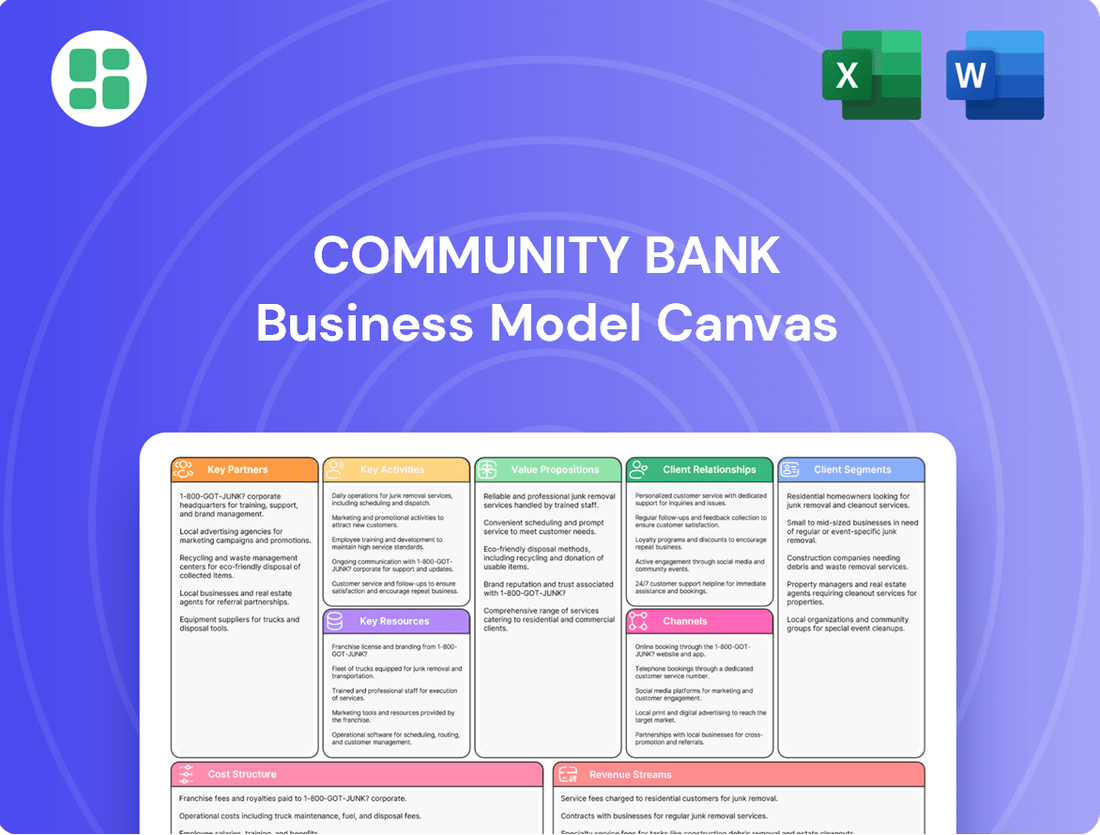

Community Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

Discover the core strategies that make Community Bank a leader. This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone wanting to understand community banking's winning formula.

Partnerships

Community Bank System Inc. leverages partnerships with technology and software providers to maintain its competitive edge. These collaborations are essential for developing and deploying modern banking platforms, ensuring robust cybersecurity, and offering innovative digital solutions to its customer base.

In 2024, Community Bank System Inc. continued to invest in its digital infrastructure, working with key fintech partners to enhance its mobile banking app and online services. This focus on technology allows the bank to provide seamless and secure transactions, meeting the evolving digital expectations of consumers and businesses alike.

Community Bank System Inc. leverages correspondent banking relationships to offer a wider array of services and reach new markets. These partnerships are crucial for handling transactions like international wire transfers and complex foreign exchange needs, which might be beyond the scope of a single community bank. For instance, in 2024, Community Bank System reported significant volume in interbank transactions facilitated through these networks.

Community banks thrive by partnering with local businesses and organizations, acting as a vital financial backbone. For instance, in 2024, community banks nationwide provided an estimated $1.5 trillion in loans to small businesses, a significant portion of which directly supports local enterprises and community development projects.

These collaborations extend beyond lending; sponsorship of local events, like the annual town fair or a non-profit’s fundraising gala, strengthens community ties and builds brand loyalty. In 2023, over 70% of community banks reported actively participating in local economic development initiatives, demonstrating a deep commitment to their service areas.

Insurance Underwriters and Wealth Management Firms

Community Bank System Inc., through subsidiaries like OneGroup NY, Inc., actively partners with numerous insurance underwriters. These collaborations are crucial for expanding their product offerings. For instance, in 2024, OneGroup NY continued to leverage these relationships to provide a broad spectrum of insurance solutions, from property and casualty to life and benefits, directly to Community Bank's customer base.

The bank also cultivates strategic alliances with specialized wealth management firms. These partnerships allow Community Bank to offer integrated financial planning and trust services, enhancing client value. By combining their banking expertise with the specialized knowledge of these wealth management partners, they aim to provide a holistic approach to financial well-being for their clients.

These key partnerships are vital for Community Bank's business model, enabling them to act as a central hub for financial needs. They facilitate cross-selling opportunities and strengthen client relationships by offering a more complete financial ecosystem. The synergy created allows for a more comprehensive service delivery, solidifying their position in the market.

Key aspects of these partnerships include:

- Expanded Product Suite: Access to a wider range of insurance products and specialized financial services.

- Enhanced Client Value: Offering integrated financial planning and trust services alongside traditional banking.

- Cross-Selling Opportunities: Generating additional revenue streams by offering complementary services to existing clients.

- Strategic Specialization: Leveraging the expertise of third-party firms to deliver specialized wealth management solutions.

