Community Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

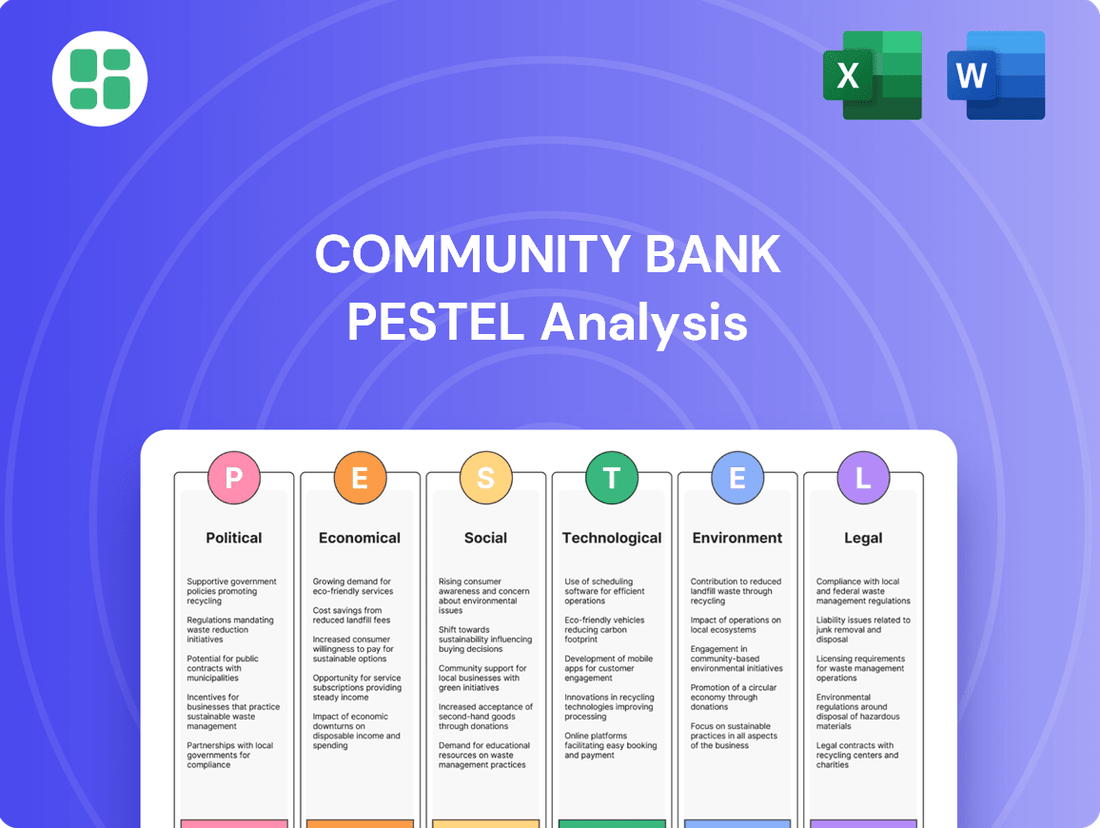

Navigate the complex external landscape impacting Community Bank with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping its future. Gain a competitive edge by leveraging these expert-driven insights to refine your strategy. Download the full analysis now for actionable intelligence to inform your decisions.

Political factors

Government policy and regulatory shifts significantly shape the operational landscape for community banks. For instance, the Federal Reserve's ongoing review of capital requirements, with potential adjustments anticipated in late 2024 or early 2025, could necessitate increased capital reserves for institutions like community banks, impacting lending capacity. Changes in consumer protection laws, such as those evolving from the Consumer Financial Protection Bureau's (CFPB) directives, also demand continuous adaptation in product offerings and disclosure practices.

The prevailing political climate, particularly the legislative agenda of a new administration, introduces considerable uncertainty. A move towards deregulation, as seen in some past policy shifts, might reduce compliance costs associated with anti-money laundering (AML) and Know Your Customer (KYC) regulations, potentially freeing up resources. Conversely, heightened political focus on financial stability or cybersecurity could lead to more stringent oversight, requiring community banks to invest further in robust internal controls and compliance frameworks to meet evolving standards.

The Federal Reserve's monetary policy decisions, particularly concerning interest rates, directly impact Community Bank's profitability. A projected environment of declining interest rates in 2025 could compress the bank's net interest margin, a key driver of earnings. For instance, if the Fed lowers the federal funds rate, the cost of funds for banks may fall, but the yield on existing assets, like loans, might not adjust as quickly, squeezing the margin.

Lower interest rates are also anticipated to stimulate loan demand, especially for mortgages. This increased demand can offer a volume offset to potentially lower interest rate spreads. Community Bank will need to strategically adjust its lending practices and deposit-gathering efforts to capitalize on these shifting market dynamics and ensure sustained profitability amidst evolving economic conditions.

