Community Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

Community Bank operates within a dynamic financial landscape, facing pressures from rivals and the constant threat of new entrants. Understanding the power of suppliers and the availability of substitutes is crucial for navigating this competitive environment. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Community Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Community banks primarily fund their operations through customer deposits, but also tap into wholesale markets and capital. The cost and ease of accessing these funds are crucial for their profitability and lending capacity. For instance, in Q1 2024, the average cost of funds for U.S. community banks saw an increase, reflecting the competitive landscape for deposits.

Technology and software providers wield considerable bargaining power over community banks. Core banking systems, essential for daily operations, and cybersecurity solutions, crucial for data protection, represent significant investments. For instance, the global banking software market was valued at approximately $35 billion in 2023 and is projected to grow, indicating the substantial economic reliance banks have on these providers.

The high switching costs associated with implementing and integrating new core banking systems give established vendors substantial leverage. Banks often face lengthy migration processes and significant upfront expenses, making it difficult to change providers. This reliance is further amplified as banks increasingly adopt advanced technologies like artificial intelligence and automation to enhance customer experience and operational efficiency.

The availability of experienced banking professionals, such as loan officers and IT specialists, directly impacts a community bank's operational costs and the quality of services it can offer. A tight labor market, especially for specialized roles like cybersecurity experts, can drive up wages and benefits, giving these skilled employees more leverage.

In 2024, the demand for talent in areas like digital banking and data analytics remained high, with reports indicating salary increases of 5-10% for these in-demand positions. This competitive environment means community banks must invest more to attract and retain the best people, directly affecting their cost structure.

Regulatory Bodies and Compliance Services

While not traditional suppliers, regulatory bodies exert significant influence by imposing substantial compliance costs and operational constraints on community banks. These entities act as a powerful external force, dictating how banks must function.

Community banks are compelled to allocate considerable resources towards compliance services and dedicated personnel to adhere to ever-changing regulations. For instance, in 2024, the cost of regulatory compliance for financial institutions continued to be a major overhead, with many smaller banks dedicating a significant portion of their operational budget to this area.

These regulatory shifts directly impact a bank's ability to adapt its operations and affect its overall profitability. For example, new data privacy regulations or capital requirement adjustments can necessitate costly system upgrades or changes in lending practices.

- Regulatory Burden: Compliance costs represent a significant operational expense for community banks.

- Adaptation Costs: Banks must invest in technology and expertise to meet evolving regulatory demands.

- Operational Constraints: Regulatory changes can limit a bank's flexibility in product offerings and risk management.

Third-Party Service Providers

Community banks, beyond their core technology, frequently engage third-party providers for essential services like payment processing, auditing, and marketing. The bank's leverage in negotiating terms hinges on the availability of alternative providers, how unique their offerings are, and how crucial the service is to the bank's operations.

For instance, in 2024, the payment processing sector continued to consolidate, with a few dominant players holding significant market share. This concentration can amplify the bargaining power of these specialized providers, especially for community banks that may lack the scale to negotiate aggressively.

- Limited Provider Options: If a community bank relies on a single or very few providers for a critical service, such as a niche core banking system upgrade, the supplier's bargaining power is significantly elevated.

- Switching Costs: High costs associated with switching providers, whether due to data migration, retraining staff, or integration complexities, further entrench the supplier's position. For example, migrating customer data from one core banking platform to another can cost hundreds of thousands, if not millions, of dollars for a community bank.

- Provider Differentiation: When third-party providers offer highly specialized or proprietary services that are difficult for competitors to replicate, their ability to command higher prices or less favorable terms increases.

The bargaining power of suppliers for community banks is a key factor influencing their profitability and operational efficiency. This power stems from factors like the concentration of suppliers, the uniqueness of their offerings, and the switching costs for the bank.

Technology vendors, particularly those providing core banking systems, hold significant sway due to high switching costs and the critical nature of their services. In 2024, the demand for specialized financial technology, like AI-driven fraud detection, further solidified the position of key providers.

