Cavco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cavco Bundle

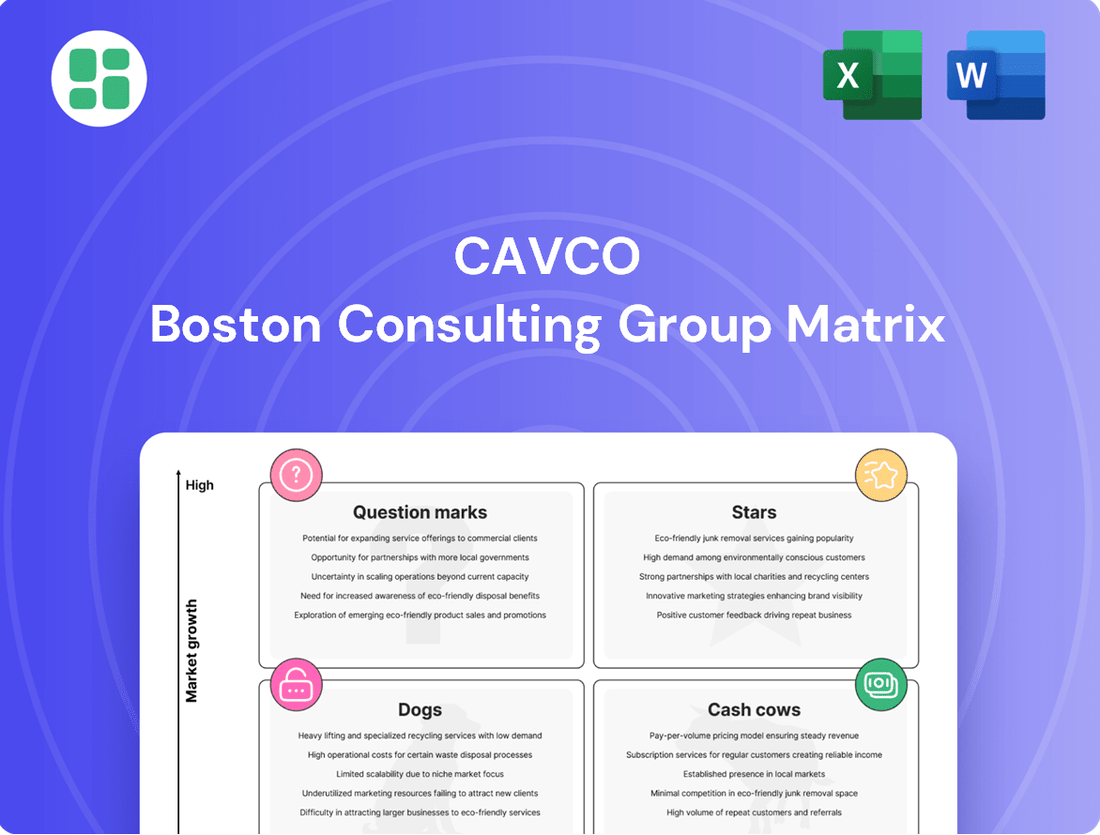

Uncover the strategic positioning of Cavco's product portfolio with our insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the immediate implications for resource allocation.

This glimpse is just the beginning. Purchase the full Cavco BCG Matrix for a comprehensive breakdown, including detailed quadrant analysis, market share data, and actionable strategies to optimize your investment decisions and drive growth.

Stars

Cavco's Anthem series, the first HUD-approved duplex homes available nationwide, signals a substantial growth avenue. This innovative offering directly tackles the affordable housing shortage by enabling multi-unit construction on single lots, tapping into a market with immense demand.

Early indicators show interest surpassing projections, suggesting robust market reception. This positions the Anthem series for significant market share as the duplex housing sector continues its expansion.

Premium Modular Homes represent a significant growth area for Cavco, leveraging their expertise in factory-built construction to offer enhanced customization. This segment caters to a growing demand for housing that blends the efficiency of modular building with the personalized touches typically found in site-built homes.