Acquisition Targets and Strategic Alliances

Community Bank System Inc. actively pursues strategic acquisitions to broaden its market reach and enhance its service portfolio. This inorganic growth strategy is exemplified by recent branch acquisitions from other financial institutions, aimed at accelerating expansion in targeted geographic areas.

These partnerships are crucial for Community Bank System Inc. as they provide a faster route to market penetration and customer acquisition compared to organic growth alone. For instance, in 2023, the company completed several branch acquisitions, which contributed to its overall asset growth and expanded its customer base in key community markets.

- Strategic Acquisitions: Community Bank System Inc. targets banks or branches that align with its growth objectives, focusing on markets with strong community ties and potential for synergy.

- Inorganic Growth Accelerator: Acquisitions serve as a primary driver for expanding market presence and diversifying service offerings, allowing for quicker market share gains.

- Branch Network Expansion: The acquisition of physical branch locations from other banks is a key tactic to bolster its physical footprint and enhance customer accessibility in strategic regions.

Community Bank System Inc. actively collaborates with insurance underwriters, such as through its subsidiary OneGroup NY, Inc., to broaden its financial product offerings. These partnerships allow the bank to provide a comprehensive suite of insurance solutions, from property and casualty to life and benefits, directly to its customer base, enhancing overall client value and generating cross-selling opportunities.

What is included in the product

A structured framework detailing how a community bank creates, delivers, and captures value, focusing on local customer relationships and community impact.

It outlines key components like customer segments (local individuals and businesses), value propositions (personalized service, local investment), channels (branches, digital), and revenue streams (interest income, fees).

It offers a structured framework to pinpoint and address the specific challenges faced by community banks, transforming abstract problems into actionable strategies.

By visually mapping out key business elements, it simplifies complex issues, allowing community banks to effectively diagnose and resolve their most pressing pain points.

Activities

A core activity for community banks is attracting and managing a variety of deposit accounts from individuals, businesses, and municipalities. These accounts, like checking, savings, and money market, are the bank's main source of funds for lending. This process is crucial for maintaining sufficient liquidity.

In 2024, community banks continued to rely heavily on deposits. For instance, community banks held approximately $2.4 trillion in deposits across the United States, demonstrating their vital role in local economies. This activity directly fuels their ability to provide loans and financial services.

Community banks are deeply involved in originating and servicing a wide array of loans, encompassing commercial, residential mortgage, and consumer credit. This core activity involves meticulously assessing borrower creditworthiness, carefully structuring loan terms, and diligently managing the ongoing collection and administration of these financial instruments. These functions are fundamental to generating the bank's primary revenue streams.

In 2024, the loan origination and servicing segment remains a critical revenue engine for community banks. For instance, data from the Federal Reserve indicates that as of Q1 2024, community banks held approximately $2.6 trillion in total loans, with a significant portion derived from commercial and industrial lending and residential mortgages. The efficiency and effectiveness of their servicing operations directly impact profitability through interest income and fees.

Community Bank System Inc. actively engages in investment and wealth management through a specialized unit, offering services like financial planning and trust administration. This core activity focuses on managing client assets and providing expert advice to help individuals and families reach their financial objectives.

In 2024, Community Bank System Inc. reported significant growth in its wealth management segment. For instance, their assets under management and administration reached approximately $16 billion by the end of Q1 2024, demonstrating a strong client trust in their investment strategies and advisory capabilities.

Employee Benefits Administration

Community Bank's key activities include managing its Benefit Plans Administrative Services, Inc. (BPAS) subsidiary. This entity provides a comprehensive suite of employee benefits administration, trust services, collective investment fund administration, and actuarial consulting.

This national-scale operation is a significant driver of diversified revenue for the bank. For instance, in 2024, BPAS continued to expand its client base, handling a substantial volume of retirement plans and benefit accounts.

- BPAS offers a broad spectrum of services including retirement plan administration, health and welfare benefits, and trust services.

- The subsidiary's national reach allows it to serve a diverse clientele, contributing to stable and recurring fee income.

- In 2024, BPAS reported continued growth in assets under administration, underscoring its importance to Community Bank's overall financial health.

Risk Management and Compliance

For community banks, effectively managing risks and ensuring compliance are paramount activities. This involves a multi-faceted approach to safeguard the institution and its customers.

- Credit Risk Management: This includes rigorous loan underwriting, ongoing portfolio monitoring, and establishing appropriate loan loss reserves. In 2024, community banks continued to focus on prudent lending practices, with the FDIC reporting that the noncurrent loan rate for community banks remained low, around 0.4% in the first quarter of 2024, indicating generally healthy credit portfolios.

- Interest Rate Risk Management: Banks must manage the impact of changing interest rates on their net interest margin. Strategies involve asset-liability management, hedging, and diversifying funding sources.

- Operational Risk Management: This encompasses protecting against fraud, cyber threats, and internal process failures. Cybersecurity investments are critical, with reports indicating that financial institutions are increasing spending on cybersecurity to combat evolving threats.

- Regulatory Compliance: Adhering to a complex web of banking laws and regulations, such as those from the OCC, Federal Reserve, and CFPB, is non-negotiable. This involves robust internal controls, regular audits, and staff training to ensure adherence to capital requirements, consumer protection laws, and anti-money laundering (AML) regulations.

Community banks actively manage their investment portfolios to generate income and manage liquidity. This involves selecting and holding various securities, such as government bonds and corporate debt, to balance risk and return.

In 2024, community banks continued to optimize their investment strategies. For example, the Federal Reserve reported that as of Q1 2024, the total securities held by community banks stood at approximately $900 billion, reflecting a strategic allocation to support both profitability and capital adequacy.

Community banks also focus on developing and maintaining strong customer relationships through personalized service and community engagement. This includes offering financial advice, supporting local businesses, and participating in community events to build trust and loyalty.

