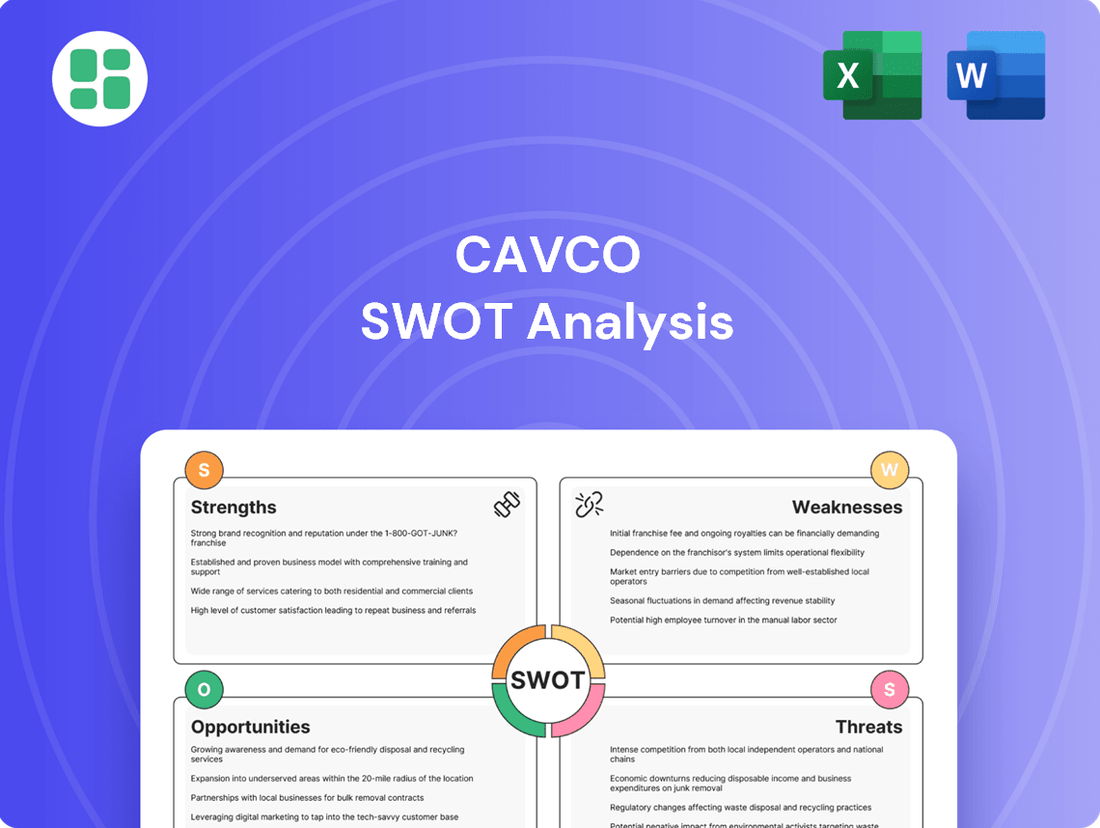

Cavco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cavco Bundle

Cavco's market position is shaped by strong brand recognition and efficient production, but it also faces challenges from evolving consumer preferences and supply chain disruptions. Understanding these dynamics is crucial for anyone looking to capitalize on opportunities within the manufactured housing sector.

Want the full story behind Cavco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cavco Industries thrives with a diversified business model, encompassing both factory-built housing and essential financial services. This dual-segment strategy, featuring subsidiaries like CountryPlace Mortgage and Standard Casualty, creates multiple revenue streams and directly supports customers throughout their homeownership journey.

The financial services arm has demonstrated robust recovery, with improved gross profit margins significantly bolstering Cavco's overall profitability. For instance, in the first quarter of fiscal year 2024, Cavco's financial services segment reported a substantial increase in operating income, highlighting its growing contribution to the company's financial health.

Cavco stands as a leading force in the manufactured and modular housing sector across the U.S., supported by an extensive network of manufacturing facilities and distribution routes. This broad reach enables the company to effectively serve a wide customer base and capitalize on market opportunities.

The company has shown impressive growth in home sales volume, coupled with enhanced capacity utilization, which reached around 75% in the first quarter of fiscal year 2026. This operational efficiency is a key strength, allowing Cavco to respond effectively to the increasing demand for accessible housing solutions and manage a substantial order backlog.

Cavco's dedication to affordability is a major strength, especially with housing costs continuing to rise. In 2023, the median home price in the US hovered around $417,000, making Cavco's manufactured homes a much more accessible option for many families.