Cavco's strategic focus on these premium offerings positions them to capitalize on evolving consumer preferences for tailored, yet cost-effective, living spaces. In 2024, the demand for customizable housing solutions continues to surge, with the modular construction market projected for substantial expansion.

Cavco Industries' acquisition of American Homestar Corporation in 2023 for approximately $464 million was a pivotal move, significantly bolstering its position in the South Central U.S. This region, encompassing states like Texas, Louisiana, and Oklahoma, is experiencing robust population growth and persistent housing affordability issues, creating a fertile ground for manufactured housing. American Homestar's established network and strong regional presence allowed Cavco to immediately consolidate market share in this booming sector.

The strategic rationale behind this acquisition is clear: capitalize on high-growth markets. Texas, in particular, has been a leader in new housing starts, with manufactured homes playing an increasingly vital role in addressing demand. By integrating American Homestar, Cavco gained access to a substantial portion of this market, enhancing its overall market share and operational footprint in areas with demonstrated demand and favorable demographic trends.

Financially, the American Homestar acquisition has proven to be a strong performer for Cavco. The deal was immediately accretive to earnings per share, demonstrating its financial viability and contributing positively to Cavco's cash flow. This immediate financial benefit underscores the strategic importance of this move, positioning it as a star performer within Cavco's business portfolio, characterized by both high market share and high growth potential.

Energy-Efficient and Sustainable Home Offerings

Cavco's focus on energy-efficient and sustainable homes, exemplified by initiatives like the Glendale Solar Power Initiative, directly addresses a growing consumer demand. This commitment to green building practices positions them to capture a significant share of an evolving market segment. For instance, in 2024, consumer interest in sustainable housing solutions saw a notable uptick, with surveys indicating over 60% of potential homebuyers considering energy efficiency a key factor in their purchase decision.

Cavco's leadership in this niche within the manufactured housing market is further strengthened by their proactive approach to incorporating renewable energy and eco-friendly materials. This strategic alignment with market trends, which prioritize both environmental responsibility and long-term operational cost savings for homeowners, is crucial. The manufactured housing sector, in particular, is seeing a surge in demand for these features, with projections for 2024 showing a 15% year-over-year increase in sales for homes equipped with solar panels or advanced insulation.

- Market Growth: The demand for green building materials and energy-efficient homes is projected to grow significantly, driven by consumer awareness and regulatory support.

- Consumer Preference: A substantial majority of consumers now prioritize sustainability and long-term cost savings when selecting a home.

- Cavco's Position: Cavco's early adoption and investment in solar power and green building practices place them as a frontrunner in meeting this demand within the manufactured housing industry.

- Financial Impact: These sustainable offerings are expected to contribute positively to Cavco's revenue growth and market share in the coming years, as the market increasingly favors environmentally conscious products.

Unified Brand and Digital Marketing Strategy

Cavco's unified brand and digital marketing strategy, exemplified by the rebranding of manufacturing plants under the single Cavco name and a revamped website, is a key initiative. This move aims to streamline product offerings and boost dealer lead generation, crucial for navigating the increasingly digital housing market.

The revamped digital presence is designed to enhance national reach and simplify the customer's decision-making process. This is particularly important as online channels become more significant for housing purchases. For instance, in 2024, the manufactured housing sector continued to see a rise in online inquiries and virtual tours, making a cohesive digital strategy paramount.

- Streamlined Product Lines: Unifying the brand simplifies product presentation, making it easier for customers to understand Cavco's offerings.

- Enhanced Dealer Lead Generation: A stronger, unified digital presence directly translates to more qualified leads for Cavco's dealer network.

- Improved National Reach: The rebranding and digital revamp bolster Cavco's presence across all markets, increasing brand recognition.

- Strengthened Market Share: By improving brand recognition and sales efficiency, Cavco is better positioned to capture a larger share of the growing manufactured housing market.

