China Development Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

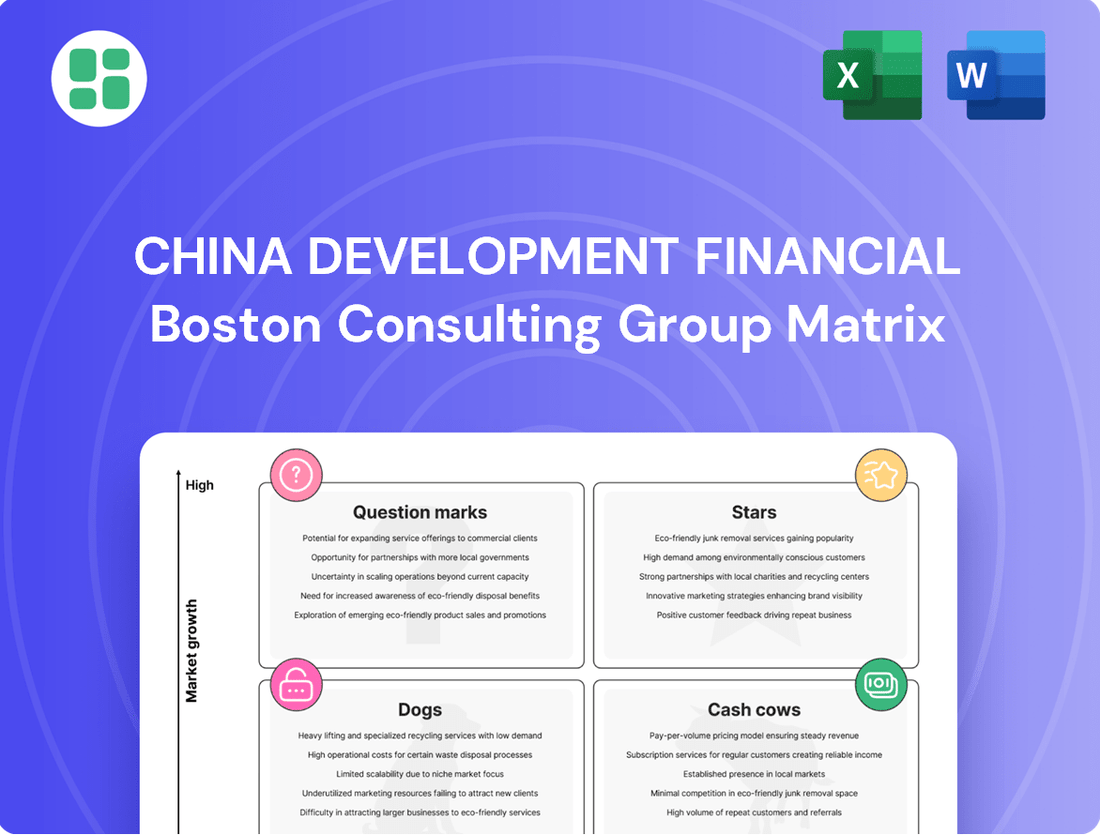

Unlock the strategic blueprint of China Development Financial's product portfolio with our comprehensive BCG Matrix analysis. Understand precisely where their offerings sit as Stars, Cash Cows, Dogs, or Question Marks, and gain the clarity needed for informed decision-making.

This preview offers a glimpse into the powerful insights contained within the full China Development Financial BCG Matrix. Purchase the complete report to receive detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategies.

Don't miss out on crucial strategic advantages. The full China Development Financial BCG Matrix provides an in-depth, quadrant-by-quadrant breakdown, equipping you with the competitive clarity necessary to navigate today's dynamic market. Get the full report now and transform your approach.

Stars

CDIB Capital Group's strategic focus on AI and semiconductors places these ventures squarely in the "Star" quadrant of the China Development Financial BCG Matrix. Taiwan's semiconductor industry, a global leader, is benefiting from surging AI demand. For instance, TSMC, a key player, saw its revenue grow by approximately 15.1% year-over-year in the first quarter of 2024, reaching NT$592.64 billion (around $18.9 billion USD), demonstrating the robust market conditions.

