Commercial Bank of Qatar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commercial Bank of Qatar Bundle

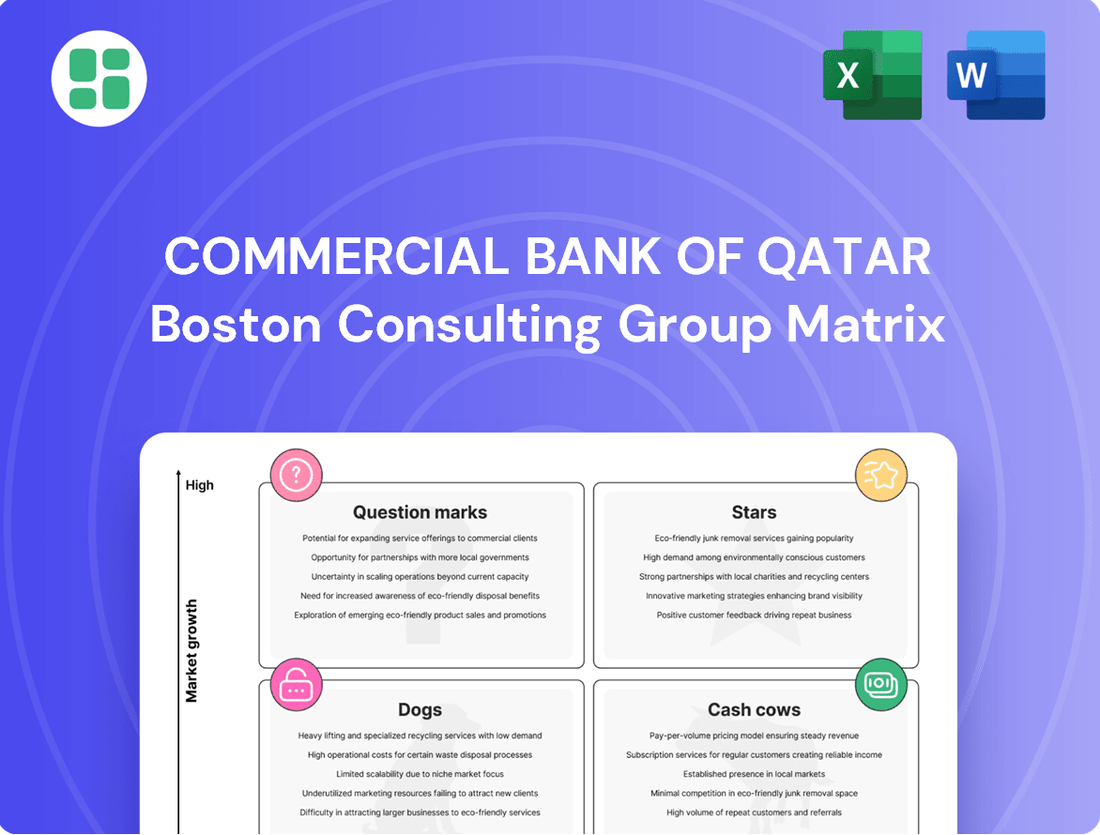

Discover the strategic positioning of Commercial Bank of Qatar's product portfolio. This preview offers a glimpse into its Stars, Cash Cows, Dogs, and Question Marks, hinting at potential growth areas and resource drains.

To truly unlock actionable insights and understand where Commercial Bank of Qatar is poised for future success or requires strategic intervention, dive into the full BCG Matrix report. Gain a comprehensive breakdown of each product's market share and growth rate, empowering you to make informed investment decisions.

Purchase the complete BCG Matrix today for a detailed analysis and a clear roadmap to optimizing your financial strategies and maximizing your competitive advantage in the dynamic banking sector.

Stars

Commercial Bank of Qatar (CBQ) truly leads the pack in digital banking within Qatar, evidenced by its pioneering introduction of services like a merchant app for mobile and QR code payments. Their commitment to digital advancement is further demonstrated by their 24/7 USD cross-border transfer service, a critical offering in today's globalized economy.