The labor market also presents a supplier dynamic, with skilled professionals in areas like cybersecurity and data analytics commanding higher wages. In Q1 2024, community banks faced increased competition for talent, leading to higher recruitment and retention costs.

| Supplier Category | Key Services | Impact on Community Banks (2024) | Supplier Bargaining Power Factors |

|---|---|---|---|

| Technology Providers | Core Banking Systems, Cybersecurity, Digital Platforms | Increased reliance on specialized software; higher IT spending | High switching costs, vendor concentration, critical service nature |

| Skilled Labor | IT Specialists, Compliance Officers, Loan Officers | Rising wage pressure, difficulty in filling specialized roles | Tight labor market, demand for niche skills, limited talent pool |

| Third-Party Service Providers | Payment Processing, Auditing, Marketing | Negotiating leverage shifts with provider consolidation | Provider differentiation, limited alternative options, service criticality |

What is included in the product

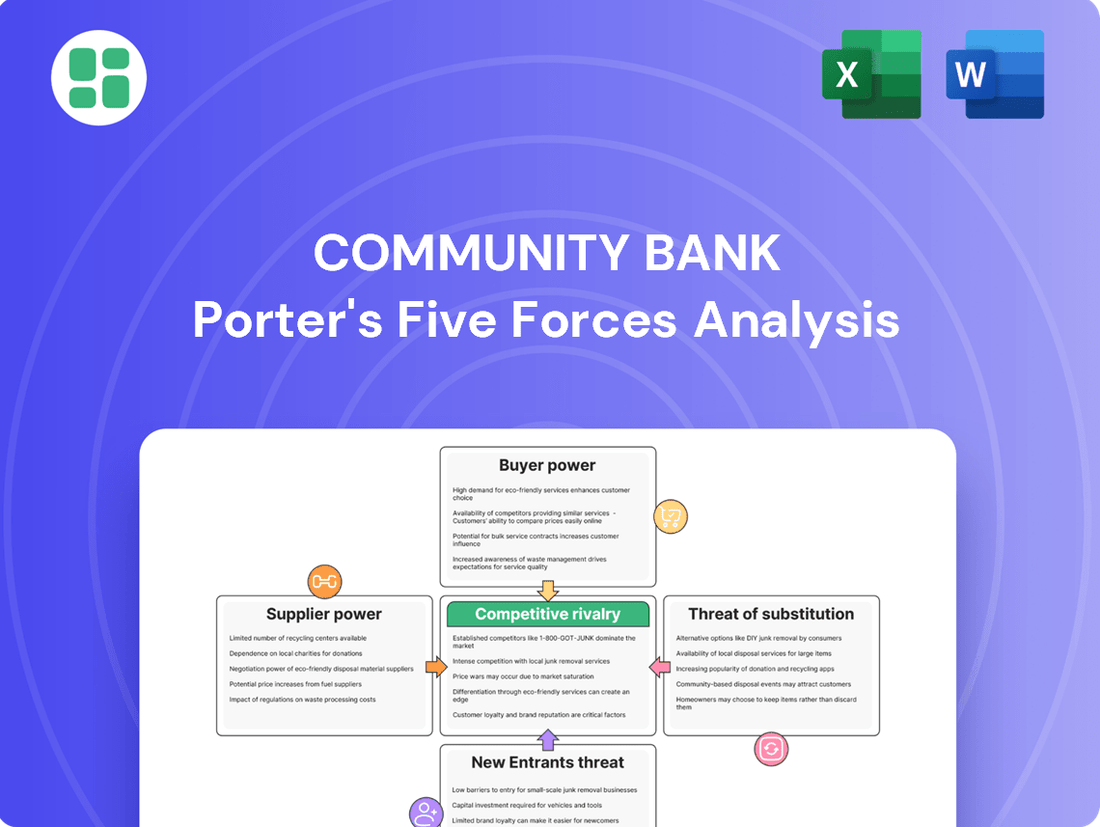

This analysis examines the competitive forces impacting Community Bank, including the threat of new entrants, the bargaining power of customers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors.

Visualize competitive intensity with a dynamic Porter's Five Forces dashboard, instantly highlighting areas of strategic vulnerability for Community Banks.

Easily assess the impact of industry shifts on Community Banks by adjusting key variables within the Five Forces model, providing actionable insights.

