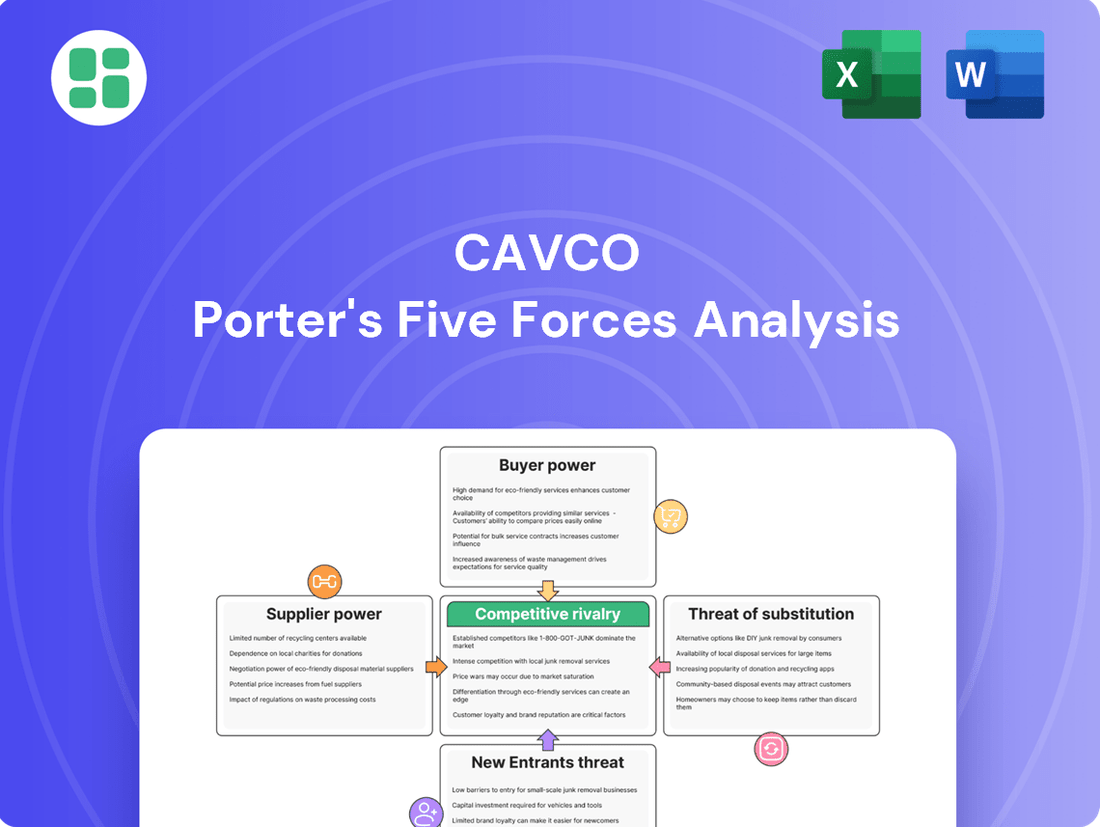

Cavco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cavco Bundle

Cavco's competitive landscape is shaped by several key forces, including the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry among existing players. Understanding these dynamics is crucial for navigating the manufactured housing industry.

The complete report reveals the real forces shaping Cavco’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The manufactured housing industry depends on a limited number of suppliers for crucial materials like lumber, steel, and appliances. This concentration means suppliers can exert more influence over pricing and terms.

While global supply chain issues have improved, certain construction materials, including steel and lumber, experienced price hikes in late 2024 and early 2025. Factors like tariffs and persistent supply chain challenges contributed to these increases, thereby strengthening the bargaining power of suppliers in the market.

Cavco Industries might encounter moderate switching costs when changing major suppliers. These costs stem from existing supplier relationships, bulk purchasing deals, and the critical need to maintain consistent component specifications for their factory-built homes. For instance, a disruption in a key component supplier could halt production lines, impacting revenue significantly.

