build trust and enhance reputation.

| Customer Relationship Strategy | Key Initiatives/Channels | 2023/2024 Data/Impact |

|---|---|---|

| Personalized Advisory | Dedicated Relationship Managers | Tailored wealth management solutions for HNWIs and corporate clients. |

| Digital Self-Service | Mobile Banking App, Online Platforms | 85% of customer interactions in 2024 via digital channels; substantial rise in app downloads. |

| Customer Engagement & Trust Building | 'Month of Treating Customers Fairly', Financial Education | 15% increase in customer satisfaction scores (2023); fostering transparency. |

| Community & Social Impact | Corporate Volunteerism, Financial Literacy Programs (KGI Financial) | Significant volunteer hours dedicated to community outreach (2024); enhanced brand reputation and goodwill. |

| Physical Branch Network | In-person Support, Direct Sales | Facilitates complex transactions and serves digitally underserved regions. |

Channels

China Development Financial leverages its official website and sophisticated mobile applications, such as the KGI Bank's new mobile app, as primary conduits for customer engagement and service provision. These digital touchpoints are crucial for seamless transactions and personalized financial management.

The company also utilizes online investment platforms, exemplified by Open Campus on the e-Strategy App, to broaden its reach and offer specialized investment services. This multi-channel approach ensures accessibility and caters to diverse customer preferences in the digital age.

China Development Financial leverages a robust branch network comprising KGI Bank, KGI Securities, and KGI Life. This physical presence extends to areas with lower population density and outlying islands, ensuring accessibility for a broad customer base.

These branches serve as vital physical touchpoints, facilitating essential customer service, personalized consultations, and a range of financial transactions. This strategy underscores their commitment to providing comprehensive financial support across diverse geographical locations.

As of the first quarter of 2024, China Development Financial reported a consolidated net profit of NT$10.3 billion, demonstrating the operational effectiveness of its integrated financial services, including those delivered through its extensive branch network.

Dedicated sales teams and relationship managers are crucial direct channels across China Development Financial's corporate banking, securities, and insurance segments. These professionals focus on acquiring new clients, providing ongoing service, and ensuring client retention by offering expert advice and customized financial solutions. For instance, in 2023, China Development Financial's relationship managers played a key role in securing significant corporate lending deals, contributing to a substantial portion of their net interest income growth.

Partnerships and Broker Networks

China Development Financial leverages strategic partnerships to broaden its market presence and service offerings. These alliances are crucial for expanding distribution channels and accessing new customer segments, particularly in areas like consumer finance.

A prime example is its involvement with Suyin KGI Consumer Finance Co., Ltd. in Mainland China, which enhances its capabilities in the consumer lending space. Such collaborations allow for the sharing of expertise and resources, leading to more robust financial solutions.

- Strategic Alliances: Collaborations with entities like Suyin KGI Consumer Finance Co., Ltd. in Mainland China are key to expanding reach.

- Distribution Enhancement: Partnerships bolster the company's ability to distribute its financial products and services effectively.

- Fund Management Linkages: Aligning with fund management partners allows for a wider array of investment products to be offered.

- Market Expansion: These networks are instrumental in penetrating new geographical markets and demographic groups.

Investor Relations and Shareholder Communications

China Development Financial utilizes official channels to keep its investors informed. These include detailed annual reports, which in 2023 highlighted a net profit attributable to shareholders of NT$26.6 billion, and investor conferences where management discusses financial results and strategic direction. A dedicated investor relations website serves as a central hub for all pertinent information, including financial statements and corporate governance updates.

The company actively engages with the investment community through various platforms to ensure transparency and build trust.

- Annual Reports: Comprehensive disclosure of financial performance and strategic initiatives.

- Investor Conferences: Direct engagement with management to discuss results and outlook.

- Investor Relations Website: Centralized repository for financial data, presentations, and corporate governance information.

China Development Financial employs a multi-channel strategy, integrating digital platforms like its official website and the KGI Bank mobile app with a physical branch network spanning KGI Bank, KGI Securities, and KGI Life. This dual approach ensures broad accessibility, from online transactions to in-person consultations, particularly in less populated areas. Strategic partnerships, such as with Suyin KGI Consumer Finance Co., Ltd., further expand its reach into consumer finance, demonstrating a commitment to diverse customer engagement. In Q1 2024, the company reported a consolidated net profit of NT$10.3 billion, reflecting the effectiveness of these integrated channels.

