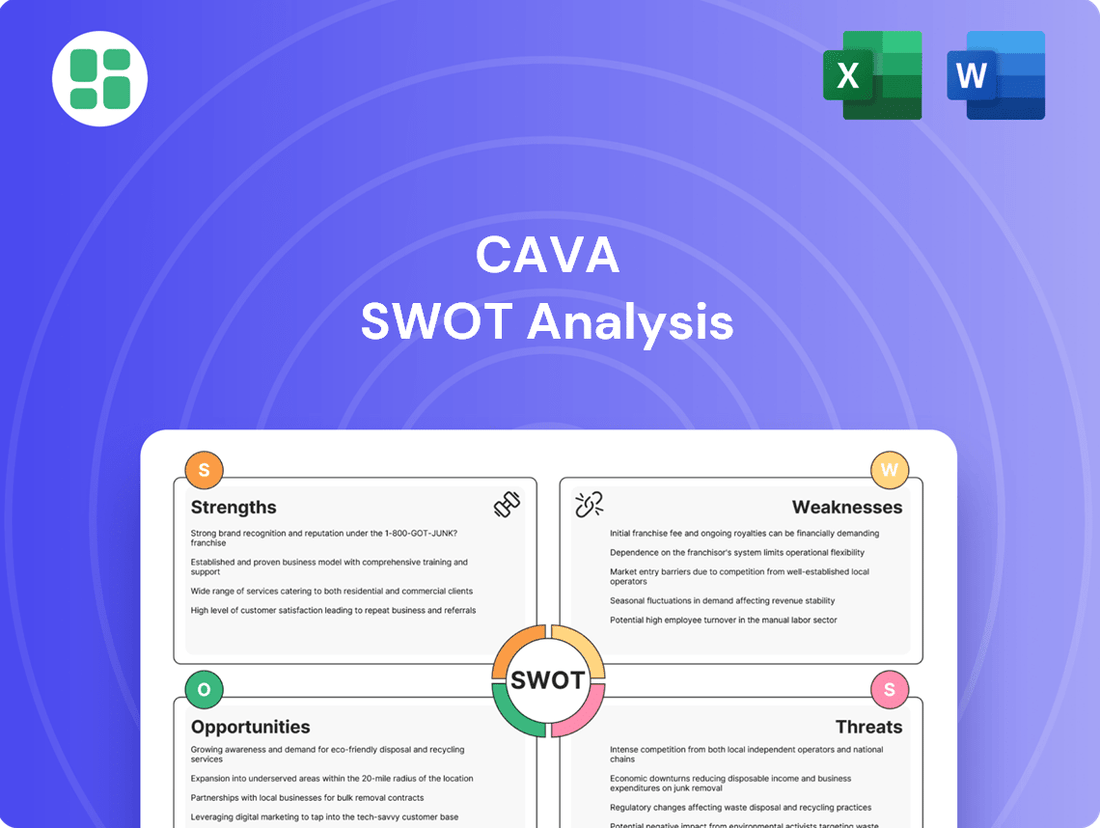

Cava SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cava Bundle

Cava's vibrant Mediterranean-inspired menu and commitment to fresh, healthy ingredients are clear strengths, but what about the competitive landscape and potential operational challenges? Our full SWOT analysis dives deep into these crucial areas, providing a comprehensive view of their market position.

Want the full story behind Cava's impressive growth, potential threats, and untapped opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CAVA has showcased impressive financial momentum, with its revenue soaring by 51% in 2024 to $744.5 million. This strong performance continued into the first quarter of 2025, where revenue jumped 18% year-over-year to $202.1 million. This growth is largely fueled by a robust 5% increase in same-restaurant sales and the successful integration of new locations.

CAVA's strength lies in its highly differentiated Mediterranean cuisine, offering customizable bowls, salads, and pitas. This focus on healthy, fresh, and flavorful options strongly appeals to today's consumers who prioritize nutritious and convenient dining experiences. This strategic positioning has cemented CAVA's leadership in the rapidly expanding fast-casual Mediterranean segment.

Cava's aggressive expansion strategy is a significant strength, evidenced by its impressive growth trajectory. The company anticipates opening over 60 new restaurants in 2025, building on a substantial number of net new openings in 2024.