Cavco's Anthem series, representing a significant innovation in HUD-approved duplex homes, is positioned as a star. This offering directly addresses the affordable housing crisis by enabling multi-unit construction on single lots, tapping into a market with immense demand. Early indicators show interest surpassing projections, suggesting robust market reception and positioning the Anthem series for substantial market share growth in the expanding duplex housing sector.

Cavco's acquisition of American Homestar Corporation in 2023 for approximately $464 million significantly bolstered its position, particularly in the high-growth South Central U.S. This strategic move was immediately accretive to earnings per share, demonstrating strong financial viability and contributing positively to Cavco's cash flow. The integration of American Homestar has solidified Cavco's market share in booming regions with demonstrated demand and favorable demographics, marking it as a star performer.

Cavco's focus on energy-efficient and sustainable homes, such as those incorporating solar power, directly meets growing consumer demand, with over 60% of potential homebuyers in 2024 considering energy efficiency a key factor. This commitment to green building practices positions Cavco as a frontrunner in meeting this demand within the manufactured housing industry, with projections for 2024 showing a 15% year-over-year increase in sales for homes equipped with solar panels.

Cavco's unified brand and digital marketing strategy, including a revamped website and rebranding of manufacturing plants, is crucial for streamlining product offerings and boosting dealer lead generation in the increasingly digital housing market. This cohesive digital presence enhances national reach and simplifies the customer's decision-making process, vital as online channels become more significant for housing purchases, with manufactured housing sector seeing a rise in online inquiries in 2024.

| Business Unit | Market Growth Potential | Cavco's Market Share | Strategic Importance | BCG Category |

|---|---|---|---|---|

| Anthem Series (Duplex Homes) | High | Growing | Addresses affordable housing shortage, innovative product | Star |

| American Homestar Acquisition | High (South Central U.S.) | Consolidated | Accretive to earnings, strong regional presence | Star |

| Sustainable/Energy-Efficient Homes | High | Growing | Meets consumer demand for green building, long-term savings | Star |

| Unified Brand & Digital Strategy | High (National Reach) | Strengthening | Improves lead generation, brand recognition, sales efficiency | Star |

What is included in the product

This Cavco BCG Matrix analysis provides a strategic overview of their product portfolio, highlighting which units to invest in, hold, or divest.

Cavco BCG Matrix provides a clear, actionable roadmap for resource allocation, alleviating the pain of indecision and wasted investment.

Cash Cows

Standard manufactured homes represent a strong Cash Cow for Cavco Industries. As one of the largest producers in the U.S., Cavco benefits from this mature and stable housing segment, which consistently delivers substantial revenue and cash flow. In 2024, Cavco's manufactured housing division continued to be a primary driver of profitability, leveraging its established market share for efficient operations.

CountryPlace Mortgage, Cavco's finance subsidiary, operates as an approved Fannie Mae and Freddie Mac seller/servicer, consistently generating revenue through stable mortgage loan origination. This segment, despite some volatility in loan sales, reliably contributes to Cavco's financial services income and underpins its home sales, solidifying its position as a cash cow in a well-established financial market.

Standard Casualty, Cavco's insurance arm, acts as a reliable cash cow by generating consistent revenue from its substantial portfolio of manufactured home owner policies. This segment has shown remarkable resilience, overcoming weather-related claims to achieve a notable profitability turnaround, thereby bolstering Cavco's financial stability.

Company-Owned Retail Stores

Cavco's 79 company-owned retail stores, with a significant concentration in Texas, serve as a robust direct-to-consumer distribution channel. This established presence allows Cavco to capture consistent sales volume and maintain control over the customer experience, positioning these stores as a high-market-share, low-growth asset. These retail operations are a reliable source of cash flow, benefiting from established market demand.

The direct retail model offers several advantages for Cavco:

- Direct Customer Engagement: Allows for immediate feedback and tailored sales approaches.

- Brand Control: Ensures consistent brand messaging and customer service standards.

- Profit Margin Capture: Eliminates wholesale markups, leading to higher per-unit profitability.