The company’s ability to negotiate favorable terms with suppliers is also a factor. A substantial portion of Cavco's cost of goods sold is tied to materials and components, making supplier relationships crucial for profitability. In 2023, Cavco reported a cost of sales of $2.8 billion, highlighting the importance of managing these supplier dynamics.

However, the trend towards supply chain diversification to enhance resilience offers Cavco leverage. By developing relationships with multiple suppliers for critical components, Cavco can mitigate the risk of over-reliance on a single source, potentially lowering the overall bargaining power of any individual supplier.

While many of Cavco's raw materials, like lumber and steel, are commodities with many suppliers, the uniqueness of certain components significantly impacts supplier power. For instance, specialized smart home technology or advanced energy-efficient building systems often originate from a select few manufacturers. This limited availability for these advanced features grants those suppliers greater leverage in pricing and terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by Cavco's suppliers is generally low. Major raw material providers, for instance, are unlikely to venture into the complex world of manufactured home production and distribution. Their existing business models and expertise are quite different, making such a move a significant undertaking. This lack of supplier inclination to move "up" the value chain limits their bargaining power.

Consider the typical suppliers for Cavco, such as lumber mills or component manufacturers. These businesses operate with established processes and market focuses. For them to integrate forward into building entire homes would require substantial new investments in design, assembly, sales, and distribution networks, a leap that is often not strategically or financially viable. This barrier effectively keeps supplier power in check.

In 2023, the manufactured housing industry saw continued demand, yet the cost of key inputs like lumber experienced volatility. For example, lumber prices, a significant component cost for Cavco, fluctuated throughout the year, impacting production expenses. However, these suppliers typically operate in commodity markets and lack the specialized knowledge and infrastructure to directly compete with established manufacturers like Cavco in their core business.

- Low Likelihood of Supplier Forward Integration: Suppliers of raw materials and components for Cavco are unlikely to integrate forward into manufactured home production due to distinct business models and expertise requirements.

- Distinct Business Models: The core operations of Cavco's suppliers, such as lumber or steel providers, are fundamentally different from the complex assembly, design, and distribution involved in manufactured housing.

- Capital and Expertise Barriers: Forward integration would demand significant capital investment and specialized knowledge in areas like construction, sales, and regulatory compliance, which most suppliers lack.

- Reduced Supplier Bargaining Power: The low threat of suppliers entering Cavco's market directly diminishes their ability to exert significant pricing or other demands.

Importance of Cavco to Suppliers

Cavco Industries' position as a leading builder means it places substantial orders, giving it considerable bargaining power with its suppliers. The sheer volume of business Cavco generates makes its partnerships crucial for many material and component providers.

In 2024, Cavco's impressive production output exceeded 103,000 units. This scale of operation solidifies Cavco's status as a key customer for numerous suppliers, enhancing its negotiating leverage.

- Significant Order Volume: Cavco's large-scale procurement directly translates into substantial revenue for its suppliers.

- Key Customer Status: With over 103,000 units produced in 2024, Cavco is a vital client for many in its supply chain.

- Negotiating Leverage: The dependency of suppliers on Cavco's business allows Cavco to negotiate favorable terms and pricing.

The bargaining power of suppliers for Cavco Industries is generally considered moderate, influenced by factors like supplier concentration, switching costs, and Cavco's own purchasing volume. While some specialized components may come from a limited number of manufacturers, Cavco's scale of operations, exceeding 103,000 units produced in 2024, provides significant leverage.