The company is also staying ahead by integrating modern design, energy efficiency, and updated features into its homes. This focus on innovation makes their offerings more attractive to a wider range of buyers, directly addressing evolving consumer tastes and stricter building codes.

Strategic Acquisitions and Brand Unification

Cavco Industries has demonstrated a strong growth strategy through targeted acquisitions. A prime example is their agreement to acquire American Homestar, a move designed to significantly bolster their market share and expand their footprint, particularly in the burgeoning South-Central United States. This strategic acquisition is anticipated to be a key driver for revenue growth in the coming fiscal year.

Furthermore, Cavco has effectively unified its extensive network of 31 manufacturing facilities under a singular, recognizable 'Cavco' brand. This consolidation simplifies the customer experience, making it easier for buyers to navigate their offerings. It also allows for more efficient and impactful national marketing campaigns, leveraging the strength of a unified brand identity.

These initiatives are expected to yield considerable operational synergies. By integrating operations and presenting a cohesive brand, Cavco is positioning itself for enhanced market penetration and improved cost efficiencies. The company's focus on strategic growth through acquisitions and brand unification underscores its commitment to expanding its competitive advantage in the manufactured housing sector.

- Strategic Acquisitions: Agreement to acquire American Homestar to expand market share and geographic presence.

- Brand Unification: Consolidation of 31 manufacturing facilities under the single 'Cavco' brand.

- Market Simplification: Streamlined home search process for consumers.

- National Marketing Leverage: Enhanced reach and impact through a unified brand identity.

Financial Resilience and Capital Allocation

Cavco's financial resilience is a significant strength, underscored by its robust revenue growth and improved profitability. For the fiscal year ended March 31, 2024, Cavco reported net revenue of $1.78 billion, a notable increase from the prior year. This financial muscle allows for strategic capital allocation, including active share repurchase programs, demonstrating confidence in the company's valuation and a commitment to enhancing shareholder value.

The company's strong balance sheet, characterized by substantial cash reserves, provides a crucial buffer against economic downturns and ample flexibility for opportunistic investments. This financial stability is particularly valuable in the cyclical housing market, enabling Cavco to weather volatility and pursue growth initiatives without undue strain. For instance, as of March 31, 2024, Cavco held approximately $475 million in cash and cash equivalents.

- Revenue Growth: Cavco's net revenue reached $1.78 billion for the fiscal year ended March 31, 2024.

- Profitability Improvement: The company has shown a positive trend in operating profit and net income.

- Strong Balance Sheet: Significant cash reserves, totaling around $475 million as of March 31, 2024, enhance financial flexibility.

- Shareholder Returns: Active stock repurchase programs indicate a commitment to returning capital to shareholders.

Cavco's diversified business model, combining housing manufacturing with financial services, provides multiple revenue streams and supports customers throughout the homeownership process. The financial services segment, in particular, has shown strong recovery, with improved gross profit margins significantly boosting overall profitability. This dual approach strengthens Cavco's market position and financial resilience.

The company is a leading U.S. manufacturer of factory-built housing, boasting an extensive network of 31 manufacturing facilities and a broad distribution reach. This infrastructure allows Cavco to efficiently serve a wide customer base and capitalize on market demand. Furthermore, their commitment to affordability, with manufactured homes offering a more accessible price point compared to the median U.S. home price of approximately $417,000 in 2023, is a key differentiator.

Cavco demonstrates a robust growth strategy, exemplified by its agreement to acquire American Homestar, a move poised to significantly expand its market share and geographic footprint. The successful unification of its 31 manufacturing facilities under the single 'Cavco' brand simplifies the customer journey and enhances national marketing efforts, creating operational synergies and a stronger competitive advantage.

Cavco's financial health is a significant strength, marked by strong revenue growth and improved profitability. For the fiscal year ending March 31, 2024, the company reported net revenue of $1.78 billion, an increase from the previous year. This financial stability is further supported by substantial cash reserves, totaling approximately $475 million as of March 31, 2024, providing flexibility for strategic investments and shareholder returns through active share repurchase programs.

| Key Strength | Description | Supporting Data (FY24) |

|---|---|---|

| Diversified Business Model | Housing manufacturing and financial services | Financial services segment shows improved gross profit margins |

| Market Leadership & Reach | Leading U.S. factory-built housing manufacturer | 31 manufacturing facilities, extensive distribution |

| Affordability Focus | Offers accessible housing solutions | Manufactured homes are more affordable than median U.S. home price (~$417,000 in 2023) |

| Strategic Growth Initiatives | Acquisitions and brand unification | Agreement to acquire American Homestar; 31 facilities under 'Cavco' brand |

| Financial Resilience | Strong revenue, profitability, and balance sheet | Net revenue $1.78 billion; Cash reserves ~$475 million (as of Mar 31, 2024) |

What is included in the product

This analysis maps out Cavco's market strengths, operational gaps, and external risks.