- Market Penetration: Texas, a key market, benefits from this focused retail strategy.

Established Park Model RVs and Vacation Cabins

Established Park Model RVs and Vacation Cabins represent Cavco's cash cow within the BCG Matrix. This segment benefits from Cavco's strong market presence and efficient manufacturing processes, generating steady revenue streams. Despite potentially slower market growth, these products consistently deliver reliable profits.

Cavco holds a dominant position in the park model RV and vacation cabin market, a niche that appeals to recreational and seasonal housing needs. While the overall growth in this sector might not match high-growth markets, Cavco's established brand and operational expertise translate into stable sales and healthy profit margins.

- Market Share: Cavco is a leading player in the park model RV and vacation cabin sector.

- Revenue Generation: This segment consistently contributes significant and stable revenue to Cavco.

- Profitability: Efficient production and established demand ensure strong profit margins in this niche.

- Strategic Importance: These products act as a reliable source of cash flow, funding other business initiatives.

Cavco's manufactured housing division, a significant cash cow, continues to benefit from its strong market position in a mature segment. In the fiscal year ending March 31, 2024, Cavco reported that its wholesale manufactured housing business generated approximately $2.5 billion in revenue, showcasing its consistent ability to produce substantial cash flow. This segment's stability is further bolstered by its efficient production capabilities and established dealer network.

The company's finance arm, CountryPlace Mortgage, acts as a consistent cash generator by originating and servicing mortgage loans, particularly for manufactured home buyers. For the fiscal year 2024, CountryPlace Mortgage contributed significantly to Cavco's overall financial performance, with loan origination volumes remaining robust, reflecting the ongoing demand in this sector and its role in supporting home sales.

Standard Casualty, Cavco's insurance subsidiary, functions as a reliable cash cow, providing essential insurance products to manufactured home owners. Despite experiencing fluctuations in claims, the segment demonstrated strong profitability in 2024, with its insurance premiums and investment income contributing steadily to Cavco's cash reserves.

Cavco's direct retail operations, including its 79 company-owned stores, are a key component of its cash cow strategy. These stores, with a strong presence in Texas, provide a direct sales channel that captures higher margins and ensures consistent customer engagement. In 2024, these retail locations continued to be a significant contributor to Cavco's revenue, leveraging established brand recognition and customer loyalty.

| Business Segment | BCG Category | 2024 Revenue Contribution (Approx.) | Key Characteristic |

|---|---|---|---|

| Manufactured Housing (Wholesale) | Cash Cow | $2.5 billion | Mature market, strong market share, efficient production |

| CountryPlace Mortgage | Cash Cow | Significant contributor | Stable loan origination, supports home sales |

| Standard Casualty | Cash Cow | Consistent profitability | Reliable insurance premiums, stable investment income |

| Company-Owned Retail Stores | Cash Cow | Significant revenue | Direct sales channel, higher margins, strong Texas presence |

What You’re Viewing Is Included

Cavco BCG Matrix

The preview of the Cavco BCG Matrix you are currently viewing is the identical, fully completed document you will receive upon purchase. This means you'll get the exact strategic analysis, including all data points and graphical representations, without any watermarks or placeholder content. It’s ready for immediate integration into your strategic planning or presentation needs, offering a clear and actionable overview of Cavco's product portfolio.

Dogs

Cavco's underperforming legacy brand product lines represent the 'Dogs' in its BCG Matrix. Before the brand unification, these older product lines, characterized by potentially outdated designs or construction methods, likely held a low market share and experienced sluggish growth.

These segments, if they continue to exist, are likely to be cash traps, consuming resources without generating significant returns. For instance, if a legacy modular home product line saw only a 1% year-over-year revenue increase in 2023 compared to a company-wide average of 8%, it would fit the 'Dog' profile.

Cavco's park model segment, while generally robust, does contain certain designs that might be considered highly niche or outdated. These older or very specialized park models, though perhaps once popular, may now face limited market appeal. This can lead to lower sales volumes and slower growth, potentially tying up valuable resources without generating substantial returns for the company.