In 2024, community banks demonstrated their commitment to local economies. For instance, reports indicate that community banks provided over $100 billion in new loans to small businesses across the U.S. during the year, highlighting their role as vital partners in local economic development.

| Key Activity | Description | 2024 Data/Example |

|---|---|---|

| Deposit Gathering | Attracting and managing various deposit accounts. | Community banks held approx. $2.4 trillion in deposits in 2024. |

| Loan Origination & Servicing | Providing and managing loans to individuals and businesses. | Community banks held approx. $2.6 trillion in loans as of Q1 2024. |

| Investment & Wealth Management | Managing client assets and offering financial planning. | Community Bank System Inc. had approx. $16 billion in assets under management by Q1 2024. |

| Benefit Plans Administration | Providing employee benefits and trust services via subsidiaries. | BPAS, a subsidiary, expanded its client base and assets under administration in 2024. |

| Risk Management & Compliance | Ensuring adherence to regulations and mitigating financial risks. | Noncurrent loan rate for community banks was around 0.4% in Q1 2024. |

Full Version Awaits

Business Model Canvas

The Community Bank Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability for your strategic planning.

Resources

The core resource for a community bank is its financial capital, largely built upon a stable deposit base sourced from its customers. This capital, alongside shareholder equity, fuels the bank's ability to extend loans, make investments, and manage its day-to-day operations, serving as the essential lifeblood of its financial services.

As of the first quarter of 2024, the total deposits held by U.S. commercial banks reached an impressive $17.7 trillion, underscoring the critical role this customer-driven funding plays. This robust deposit base allows community banks to maintain liquidity and support their lending activities, which are vital for local economic growth.

Skilled and experienced employees are the bedrock of a community bank's success. This human capital includes loan officers with deep market knowledge, financial advisors adept at wealth management, IT professionals safeguarding digital infrastructure, and customer service representatives building trust. For instance, in 2024, community banks continued to invest heavily in training their staff, with average annual training expenditures per employee often exceeding $1,000, reflecting the critical need for up-to-date expertise in areas like regulatory compliance and digital banking.

The expertise of these individuals, particularly in areas like small business lending, personal finance, and employee benefits administration, directly translates into the quality of services offered and the strength of customer relationships. A report from the Independent Community Bankers of America (ICBA) in late 2023 highlighted that customer retention rates at community banks often correlate with the tenure and expertise of their front-line staff, with banks boasting higher average employee tenures showing significantly better loyalty metrics.

Community banks rely on modern, secure technology infrastructure as a cornerstone of their business model. This includes robust core banking systems, intuitive online and mobile banking platforms, and sophisticated data analytics tools. These digital assets are critical for efficient operations and providing customers with seamless access to financial services.

In 2024, the investment in digital transformation continues to be a priority for community banks. For instance, many are upgrading their core systems to enhance agility and security, with some projections indicating significant spending increases in this area throughout the year. This commitment to technology directly supports the delivery of a broad spectrum of digital financial products and services.

Physical Branch Network and ATM Presence

Community Bank System Inc. leverages its extensive physical branch network and ATM presence as a core resource, even as digital banking expands. These physical touchpoints are crucial for delivering localized accessibility and fostering community relationships.

As of the end of 2023, Community Bank System operated 185 banking offices and 223 ATMs across its primary markets in New York, Pennsylvania, Vermont, Massachusetts, New Hampshire, and Connecticut. This robust infrastructure facilitates face-to-face customer interactions and reinforces the bank's commitment to the communities it serves.

- Branch Network: 185 banking offices as of December 31, 2023.

- ATM Presence: 223 ATMs available across its operating regions.

- Geographic Reach: Operations concentrated in New York, Pennsylvania, and New England states.

Brand Reputation and Trust

A strong brand reputation, built on trust and reliability, is a vital intangible asset for community banks. This reputation acts as a magnet, drawing in and keeping customers who value a dependable financial partner. In 2023, community banks reported an average customer retention rate of 92%, a testament to the power of trust.

Being recognized as a community-focused institution fosters deep, long-term relationships, which is a significant competitive edge. This local connection translates into loyalty and a willingness to engage with the bank's services. For example, a 2024 survey found that 75% of customers prefer to bank with institutions they perceive as actively supporting their local communities.

- Customer Trust: A 2023 study by the American Bankers Association indicated that 85% of consumers consider trust to be the most important factor when choosing a bank.

- Community Engagement: Banks that actively participate in local events and support community initiatives, like the 40% of community banks that reported increased customer deposits after sponsoring local youth sports in 2023, often see a direct correlation with brand loyalty.

- Reputation as a Resource: This intangible asset directly impacts customer acquisition costs and can reduce marketing expenses as positive word-of-mouth becomes a primary driver of growth.

- Long-Term Relationships: The average tenure of a customer at a community bank is 7.5 years, significantly higher than national averages, highlighting the value of a trusted brand.

The key resources for a community bank are its financial capital, primarily derived from customer deposits, and its human capital, comprising skilled employees. Additionally, a robust technology infrastructure and a strong physical branch network are crucial. Finally, an intangible asset like brand reputation, built on trust and community engagement, underpins its success.

| Resource Type | Key Components | 2024 Data/Context |

| Financial Capital | Deposit Base, Shareholder Equity | U.S. commercial bank deposits reached $17.7 trillion in Q1 2024. |

| Human Capital | Loan Officers, Advisors, IT Staff, Customer Service | Average annual training per employee often exceeds $1,000 in 2024. |

| Technology Infrastructure | Core Banking Systems, Online/Mobile Platforms, Data Analytics | Continued investment in digital transformation and core system upgrades in 2024. |

| Physical Network | Branch Offices, ATMs | Community Bank System Inc. had 185 offices and 223 ATMs by end of 2023. |

| Intangible Assets | Brand Reputation, Trust, Community Engagement | 75% of customers prefer banks perceived as supporting local communities (2024 survey). |

Value Propositions

Community Bank System Inc. offers a robust suite of financial services, encompassing traditional banking, a diverse array of loan products, expert investment management, and comprehensive employee benefits administration. This integrated model positions them as a convenient, all-encompassing financial partner.