With Qatar actively fostering a digital economy and boasting high digital adoption rates, CBQ's innovative mobile app solutions are positioned in a high-growth sector. The bank's substantial investment in these capabilities allows it to maintain a significant, leading market share in this rapidly expanding digital landscape.

Commercial Bank of Qatar (CBQ) is actively leading in sustainable finance, evidenced by its launch of Green Vehicle and Green Mortgage loans designed to promote environmentally conscious choices. These initiatives underscore the bank's dedication to supporting a greener economy.

Further solidifying its commitment, CBQ successfully issued a substantial CHF 225 million Green Bond in September 2024. This issuance marked the largest of its kind originating from Qatar, highlighting CBQ's significant role in mobilizing capital for sustainable projects.

The broader market context is highly favorable, with Qatar Central Bank outlining its ESG and sustainable finance strategy in 2024. This strategy aims to position Qatar as a key hub for sustainable finance, indicating rapid growth in this sector and placing CBQ's green products at the forefront of market innovation.

Credit card issuance represents a significant growth area for Commercial Bank of Qatar (CBQ). The bank was awarded Fastest Growing Credit Card Issuer – Qatar 2024 by International Finance, highlighting its strong performance in this sector.

This achievement stems from CBQ's focus on innovation, including the adoption of contactless payments and digital wallet solutions like CB Pay, which appeal to modern consumers. These advancements, coupled with strategic partnerships, are key drivers of their expanding customer base.

The broader economic climate in Qatar, characterized by increasing consumer spending and rising disposable incomes, provides a fertile ground for CBQ's credit card business. The bank is actively leveraging these trends to capture a larger market share with its customized product offerings.

Wealth Management Services (Premium/Digital)

Commercial Bank of Qatar's (CBQ) wealth management services, particularly its premium and digital offerings, represent a significant growth engine. The division has experienced remarkable expansion, catering to high-net-worth individuals with highly personalized and bespoke financial solutions.

The digital investment market in Qatar is poised for substantial growth, expected to spearhead fintech advancements. Projections indicate a significant increase in Assets Under Management (AUM) within this sector by 2025, highlighting a strong market trend.

- CBQ's wealth management division is experiencing substantial growth, driven by personalized services for high-net-worth clients.

- The digital investment market in Qatar is anticipated to be a primary driver of fintech growth.

- Assets Under Management (AUM) in Qatar's digital investment sector are projected to rise significantly by 2025.

- This convergence of CBQ's robust wealth management capabilities and the digital market's expansion positions the bank for increased prominence in a high-growth area.

Corporate & SME Digital Lending

Commercial Bank of Qatar (CBQ) is actively enhancing its digital lending capabilities for both corporate and SME clients, recognizing the evolving needs of the market. This strategic focus is crucial as domestic credit growth moderates, making digital innovation a key differentiator. CBQ’s advanced corporate trade portal, which leverages AI and OCR, exemplifies this commitment by significantly streamlining transaction processes for businesses.

The Qatari economy's ongoing diversification and the government's strong backing for Small and Medium Enterprises (SMEs) create a fertile ground for digitally-driven financing solutions. This environment presents a substantial opportunity for CBQ to expand its reach and capture market share in a segment poised for significant growth. The bank's proactive investments in these digital platforms are designed to meet the demand for efficient and accessible corporate and SME financing.

- Digital Transformation: CBQ's corporate trade portal utilizes AI and OCR for process optimization.

- Market Opportunity: Qatar's economic diversification and SME support fuel demand for digital lending.

- Strategic Positioning: Investments in digital corporate and SME financing aim to capture high-growth market share.

Commercial Bank of Qatar's (CBQ) digital banking services are a clear star in its BCG matrix. The bank's proactive introduction of services like a merchant app for mobile and QR code payments, alongside its 24/7 USD cross-border transfer capability, positions it as a leader in a high-growth digital economy. With Qatar's strong digital adoption rates, CBQ's substantial investments in these areas ensure a leading market share.

| Category | Market Growth Rate | Relative Market Share | BCG Matrix Position |

|---|---|---|---|

| Digital Banking | High | High (Leader) | Star |

| Sustainable Finance | High | High (Leader) | Star |

| Credit Card Issuance | High | High (Fastest Growing Issuer 2024) | Star |

| Wealth Management | High | High (Significant Expansion) | Star |

| Corporate & SME Digital Lending | High | High (Strategic Investments) | Star |

What is included in the product

This BCG Matrix overview provides tailored analysis for Commercial Bank of Qatar's product portfolio, highlighting which units to invest in, hold, or divest.