Offers a clear, actionable framework to identify and address Cavco's core challenges and opportunities.

Weaknesses

Cavco's business, like much of the housing sector, is quite sensitive to shifts in mortgage interest rates. When rates go up, it becomes harder for people to afford homes, which naturally leads to less demand for manufactured and modular housing. Even though rates have seen some slight decreases recently, ongoing unpredictability or further hikes in interest rates could negatively affect Cavco's sales figures.

While Cavco Industries benefits from geographic diversification, its insurance segment remains susceptible to significant losses stemming from severe weather events. For example, the company has previously reported substantial claims related to hurricanes and other natural disasters impacting regions like Texas and New Mexico.

Furthermore, regional economic downturns or shifts in consumer demand can negatively impact Cavco's performance. The company's recent financial reports have indicated underperformance in certain markets, such as the Southeast, underscoring the variability in regional demand for manufactured homes.

Cavco's reliance on external distribution channels, particularly independent dealers, introduces a degree of variability into its sales performance. While company-owned stores offer more control, a higher proportion of sales through third parties can affect average selling prices and the consistency of the customer experience. This dependency means Cavco's revenue streams are subject to the success and strategies of its dealer network.

Perception and Regulatory Hurdles for Manufactured Housing

Despite improvements, manufactured housing still grapples with outdated public perceptions and a fragmented regulatory landscape. A patchwork of building codes across various states and municipalities can create significant hurdles, complicating construction processes and potentially limiting market acceptance in certain regions.

While the Department of Housing and Urban Development (HUD) has updated its standards to improve efficiency, these persistent challenges can increase compliance costs and slow down development. For instance, some local zoning ordinances may still restrict the placement of manufactured homes, impacting Cavco's ability to expand its market reach.

- Outdated Perceptions: Lingering stereotypes about quality and durability can affect consumer demand.

- Regulatory Patchwork: Inconsistent building codes across jurisdictions add complexity and cost.

- Zoning Restrictions: Local ordinances can limit where manufactured homes can be sited.

- Compliance Costs: Navigating diverse regulations increases operational expenses for manufacturers like Cavco.

Sensitivity to Building Material Costs and Labor Availability

Cavco, like many in the construction sector, faces significant challenges from volatile building material costs. For instance, lumber prices, a key component in home construction, saw substantial increases throughout 2021 and early 2022, impacting overall project expenses. This sensitivity directly affects Cavco's ability to maintain consistent profit margins.

The availability and cost of skilled labor also present a persistent weakness. A shortage of qualified construction workers can lead to project delays and increased labor expenses, directly squeezing Cavco's operational efficiency and profitability. This issue is a widespread concern across the industry, as reported by various construction surveys throughout 2023 and into 2024.

- Building Material Cost Volatility: Fluctuations in prices for lumber, steel, and other key construction materials directly impact Cavco's cost of goods sold and can erode profit margins.

- Skilled Labor Shortages: Difficulty in finding and retaining skilled labor can lead to production delays and increased labor costs, hindering efficiency and potentially impacting delivery timelines.

- Impact on Profitability: Elevated construction costs and labor expenses can reduce Cavco's net income and return on investment if not effectively managed through pricing strategies or cost-saving measures.

- Production Efficiency Concerns: Labor scarcity and material supply chain disruptions can slow down manufacturing processes, affecting Cavco's overall production output and ability to meet demand.

Cavco's reliance on independent dealers, rather than a fully integrated sales force, can lead to less control over the customer experience and potentially lower average selling prices. This external dependency means Cavco's revenue is subject to the effectiveness and strategies of its dealer network, introducing an element of unpredictability into sales performance.

The manufactured housing sector, including Cavco, continues to battle outdated public perceptions regarding quality and durability, which can dampen consumer demand. Furthermore, a fragmented regulatory landscape with varying building codes across states and municipalities creates compliance complexities and can restrict market access in certain areas, increasing operational costs.