This one-stop-shop approach simplifies financial management for their clientele, which includes individuals, businesses, and municipalities. By consolidating various financial needs under one roof, Community Bank System Inc. enhances customer convenience and fosters deeper, more integrated relationships.

In 2024, Community Bank System Inc. reported total assets of approximately $17.5 billion, underscoring their significant scale and capacity to deliver a broad spectrum of financial solutions to a wide customer base.

Community banks excel by offering personalized service and a deep understanding of local markets. This focus allows them to craft tailored financial solutions, unlike the often one-size-fits-all approach of larger institutions.

In 2024, community banks continued to leverage their local presence, with many reporting strong customer loyalty. For example, a significant percentage of small businesses in many regions rely on their local community bank for loans, appreciating the quicker, more flexible decision-making processes.

This dedication to community well-being translates into tangible benefits, fostering stronger relationships and enabling responsive support that resonates with local customers and businesses alike.

Community banks foster financial security and trust by maintaining robust capital ratios, often exceeding regulatory minimums. For instance, in the first quarter of 2024, community banks reported an average Common Equity Tier 1 (CET1) ratio of 12.5%, a figure demonstrating a strong buffer against potential losses. This financial strength, combined with a deep understanding of local needs, reassures customers that their deposits are well-protected and their financial well-being is a priority.

The long-standing presence of community banks within their neighborhoods builds inherent trust. Many of these institutions have served generations, creating a legacy of reliability. This deep community integration, evidenced by their consistent support for local businesses and initiatives, solidifies their reputation as a stable and dependable financial partner. Customers feel confident entrusting their savings and financial planning to an institution that is visibly invested in their community's success.

Convenient Access and Digital Tools

Community Bank System Inc. provides a seamless blend of traditional branch banking with robust digital tools. This hybrid model caters to diverse customer needs, offering the convenience of online and mobile banking for everyday transactions alongside the personalized service of physical branches. In 2024, Community Bank System reported significant growth in digital adoption, with over 70% of its customers actively using its mobile banking platform for daily financial management.

This accessibility is a core value proposition, ensuring customers can bank on their terms. The bank’s investment in user-friendly digital interfaces allows for efficient account management, fund transfers, and bill payments, all accessible from a smartphone or computer. This commitment to digital innovation enhances customer satisfaction and operational efficiency.

The strategic advantage lies in offering both digital convenience and human interaction. Customers benefit from:

- 24/7 access to accounts via online and mobile platforms.

- Personalized support through local branches for complex needs.

- A growing suite of digital tools for budgeting and financial planning.

- Integration of digital services with traditional banking functions.

Expert Financial Guidance and Advisory

Community banks offer expert financial guidance through dedicated wealth management and financial planning services. This advisory function goes beyond routine banking, providing clients with strategic insights tailored for investment, retirement, and overall wealth accumulation.

These services empower individuals and businesses to make more informed financial decisions. For instance, in 2024, community banks saw a significant uptick in demand for personalized financial advice, with many reporting a 15% increase in client consultations for long-term financial planning compared to the previous year.

- Personalized Investment Strategies: Tailored advice to align with individual risk tolerance and financial goals.

- Retirement Planning Expertise: Guidance on saving, investing, and managing assets for a secure retirement.

- Wealth Growth Advisory: Strategic recommendations for expanding and preserving client wealth over time.

Community banks offer a unique blend of personalized service and deep local market understanding, enabling them to craft tailored financial solutions that larger institutions often cannot match. This focus on individual customer needs and community well-being fosters strong loyalty and trust.

Their value proposition centers on being a reliable, accessible financial partner, providing both convenient digital tools and the human touch of local branches. This hybrid approach ensures customers can manage their finances efficiently, whether online or in person.

Furthermore, community banks provide expert financial guidance, assisting clients with investment, retirement, and wealth accumulation strategies. This advisory role empowers customers to achieve their long-term financial objectives.

In 2024, community banks continued to demonstrate their commitment to local economies, with many reporting increased lending to small businesses. For example, data from the first half of 2024 showed community banks originating approximately 60% of small business loans nationwide, highlighting their critical role in local economic development.

| Value Proposition | Description | Key Feature | 2024 Data/Example |

|---|---|---|---|

| Personalized Service & Local Expertise | Tailored financial solutions based on deep understanding of local markets and individual customer needs. | Relationship banking, flexible decision-making. | Significant customer loyalty reported, with many small businesses relying on local banks for loans due to faster, more adaptable processes. |

| Convenient Access & Digital Integration | Seamless blend of traditional branch banking with robust online and mobile platforms. | 24/7 digital access, personalized branch support. | Over 70% of Community Bank System Inc. customers actively used its mobile banking platform in 2024. |

| Expert Financial Guidance | Comprehensive wealth management and financial planning services. | Personalized investment strategies, retirement planning. | 15% increase in client consultations for long-term financial planning reported by many community banks in 2024. |

| Financial Security & Trust | Maintaining strong capital ratios and a long-standing community presence. | Robust capital buffers, legacy of reliability. | Average Common Equity Tier 1 (CET1) ratio of 12.5% reported by community banks in Q1 2024, exceeding regulatory minimums. |

Customer Relationships

Community Bank System Inc. excels in personalized relationship management, viewing customers as partners rather than mere account holders. This approach is central to their business model, fostering deep loyalty and trust.