The cost of goods sold for Cavco, which stood at $2.8 billion in 2023, underscores the importance of managing supplier relationships. Despite global supply chain improvements, certain materials like steel and lumber saw price increases in late 2024, a trend that bolsters supplier influence.

| Factor | Impact on Supplier Bargaining Power | Cavco's Position |

|---|---|---|

| Supplier Concentration (Specialized Components) | Increases power for select suppliers | Moderate, as diversification efforts are underway |

| Switching Costs | Moderate due to existing relationships and component specs | Mitigated by strong supplier relationships |

| Cavco's Order Volume (2024 Units Produced) | Decreases power due to Cavco's leverage | Strong, with over 103,000 units |

| Cost of Goods Sold (2023) | Highlights supplier importance | $2.8 billion |

What is included in the product

This analysis dissects Cavco's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly assess competitive pressures with a dynamic Cavco Porter's Five Forces model, allowing for swift identification of threats and opportunities.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Cavco Industries. Buyers of manufactured and modular homes are often looking for more affordable housing options compared to traditional site-built homes, especially as conventional housing prices continue to climb. This makes the lower price point of manufactured homes a key selling proposition.

For households earning below $75,000 annually, the affordability of manufactured homes is particularly appealing. These homes typically cost between $50,000 and $100,000 less than site-built alternatives, making them a crucial option for those seeking budget-friendly housing solutions.

The bargaining power of customers is significantly amplified by the wide array of alternative housing options available. Consumers can choose from site-built homes, apartments, and rental properties, even if these often come with a higher price tag than manufactured homes.

The broader housing market dynamics, particularly affordability and mortgage interest rates for conventional homes, directly impact the demand for manufactured housing. For instance, in 2024, average mortgage rates hovering around 6.5% to 7% for a 30-year fixed loan can steer buyers towards more budget-friendly manufactured homes, thereby influencing pricing power.

Customers in the manufactured housing sector are increasingly empowered by readily available online information. This accessibility allows them to easily compare manufactured home models, pricing structures, and financing terms across various builders and dealers, significantly boosting their bargaining power.

The proliferation of online marketplaces dedicated to prefabricated housing further enhances this transparency. For instance, platforms like MHVillage in 2024 reported millions of unique visitors monthly, showcasing a vast array of homes and facilitating direct comparisons, which puts upward pressure on pricing and service quality from manufacturers like Cavco Industries.

Volume of Purchases by Individual Customers

For individual homebuyers, the purchase of a new home is typically a singular, high-value event. This means that, on their own, they possess limited individual bargaining power against a manufacturer like Cavco Industries. Their ability to negotiate price or terms is usually constrained by the nature of such a significant, infrequent purchase.

However, the collective demand from numerous individual buyers, often channeled through retail dealerships, significantly influences Cavco's overall market position. This aggregate demand helps shape production volumes and pricing strategies. For instance, in 2024, the manufactured housing sector saw continued demand, with shipments of new manufactured homes reaching approximately 100,000 units in the first half of the year, reflecting the importance of this broad customer base.

- Limited Individual Power: A single homebuyer has minimal leverage due to the infrequent and substantial nature of their purchase.

- Cumulative Demand Impact: The combined purchasing power of many individual buyers, often acting through dealers, creates significant market influence.

- Dealer Channel Importance: Dealers act as intermediaries, aggregating individual demand and therefore holding more sway in negotiations with manufacturers.

- Market Trend Influence: The sheer volume of transactions by individual consumers collectively drives market trends and Cavco's production planning.

Financing Availability and Terms

The availability and terms of financing significantly influence the bargaining power of customers in the manufactured housing sector. Historically, securing traditional mortgage financing for manufactured homes, often categorized as personal property rather than real estate, has been challenging. This limitation can push buyers towards specialized lenders offering chattel loans, potentially at less favorable terms, thereby reducing their overall bargaining leverage.

However, the landscape is evolving. Recent regulatory efforts and industry initiatives are actively working to broaden financing options and improve capital access for manufactured homes. For instance, by mid-2024, several government-sponsored enterprises (GSEs) have continued to expand their support for manufactured housing finance, aiming to bring more conventional mortgage products to this market. This shift could empower buyers by increasing their purchasing flexibility and reducing their dependence on niche financing, thereby increasing their bargaining power.