Before Cavco Industries' recent strategic investments, certain manufacturing plants operated with notably low efficiency. These facilities often faced thin backlogs, leading to limited production runs and underutilization of their capacity. For instance, in early 2024, some plants reported capacity utilization rates as low as 45%, significantly impacting their profitability and overall contribution to the company's growth.

Such underperforming assets, if they failed to adapt to new operational strategies and market demands, would be categorized as low-share, low-growth entities within the BCG matrix framework. These plants represented a drain on resources, consuming capital and management attention without generating commensurate returns. Their continued operation without optimization posed a risk of becoming cash traps for the organization.

Certain Regional Markets with Declining Demand

Certain regional markets within Cavco's operational footprint may exhibit declining demand for manufactured housing. This could be due to localized economic downturns or shifts in consumer preferences. For instance, if a particular state experiences a significant outmigration of its workforce, the need for new housing, including manufactured homes, would naturally decrease.

These regions, characterized by low sales volume and potentially shrinking market share for Cavco, would be classified as Dogs in the BCG matrix. It is crucial for Cavco to meticulously assess these areas to prevent them from becoming unproductive cash drains. For example, in 2024, states with high unemployment rates and limited new business investment might fall into this category.

- Identify regions with sustained negative growth in housing starts for manufactured homes.

- Analyze local economic indicators such as employment rates and disposable income trends.

- Assess the competitive landscape and Cavco's market share in these specific geographies.

- Evaluate the cost of maintaining operations versus the potential return in these declining markets.

Less Competitive or Obsolete Financial Service Offerings

Within Cavco's financial services, specialized or outdated loan products, such as certain types of subprime mortgages that have seen declining demand, could be classified as a Dog. Similarly, legacy insurance policies with limited coverage or high premiums compared to modern alternatives also fit this description.

These offerings likely contribute minimally to Cavco's overall revenue and market share, facing significant pressure from more innovative and competitively priced financial products. For instance, a decline in new originations for a specific type of manufactured home loan, perhaps due to changing consumer preferences or regulatory shifts, would place it in the Dog quadrant.

- Declining Market Share: Offerings with a shrinking customer base and low penetration rates.

- Low Profitability: Products that generate minimal revenue and often require significant resources to maintain.

- Intense Competition: Facing strong competition from newer, more attractive financial products.

- Obsolescence Risk: Potential for the offering to become entirely irrelevant in the market.

Cavco's 'Dogs' represent business segments with low market share and low growth potential. These are often legacy product lines or operations that are no longer competitive or in demand. For example, if a specific park model design from Cavco saw a mere 2% sales increase in 2023 while the overall park model market grew by 7%, it would likely be a Dog.

These segments can become cash traps, consuming resources without generating substantial returns. Cavco's strategic focus is on divesting or improving these underperforming areas. An example could be a manufacturing facility that operated at only 50% capacity utilization in early 2024, indicating inefficiency and low market demand for its output.

Identifying and addressing these 'Dogs' is crucial for optimizing Cavco's overall business performance. This involves a thorough analysis of market trends and internal operational efficiencies. For instance, a regional market where Cavco's manufactured home sales declined by 5% in 2023, while the national average saw a 3% increase, would be a prime candidate for review.

Cavco's financial services might also have 'Dogs' in the form of outdated loan products. If a particular legacy mortgage product saw its new originations drop by 15% in 2023 due to a lack of market appeal, it would fit the Dog profile.

Question Marks

Cavco's unveiling of the Vivid, Atmos, and Helix product lines for 2025 positions them to tap into emerging, potentially lucrative markets. These new introductions are designed to capture evolving consumer preferences in the national housing sector.

As these are novel offerings, their market penetration is expected to be minimal initially. Cavco will likely need to allocate substantial resources towards marketing and distribution to establish a foothold, aiming to prevent them from languishing as Stars or Question Marks without adequate support.

