Commercial Bank of Qatar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial Bank of Qatar Bundle

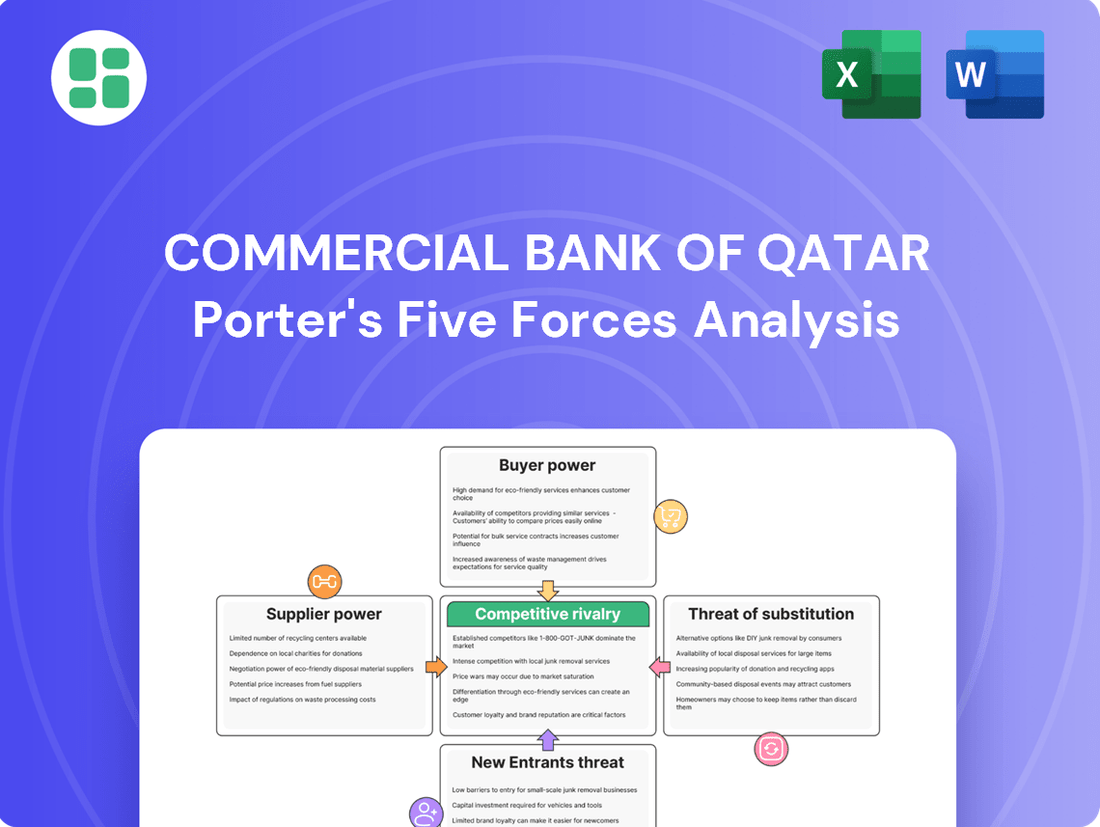

The Commercial Bank of Qatar operates within a dynamic banking landscape, facing significant competitive rivalry and evolving customer expectations. Understanding the interplay of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Commercial Bank of Qatar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Commercial Bank of Qatar's reliance on customer deposits as its core funding source means that the concentration of its depositors directly impacts supplier power. While individual retail depositors are numerous and fragmented, large corporate or institutional depositors hold significant sway. These entities, by virtue of the sheer volume of funds they entrust to the bank, can negotiate for more advantageous interest rates or service fees, effectively increasing the bank's funding costs.

The Qatari banking sector, including Commercial Bank of Qatar, has experienced robust growth in domestic deposits. As of the first quarter of 2024, total Qatari bank deposits reached approximately QAR 1.1 trillion, reflecting a healthy inflow of funds. This overall growth can somewhat dilute the power of any single large depositor, but significant concentrations still exist, providing these key clients with leverage.