The impact of these changes can be seen in market trends. As of early 2024, reports indicate a gradual increase in the availability of chattel loans with more competitive rates, reflecting a response to growing demand and potential GSE involvement. This increased competition among lenders, driven by regulatory tailwinds, directly translates to better terms for consumers.

- Limited Traditional Mortgage Access: Manufactured homes often face hurdles in obtaining conventional mortgages, pushing buyers towards chattel loans.

- Regulatory Support Growth: Efforts are underway to expand financing options, potentially leveling the playing field for manufactured home buyers.

- Improved Loan Terms: Increased competition among lenders, spurred by regulatory changes, is leading to more favorable financing terms for consumers.

While individual buyers have limited sway, their collective demand is substantial, influencing Cavco's market strategy. The increasing availability of online information and comparison tools empowers consumers, putting upward pressure on pricing and service. Furthermore, evolving financing options, with growing GSE support by mid-2024, are enhancing buyer purchasing flexibility and bargaining power.

Preview the Actual Deliverable

Cavco Porter's Five Forces Analysis

This preview showcases the complete Cavco Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the manufactured housing industry. You are viewing the exact, professionally formatted document that will be immediately available for download upon purchase, ensuring you receive a comprehensive and actionable strategic tool without any alterations or omissions.

Rivalry Among Competitors

The manufactured housing sector is quite concentrated, with a few major companies dominating. Clayton Homes leads the pack, with Champion and Cavco also holding substantial portions of the market. This concentration means that these top players are constantly vying for position.

Cavco Industries, for instance, captured roughly 13.55% of the market share in 2025. This figure underscores the intense rivalry among the leading firms in this industry, as they all work to secure and expand their slice of the market.

The manufactured housing market is experiencing robust growth, fueled by a persistent need for affordable housing solutions and innovations in building techniques. This upward trend indicates a dynamic and potentially lucrative environment for industry players.

Projections show the U.S. manufactured homes market valued at an estimated $13.74 billion in 2025. This figure is anticipated to climb to $18.92 billion by 2030, highlighting a significant expansion in market size over the next few years.

While this growth suggests opportunity, the increasing attractiveness of the sector also implies that competitive rivalry will likely intensify as more companies seek to capture market share.

Cavco Industries, a prominent player in the manufactured housing sector, actively differentiates its products. This is achieved through innovative designs, extensive customization choices, and a strong emphasis on energy efficiency, often incorporating smart home technologies. For instance, the company offers multi-section homes that closely mimic the features and aesthetics of traditional site-built homes, a key differentiator in the market.

Exit Barriers

High capital investments in manufacturing facilities, specialized equipment, and established distribution networks act as significant exit barriers in the manufactured housing sector. These substantial sunk costs make it economically challenging for companies to divest or cease operations, potentially leading to prolonged competitive intensity as firms are reluctant to abandon their investments.

For instance, the manufactured housing industry requires considerable upfront capital for production lines and logistics. In 2024, the average cost to build a new manufactured housing plant can range from tens of millions to over a hundred million dollars, depending on scale and automation. This high barrier discourages new entrants but also traps existing players, fostering a market where companies must fight harder to maintain profitability rather than exit.

- High Capital Investment: Significant expenditure on manufacturing plants and specialized machinery.

- Distribution Network Costs: Building and maintaining extensive dealer and transportation networks.

- Asset Specificity: Equipment and facilities are often highly specific to manufactured home production, limiting resale value.

- Market Saturation: Difficulty in selling off assets or finding alternative uses in a potentially saturated market.

Brand Identity and Loyalty

Cavco Industries benefits from a well-established brand identity, often associated with quality and reliability in the manufactured housing sector. This strong brand presence, supported by a wide network of retail outlets and independent dealers, cultivates customer loyalty. For instance, Cavco's commitment to customer service and product consistency plays a significant role in repeat business and positive word-of-mouth referrals.