Government spending and fiscal policies directly shape the economic landscape for Community Bank. For example, increased infrastructure spending, like the $1.2 trillion Infrastructure Investment and Jobs Act enacted in 2021, can stimulate economic growth, potentially boosting loan demand from businesses and individuals. Conversely, shifts in tax laws, such as changes to corporate tax rates, could impact the bank's net income and its capacity for investment or lending.

Consumer debt levels, a key indicator influenced by fiscal policy, are critical for assessing credit quality. In Q1 2024, total household debt in the U.S. reached approximately $17.7 trillion, according to the Federal Reserve. A rise in this debt, potentially exacerbated by government stimulus measures or tax relief, could lead to higher delinquency rates for Community Bank if borrowers struggle with repayment, thereby affecting its asset quality.

Changes in tax structures can also influence Community Bank's profitability and strategic decisions. For instance, if tax policies favor certain types of investments or lending, the bank might adjust its portfolio accordingly. The Tax Cuts and Jobs Act of 2017, which lowered the corporate tax rate, had a significant impact on financial institutions' bottom lines, affecting their capital reserves and lending capacity.

Political Stability and Geopolitical Events

Political stability, both at home and abroad, significantly influences investor confidence and the overall pace of economic growth, which in turn indirectly impacts the banking sector. For instance, the ongoing geopolitical tensions in Eastern Europe, which intensified in early 2022, have continued to create economic uncertainty through 2024, affecting global supply chains and inflation rates. This uncertainty can lead to fluctuating market valuations and potentially higher operational costs for financial institutions, including community banks, as they navigate increased compliance and risk management needs.

Geopolitical conflicts and trade disputes can directly impact financial markets. The continued trade friction between major economies, observed throughout 2023 and into 2024, has created volatility in currency exchange rates and commodity prices. While Community Bank operates on a regional level, it is not immune to this broader market sentiment. These external pressures can affect loan demand, interest rate environments, and the overall profitability of the bank.

- Global Instability: Events like the protracted conflict in Ukraine and increasing trade tensions between major economic blocs contribute to a less predictable global economic outlook.

- Investor Sentiment: Geopolitical risks often dampen investor confidence, leading to reduced capital investment and potentially slower economic activity, which affects banking sector growth.

- Operational Costs: Heightened geopolitical risk can necessitate increased spending on cybersecurity, compliance, and risk mitigation strategies for financial institutions.

Government Support and Community Reinvestment Act (CRA)

Government support, particularly through initiatives like the Community Reinvestment Act (CRA), plays a significant role in shaping Community Bank's operations. The CRA encourages banks to serve the credit needs of all segments of their communities, including low- and moderate-income areas. This aligns directly with Community Bank's mission and name, making compliance and adaptation to evolving CRA requirements a strategic imperative.

Changes in CRA regulations, such as updated assessment area definitions or lending thresholds, can directly impact Community Bank's lending strategies and community outreach efforts. For instance, the Office of the Comptroller of the Currency (OCC), Federal Reserve, and FDIC proposed updates to the CRA in 2023, aiming to modernize the framework for the current economic landscape. These proposed changes could influence how Community Bank is evaluated and rewarded for its community development activities, potentially requiring adjustments to its business model and investment priorities.

- CRA Modernization Efforts: Regulatory bodies like the OCC, Federal Reserve, and FDIC have been actively working on updating the CRA, with proposals released in 2023.

- Impact on Lending: New CRA rules could alter lending targets and performance metrics, influencing Community Bank's loan origination strategies, especially in underserved areas.

- Community Engagement: Adapting to revised CRA requirements necessitates robust community engagement and reporting, ensuring the bank demonstrates meaningful impact.

Government policy and regulatory shifts are crucial for community banks. For example, the Federal Reserve's ongoing review of capital requirements, with potential adjustments anticipated in late 2024 or early 2025, could necessitate increased capital reserves. Changes in consumer protection laws, stemming from CFPB directives, also demand continuous adaptation in product offerings and disclosure practices.

The political climate introduces uncertainty; deregulation could reduce compliance costs for AML and KYC, but increased focus on financial stability or cybersecurity might require more investment in internal controls. Government spending, like the Infrastructure Investment and Jobs Act, can stimulate economic growth and loan demand, while tax law changes can impact net income and lending capacity.

Consumer debt levels, influenced by fiscal policy, are key to credit quality. With total household debt around $17.7 trillion in Q1 2024, rising debt could lead to higher delinquency rates, affecting asset quality. Changes in tax structures, like the 2017 corporate tax rate reduction, also influence profitability and strategic decisions, impacting capital reserves and lending capacity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting the Community Bank, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic advantages.

The Community Bank PESTLE analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of sifting through extensive data.

Economic factors

The interest rate environment is a critical economic factor for community banks. While forecasts suggest a decline in interest rates during 2025, deposit costs are anticipated to remain high. This persistent elevated cost of deposits could put pressure on community banks' net interest margins, impacting profitability.