The Commercial Bank of Qatar's reliance on external funding, a common trait among GCC banks, positions global financial markets and interbank lenders as significant suppliers. Their terms directly impact the bank's cost of funds, as seen in the interbank lending rates which can fluctuate based on global liquidity conditions.

For instance, in early 2024, global interest rate hikes influenced the cost of borrowing for many banks, including those in Qatar. Despite this, Qatar's strong sovereign backing provides a degree of stability, somewhat cushioning the impact of external funding market volatility on the bank's operations.

Commercial Bank of Qatar's (CBQ) significant investments in digital transformation, including AI and advanced technologies, amplify its reliance on specialized IT and software providers. This dependence grants these suppliers, particularly those with unique or proprietary banking solutions, considerable leverage.

For instance, the global IT services market was projected to reach $1.3 trillion in 2024, with specialized segments like AI and cloud services commanding premium pricing. CBQ's strategic push into AI, a critical component of its future growth, means it may face higher costs or less favorable terms from vendors offering these advanced capabilities.

Skilled Human Capital

The banking sector, especially with its ongoing digital evolution, relies heavily on professionals with specialized skills like data analytics, cybersecurity, and seasoned financial management. The limited availability of these experts gives them significant leverage, potentially driving up hiring and retention expenses for banks such as Commercial Bank of Qatar (CBQ).

CBQ is proactively addressing this by investing in developing its workforce in these critical domains. For instance, in 2024, the global demand for cybersecurity professionals was projected to outstrip supply by over 3 million individuals, a trend directly impacting recruitment costs for financial institutions.

- Talent Scarcity: The banking industry faces a shortage of professionals in areas like AI, machine learning, and cloud computing.

- Increased Costs: This scarcity translates to higher salaries, signing bonuses, and retention packages for sought-after employees.

- CBQ's Strategy: The bank is focusing on internal upskilling and reskilling programs to build a robust talent pipeline.

- Industry Impact: In 2023, the average salary for a senior data scientist in the financial services sector in the GCC region saw an increase of approximately 10-15% compared to the previous year.

Regulatory Bodies and Central Bank

The Qatar Central Bank (QCB) significantly impacts commercial banks by acting as a crucial supplier of operating licenses and the overarching regulatory environment. Its directives on capital adequacy, data privacy, and digital financial services directly shape operational expenses and strategic choices for institutions like Commercial Bank of Qatar. For instance, QCB's 2024 initiatives to enhance cybersecurity and data governance frameworks necessitate substantial investment in technology and compliance, thereby increasing the cost of doing business.

These regulations, which include stringent capital requirements and guidelines for digital banking expansion, elevate the bargaining power of the QCB. Banks must adhere to these mandates to maintain their license to operate, making compliance a non-negotiable cost. The QCB's evolving stance on digital transformation, as seen in its ongoing development of a comprehensive digital banking framework, requires continuous adaptation and investment from commercial banks, reinforcing its supplier-like influence.

The QCB's influence is further demonstrated through its role in ensuring financial stability. By setting reserve requirements and liquidity ratios, the QCB dictates how much capital banks must hold, affecting their ability to lend and invest. For example, in early 2024, the QCB maintained its benchmark deposit rate at 5.75%, influencing the cost of funds for all banks operating within Qatar.

- Regulatory Framework: QCB's licensing and operational rules are essential for banks.

- Compliance Costs: Adherence to QCB directives on capital, data, and digital banking increases operational expenses.

- Financial Stability Mandate: QCB's reserve and liquidity requirements impact bank profitability and lending capacity.

- Digital Banking Push: Ongoing QCB initiatives in digital finance require significant bank investment.