The Commercial Bank of Qatar's BCG Matrix offers a clear, actionable overview of its portfolio, relieving the pain of strategic uncertainty.

This one-page overview, optimized for C-level, provides a distraction-free view of business unit performance.

Cash Cows

Commercial Bank of Qatar's traditional corporate banking and lending operations are its bedrock, serving large corporations with essential commercial and investment banking services. This segment is characterized by its stability and high transaction volumes, ensuring a steady stream of revenue that significantly bolsters the bank's overall profitability.

Despite operating in a mature market, the bank's robust domestic presence and its designation as a Domestic Systematically Important Bank (DSIB) in Qatar solidify its substantial market share. For instance, in 2024, Commercial Bank reported a net interest income of QAR 5.5 billion, a testament to the consistent performance of its core lending activities.

Retail deposit accounts, encompassing current and savings accounts, represent a bedrock of funding for Commercial Bank of Qatar. These foundational products are crucial in a well-established market, ensuring a steady flow of liquidity and maintaining a substantial market share for the bank. Customer deposits saw an increase in 2024, with early indications for H1 2025 showing continued growth, especially in lower-cost deposit categories.

These stable, low-cost funds are vital for powering the bank's broader operations, from lending to investment activities. Their essential nature in the banking landscape means they require minimal additional marketing spend to maintain their position. Commercial Bank's strong performance in attracting and retaining these deposits underscores their status as a key Cash Cow.

Conventional mortgage products are a cornerstone for Commercial Bank of Qatar (CBQ), acting as significant cash cows. These standard home loans represent a substantial portion of the bank's lending, bolstering its overall loans and advances. In 2023, the real estate sector in Qatar accounted for approximately 28% of total domestic credit, a testament to the market’s depth and CBQ’s established presence within it.

Trade Finance Services

Commercial Bank of Qatar's Trade Finance Services stand as a prime example of a Cash Cow within its BCG Matrix. The bank's dominance in this sector is underscored by its recognition as the 'Best Trade Finance Provider' in Qatar for 2023. This mature, high-volume service is fundamental to Qatar's robust trade activities, generating steady fee-based income from a loyal customer base.

This segment boasts a high market share within a market characterized by low growth but exceptional stability. The consistent revenue stream from trade finance, a critical component of international commerce, solidifies its position as a reliable profit generator for the bank.

- Award Recognition: Named 'Best Trade Finance Provider' in Qatar for 2023.

- Market Position: High market share in a stable, low-growth sector.

- Revenue Generation: Consistent fee-based income from an established client base.

- Strategic Importance: Crucial for supporting Qatar's significant trade activities.

Treasury and Interbank Operations

Treasury and Interbank Operations for Commercial Bank of Qatar (CBQ) are firmly positioned as Cash Cows within its BCG Matrix. These operations are characterized by their high market share in the interbank and wholesale funding arenas, contributing stable, predictable earnings. CBQ's extensive treasury activities, including the management of significant debt securities, underscore the essential nature of these functions for liquidity, interest rate risk, and foreign exchange exposure management.

- High Market Share: CBQ holds a substantial position in interbank and wholesale funding markets.

- Stable Earnings: These operations generate consistent, albeit low-growth, revenue streams for the bank.

- Essential Functions: Treasury activities are critical for managing liquidity, interest rate risk, and foreign exchange exposures.

- Diversified Funding: The bank actively manages a range of funding sources, including significant debt securities.