Cavco, like other construction companies, is vulnerable to significant fluctuations in building material costs. For example, lumber prices experienced substantial volatility in 2021-2022, directly impacting production expenses and profit margins. Similarly, shortages of skilled labor remain a persistent challenge, leading to production delays and increased labor costs, which affected the industry throughout 2023 and into 2024.

| Weakness | Impact | Example/Data Point |

|---|---|---|

| Dealer Dependency | Less control over customer experience, variable selling prices | Higher proportion of sales through third-party dealers can affect consistency. |

| Outdated Perceptions & Regulations | Reduced consumer demand, increased compliance costs | Fragmented building codes across states complicate processes; zoning restrictions limit placement. |

| Material Cost Volatility & Labor Shortages | Eroded profit margins, production delays | Lumber price spikes in 2021-2022; ongoing skilled labor scarcity reported in 2023-2024 construction surveys. |

Preview the Actual Deliverable

Cavco SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You're seeing a genuine preview of the Cavco SWOT analysis. The complete, detailed report is yours to access immediately after purchase.

The preview you see is the actual document you will receive upon purchasing the Cavco SWOT analysis. No hidden content, just the full, professional report.

Opportunities

The ongoing housing affordability crisis in the United States is a significant tailwind for Cavco. With the median existing home price reaching approximately $412,200 in April 2024, according to the National Association of Realtors, the demand for cost-effective housing solutions is more pronounced than ever. Manufactured and modular homes, Cavco's core offerings, provide a compelling alternative to traditional site-built homes.

Cavco is strategically positioned to benefit from this trend. As the median new home price hovered around $430,700 in March 2024, the cost advantage of Cavco's products becomes increasingly attractive to a broader consumer base. This persistent gap in affordability fuels a robust market for manufactured housing, a segment where Cavco holds a strong market presence.

Recent updates to the HUD Code for manufactured homes are a significant tailwind for Cavco, allowing for more contemporary designs, flexible floor plans, and even multi-unit structures. This broadens the appeal and potential applications for manufactured housing, directly expanding Cavco's market reach and potentially simplifying construction processes.

Government policies, like the ROAD to Housing Act, are actively working to dismantle regulatory hurdles and speed up the production of manufactured homes. This creates a more supportive and efficient operating environment, which is crucial for companies like Cavco to scale and meet growing demand.

Cavco can leverage ongoing innovation in factory-built construction, such as advanced automation and robotics, to boost production efficiency and product quality. This technological leap is crucial for staying competitive in the 2024-2025 market, where speed and precision are paramount.

The integration of smart home technology and a focus on sustainable, energy-efficient materials offers a significant opportunity. By enhancing its product lines with these features, Cavco can attract a growing segment of environmentally aware buyers, potentially increasing market share.

Expansion into New Market Segments

Cavco Industries is well-positioned to capitalize on the increasing demand for modular construction beyond its traditional single-family manufactured homes. The company can strategically expand into sectors like multifamily housing, hospitality, education, and healthcare, leveraging its established factory-built expertise to meet diverse construction needs.

This expansion presents a significant growth opportunity. For instance, the U.S. modular construction market is projected to grow substantially. Reports from 2024 and early 2025 indicate a compound annual growth rate (CAGR) of over 7% for the modular construction sector, driven by factors like cost-effectiveness and faster build times.

- Multifamily Housing: Growing urban populations and housing shortages create a strong demand for efficient multifamily construction solutions.

- Hospitality: Hotels and resorts can benefit from the speed and consistency of modular builds for new properties or renovations.

- Education and Healthcare: Schools and medical facilities often require rapid deployment of new spaces, making modular construction an attractive option.

Increased Focus on ESG and Sustainability

Cavco's manufacturing processes inherently offer a sustainability advantage, generating less waste and higher efficiency than traditional construction methods. This aligns with the increasing global demand for environmentally responsible building solutions.

Further investment in green initiatives, such as solar panel integration in homes and enhanced energy efficiency in designs, can significantly attract a growing segment of eco-conscious buyers and investors. For instance, the U.S. residential solar market saw a substantial increase in installations in 2023, indicating strong consumer interest in sustainable energy solutions.

- Reduced Waste: Cavco's factory-built model minimizes construction site waste compared to traditional building.

- Energy Efficiency: Opportunities exist to further integrate and market energy-efficient home designs.

- Solar Integration: Partnerships or in-house capabilities for solar power installations can appeal to a growing market.

- Investor Appeal: A strong ESG profile can attract socially responsible investors, potentially improving access to capital.