The bargaining power of suppliers for Commercial Bank of Qatar (CBQ) is influenced by its reliance on depositors, external funding sources, specialized technology providers, and skilled talent. Additionally, the Qatar Central Bank (QCB) acts as a significant supplier of licenses and regulatory frameworks, directly impacting operational costs and strategies.

| Supplier Type | Impact on CBQ | 2024 Data/Trend |

|---|---|---|

| Depositors (Large Corporate/Institutional) | Negotiate for better rates, increasing funding costs. | Total Qatari bank deposits ~QAR 1.1 trillion (Q1 2024). Concentration still provides leverage. |

| External Funding Markets/Interbank Lenders | Terms affect cost of funds; influenced by global liquidity. | Global interest rate hikes in early 2024 impacted borrowing costs. |

| IT & Software Providers (AI, Cloud) | Unique solutions grant leverage, potentially leading to higher costs. | Global IT services market projected at $1.3 trillion (2024). AI services command premium pricing. |

| Specialized Talent (AI, Cybersecurity) | Scarcity drives up recruitment and retention expenses. | Global cybersecurity talent shortage projected over 3 million (2024). GCC senior data scientist salaries increased 10-15% (2023). |

| Qatar Central Bank (QCB) | Licenses and regulations increase compliance and technology investment costs. | QCB initiatives in cybersecurity and digital banking require significant bank investment. QCB deposit rate maintained at 5.75% (early 2024). |

What is included in the product

This analysis offers a comprehensive examination of the competitive forces impacting Commercial Bank of Qatar, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Quickly assess competitive pressures and identify vulnerabilities in the Qatari banking sector, enabling proactive strategies to mitigate threats.

Customers Bargaining Power

For retail and small business clients of Commercial Bank of Qatar, the effort involved in switching banks can feel substantial. This includes the hassle of updating automatic payments, moving any existing loans, and getting familiar with a new online or mobile banking system. These perceived or actual costs can make customers think twice before moving their accounts.

While advancements in digital banking are designed to make the process smoother, the perception of high switching costs can still limit how much power customers have in negotiating better terms or rates. For instance, if a customer feels it’s too difficult to switch, they might be less inclined to demand better service or lower fees.

However, as more people become comfortable with digital banking tools, these switching costs are likely to decrease over time. In 2023, Qatar's financial sector saw continued growth in digital transactions, with mobile banking adoption on the rise, suggesting a gradual erosion of these barriers.

Customers in Qatar are increasingly well-informed about financial products, interest rates, and fees thanks to readily available online comparison tools and digital platforms. This heightened transparency significantly boosts their ability to compare offerings from various banks, thereby amplifying their bargaining power and intensifying competition within the sector.

Large corporate clients, government entities, and high-net-worth individuals wield considerable bargaining power. Their substantial transaction volumes allow them to negotiate tailored financial solutions, including customized loan terms and specialized treasury services. For instance, in 2024, major corporate clients often secured preferential rates on large-scale financing, directly impacting Commercial Bank of Qatar's (CBQ) margins on these deals.

CBQ's strategic focus on supporting Small and Medium Enterprises (SMEs) also acknowledges their growing collective bargaining potential. As the SME sector expands, its demand for standardized yet competitive banking products increases, prompting banks like CBQ to offer more attractive packages to capture this market share, influencing pricing and service offerings.

Digital Banking Adoption and Convenience

Customers in Qatar's banking sector increasingly expect highly convenient and intuitive digital banking experiences. This trend significantly amplifies their bargaining power, as they can readily switch to institutions offering superior online and mobile platforms. For instance, Qatar's internet penetration rate stood at approximately 99% as of early 2024, highlighting the widespread digital access that fuels these customer expectations.

Commercial Bank of Qatar (CBQ) recognizes this shift and has made substantial investments in enhancing its digital offerings for both small and medium-sized enterprises (SMEs) and retail customers. This strategic focus aims to meet and exceed these elevated customer demands, thereby mitigating the risk of customer attrition due to a lack of advanced digital solutions.

- High Digital Adoption: Qatar's population exhibits a very high adoption rate of digital services, creating a baseline expectation for seamless online and mobile banking.

- Customer Expectation for Convenience: Consumers are increasingly prioritizing ease of use and accessibility, readily switching providers if digital services are not up to par.

- CBQ's Digital Investment: Commercial Bank of Qatar has actively invested in digital transformation initiatives to cater to the evolving needs of its retail and SME customer segments.

- Competitive Landscape: Banks failing to deliver competitive digital experiences face increased customer power, as customers can easily move to competitors offering better digital solutions.