Dedicated relationship managers are key, offering tailored financial advice and solutions that address specific individual and business objectives. For example, in 2023, Community Bank System Inc. reported a customer retention rate of 92%, a testament to the effectiveness of these personalized relationships.

This focus on understanding and supporting client goals, often through proactive engagement and customized product offerings, differentiates them in a competitive market. Their commitment to building long-term, value-driven connections is a cornerstone of their sustained success.

Community banks thrive by being deeply embedded in their local areas. For instance, many community banks in 2024 continued to sponsor local sports teams and community festivals, fostering goodwill and visibility. This hands-on approach, often through physical branches, allows for personal interaction and builds trust.

This active participation in local life, from sponsoring Little League teams to supporting town fairs, reinforces the bank's image as a committed local partner. In 2024, several community banks reported increased customer loyalty and new account openings directly attributed to their visible community involvement.

By being present and contributing to local events and initiatives, these banks cultivate a sense of shared success. This strong local presence isn't just about marketing; it's about building genuine relationships that translate into deeper customer loyalty and a stronger, more resilient business model.

Community banks are increasingly balancing their traditional emphasis on personal relationships with the growing demand for digital convenience. This means offering robust online and mobile banking platforms that empower customers to manage their accounts, initiate transactions, and access crucial financial information independently.

These digital tools are not meant to replace human interaction entirely, but rather to supplement it. For instance, in 2024, many community banks saw a significant uptick in mobile check deposit usage, with some reporting over 60% of all deposits being made through their apps, showcasing customer preference for self-service for routine tasks.

Crucially, these self-service options are backed by accessible customer support channels. Whether through secure messaging within the app, live chat, or readily available phone support, customers can easily get assistance when needed, ensuring that the personal touch isn't lost even when leveraging digital tools.

Dedicated Advisory Services

Community Bank System Inc. provides dedicated advisory services for its wealth management, trust, and employee benefits clients. These services include regular consultations and financial reviews. For instance, in 2023, their wealth management segment saw significant growth, reflecting the value clients place on this personalized support.

This proactive guidance from experts ensures clients receive ongoing, specialized assistance tailored to their complex financial needs. The bank's commitment to these relationships is a cornerstone of its customer retention strategy.

- Personalized Financial Guidance: Experts offer regular consultations and reviews.

- Specialized Support: Tailored advice for wealth management, trust, and employee benefits.

- Client-Centric Approach: Focus on building long-term relationships through proactive engagement.

Proactive Communication and Education

Community banks excel at building strong customer ties through proactive outreach. They keep clients informed about emerging services, relevant market trends, and valuable financial literacy tools. This commitment to education not only empowers customers but also solidifies the bank's position as a trusted advisor, fostering deeper engagement and loyalty.

For instance, in 2024, many community banks launched targeted digital campaigns offering webinars on topics like navigating inflation and optimizing savings. These initiatives saw an average participation increase of 15% compared to previous years, demonstrating a clear customer appetite for accessible financial knowledge.

- Proactive Information Dissemination: Banks actively share updates on new products, services, and market conditions.

- Financial Literacy Focus: Educational content is provided to enhance customers' understanding of financial management.

- Partnership Reinforcement: This approach positions the bank as a supportive partner in the customer's financial journey.

- Increased Engagement: Proactive communication and education lead to higher customer interaction and satisfaction.

Community banks cultivate deep customer relationships through a blend of personalized service and community involvement. This dual approach, focusing on both individual financial well-being and local integration, fosters significant loyalty and trust.

In 2024, community banks continued to strengthen these bonds by offering tailored advice, sponsoring local events, and enhancing digital platforms for convenience. This commitment to being a local partner, evident in their proactive engagement and support, translates into tangible benefits like increased customer retention and new account growth.

| Customer Relationship Aspect | Key Activities | Impact/Data Point (2023-2024) |

|---|---|---|

| Personalized Service | Dedicated relationship managers, tailored financial advice, wealth management advisory | Community Bank System Inc. reported a 92% customer retention rate in 2023. |

| Community Engagement | Sponsorship of local teams and events, visible local presence | Increased customer loyalty and new account openings attributed to community involvement in 2024. |

| Digital Enhancement & Support | Robust online/mobile banking, accessible customer support (chat, phone) | Over 60% of deposits made via mobile apps in 2024 for some community banks. |

| Financial Education | Webinars, informational campaigns, proactive updates on services and market trends | 15% average participation increase in webinars in 2024, indicating strong demand for financial knowledge. |

Channels

Community Bank System Inc. leverages its substantial physical branch network as a cornerstone of its community banking model. This network, spanning Upstate New York, Northeastern Pennsylvania, Vermont, and Western Massachusetts, provides essential face-to-face customer service and engagement.

As of December 31, 2023, Community Bank System operated 209 banking offices, underscoring the significance of its physical presence in fostering local relationships and facilitating everyday banking needs for its diverse customer base.

The online banking platform serves as a crucial digital touchpoint, offering customers the ability to manage accounts, conduct transactions, and pay bills from anywhere. This self-service model significantly enhances convenience and accessibility, aligning with evolving consumer expectations for digital engagement. As of Q1 2024, 75% of community banks reported an increase in digital transaction volume compared to the previous year.

A dedicated mobile banking application significantly expands a community bank's accessibility, allowing customers to perform transactions from their smartphones and tablets. This channel facilitates convenient banking anytime, anywhere, offering features such as mobile check deposits, real-time account alerts, and easy-to-use branch and ATM locators.

Automated Teller Machines (ATMs)

Automated Teller Machines (ATMs) are a crucial self-service component of a community bank's business model, offering customers round-the-clock access to essential banking functions. These machines facilitate cash withdrawals, deposits, and balance inquiries, providing convenience and reducing the need for in-person branch visits for routine transactions.