Customers Bargaining Power

For straightforward deposit accounts and basic loan products, customers can readily switch banks, a trend amplified by the convenience of digital banking. This low barrier to entry means consumers can easily shop around for better interest rates, lower fees, or superior service. In 2023, the average customer retention rate for community banks hovered around 90%, but a significant portion of that churn can be attributed to rate shopping for savings accounts and CDs, where switching costs are minimal.

Customers now have unprecedented access to information, allowing them to easily compare interest rates on deposits and loans, as well as fees for various banking services across numerous institutions. This ease of access is significantly amplified by online comparison tools and increasingly transparent pricing models adopted by financial institutions.

This heightened customer awareness directly translates into intense price competition for community banks. For instance, in 2024, online platforms frequently highlighted average savings account rates that varied by over 200 basis points between institutions, forcing banks to offer more attractive rates to attract and retain depositors.

The pressure to remain competitive on pricing directly impacts a community bank's profitability, particularly its net interest margins. When customers can readily identify and switch to banks offering better rates or lower fees, it erodes the bank's pricing power and can lead to a squeeze on the spread between interest earned on loans and interest paid on deposits.

Community banks often build loyalty through relationship banking, fostering personalized service and local knowledge. This can somewhat mitigate customer bargaining power, as customers who value these deeper connections may be less inclined to switch for minor price differences. For instance, a 2024 survey indicated that 65% of community bank customers cited personalized service as a key reason for their loyalty.

However, when customers prioritize purely transactional needs, their bargaining power significantly increases. In these instances, convenience and cost become the primary drivers. For example, a customer needing a simple wire transfer or a basic checking account might easily switch to a larger institution offering lower fees or a more streamlined digital experience, highlighting their leverage in a competitive market.

Diverse Financial Service Options

Customers today have an unprecedented number of financial service options, significantly increasing their bargaining power. Beyond traditional community banks, consumers can turn to credit unions, which often offer competitive rates and lower fees. The rise of online-only banks, like Ally Bank or Chime, provides further competition by offering streamlined digital experiences and often higher interest rates on savings accounts.

Fintech companies have also emerged as powerful alternatives, unbundling traditional banking services. For instance, services like Square or PayPal offer payment processing and merchant services, while companies like Robinhood or Wealthfront provide investment and wealth management tools. This ability for customers to pick and choose specialized services from different providers means they can easily switch to a competitor if a community bank's offerings don't meet their needs or expectations.

The impact of these diverse options is tangible. In 2024, the digital banking sector continued its rapid expansion, with reports indicating that over 70% of consumers used at least one non-traditional financial service provider. This trend highlights the growing customer comfort with and reliance on alternative financial solutions, directly amplifying their leverage in the market.

- Increased Competition: The proliferation of credit unions, online banks, and fintech platforms means customers have more choices than ever before.

- Service Unbundling: Customers can select specific services from different providers, rather than relying on a single institution for all their financial needs.

- Digital Adoption: By mid-2024, over 70% of consumers were engaging with at least one non-traditional financial service provider, demonstrating a clear shift in customer behavior.

- Price Sensitivity: With readily available alternatives, customers are more likely to shop around for the best rates and lowest fees, putting pressure on community banks to remain competitive.

Impact of Digitalization and Mobile Banking

The rise of digital and mobile banking has significantly shifted the bargaining power towards customers. With easy access to financial management and services anytime, anywhere, customer expectations for seamless digital experiences have soared. This empowers them to switch to banks offering better digital tools, diminishing the importance of a physical branch network.

For instance, by the end of 2023, over 70% of banking customers in the US were actively using mobile banking apps, a number projected to grow. This widespread adoption means customers can readily compare offerings and switch providers if their digital needs aren't met.

- Increased Customer Options: Digital platforms allow customers to easily compare rates, fees, and services across multiple financial institutions, thereby increasing their ability to switch.

- Demand for Digital Excellence: Customers now expect intuitive mobile apps and online portals, forcing banks to invest heavily in technology to retain and attract clients.

- Reduced Switching Costs: Digital onboarding and account management have lowered the effort and time required for customers to move their banking business elsewhere.