Availability of Alternative Financial Services

Customers in Qatar have a growing array of financial service providers to choose from, significantly impacting their bargaining power. Beyond conventional commercial banks, the market includes a robust presence of Islamic banks, which cater to specific Sharia-compliant financial needs. For instance, in 2023, Islamic banks held a substantial portion of the total banking sector assets in Qatar, demonstrating their competitive standing.

Furthermore, international banks operating in Qatar offer diverse products and services, often with competitive pricing and specialized expertise. This global competition intensifies the pressure on domestic commercial banks to retain customers. The ease with which customers can switch providers or explore new options means banks must continually offer attractive terms and superior service to maintain loyalty.

Emerging FinTech solutions are also playing a crucial role in empowering customers. Digital payment platforms, online lending services, and wealth management apps provide convenient and often lower-cost alternatives to traditional banking. By 2024, the adoption of digital banking services in Qatar is projected to continue its upward trend, reflecting a clear shift in customer preferences and a heightened ability to negotiate terms.

- Increased Choice: Customers can select from commercial banks, Islamic banks, international banks, and FinTech providers.

- Competitive Landscape: The presence of multiple players intensifies competition, pushing banks to offer better value.

- FinTech Disruption: Digital solutions provide accessible and often cheaper alternatives, increasing customer leverage.

- Customer Mobility: The ease of switching providers means banks must actively work to retain their client base through competitive offerings.

Customers in Qatar, particularly large corporations and high-net-worth individuals, possess significant bargaining power due to their substantial transaction volumes. In 2024, these clients frequently negotiated preferential rates on major financing deals, directly impacting Commercial Bank of Qatar's profit margins. The increasing digital savviness and access to comparative tools further empower all customer segments to demand better terms, as evidenced by Qatar's nearly 99% internet penetration rate in early 2024.

The growing availability of alternative financial providers, including Islamic banks and FinTech solutions, intensifies competition and customer leverage. By 2024, FinTech adoption continued to rise, offering convenient and cost-effective alternatives that push traditional banks to offer more attractive packages to retain clients.

The bargaining power of customers is amplified by the increasing ease of switching financial providers and the growing demand for seamless digital banking experiences. Commercial Bank of Qatar's investments in digital transformation aim to meet these elevated expectations, mitigating the risk of customer attrition in a market where service and convenience are key differentiators.

| Customer Segment | Bargaining Power Drivers | Impact on CBQ |

|---|---|---|

| Large Corporations & HNWIs | High transaction volumes, negotiation of preferential rates | Reduced margins on large deals |

| SMEs | Growing collective demand for competitive packages | Pressure to offer standardized, attractive product offerings |

| Retail & Small Business | Perceived switching costs, increasing digital savviness | Need for superior digital experience to retain customers |

| All Segments | Increased choice (Islamic banks, FinTech), digital convenience expectations | Intensified competition, need for continuous service improvement |

Preview Before You Purchase

Commercial Bank of Qatar Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Commercial Bank of Qatar's Porter's Five Forces analysis, covering the intensity of rivalry among existing competitors, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products or services within the Qatari banking sector.

Rivalry Among Competitors

Commercial Bank of Qatar (CBQ) faces intense competition in a market populated by robust local institutions and international players. Key domestic rivals include Qatar National Bank (QNB), Qatar Islamic Bank (QIB), Doha Bank, Dukhan Bank, and Ahlibank, all of which command significant market share and customer loyalty.

QNB, in particular, stands as a formidable competitor, often cited as the largest bank in Qatar by assets, frequently exceeding QAR 1 trillion in recent years, which presents a substantial challenge for CBQ. The presence of these established entities, coupled with the operational reach of international banks, intensifies rivalry and necessitates continuous strategic adaptation for CBQ.

The Qatari banking sector is experiencing robust growth, with total assets reaching QAR 1,088 billion by the end of 2023, and domestic deposits growing by 3.7% in the same period. This expansion, fueled by economic diversification and the significant North Field Expansion project, creates a more favorable environment for commercial banks. The availability of increasing opportunities can temper the intensity of competitive rivalry, as banks can focus on expanding their operations rather than engaging in aggressive market share battles.