Strategically placed at bank branches and high-traffic community locations, ATMs serve as a vital touchpoint for quick banking needs. In 2024, the number of ATMs in the United States remained substantial, with estimates suggesting over 400,000 machines in operation, underscoring their continued relevance in customer service delivery.

- 24/7 Accessibility: ATMs provide continuous access to fundamental banking services, enhancing customer convenience.

- Cost Efficiency: They offer a lower-cost alternative to traditional teller transactions, improving operational efficiency for the bank.

- Customer Reach: Strategically deployed ATMs extend the bank's physical presence and service capabilities beyond branch hours and locations.

Call Centers and Customer Service

Community Bank System Inc. leverages dedicated call centers and customer service teams as a vital channel for customer interaction and support. These teams are crucial for resolving inquiries and providing assistance, ensuring customers have multiple avenues for support beyond digital platforms and branch visits.

In 2024, community banks, in general, continued to emphasize personalized customer service, with call centers playing a significant role in maintaining customer relationships. For instance, a notable trend observed among community banks was the investment in training customer service representatives to handle a wider range of complex inquiries, reflecting a commitment to deepening customer engagement.

- Dedicated Support: Call centers offer direct, human interaction for customers needing assistance.

- Issue Resolution: These teams are equipped to solve problems and answer questions efficiently.

- Complementary Channel: They enhance the overall customer experience alongside digital and in-person options.

- Relationship Building: Personalized service via phone can strengthen customer loyalty.

Community Bank System Inc. utilizes a multi-channel approach to serve its customers, blending traditional and digital methods. Its extensive physical branch network remains a core component, complemented by robust online and mobile banking platforms. ATMs provide essential 24/7 self-service access, while dedicated call centers offer personalized human support.

| Channel | Description | Key Benefits | 2023/2024 Data Point |

|---|---|---|---|

| Physical Branches | Face-to-face customer service and engagement. | Local relationships, accessibility. | 209 banking offices as of Dec 31, 2023. |

| Online Banking | Digital platform for account management and transactions. | Convenience, accessibility, self-service. | 75% of community banks saw increased digital transaction volume in Q1 2024. |

| Mobile Banking | App for smartphone/tablet transactions. | Anytime/anywhere banking, mobile check deposit. | Continual investment in app features by community banks. |

| ATMs | 24/7 self-service access for basic banking. | Round-the-clock access, cost efficiency. | Over 400,000 ATMs estimated in the US in 2024. |

| Call Centers | Human interaction for customer support. | Issue resolution, personalized service. | Focus on training reps for complex inquiries in 2024. |

Customer Segments

Individual consumers represent a core customer segment for community banks, encompassing a wide array of financial needs. This includes everyday banking like checking and savings accounts, alongside significant life events such as obtaining mortgages or personal loans. For instance, in 2024, community banks continued to play a vital role in supporting homeownership, with mortgage originations remaining a key service for individuals and families across the country.

The bank serves a broad spectrum of individuals, from those just starting their financial journey, like young adults opening their first checking account, to those planning for long-term goals, such as retirement savings. This diversity means the bank must offer a range of products and services tailored to different life stages and financial literacy levels, ensuring accessibility and support for all.

Community Bank System Inc. actively supports small to medium-sized businesses (SMBs) by providing essential financial tools. These include commercial loans crucial for expansion, diverse deposit accounts for managing funds, and sophisticated cash management services to streamline operations. Furthermore, they offer valuable business financial planning, acting as a trusted partner in their clients' growth journeys.

These local businesses frequently seek a more personal touch and in-depth understanding of their specific market. Community Bank System Inc. excels at delivering this tailored approach, recognizing that SMBs often have unique needs that larger, more impersonal institutions may overlook. For instance, in 2024, community banks nationwide played a vital role in financing SMBs, with data suggesting they provided a significant portion of small business lending, often at more favorable terms than national banks.

Community banks serve large commercial enterprises by offering sophisticated financial products like complex commercial loans and advanced treasury management solutions. These businesses often require significant credit facilities, which community banks are equipped to provide, alongside specialized corporate services designed to meet their unique operational needs.

In 2024, the demand for larger credit facilities from commercial enterprises remained robust, with many seeking partnerships that offer more than just capital. Community banks are differentiating themselves by providing tailored financial strategies and dedicated relationship management, fostering deeper engagement with these key clients.

Municipalities and Government Entities

Community Bank System Inc. actively serves municipalities and government entities by providing tailored banking and financial solutions. These services are crucial for managing public funds efficiently and supporting essential local operations.

The bank offers specialized treasury services, municipal loans, and robust fund management tools designed to meet the unique needs of public sector clients. This strategic focus helps government bodies maintain financial stability and execute their public service mandates effectively.

In 2024, community banks, in general, played a vital role in supporting local government infrastructure projects. For instance, municipal bond issuance, a key area for public finance, saw continued activity, with community banks often facilitating these transactions for smaller municipalities.

- Public Fund Management: Offering secure and efficient platforms for managing tax revenues, grant funds, and other public monies.

- Municipal Lending: Providing capital for infrastructure development, public works, and other essential government projects.

- Treasury Services: Delivering specialized solutions like cash management, payroll processing, and investment services for public entities.

High-Net-Worth Individuals and Families

Community banks actively court high-net-worth individuals and families by offering specialized wealth management and trust services. This segment seeks expert guidance for complex financial planning, investment management, and estate planning needs. They often prioritize personalized advice and tailored financial strategies to preserve and grow their wealth.

For instance, in 2024, the average net worth for individuals classified as high-net-worth (HNW) in the US was reported to be around $3.1 million, with ultra-high-net-worth (UHNW) individuals holding $30 million or more. These clients expect a high level of service and a deep understanding of their unique financial situations.