Customers wield significant bargaining power due to the ease of switching and access to information, forcing community banks to compete aggressively on price and service. The proliferation of digital banking, fintech alternatives, and the unbundling of services further amplify this power, compelling banks to innovate and offer superior digital experiences to retain clients.

| Factor | Impact on Community Banks | 2023/2024 Data Point |

|---|---|---|

| Ease of Switching | Low switching costs empower customers to seek better rates and lower fees. | Average customer retention rate ~90% in 2023, with rate shopping a key driver of churn. |

| Information Access | Online comparison tools increase price transparency and customer awareness. | Savings account rates in 2024 varied by over 200 basis points across institutions. |

| Alternative Providers | Credit unions, online banks, and fintechs offer competitive alternatives. | Over 70% of consumers used at least one non-traditional financial service provider by mid-2024. |

| Digital Expectations | Customers demand seamless digital experiences, influencing provider choice. | Over 70% of US banking customers actively used mobile banking apps by end of 2023. |

What You See Is What You Get

Community Bank Porter's Five Forces Analysis

This preview shows the exact Community Bank Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed analysis is fully formatted and ready for your immediate use, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Community Bank System, Inc. faces significant competitive pressure from large national and regional banks. These behemoths, like JPMorgan Chase and Bank of America, boast extensive branch networks and advanced digital platforms, giving them a distinct advantage in customer reach and service offerings.

These larger players can also leverage substantial economies of scale and massive marketing budgets, allowing them to attract and retain customers more effectively. For instance, in 2024, the top five U.S. banks held over $10 trillion in assets, dwarfing the asset base of most community banks and enabling aggressive pricing and product development.

Community Bank N.A. encounters significant rivalry from other community banks within its core operating areas of Upstate New York, Northeastern Pennsylvania, Vermont, and Western Massachusetts. These local competitors often differentiate themselves through highly personalized customer service, deep understanding of regional economic nuances, and active participation in community initiatives.

The financial services sector is seeing a surge in competition, largely driven by nimble fintech companies that provide specialized digital offerings. These firms excel in areas like online lending, seamless payment processing, and accessible investment platforms, directly challenging traditional community banks.

Adding to this competitive pressure are credit unions, which leverage their non-profit status to offer services with often lower fees. This cost advantage makes them a compelling alternative for consumers, further intensifying the rivalry and forcing community banks to adapt their strategies.

By mid-2024, fintech adoption continued its upward trend, with a significant percentage of consumers utilizing at least one fintech service for their financial needs. Simultaneously, credit union membership has shown steady growth, indicating their increasing relevance and competitive threat to community banks in the evolving financial ecosystem.

Price Competition and Net Interest Margin Pressure

In a mature banking landscape, community banks face fierce rivalry, especially concerning pricing for loans and deposit rates. This intense competition directly impacts their net interest margins, a crucial measure of profitability. For instance, in early 2024, the average net interest margin for U.S. community banks hovered around 3.0%, a figure that can be significantly compressed by aggressive pricing strategies from larger competitors or even other community institutions.

This environment necessitates careful management of key financial levers. Community banks must strategically balance their loan-to-deposit ratios, ensuring they are not overly reliant on expensive funding. Furthermore, controlling the cost of funds, whether through attracting stable, lower-cost core deposits or managing wholesale funding, becomes paramount to maintaining healthy margins.

- Intense Price Competition: Banks frequently compete on interest rates for both loans and deposits, especially in established markets.

- Net Interest Margin (NIM) Squeeze: Aggressive pricing can reduce the difference between interest income earned on loans and interest paid on deposits, impacting profitability.

- Strategic Management: Community banks must actively manage their loan-to-deposit ratios and the cost of their funding sources to mitigate NIM pressure.

- 2024 Data Point: The average NIM for U.S. community banks was approximately 3.0% in early 2024, highlighting the sensitivity to pricing pressures.

Focus on Digital Transformation and Customer Experience

Community banks face intense rivalry as they prioritize digital transformation to enhance customer experience. This involves significant investment in areas like advanced mobile banking apps, streamlined online account opening processes, and sophisticated real-time fraud detection systems. The competitive landscape is increasingly defined by which institutions can offer the most seamless and efficient digital journey for their customers, directly impacting acquisition and retention rates.