For instance, the Federal Reserve's benchmark federal funds rate, which influences broader market rates, has seen significant adjustments. In early 2024, rates remained elevated, but projections for 2025 indicate a potential easing. However, the stickiness of deposit rates, driven by competition and depositor preferences for higher yields, means banks may not see immediate margin expansion even with falling market rates.

Community banks must therefore focus on sophisticated asset-liability management. This involves strategically adjusting loan portfolios and funding sources to navigate the changing rate landscape and protect their net interest income. Effectively managing duration gaps and seeking stable, lower-cost funding will be paramount.

Overall economic growth and Gross Domestic Product (GDP) are fundamental drivers for Community Bank. They directly impact how much people and businesses want to borrow, how likely they are to pay back loans, and the types of investment opportunities available.

Looking ahead, forecasts suggest a slowdown in US GDP growth for 2025, with projections indicating a rate around 1.8% to 2.2%. This deceleration could mean consumers spend less and businesses invest more cautiously, which might curb loan demand and potentially lead to more loan defaults for the bank.

Community Bank's success is therefore intrinsically linked to the economic well-being of the areas it operates in, both locally and nationally. A robust economy generally translates to better financial performance for the bank.

Inflationary pressures continue to impact consumer purchasing power. For instance, the US Consumer Price Index (CPI) saw a year-over-year increase of 3.3% in May 2024, though this marks a slight moderation from earlier peaks. This persistent inflation directly affects how much discretionary income households have, which can influence their ability to save or take on new debt, impacting deposit growth and loan repayment for Community Bank.

Furthermore, elevated consumer debt levels and the gradual depletion of excess savings accumulated during the pandemic present a significant risk. In Q1 2024, total household debt in the US reached a record $17.7 trillion. As savings dwindle and debt burdens remain high, consumers may cut back on spending, leading to slower business activity and potentially increasing loan delinquencies, which directly affects Community Bank's loan portfolio performance.

Unemployment Rates

Unemployment rates significantly influence a community bank's financial health. High unemployment directly impacts individuals' capacity to service existing loans and their ability to take on new credit, potentially leading to increased defaults and a strain on the bank's loan portfolio. For instance, if unemployment rises, a community bank might see a higher percentage of its mortgage or personal loan customers struggling to make payments.

Businesses, too, are affected. When unemployment is high, consumer spending typically declines, impacting business revenue and their ability to repay commercial loans or invest in expansion. This reduced business activity can also dampen demand for new loans, affecting the bank's growth prospects. Even in a scenario of a soft economic landing, a persistent uptick in unemployment, say from 3.5% to 4.5% in the US, could signal a more challenging credit environment for community banks.

- Impact on Loan Repayment: Higher unemployment means fewer people have stable incomes, increasing the likelihood of loan defaults for personal loans, auto loans, and mortgages.

- Business Investment and Demand: Elevated unemployment often correlates with reduced consumer spending, which can hinder business revenue and their willingness to seek new loans or expand operations.

- Credit Risk Assessment: Community banks must closely monitor unemployment figures as a key indicator for adjusting their credit risk models and provisioning for potential loan losses.

- Economic Outlook Correlation: Changes in unemployment rates, such as a rise from 3.8% in early 2024 to an anticipated 4.1% by late 2024 in some forecasts, directly inform a community bank's strategic planning and lending policies.

Competition and Market Dynamics

Community banks operate in a highly competitive environment. They contend with large national institutions, agile fintech startups, and other regional players, all vying for customer deposits and loans. This intense competition directly impacts Community Bank's ability to grow its market share and maintain pricing power.

Midsize and regional banks, including Community Bank, often find themselves in a challenging position regarding deposit rates. To attract and retain funds, they may need to offer more competitive interest rates, which can squeeze profit margins. Furthermore, keeping pace with evolving customer expectations for digital services and seamless user experiences is a constant pressure point.

- Deposit Rate Competition: In early 2024, the average interest rate on savings accounts at large banks hovered around 0.35%, while community banks often offered rates closer to 1.00% or higher to remain competitive.

- Fintech Impact: Fintech companies have captured a significant portion of the payments and lending markets, forcing traditional banks to invest heavily in technology upgrades.

- Customer Expectations: A 2024 survey indicated that over 70% of consumers expect seamless digital banking experiences, including mobile check deposit and instant transfers.

- Market Share Challenges: Large banks, with their extensive branch networks and marketing budgets, continue to dominate market share in many regions, making it harder for community banks to expand.

The interest rate environment is a critical economic factor for community banks. While forecasts suggest a decline in interest rates during 2025, deposit costs are anticipated to remain high. This persistent elevated cost of deposits could put pressure on community banks' net interest margins, impacting profitability.