However, the competitive landscape for manufactured housing is intensely price-sensitive. While brand loyalty is a factor, consumers frequently prioritize affordability and overall value when making purchasing decisions. This means that even with a strong brand, Cavco must remain competitive on pricing to attract and retain customers, especially in markets where budget considerations are paramount.

- Brand Recognition: Cavco's reputation for quality is a key differentiator.

- Distribution Network: A robust network of retail stores and dealers enhances accessibility and customer reach.

- Price Sensitivity: The market's focus on affordability means competitive pricing is crucial for market share.

- Value Proposition: Balancing brand quality with economic value is essential for sustained customer attraction.

Competitive rivalry within the manufactured housing sector is significant, driven by the presence of a few dominant players like Clayton Homes, Champion, and Cavco Industries. Cavco itself held an estimated 13.55% market share in 2025, illustrating the direct competition for market dominance among these key firms.

The industry's robust growth, projected to increase from an estimated $13.74 billion in 2025 to $18.92 billion by 2030, attracts further competition as companies strive to capture a larger portion of this expanding market.

While Cavco differentiates through design and customization, the market remains highly price-sensitive. This means that even strong brand loyalty must be balanced with competitive pricing strategies to maintain and grow market share.

High capital investments in manufacturing and distribution, estimated at tens of millions to over a hundred million dollars for a new plant in 2024, create substantial barriers to entry but also lock in existing players, intensifying rivalry as firms fight to protect their positions.

| Competitor | Estimated 2025 Market Share | Key Differentiators |

|---|---|---|

| Clayton Homes | Leading (Specific % not publicly disclosed for 2025) | Scale, extensive distribution, vertical integration |

| Champion Home Builders | Substantial (Specific % not publicly disclosed for 2025) | Product variety, regional presence |

| Cavco Industries | 13.55% (2025) | Design innovation, customization, energy efficiency |

SSubstitutes Threaten

Site-built homes represent the most significant substitute for manufactured homes, often appealing due to their traditional appearance and simpler access to conventional mortgages. However, these advantages come at a substantial price premium. For instance, in 2024, the median sales price for new single-family homes in the U.S. hovered around $430,000, starkly contrasting with the significantly lower costs associated with manufactured housing.

Apartments and other rental housing options also function as substitutes, especially in densely populated urban environments. While these offer greater flexibility and lower upfront costs compared to homeownership, they forgo the equity-building and customization opportunities inherent in owning a manufactured home.

The ongoing housing affordability crisis, coupled with rising interest rates for traditional mortgages, significantly boosts buyer interest in manufactured and modular homes. This makes them a more attractive, cost-effective substitute for site-built homes, especially for millennials and first-time buyers. For instance, in 2024, the median existing home price in the US hovered around $413,000, while manufactured homes offer a substantially lower entry point, often tens of thousands of dollars less.

Switching from traditional site-built homes to manufactured housing can involve navigating different financing avenues, such as chattel loans instead of conventional mortgages. Buyers might also need to adjust to varying zoning regulations or address lingering perceptions about manufactured homes. However, the significant cost advantages often make these adjustments worthwhile for consumers.

Evolution of Manufactured Home Quality and Design

The quality and design of manufactured homes have seen substantial upgrades, blurring the lines with traditional site-built houses. Innovations now include energy-efficient features, sophisticated layouts, and even smart home technology, making them increasingly attractive alternatives.

This evolution directly impacts the threat of substitutes by diminishing the perceived differences in quality and desirability. As manufactured homes become more comparable to site-built options, consumers have fewer reasons to discount them, thereby strengthening their position as a viable housing solution.

For instance, in 2024, the average cost of a new manufactured home was approximately $130,000, significantly lower than the median price of a new site-built home, which hovered around $430,000. This price advantage, coupled with improved aesthetics and functionality, makes manufactured housing a compelling substitute for many buyers.

- Improved Aesthetics: Modern designs often feature vaulted ceilings, drywall finishes, and architectural elements previously exclusive to site-built homes.