This disciplined approach is designed to achieve a target of 1,000 restaurants by 2032, showcasing a clear vision for market penetration and long-term scalability.

Strong Unit Economics and Profitability

CAVA demonstrates strong unit economics, highlighted by impressive average unit volumes (AUVs) and robust restaurant-level profit margins. These metrics underscore the efficiency of its operational model and its ability to generate substantial profits at the individual restaurant level.

This financial strength at the unit level is a key driver for CAVA's overall health, providing the capital necessary to fuel its ambitious expansion plans. For instance, CAVA reported a same-store sales growth of 17.9% in the first quarter of 2024, demonstrating continued customer demand and operational success.

The company's focus on optimizing costs and maximizing revenue per location contributes to these favorable unit economics. CAVA's restaurant-level operating margins have consistently been in the mid-to-high teens, a testament to its effective management and appealing product offering.

- High Average Unit Volumes (AUVs): CAVA's restaurants consistently achieve strong sales figures per location, indicating broad customer acceptance and effective market penetration.

- Healthy Restaurant-Level Profit Margins: The company maintains impressive profitability at the individual restaurant level, typically in the mid-to-high teens, showcasing operational efficiency.

- Efficient Operations: Strong unit economics are a direct result of CAVA's streamlined operational processes and effective cost management strategies.

- Funding for Growth: The profitability of individual units provides a solid financial foundation, enabling CAVA to reinvest in new store openings and market expansion.

Digital Integration and Operational Efficiency

Cava’s digital integration is a significant strength, with digital channels accounting for a substantial portion of its sales. In the first quarter of 2024, digital sales represented 57% of total sales, demonstrating the company's robust online presence and customer adoption of digital ordering. This focus on digital platforms not only drives convenience for customers but also provides valuable data for operational improvements.

Strategic investments in technology, like the Connected Kitchen Initiative, are enhancing operational efficiency across Cava's locations. This initiative aims to streamline kitchen operations, reduce wait times, and improve order accuracy, ultimately leading to a better guest experience. By leveraging technology, Cava is building a foundation for scalable growth and improved service delivery.

- Digital Sales Dominance: Digital revenue constituted 57% of total sales in Q1 2024.

- Connected Kitchen Initiative: Technology investments boost operational efficiency and guest satisfaction.

- Scalable Operations: Digital and technological advancements support efficient expansion.

CAVA's core strength lies in its differentiated Mediterranean menu, offering healthy and customizable options that resonate with modern consumers. This focus has positioned them as a leader in a growing niche. The company's aggressive expansion strategy is a major advantage, with plans for over 60 new locations in 2025, targeting 1,000 by 2032.

Strong unit economics, characterized by high average unit volumes and robust profit margins in the mid-to-high teens, provide a solid financial base for this growth. Furthermore, CAVA's digital integration is a key strength, with digital channels accounting for 57% of sales in Q1 2024, supported by technological investments like the Connected Kitchen Initiative.

| Metric | Q1 2024 | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Revenue Growth | 18% (Q1 YoY) | 51% | N/A |

| Same-Restaurant Sales Growth | 17.9% (Q1) | 5% | N/A |

| Digital Sales % | 57% | N/A | N/A |

| New Restaurants | N/A | Significant Net New Openings | Over 60 |

What is included in the product

Analyzes Cava’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap by highlighting key opportunities and mitigating potential threats.

Weaknesses

While Cava Group (CAVA) has shown impressive growth, its stock currently trades at a very high valuation. For instance, as of early 2024, CAVA's price-to-earnings (P/E) ratio is significantly higher than many established restaurant chains, signaling that investors have high expectations for future earnings. This elevated valuation makes the stock particularly sensitive to any stumbles in meeting those ambitious growth targets, potentially leading to increased volatility.

CAVA's reliance on consumer discretionary spending presents a significant vulnerability. As a fast-casual chain, its sales are directly tied to how much disposable income consumers have available for dining out. Economic downturns or periods of high inflation, like those experienced in 2023 and continuing into 2024 with persistent inflation concerns, can easily lead consumers to cut back on non-essential purchases, directly impacting CAVA's customer traffic and overall sales trajectory.