Overall economic growth and Gross Domestic Product (GDP) are fundamental drivers for Community Bank. They directly impact how much people and businesses want to borrow, how likely they are to pay back loans, and the types of investment opportunities available. Forecasts suggest a slowdown in US GDP growth for 2025, with projections indicating a rate around 1.8% to 2.2%.

Inflationary pressures continue to impact consumer purchasing power. The US Consumer Price Index (CPI) saw a year-over-year increase of 3.3% in May 2024. Elevated consumer debt levels, reaching a record $17.7 trillion in Q1 2024, coupled with depleting savings, present a risk to spending and loan repayment.

Unemployment rates significantly influence a community bank's financial health. High unemployment directly impacts individuals' capacity to service existing loans and their ability to take on new credit, potentially leading to increased defaults. A rise in the US unemployment rate from 3.8% in early 2024 to an anticipated 4.1% by late 2024 could signal a more challenging credit environment.

Preview the Actual Deliverable

Community Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Community Bank PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. Understand key drivers and potential challenges to inform strategic decisions.

Sociological factors

Demographic shifts are reshaping banking needs, with an aging population often valuing in-person interactions and established relationships. Conversely, younger demographics like Millennials and Gen Z, who represent a growing portion of the consumer base, overwhelmingly favor digital and mobile-first banking solutions. For instance, a 2024 survey indicated that over 70% of Gen Z adults prefer using mobile banking apps for most transactions.

These generational preferences directly impact how community banks must operate. While older customers may still rely on physical branches, younger customers are increasingly drawn to digital platforms and expect seamless online account opening and management. Furthermore, younger generations are often more attuned to a bank's social responsibility and community involvement, making these aspects crucial for attracting and retaining their business.

Consumer behavior is rapidly shifting towards digital channels, with a significant portion of banking activities now conducted online or via mobile apps. For instance, in early 2024, over 70% of banking customers reported using mobile banking apps regularly, a trend that continued to grow throughout the year. This necessitates that Community Banks invest heavily in their digital infrastructure, offering intuitive platforms for tasks like account opening and providing personalized financial management tools to keep pace with evolving customer expectations and the competitive landscape dominated by digital-first institutions.

Financial literacy levels vary significantly across demographics, creating a clear need for accessible education. For instance, a 2023 FINRA study indicated that only 60% of Americans could answer basic financial literacy questions correctly, with younger adults often scoring lower.

Community banks can capitalize on this by offering tailored financial education programs. Younger demographics, especially Gen Z and Millennials, express a keen interest in learning about investing and credit management, with surveys showing over 70% of these groups actively seeking financial advice online.

By providing workshops, online resources, and personalized advisory services, Community Bank can empower these individuals, fostering stronger customer relationships and driving engagement with the bank's products and services.

Trust and Brand Loyalty

Trust is the bedrock for community banks, fostering deep local relationships and encouraging repeat business. However, evolving consumer expectations, particularly among younger demographics, present a challenge. A 2024 survey indicated that while 70% of Gen Xers feel loyal to their primary bank, only 45% of Gen Zers express similar sentiment, often prioritizing digital convenience and ethical alignment over long-standing ties.

This shift means community banks must actively cultivate trust beyond traditional personal interactions. Brand loyalty is increasingly influenced by a bank's perceived social responsibility and its ability to offer seamless digital solutions that rival fintech offerings. For instance, banks demonstrating strong community investment or offering user-friendly mobile apps tend to see higher engagement rates across all age groups.

To counter potential erosion of loyalty, community banks are focusing on:

- Enhancing Digital Platforms: Investing in intuitive mobile banking apps and online services to meet the expectations of younger, digitally native customers.

- Demonstrating Social Impact: Highlighting community involvement, sustainable practices, and ethical lending policies to resonate with value-driven consumers.

- Personalized Customer Service: Leveraging data to offer tailored financial advice and solutions, reinforcing the value of human connection even in a digital age.

- Transparency in Operations: Clearly communicating fees, policies, and decision-making processes to build and maintain customer confidence.

Community Engagement and Social Impact

Community banks thrive on deep local ties. Their active involvement in community events and support for local causes directly shapes their reputation and attracts customers who value social responsibility. This is particularly true for younger generations, like Gen Z, who increasingly base their financial decisions on a company's ethical standing and community impact.

For instance, a 2024 study indicated that 68% of Gen Z consumers prefer to bank with institutions that demonstrate a commitment to social and environmental issues. Community banks can leverage this by highlighting their local investments and charitable contributions. In 2023, community banks collectively contributed over $10 billion to local economies through loans and community development initiatives, a figure that resonates strongly with socially conscious consumers.

- Brand Loyalty: Demonstrating social impact fosters stronger customer loyalty, especially among younger demographics.

- Customer Acquisition: Aligning with personal values can attract new customers who prioritize ethical banking.

- Community Investment: Active engagement strengthens community ties and reinforces the bank's local relevance.