KGI Securities, a key subsidiary of China Development Financial Holding Corporation (CDFHC), is shining brightly in the wealth management sector. In 2024, their wealth management business achieved record-breaking revenue and saw a significant increase in assets under management.

This stellar performance is fueled by a booming Taiwan capital market, characterized by strong engagement from retail investors and a notable rise in overall trading value. This dynamic environment allows KGI Securities' wealth management services to capture a substantial market share within a rapidly growing financial services area, solidifying its position as a Star in the BCG matrix.

Securities brokerage, exemplified by KGI Securities' strong second-place position in Taiwan's domestic market, represents a star in China Development Financial's BCG matrix. Taiwan's stock market experienced a notable surge in average daily trading value in 2024, with substantial profit growth observed across the sector.

The robust performance of Taiwan's stock market, significantly boosted by the AI industry's momentum, positions securities brokerage as a high-growth, high-market-share segment for CDFHC. Continued strategic investment is crucial to solidify and expand this leading position.

Green Energy and Infrastructure Investments

Taiwan's commitment to green energy and infrastructure is a significant driver for investment, with private equity and venture capital pouring into these burgeoning sectors. CDIB Capital Group’s participation in these government-backed projects places its green energy and infrastructure holdings in a strong position within the BCG matrix, likely as Stars.

These sectors are not just about environmental responsibility; they represent substantial economic opportunities. For instance, Taiwan aims to increase renewable energy generation to 40% of its total power supply by 2025, a target that necessitates massive infrastructure investment. This strategic alignment with national development goals fuels their high growth potential.

- High Growth Potential: Driven by government mandates and increasing demand for sustainable solutions.

- Market Leadership Prospects: Investments align with Taiwan's strategic vision for future economic development.

- Government Support: Substantial public funding and policy incentives bolster private sector involvement.

- Attracting Capital: Over $10 billion in private capital was channeled into Taiwan's renewable energy sector in 2023 alone, indicating strong investor confidence.

Digital Financial Services Expansion

China Development Financial Holding Corporation (CDFHC), notably via KGI Bank, is actively investing in and rolling out new digital financial services. This strategic push aligns with Taiwan's national goals to increase mobile payment adoption and expand digital banking services, signaling a market ripe for growth.

Taiwan's mobile payment market is projected to see continued expansion. By the end of 2023, over 70% of Taiwanese adults were estimated to have used mobile payments, with projections indicating this figure could reach 85% by 2025. CDFHC's focus on this sector positions it to capitalize on this upward trend.

- Digital Banking Growth: KGI Bank's digital offerings are a key component of CDFHC's strategy to capture market share in Taiwan's rapidly digitizing financial landscape.

- Mobile Payment Penetration: With Taiwan aiming for higher mobile payment penetration, CDFHC's investments are targeted at a high-growth segment of the consumer market.

- Investment for Scaling: Successful market capture in digital financial services will necessitate ongoing investment to support and scale these innovative platforms.

Stars within China Development Financial's BCG matrix represent high-growth, high-market-share ventures. CDIB Capital Group's focus on AI and semiconductors, with TSMC's Q1 2024 revenue up 15.1% to NT$592.64 billion, exemplifies this. KGI Securities' wealth management, achieving record revenue in 2024, also shines, benefiting from Taiwan's booming capital market and increased trading values.