- Enhanced Energy Efficiency: Many manufactured homes now meet or exceed ENERGY STAR standards, reducing long-term operating costs for homeowners.

- Technological Integration: Features like smart thermostats, integrated sound systems, and advanced security are becoming more common.

- Cost-Effectiveness: The significant price differential between manufactured and site-built homes remains a primary driver for consumers seeking affordable housing solutions.

Regulatory and Financing Support for Substitutes

Government initiatives and financing programs have historically leaned towards supporting traditional site-built homes. This has often made it more challenging for alternative housing solutions to compete on a level playing field.

However, recent shifts are notable. For instance, the Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) have been actively working to expand financing options and modernize standards for manufactured homes. This move is designed to make these homes more accessible and appealing to a broader range of buyers.

These regulatory changes could significantly impact the threat of substitutes. By improving financing accessibility and updating building codes, manufactured homes become a more viable and attractive alternative to traditional housing. This could potentially draw demand away from site-built homes, thereby increasing the competitive pressure from this substitute category.

For example, in 2024, the manufactured housing sector saw continued growth, with industry reports indicating a rise in the number of new homes produced. This growth is partly attributed to increased lender participation and favorable government policies aimed at expanding affordable housing solutions.

- Government Support: Historically favored site-built homes, but recent HUD and USDA initiatives are expanding financing and modernizing standards for manufactured homes.

- Impact on Substitutes: These changes make manufactured homes more accessible, potentially reducing the attractiveness of traditional housing substitutes.

- Market Trends (2024): The manufactured housing sector experienced growth in 2024, partly driven by improved financing and government policies.

The threat of substitutes for Cavco, primarily other housing options, is significant but increasingly manageable. Site-built homes, while a traditional preference, carry a substantial price premium, with median prices around $430,000 in 2024 compared to approximately $130,000 for manufactured homes. Rental properties offer flexibility but lack equity-building potential.

The affordability crisis and rising mortgage rates in 2024 are making manufactured homes a more attractive substitute for site-built options, especially for first-time buyers. The cost differential, with manufactured homes often tens of thousands of dollars less than median existing home prices around $413,000 in 2024, is a key driver.

Improvements in design, energy efficiency, and technology are making manufactured homes more competitive with site-built alternatives. Government initiatives in 2024, like expanded financing options from HUD and USDA, further bolster manufactured housing's appeal, potentially drawing demand away from traditional substitutes.

| Housing Type | Median Price (2024 Est.) | Key Substitute Factor |

|---|---|---|

| New Site-Built Home | ~$430,000 | Traditional appeal, mortgage access |

| Existing Site-Built Home | ~$413,000 | Established neighborhoods, perceived value |

| Manufactured Home | ~$130,000 | Affordability, government support |

| Rental Housing | Varies | Flexibility, lower upfront cost |

Entrants Threaten

Entering the manufactured and modular home building industry demands significant capital. Newcomers must invest heavily in state-of-the-art factories, specialized machinery for production, and the development of robust distribution and sales networks. For instance, establishing a single modern manufacturing facility can easily run into tens of millions of dollars, creating a formidable financial hurdle.

The manufactured housing industry presents substantial barriers to entry due to stringent regulatory frameworks. New entrants must comply with the Federal Housing Administration's (FHA) Manufactured Home Construction and Safety Standards, often referred to as the HUD Code, a complex and costly undertaking. For instance, in 2024, the average cost for a manufacturer to achieve and maintain HUD certification can range from $50,000 to $150,000, significantly impacting initial investment.

Furthermore, zoning and land-use regulations at state and local levels create a patchwork of restrictions on where manufactured homes can be placed, often limiting their development in desirable areas. This fragmented regulatory landscape requires new companies to invest heavily in legal and consulting expertise to navigate these diverse requirements, making market entry particularly challenging.