Banks in Qatar are intensely focused on differentiating their products and services through significant investments in digital innovation and artificial intelligence. This strategic push aims to move beyond simple price competition. For example, Commercial Bank of Qatar (CBQ) is heavily investing in digital excellence and AI-powered solutions, alongside developing tailored services specifically for segments like Small and Medium-sized Enterprises (SMEs).

These efforts are designed to establish unique value propositions that attract and retain customers. By offering advanced digital platforms and personalized banking experiences, CBQ and its peers seek to build stronger customer loyalty. This differentiation strategy is crucial in a market where traditional banking services are becoming increasingly commoditized, with banks like CBQ aiming to capture market share through superior customer engagement and specialized offerings.

High Exit Barriers

The banking sector, including institutions like Commercial Bank of Qatar, faces substantial exit barriers. These include the immense capital tied up in physical infrastructure, technology, and a highly regulated operational framework. For instance, the Basel III accord mandates stringent capital adequacy ratios, making it costly to simply divest assets and leave the market.

These high exit barriers mean that banks are often compelled to stay in the market and continue competing, even when facing economic downturns or reduced profitability. This persistence fuels intense rivalry among existing players. In 2024, the global banking sector continued to navigate a complex environment, with many regional banks demonstrating resilience despite ongoing economic uncertainties.

- Significant Capital Investments: Banks have made substantial investments in technology, branch networks, and human capital, making divestment difficult and costly.

- Complex Regulatory Environment: Stringent regulations, such as those related to capital reserves and consumer protection, create hurdles for exiting the market.

- Reputational Costs: A bank’s withdrawal can damage its reputation and that of its parent company, impacting future business ventures.

- Interconnectedness: The financial system's interconnectedness means that a bank's exit can have ripple effects, often necessitating government intervention or consolidation rather than outright closure.

Regulatory Environment and Government Support

The competitive rivalry within Qatar's banking sector is significantly influenced by a stable regulatory environment overseen by the Qatar Central Bank. This oversight, coupled with robust government support for the banking industry, fosters considerable stability and resilience. For instance, in 2023, the QCB continued to implement measures aimed at strengthening the financial system, contributing to the sector's overall health.

While this supportive framework enhances stability, regulations also actively shape competitive dynamics. Initiatives promoting financial inclusion, such as digital banking solutions for underserved populations, and the establishment of clear standards for new digital services, directly influence how banks compete and innovate. These regulatory directives can level the playing field or create new avenues for differentiation among established players and emerging fintechs.

- Regulatory Stability: Qatar Central Bank's consistent oversight provides a predictable operating environment.

- Government Support: Strong backing from the government bolsters the banking sector's resilience, evident in continued infrastructure development and economic diversification initiatives.

- Regulation-Driven Competition: Rules on financial inclusion and digital service standards directly impact competitive strategies, encouraging innovation in areas like mobile banking and accessible financial products.

Competitive rivalry in Qatar's banking sector is fierce, driven by strong domestic players like QNB, which boasts assets often exceeding QAR 1 trillion. This intense competition is further amplified by international banks operating in the region, forcing institutions like Commercial Bank of Qatar (CBQ) to continuously innovate and differentiate their offerings.

Banks are investing heavily in digital transformation and AI to create unique value propositions, moving beyond price-based competition. CBQ's focus on digital excellence and tailored SME solutions exemplifies this trend, aiming to foster customer loyalty in a market where services can become commoditized.