For instance, in 2024, many community banks are rolling out features such as AI-powered chatbots for instant customer support and personalized digital banking dashboards. The effectiveness of these digital initiatives is a key differentiator.

- Digital Investment: Banks are channeling substantial capital into upgrading digital platforms.

- Customer Experience Focus: Seamless digital interactions are paramount for customer loyalty.

- Key Battlegrounds: Mobile banking, online onboarding, and fraud prevention are critical competitive areas.

- 2024 Trends: AI chatbots and personalized digital interfaces are becoming standard offerings.

The competitive rivalry for community banks is fierce, stemming from large national institutions, other community banks, and increasingly, fintech companies and credit unions. This pressure is particularly evident in pricing for loans and deposits, which directly impacts net interest margins. For example, in early 2024, the average net interest margin for U.S. community banks was around 3.0%, a figure easily eroded by aggressive competitors.

Digital transformation is another major battleground, with significant investments in mobile banking, online onboarding, and AI-powered customer service tools like chatbots. By mid-2024, consumer adoption of fintech services continued to rise, and credit union membership showed steady growth, underscoring the need for community banks to innovate to retain and attract customers.

| Competitor Type | Key Strengths | Impact on Community Banks | 2024 Context |

|---|---|---|---|

| Large National Banks | Economies of scale, extensive networks, large marketing budgets | Price competition, broader product offerings | Top 5 U.S. banks held over $10 trillion in assets |

| Other Community Banks | Personalized service, local market knowledge | Intense local competition, price wars | Focus on community engagement and tailored services |

| Fintech Companies | Agile digital platforms, specialized offerings | Disruption of traditional services, customer acquisition | Increasing consumer adoption of fintech services |

| Credit Unions | Non-profit status, lower fees | Cost advantage, growing membership | Steady growth in membership, offering competitive alternatives |

SSubstitutes Threaten

Fintech lending platforms, including online lenders and peer-to-peer platforms, present a significant threat of substitution for community banks. These digital alternatives often provide faster loan application and approval processes, appealing to customers, especially small businesses and individuals, who value speed and convenience. For instance, in 2024, the online lending market continued its robust growth, with many platforms reporting significant increases in loan origination volumes compared to the previous year, directly siphoning off potential borrowers from traditional institutions.

Digital payment systems and mobile wallets like PayPal, Venmo, and Apple Pay present a significant threat by offering convenient alternatives to traditional banking transactions. These platforms, while often connected to bank accounts, streamline daily payments, reducing direct customer engagement with community banks. This shift can diminish fee-based revenue streams and weaken customer loyalty as users become accustomed to the integrated experience of these fintech solutions.

Customers seeking investment and wealth management services face a broad array of non-bank alternatives. These include digital platforms like robo-advisors and online brokerages, as well as independent financial advisors, all of which present direct competition to community banks' offerings.

These non-bank competitors often differentiate themselves by providing lower fee structures or highly specialized investment strategies. For instance, the global robo-advisor market was valued at approximately $2.4 billion in 2023 and is projected to grow significantly, indicating a strong customer preference for these cost-effective and targeted solutions.

Community Bank System, Inc.'s wealth management division must contend with the accessibility and often lower overhead costs of these fintech-driven and independent advisory services. The increasing adoption rates of these platforms, driven by their user-friendly interfaces and competitive pricing, pose a substantial threat of substitution.

Alternative Savings and Investment Vehicles

Customers increasingly view alternative savings and investment vehicles as viable substitutes for traditional bank deposits. When interest rates on savings accounts and CDs are low, individuals and businesses are more likely to move their funds to options like money market funds, government bonds, or direct equity investments. For instance, in early 2024, with the Federal Reserve holding interest rates steady after a period of hikes, many investors sought higher yields in Treasury bills and short-term bond funds, potentially reducing the deposit base for community banks.

These substitutes directly threaten community banks by siphoning off deposits, which are a primary source of funding and liquidity. If a significant portion of a bank's deposit base migrates to these alternatives, it can constrain the bank's ability to lend and invest, potentially impacting its profitability and operational capacity. This trend is particularly pronounced for community banks that may not offer competitive rates on deposits compared to larger institutions or specialized investment platforms.