Commercial Bank of Qatar's core corporate banking and lending, retail deposits, conventional mortgages, trade finance, and treasury operations are all strong Cash Cows. These segments benefit from high market share in mature, stable markets, generating consistent and predictable revenue streams. The bank's robust domestic presence and established client relationships are key drivers of their success in these areas.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Corporate Banking & Lending | Cash Cow | Stability, high transaction volumes, steady revenue | Net Interest Income: QAR 5.5 billion |

| Retail Deposit Accounts | Cash Cow | Stable funding, low-cost liquidity, strong market share | Continued growth in H1 2025, especially low-cost deposits |

| Conventional Mortgages | Cash Cow | Substantial lending portion, supports real estate sector | Real estate sector ~28% of domestic credit (2023) |

| Trade Finance Services | Cash Cow | High market share, stable fee income, low growth | Awarded 'Best Trade Finance Provider' in Qatar (2023) |

| Treasury & Interbank Operations | Cash Cow | High market share, predictable earnings, risk management | Manages significant debt securities, vital for liquidity |

Full Transparency, Always

Commercial Bank of Qatar BCG Matrix

The preview of the Commercial Bank of Qatar BCG Matrix you are currently viewing is the exact, fully intact document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, professionally formatted analysis ready for your strategic decision-making. You can trust that the insights and visual representations presented here are precisely what you'll be able to download and utilize for your business planning and competitive assessments.

Dogs

Alternatif Bank, Commercial Bank of Qatar's Turkish subsidiary, has been a consistent drain on the group's profitability. In 2024, its losses negatively impacted the overall net profit, a trend that continued into Q1 and H1 of 2025. This performance suggests a challenging, low-growth market in Turkey for Commercial Bank, where its market share is likely small and operational hurdles are significant.

The ongoing financial strain from Alternatif Bank positions it as a potential cash trap within the BCG matrix. The subsidiary is consuming valuable resources without generating sufficient returns, highlighting a need for strategic re-evaluation of its role within the Commercial Bank of Qatar's portfolio.

As Commercial Bank of Qatar (CBQ) pushes forward with its digital transformation, services that are still heavily dependent on physical branches, without any digital counterpart, are starting to show signs of struggle. These are the legacy services.

These outdated services are in a market that isn't growing much anymore. Think about services that absolutely require you to visit a branch for everything. Customer preference has clearly shifted towards digital platforms, meaning fewer people are using these traditional offerings. In 2024, it's estimated that over 70% of banking transactions in Qatar are now conducted digitally, highlighting the shrinking relevance of purely branch-dependent services.

These legacy services can be seen as inefficient assets for CBQ. They likely consume resources, like staffing and maintaining physical spaces, but don't bring in much business or offer a strong competitive edge in today's market. This situation makes them prime candidates for re-evaluation or divestment as the bank focuses its investments on more modern, digitally integrated solutions.

Niche, underperforming investment funds within Commercial Bank of Qatar's (CBQ) portfolio represent potential 'Dogs' in a BCG Matrix analysis. These might include specialized emerging market debt funds or niche sector equity funds that have struggled to gain traction. For instance, if a particular CBQ-managed fund focused on a very specific technology sector saw its Assets Under Management (AUM) drop by 15% in 2024, it would exemplify this category.

These underperformers typically exhibit both low market share within their investment segment and low growth prospects. Their contribution to CBQ's overall profitability is likely marginal, potentially even negative after accounting for management and operational costs. For example, a CBQ advisory product targeting a small, declining industry might have seen its revenue decline by 10% year-over-year in 2024, indicating a shrinking market and poor performance.

Such funds or products are prime candidates for strategic review, potentially leading to divestiture or a significant restructuring to improve their viability. If a CBQ investment fund's net return for 2024 was a negative 5%, significantly lagging its benchmark index which returned a positive 8%, it clearly signals underperformance and a potential 'Dog' status.

Undifferentiated Basic Retail Products

Undifferentiated basic retail products, like simple savings accounts with no advanced digital features, are essentially commodities in the banking sector. These offerings often struggle to attract new customers or keep existing ones when more agile competitors provide superior digital experiences or unique benefits. In 2024, many traditional banks found their basic deposit accounts facing intense competition from fintechs and neobanks, leading to stagnant growth in this segment.

These products typically reside in low-growth, highly competitive markets, often resulting in a low market share for the bank. Their limited competitive advantage means they contribute very little to overall profitability. For instance, a basic checking account with no overdraft protection or mobile check deposit capabilities would fall into this category, offering minimal revenue streams beyond the initial deposit.