The sector's robust growth, with total assets reaching QAR 1,088 billion by the end of 2023, offers opportunities that can temper rivalry. However, significant exit barriers, including substantial capital investments and stringent regulatory requirements like Basel III, ensure that existing players remain committed, sustaining a high level of competition.

| Competitor | Estimated Assets (QAR Billion, end-2023/early-2024) | Key Differentiators |

|---|---|---|

| Qatar National Bank (QNB) | > 1,000 | Largest market share, extensive network, strong international presence |

| Qatar Islamic Bank (QIB) | ~ 300-350 | Leading Islamic banking services, strong retail and corporate focus |

| Doha Bank | ~ 100-120 | Digital innovation, SME financing, international branches |

| Commercial Bank of Qatar (CBQ) | ~ 170-190 | Digital excellence, AI integration, SME solutions, corporate banking |

SSubstitutes Threaten

The rise of FinTech and digital payment solutions presents a substantial threat of substitutes for commercial banks like Commercial Bank of Qatar (CBQ). Companies offering digital wallets, mobile payment apps, and online lending bypass traditional banking infrastructure, directly competing for customer transactions and credit needs. For instance, the global FinTech market was valued at approximately $2.5 trillion in 2023 and is projected to grow significantly, indicating a strong shift towards these alternative financial services.

These innovative platforms can offer greater convenience and often lower fees, drawing customers away from established banks. Qatar's commitment to fostering FinTech innovation, with initiatives like the Qatar FinTech Hub, further accelerates the adoption of these substitutes. This environment means CBQ must continually adapt to retain its customer base and market share against these agile, digitally-native competitors.

Large corporate clients increasingly bypass traditional commercial banks by accessing capital markets directly. In 2024, the global bond issuance market saw significant activity, with corporations raising substantial funds through their own offerings, reducing their need for large corporate loans from banks like Commercial Bank of Qatar (CBQ).

This direct access to capital markets, through mechanisms like initial public offerings (IPOs) or seasoned equity offerings, provides an alternative to bank financing. For instance, in the first half of 2024, equity capital markets activity globally rebounded, offering companies another avenue for funding that competes with bank lending.

Emerging alternative financing platforms like peer-to-peer lending and crowdfunding offer individuals and small businesses ways to get funding without traditional banks. While these models are still developing in Qatar, they represent a growing potential substitute for conventional bank credit.

Globally, the alternative finance market has seen significant growth. For instance, by the end of 2023, the global P2P lending market was valued at over $100 billion, with crowdfunding platforms facilitating billions more. This trend indicates a shift in how capital is accessed, potentially impacting traditional banks’ market share.

In Qatar, the regulatory landscape for these platforms is still evolving, but the underlying demand for accessible financing suggests a future where these substitutes could gain traction. As these platforms mature, they may offer more competitive rates or faster processing times, drawing customers away from established banks.

Islamic Financial Products

For customers specifically seeking Sharia-compliant financial solutions, Islamic banks present a direct and comprehensive substitute for conventional banking offerings. These institutions provide a full spectrum of products, including deposits, financing, and wealth management, all structured to adhere to Islamic law. Commercial Bank of Qatar (CBQ) recognizes this significant substitute threat and actively caters to this segment by offering its own suite of Islamic banking packages, aiming to retain customers who prioritize these principles.

The growth of the Islamic finance sector underscores the potency of this substitute. Globally, the Islamic finance industry has seen substantial expansion. For instance, by the end of 2023, the total assets managed by Islamic financial institutions were estimated to be over $3.7 trillion, with projections indicating continued robust growth through 2024 and beyond. This increasing market share means that a growing number of consumers and businesses have viable, Sharia-compliant alternatives readily available, directly impacting the customer base for conventional banks like CBQ.

- Growing Islamic Finance Market: Global Islamic finance assets are projected to reach $4.9 trillion by 2025, highlighting the increasing availability of Sharia-compliant alternatives.

- Product Parity: Islamic banks offer comparable products to conventional banks, including savings accounts, loans (through Murabaha or Ijara structures), and investment funds, making them a strong substitute.

- Customer Preference Shift: A segment of the population, particularly in Muslim-majority regions, actively prefers Sharia-compliant products due to religious and ethical considerations.

- CBQ's Response: Commercial Bank of Qatar's introduction of Islamic banking windows and products demonstrates an acknowledgment of this competitive pressure and an effort to capture market share within this segment.