| Business Segment | Market Growth | Market Share | BCG Quadrant | Supporting Data |

|---|---|---|---|---|

| AI & Semiconductors (CDIB Capital) | High | High | Star | TSMC Q1 2024 Revenue: NT$592.64 billion (+15.1% YoY) |

| Wealth Management (KGI Securities) | High | High | Star | Record revenue and AUM growth in 2024 |

| Securities Brokerage (KGI Securities) | High | High | Star | KGI Securities holds 2nd place in Taiwan market; Avg. daily trading value surged in 2024 |

| Green Energy & Infrastructure (CDIB Capital) | High | High | Star | Over $10 billion private capital into renewables in 2023; Taiwan aims for 40% renewable energy by 2025 |

| Digital Financial Services (KGI Bank) | High | High | Star | Over 70% of Taiwanese adults used mobile payments end-2023; projected 85% by 2025 |

What is included in the product

The China Development Financial BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide resource allocation and investment decisions.

Strategic allocation of resources by pinpointing Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Traditional Corporate Banking, represented by KGI Bank, is a solid cash cow for China Development Financial Holding Company (CDFHC). Operating in Taiwan's mature and stable corporate banking market, KGI Bank benefits from a strong domestic presence with 51 branches.

This sector, dominated by local players, consistently delivers significant pre-tax profits to the financial industry. Despite anticipated moderate loan growth in 2025, its established nature and profitability solidify its position as a reliable income generator.

China Life Insurance stands as a cornerstone of China Development Financial Holding Corporation (CDFHC), significantly bolstering its overall profitability. Operating within Taiwan's substantial and well-established life insurance market, this segment is a prime example of a Cash Cow.

While the Taiwanese life insurance market exhibits steady, rather than rapid, long-term growth, it consistently generates robust premium income and substantial profits. This dependable revenue stream provides CDFHC with a stable and significant cash flow, underscoring its Cash Cow status.

For 2024, China Life Insurance is expected to continue its role as a key cash generator, reflecting the maturity and stability of its market. The company's strong market position ensures consistent earnings, allowing CDFHC to allocate these funds to other strategic growth areas.

CDIB Capital Group's mature private equity holdings are its cash cows. With over 200 companies in its portfolio, many are established, generating consistent cash flow rather than rapid growth.

These mature assets, including 31 publicly listed companies, are likely beyond their peak expansion. They offer stable returns and potential divestiture opportunities, providing reliable income for reinvestment or distribution.

Mortgage Lending Business

Mortgage lending, a cornerstone of KGI Bank's portfolio, demonstrated robust performance in 2024, fueling significant loan expansion. This growth underscores its substantial market penetration within China’s domestic banking landscape.

Despite an anticipated moderation in overall loan growth for 2025, the mortgage segment is poised to remain a stable, high-market-share business. It consistently generates predictable interest income and ancillary fees, solidifying its role as a dependable cash cow for the bank.

- 2024 Loan Growth: Mortgage lending contributed significantly to overall loan growth, reflecting strong market demand.

- Market Penetration: KGI Bank holds a high market share in domestic mortgage lending.

- Stable Income Stream: The business provides consistent interest income and fee generation.

- Cash Cow Status: Mortgage lending is a dependable source of revenue, functioning as a cash cow.

Diversified Investment Portfolio Income

China Development Financial Holding Corporation (CDFHC), as an investment holding company, leverages a diversified portfolio across various financial instruments. This diversification acts as a significant income generator, contributing to its overall financial stability.

The global financial market's stabilization in 2023, coupled with a notable increase in capital market transaction volumes, directly benefited CDFHC's related business operations. These positive market conditions translated into enhanced income streams for the company.

While not every segment of CDFHC's portfolio may exhibit high growth, its broad composition ensures a consistent and reliable flow of income. This steady income underpins the company's strong financial standing.

- Diversified Income Streams: CDFHC's investments span multiple financial sectors, providing a buffer against volatility in any single market.

- Market Tailwinds in 2023: Improved global financial market stability and increased capital market activity boosted earnings from relevant business units.

- Steady Cash Flow Generation: The portfolio's nature as a "cash cow" is characterized by its ability to generate consistent income, supporting overall financial health.

- Contribution to Financial Robustness: The reliable income from its diversified holdings solidifies CDFHC's robust financial position and operational capacity.