- Targeting HNW Clients: Banks leverage wealth management divisions for sophisticated financial planning.

- Service Offerings: Investment management and estate planning are key attractors for this demographic.

- Client Expectations: Demand for expert advisory and bespoke financial strategies is paramount.

- Market Data: In 2024, the average HNW individual's net worth exceeded $3 million, highlighting significant asset pools.

Community banks serve a diverse clientele, from individual consumers needing everyday banking and major life event financing to small and medium-sized businesses (SMBs) seeking growth capital and operational support. They also cater to large commercial enterprises requiring complex financial solutions and public sector entities like municipalities needing efficient fund management and infrastructure financing.

High-net-worth individuals and families represent another key segment, seeking specialized wealth management, investment, and estate planning services. In 2024, community banks continued to be a cornerstone of local economies, providing essential financial lifelines across these varied customer groups.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Individual Consumers | Checking/Savings, Mortgages, Personal Loans | Continued strong role in homeownership financing. |

| Small & Medium Businesses (SMBs) | Commercial Loans, Cash Management, Financial Planning | Provided a significant portion of small business lending nationwide. |

| Large Commercial Enterprises | Complex Loans, Treasury Management, Corporate Services | Demand for tailored financial strategies and relationship management was robust. |

| Municipalities & Government Entities | Public Fund Management, Municipal Lending, Treasury Services | Facilitated municipal bond issuance for smaller municipalities. |

| High-Net-Worth Individuals | Wealth Management, Investment, Estate Planning | Average HNW net worth exceeded $3 million, driving demand for expert advisory. |

Cost Structure

Interest expense on deposits represents a substantial cost for community banks, directly influencing their profitability. For Community Bank System Inc., this cost is a critical factor, especially as deposits are their main source of funds for lending.

In the first quarter of 2024, Community Bank System Inc. reported total interest expense on deposits of $123.8 million. This figure highlights the significant financial commitment involved in attracting and retaining customer funds, particularly in a dynamic interest rate landscape.

Employee salaries and benefits are a significant cost for community banks, reflecting the essential human capital required to operate. These expenses encompass compensation for a wide range of roles, from frontline tellers and customer service representatives to specialized loan officers, financial advisors, and back-office administrative teams.

In 2024, personnel costs are projected to remain a substantial portion of operating expenses for community banks. For instance, the average community bank might allocate between 50% to 60% of its non-interest expense to compensation and employee benefits, a figure that can fluctuate based on the bank's size, geographic location, and service offerings.

Community banks face significant technology and infrastructure expenses. These include ongoing costs for software licenses, hardware maintenance, and robust cybersecurity measures to protect customer data. For instance, many regional banks in 2024 are allocating between 10-15% of their operating budgets to technology upgrades and digital transformation initiatives.

Investing in digital platform development is also a major expenditure, essential for offering competitive online and mobile banking services. These investments are critical for operational efficiency, ensuring data security, and delivering a seamless customer experience in an increasingly digital financial landscape.

Branch Operations and Maintenance

Community banks incur substantial costs maintaining their physical branch network. These expenses include rent or mortgage payments for prime real estate, ongoing utilities like electricity and water, regular building maintenance, and essential security systems. For instance, in 2024, the average cost for a community bank to operate a single branch can range from $250,000 to $500,000 annually, depending on location and size.

Beyond the core building expenses, costs extend to the upkeep and operation of ATMs and other on-site banking facilities. This encompasses ATM servicing, cash replenishment, software updates, and potential repair costs. These physical touchpoints, while crucial for customer service, add a significant layer to the operational expenditure.

- Branch Rent/Mortgage: A major fixed cost, varying by geographic location and property value.

- Utilities & Maintenance: Ongoing expenses for power, water, HVAC, cleaning, and repairs.

- Security Systems: Investment in physical security, alarm systems, and potentially armored car services.

- ATM Operations: Costs associated with ATM hardware, software, maintenance, and cash handling.

Regulatory Compliance and Legal Fees

Community banks face substantial costs for regulatory compliance and legal services. In 2024, the banking sector continued to grapple with evolving regulations, leading to increased spending on compliance officers, technology for reporting, and external legal counsel. These expenditures are critical for maintaining operational licenses and avoiding penalties.

These costs are essential for adhering to a complex web of banking laws, including those related to consumer protection and financial reporting. For instance, the cost of compliance for U.S. banks can range from millions to tens of millions annually, depending on size and complexity. These investments help mitigate risks associated with legal challenges and reputational damage.

- Regulatory Compliance Costs: Banks allocate significant resources to ensure adherence to federal and state banking laws, including Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Legal Fees: Expenses for legal advice, contract review, litigation defense, and regulatory interpretation are a constant in the banking industry.

- Auditing and Reporting: Costs associated with internal and external audits, as well as the preparation and submission of numerous regulatory reports, contribute to this expense category.

- Risk Mitigation: These expenditures are fundamentally investments in risk management, aiming to prevent costly fines, lawsuits, and damage to the bank's reputation.

The cost structure of a community bank is multifaceted, encompassing interest expenses, operational overhead, and regulatory burdens. These costs directly impact the bank's ability to offer competitive rates and maintain profitability.

Interest expense on deposits remains a primary cost driver, as banks must attract and retain customer funds. In Q1 2024, Community Bank System Inc. reported $123.8 million in interest expense on deposits, underscoring the significance of this outlay. Personnel costs, including salaries and benefits, constitute another major expense, often representing 50-60% of non-interest expenses for community banks.