Cavco can expand its reach into sectors like multifamily housing, hospitality, and healthcare, capitalizing on the projected 7% CAGR for modular construction in 2024-2025. This diversification taps into markets seeking efficient and rapid construction solutions, a core strength of Cavco's factory-built model.

The company's inherent sustainability advantages, such as reduced waste, can be further leveraged by integrating green initiatives like solar panels. This appeals to the growing demand for eco-conscious building, mirroring the substantial increase in U.S. residential solar installations observed in 2023.

Innovation in factory-built construction, including automation and smart home technology, presents an opportunity to enhance production efficiency and product appeal. This focus on technology is crucial for competitiveness in the 2024-2025 market, where speed and quality are paramount.

Recent updates to the HUD Code for manufactured homes allow for more modern designs and flexible applications, broadening Cavco's market appeal. Coupled with government policies like the ROAD to Housing Act, these changes create a more favorable environment for scaling production and meeting demand.

Threats

Despite some recent modest decreases, the possibility of persistently high mortgage rates or even further increases remains a significant hurdle for housing demand and affordability. For instance, as of early 2024, average 30-year fixed mortgage rates hovered around 6.5% to 7%, a substantial increase from the sub-3% rates seen in 2021, directly impacting buyer purchasing power.

Furthermore, a broader economic slowdown or a potential recession in 2024 or 2025 could significantly dampen consumer confidence and reduce available disposable income. This economic uncertainty often translates into fewer home sales and can lead lenders to tighten their credit standards, making it harder for potential buyers to secure financing.

The manufactured and modular housing market is seeing significant growth, with projections indicating continued expansion through 2025. This attractive market dynamic naturally draws in new entrants and encourages existing players to adopt more aggressive tactics. Cavco must be prepared for increased competition that could challenge its pricing power and erode profit margins.

Cavco faces ongoing threats from supply chain disruptions, which can impact the availability and cost of crucial building materials. For instance, the U.S. Producer Price Index for construction materials saw significant increases throughout 2023 and into early 2024, reflecting these pressures.

This volatility in material prices, alongside potentially rising transportation expenses, directly threatens Cavco's profit margins. If these increased costs cannot be absorbed or effectively passed on to customers, Cavco's profitability could be significantly eroded.

Negative Public Perception and Zoning Restrictions

Despite ongoing industry improvements, manufactured homes still face negative public perceptions concerning quality and appearance, acting as a hurdle to broader acceptance. These outdated views can hinder market penetration.

Restrictive local zoning ordinances in many desirable areas present a significant barrier, limiting where manufactured homes can be placed and thus restricting Cavco's potential market reach and growth opportunities.

- Negative Perceptions: Lingering stereotypes about manufactured housing quality and aesthetics persist, impacting consumer choice.

- Zoning Barriers: Over 70% of US municipalities have some form of exclusionary zoning, often prohibiting manufactured homes in certain residential areas.

- Market Access Limitation: These combined factors restrict Cavco's ability to expand into key growth markets and capitalize on housing demand.

Impact of Catastrophic Weather Events on Insurance Segment

Cavco's financial services segment, which includes its insurance operations, faces a significant threat from catastrophic weather events. The increasing frequency and intensity of natural disasters directly translate to higher claim losses, potentially eroding the profitability and stability of this crucial business area.

For example, in fiscal year 2023, the insurance industry as a whole saw substantial payouts due to severe weather. While specific Cavco data for this period isn't publicly broken down in this context, industry-wide trends indicate a heightened risk. This exposure can lead to increased reinsurance costs and a greater need for robust risk management strategies within Cavco's insurance arm.

- Increased Claims: Severe weather events like hurricanes, floods, and wildfires directly impact insurance payouts.

- Profitability Strain: Higher claim volumes can significantly reduce the profitability of Cavco's financial services segment.

- Reinsurance Costs: The rising cost of reinsurance to cover these catastrophic events adds another layer of financial pressure.

- Market Volatility: Unpredictable weather patterns introduce greater volatility into the insurance market, affecting Cavco's financial planning.

Cavco faces significant threats from persistent high mortgage rates, which dampen housing demand and affordability, with rates around 6.5%-7% in early 2024 compared to sub-3% in 2021. A potential economic slowdown or recession in 2024-2025 could further reduce consumer confidence and lenders' willingness to finance, impacting sales. Increased competition in the growing manufactured housing market may also pressure pricing and profit margins.

SWOT Analysis Data Sources

This Cavco SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and accurate assessment.