China Life Insurance remains a significant contributor to China Development Financial Holding Corporation's (CDFHC) earnings, functioning as a core cash cow. In 2024, the Taiwanese life insurance sector, characterized by its maturity and stable demand, continued to provide a dependable revenue stream for China Life. This stability is crucial for CDFHC, allowing for consistent profit generation that can be reinvested in higher-growth areas.

| Segment | 2024 Performance | Cash Flow Contribution | BCG Status |

|---|---|---|---|

| China Life Insurance | Robust premium income and profit generation in a mature market. | Significant and stable. | Cash Cow |

| KGI Bank (Corporate Banking) | Solid pre-tax profits, moderate loan growth expected. | Reliable income generator. | Cash Cow |

| CDIB Capital Group (Mature PE) | Consistent cash flow from over 200 established portfolio companies. | Stable returns and divestiture potential. | Cash Cow |

What You’re Viewing Is Included

China Development Financial BCG Matrix

The China Development Financial BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just the complete, professional-grade analysis ready for your strategic decision-making. You can be confident that the insights and structure presented here are precisely what you'll be working with to understand China's development landscape. This comprehensive report is designed for immediate application in your business planning and competitive strategy.

Dogs

Within CDIB Capital Group's diverse holdings, certain private equity and venture capital investments from earlier periods might be exhibiting sluggish performance. These legacy assets, if they haven't been strategically divested or revitalized, can immobilize valuable capital. For instance, a private equity fund CDIB invested in back in 2015, targeting a mature but slow-growing sector, may now represent a low market share in a stagnant market. As of early 2024, data suggests that private equity exits for underperforming assets have become more common as managers focus on optimizing portfolio returns.

Taiwan's banking sector is highly saturated, with over 30 local banks, intensifying competition for traditional retail banking services. This saturation often leads to squeezed net interest margins, with average net interest margins for Taiwanese banks hovering around 1.2% in recent years, making it difficult for basic offerings to generate significant profit.

If KGI Bank's traditional retail banking products, such as basic savings accounts or standard checking services, lack unique features or a substantial customer base compared to competitors, they would likely be classified as Dogs in the BCG Matrix. These offerings may struggle to grow and could consume resources without generating substantial returns, potentially acting as cash traps within the bank's portfolio.

Within China Development Financial's BCG matrix, niche, low-volume brokerage segments for KGI Securities could represent question marks or even dogs. While KGI excels in broader markets, areas like highly specialized derivatives trading or specific regional private placements might not see the same AI-driven growth or wealth management inflows.

If KGI's market share in these granular segments is small and growth prospects are dim, they may not warrant significant investment. For instance, if a particular low-volume segment saw only a 2% year-over-year growth in 2024, compared to the overall market's 8% expansion, it would highlight a potential underperformance.

Non-Strategic International Ventures

Non-Strategic International Ventures, within the context of China Development Financial (CDFHC) and its strategic positioning, represent overseas operations that haven't achieved significant market penetration or are situated in stagnant global economies. These ventures, while part of CDFHC's international outlook, drain valuable resources without yielding proportional returns or establishing a robust presence. The general risk inherent in international expansion, particularly in less dynamic markets, means these ventures could be candidates for re-evaluation.

While specific ventures are not detailed, the principle applies to any international expansion that fails to capture substantial market share or operates within foreign markets experiencing persistently low growth rates. Such underperforming international arms consume capital and management attention that could be better allocated to more promising areas of the business. For instance, if CDFHC had invested in a market with a projected GDP growth of under 2% in 2024, and failed to secure more than a 1% market share, it would fit this description.

- Resource Drain: Ventures failing to gain traction consume capital and management focus.

- Low Growth Markets: Operations in economies with sub-par GDP growth (e.g., below 2% in 2024) are particularly vulnerable.

- Market Share Deficit: A lack of significant market presence (e.g., under 1% share) indicates strategic misalignment.