CAVA has faced a significant headwind from rising input costs, impacting everything from food and beverage ingredients to packaging materials. This surge in expenses, partly driven by strategic menu expansions like the introduction of steak nationwide, puts a strain on the company's profitability.

While CAVA has managed to partially mitigate these cost pressures through increased sales volume, the sustained rise in input expenses remains a key challenge. If these costs continue to outpace sales leverage, they could notably compress restaurant-level profit margins, requiring careful cost management strategies.

Potential for Slower Traffic Growth

While Cava's overall sales growth is robust, a closer look at 2024 reveals some quarters experienced a dip in guest traffic. This slowdown, though offset by strategic menu price adjustments, highlights a potential challenge in maintaining consistent customer footfall.

Sustaining robust traffic growth is paramount for Cava's long-term success, directly impacting same-restaurant sales and the feasibility of its ambitious expansion plans. For instance, if traffic growth falters, achieving the projected 100 new restaurant openings annually becomes more challenging.

- Traffic Growth Concerns: Some quarters in 2024 saw a deceleration in guest traffic, a key metric for sustained growth.

- Price Increases Offset: Menu price hikes helped mask some of the traffic slowdown, but this is not a long-term solution for traffic issues.

- Importance of Footfall: Consistent increases in customer visits are vital for driving same-restaurant sales and supporting ambitious expansion targets.

Geographic Concentration and New Market Challenges

CAVA's rapid expansion, while a strength, also presents a weakness in terms of geographic concentration. The company is still in the nascent stages of its national rollout, meaning its success is heavily reliant on replicating its model effectively in diverse new markets. This can be a significant hurdle, as operating costs can escalate in prime locations, and adapting to varied regional consumer tastes requires careful strategic planning and execution.

Challenges in new markets are multifaceted. CAVA must navigate higher operating expenses in sought-after trade areas, which can impact profitability. Furthermore, understanding and catering to diverse regional consumer preferences is crucial for sustained growth. For instance, a menu item that thrives in a coastal city might not resonate as strongly in a landlocked state, necessitating flexibility in their offerings and marketing strategies.

- Geographic Concentration: CAVA's national build-out is ongoing, creating reliance on successful entry into new regions.

- New Market Operating Costs: Higher expenses are often encountered in desirable trade areas, potentially squeezing margins.

- Regional Preference Adaptation: CAVA must tailor its offerings to diverse consumer tastes across different geographic locations.

- Replication Risk: The company's ability to consistently reproduce its successful model in new markets is a critical factor for continued growth.

CAVA's high valuation, with P/E ratios significantly above many established chains in early 2024, makes it vulnerable to any missed growth expectations, potentially increasing stock volatility. The company's reliance on discretionary spending means economic slowdowns or inflation, as seen in 2023-2024, could directly impact customer traffic and sales.

Rising input costs, including food and packaging, continue to pressure CAVA's profitability, even with increased sales volume. Furthermore, some quarters in 2024 showed a dip in guest traffic, which, despite being offset by price increases, highlights a challenge in maintaining consistent customer footfall essential for same-restaurant sales and expansion goals.

| Metric | Value (as of early 2024/2025 data) | Implication |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | Significantly higher than established chains | High investor expectations, increased volatility risk |

| Consumer Discretionary Spending Reliance | High | Vulnerable to economic downturns and inflation |

| Input Cost Trends | Rising | Pressures profitability, requires careful cost management |

| Guest Traffic Trends (select quarters 2024) | Decelerated | Impacts same-restaurant sales and expansion feasibility |

Full Version Awaits

Cava SWOT Analysis

This is the actual Cava SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full Cava SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of its market position.

This is a real excerpt from the complete Cava SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

Opportunities

CAVA is poised for substantial growth, with a clear strategy to significantly expand its restaurant presence across the United States. The company has articulated an ambitious long-term target of establishing 1,000 locations by the year 2032.

This extensive whitespace presents a compelling opportunity for CAVA to capture a larger share of the fast-casual Mediterranean market, driving considerable revenue increases and solidifying its brand dominance.

Consumers are increasingly prioritizing health and exploring diverse flavors, with Mediterranean cuisine experiencing significant growth. This shift directly benefits CAVA, as its menu naturally aligns with these evolving preferences, offering a compelling option for health-conscious diners.