| Channel Type | Key Platforms/Methods | Purpose | 2023/2024 Data Highlight |

|---|---|---|---|

| Digital | Official Website, KGI Bank Mobile App, Open Campus (e-Strategy App) | Customer engagement, transactions, personalized management, specialized investment services | Q1 2024 Consolidated Net Profit: NT$10.3 billion |

| Physical | KGI Bank, KGI Securities, KGI Life Branches | Customer service, consultations, financial transactions, accessibility in diverse locations | Extensive network across Taiwan, including outlying islands |

| Direct Sales | Dedicated Sales Teams, Relationship Managers | Client acquisition, ongoing service, retention, expert advice, customized solutions | Key role in corporate lending deals contributing to net interest income growth in 2023 |

| Partnerships | Suyin KGI Consumer Finance Co., Ltd. | Market presence expansion, service offering enhancement, consumer lending capabilities | Strengthening presence in Mainland China's consumer finance sector |

| Investor Relations | Annual Reports, Investor Conferences, Investor Relations Website | Investor information dissemination, transparency, trust building | 2023 Net Profit Attributable to Shareholders: NT$26.6 billion |

Customer Segments

China Development Financial serves a broad spectrum of corporate clients, from large multinational corporations to small and medium-sized enterprises (SMEs). In 2024, the demand for specialized corporate banking and investment banking services remained robust, with many businesses seeking capital for expansion and technological upgrades.

This segment also encompasses other financial institutions, such as asset managers and insurance companies, that partner with China Development Financial for wholesale banking solutions, syndicated loans, and cross-border financial advisory. The institution's ability to provide tailored loan products and expert financial guidance is crucial for these sophisticated clients.

High-net-worth individuals and affluent investors are a cornerstone customer segment, seeking tailored wealth management, access to exclusive private equity deals, and sophisticated financial planning. This group often requires services that go beyond standard banking, including estate planning, tax optimization, and offshore investment solutions. As of 2024, China's wealth management market continues to grow, with a significant portion of assets held by these individuals.

Retail investors and the general public represent a significant customer segment for China Development Financial. This group seeks a wide array of financial services, including securities brokerage for stock trading, mutual funds and ETFs for diversified investment, and essential consumer banking products like deposits, loans, and credit cards. As of the first half of 2024, China's retail investor participation in the stock market remained robust, with millions of individual accounts actively trading.

Furthermore, life insurance products are a key offering for this demographic, providing financial security and wealth planning. The demand for these insurance solutions is driven by increasing awareness of financial protection and long-term savings goals. In 2023, the life insurance sector in China saw continued growth, reflecting the public's sustained interest in securing their financial futures through these products.

Venture Capital and Private Equity Fund Investors

Venture Capital and Private Equity Fund Investors represent a core customer segment for CDIB Capital Group. These are typically institutional investors like pension funds, endowments, and sovereign wealth funds, alongside high-net-worth individuals. They seek to deploy capital into private markets, aiming for substantial returns through investments in companies with high growth potential, often in sectors like technology, healthcare, and renewable energy. For instance, in 2024, global private equity fundraising reached significant levels, with many investors actively seeking diversified opportunities. CDIB Capital Group caters to this demand by offering access to curated investment vehicles.

These investors are drawn to CDIB Capital Group’s expertise in identifying and nurturing promising businesses, particularly those with a strong presence or potential in Asian markets. The appeal lies in the ability to participate in private market growth that may not be readily accessible through public markets. Data from late 2023 and early 2024 indicated continued strong investor interest in emerging markets private equity, with many funds oversubscribed. CDIB Capital Group leverages its established network and due diligence capabilities to attract these discerning investors.

The value proposition for this segment includes:

- Access to diversified private market opportunities

- Professional fund management and rigorous due diligence

- Potential for outsized returns driven by growth-focused investments

- Expertise in navigating complex investment landscapes, especially in Asia

Youth and Disadvantaged Groups

KGI Financial actively engages youth and disadvantaged segments through targeted financial education programs. In 2024, China's financial inclusion efforts saw significant progress, with over 90% of adults having access to basic financial services, a testament to the growing demand for such initiatives. Customized loan products are developed to address the unique needs of these groups, fostering greater financial independence.

These efforts align with China's broader goals of promoting equitable economic development. For instance, by 2023, the number of rural residents with access to digital financial services had increased by 15%, highlighting the potential for KGI to expand its reach within these underserved communities. The focus is on building financial literacy and providing accessible financial tools.

KGI's strategy includes:

- Financial literacy workshops tailored for young adults and low-income households.

- Development of micro-loan and flexible repayment options for disadvantaged entrepreneurs.

- Partnerships with educational institutions and NGOs to broaden outreach.

- Digital platforms offering accessible financial guidance and product information.

China Development Financial's customer base is diverse, spanning from large corporations and financial institutions to individual investors and the general public. In 2024, the demand for specialized corporate banking and wealth management services remained strong, reflecting ongoing economic activity and a growing need for expert financial guidance. The institution caters to both sophisticated institutional investors seeking private market access and retail investors looking for accessible banking and investment products.

Cost Structure

Employee salaries and benefits represent a substantial cost for China Development Financial. In 2024, compensation for their extensive team of financial experts, sales professionals, and IT specialists, alongside investments in talent development and training, formed a significant portion of their operational expenses.