- Reputational Strength: Socially responsible practices build a positive brand image, crucial for long-term success.

Shifting generational attitudes are a key sociological factor for community banks, with younger demographics like Gen Z and Millennials prioritizing digital convenience and social responsibility. For instance, a 2024 survey showed over 70% of Gen Z prefer mobile banking, while 68% of them favor institutions with demonstrated social and environmental commitment.

Community banks must adapt by enhancing their digital platforms and highlighting their local impact to foster trust and loyalty across all age groups. In 2023, community banks collectively contributed over $10 billion to local economies, a figure that can resonate with value-driven consumers seeking ethical financial partners.

Financial literacy also plays a crucial role, with a 2023 FINRA study revealing only 60% of Americans answered basic financial questions correctly, particularly younger adults. Offering tailored educational programs can build stronger customer relationships and drive engagement with the bank's services.

| Demographic Segment | Preference Focus | Community Bank Opportunity |

|---|---|---|

| Aging Population | In-person interaction, established relationships | Maintain strong branch presence, personalized service |

| Millennials & Gen Z | Digital convenience, social responsibility | Invest in mobile apps, highlight community impact |

| General Population | Financial literacy, trust, brand loyalty | Offer educational resources, transparent operations |

Technological factors

Community banks face significant pressure to embrace digital transformation, with a growing expectation for seamless online and mobile banking experiences. For instance, as of early 2025, over 85% of retail banking transactions are conducted digitally in many developed markets, a trend that continues to accelerate. This necessitates substantial investment in upgrading core banking systems and adopting cloud-based solutions to remain competitive.

Automation, particularly through Robotic Process Automation (RPA), presents a key opportunity for community banks to boost efficiency and cut costs. By automating repetitive tasks like data entry, account reconciliation, and customer onboarding, banks can free up staff for more value-added activities. Early adopters have reported cost reductions of up to 30% in back-office operations, demonstrating the tangible benefits of this technological shift.

Artificial Intelligence and Machine Learning are transforming community banking, enhancing fraud detection and risk management. For instance, AI algorithms can analyze vast transaction data in real-time, identifying suspicious patterns far faster than traditional methods. This technology also enables hyper-personalized customer service, offering tailored financial advice and product recommendations.

Community Bank can harness AI to boost data accuracy and strengthen security protocols. By 2025, it's projected that AI in fraud detection will save the global financial industry billions annually. Leveraging AI for proactive customer support, such as predicting potential account issues, can significantly improve customer satisfaction and retention.

The escalating threat landscape, marked by a surge in sophisticated cyberattacks like ransomware and phishing, presents a critical challenge for community banks. In 2024, the average cost of a data breach for financial institutions reached an alarming $5.5 million, underscoring the financial implications of inadequate security. Community banks must invest heavily in advanced defenses, such as AI-driven threat detection, to safeguard sensitive customer information and preserve their reputation.

Open Banking and API-Driven Ecosystems

The expansion of open banking, driven by regulations like PSD2 in Europe and similar initiatives globally, is fundamentally reshaping financial services. This shift encourages the development of API-driven ecosystems, where third-party providers can securely access customer financial data with explicit consent. This fosters significant innovation and competition, as fintech companies leverage these APIs to create novel financial products and services. For instance, by mid-2024, it's projected that over 75% of banks in developed markets will have actively engaged with open banking APIs, demonstrating a clear trend towards data sharing and collaboration.

Community banks must proactively engage with this evolving landscape. Exploring API adoption is crucial for enhancing internal processes and for enabling seamless integration with external partners. Forming strategic partnerships with fintech companies can unlock new revenue streams and expand service offerings, allowing community banks to compete more effectively. In 2023, fintech partnerships contributed to an average 15% increase in customer acquisition for banks that actively pursued them, highlighting the tangible benefits of this collaborative approach.

- API Adoption: Community banks should prioritize developing or adopting robust API strategies to facilitate data sharing and service integration.

- Fintech Partnerships: Identifying and collaborating with fintechs offering complementary services can drive innovation and customer engagement.

- Customer Data Utilization: Leveraging customer-consented data through APIs can lead to more personalized product offerings and improved customer experiences.

- Competitive Landscape: Understanding how open banking is enabling new competitors is vital for developing effective counter-strategies.

Cloud Computing and Data Management

The banking sector's move to cloud computing is a significant technological shift, offering community banks a pathway to more scalable and secure operations. This transition is vital for managing the ever-increasing volume of financial data efficiently. By adopting cloud solutions, community banks can streamline data processing, improve accessibility, and enhance their overall operational agility.

Community banks exploring hybrid or multi-cloud strategies can unlock substantial benefits. These approaches allow for greater flexibility in data management and processing, which is essential for supporting advanced analytics and artificial intelligence (AI) functionalities. For instance, in 2024, the global cloud computing market in financial services was projected to reach over $60 billion, highlighting the widespread adoption and the potential for data-driven insights.