- Low Differentiation: Products like standard savings accounts with minimal features offer little to distinguish them from competitors.

- Low Fee Potential: Revenue generation is limited, primarily relying on interest margins rather than service fees.

- Intense Competition: The market for basic retail banking products is crowded, with numerous players vying for customer deposits.

- Struggles for Growth: In 2024, many banks saw minimal growth in these product categories due to the lack of unique selling propositions.

Specific International Trade Corridors with Low Volume

While trade finance generally thrives for Commercial Bank of Qatar (CBQ), certain niche international trade corridors with minimal activity can be classified as dogs in the BCG matrix. These are routes where CBQ has established a presence but processes very few transactions.

These low-volume corridors often represent a significant drain on resources. The overheads associated with maintaining operations, compliance, and staff for these routes can far outweigh the revenue generated, signaling both a low market share and negligible growth potential within those specific markets.

- Low Transaction Volume: For instance, a corridor like Qatar to a less-developed African nation might see only a handful of trade finance deals processed annually by CBQ, perhaps fewer than 50 in 2024.

- Disproportionate Overheads: The cost of managing regulatory compliance and operational support for these few deals could exceed QAR 500,000 annually, significantly impacting profitability.

- Limited Growth Prospects: Market analysis for these specific corridors might indicate a projected CAGR of less than 1% over the next five years, reinforcing their 'dog' status.

- Strategic Re-evaluation: CBQ may need to consider whether to divest from or significantly restructure operations in these specific low-volume corridors to reallocate capital to more promising areas.

Certain niche international trade corridors with minimal activity can be classified as dogs within the BCG matrix for Commercial Bank of Qatar (CBQ). These are routes where CBQ has established a presence but processes very few transactions, leading to low market share and negligible growth potential.

These low-volume corridors represent a drain on resources, as overheads for operations and compliance can outweigh generated revenue. For example, a specific corridor might see fewer than 50 trade finance deals processed annually by CBQ in 2024, with management costs exceeding QAR 500,000.

These underperforming segments require strategic re-evaluation, potentially leading to divestiture or restructuring to reallocate capital to more promising areas.

Undifferentiated basic retail products, such as simple savings accounts with no advanced digital features, also fall into the 'dog' category. These offerings struggle to attract customers in a crowded market, contributing minimally to profitability.

| Category | Market Share | Market Growth | Profitability | Example |

| Niche Trade Corridors | Low | Low | Low/Negative | Specific Qatar-to-less-developed African nation trade routes |

| Basic Retail Products | Low | Low | Low | Standard savings accounts without digital features |

Question Marks

Qatar's National Fintech Strategy actively promotes blockchain innovation, signaling a robust growth trajectory for these technologies. Commercial Bank's exploration of blockchain for services like cross-border payments and trade finance positions these initiatives within the question mark category.

While currently holding a low market share due to their early development stage, these blockchain ventures represent significant investment. Their potential to evolve into future Stars hinges on successful adoption and scaling, mirroring the strategic gamble often associated with question mark products.

The Qatari fintech landscape is experiencing a surge, particularly in digital investment and robo-advisory services. Projections indicate a substantial increase in Assets Under Management (AUM) within this sector. Commercial Bank of Qatar (CBQ) is strategically positioning itself by introducing AI-powered personal finance assistants to tap into this burgeoning market.

For CBQ, these innovative AI-driven advisory tools, while operating in a high-growth segment, currently represent a low market share. This is typical for new ventures as they focus on building user adoption and brand recognition within a competitive environment.

The Qatari fintech landscape is buzzing with innovation, particularly in digital payments. Buy Now, Pay Later (BNPL) services and sophisticated e-wallets are rapidly gaining traction, presenting both opportunities and challenges for established players like Commercial Bank of Qatar (CBQ).

If CBQ is actively participating or expanding its presence in these dynamic digital payment ecosystems, beyond its existing digital wallet, these segments represent high-growth frontiers. Here, CBQ is likely in a phase of market share development, akin to a ‘Question Mark’ in the BCG matrix, requiring strategic investment to capitalize on their potential.