Internal Corporate Financing and Non-Bank Financial Institutions

Large corporations with robust internal cash reserves or direct access to funding from their parent entities often bypass traditional commercial banking for certain needs. This can include utilizing specialized non-bank financial institutions for services such as wealth management, investment banking, or tailored insurance products. For instance, in 2024, many global corporations continued to leverage their strong balance sheets, with aggregate corporate cash holdings exceeding trillions of dollars, allowing them to self-fund projects and reduce reliance on external bank credit lines.

The availability of these alternative financing channels and specialized services from non-bank entities presents a significant threat of substitutes for commercial banks like Commercial Bank of Qatar. Corporations can opt for direct capital markets access or private equity funding, circumventing the need for a full suite of commercial banking services. This trend is amplified as non-bank financial institutions, which accounted for approximately 40% of global financial assets in 2023, offer increasingly competitive and specialized solutions.

- Internal Financing: Corporations with strong cash flow can self-fund operations and investments, reducing the need for bank loans.

- Non-Bank Financial Institutions: Specialized firms offer services like asset management, investment banking, and insurance, acting as substitutes for commercial bank offerings.

- Capital Markets: Direct access to bond and equity markets allows large corporations to raise capital without relying on commercial banks.

- Market Trends: The growing influence of fintech and alternative lenders in 2024 provides further substitute options for traditional banking services.

The threat of substitutes for Commercial Bank of Qatar (CBQ) is multifaceted, encompassing digital financial solutions, direct access to capital markets, and alternative financing platforms. FinTech innovations like digital wallets and mobile payment apps offer convenient, lower-fee alternatives, a trend supported by the global FinTech market's valuation of approximately $2.5 trillion in 2023. Large corporations increasingly bypass traditional lending by issuing bonds or equities directly, a market that saw significant global activity in 2024. Furthermore, peer-to-peer lending and crowdfunding platforms are emerging as substitutes, with the global P2P lending market exceeding $100 billion by the end of 2023.

| Substitute Category | Example | Market Size/Growth Indicator (Approx.) | Impact on CBQ |

|---|---|---|---|

| FinTech & Digital Payments | Digital Wallets, Mobile Payment Apps | Global FinTech Market: ~$2.5 trillion (2023) | Customer transaction and credit displacement |

| Capital Markets Access | Corporate Bond Issuance, IPOs | Significant global activity in 2024 | Reduced demand for corporate loans |

| Alternative Financing | Peer-to-Peer Lending, Crowdfunding | Global P2P Lending Market: >$100 billion (end of 2023) | Competition for individual and SME financing |

Entrants Threaten

Establishing a new commercial bank in Qatar, be it a traditional brick-and-mortar institution or a digital-only player, demands a significant capital outlay. This is primarily driven by stringent regulatory minimums set by the Qatar Central Bank (QCB) and the need to develop robust operational infrastructure, including technology and physical branches. For instance, the QCB mandates specific paid-up capital requirements for new banks, which can run into hundreds of millions of Qatari Riyals, effectively acting as a substantial barrier to entry for many aspiring financial institutions.

The threat of new entrants for commercial banks in Qatar is significantly mitigated by a strict regulatory landscape. The Qatar Central Bank (QCB) imposes rigorous licensing procedures and ongoing compliance demands, including robust Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) and data protection measures. For instance, as of early 2024, obtaining a full banking license remains a complex and capital-intensive process, deterring many potential new players.

While the QCB has signaled openness to digital-only banks, these new entrants must still navigate a stringent framework and face considerable regulatory scrutiny. This means that even innovative digital challengers must meet high standards for capital adequacy, operational resilience, and consumer protection, making market entry a substantial hurdle. In 2023, the QCB continued to emphasize strong governance and risk management for all financial institutions, reinforcing these barriers.

Established banks like Commercial Bank of Qatar have cultivated deep customer loyalty over many years. This strong brand recognition and the trust associated with it present a formidable barrier for any new players entering the market.

Potential new entrants must overcome the significant hurdle of earning customer confidence. In Qatar's financial landscape, where personal relationships and a solid reputation are paramount, attracting a substantial client base is exceptionally challenging for newcomers.