CAVA's digital and loyalty programs offer significant growth potential. By further developing its mobile ordering, pick-up shelves, and loyalty initiatives, CAVA can boost customer engagement and encourage repeat visits. This focus on digital convenience is crucial for increasing the digital revenue mix and strengthening brand loyalty.

Menu Innovation and Product Diversification

Cava's menu innovation, exemplified by its national steak launch in early 2024, presents a significant opportunity to broaden its customer base and boost average transaction values. This strategic move aims to capture diners seeking heartier options, potentially increasing check sizes beyond the typical Mediterranean-focused meals.

Beyond the in-restaurant experience, Cava can leverage its popular dips and spreads by expanding into additional retail channels. This diversification strategy could unlock new revenue streams and significantly enhance brand recognition and accessibility for consumers outside of its physical locations.

- National Steak Launch: Introduced in Q1 2024, this item aims to attract a wider demographic and increase average check size.

- Retail Expansion: Exploring grocery store partnerships for dips and spreads could create a substantial new revenue channel.

- Product Line Extension: Further development of pre-packaged meal kits or catering options could tap into different consumer needs and occasions.

- Seasonal Offerings: Introducing limited-time offers (LTOs) based on seasonal ingredients can drive repeat visits and create buzz.

Leveraging Data and AI for Operational Excellence

Cava's 'Connected Kitchen Initiative' exemplifies a strategic move towards operational excellence by leveraging data and AI. This initiative aims to refine forecasting accuracy, optimize food preparation processes, and streamline staff scheduling. By doing so, Cava can significantly reduce waste, a common challenge in the fast-casual sector, and ensure a smoother, more efficient customer experience. For instance, improved forecasting can directly impact ingredient purchasing, potentially lowering food costs and minimizing spoilage.

Continued investment in artificial intelligence and advanced data analytics offers Cava a distinct competitive advantage. These technologies can unlock deeper insights into consumer behavior, supply chain dynamics, and in-store performance metrics. This data-driven approach allows for more agile decision-making, enabling Cava to adapt quickly to market shifts and customer preferences, ultimately enhancing profitability and market position.

The opportunities presented by data and AI for Cava include:

- Enhanced Demand Forecasting: AI-powered tools can analyze historical sales data, seasonality, local events, and even weather patterns to predict customer demand with greater precision, leading to optimized inventory levels and reduced waste.

- Optimized Kitchen Operations: Data analytics can identify bottlenecks in prep work and service flow, allowing for adjustments to staffing, station setup, and workflow to improve speed and efficiency.

- Personalized Customer Experiences: By analyzing customer purchase history and preferences through loyalty programs or app data, Cava can offer personalized recommendations and promotions, boosting customer satisfaction and repeat business.

- Supply Chain Efficiency: AI can help manage supplier relationships, track ingredient quality, and predict potential disruptions, ensuring a more resilient and cost-effective supply chain.

CAVA's strategic expansion into 1,000 locations by 2032 offers a vast runway for growth in the burgeoning fast-casual Mediterranean market. This expansion is supported by a growing consumer preference for healthy, flavorful options, a trend CAVA is well-positioned to capitalize on.

The company's focus on digital innovation, including its mobile app and loyalty program, is set to enhance customer engagement and drive repeat business, further solidifying its market presence.

Menu innovation, such as the national steak launch in early 2024, aims to broaden appeal and increase average transaction values, attracting a wider customer base.

Furthermore, expanding retail presence for its popular dips and spreads presents a significant opportunity to unlock new revenue streams and increase brand accessibility.

| Opportunity | Description | 2024/2025 Relevance |

|---|---|---|

| Market Expansion | Target of 1,000 locations by 2032 | Provides significant whitespace for capturing market share. |

| Consumer Trends | Growing demand for healthy, flavorful Mediterranean cuisine | Aligns directly with CAVA's core offerings. |

| Digital & Loyalty Programs | Enhancing mobile ordering, pick-up, and loyalty initiatives | Drives customer engagement and repeat visits. |

| Menu Innovation | National steak launch (Q1 2024) | Broadens customer appeal and increases average check size. |

| Retail Expansion | Partnerships for dips and spreads | Creates new revenue channels and brand visibility. |

Threats

The fast-casual restaurant landscape is incredibly crowded, with many well-known brands and new entrants constantly emerging to capture consumer attention and spending. CAVA operates within this dynamic environment, facing pressure from a wide array of competitors.