- Money Market Funds: These funds offer liquidity and often slightly higher yields than traditional savings accounts, making them attractive during periods of rising or stable interest rates.

- Government Bonds: Treasury bills, notes, and bonds are considered safe-haven assets and can provide attractive yields, especially when interest rates are elevated.

- Direct Stock Investments: For investors with a higher risk tolerance, direct investment in stocks or exchange-traded funds (ETFs) can offer potential for capital appreciation and dividends, bypassing banks entirely.

- Certificates of Deposit (CDs) from Other Institutions: While also a bank product, CDs from institutions offering higher rates can act as a substitute for a community bank's own deposit offerings.

In-house Corporate Finance and Direct Funding

Larger corporations and even some municipal entities are increasingly exploring direct funding avenues, bypassing traditional community banks. This trend significantly impacts the threat of substitutes by offering alternative sources for substantial capital requirements.

For instance, in 2024, the volume of corporate bond issuance remained robust, providing a direct channel for companies to raise capital without relying on bank loans. This direct access to capital markets acts as a potent substitute for traditional commercial lending.

Internal financing, where companies utilize retained earnings or manage their cash flow more efficiently, also presents a significant substitute. This reduces the overall demand for external financing from banks, including community banks.

- Direct Capital Markets Access: Businesses can issue bonds or equity directly, bypassing banks.

- Internal Funding: Companies use retained earnings and efficient cash management to fund operations and growth.

- Reduced Demand for Commercial Loans: These substitutes directly lower the need for traditional bank financing.

- Impact on Community Banks: This threat can limit the market share and profitability of community banks in corporate lending.

The threat of substitutes for community banks is substantial, driven by the rise of fintech and alternative financial services. These substitutes often offer greater convenience, speed, and potentially lower costs, directly challenging traditional banking models.

Fintech lending platforms and digital payment systems are key substitutes, capturing market share from traditional loan origination and transaction services. For example, online lending continued its strong growth in 2024, directly competing for borrowers.

Customers also increasingly turn to non-bank investment and savings vehicles, such as robo-advisors and money market funds, especially when traditional deposit rates are low. The global robo-advisor market's growth, valued at approximately $2.4 billion in 2023, underscores this shift.

Furthermore, corporations are increasingly accessing capital markets directly through bond issuance, bypassing banks altogether. In 2024, corporate bond issuance remained robust, illustrating this trend.

| Substitute Category | Examples | Impact on Community Banks | 2024 Trend/Data Point |

|---|---|---|---|

| Fintech Lending | Online lenders, P2P platforms | Siphons loan demand, reduces interest income | Continued robust growth in loan origination |

| Digital Payments | PayPal, Venmo, mobile wallets | Reduces transaction volume, erodes fee income | Increased adoption for daily payments |

| Investment Vehicles | Robo-advisors, money market funds, bonds | Drains deposit base, reduces funding for lending | Robo-advisor market valued at ~$2.4B in 2023, growing |

| Direct Capital Markets | Corporate bonds, equity issuance | Limits commercial lending opportunities | Robust corporate bond issuance |

Entrants Threaten

High regulatory barriers significantly deter new entrants in the community banking sector. Obtaining the necessary licenses, adhering to stringent compliance protocols, and maintaining substantial capital reserves are costly and time-consuming hurdles. For instance, in 2024, the average initial capital requirement for a new bank charter can easily run into millions of dollars, a substantial investment that many potential competitors cannot afford.

Launching a new community bank demands significant upfront capital. Think about building branches, investing in secure IT systems, and ensuring compliance with stringent regulatory capital requirements, like the Basel III framework. For instance, as of early 2024, many new bank applications require millions in seed capital just to get started.

This high barrier to entry effectively deters many potential competitors, particularly smaller startups or fintech companies without deep pockets. The sheer financial commitment needed to establish a credible and compliant banking operation is a major hurdle that protects existing community banks.