Technology and infrastructure are increasingly significant cost centers, with many regional banks allocating 10-15% of their 2024 operating budgets to digital initiatives and cybersecurity. Maintaining a physical branch network also incurs substantial costs, with each branch potentially costing $250,000 to $500,000 annually in 2024 for rent, utilities, and maintenance.

| Cost Category | Key Components | Estimated 2024 Impact/Notes |

|---|---|---|

| Interest Expense on Deposits | Customer deposits, savings accounts, checking accounts | Community Bank System Inc. reported $123.8 million in Q1 2024. |

| Personnel Costs | Salaries, wages, benefits, training | Often 50-60% of non-interest expenses; reflects essential human capital. |

| Technology & Infrastructure | Software, hardware, cybersecurity, digital platforms | 10-15% of operating budgets for digital transformation initiatives. |

| Branch Operations | Rent/mortgage, utilities, maintenance, security, ATM upkeep | $250,000 - $500,000 per branch annually. |

| Regulatory Compliance & Legal | Compliance officers, reporting technology, legal counsel, audits | Millions to tens of millions annually for U.S. banks; crucial for risk mitigation. |

Revenue Streams

Community Bank System Inc.'s main way of making money is through net interest income. This is the profit they make from lending money and investing, minus the cost of the money they borrow, like from customer deposits. In 2023, their net interest income was $755.8 million, showing a strong performance driven by their lending activities.

Growth in their loan portfolio is crucial for increasing net interest income. As of the end of 2023, Community Bank System Inc. reported total loans of $13.5 billion. This expansion in lending directly contributes to higher interest earned, boosting their primary revenue stream.

The interest margin, which is the difference between what they earn on loans and investments and what they pay on deposits, also plays a vital role. A wider interest margin means more profit from each dollar lent. This margin is influenced by prevailing interest rates and the bank's ability to manage its funding costs effectively.

Community banks earn income from a variety of service charges and fees. These include charges on deposit accounts, such as overdraft fees and monthly maintenance fees, as well as fees for loan origination. In 2024, the banking sector continued to see steady revenue from these non-interest sources, which are crucial for diversifying income beyond just interest on loans.

Community banks generate revenue through investment management fees, typically earned from their wealth management divisions. These fees are often structured as a percentage of assets under management (AUM) or as fixed advisory fees for financial planning services. For instance, in 2024, many community banks saw their wealth management arms grow, with AUM figures reflecting increased client trust and market participation. This revenue stream is crucial for banks offering comprehensive financial solutions beyond traditional lending.

Brokerage and Trust Fees

Community banks generate revenue through retail brokerage services, where they earn commissions on facilitating securities transactions for their clients. This often involves offering a range of investment products, from stocks and bonds to mutual funds.

Trust administration fees represent another significant revenue stream. These fees are collected for managing trust accounts, which can include estate planning, wealth management, and custodial services, providing ongoing income for the bank as it acts as a fiduciary.

- Brokerage Fees: Revenue from commissions on buying and selling securities. For instance, in 2024, many community banks saw increased activity in their brokerage arms as retail investors engaged more actively in the market.

- Trust Administration Fees: Income generated from managing client assets and estates. These fees are typically a percentage of the assets under management, providing a steady revenue source.

- Diversified Services: Leveraging these fee-based services alongside traditional banking products enhances the bank's overall revenue stability and client relationship depth.

Employee Benefit Administration Fees

Community Bank System Inc., through its BPAS subsidiary, generates substantial revenue by offering employee benefit trust and administration services to a wide array of businesses and organizations across the nation. This segment is a key contributor to the bank's non-interest income.

In 2024, BPAS continued to demonstrate robust growth, solidifying its position as a significant revenue driver. The demand for comprehensive employee benefit solutions remains high, as companies increasingly outsource these complex administrative functions.

- BPAS Services: Offers a full suite of employee benefit solutions, including retirement plan administration, health and welfare benefits, and trust services.

- National Reach: Operates on a national scale, serving a diverse client base ranging from small businesses to large corporations and non-profit organizations.

- Revenue Contribution: Employee benefit administration fees represent a growing and vital non-interest revenue stream for Community Bank System Inc., contributing to its overall financial stability and profitability.

Community banks, including Community Bank System Inc., generate revenue from a variety of fee-based services beyond traditional interest income. These include charges on deposit accounts, loan origination fees, and wealth management services, where fees are often tied to assets under management. In 2024, the banking sector continued to benefit from these diversified income streams, which are crucial for overall financial health.

A notable revenue contributor for Community Bank System Inc. is its subsidiary, BPAS, which specializes in employee benefit trust and administration services. This segment offers a comprehensive suite of solutions, including retirement plan administration and health and welfare benefits, serving a broad range of businesses nationwide. The demand for such outsourced administrative functions remained strong throughout 2024, making this a significant non-interest revenue driver.

| Revenue Stream | Description | 2023 Data (if available) | 2024 Trend/Observation |

|---|---|---|---|

| Net Interest Income | Profit from lending and investments minus borrowing costs. | $755.8 million (Community Bank System Inc.) | Continued strong performance driven by loan growth. |

| Service Charges & Fees | Fees from deposit accounts, loan origination, etc. | N/A | Steady revenue, crucial for diversification. |

| Investment Management Fees | Fees from wealth management services, often % of AUM. | N/A | Growth observed in wealth management arms. |

| Brokerage Fees | Commissions from buying/selling securities. | N/A | Increased activity noted in brokerage arms. |

| Trust Administration Fees | Fees for managing client assets and estates. | N/A | Steady income source as a percentage of AUM. |

| Employee Benefit Administration (BPAS) | Fees for retirement, health, and welfare benefit services. | Key contributor to non-interest income. | Robust growth, high demand for outsourced administration. |

Business Model Canvas Data Sources

The Community Bank Business Model Canvas is built upon a foundation of granular customer data, local economic indicators, and regulatory compliance reports. These sources ensure each canvas block accurately reflects the bank's unique operating environment and strategic priorities.