- Opportunity Cost: Resources could be redeployed to higher-return domestic or more promising international ventures.

Outdated IT Infrastructure and Maintenance

China Development Financial Holding Corporation (CDFHC), despite its push for digitalization, faces challenges with its legacy IT infrastructure. These older systems are often inefficient and lack the scalability needed for modern financial operations. This can result in significant maintenance costs without delivering a competitive edge or substantial performance improvements.

In the context of a BCG Matrix, these outdated IT systems would likely be categorized as Dogs. They possess low market share in terms of modern technological adoption and offer limited potential for future growth or enhanced operational efficiency. The resources allocated to maintaining these systems could be better utilized elsewhere.

- Low Market Share: Legacy systems struggle to compete with newer, more agile technologies, limiting their adoption and perceived value in the current market.

- Limited Growth Potential: These systems are often difficult and expensive to upgrade, hindering their ability to adapt to evolving business needs and market demands.

- Cash Drain: Continued investment in maintaining outdated infrastructure can divert capital from more promising growth areas, negatively impacting overall financial performance.

Within China Development Financial's portfolio, certain business units or products may exhibit characteristics of Dogs. These are typically offerings with low market share in industries experiencing little to no growth. For instance, a specific niche financial product that has seen declining customer interest and faces intense competition would fit this description.

Such units often require significant resources for maintenance but generate minimal returns, acting as a drag on overall profitability. As of early 2024, many financial institutions were actively reviewing such underperforming assets to streamline operations and reallocate capital to more promising ventures.

For example, if a particular segment of KGI Securities' business, like a very specific, low-volume over-the-counter derivatives desk, has a negligible market share and the overall market for that niche is projected to grow by less than 1% annually, it would be a prime candidate for the Dog classification.

These segments consume management attention and operational capital without contributing meaningfully to growth or profits, highlighting an opportunity cost for the company.

| Business Unit Example | Market Share (Estimate) | Market Growth (2024 Estimate) | BCG Classification | Rationale |

|---|---|---|---|---|

| Niche Brokerage Segment | < 2% | < 1% | Dog | Low market share in a stagnant, low-growth niche. |

| Legacy IT Infrastructure | Low (in terms of modern adoption) | Negligible | Dog | Outdated, costly to maintain, offers no competitive advantage. |

| Underperforming International Venture | < 1% | < 2% (GDP Growth) | Dog | Operates in a slow-growth market with minimal penetration. |

Question Marks

KGI Bank is investing heavily in fintech and digital banking solutions, aiming to capture a slice of Taiwan's emerging digital-only banking market. This sector is experiencing rapid growth, fueled by a surge in digital adoption, with Taiwan's digital payment transaction value projected to reach NT$1.3 trillion by the end of 2024, up from NT$1.1 trillion in 2023.

Despite this potential, the digital-only banking landscape in Taiwan is intensely competitive. KGI Bank's current market share in these nascent digital ventures is likely modest, reflecting the early stage of their development and the presence of established players. These initiatives require significant capital investment, making their future trajectory as high-growth Stars uncertain.

CDIB Capital Group actively engages in early-stage venture capital, backing nascent, innovative startups like its recent commitment to an AI Fund. These ventures, while positioned for substantial growth, typically begin with minimal market presence and significant inherent risk.

Such investments are capital-intensive, demanding substantial funding to nurture their potential and transition them from question marks to future stars within the BCG framework. For instance, in 2024, the venture capital industry saw a notable increase in funding for AI startups, with global investment reaching hundreds of billions of dollars, underscoring the high-risk, high-reward nature of these early-stage plays.

China Development Financial Holding Corporation (CDFHC) aims for aggressive international market entries to capture high-growth opportunities abroad. These ventures are characterized by a low initial market share in new geographies but target significant expansion. For instance, CDFHC's strategic focus on Southeast Asia, a region projected to see a 7% CAGR in financial services through 2028, exemplifies this approach.