Building customer trust and brand recognition in financial services is a lengthy and resource-intensive process. Established community banks, like Community Bank System, Inc., have cultivated this trust over decades through consistent local presence and a solid reputation. For instance, as of the first quarter of 2024, Community Bank System reported total assets of $17.0 billion, reflecting a long-standing and substantial market presence.

This deep-rooted trust makes it incredibly difficult for new entrants to quickly capture market share or instill the same level of confidence in potential customers. Newcomers face the uphill battle of demonstrating reliability and security, which are paramount in banking, a hurdle that often requires years of consistent performance and community engagement to overcome.

Economies of Scale and Scope

Existing community banks leverage significant economies of scale, which create a substantial barrier for new entrants. These scale advantages are evident in operational efficiencies, technology investments, and marketing reach, enabling incumbents to offer more competitive pricing and a broader suite of financial products. For instance, a large community bank might spread the cost of a sophisticated digital banking platform across millions of accounts, a feat difficult for a startup to replicate cost-effectively.

Newcomers often face a steep climb to achieve similar cost efficiencies. This initial disadvantage can manifest as higher per-unit operating costs and a reduced ability to compete on price or service breadth. In 2024, the average community bank with assets between $1 billion and $10 billion reported efficiency ratios in the range of 55-65%, indicating a well-established cost structure that new entrants would struggle to match from inception.

- Economies of Scale: Established banks benefit from lower per-unit costs due to high volume in operations, technology, and marketing.

- Cost Disadvantage for New Entrants: Startups lack the scale to match pricing and service offerings of incumbents.

- 2024 Efficiency Ratios: Community banks ($1B-$10B assets) typically operate with efficiency ratios between 55% and 65%.

Talent Acquisition and Infrastructure Development

The threat of new entrants in the community banking sector is significantly influenced by the hurdles in talent acquisition and infrastructure development. Attracting seasoned banking professionals and establishing a robust technological backbone from the ground up requires substantial capital and expertise. New players must contend with established institutions for skilled employees and invest heavily in secure, cutting-edge IT systems to remain competitive and meet evolving customer expectations.

For instance, in 2024, the average cost to onboard a new employee in the financial services sector can range from $5,000 to $10,000, excluding ongoing training and development. Furthermore, the investment in core banking software and cybersecurity measures can easily run into millions of dollars for a new institution. This high barrier to entry, particularly concerning human capital and technology, can deter potential new community banks.

- Talent Competition: New entrants must compete with established banks for experienced loan officers, compliance experts, and IT specialists.

- Infrastructure Costs: Building secure and compliant IT systems, including core banking platforms and digital channels, represents a significant upfront investment.

- Regulatory Compliance: Meeting stringent banking regulations necessitates specialized knowledge and often requires costly system upgrades and personnel.

- Brand Recognition: New banks lack the established trust and brand recognition that community banks have cultivated over years, making talent attraction more challenging.

The threat of new entrants in community banking is low due to substantial regulatory and capital requirements. For example, in 2024, establishing a new bank often necessitates millions in initial capital, a significant deterrent for many aspiring competitors.

New entrants also face the challenge of building customer trust and brand loyalty, a process that takes years for established institutions. Community Bank System, with $17.0 billion in assets as of Q1 2024, exemplifies this long-standing market presence.

Economies of scale enjoyed by existing banks, reflected in 2024 efficiency ratios of 55-65% for banks with $1B-$10B in assets, create a cost disadvantage for startups. Furthermore, acquiring skilled talent and building robust IT infrastructure are costly barriers.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | Significant upfront investment needed for licensing and operations. | Millions of dollars for initial charter. |

| Brand & Trust | Established reputation built over years is hard to replicate. | Community Bank System's $17.0B assets (Q1 2024) show market longevity. |

| Economies of Scale | Lower per-unit costs for incumbents due to volume. | Efficiency ratios of 55-65% for $1B-$10B asset banks. |

| Talent & Technology | High costs for skilled staff and advanced IT systems. | $5k-$10k onboarding cost per employee; millions for core banking software. |

Porter's Five Forces Analysis Data Sources

Our Community Bank Porter's Five Forces analysis leverages data from the FDIC, Federal Reserve, and industry-specific publications. This ensures a comprehensive understanding of regulatory environments, market trends, and competitive pressures within the banking sector.