This includes other chains focusing on healthy and customizable meals, established fast-casual giants like Chipotle and Panera Bread, and even traditional quick-service restaurants that are increasingly offering healthier options. For instance, as of Q1 2024, the fast-casual segment continues to see robust growth, with companies like Chipotle reporting strong same-store sales, highlighting the intense rivalry for market share.

Ongoing inflation, particularly in food and labor, presents a significant threat to Cava's profitability, potentially squeezing already tight margins. For instance, the US Consumer Price Index for food away from home saw a notable increase throughout 2023 and into early 2024, impacting restaurant operating expenses.

Simultaneously, persistent economic uncertainty and diminished consumer purchasing power could dampen discretionary spending, directly affecting Cava's dine-in and takeout revenue streams. As inflation continues to affect household budgets, consumers may cut back on non-essential expenditures like dining out.

CAVA's reliance on fresh ingredients makes it vulnerable to supply chain disruptions. For instance, the company experienced temporary ingredient shortages in early 2024, impacting menu availability in some locations. These disruptions, coupled with potential food safety incidents, pose a significant threat to CAVA's operational consistency and brand image, as consumers expect high-quality, safe food.

Changing Consumer Preferences and Dietary Trends

While Mediterranean cuisine enjoys robust popularity, consumer tastes are notoriously fickle and can pivot swiftly. A downturn in the appeal of Mediterranean flavors or the ascendance of competing healthy eating movements presents a significant threat to CAVA's established market standing.

For instance, the global healthy eating market, valued at approximately $916 billion in 2023, is projected to reach over $1.1 trillion by 2028, indicating a dynamic landscape where new trends can emerge rapidly. CAVA must remain agile to adapt to these shifts.

- Shifting Dietary Fads: The rise of plant-based diets or specific macronutrient-focused eating patterns could divert consumers from Mediterranean-style options.

- Health Perception Evolution: Consumer understanding of "healthy" can change, potentially favoring cuisines perceived as more beneficial than Mediterranean.

- Competitive Cuisine Innovation: Other healthy cuisine categories might innovate with new flavor profiles or health benefits, drawing consumer attention away from CAVA.

Labor Shortages and Wage Increases

The restaurant sector, including businesses like Cava, faces significant headwinds from labor shortages and escalating wage demands. This trend, exacerbated by post-pandemic shifts in workforce expectations, directly impacts operational costs. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for leisure and hospitality workers increased by 4.8% year-over-year as of April 2024, a figure that continues to climb.

These rising labor costs put pressure on profit margins, forcing restaurants to either absorb the expenses or pass them on to consumers. Beyond wages, the struggle to attract and retain qualified staff can lead to compromised service quality and decreased operational efficiency, directly affecting the customer experience and Cava's ability to scale effectively.

- Rising Labor Costs: Average hourly earnings in leisure and hospitality saw a 4.8% increase year-over-year by April 2024.

- Staffing Challenges: Difficulty in hiring and retaining employees impacts service standards.

- Profitability Squeeze: Increased wages can directly reduce net income if not offset by price increases or efficiency gains.

CAVA faces intense competition from a crowded fast-casual market, including established players like Chipotle and emerging healthy-eating concepts. The company must continually innovate and differentiate to maintain its market share amidst this rivalry.

Inflationary pressures on food and labor costs, as evidenced by a 4.8% year-over-year increase in leisure and hospitality wages by April 2024, directly threaten CAVA's profitability. Economic uncertainty also looms, potentially reducing consumer discretionary spending on dining out.

Supply chain vulnerabilities, such as ingredient shortages experienced in early 2024, can disrupt operations and impact menu availability. Furthermore, evolving consumer tastes and the potential rise of competing healthy food trends pose a risk to CAVA's core Mediterranean appeal.

SWOT Analysis Data Sources

This Cava SWOT analysis is built on a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.