In 2024, the global BNPL market was projected to reach over $3.5 trillion by 2030, indicating substantial growth. For Qatar, while specific 2024 figures for BNPL adoption are still emerging, the broader digital payment transaction volume in the GCC region saw significant increases, with e-wallets playing a crucial role. CBQ’s strategic focus on these areas is key to navigating this evolving market.

Cross-Border Remittance Innovations (New Channels/Partnerships)

Commercial Bank of Qatar (CBQ) can explore new partnerships to enhance its 24/7 USD cross-border transfer services, particularly for high-growth remittance corridors. For instance, collaborations with fintech firms specializing in emerging markets could unlock significant potential. The global remittance market was projected to reach $1.1 trillion by 2023, according to the World Bank, highlighting the substantial opportunity for CBQ to expand its reach.

Introducing new, potentially disruptive technologies like blockchain-based remittance platforms or leveraging APIs for seamless integration with digital wallets could position CBQ as an innovator. While these initiatives target a rapidly expanding market for international transfers, they would likely begin with a modest market share, facing competition from established remittance providers and alternative payment methods.

- Partnerships for High-Growth Corridors: CBQ could forge alliances with remittance providers focusing on corridors with significant outbound flows from Qatar, such as to South Asia or Southeast Asia.

- Technology Adoption: Exploring the integration of blockchain or advanced API solutions could streamline cross-border transactions, offering faster and cheaper alternatives.

- Market Entry Strategy: Initial low market share is anticipated due to competition, necessitating a focused go-to-market strategy to build traction.

- Market Size: The global remittance market's continued growth, estimated to be in the trillions, underscores the strategic importance of these innovations.

Expansion into New, High-Growth Regional Digital Markets

Commercial Bank of Qatar could strategically target emerging markets in Southeast Asia or Africa, regions demonstrating rapid digital adoption and a growing middle class. For instance, the digital banking sector in many African nations saw significant growth in 2024, with mobile money transactions reaching billions of dollars.

- High Growth Potential: Markets like Vietnam or Nigeria are projected to experience double-digit annual growth in digital financial services through 2025, driven by increasing internet penetration and smartphone usage.

- Low Initial Market Share: Entering these markets would mean starting from a near-zero market share, necessitating significant upfront investment in technology, marketing, and local partnerships to build brand awareness and customer trust.

- Investment Requirements: Establishing a digital-first presence will demand substantial capital for platform development, cybersecurity, regulatory compliance, and talent acquisition, potentially impacting short-term profitability.

- Strategic Risk: While the upside is considerable, the competitive landscape and evolving regulatory environments in these new regions present inherent risks that require careful management and a flexible, adaptable business model.

Commercial Bank of Qatar's ventures into blockchain for cross-border payments and AI-driven personal finance assistants represent classic question marks. These initiatives are in high-growth areas, aligning with Qatar's fintech ambitions, but currently hold minimal market share as they require significant investment to gain traction and scale.

The bank's strategic focus on digital payment ecosystems, including Buy Now, Pay Later (BNPL) and e-wallets, also places these segments within the question mark category. While the global BNPL market is projected for substantial growth, CBQ's participation likely starts with a low market share, necessitating strategic investment to capture market share.

Expanding remittance services into high-growth corridors and emerging markets in Southeast Asia and Africa are also question marks for CBQ. These ventures target rapidly expanding markets with significant potential, but entering them means starting with a low market share, requiring substantial capital and strategic partnerships to build a presence.

| Initiative | Market Growth Potential | Current Market Share | Strategic Focus | Investment Need |

|---|---|---|---|---|

| Blockchain for Payments | High (Fintech Strategy) | Low | Scaling & Adoption | High |

| AI Personal Finance Assistants | High (Digital Investment) | Low | User Acquisition | High |

| BNPL & E-wallets | High (Digital Payments) | Low to Moderate | Market Share Development | Moderate to High |

| Remittance Expansion | High (Global Remittance) | Low | Partnerships & Market Entry | High |

BCG Matrix Data Sources

Our BCG Matrix for Commercial Bank of Qatar is built on a foundation of official financial disclosures, market share data from industry reports, and expert analysis of the banking sector's growth prospects.