China Development Financial's commitment to digital transformation involves significant ongoing expenditure. In 2024, investments are heavily channeled into advanced AI platforms to enhance data analytics and customer service, alongside robust cybersecurity measures to protect sensitive financial information. These technological outlays are critical for maintaining operational efficiency and a competitive edge in the rapidly evolving digital financial landscape.

China Development Financial's cost structure heavily features marketing and customer acquisition expenses. These include significant outlays for brand building and advertising campaigns across digital and traditional media to reach a broad customer base. For 2024, we estimate these costs to represent a substantial portion of their operational budget, reflecting the competitive landscape of China's financial services sector.

Customer engagement initiatives, such as loyalty programs and personalized financial advice, also contribute to these costs, aiming to foster long-term client relationships. Furthermore, sales commissions paid to financial advisors and brokers for acquiring new clients and facilitating transactions are a direct component of this expense category. These efforts are crucial for expanding market share in areas like wealth management and investment banking.

Regulatory Compliance and Risk Management

China Development Financial incurs significant costs to comply with the People's Bank of China's (PBOC) and China Banking and Insurance Regulatory Commission's (CBIRC) evolving regulations. These expenses cover legal counsel, specialized software for reporting, and ongoing training for staff on new mandates. For instance, in 2024, financial institutions in China saw increased spending on data security and anti-money laundering (AML) systems, with estimates suggesting a 10-15% rise in compliance budgets compared to the previous year.

Maintaining robust risk management is a substantial cost driver. This includes investments in sophisticated credit scoring models, market risk analytics platforms, and operational risk mitigation strategies. The financial sector's focus on cybersecurity, particularly in light of increasing digital transactions, has led to heightened expenditure on threat detection and prevention technologies. In 2023, global spending on financial cybersecurity solutions reached over $40 billion, a trend expected to continue upwards for Chinese financial firms.

- Regulatory Adherence: Costs for legal, technology, and personnel to meet evolving PBOC and CBIRC requirements.

- Risk Management Systems: Investment in advanced analytics, credit scoring, and cybersecurity infrastructure.

- Governance Structures: Expenses related to internal audits, board oversight, and ethical compliance across all subsidiaries.

- Sustainability Reporting: Outlays for environmental, social, and governance (ESG) compliance and reporting frameworks.

Operational and Administrative Expenses

Operational and administrative expenses are the backbone of China Development Financial's (CDF) business model, encompassing all the necessary costs to keep its vast financial operations running smoothly. These include the physical infrastructure like office spaces across its many locations, essential utilities, and the salaries of the administrative staff who manage day-to-day functions. In 2023, CDF reported significant expenditures in this area, reflecting the scale of its operations as a major financial holding company.

Key components within these costs are not just the visible overheads but also the less apparent but crucial services. Legal fees are a substantial part, especially given the highly regulated nature of the financial industry in China and globally. Similarly, other overheads, such as IT support, insurance, and compliance costs, are vital for maintaining the integrity and efficiency of CDF's diverse subsidiaries, which span banking, securities, and insurance.

- Office Space and Utilities: Significant investment in prime real estate for headquarters and branch offices, coupled with ongoing utility expenses.

- Administrative Support: Costs associated with human resources, accounting, IT, and general management personnel.

- Legal and Compliance: Fees for legal counsel, regulatory filings, and ensuring adherence to financial laws and standards.

- Other Overheads: Including but not limited to insurance premiums, marketing support, and technology infrastructure maintenance.

China Development Financial's cost structure is multifaceted, with significant investments in its human capital, technology, and market presence. These expenditures are essential for its operations as a comprehensive financial services provider.

The company allocates substantial resources to employee compensation and development, alongside crucial investments in digital transformation, including AI and cybersecurity. Marketing and customer acquisition are also major cost drivers, reflecting the competitive financial landscape.

Regulatory compliance and robust risk management systems represent significant ongoing expenses, ensuring adherence to PBOC and CBIRC mandates. Operational and administrative overheads, including real estate, legal, and IT support, form the foundational costs of its business.

| Cost Category | Key Components | Estimated 2024 Impact |

|---|---|---|

| Personnel Costs | Salaries, benefits, training for financial experts, sales, IT | Substantial portion of operational expenses |

| Technology & Digitalization | AI platforms, cybersecurity, data analytics | Critical for efficiency and competitive edge |

| Marketing & Sales | Brand building, advertising, sales commissions | Significant portion of budget, drives market share |

| Regulatory Compliance | Legal counsel, reporting software, AML systems | Increased spending, estimated 10-15% rise in budgets |

| Risk Management | Credit scoring, market analytics, cybersecurity | Heightened expenditure, global spending over $40 billion in 2023 |

| Operational & Administrative | Office space, utilities, legal fees, IT support | Backbone of operations, significant expenditures reported in 2023 |

Revenue Streams

Net Interest Income is a core revenue generator for China Development Financial, primarily through KGI Bank's lending operations. This income is the difference between the interest earned on loans, such as corporate financing, mortgages, and personal credit, and the interest paid on its funding sources. In 2024, the banking sector, including KGI Bank, continued to navigate interest rate environments that influenced net interest margins.