Economies of Scale and Scope

Incumbent banks in Qatar, like Commercial Bank of Qatar, leverage significant economies of scale in their operations. This includes extensive technology infrastructure and widespread marketing efforts, enabling them to offer competitive pricing and a comprehensive range of financial products. For instance, as of the first quarter of 2024, Commercial Bank of Qatar reported total assets of QAR 185.3 billion, demonstrating the scale of its operations.

New entrants face a substantial hurdle in matching these cost efficiencies. Without an established large customer base or the ability to secure significant initial investment to build comparable infrastructure, they struggle to compete on price and service breadth. This disparity in operational leverage creates a strong barrier, protecting existing players from immediate, large-scale disruption.

- Economies of Scale: Existing banks benefit from lower per-unit costs due to high-volume operations in technology, marketing, and administration.

- Infrastructure Investment: New entrants require massive upfront capital for branch networks, digital platforms, and regulatory compliance, which is difficult to recoup without an existing market share.

- Customer Acquisition Costs: Attracting customers away from established, trusted institutions involves high marketing and promotional expenses for new players.

- Service Breadth: Incumbents offer a full spectrum of services, from retail banking to corporate finance, which is challenging for a new entrant to replicate initially.

Limited Market Niches

While the Qatar Central Bank (QCB) is actively promoting digital banking to reach underserved populations and enhance financial inclusion, the most lucrative market segments might already be well-established and controlled by the dominant, larger banks. This presents a significant hurdle for any new competitor aiming to enter the commercial banking sector.

New entrants need to be strategic, pinpointing and effectively targeting market niches that are not only viable but also potentially underserved by current offerings. For instance, while digital banks are encouraged, their success hinges on carving out distinct value propositions rather than simply replicating existing services. In 2023, Qatar's banking sector saw a 7.5% growth in total assets, reaching QAR 1,783 billion, indicating a robust market but also one where established players hold considerable sway.

- Limited Profitable Niches: Established banks often dominate high-margin segments, making it difficult for newcomers to gain immediate traction.

- Digital Banking Opportunities: The QCB's push for digital banking creates avenues for new entrants to target specific customer needs, potentially through specialized services or enhanced user experiences.

- Market Saturation Concerns: Major profitable niches may already be saturated, requiring new entrants to innovate and differentiate significantly to capture market share.

The threat of new entrants into Qatar's commercial banking sector is relatively low, primarily due to substantial capital requirements and stringent regulatory hurdles imposed by the Qatar Central Bank (QCB). For example, as of early 2024, obtaining a banking license involves significant capital and adherence to complex compliance standards, making it a formidable barrier for aspiring institutions.

Established players like Commercial Bank of Qatar benefit from considerable economies of scale, with total assets reaching QAR 185.3 billion in Q1 2024, allowing for cost efficiencies and competitive pricing that new entrants struggle to match. Furthermore, deep-rooted customer loyalty and brand recognition built over years present a significant challenge for newcomers seeking to acquire a substantial client base.

While digital banking presents an opportunity, new entrants must still navigate regulatory scrutiny and demonstrate robust operational resilience, even when targeting specific niches. Despite a growing market, with total banking sector assets reaching QAR 1,783 billion in 2023, established banks often control the most profitable segments, requiring significant differentiation for newcomers.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | QCB mandates high paid-up capital for new banks, running into hundreds of millions of Qatari Riyals. | Substantial financial barrier, limiting the pool of potential entrants. |

| Regulatory Compliance | Stringent licensing, AML/CFT, and data protection measures require extensive resources. | Increases operational complexity and cost, demanding significant investment in compliance infrastructure. |

| Economies of Scale | Incumbents like Commercial Bank of Qatar (QAR 185.3 billion assets in Q1 2024) operate at lower per-unit costs. | New entrants face difficulty competing on price and service breadth due to higher initial operating costs. |

| Customer Loyalty & Brand Reputation | Established banks possess deep customer trust and brand recognition. | High customer acquisition costs and a lengthy process to build comparable trust for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Commercial Bank of Qatar is built upon a foundation of official company disclosures, including annual reports and investor presentations. We also leverage industry-specific reports from reputable financial institutions and market research firms that track the Qatari banking sector.