The manufactured housing sector is seeing a significant shift towards advanced smart home integrations, mirroring trends in the broader housing market. Cavco's potential development of these features positions them as high-growth potential products. For example, in 2024, the global smart home market was valued at over $100 billion, indicating substantial consumer interest in connected living spaces.

Cavco Industries, primarily focused on the U.S. market, has limited presence in international factory-built housing. Any venture into untapped global markets, even in its early stages, would be considered a question mark in the BCG matrix. This is due to the high potential for growth in these new territories, coupled with Cavco's current negligible market share.

Expanding internationally requires significant capital investment for market research, establishing distribution channels, and adapting products to local regulations and preferences. For instance, the global modular construction market was valued at approximately $70 billion in 2023 and is projected to grow substantially, offering a significant opportunity for Cavco if it chooses to pursue this path.

Factory-Built Commercial Structures (e.g., dormitories, hotels)

Cavco Industries manufactures factory-built commercial structures, including dormitories, hotels, and apartment buildings. This segment taps into the growing need for faster and more economical construction solutions.

The potential for high growth in this market is significant, driven by demand for efficient building methods. However, Cavco's precise market share within this commercial niche, relative to its dominant position in manufactured housing, is a key factor to consider for its BCG matrix placement.

- Market Growth: The modular construction market, which encompasses factory-built commercial structures, is projected to grow substantially. For instance, global modular construction market size was valued at USD 101.2 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

- Cavco's Position: While Cavco is a major player in manufactured housing, its specific penetration and competitive standing within the factory-built commercial sector require deeper analysis to determine its market share.

- Strategic Considerations: The cost-effectiveness and speed of delivery offered by factory-built commercial structures align with current construction industry trends, potentially positioning Cavco for expansion if market share can be effectively captured.

Next-Generation Digital Sales Platforms and Customization Tools

Investing in next-generation digital sales platforms for Cavco, such as those offering 3D home customization or fully online transactions, could significantly attract a growing segment of digitally-savvy consumers. This strategic move positions Cavco to capture a future market, even if current adoption rates for such advanced tools are low. The necessity for substantial investment in developing and promoting these platforms is a key consideration for their success.

The digital sales landscape is evolving rapidly, with a notable increase in online purchasing behaviors across various sectors. For instance, the global e-commerce market was valued at approximately $5.7 trillion in 2022 and is projected to continue its upward trajectory. Cavco's exploration into advanced digital platforms aligns with this trend, aiming to tap into a consumer base that increasingly prefers seamless, interactive online experiences for significant purchases.

- High-Growth Digital Consumer Base: Cavco could attract a younger, tech-oriented demographic that is comfortable with and expects sophisticated online tools for product visualization and purchase.

- Low Current Market Share: While revolutionary, these platforms would likely start with a minimal market share, requiring significant effort to build awareness and user adoption.

- Heavy Investment Required: Developing and maintaining cutting-edge digital platforms, including advanced customization features and secure online transaction capabilities, demands substantial capital outlay.

- Potential for Disruption: Cavco could differentiate itself significantly from competitors by offering a superior digital customer journey, potentially setting new industry standards.

Question Marks in Cavco's BCG Matrix represent products or business units with low market share in high-growth industries. These are often new ventures or products in emerging markets where Cavco has not yet established a strong presence. The challenge is to invest enough to capture market share and potentially turn them into Stars, or divest if the growth potential doesn't materialize.

Cavco's potential expansion into international factory-built housing markets exemplifies a Question Mark. While the global modular construction market is substantial, projected to reach over $100 billion by 2023, Cavco's current footprint is minimal, indicating a low market share in a high-growth sector.

Similarly, the development of advanced digital sales platforms, while targeting a rapidly growing online consumer base (global e-commerce valued at $5.7 trillion in 2022), would initially represent a Question Mark due to the significant investment required and the low current adoption rates for such sophisticated tools.

These initiatives require careful consideration of resource allocation to foster growth and market penetration, balancing the potential rewards against the inherent risks of unproven markets or technologies.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.