- Scalability: Cloud platforms allow banks to easily scale their IT resources up or down based on demand, a crucial advantage during peak transaction periods.

- Data Security: Reputable cloud providers offer robust security measures, often exceeding what individual banks can implement, protecting sensitive customer data.

- AI Integration: Cloud infrastructure is foundational for implementing AI-driven fraud detection, personalized customer service, and predictive analytics.

- Cost Efficiency: Moving to the cloud can reduce capital expenditure on hardware and maintenance, shifting costs to a more predictable operational expense model.

Community banks must prioritize digital transformation to meet customer expectations for online and mobile services, with over 85% of retail transactions in developed markets already digital by early 2025. Automation, particularly RPA, offers significant efficiency gains, with early adopters seeing up to 30% cost reductions in back-office operations. AI and machine learning are crucial for enhancing fraud detection and personalizing customer service, with AI in fraud detection projected to save the financial industry billions annually by 2025.

The escalating threat of sophisticated cyberattacks, costing financial institutions an average of $5.5 million per data breach in 2024, necessitates heavy investment in advanced security measures like AI-driven threat detection. Open banking, fueled by regulations and API adoption, is fostering innovation and competition, with over 75% of banks in developed markets expected to engage with open banking APIs by mid-2024. Cloud computing adoption is vital for scalability and security, with the global cloud market in financial services projected to exceed $60 billion in 2024.

| Technological Factor | Key Trend/Impact | Data/Statistic (as of 2024/2025) | Implication for Community Banks |

| Digital Transformation | Customer demand for seamless online/mobile banking | >85% of retail transactions are digital (early 2025) | Requires investment in digital infrastructure and user experience. |

| Automation (RPA) | Increased operational efficiency, cost reduction | Up to 30% cost reduction in back-office operations | Automate repetitive tasks to free up staff and reduce overhead. |

| Artificial Intelligence (AI) / Machine Learning (ML) | Enhanced fraud detection, personalized service | AI in fraud detection to save billions globally annually (by 2025) | Implement AI for better risk management and customer engagement. |

| Cybersecurity | Increased sophistication of cyber threats | Average cost of data breach: $5.5 million (2024) | Invest in advanced security to protect data and reputation. |

| Open Banking | API-driven ecosystems, data sharing | >75% of banks to engage with APIs (mid-2024) | Develop API strategies and explore fintech partnerships. |

| Cloud Computing | Scalability, security, data management | Global cloud market in financial services: >$60 billion (2024) | Adopt cloud for agility, cost efficiency, and AI integration. |

Legal factors

Community banks navigate a complex web of federal and state banking regulations, encompassing capital adequacy, liquidity, and consumer protection. For instance, the Federal Reserve's stress tests, like those conducted in 2024, assess banks' resilience to economic downturns, impacting their capital planning and lending capacity. These regulations, enforced by bodies such as the FDIC and CFPB, demand constant vigilance and investment in compliance systems to avoid penalties and maintain operational integrity.

Community banks must navigate stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations to prevent illicit financial activities. The AML Act of 2020, for instance, mandates the modernization of AML/CFT programs, including the incorporation of specific AML/CFT priorities. In 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize robust customer due diligence and suspicious activity reporting, with penalties for non-compliance often reaching millions of dollars.

Community banks face increasing pressure from stringent data privacy laws like GDPR and CCPA, impacting how they handle customer and transaction data. Failure to comply can result in hefty fines; for instance, the EU's GDPR can levy penalties up to 4% of global annual revenue. This necessitates significant investment in robust data governance and advanced cybersecurity to prevent breaches, a critical concern as financial sector cyberattacks surged by 55% in 2023 according to IBM's X-Force Threat Intelligence Index.

Consumer Protection Regulations

Consumer protection regulations, such as those governing overdraft fees and fair lending, significantly shape Community Bank's product development and operational strategies. For instance, the Consumer Financial Protection Bureau's (CFPB) ongoing scrutiny of overdraft practices, with potential new rules anticipated in 2024-2025, necessitates careful review and potential adjustments to fee structures and disclosure policies to ensure compliance and mitigate risks. The Equal Credit Opportunity Act (ECOA) also mandates that lending decisions be based solely on creditworthiness, impacting how Community Bank assesses loan applications and markets its services.

These regulations directly influence Community Bank's product offerings and operational procedures. For example, the CFPB's focus on overdraft fees, with reports indicating a significant portion of bank revenue derived from these fees, means banks must adapt their models. A 2023 CFPB report highlighted that large banks collected billions in overdraft fees annually, underscoring the financial impact of regulatory changes in this area. Compliance with fair lending laws, like ECOA, is paramount to avoid discriminatory practices and potential legal challenges, ensuring equitable access to credit for all consumers.

- Overdraft Fee Scrutiny: Anticipated regulatory changes in 2024-2025 by the CFPB could impact revenue streams and require operational adjustments for Community Banks.