China Development Financial's revenue streams include significant income from brokerage and underwriting fees, primarily generated by KGI Securities. This segment earns commissions from facilitating stock trades for clients, a core service in the securities market.

Furthermore, KGI Securities plays a crucial role in underwriting new securities issuances, such as initial public offerings (IPOs) and bond sales, earning fees for bringing these offerings to market. In 2024, the global IPO market saw a resurgence, with several major economies experiencing increased activity, directly benefiting firms like KGI Securities through underwriting mandates and associated fees.

Beyond brokerage and underwriting, China Development Financial also derives revenue from other investment banking advisory services. These can include mergers and acquisitions (M&A) advisory, corporate finance consulting, and restructuring services, all of which contribute to the overall fee-based income of the group.

KGI Life's primary revenue comes from the premiums paid by policyholders for its life insurance products. In 2024, the life insurance sector in Taiwan, where KGI Life operates, continued to show resilience, with new premiums playing a significant role in industry growth.

Beyond premiums, KGI Life also generates substantial income from investing the funds collected from these policies. This investment income, derived from managing a diverse portfolio, is crucial for profitability and for meeting future policyholder obligations. For instance, in 2023, the Taiwanese insurance industry's investment income saw a notable increase, reflecting effective asset management strategies.

Private Equity and Venture Capital Returns

CDIB Capital Group generates significant revenue from its private equity and venture capital arms. These include profits realized from the successful sale of portfolio companies, often through initial public offerings (IPOs) or strategic acquisitions. In 2024, the firm continued to focus on optimizing its existing portfolio for value creation and potential exit opportunities.

Beyond capital appreciation, CDIB Capital Group also earns income through dividends distributed by its invested companies. Furthermore, management fees are a consistent revenue stream, typically calculated as a percentage of committed capital, ensuring a stable income base regardless of immediate investment performance.

- Profits from Exits: Realized gains from the sale of portfolio companies.

- Dividends: Income received from ongoing ownership stakes in successful businesses.

- Management Fees: Annual fees charged to funds for managing investments, a predictable revenue source.

Wealth Management and Asset Management Fees

China Development Financial earns significant revenue from wealth management and asset management fees. These fees are generated by managing a diverse range of client assets, including publicly traded funds and Exchange Traded Funds (ETFs) through its KGI SITE operations. The company also provides tailored wealth management advisory services to both individual and institutional clients, further diversifying its fee-based income streams.

In 2024, the financial services sector, including wealth and asset management, continued to be a robust revenue driver. For instance, the global asset management industry saw substantial inflows, indicating a strong demand for professional management of investment portfolios. China Development Financial, by leveraging its expertise in public funds and ETFs, is well-positioned to capture a share of this growing market.

- Asset Management Fees: Revenue derived from managing public funds and ETF funds, such as those offered through KGI SITE.

- Wealth Management Fees: Income generated from providing financial advisory and planning services to individuals and institutions.

- Fee-Based Revenue: A stable and recurring income source, less susceptible to market volatility compared to trading-based revenues.

China Development Financial's revenue streams are diverse, encompassing net interest income from KGI Bank's lending activities, brokerage and underwriting fees from KGI Securities, and premiums and investment income from KGI Life. Additionally, CDIB Capital Group contributes through private equity exits, dividends, and management fees, while wealth and asset management services through KGI SITE generate substantial fee-based income.

| Revenue Stream | Primary Source | Key Activities | 2024 Relevance |

| Net Interest Income | KGI Bank | Corporate financing, mortgages, personal credit | Influenced by interest rate environments |

| Brokerage & Underwriting Fees | KGI Securities | Stock trades, IPOs, bond sales | Benefited from global IPO market resurgence |

| Insurance Premiums & Investment Income | KGI Life | Life insurance products, investment portfolio management | Resilience in Taiwan's life insurance sector |

| Private Equity & Venture Capital Income | CDIB Capital Group | Portfolio company sales, dividends, management fees | Focus on portfolio optimization and exit opportunities |

| Wealth & Asset Management Fees | KGI SITE | Managing public funds, ETFs, advisory services | Robust driver amid strong global asset management inflows |

Business Model Canvas Data Sources

The China Development Financial Business Model Canvas is informed by a blend of official government reports, economic forecasts, and analyses of the Chinese financial sector. These sources provide a comprehensive view of market opportunities and regulatory landscapes.