Such aggressive international expansions are inherently high-risk, high-reward. CDFHC’s commitment to these markets necessitates substantial capital investment, with early-stage funding for new operations often exceeding $50 million for similar financial institutions entering emerging markets. The success of these ventures remains uncertain, placing them firmly in the 'question mark' category of the BCG matrix, demanding careful monitoring and strategic adjustments.

Specialized Green Finance Products

Specialized green finance products, such as green bonds and sustainable investment funds, represent a high-growth potential area for China Development Financial Holdings Corporation (CDFHC), fueled by escalating global Environmental, Social, and Governance (ESG) demands. While CDFHC is actively participating in green energy, breaking into these specific product niches may initially see a smaller market share as they establish their footing.

The success of these specialized products hinges on substantial marketing and user adoption strategies. For instance, in 2023, the global green bond market issuance reached approximately $700 billion, indicating significant investor appetite and a growing market for such instruments.

CDFHC's strategic focus on these products aligns with the broader trend of sustainable finance, which is projected to continue its upward trajectory.

- Green Bonds: Growing investor demand for environmentally friendly investments.

- Sustainable Investment Funds: Capitalizing on the increasing interest in ESG-aligned portfolios.

- Market Entry Challenges: Initial low market share due to newness and competition.

- Growth Drivers: Global ESG trends and supportive government policies for green finance.

Cross-Sectoral Financial Solutions Integration

China Development Financial Holding Corporation (CDFHC) is pursuing a strategy of integrating financial solutions across its banking, securities, insurance, and private equity/venture capital arms. This cross-sectoral approach aims to leverage synergies and offer clients a comprehensive suite of financial services. The potential for high growth in integrated financial solutions is significant, as customers increasingly seek one-stop shops for their financial needs.

However, the success of this integration is uncertain, placing it in the Question Mark quadrant of the BCG Matrix. Challenges include fostering seamless cross-selling between distinct business units and achieving substantial market share for these bundled offerings. CDFHC's 2024 performance in this area will be a key indicator of its ability to overcome these hurdles. For instance, if cross-selling initiatives only yielded a 5% increase in revenue from existing clients in 2024, it would suggest significant integration challenges.

- Market Potential: High, driven by demand for comprehensive financial services.

- Integration Challenges: Difficulties in achieving seamless cross-selling and market penetration for combined offerings.

- Strategic Investment: Requires substantial internal coordination and financial commitment.

- Uncertainty: The ultimate market impact and profitability remain a key question mark for 2024 and beyond.

Question Marks within CDFHC's portfolio represent ventures with high growth potential but currently low market share, requiring significant investment and facing considerable uncertainty. These include KGI Bank's digital-only banking initiatives, CDIB Capital Group's early-stage AI fund investments, and CDFHC's aggressive international market entries, particularly in Southeast Asia.

Specialized green finance products and the integration of financial solutions across CDFHC's business units also fall into this category, facing challenges in market penetration and cross-selling despite strong market potential.

The success of these question marks is critical for CDFHC's future growth, with 2024 performance in areas like digital banking adoption and cross-selling initiatives serving as key indicators of their trajectory.

| Venture Area | Growth Potential | Current Market Share | Investment Required | Key Uncertainty |

| Digital-Only Banking (KGI Bank) | High | Low | High | Competitive Landscape |

| AI Startups (CDIB Capital) | Very High | Negligible | Very High | Technology Adoption & Risk |

| International Expansion (SEA) | High | Low | High | Regulatory & Market Fit |

| Green Finance Products | High | Low | Moderate to High | User Adoption & Competition |

| Integrated Financial Solutions | High | Low | Moderate | Cross-selling Effectiveness |

BCG Matrix Data Sources

Our China Development Financial BCG Matrix is built on a foundation of comprehensive data, including government economic reports, financial statements of key development banks, and in-depth market research on China's financial sector.