- Fair Lending Compliance: Adherence to laws like the Equal Credit Opportunity Act (ECOA) is crucial to prevent discrimination and maintain legal standing in lending practices.

- Impact on Product Design: Consumer protection rules directly influence how financial products are structured, marketed, and disclosed to customers.

- Risk Mitigation: Proactive adaptation to evolving consumer protection standards helps Community Banks avoid penalties and maintain public trust.

Litigation and Legal Challenges

The banking sector, including community banks, faces ongoing litigation risks stemming from new regulations and existing practices. This creates an environment where uncertainty can impact strategic planning and operational adjustments. For instance, the aftermath of the 2023 regional bank failures saw increased scrutiny and potential for legal challenges related to risk management and compliance, impacting institutions like Community Bank.

Community Bank must diligently track legal developments, including potential Supreme Court rulings that could reshape the landscape of financial regulations. Such shifts can necessitate significant changes in how banks operate, from lending practices to consumer protection measures. For example, ongoing debates around fair lending practices and data privacy could lead to new legal precedents affecting Community Bank's customer interactions and data handling.

- Regulatory Uncertainty: Potential legal challenges to new or existing financial regulations introduce unpredictability for Community Bank's operations and strategic direction.

- Supreme Court Impact: Monitoring Supreme Court decisions is crucial, as rulings can redefine the boundaries of financial regulation, requiring adaptive operational strategies.

- Litigation Trends: The banking industry, as of late 2024 and early 2025, continues to see litigation related to consumer protection, cybersecurity breaches, and compliance failures, areas Community Bank must actively manage.

Community banks operate within a dynamic legal framework, facing evolving consumer protection mandates and stringent compliance requirements. The CFPB's continued focus on overdraft fees, with potential rule changes anticipated for 2024-2025, directly impacts revenue models and necessitates operational adjustments. Furthermore, adherence to fair lending laws like the Equal Credit Opportunity Act remains critical to prevent discriminatory practices and mitigate legal risks.

| Regulatory Area | Key Legislation/Agency | Impact on Community Banks (2024-2025 Outlook) | Example Compliance Action |

|---|---|---|---|

| Consumer Protection | CFPB, Overdraft Fee Rules | Potential revenue impact from fee adjustments; need for revised product disclosures. | Review and modify overdraft fee structures and transparency. |

| Fair Lending | ECOA, Fair Housing Act | Ensuring non-discriminatory lending practices; avoiding legal challenges. | Regular audits of loan application and approval processes. |

| Data Privacy | CCPA, GDPR (if applicable) | Investment in cybersecurity and data governance to prevent breaches and fines. | Implement enhanced data encryption and access controls. |

Environmental factors

Climate change is increasingly posing physical risks to financial institutions like community banks. The growing frequency and intensity of extreme weather events, such as floods, hurricanes, and wildfires, directly threaten the value of collateral backing loans. For instance, in 2023, the United States experienced 28 separate billion-dollar weather and climate disasters, totaling over $150 billion in damages, according to NOAA data. This can significantly impact a bank's real estate portfolio and the ability of borrowers to repay loans.

Community banks must proactively assess and manage their exposure to these climate-related physical risks. This involves evaluating how natural disasters could affect borrowers' repayment capacity, especially in regions with high vulnerability. For example, a bank with a significant concentration of mortgages in coastal Florida or wildfire-prone California needs to understand the potential impact of rising sea levels or increased fire risk on property values and borrower stability.

The increasing focus on Environmental, Social, and Governance (ESG) factors is reshaping how banks operate, with investors, regulators, and customers demanding more sustainable practices. For instance, by the end of 2024, many financial institutions are expected to have integrated ESG considerations into at least 75% of their new lending and underwriting processes, reflecting a significant shift in risk assessment and investment strategies.

Community Bank should proactively embed ESG principles into its core operations. This could involve developing new sustainable finance products, such as green loans for energy-efficient home improvements, and strengthening community reinvestment programs that prioritize underserved areas, aligning with the growing market expectation for responsible banking.

The global green finance market is expanding rapidly, with green bond issuance projected to reach $1.5 trillion in 2024, up from $1.3 trillion in 2023, according to BloombergNEF. This surge indicates a strong investor appetite for environmentally responsible assets.

Community banks can capitalize on this trend by offering green financial products, such as loans for energy-efficient home improvements or businesses adopting sustainable practices. For instance, sustainability-linked loans, which tie interest rates to environmental performance targets, are gaining traction, with the market expected to grow significantly in 2024-2025.

By aligning their offerings with environmental, social, and governance (ESG) principles, community banks can attract a growing base of environmentally conscious customers and investors. This strategic move not only supports sustainable development but also enhances the bank's reputation and market position in an increasingly eco-aware financial landscape.