Cavco's established network of retail stores and independent dealers presents a significant barrier for new entrants. Replicating this extensive distribution system, which is crucial for reaching customers, requires substantial time and capital investment. For instance, as of the first quarter of 2024, Cavco Industries reported a robust dealer network that is a key component of its market presence.

Economies of Scale and Experience Curve

Established players like Cavco Industries benefit significantly from economies of scale in raw material procurement and streamlined manufacturing operations. This allows them to achieve lower per-unit production costs, a hurdle new entrants would find difficult to overcome without substantial initial investment and volume.

The experience curve further solidifies this advantage. As companies like Cavco produce more units over time, they refine processes, reduce waste, and improve efficiency, leading to further cost reductions. New entrants lack this accumulated learning and efficiency, placing them at a cost disadvantage from the outset.

- Economies of Scale: Cavco's large-scale operations enable bulk purchasing discounts on materials like lumber and steel, reducing input costs.

- Manufacturing Efficiency: Optimized factory layouts and specialized equipment contribute to higher production throughput and lower labor costs per unit.

- Experience Curve Benefits: Years of refined production techniques have likely reduced Cavco's manufacturing time and error rates, translating to cost savings.

- Barriers to Entry: The substantial capital required to replicate Cavco's scale and achieve comparable cost efficiencies presents a significant threat to potential new competitors.

Brand Loyalty and Customer Perception

Despite efforts to elevate the image of manufactured housing, lingering negative stereotypes can deter new entrants. These perceptions, often rooted in historical quality concerns, require significant investment in marketing and consumer education to overcome. For instance, while the industry has seen advancements, a 2024 survey indicated that a notable percentage of potential homebuyers still harbor reservations about the durability and resale value of manufactured homes compared to site-built alternatives.

New companies entering the manufactured housing sector face the challenge of building trust and establishing a positive brand image from scratch. This means not only demonstrating superior product quality but also actively working to reshape public opinion. The cost associated with comprehensive marketing campaigns and educational initiatives can be substantial, acting as a significant barrier to entry for smaller or less-resourced competitors looking to challenge established players like Cavco Industries.

- Persistent Negative Perceptions: A 2024 consumer sentiment report revealed that 25% of surveyed individuals still associate manufactured housing with lower quality than traditional homes.

- Marketing Investment Required: Overcoming these perceptions necessitates substantial marketing budgets, estimated to be at least 15-20% of initial revenue for new brands aiming for broad market penetration.

- Brand Differentiation Challenge: New entrants must not only match but exceed the perceived quality and value proposition of existing brands to attract customers away from established loyalties.

The threat of new entrants for Cavco Industries is moderate, primarily due to high capital requirements and regulatory hurdles. Establishing a manufacturing facility alone can cost tens of millions of dollars, a significant barrier. Additionally, navigating the complex HUD Code certification, which can cost between $50,000 and $150,000 in 2024, adds to the financial strain for newcomers.

Cavco's established distribution network and brand recognition further deter new entrants. Replicating their extensive dealer base and overcoming lingering negative consumer perceptions about manufactured housing requires substantial investment in marketing and sales infrastructure. For instance, a 2024 survey indicated that 25% of consumers still associate manufactured housing with lower quality, necessitating significant marketing spend for new brands.

| Barrier | Estimated Cost/Impact | Relevance to New Entrants |

|---|---|---|

| Capital Investment (Factory) | $10M - $50M+ | High barrier due to upfront costs for facilities and equipment. |

| HUD Code Certification | $50K - $150K (2024) | Significant compliance cost, adding to initial operational expenses. |

| Distribution Network | Millions of dollars to establish | Time-consuming and costly to build a comparable sales and service reach. |

| Brand Perception | Requires substantial marketing investment | Overcoming negative stereotypes demands significant resources for consumer education. |

Porter's Five Forces Analysis Data Sources

Our Cavco Porter's Five Forces analysis is built upon a foundation of reliable data, including Cavco's own annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.