Regulatory Pressure on Climate Risk Disclosure

Regulators are increasingly focusing on climate risk disclosure for financial institutions. This means community banks, like others, will likely face growing demands to quantify and report on climate-related financial exposures, such as financed emissions. For instance, the U.S. Securities and Exchange Commission (SEC) proposed rules in 2022 requiring climate-related disclosures, though the final rules were scaled back, indicating an ongoing trend toward greater transparency. This evolving landscape necessitates that community banks develop robust frameworks to assess their carbon footprint and align their loan portfolios with emerging sustainability objectives.

These regulatory shifts will likely translate into new reporting requirements. Community banks may need to implement systems to measure the greenhouse gas emissions associated with their lending activities. This could involve developing methodologies for calculating financed emissions, a complex task that requires data collection and analysis across various sectors. Furthermore, banks will be expected to demonstrate how their portfolios contribute to or detract from climate-related goals, potentially impacting strategic lending decisions and capital allocation.

- Evolving Reporting Standards: Expect increased scrutiny and potentially new mandatory disclosures related to climate risk by 2025, mirroring trends seen in larger financial institutions.

- Financed Emissions Measurement: Banks will need to invest in tools and expertise to accurately measure emissions embedded in their loan portfolios, a key component of climate risk assessment.

- Portfolio Alignment: A growing expectation exists for community banks to demonstrate how their lending practices align with national and international climate targets.

Operational Environmental Footprint

Community banks are increasingly scrutinizing their own operational environmental footprint. This includes tracking energy consumption in branches and offices, implementing robust waste management programs, and optimizing resource use. For instance, many banks are setting targets to reduce their carbon emissions, with some aiming for carbon neutrality by 2030 or 2035. In 2024, a significant number of community banks reported investments in energy-efficient lighting and HVAC systems, leading to an average reduction of 15% in their building energy consumption compared to 2022 figures.

Adopting sustainable banking practices isn't just about compliance; it's a strategic move to enhance public image and attract environmentally conscious customers and investors. By investing in renewable energy sources for their facilities or offering green financing options, community banks can differentiate themselves. A 2025 survey indicated that 60% of consumers consider a company's environmental policies when choosing a financial institution. Furthermore, the push towards digital transformation, reducing paper usage, and promoting remote work are key components of this strategy, aligning with broader environmental goals.

- Energy Efficiency: Many community banks are upgrading to LED lighting and smart thermostats, aiming for a 20% reduction in electricity usage by 2026.

- Waste Reduction: Initiatives like paperless banking and enhanced recycling programs are common, with targets to divert 75% of operational waste from landfills by 2027.

- Carbon Footprint: Several institutions are exploring carbon offsetting programs and investing in renewable energy credits to achieve carbon neutrality in their operations.

- Sustainable Investments: Community banks are also increasing their offerings of green loans and ESG-focused investment products, reflecting growing stakeholder demand.

Climate change presents tangible risks to community banks, impacting loan collateral and borrower repayment through increased extreme weather events. In 2023 alone, the U.S. faced 28 billion-dollar weather disasters, causing over $150 billion in damages, as reported by NOAA. This highlights the need for banks to assess their exposure, particularly in vulnerable regions, to ensure loan portfolio stability.

The growing emphasis on ESG factors is driving significant changes in banking operations, with a notable shift towards sustainable finance. By the close of 2024, many financial institutions are expected to incorporate ESG considerations into at least 75% of their new lending and underwriting, signaling a move toward more responsible risk assessment and investment strategies.

Community banks can leverage the expanding green finance market, projected to reach $1.5 trillion in green bond issuance for 2024, by offering products like green loans. This strategic alignment with environmental consciousness not only attracts eco-aware customers but also strengthens the bank's market standing.

Regulatory bodies are increasing their focus on climate risk disclosure, requiring community banks to quantify and report on financial exposures related to climate change. This includes measuring financed emissions, a trend underscored by proposed SEC rules in 2022, necessitating robust frameworks for assessing carbon footprints and aligning loan portfolios with sustainability objectives.

| Environmental Factor | Impact on Community Banks | Data/Trend (2024-2025) |

| Extreme Weather Events | Risk to collateral, borrower repayment capacity | 28 billion-dollar disasters in US in 2023 ($150B+ damages) |

| ESG Integration | Shift in lending/underwriting, investor demand | 75% of new lending expected to include ESG by end of 2024 |

| Green Finance Market Growth | Opportunity for new products, attracting customers | Green bond issuance projected at $1.5T in 2024 |

| Climate Risk Disclosure | Increased regulatory scrutiny, reporting requirements | Ongoing trend towards greater transparency in climate disclosures |

PESTLE Analysis Data Sources

Our Community Bank PESTLE Analysis is built on a robust foundation of data from reputable financial institutions, government regulatory bodies, and industry-specific market research. We incorporate economic indicators, demographic trends, and legislative updates to ensure a comprehensive and accurate assessment.